The post Malaysian's Step by Step Guide to Invest in Low-Cost Index ETFs appeared first on Ringgit Freedom.

]]>I wish I had read about low-cost Index ETFs investing earlier - but I guess now is still never too late! This article will be aimed at those who want to get started with investing through investing in low-cost index ETFs but have no idea how to look for the right ETFs. Rather than telling you what to buy, we'll instead go through the few areas to look at before selecting the fund.

For me, the book that really inspired me to get into the whole shebang of low-cost index ETFs investing is the The Little Book of Common Sense Investing by John C. Bogle whom had democratized the low-cost index fund investing when he incorporated Vanguard Inc. P/S This article is NOT sponsored.

As always - let's first establish our basic understanding of exactly what is ETF before we start going around and scream WTFish!?!?

Table of contents

Index ETF!? I Need DEX 🤺 (to) Eat the Fish?! 🐠

Dexterity (DEX) nor the Fish has anything to do with Index ETF. Instead, ETF stands for Exchange-Traded Fund. As the name implies, ETFs are listed in our typical stock exchanges where we can trade (buy or sell) just like how we do with our typical stocks - usually with the same commissions/fee structure (and sometimes cheaper too!). Similar to Mutual Funds which are a more well-known counterpart, these funds will typically hold a basket of diversified stocks but have some key differences.

Both Mutual Funds and ETFs are typically created with a specific investment strategy/objective in mind, for example, a technology-stocks focused funds. However, the key differences between the two lies in where Mutual Funds are purchased directly from the Fund Providers (e.g. Principal, Kenanga, Public Mutual) and are actively managed by one or many fund managers with the goal to maximize profits.

Contrary, ETFs are listed in the Stock Exchange just like any other stocks, and can be purchased from any brokers (like Interactive Brokers) where invested funds will be used by fund managers to buy assets based on the initially set strategy, irrespective of market conditions. Fund managers passively manage the fund and do not make any trades to maximize profits, unless when the underlying index / fund strategy changes or when new capital gets injected where they will follow the existing allocation strategy to buy stocks. Ultimately, ETFs underlying assets (or NAVs) are basically a basket of stocks from different companies.

Okay.. what about that "Index" then!? Right... I forgot to explain that bit. The "Index" here is mostly referring to ETFs that primarily aims to replicate the performance of... an index, such as S&P 500. Take an example if I wanted to mimic (US) market's overall performance in my portfolio, without using any of my brain power - I could easily look up the list of Fortune 500 companies and buy all of their company stocks. Except this will probably cost me a bomb with at least 500+ transactions fees incurred.

A better alternative for me is just to buy up the market index, right!?!? Unfortunately I can't do that as market indices are merely "made up" to represent a specific segment of the market and its performance and hence came the "index ETFs" whose funds' sole objective serves exactly that purpose. Instead of buying 500+ separate company stocks like my previous example, I could have just made ONE SINGLE TRANSACTION and buy Vanguard S&P 500 ETF (VOO) instead to achieve the same outcome, with much lesser transaction fees.

With this one single trade alone, I have essentially bought the stocks of different companies like Google, Facebook, Amazon, ... and 490+ other companies in one single trade without incurring 500x separate trades required for such diversification (and along the way more transaction fees). This is especially great for the majority of the investors who may not be great for individual stock picking, and are lazy investors (myself included). As Warren Buffett once said,

A low-cost index fund is the most sensible equity investment for the great majority of investors

Warren Buffet

Now, you may be wondering: "If I wanted diversification, why not just go with Unit Trust/Mutual Fund and let the professionals manage the fund for me?"

Why DIY Index ETFs?

For many people, the idea of doing it yourself to buy Index ETFs can be both daunting and overwhelming. Amongst many of my friends/colleagues, when it comes to managing finances/money, one of the most common sentences that I have always heard time and time again is the following:

I don't know enough about managing money, so it's better off for me to leave it to the professionals.

Random Friends / Colleagues

The most common route that non-financially savvy folks will opt for, when it comes to investing after getting enough of the fixed deposits will usually be Insurance "Savings" plan and later, Mutual Funds/Unit Trusts. These are typically signed up through your friendly agents, friends or even relatives as some of them may already work in the financial industry. Whilst not all apples are bad nor people are inherently bad, the systems in Malaysia unfortunately does not help either.

Often, people don't even know what they had signed up for and blindly trusted their friends / agents. Who at least reads up the insurance policies before signing on the dotted line? I know I do. I don't want to repeat myself too much since I've ranted enough about these on my Getting Started - Financial Freedom for Malaysians! post, but in short from my perspective, the reasons to go for DIY Index ETFs instead of Mutual Fund/Unit Trusts or even RoboAdvisors ETFs are the following:

- Full Autonomy - you decide what you want and how you want to slice your (investment) pie

- ETFs Selection - with DIY approach plus international brokers with strong global presence, you open yourself up to more ETF choices and can tailor your investment portfolio to target specific segments where needed.

- Cost Efficient-ish - depending on your investment amount and cadence, you may (or may not) get to save more in the long run but generally it's much cheaper without the expensive annual AUM fees or transaction and other hidden fees

- Tax Efficient - DIY-ing also means that you can, based on your tax residency and residential country, to find the most tax-efficient route and avoid common US tax-traps!

- Simplicity - this may sound ironic but it's actually quite simple once you get the hang of it. You just need to make one transaction (or more) every other weeks / months / quarters / years - depending on your financial capability.

But of course, doing it yourself is not all rosy and beautiful. There's definitely more works to it as you can't simply have Direct Debit setup to directly deduct funds from your Maybank (or other Malaysian banks) and invest onto ETFs offered by some RoboAdvisors providers like StashAway. For most folks, I would still recommend to go for RoboAdvisors like StashAway as it's much more simpler and less headache for the less adventurous ones but for those who are willing, read on more!

Note that this article will not cover the transactional aspects of buying/selling the ETF 'stocks'. If you need guidance on that, feel free to check out my previous post on Beginner's Guide: Investing Abroad via Interactive Brokers from Malaysia as that's what I use to buy my ETFs.

How to choose the 'right' ETFs!?!? There's so many of them!

Picking an ETF can be a simple exercise - some closed their eyes blindly and purely follow recommendations from their favourite book's author, their favourite bloggers, or whatever's hot in the market today.

However, some would like to at least have some sciensy logic to it rather than doing it blind. Afterall, knowledge is power, isn't it?

Whilst I won't be able to cover every single aspects on this topic (as it's pretty broad topic afterall), I will point out some key considerations that I personally exercise when picking my ETF funds.

Strategy / Objective

As there are many varieties of ETFs, with "Index ETFs" being just one of those, you need to be clear on the selection of fund with its strategy/objective aligning to your personal investment goals.

Personally for me, since I'm going after low-cost Index ETF's, the fund's strategy must align as such with the sole purpose to replicate market index's performance.

Sectors / Geographical

Closely related to the above, the strategy/objective will usually also include a specific sector (i.e. technology, green energy, oil, etc.) or geographical area (i.e. US, Greater China, Asia Pacific, etc.). Depending on what your overall portfolio allocation plan, you may need to fine tune this to hit your allocation targets.

Personally for me, since I strive to maintain 30/30/40 between US/China/Others incl. Fixed Income or Gold; I mix in several broad-based ETFs and region-specific ETFs to increase my exposure to certain region.

Domicilation / Taxation

Probably one of the most important criterion amongst others - where the fund is domiciled (or "set-up" in layman term). In the end, the monies you invested will be used to buy underlying assets (e.g. Amazon stocks) so you will end up holding the same "asset". However, depending on where the ETF fund is domiciled at, your tax treatment may differ. Consult a tax professional to get advice on this one, or visit online sites like Bogleheads which has good information on this topic to avoid common US tax-traps.

Personally for me, since I'm a Malaysian Citizen and also a Tax Resident in Malaysia (they are two different things!), unfortunately this also means that I'm disadvantaged to directly hold US assets/stocks since there are no tax treaty between US and Malaysia and I'm better off to hold US assets indirectly through funds domiciled offshore, such as Ireland.

Currency Denomination

The currency used for the listed ETF. This one really do not have too much of an impact - in the end, whatever currency you opt for and deposit into the brokerage (and later fund provider) will be used to buy underlying assets, which are typically stocks listed in their origin exchanges/currencies. Most will opt for currency that works in their favour to reduce the number of currency exchanges to be done.

Transaction Fees

Remember ETFs are listed in the stock exchange, like any other stocks? You've probably guessed it then! Depending on the broker that you use, they may have different transaction fees based on stocks / ETFs purchased, and are also influenced by factors such as the Stock Exchange (i.e. London Stock Exchange charge more on average).

Personally for me, I am using Interactive Brokers since they provide me with global worldwide access, most importantly to London Stock Exchange where I transact for most of my Ireland-domiciled funds.

Expense Ratio (a.k.a Annual Fees & Costs)

Another important criterion here which directly affects the amount of fee you have to pay (usually per annum), deducted directly from the capitals held. Most low-cost index ETFs come with an expense ratio of approximately 0.15% to 0.50% on average, depending on fund provider, fund domicilation and fund size.

Personally I try to keep this as low as possible, but are usually limited by other factors such as fund domicilation / taxation.

Dividend Model (a.k.a Accumulating vs Distributing)

Some companies may choose to distribute dividends on a periodic basis, which essentially are cash given to investors. Since we are holding the company stocks via an "intermediary" (i.e. the index ETF), depending on the type of ETF we purchase - whether Accumulating or Distributing, the treatment of the dividends received will be different.

In a perfect scenario (where there are no transaction fees etc.), there are no differences as to which model you choose but in reality, since we'll be dealing with brokerages which will likely charge us fees for any/every transactions made, Accumulating is almost always better, except if you need the cash (i.e. during retirement years).

Personally, I opted for Accumulating funds where possible since I would like to avoid receiving small sum of cash in my brokerage account, and incur additional transaction fees just to "buy back" additional ETF shares. At least with 'accumulating' funds, the re-investment is done at fund provider level which bypasses my brokerage and saves me transaction fees.

Fund Size / Liquidity

Fund size simply refers to the amount of funds held in the ETFs, or in proper terms, assets under management. The large the fund size is, the easier it is for the fund providers / managers to optimize costs and bring down expense ratios. The lower the expense ratio, more people will be willing to opt for the ETF (vs. competition) and hence providing better liquidity for buyers/sellers to trade at fair value.

If the ETF has bad liquidity, often, the asking / bidding price on the stock exchange may differ from the actual Net Asset Value (NAV) of the asset, hence creating a disparity and resulting in a loss (or gain in some cases).

Personally, since I don't intend to trade often, I did not prioritize too much on this point so long as the fund size is of reasonable amount (hundred of millions or billions).

Tracking Accuracy

Another pretty important criterion, especially for index ETF investors. What's the use of an Index ETF if it can't even accurately trace an index? Imagine buying a S&P 500 Index ETF only to find out that its performance is nothing like the SP500...

Tracking accuracy is nothing, but as its name imply, how accurate the ETF is tracking the Index.

Phew, that's a long list of definition and explanation. It might be hard to digest everything at one go, so perhaps a better way to learn is to pick some real examples and go through them together to see how it works in action?

Example Scenario

For the sake of disclosure, none of the ETF's written on this post shall be treated as a recommendation. Please do your own due diligence and research before deciding on one. I am merely sharing real examples so that you can at least understand see how/what goes through my head when I was deciding for "the ETF(s)" that I had opted for.

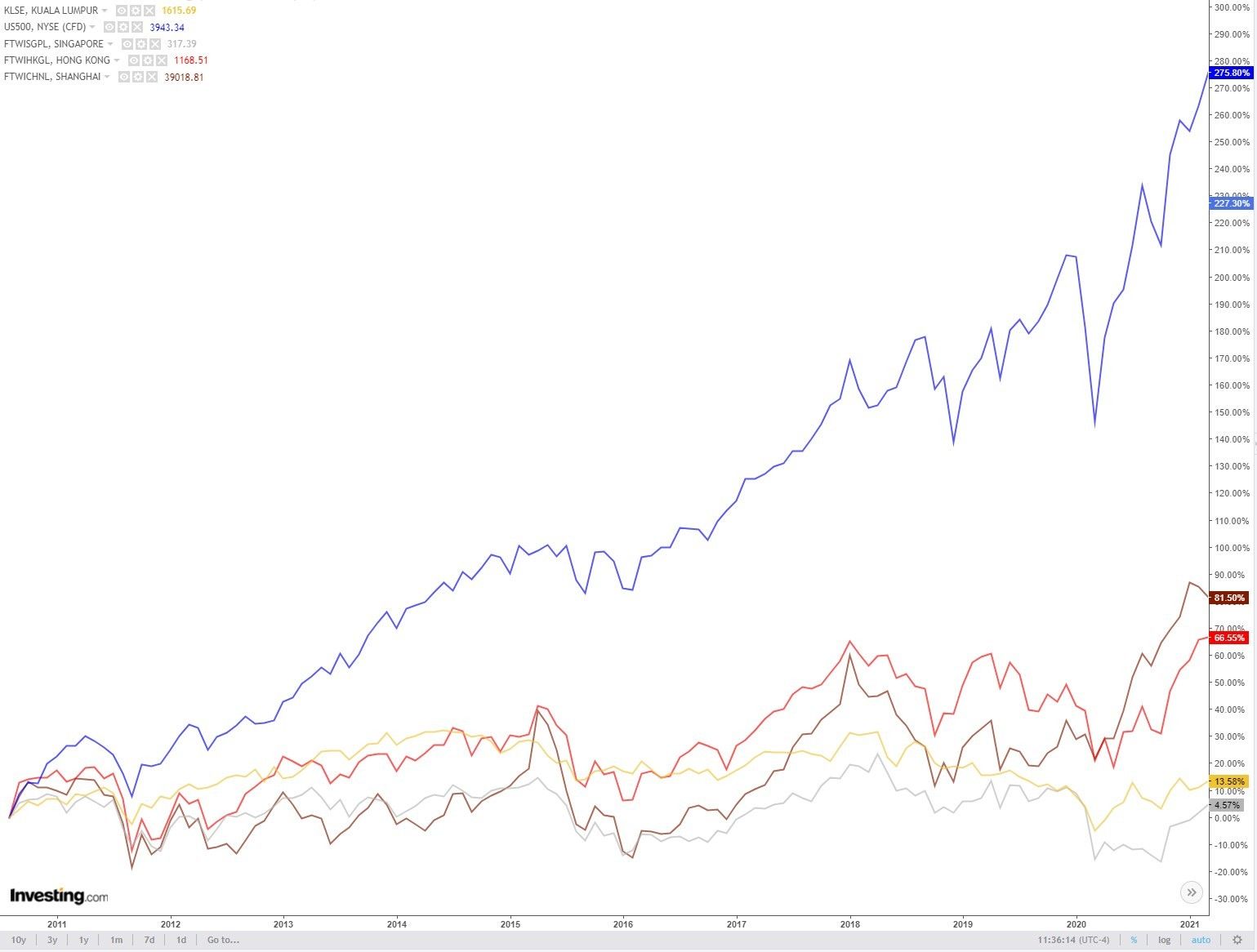

Let's run through a scenario - say, I am looking to buy a broad market index funds like S&P500. However, we know that S&P500 are made up of 500+ US-listed companies with 100% exposures to the US market. From a quick analysis, I also found that my portfolio is already US-heavy, and I wanted more exposure into the China market (for better or worse...).

