At some point in life, many of us dreamt of getting rich and not having to work for the rest of our life. Whilst there’s many ways that we can become millionaire out of the blue – strike a lottery, insurance payout from beloved ones (touchwood!), “skim-cepat-kaya”, gambling, etc.; but obviously none of these are practical and some are even fraud/illegal. Plus, even if we strike the jackpot, without proper personal finance principles, it’s all matter of time before we fall back to square one.

If you are here to look for shortcut to amass wealth, stock tips, or “lobang” to get rich, then you can already stop reading from here on as this website is not for you. Rather, it will be purely focusing on personal finance 101 and taking actions on things we can truly control.

So let’s get started!

If you are more of a visual person rather than text, feel free to check out my "Financial Freedom Series" on my Instagram instead. Less word, more pictures. Start from this post and navigate upwards https://www.instagram.com/p/CS0P7bYlsyw/ or use this link instead for quick search

Whilst understanding personal finance is important, mere understanding with zero actions taken are still useless.

Having a clear goal in mind helps to prevent you from dropping out early - as it will help to you to drive motivation.

Humans are pretty simple - if it is something you truly want to achieve for whatever reason, you'll naturally have a stronger drive to MAKE IT HAPPEN. Likewise, without a goal and you'll be wandering around mindlessly following others' footprint, and one day you might just stop caring about all these crap and go back to square one.

Chances are, you might find it hard to even do an estimation, unless you already know how much you need to spend based on current lifestyle by keeping track of your expenses.

Regardless if you managed to come up with an estimate (or not) - it doesn't matter yet at this stage, but keep those goals in mind as you will need it somewhere down the road 😀

Pilots have radar. Captains have compass. We have Google Maps or Waze.

Why are these even relevant? Well you see, would you rather be sitting on a plane with radar, or one where the pilot is trying to navigate around through gut-feel, hoping to bring you to your destination before running out of fuel?

The same applies in personal finance, where you are in the driver’s seat navigating the way forward into the future