I can go for several approaches here:

- I can opt to select multiple index ETFs and balance amongst them in a specific ratio/allocation %, such as combining S&P 500 US funds and a Greater China Fund.

- I can ignore my worries and directly buy into S&P500 index funds only

- I can look up for funds whose strategy aligns with mine and has exposures beyond just the US market

Now that I have decided that pathway 3 may suit me better, I looked up various options and found that Vanguard Total World Stock Index Fund ETF (VT) may suit my need. Let's run through the few criterias that we discussed earlier.

| Ticker | VT listed in the New York Stock Exchange |

| Strategy / Objective | Total World Stock Index Fund seeks to track the performance of a benchmark index that measures the investment return of global stocks. |

| Sectors / Geographical | FTSE Global All Cap Index (global large, mid and small caps with exposure of 60% US and 40% other countries) |

| Domicilation / Taxation | United States |

| Currency Denomination | USD |

| Transaction Fees | Depending on brokerage. Since I'm using Interactive Brokers, at least a minimum of $0.35 per transaction and goes higher from there depending on transacted amount. |

| Expense Ratio | 0.07% |

| Dividend Model | Distributing (Quarterly) |

| Fund Size / Liquidity | Approx. $39.95B in Assets Under Management with average 1,260,516 trading volumes daily. |

| Tracking Accuracy | Almost 100% (visually), or R-Squared value of 1.0 (no tracking errors) |

Now, where did I find those information, you may ask. I typically like to comb through multiple websites, primarily from the fund providers' provided fact sheet, Yahoo Finance, and also some ETFs-focused website as many of those information are already compiled.

After considering all these information, whilst I liked this ETF especially with the low expense ratio, I didn't like the fact that dividends are distributed (incurring me transaction fees to re-invest via brokers later) and the funds are domiciled in the US (which is disadvantaged for me) hence I had to look for an alternative. Maybe something of equivalent but domiciled elsewhere?

That's where I found Vanguard FTSE All-World UCITS ETF USD Acc (VWRA), and if you look at the facts below, it'll almost be dejavu except for underlined changes. It is basically a replica of VT, except for the stock exchange listed, fund domicilation, slightly higher expense ratio but with an accumulating dividend policy. Of course, this one have way lower average daily trade volumes and almost less than half asset under management but it'll do for now.

| Ticker | VWRA listed in the London Stock Exchange |

| Strategy / Objective | Total World Stock Index Fund seeks to track the performance of a benchmark index that measures the investment return of global stocks. |

| Sectors / Geographical | FTSE Global All Cap Index (global large, mid and small caps with exposure of 60% US and 40% other countries) |

| Domicilation / Taxation | Ireland |

| Currency Denomination | USD |

| Transaction Fees | Depending on brokerage. Since I'm using Interactive Brokers, at least a minimum of $1.70 per transaction and goes higher from there depending on transacted amount. |

| Expense Ratio | 0.22% |

| Dividend Model | Accumulating |

| Fund Size / Liquidity | Approx. $19.12B in Assets Under Management with average 48,276 trading volumes daily. |

| Tracking Accuracy | Almost 100% (visually), or R-Squared value of 1.0 (no tracking errors) |

And that's basically it! Going through all the steps above have helped me to finalize and shortlist VWRA as one of my favourite ticker as it meet most of my criteria - being globally diversified with exposures beyond US, tax advantages, rather-low expense ratio, and etc.

Unfortunately, not all index ETFs have sister listing in Stock Exchange / Fund Domicilation outside of home country - in cases of Greater China ETFs. So depending on your use case, you may / may not come across the "perfect one" that suits you. As with life, you just need to make the best decision that you can given the various constraints.

Wrap Up

I hope the above step-by-step walkthrough helps you to understand how to select and find your favourite low-cost index (ETF) funds. Always remember to come back to your investment strategy as that will ultimately fuel all your other decisions.

As always - thanks for reading and see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie

The post Malaysian's Step by Step Guide to Invest in Low-Cost Index ETFs appeared first on Ringgit Freedom.

]]>The post Beginner's Guide: Investing Abroad via Interactive Brokers from Malaysia appeared first on Ringgit Freedom.

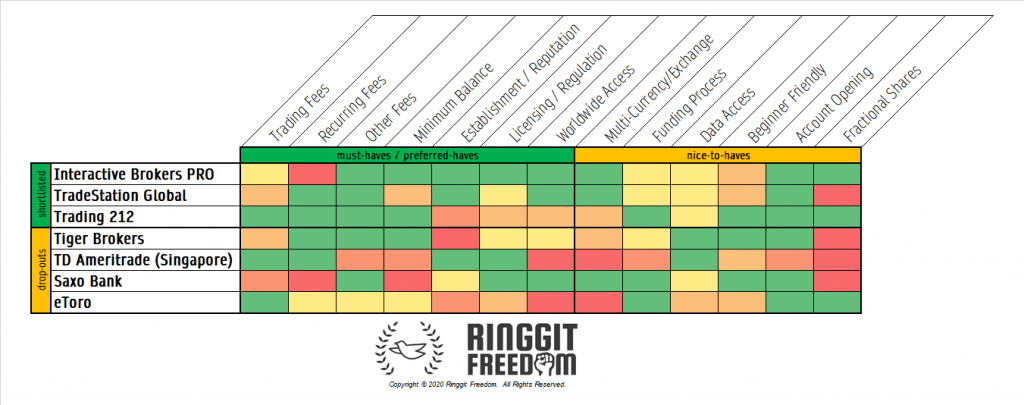

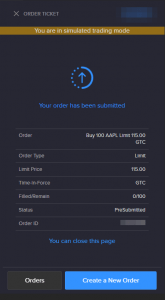

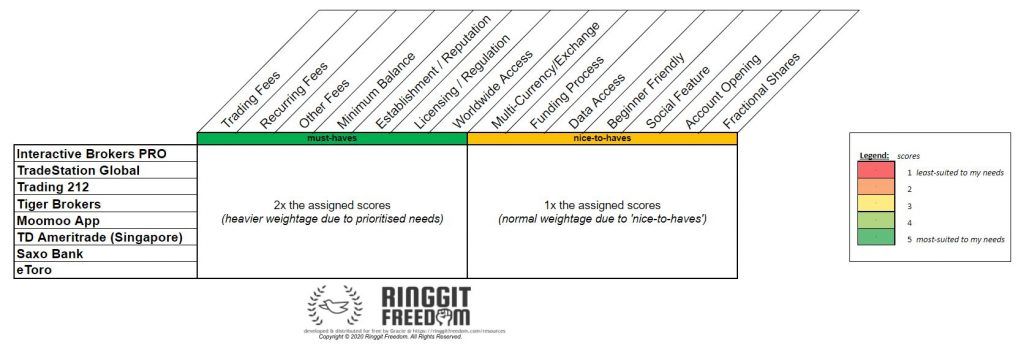

]]>I wrote a comprehensive comparison of few of the key international brokerage players in my previous post: Malaysia International Brokerage Comparison, feel free to check it out on my thought processes before arriving on Interactive Broker as my primary (international) brokerage. After all, "Best" is a very subjective word and in the end it really boils down to what we want.

Now, if you have decided to go ahead and get started with Interactive Brokers, let's run through some of the basics to get you up and running to invest through Interactive Brokers. To keep things easier to digest, I will be trying to simplify some of the chapters (i.e. funding) as much as possible - with detailed breakdown potentially explained in a separate post (if required) just to avoid drowning those whom just want to get started with international investing.

For sake of clarity, the Interactive Brokers account referred throughout the entire guide below is the Interactive Brokers: PRO account - as the "zero commission" LITE account is only available for U.S. Citizens and not available for us Malaysians. Zero commissions are nothing but merely an illusion anyway...

I hope this guide will be useful enough to get you from zero-to-hundred in accelerating your progress towards investing internationally!

Table of Contents

- Why Interactive Brokers?

- Is "Interactive Brokers" approved by Securities Commission Malaysia?

- Opening Interactive Brokers Account from Malaysia

- Funding Interactive Brokers Account from Malaysia

- Navigating Interactive Brokers Client Portal

- What's Next?

Why Interactive Brokers?

I have actually done a pretty comprehensive comparison across quite a number of popular international brokerages in my previous post, but just as a quick recap on why Interactive Brokers are good for us Malaysians intending to invest abroad.

- Truly Global with access to 150 markets in 33 countries and with 26 currencies (as of the time of update)

- One of the lowest commissions players in the industry to trade Stocks and FOREX (with a real spot exchange rate and no markups)

- Low barrier of entry - No Minimum Holdings ($0) and ZERO inactivity fees ($0/month) since their update in July 2021

- Free Withdrawal (once per month) or $10 USD per withdrawal thereafter

- Acceptance of account funding through multiple countries, currencies and sources, including 3rd party transfers (e.g. Wise) - awesome for folks with overseas accounts like Singapore

- Regulated by US Securities and Exchange Commission and the Commodity Futures Trading Commission; and also a member of FINRA & SPIC in the United States of America.

- Well established since 1970s with strong investors' protection - a Broker You Can Trust for Financial Strength.

- Offers the lowest Margin Loan interest rates and paying up to USD 4.33% on instantly available cash balances in your brokerage account

With their extremely low commissions (and margin interest, for those up for it) - it makes it extremely cheap and efficient especially for long-term buy-and-forget investors like myself. Just to illustrate the point:

- for US-listed Stocks (min. $0.35 USD or $0.0035 USD per Share up to maximum of 1% trade value) plus clearing & exchange fees - too complex to summarise!

- for UK-listed Stocks (min. $1.0 GBP or 0.050% trade value) plus clearing & exchanges fees of approx 0.000045% trade value (or minimum $0.16 GBP)

- for HK-listed Stocks (min. $12 HKD or 0.050% trade value) plus clearing & exchanges fees of approx 0.007% trade value (or minimum $2.5 HKD)

- for FOREX (min. $2 USD or 0.00002% trade value) with the real spot exchange rate, no markups.

Most other brokers charge either a higher commission or hide some of the costs by marking up the purchase price, resulting in a lack of transparency for us investors. Personally, I am using my IBKR account with access to the London Stock Exchange to buy ETFs domiciled in Ireland, such as CSPX or VWRA, to have a slightly reduced Withholding Tax applied on the receipt of the dividends (15% instead of 30%).

If you are interested in the details, head to my previous post on the comparison between various international brokerages. And if you're still not convinced, check out IBKR's very own overview page summarizing their key benefits. Remember to look only at IBKR PRO plan!

Is "Interactive Brokers" approved by Securities Commission Malaysia?

NO!

Interactive Brokers is not officially established in Malaysia, hence they are not governed nor approved by our Malaysia's Securities Commission and all of our accounts opened will be regulated directly by the institution we opened our account in.

For those thinking to open an account through our IB Singapore (since it's the closest neighbour governed by MAS), sorry to tell you but unfortunately, we cannot select which of IB's entities to govern our account during the application. The entity is assigned based on our legal residence which in the case of Malaysia, our account will be opened directly under Interactive Brokers LLC in the United States.

This also means that in case shit happens, there's nothing that the Securities Commission Malaysia can do to help us, other than going directly to the international bodies (i.e. US Securities and Exchange Commission, Commodity Futures Trading Commission). However, this is not much of a concern for me - to be frank I am quite comfortable with international regulatory bodies as they're mostly pretty strict, if not more, than our counterparts.

So if you are not comfortable with international regulatory bodies - you have no other choice but to stick with local brokerages with hefty costs just to invest abroad (plus all the "handling charges" and unfavourable "currency conversions"). Unfortunately, I don't see this changing anytime in the mid-to-long term as Malaysia needs to protect our local brokerage to ensure local companies' survival. With our company's size and capital in Malaysia, how can we compete directly against a Fortune 1000 company on such a global scale?

But if you want to utilise one of the most cost-effective (and also international reach) brokerages, then read on!

Opening Interactive Brokers Account from Malaysia

Fortunately, the entire account opening process is very easy and you won't need to visit any banks or sign any paper forms. In fact, the whole process seems simpler than how I have opened my IBKR account indirectly through Tradestation Global back in October 2020 as there's no middleman involved here.

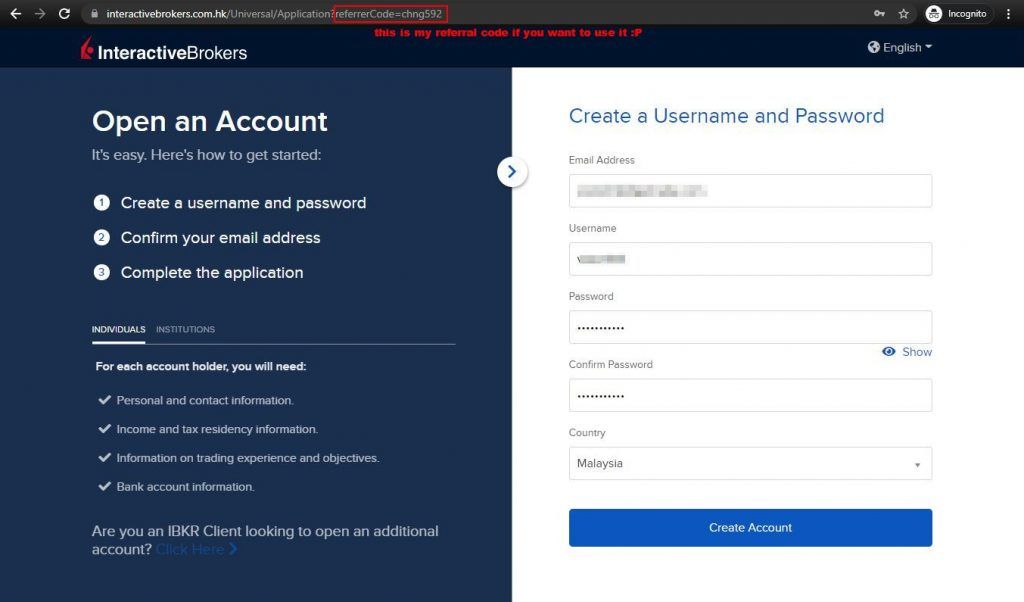

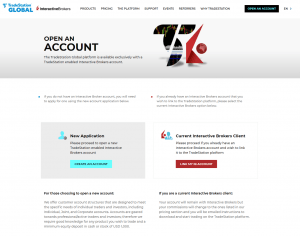

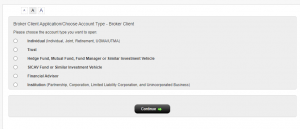

Sign-Up - Step 1: Initiate Sign Up

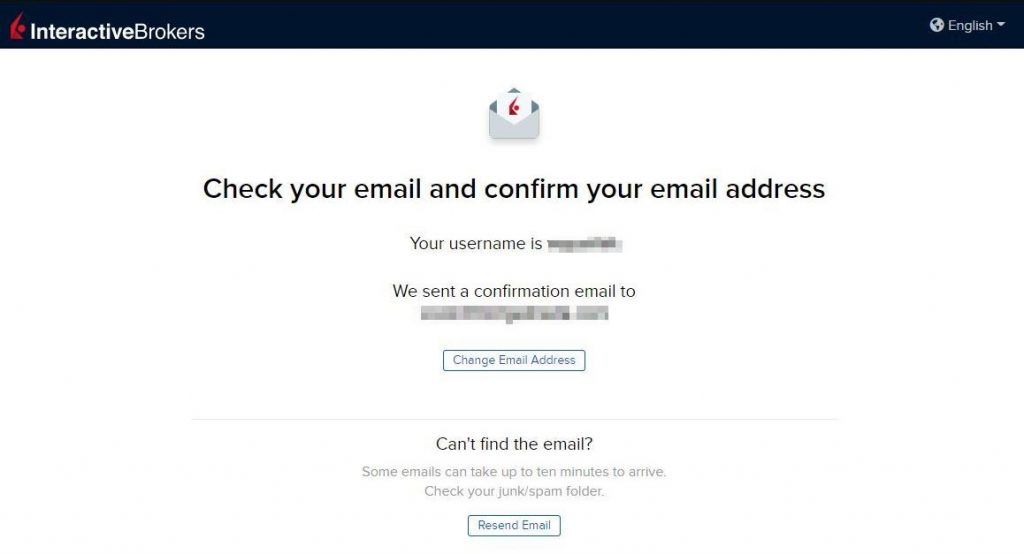

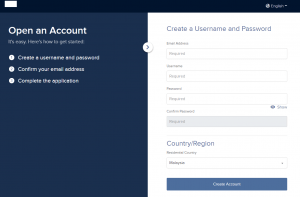

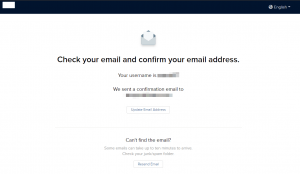

Firstly, you'll need an IBKR account. You can directly visit the Interactive Brokers' Sign Up page* and proceed to create a login account with your unique username and password, and also complete the email verification process. Only when you have done this, you can proceed with filling up the lengthy account application form.

Just head to this link* to get started on the application process. You may get redirected to different countries' website for Interactive Brokers, depending on their server. As of writing, I sometimes get redirected to either their Hong Kong, Australia, or their Global server depending on timing/connection. Nevertheless, it doesn't really impact your application process so long as you select your resident country accurately (i.e. Malaysia for most of us).

Again, it does not matter which IBKR server they route you to - as Malaysians can only have our account governed directly by IB LLC in the States.

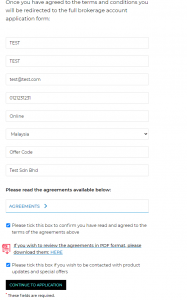

Sign-Up - Step 2: Complete Application Form

Once your email have been verified, you will be redirected to a login page asking you to key in your earlier username and password in order to proceed with Completing a Started Application process. The form itself can be quite lengthy so set aside at least 10-15 minutes to do it quietly. If you have to leave half way throughout the process, that's fine - just remember to "Save" it so that you can resume later by logging into IBKR again using the link in your email or their homepage.

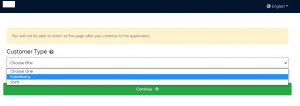

Application Form Overview

As the application form itself is quite straightforward (and lengthy), I won't go too much into all the sections in this post but instead, I'll highlight a few key points in the next few chapters and common mistakes to make sure you DON'T MISS IT. Just for a quick overview, below are all the sections you need to fill up before completing the application form. Now you know why I said could be lengthy...

- Customer Type (individual vs. joint)

- About You

- Contact Information (name, address, mobile) p/s last name is your family name; first name is your given name!

- Personal Information (date of birth, marital status, tax residency & tax identification number)

- Identification Details (identification document type, country of issuance, document number)

- Employment Details (employment status, employer details if applicable)

- Source of Wealth (where your monies from?)

- Account Base Currency (default currency used for some commissions deduction, reporting purposes, or to determine margin requirements)

- Security Questions (you'll need 3 of it. DON'T FORGET THEM!)

- Regulatory

- Account Type (cash, margin, or portfolio margin)

- Income and Net Worth (depending on your income and net worth level, you may be disqualified to access some of their product offerings)

- Investment Objectives and Purpose

- Trading Experience and Permissions

- Declaration & Reviews (W-8BEN, Tax Residence, Digital Agreements & Disclosures)

- Application Status

- Account Funding

- Mobile Verification

- Identification Document Verification

- Address Verification

Customer Type: Individual vs. Joint

For those married with spouse / partner, joint account might be an interesting option where both parties have equal rights to access / manage the account in the event of death of one holders. However, there might still be legal / tax implications or requirements surrounding the will process to avoid dispute and it is best to consult estate planning services.

As I am still single with only my mom as dependent (with sufficient cashflow elsewhere for my mom to inherit in the event of my death), my account was set up as 'Individual' customer type. For those with experience with 'Joint Account', feel free to share it in comments below!

About You: Identification Document

Whilst Passport is the "default" international document - Interactive Brokers seems to prefer our Malaysian NRIC as they can provide instant verification when you upload your identification document. I opened my account using NRIC without issues - irrespective of document you have selected, you need to submit photo of the identification document as part of the verification process.

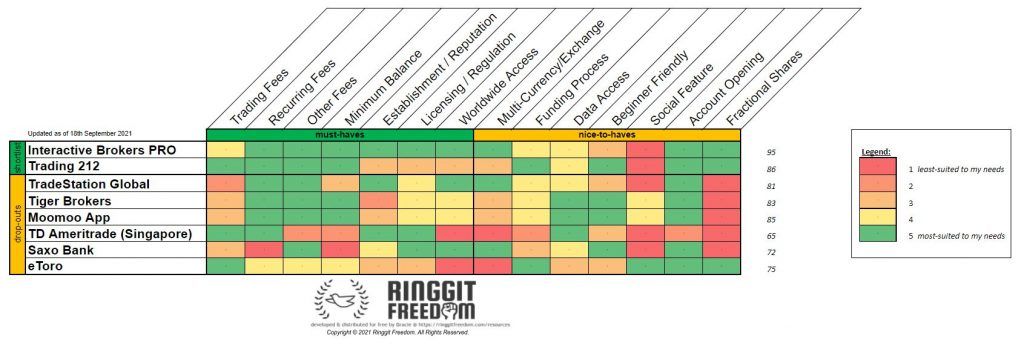

About You: Tax Identification Number

There's always confusion when it comes to TIN. Some thinks that Malaysia doesn't have one but it is wrong.

All Malaysian / Tax Residents whom are liable to report personal income tax will definitely have TIN - it's basically your LHDN Tax File Number. Don't ever skip this otherwise it might be deemed as attempt to escape taxes (though we Malaysians are lucky to have 0% capital gain tax). Input the tax number as per your file without space (e.g. SGxxxxxxxxxx for my case)

If you have multiple tax residency, make sure you highlight them as well (e.g. in-between transition during a Short Term Assignment in a overseas position). If in doubt, consult your tax agents.

About You: Base Currency

This is another area most people (myself included) get confused. From my experience it serves mainly two purposes:

- Currency of translation for statements - for consolidated reporting purposes

- Currency used to charge some of the commissions (e.g. Currency Conversion commissions)

Personally, I pick USD as it is easier for me to manage (and also to do mental mathematics) - unless if one day MYR option appears there... If interested, you can read more about base currency here.

IMPORTANT: Remember your base currency - as it'll be one of the important point shown later during funding in / currency conversion processes

Regulatory: Account Type

There are 3 types of account type here: Cash, Margin, or Portfolio Margin. For most of us, the discussion is mostly "Cash" vs "Margin" as these are much more accessible option as compared to the "Portfolio Margin" which has high net-worth requirement (read more).

Generally, you should always go for Cash Account option - unless you know what you're doing. Again, to re-iterate, never ever trade with other people's money unless you know what you are doing. Leverage is a double-edged sword as it can amplify both your returns and losses.

Nevertheless, their Margin account is very attractive with one of the lowest interest rate and personally I switched my account to 'Margin type' sometime in February 2021. On cash account, you can only place "Limit Orders" utilising the actual cash positions you have - meaning you'll have a pile of cash sitting in IBKR account doing nothing and I hated that. I don't trade on margins, but I use the Margin facility to place imaginary limit orders with a very low/attractive entry price and will only replenish cash whenever orders are filled - typically during a market crash.

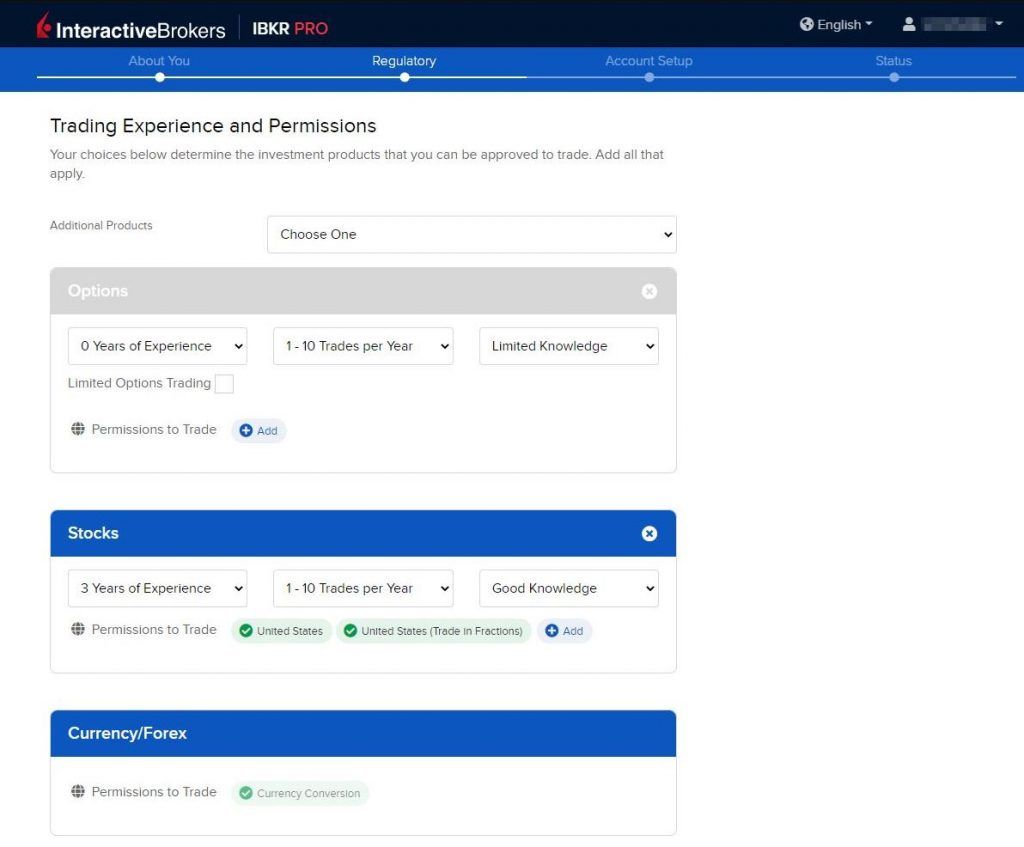

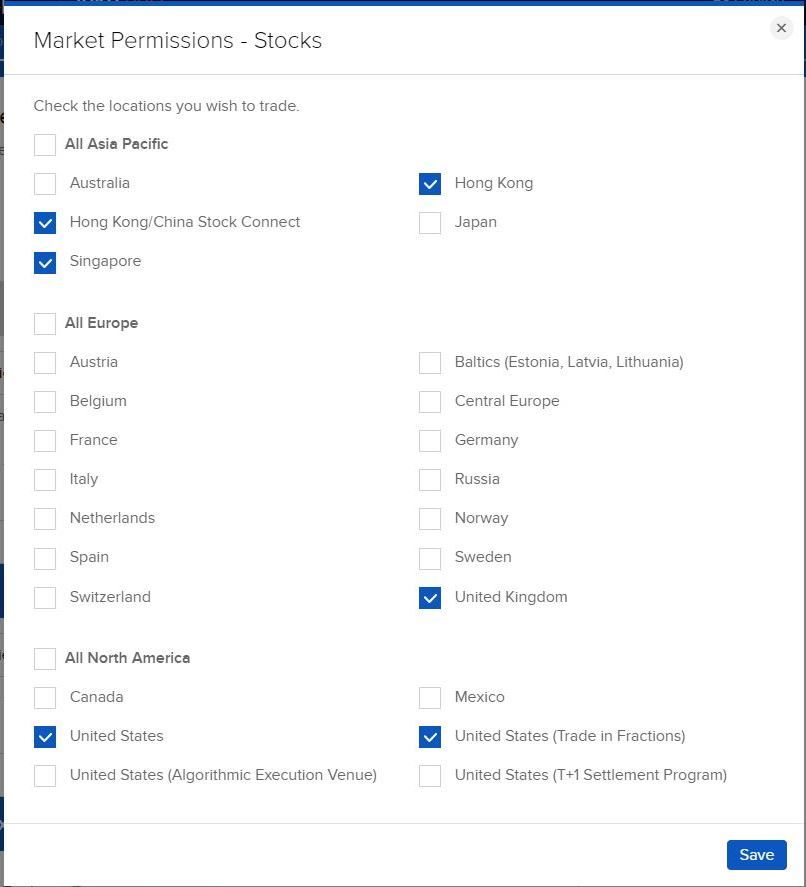

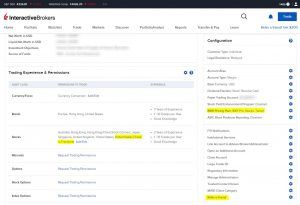

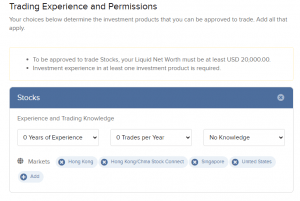

Regulatory: Trading Experience and Permissions

Choose the minimum permissions you need - you can always revisit and add more later. Personally I just went with Stocks for US (including Fractional Shares), Hong Kong, China, Singapore and most importantly United Kingdom (for my Ireland-domiciled ETFs!).

Note that they requires investor with at least sound knowledge before approving your trade permissions, and may restrict investors from getting access to higher-risk vehicles without proper experience.

Sign Up - Step 3: Complete Verification with Supporting Documents

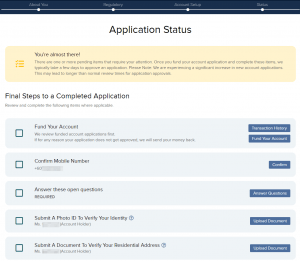

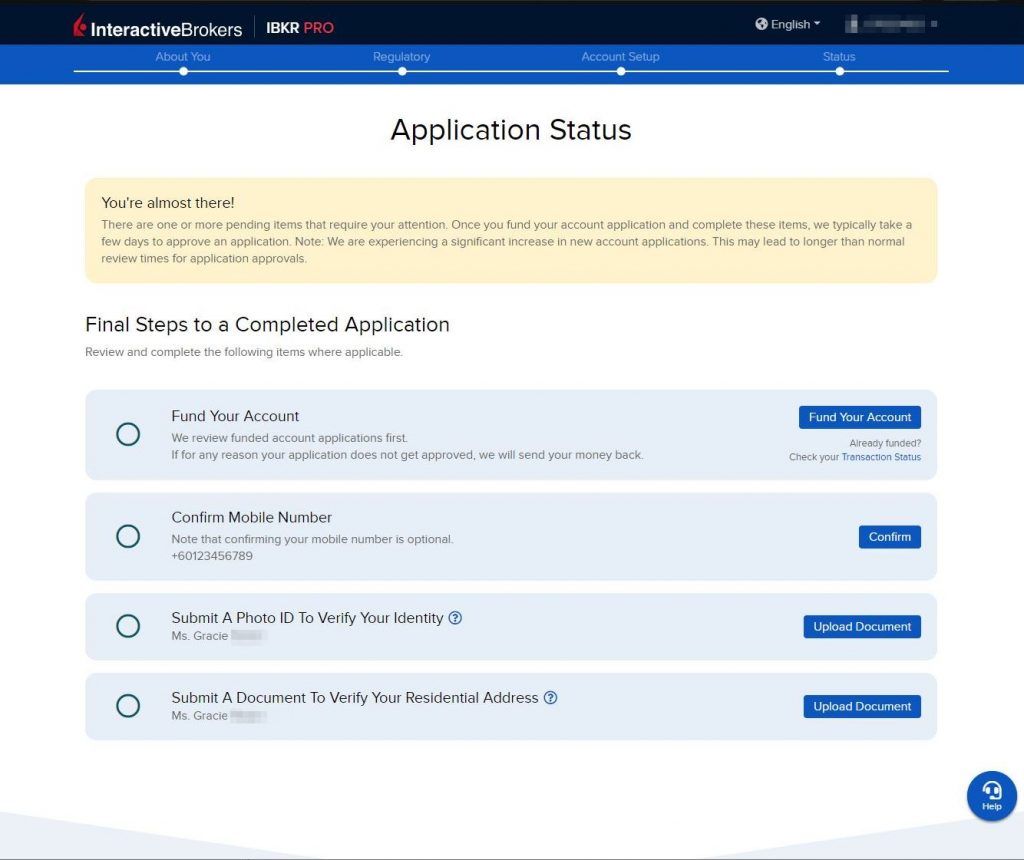

Once you have completed all the forms and signed all the agreements, you should be able to see your application status page where you need to submit supporting documents, fund your account, or verify your mobile number.

Depending on information provided earlier, there may be additional questions asked in this stage - for example, if they needed a better understanding on your income sources.

- Mobile Number confirmation - just SMS TAC verification to keep your account safe

- For Photo ID submission - as previously commented, just upload your NRIC front/back for their verification.

- For Address Verification - submit something else from credible sources with address clearly visible. They accept Bank or Credit Card Statement, Government-Issued Document/Letters (e.g. Drivers' License, Assessment Tax, etc.), Utility Bills (except Telco) or Property Evidence.

- p/s If you're thinking to use TNB - think twice. The bill is in Bahasa and if address are not spelt EXACTLY the same as your NRIC, you'll get headaches. Mine was rejected because of that and I ended up using Credit Card Statement from reputable international bank (HSBC).

- Account Funding - optional at this stage, but recommended to speed up the process. They review funded account first - see next chapter for details on funding processes.

From my personal experience, I funded my account to speed up the application process, but because of the 1x rejection (due to unaccepted address verification document), the entire application process took me close to 4-5 working days after resubmitting my address verification document (could've been shorter if I didn't get rejected to begin with).

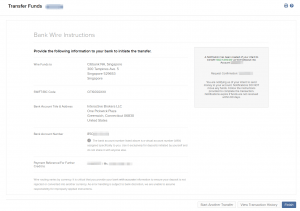

Funding Interactive Brokers Account from Malaysia

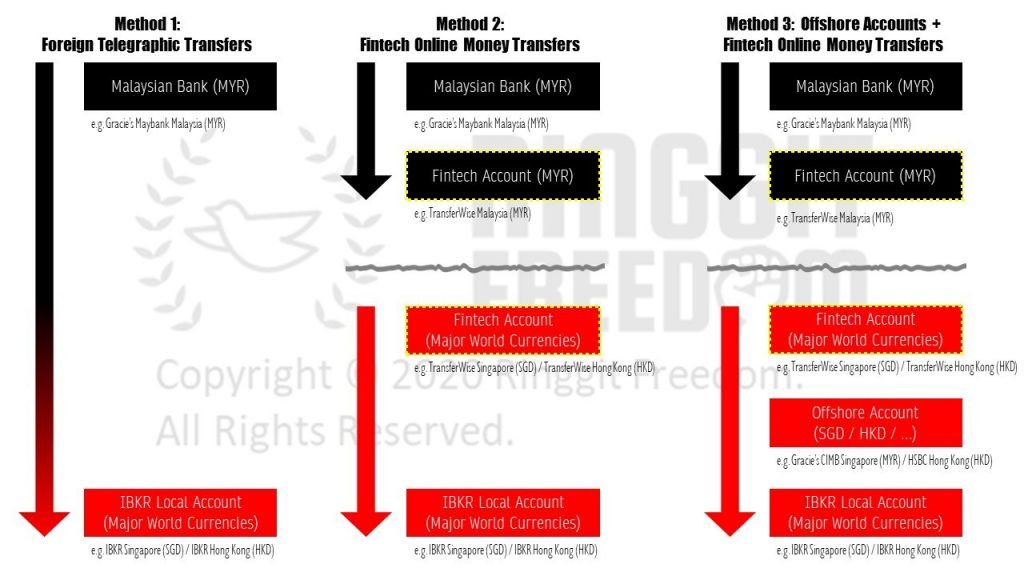

There are 3 common methods used by us Malaysians to fund our international brokerage account:

- Method 1: Directly engage your bank's Foreign Telegraphic Transfer (TT) service from your local account (in MYR) to IBKR's international account (in world's major currency)

- Money Trail: Your Malaysia Bank > IBKR International Account

- Method 2: Transfer amounts from your local account (in MYR) to Fintech's account (in MYR), and leverage the Fintech to help complete the transfer (as the middleman) through Fintech's local account into IBKR's local account in world's major currency that you choose, (e.g. local Singapore bank account for SGD)

- Money Trail: Your Malaysia Bank > Wise Malaysia Account || trail disconnected || Wise International Account > IBKR International Account

- Method 3: Similar to Method 2, but passes through your offshore account first so that the inbound transfer into your IBKR is from your own name

- Money Flow: Your Malaysia Bank > Wise Malaysia Account || trail disconnected || Wise International Account > Your International Account > IBKR International Acco

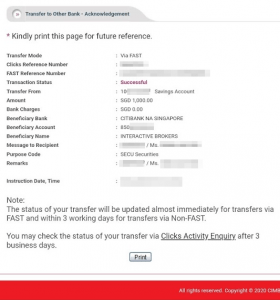

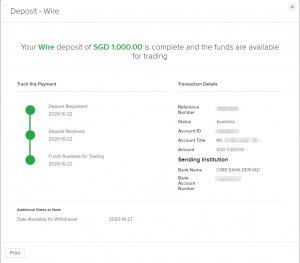

If you don't plan to withdraw any amounts from your Interactive Brokers account any time soon, then the easiest way is just use Wise and perform the transfer into your Interactive Brokers account. However, if you choose this method, there will be a few days of holding period where you cannot deploy the cash after the transfer. You may also be subjected to audit in months down the road (up to even 7++ months) where you will be requested to provide evidence and paper trail of your fund transfers.

Alternatively, if you're lazy for random audits down the road, or wants to avoid the holding period, you can also opt to open a Singapore Bank Account (fully online!) by following my guide here: Opening CIMB Singapore account without visiting Singapore for Malaysians. This will allow you to then transfer from Wise to your offshore Singapore account, followed by a local transfer using your Singapore account onto Interactive Brokers' Singapore account under your own name denominated in SGD. Through this method however, you'll need to perform a currency conversion within IBKR itself which will cost you $2 in commissions - no issues with exchange rates though as IBKR uses near real time spot-rate as the conversion basis.

I generally prefers Method 3, since it helps to ensure that all deposits into foreign brokers will always be under my own name (to keep money trails clean). Whilst you don't need an offshore account to invest internationally, I strongly recommend you to open one in case of future withdrawals as it would be the most efficient way to withdraw from IBKR. If you haven't have one - Singapore is the easiest way.

Now, to keep this guide simple, I'll only be illustrating Method 2 below as it is simply the easiest way for beginners and works for almost all international currencies (e.g. USD, EUR, GBP, HKD, etc.).

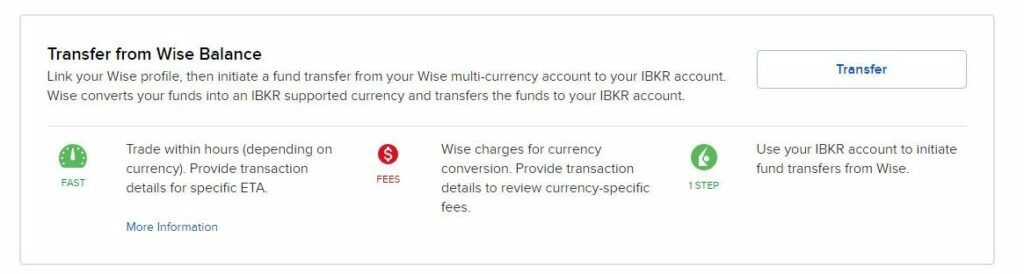

The recent update since March 2023 with direct integration between IBKR and Wise has also made this even easier to only a measly 3 steps to complete a transfer at low cost!

Funding - Step 1: Open a Wise Account (first-time setup only)

You can sign up using my referral link here**. I won't go through the details on the account opening step-by-step as it is relatively simple - sign up, complete verification, and you're good to go! Note that you MUST open a Wise account for this simplified Method 2 to work as only Wise have direct integration with IBKR.

You can also opt for other fintech players like BigPay, InstaReM, etc. depending on your preferences. I personally choose Wise as they typically the fastest transfer with competitive enough rates for most of the time. Though sometimes other Fintech players may have better rates - so there's no harm to compare rates before your transfer especially if you are using Method 3.

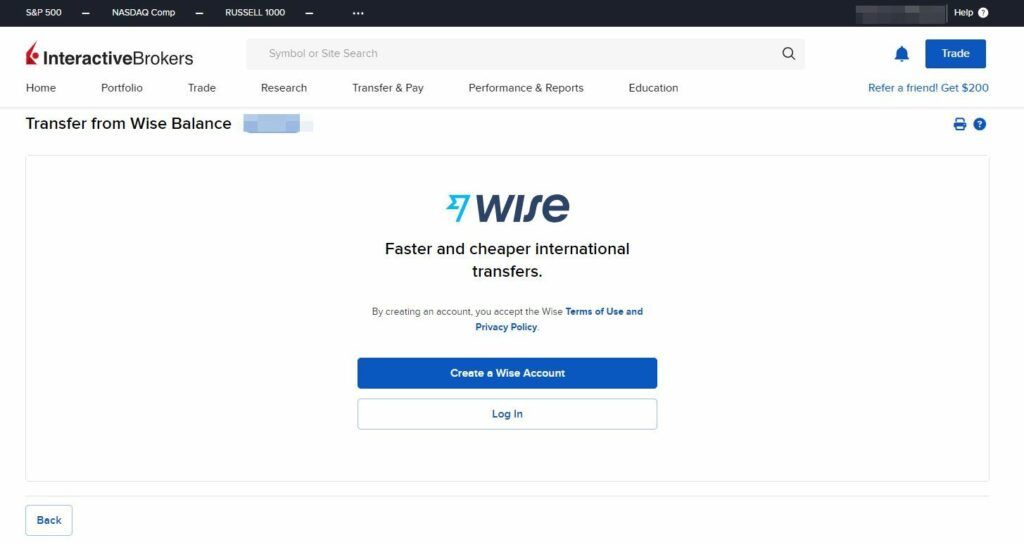

Funding - Step 2: Enable IBKR-Wise Integration for your IBKR Account (first-time setup only)

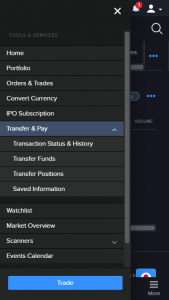

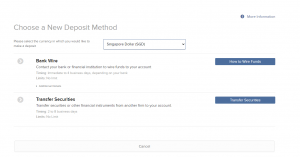

Login to your Interactive Brokers account. If your account application hasn't been approved yet, you can see the "Fund Your Account" button in your Application Status dashboard. Otherwise, if you already have a fully-activated account, just log-in and access the "Transfer & Pay" section and find the "Transfer Funds" button and you'll see this shiny new button to Transfer from Wise Balance

If you haven't linked your Wise account with your IBKR prior to this, you'll see a prompt to login into your Wise account. Simply log in to your Wise account created earlier and follow through with the steps until your account is successfully linked to your IBKR.

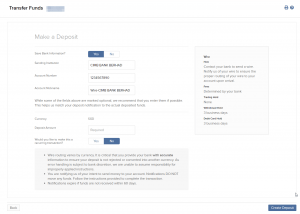

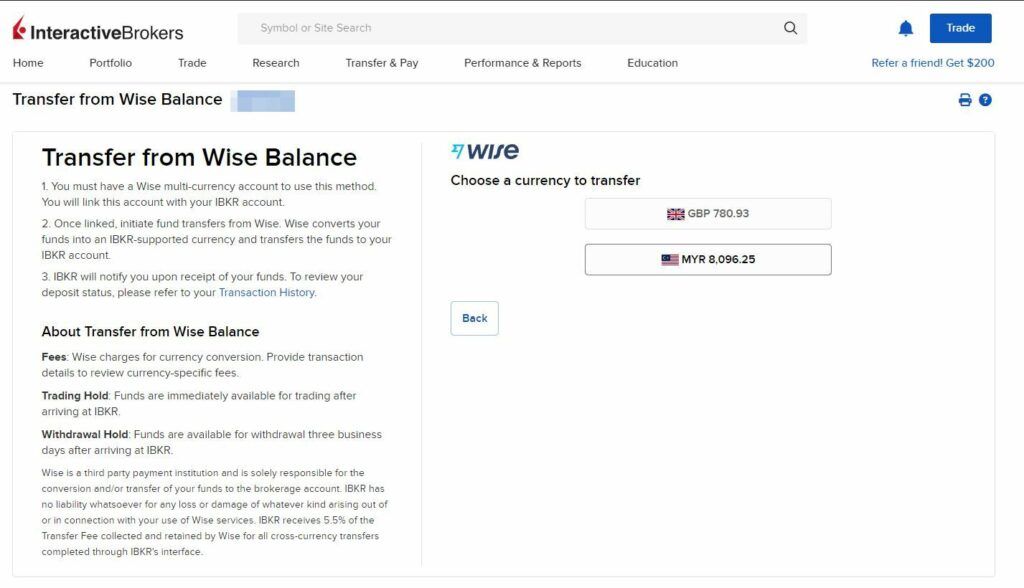

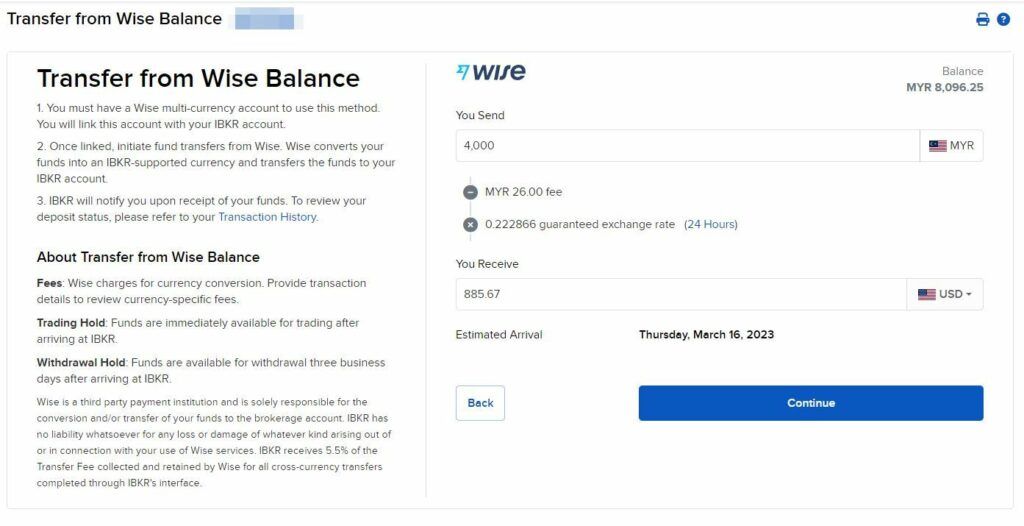

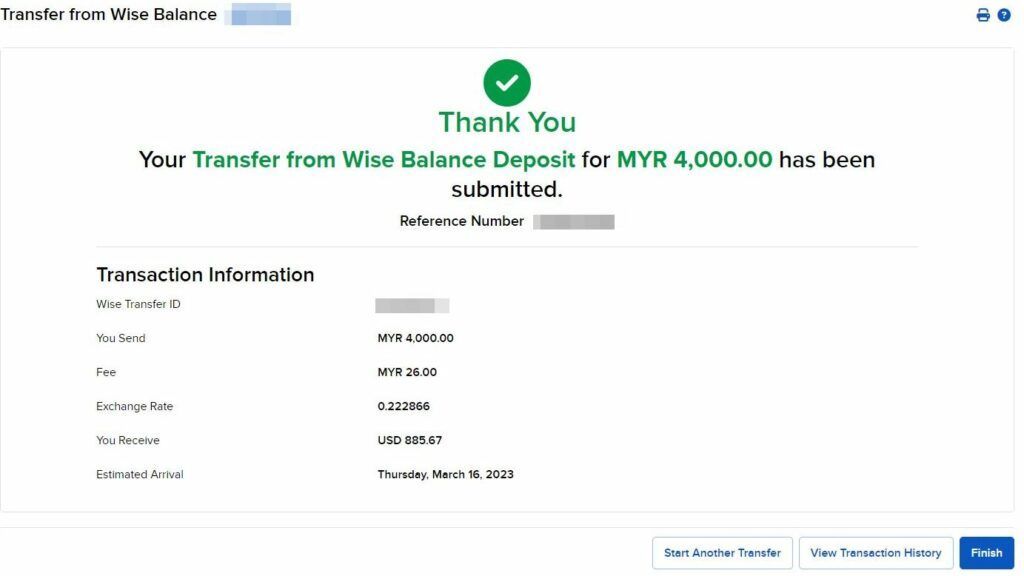

Funding - Step 3: Proceed with the Transfer from Wise Balance option in IBKR

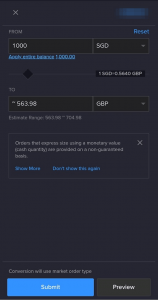

If you have successfully linked your Wise account to your IBKR account, whenever you choose the Transfer from Wise Balance option, you'll automatically see your balances in Wise directly within the IBKR page.

Ensure that you have enough funds in your Wise Account. If you don't have balances yet, just go back to Wise to initiate a topup via FPX (or any other currency). You can have balances in any currency as Wise will automatically do the conversion into your target currency. Personally, I top up directly into my Wise-MYR account.

All fees are handled on Wise, including whatever premiums that IBKR collects from Wise directly (approx. 5.5% premium on top of Wise's fee, inclusive). IBKR is not involved in this conversion process so they won't be charging you the $2 commission.

Yup. That's it, your transfer is done. If you take out the first-time setups, it's literally done in all single step within IBKR itself.

UPDATE 19 FEB 2022: With the recent Multi-Currency account made available for all Malaysians, another easier way if you opt for USD is just to enable Direct ACH Transfer for your Interactive Brokers account. Follow the similar step as above but select "USD" > "Direct ACH Transfer from your Bank" instead of the traditional "Bank Wire" method. This method is quicker as you don't even need to notify IBKR (aside from the first time set up!)

UPDATE 18 MAR 2023: With the recent addition of direct integration between IBKR and Wise, the steps to transfer are even easier and the article has been updated to reflect that. if you're interested still in the Direct ACH transfer, check out my other article here.

Navigating Interactive Brokers Client Portal

Login into Interactive Brokers via their homepage. Once your account is fully verified and approved, you will see a huge dashboard and hopefully without any errors (i.e. missing trading permissions). In case if there are some error messages, most likely your account setup has not been completed yet - perhaps wait for another business day (US timezone) and see how it goes, before contacting the IBKR Customer Support.

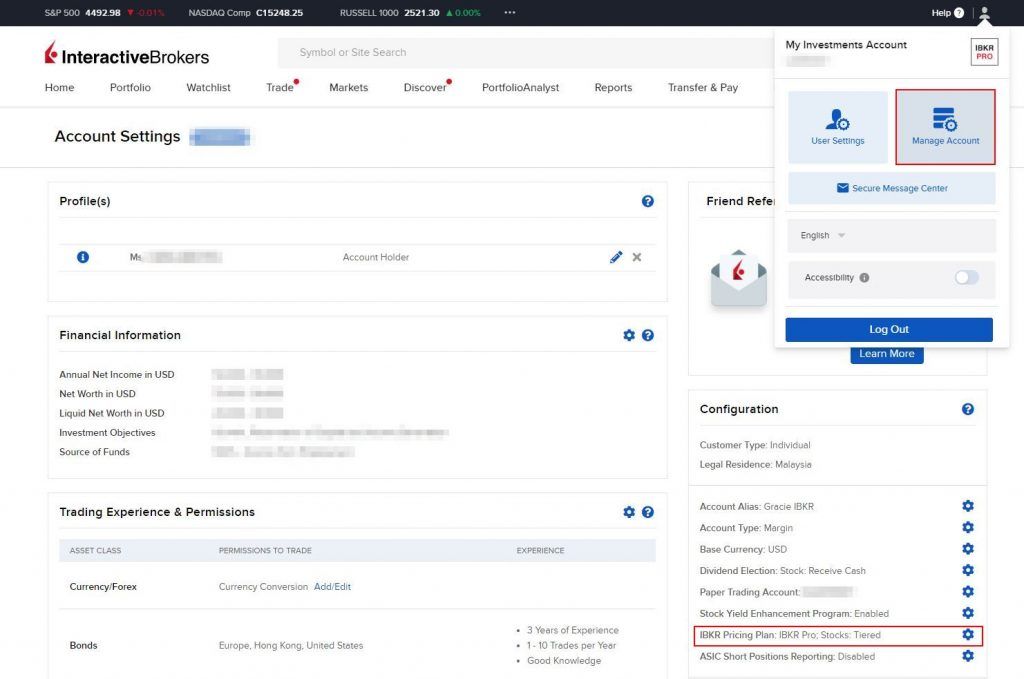

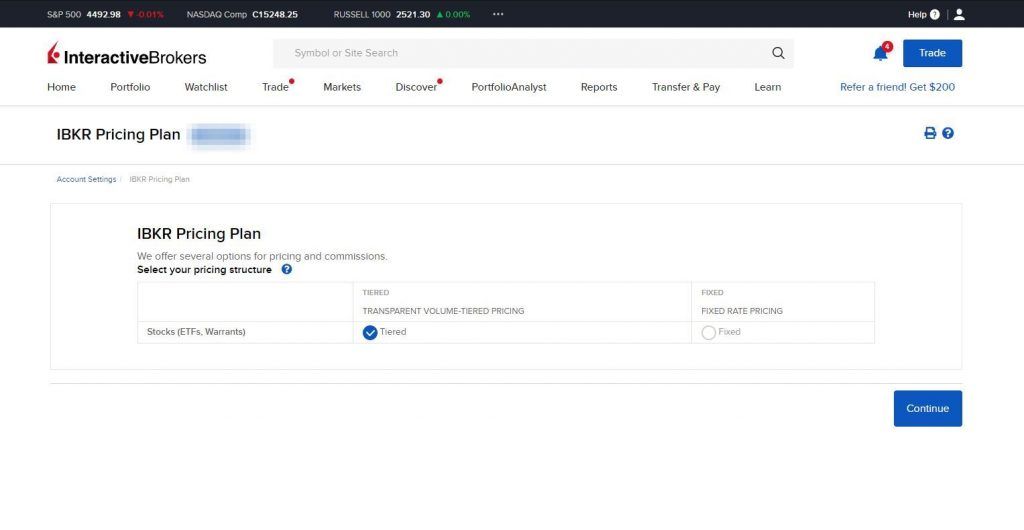

Account Pricing - Tiered vs. Fixed Pricing

When everything is ready, before you start trading - make sure to change your account pricing model to Tiered Pricing instead of Fixed Pricing as it works better for most of us unless your trade size is huge enough to leverage the Fixed Pricing model.

It's a very complex topic but the key difference between the two is where the commissions charged in Tiered Pricing is gross before adding the clearing fees and exchange fees; whereas in Fixed Pricing everything is already net inclusive of commissions, clearing fees, and exchange fees. If you want, you can do a detailed calculation using information on their pricing page here or search their examples here.

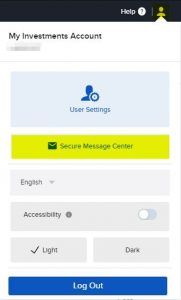

To check or change your account pricing model, head over to your 'Account Settings' page and then select the 'IBKR Pricing Plan' setting button

Once you are done, select your preferred pricing model. Personally I am using Tiered Pricing as it makes the most sense and are cheaper than Fixed Pricing, at least until when I have ultra-high net-worth and make big fat trades...

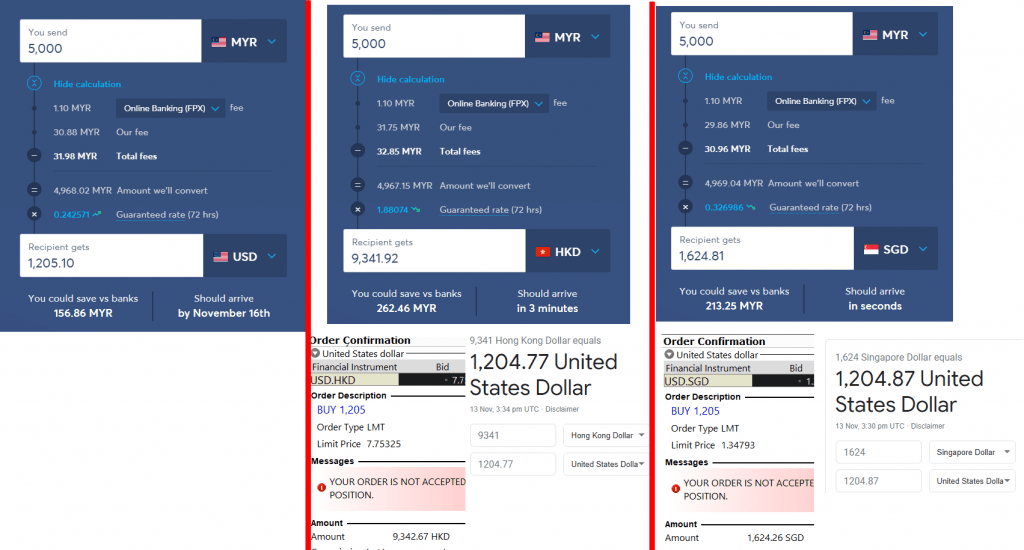

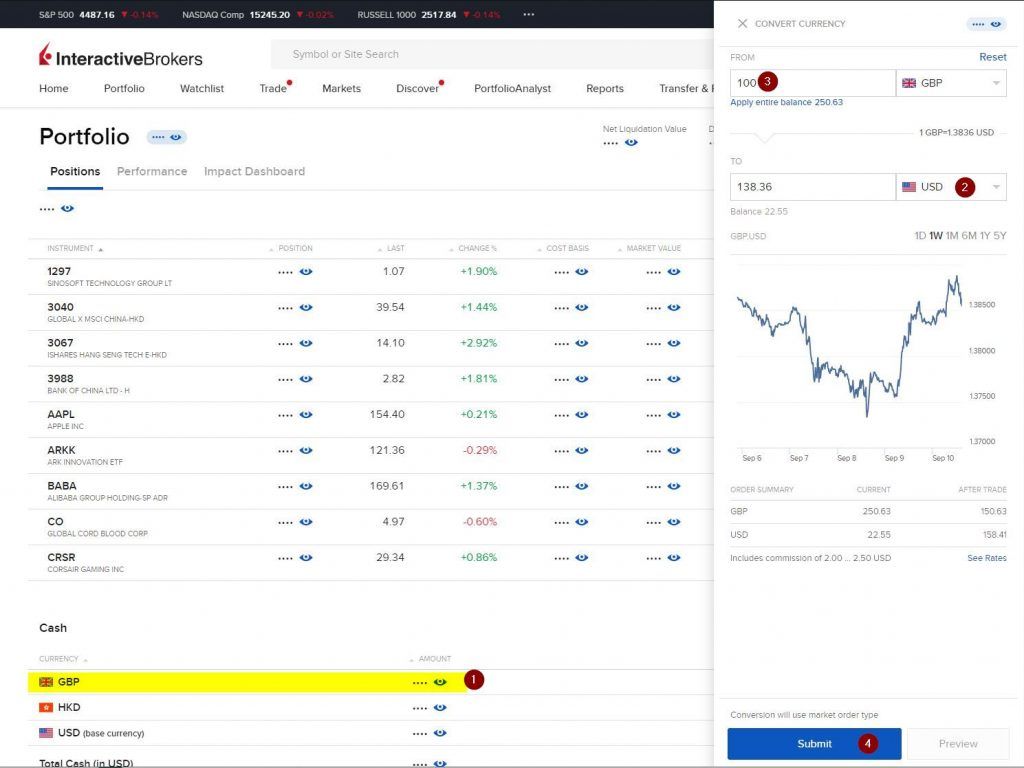

Currency Conversion

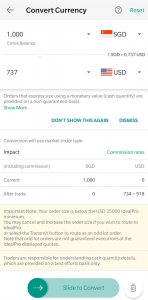

You can hold up to 26+ different currencies in Interactive Brokers, which was one of their strong selling point of dominant international presences. When you initiate a fund-in process, IBKR will store the amount you have transferred in its original currency. If the stocks / ETFs you intend to buy is different from your initially funded currencies, then you need to perform currency conversion within the IBKR itself.

To start the currency conversion within IBKR, just login to Interactive Brokers and select Convert Currency from the menu. Select the currency you currently own and convert it to your target currency, which will be used to purchase stocks / funds. Once confirmed, just submit the order and it will usually take a few seconds or minutes to fill-up the currency exchange order.

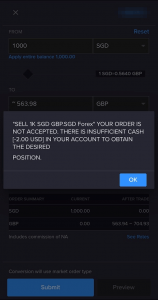

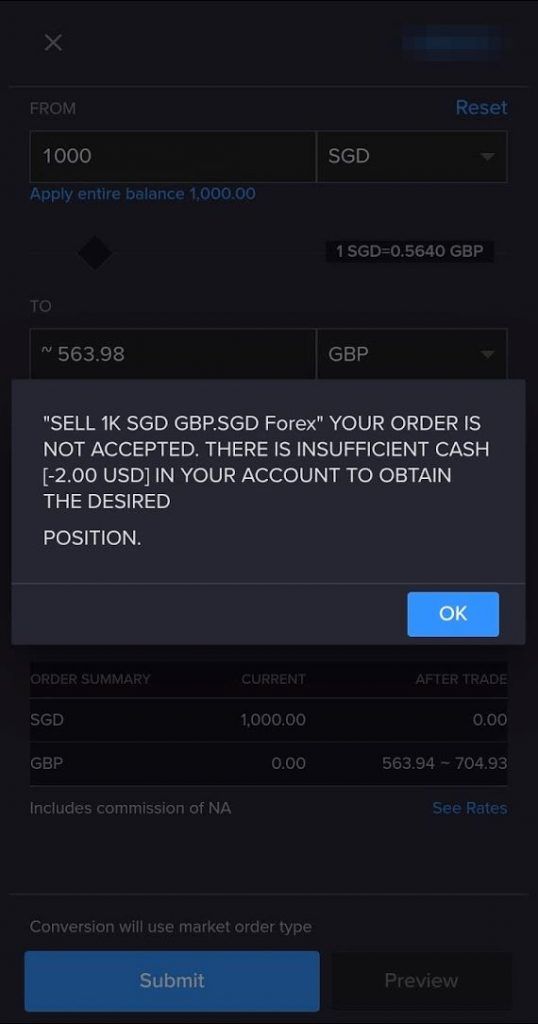

In case if you get some error message like "Your order is not accepted. There is insufficient cash [-2.00 USD] in your account to obtain the desired position." like below, then it means that your Base Currency do not have the sufficient amounts required to cover the FOREX commissions. So make sure to always fund your base currency first before anything else. Back then, I solved mine by converting some amounts into USD so that it has some balances to cover FOREX commissions.

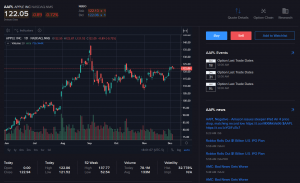

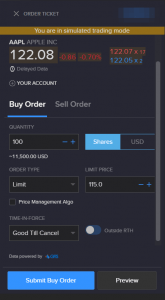

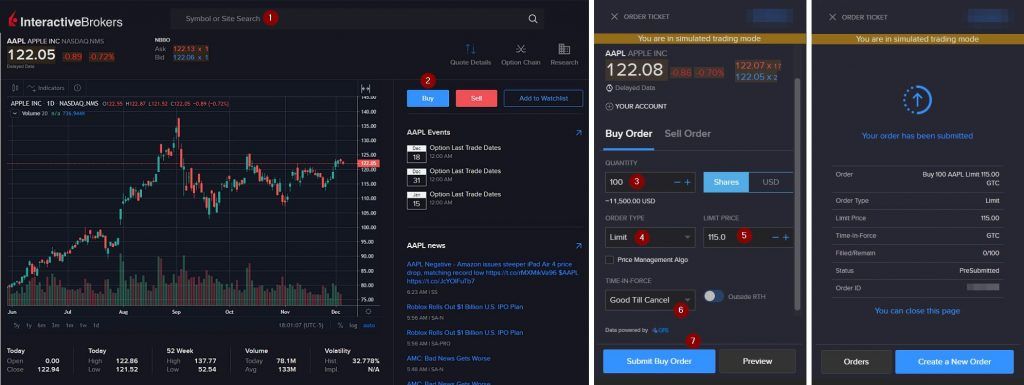

Buying Your First Stock

Once your account has sufficient funds (or if you're within margin limits), you can go ahead and place your order for your first stock (or ETF!). Buying stocks using their web app (or mobile app) is actually very simple - in 3 steps:

- "Search" the ticker symbol (e.g. AAPL)

- Hit "Buy" and input your desired quantity/order type/price/time-in-force

- And hit the "Submit Order" button and you're done!

What's Next?

I hope this guide have been helpful in your journey to get started with opening an international trading account, tapping into the power of Interactive Brokers. Frankly I'm grateful to be able to utilise IBKR sooner than imagined, thanks to their initiative to remove inactivity fees back in July 2021.

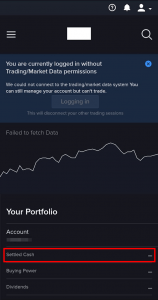

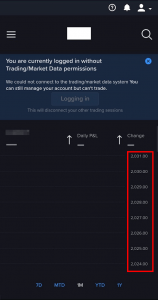

As you can see from My Portfolio, I am a strong advocate for passive and long-term investing through ETFs, and IBKR's global access with spot-rate currency conversions, plus its low commission / fees structure is really a blessing for me.

Thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie

DISCLAIMER

This is NOT a sponsored post, but contains affiliate link where I may get rewarded when you sign up with my link and fulfils certain criteria.

* by using my Interactive Brokers sign-up link, you will be indirectly supporting my blog as I get a very small token of commission for every successful click by unique visitors.

** by using my Wise referral link, I will get 30 GBP for every 3 successful referrals when you complete your first transfer and part of the commissions will go to a non-profit community charity foundation.

PROMOTIONAL RELATIONSHIP DISCLOSURE FROM INTERACTIVE BROKERS

This content is provided by a paid Influencer of Interactive Brokers. Influencer is not employed by, partnered with, or otherwise affiliated with Interactive Brokers in any additional fashion. This content represents the opinions of Influencer, which are not necessarily shared by Interactive Brokers. The experiences of the Influencer may not be representative of other customers, and nothing within this content is a guarantee of future performance or success.

None of the information contained herein constitutes a recommendation, promotion, offer, or solicitation of an offer by Interactive Brokers to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy. Investment involves risks. Investors should obtain their own independent financial advice and understand the risks associated with investment products and services before making investment decisions. Risk disclosure statements can be found on the Interactive Brokers website.

Interactive Brokers is a FINRA registered broker and SIPC member, as well as a National Futures Association registered Futures Commission Merchant. Interactive Brokers provides execution and clearing services to its customers. For more information regarding Interactive Brokers or any Interactive Brokers products or services referred to in this video, please visit www.interactivebrokers.com.

The post Beginner's Guide: Investing Abroad via Interactive Brokers from Malaysia appeared first on Ringgit Freedom.

]]>The post Interactive Brokers: Inactivity Fees Removed!? appeared first on Ringgit Freedom.

]]>- has at least USD100K in portfolio's worth

- generated at least $10 in commissions on a monthly basis - which requires at least 28 small trades (assuming 100 shares per trade)

After some digging, turns out that they've effectively eliminated the fees for good (at least for now...) as a measure to remove impediments for potential clients to maintain accounts with IBKR.

Removal of these conditions have sent some shock waves across various forums, blogs, or even in Reddit itself - not just Malaysia, Singapore, but also the European part of the world.

Frankly speaking, I was very sceptical when the news first broke out, as it seemed too good to be true but after digging around for a bit, it REALLY IS TRUE! I guess Christmas came early this year...

Table of Contents

- What's with all the Fuss!?

- Why Interactive Brokers?

- I’m already with TradeStation Global, What Now!?

- I’m new and wants to apply with Interactive Brokers, How?!

- Wrap Up

What's with all the Fuss!?

When I first decided to diversify from investing locally within Malaysia, into investing abroad across various international markets - one thing that frustrated me was that I couldn't find a PERFECT brokerage that suits my investing style.

I like to buy and forget, barely making any transactions on a quarterly basis, wants exposure beyond just the US with strong international bank account presences, and dislikes managing multiple brokerage account

That's how I first ended up with TradeStation Global - as the only reason was that dreaded inactivity fee from IBKR. With my current net worth and investment style, I simply cannot generate at least $10 in commissions on a monthly basis; nor I have a $100K USD worth of Portfolio to be eligible to waive the fees.

AND I WAS NOT ALONE! There's plenty of us on the FI journey who have opted for alternative brokerage house just for this reason alone.

The simple act of removing monthly fees with zero minimum balance has literally sent the shockwave to all of us - who was on the fence, with a strong urge to jump into IBKR's lap immediately.

Why Interactive Brokers?

While TradeStation Global worked very well as a painkiller, doing almost everything that Interactive Brokers does without the monthly fees; but indirectly we have to pay a slight premium for every trade that we make - i.e. minimum commissions of $1.5 for TSG vs $0.35 for IBKR.

Let's not also forget - the vanilla IBKR PRO allows their customer to activate for free the "Fractional US Shares" feature on their account, whereas the TSG users are not eligible to. Frankly, these are the only two potential key differentiating factors when comparing the two, since TSG holders have already long-enjoyed all the other perks that come with Interactive Brokers.

Just as a quick recap, any investors through Interactive Brokers (whether directly or indirectly via TSG) are already enjoying these features:

- Access to major stock exchanges around the world, including my personal favourite Ireland-domiciled funds on London Stock Exchanges (or China/HK-domiciled Funds on Hong Kong Connect)

- Strong international presence with several currencies supported (with bank accounts in the respective currencies' country)

- True spot exchange rate with zero markups on the exchange rate, with a low currency conversion fee of only $2.

- Flexibility in using 3rd Party Transfers such as Wise to fund their account (documentation/audit trail required!)

- Strong investors' protection and recognition across reputable regulatory bodies around the world - US, UK, EU, SG, HK, AU, and so on.

I'm already with TradeStation Global, What Now!?

I believe most of us have already, to a certain extent, already have the thought process to immediately jump-ship from TradeStation Global into the Interactive Brokers. As mentioned in previous chapter, the differences between the two are so minimal and really boils down to the following:

- IBKR PRO allows investor to activate fractional shares (for selected US stocks only)

- IBKR PRO have lower minimum-commissions per trade, at $0.35 for US shares (vs. $1.50 at TSG)

Should I De-link from TSG?

As with all decisions, it's always personal and up to you. What's most important is that the decision works for you - and here are some thoughts process that may help you to navigate through it:

Does your trade frequency / volume benefit from the low-commission rate?

IBKR's rate at $0.0035/shares with minimum of $0.35 per trade vs. TSG's $0.0070/shares with minimum of $1.50 per trade

How important is US-fractional shares trading to you?

Since the Fractional Shares trading feature only covers selected US shares, those of us whom are heavier into index funds domiciled in Ireland (or Hong Kong, in my case) will be out of luck

Do you need it NOW?

Competition is always good - as it pushes business into doing more things to acquire or retain customers. Perhaps, on the hindsight, IBKR would not even make this drastic decision if not for the likes of TSG (and all the new zero-commissions brokerage out there)

TSG's response have been subtle so far (by eliminating minimum funding requirement) - we'll never know what they may offer as part of their desperate retention strategy

What's My Decision?

I was still hesitating when I was preparing for this article - and writing definitely has helped me to better organise and crystalise my thoughts process allowing me to think deeper before jumping the gun.

On one hand, I want to switch immediately, as I have always wanted to apply with IBKR but wanted to save on the $10 monthly fees. On the other hand, I'm also curious as to what TSG will come out with, in desperation, to escape this unscathed. Especially since their secondary Unique Selling Point (or might even be primary), has always been the zero-inactivity fee with low-minimum funding but still having the near-full IBKR experience.

Of course, they still have their fancy desktop app, but that might appeal more to sophisticated traders and not retail investors like us. No matter how much I think about it - it seems to be an extremely sticky situation for TSG to be in as their current business model is to generate profits from the markup commissions.

If they are forced to commission-match with IBKR, that means their income source has to come from elsewhere - and I just cannot think what else they can offer at this stage except to tap into their proprietary software and also dedicated advisory support.

Looking back at the Brexit incident not too long ago where TSG had to handle a similar crisis - TSG was forced to introduce a monthly $15 Subscription Fee for their software after matching IBKR's default commission model. Even in that situation, it seemed to make more sense to stick with standard IBKR's $10 monthly fee (at that point in time, prior to the removal today) - unless you really want the software.

Given the outlook, I'm leaning more towards going ahead with the de-link since I don't see much maneuvers/cards that TSG can play from business model perspective.

Step-by-Step to De-Link TradeStation Global from Interactive Brokers

Thanks to the power of the internet, and various contributors ranging from my friend, Lowyat Forum, Reddit, most importantly IBKR FAQ - I managed to compile the below steps even before I completed the delinking process myself.

Below is a rough summary of what I have went through so to manage the expectations, for someone who were quite unlucky (compared to few others that I see in LYN forum)

- Saturday, 10th Jul 0100: Sent completed form to TSG, cc IBKR, with ticket lodged

- Monday, 12th Jul 2200: Email received from IB on verbal verification requirement

- Tuesday, 13th Jul 0030: Completed verbal verification by calling the Hong Kong number

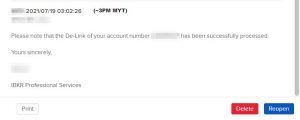

- Saturday, 17th Jul 0430: IBKR "unlocked" with IBKR Pricing Tier, US Fractional Shares checkbox, and Refer a Friend functionality.

- Monday, 19th Jul 1502: Received message from IBKR indicating the completion of my account de-linking process.

- Tuesday, 20th Jul 1000: Verified Trade Confirmation Reports for 19th July and confirmed that TradeStation International Ltd is no longer reflecting in my account statements.

One key takeaway throughout this exercise is this: EVERYONE'S DE-LINKING EXPERIENCE IS DIFFERENT. Very odd for an institution which should have some sort of standardized processes to a certain extent.... But hopefully the below steps would still be useful as a reference to kickoff your de-linking journey, should you proceed!

Step 1: Request to De-Link Account via TSG Support

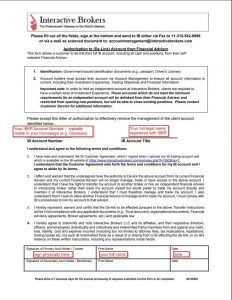

When you first send an email to TradeStation Global to request to de-link your account, they will share the below authorization form to fill up. To speed up the process, you can get a copy of this PDF here.

You must physically print it, sign it, and scan it back to them, together with your ID copy attached. Electronic signatures are NOT ACCEPTED!

I don't know if it's required, but I just kept keep [email protected] in copy when I sent the email.

Step 2: Notify IBKR to perform manual transfer review

Once you have emailed TSG on the authorization to de-link, you may proceed to notify IBKR through their ticketing system to perform a full manual transfer review so that you can complete the transfer from Master Account into Individual Account

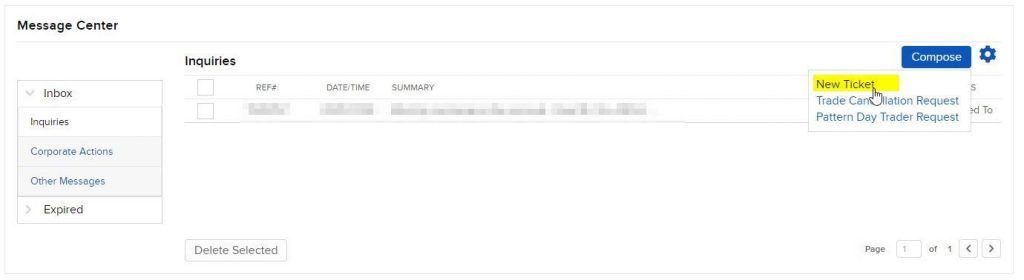

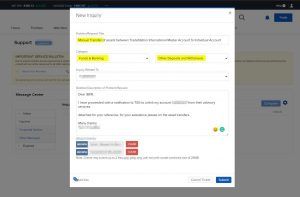

2.1 Login in to your IBKR Web Client and go to "Message Center"

2.2 Submit a New Ticket

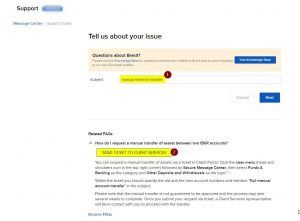

2.3 Search for manual internal transfer then go ahead and click on "Send Ticket to Client Services"

2.4 Make sure to select "Fund & Banking" and "Other Deposits & Withdrawals" as the categories.

As for the details, FAQ mentioned to provide old/new account number - I can't seem to find any different account numbers generated for TSG so I omitted that - will update back when I hear from IBKR team.

Step 3: Time for a Verbal Verification... better remember your Security Answers!

As I did both Step 1 & 2 pretty late on Friday night, I have probably missed Friday's train on the transfer verification processing. Thankfully the wait wasn't too long and I have gotten the verification request email on the subsequent working day during Monday evening (UK time).

All the email does is to ask you to call them to perform a verbal verification.

You will need the following details with you (at least in my case):

- Reference Ticket # (above email)

- Your Mobile Phone with App on standby (they may send a notification to verify via biometrics)

- IBKR Account # Number (Uxxxxxx)

- Current Master Name (TradeStation International)

- Full Name

- Date of Birth

- Birth Country

- Security Question #1, #2 and #3 (p/s if you forgot your security questions, take a look at this list and see if any of it rings a bell. Otherwise, you might have to reset it by sending it to the email listed in the form)

I have briefly summarized the processes that I went through.

3.1 Pick a Number and Call IBKR

I selected their Hong Kong ones (+852-2156-7907) as it's cheaper for me to dial Hong Kong than US via my company phone. In any case, it doesn't really matter as I called them midnight Malaysia time hence the Hong Kong agents was already out, and the call was automatically routed to US/Europe agents as they utilize Follow the Sun support model with 24 hours coverage.

There's a few greeting IVR's to go through and all-in-all I waited for approximately ~13 minutes (with good soft music choice). Below was the IVR menu that I went through, but may differ depending on timing/the number you called.

PRESS 1 FOR ENGLISH

PRESS 1 FOR EXISTING ACCOUNT

ENTER 7 DIGIT ACC NUMBER

PRESS 2 FOR TRANSFER-RELATED INQUIRIES

PRESS 0 FOR MENU

PRESS 3 FOR OTHER POSITION TRANSFERS - REMAIN ON THE LINE FOR LIVE AGENT.

From what I have gathered so far, it might be better off to just install Skype and and dial their US TOLL FREE number @ +18666942757. As a matter of fact, it might even be worthwhile to just install Skype app on your phone, save the number to the contacts, so that in case of emergency you'll be able to connect with IBKR, free of charge.

3.2 Once routed to a Live Agent...

Inform them of your intent to perform verbal verification, and provide them with the case reference number (in the email)

Before they proceed further, they will first verify your identity via mobile app notification. They will send a notification to your IBKR Mobile App and requests you to click on the notification to get verified using my phone's biometrics.

Following that, it's exam time! Just answer the questions listed in the earlier section.

I almost panicked when I forgot the answer to my 3rd question as I don't remember what was the answer I set. Gosh, why did I even set myself up with a security question that has multiple-choice answers!?!?!?

The problem for me was I had to take the call in an impromptu manner since I don't remember the security questions I have set during registration. There was also no way to warm up as the security questions set was not visible in IBKR Portal.

Thankfully I got it right after 3 attempts and the verification is then completed - I think the Agent was being nice to me since I answered everything else pretty much immediately, except the last security question.

The call was done in less than 5 minutes. At this juncture, all I was told is wait - no timeline, no commitment, nada. According to the agent, it really depends on the backlog/queue and it is hard to say now as he does not have visibility. In case of any updates, they will reach out again via IBKR Messages or Email so I was told to keep an eye on it.

Step 4: Now the hardest part... patience and wait!

From what I read online in various Reddit posts - this entire process will take at least 3 days (if you're lucky) or up to 3 weeks (which happened during the Brexit peak).

Looking at the current situation, I'd assume that we'll be closer to the peak period than the non-peak - since it's basically a crisis for TSG. Fortunately for me, the entire process took only approx. 8 days - which is also a mixture of late-submission hence missing the boat and/or being unlucky to go through verbal verification.

There are few ways to check the progress, with the easiest being the Home screen no longer censoring IBKR's logo and an additional "Refer a friend" tab appearing.

If you visit your account settings, you will also see a few options added where you can now sign up for fractional shares, select IBKR pricing plan, or visit your Refer a Friend page.

The last method that you can check on the progress is to run any report and check if the Account is still assigned to TSG as the Master Title. I'm still waiting for 19th July's Daily report which would probably only come by end of day US time...

And finally - my account is fully de-linked!

On the 19th July evening - I finally received a message from IBKR indicating that my account de-linking process have been successfully processed.

Verified it in the reports section and it is indeed not showing Master Account Title under TradeStation International Ltd anymore.

Just as a quick recap, below are what I went through but remember that everyone's experience may differ slightly depending on your luck (and the person handling your case) - so don't worry even if you went through a slightly different process than what I did. Most importantly is the outcome. Do share in the comments below your experience so that others can also benefit from it!

- Saturday, 10th Jul 0100: Sent completed form to TSG, cc IBKR, with ticket lodged

- Monday, 12th Jul 2200: Email received from IB on verbal verification requirement

- Tuesday, 13th Jul 0030: Completed verbal verification by calling the Hong Kong number

- Saturday, 17th Jul 0430: IBKR "unlocked" with IBKR Pricing Tier, US Fractional Shares checkbox, and Refer a Friend functionality.

- Monday, 19th Jul 1502: Received message from IBKR indicating the completion of my account de-linking process.

- Tuesday, 20th Jul 1000: Verified Trade Confirmation Reports for 19th July and confirmed that TradeStation International Ltd is no longer reflecting in my account statements.

I'm new and wants to apply with Interactive Brokers, How?!

You may refer to this step-by-step guide on Beginner's Guide: Investing Abroad via Interactive Brokers from Malaysia. The guide will basically carry you from zero-to-hero up to buying your first stocks successfully via Interactive Brokers. Or if you're lazy to read through articles and just want to brave through the process, here's the direct sign-up link* for you!

Why? Because TradeStation Global has always been using IBKR's backbone, and their role has always been an introducer with differentiation from product commissions/pricing perspective, as well as their in-house developed app.

Wrap Up

I hope this guide has provided you with a deeper insight on the whole saga from Interactive Brokers' decision to remove monthly inactivity fees from their product offerings, which opened up a whole new opportunity for some of us (especially buy-and-hold investors).

On the flip side, I personally feel bad for introducer brokers like TradeStation Global as they have been able to provide this service for years, by charging a slightly higher commission premium as their business model - and this decision definitely will impact them. I'm also wondering how much information was shared by IBKR to their business partners (introducer brokers) when these decisions were made...

In any case, it is a capitalist world and the fittest and agile ones may survive. Let me know what would be your decision - whether if you would stick with the existing TSG to see their counter offers, or to jump ship already to IBKR?

As always - thanks for reading and see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie

DISCLAIMER

This is NOT a sponsored post, but contains affiliate link where I may get rewarded when you sign up with my link and fulfils certain criteria.

* by using my Interactive Brokers sign-up link, you will be indirectly supporting my blog as I get a very small token of commission for every successful click by unique visitors.

PROMOTIONAL RELATIONSHIP DISCLOSURE FROM INTERACTIVE BROKERS

This content is provided by a paid Influencer of Interactive Brokers. Influencer is not employed by, partnered with, or otherwise affiliated with Interactive Brokers in any additional fashion. This content represents the opinions of Influencer, which are not necessarily shared by Interactive Brokers. The experiences of the Influencer may not be representative of other customers, and nothing within this content is a guarantee of future performance or success.

None of the information contained herein constitutes a recommendation, promotion, offer, or solicitation of an offer by Interactive Brokers to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy. Investment involves risks. Investors should obtain their own independent financial advice and understand the risks associated with investment products and services before making investment decisions. Risk disclosure statements can be found on the Interactive Brokers website.

Interactive Brokers is a FINRA registered broker and SIPC member, as well as a National Futures Association registered Futures Commission Merchant. Interactive Brokers provides execution and clearing services to its customers. For more information regarding Interactive Brokers or any Interactive Brokers products or services referred to in this video, please visit www.interactivebrokers.com.

The post Interactive Brokers: Inactivity Fees Removed!? appeared first on Ringgit Freedom.

]]>The post StashAway Malaysia Review: Investments Automated appeared first on Ringgit Freedom.

]]>For those of you who have been following my investment journey, you will definitely notice that StashAway contributes a significant portion above 25% of my entire portfolio.

There are few good reasons for this, and today we'll be breaking down on how exactly StashAway have helped me to automate my financial journey. But before we do that, as always, let's at least first understand what and who StashAway Malaysia is about!

Table of Contents

- What is StashAway?

- How Safe is StashAway?

- Why do I like StashAway?

- Passive Investment Strategy

- Diversification, Rebalancing & Re-optimisation

- Automated Deductions

- Low-cost

- Goal-Based Investing

- What StashAway could’ve done better?

- Fees

- Processing Lead Time

- Custom Portfolios

- Wrap Up

What is StashAway?

StashAway is a Robo-advisory investment firm providing digital wealth services aiming to simplify investing, targeted at retail investors. StashAway was founded back in 2016 and headquartered in Singapore, but their initial product launch only happened almost a year later in July 2017 for Singapore and have since expanded into StashAway Malaysia since November 2018.

With the word "Robo" - most people can't help but think that there is some form of robot / artificial intelligence (AI) involved in making investment decisions to maximise profits for the client. This has to be one of the most common misconceptions people have with StashAway or any Robo-advisors for the matter.

While that may be one of the potential future direction for Robo-advisors to grow, in terms of technology in the distant future, the "Robo"-advisory in today's FinTech has not reached that stage and are mostly limiting its "Robo" use to risk assessment and consumer profiling, relying on consumer's input and a set of rather fixed algorithms.

These algorithms, on behalf of human-advisors, will then come out with some proposals on how much risk appetite the customer should be taking into account their current income, assets, liabilities, investment horizon, and goals.

How Safe is StashAway?

As with any other forms of investment, it will typically involve ones' hard work and savings so it's only natural to worry about the security of our funds - and whether if it is in good hands. Hence it's not surprising to see the below predictions when searching for "is StashAway ...." as the public may be concerned about how safe is their money with StashAway Malaysia.

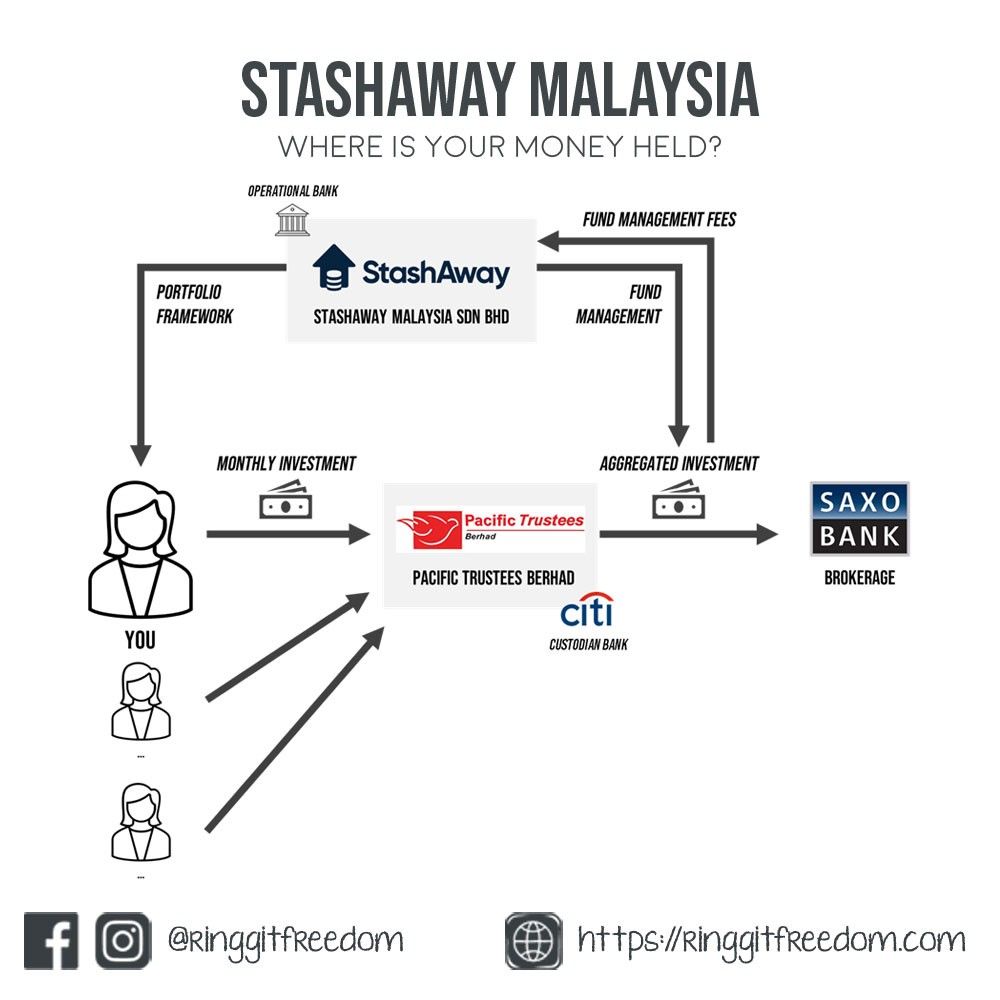

Fret not, StashAway Malaysia is regulated by our beloved Securities Commission Malaysia, granting StashAway Malaysia with the Capital Market Services License (CMSL) to provide fund management services to us, the retail investors. Just like any other financial institutions, StashAway is subjected to the same compliance, audit or reporting requirements.

Additionally, all of the investment funds that we have deposited will be managed by Pacific Trustees Berhad, in a completely separate account from StashAway's primary account. Even if StashAway ends up winding their business due to various circumstances, our investments will still be safe in the sense that StashAway won't be able to "zhao-lou" (run away, in Cantonese) with our monies.

In layman terms, StashAway only has access to their own finances (e.g. operational profits or expenses) and all investment funds are solely held by Pacific Trustees through their Citibank's trust account or SaxoBank's brokerage account.

The only right that StashAway is to manage the investment funds on our behalf, in accordance with our agreement in the Portfolios we have created. Order execution will be done accordingly through their brokerage (Saxo Bank) - and funds will then move from Pacific Trustees' bank account into the brokerage, with Pacific Trustees named as their beneficiary.

You can read more about StashAway's commitment to security here (for Malaysia) or here (for Singapore).

Why do I like StashAway?

Now that we know what StashAway is - let's dive into the five reasons why and how StashAway has helped me to automate my investment portfolios.

Passive Investment Strategy

Passive Investment Strategy is one of the main reason why I like StashAway so much - as they literally simplified my investment journey.

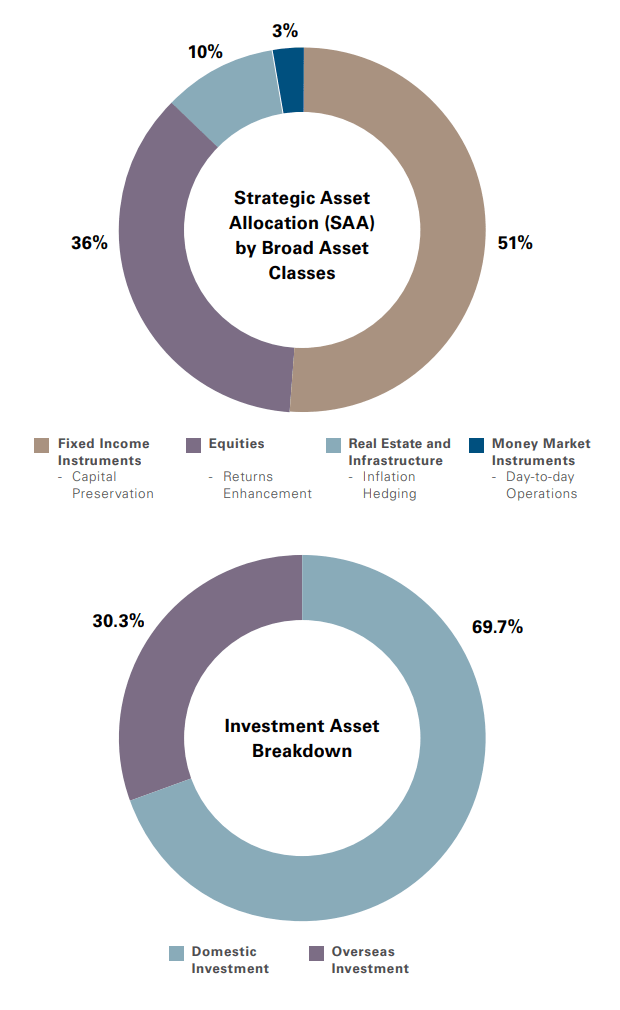

StashAway works by buying into Exchange Traded Funds (ETF), based on their target asset class / geographical allocation in their sophisticated investment framework - the StashAway ERAA® (Economic Regime-based Asset Allocation). The framework proposes a corresponding portfolio based on individual investors' selected risk appetite or goals, focusing on reducing risk exposures whilst maximising returns.

With this, StashAway took out all the needs for me to constantly check and monitor my portfolio, finding out when to buy/sell, or the need to rebalance manually when the asset ratio goes haywire. All I needed to do was to select the corresponding risk appetite or goals that match my profile and do my monthly top-ups a.k.a Dollar Cost Averaging.

Without the need to manage and constantly think/worry about all these, I get to focus on my day-to-day and less on my investment journeys as there isn't much "thinking" that I need to do, except when reviewing my investment strategy holistically (perhaps on a quarterly/half-yearly basis).

Diversification, Rebalancing & Re-optimisation

Since StashAway invests in a basket of securities through ETFs instead of individual securities, the portfolio will be well-diversified to protect investors from overexposure to any single securities.

StashAway's investment framework (ERAA) allows them to build an all-weather portfolio taking into consideration various economic factors; aside from just doing the traditional allocation such as 60-40 stocks-bond rule. Through diversification, each of these assets will its own target allocation (in %) based on the portfolio's risk index.

If any of the assets drastically rose/dropped due to market movements and resulted in an imbalance portfolio with weights beyond the original target allocation; rebalancing will then take place automatically through their systematic algorithms.

There are two ways rebalancing can happen:-

- For portfolios without frequent/recurring transactions, the rebalancing will sell some quantities of the performing assets (redeeming the profits) until it reaches the desired target allocation, then buy into underperforming assets (since it's "cheaper" now) so that the portfolio balances itself onto original targets.

- However, for portfolios with recurring/more frequent transactions, (e.g. recurring monthly deposits), the rebalancing may only happen at a later stage during the next purchase, by buying less of the performing assets and buying more of the underperforming assets.

The rebalancing would ultimately bring the portfolio back to its intended target allocation. These rebalancing activities, however, will only work if the underlying assumptions and target allocation remain unchanged. But what if the economics factor or underlying assumptions have significantly changed (e.g. after March 2020 COVID-19 Crash)?

StashAway also offers portfolio re-optimisation when such an event happens for individual investors to choose to opt-in onto the new target allocation or opt-out and remain with the old target allocation.

This has happened exactly in May 2020 when the team in StashAway decided that, based on their investment framework, to further optimise the portfolio exposures on various sectors/geographical areas.

If you are interested, you can read more on how StashAway approaches rebalancing and re-optimisation here.

Automated Deductions

For those of you whom are a salaried worker and are eligible to contribute to both EPF / Monthly Tax Deductions - do you usually give much thoughts about the auto deductions for EPF and Tax, or do you leave it as is maybe until tax filing seasons?

Chances are - most of us don't think about it as much. Because these deductions already took place before we get to see or touch the salary. This concept is very powerful and the only reason government does so is to ensure that you pay your tax dues, or forced-saving for your retirements, before spending it all. Imagine applying this to our personal finance journey.

This is where StashAway Direct Debit comes into picture - some absolutely hates it (after their last technical glitch) and some obviously loves it. I'm in the latter category. With direct debit facility offered by StashAway, it allows me to automatically deduct my bank account for fixed contributions immediately upon receiving my salary, or on dates I set it to be.

And after having auto deductions for more than 6 months (sitting at 21 months as of this article), my brain is already accustomed to not having that amount of money and eventually, it became a habit for me to "pay myself first" before spending, without even thinking about it!

The only exception here is where I need to put in some conscious efforts to make sure that I always review my "auto deductions amount" from time to time - to ensure that the deduction amount will always grow in tandem with the rate of inflation/merit increments. This way, I will be sure that I'm always taxing myself based on % of my income rather than a flat amount which may be insufficient in the long run.

Low-cost

For most of us when we first start our investment journey, our capital will typically be smaller - and any amount of fees (especially minimum charges) will eat up a higher % of our investments. Even though my total portfolio has already surpassed the RM100K mark, it can still be very expensive when I invest internationally if I don't pay attention to the fees.

As briefly explained in my previous post on investing internationally, cost efficiency matters especially when our capital is small. This is where StashAway truly shines as they allow us to invest any amount of capital (even if it's just RM10) with a bare minimum to near zero charges.

Just to illustrate the point, for every single "trade" (top-up) that we do, typically on a weekly or monthly basis, StashAway charges only:

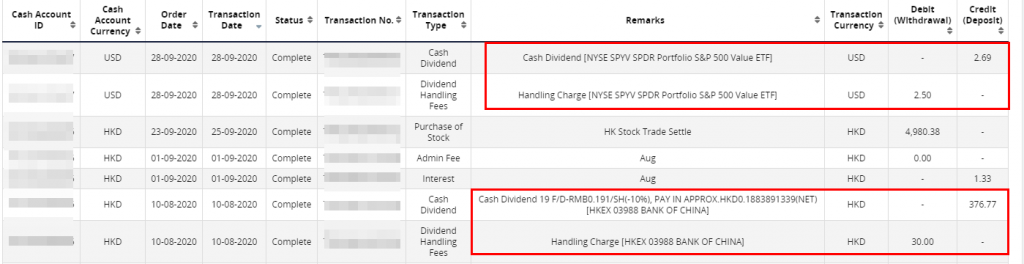

- 0% upfront load / sales charge

- 0.1% on Currency Conversion (FOREX) with spot rate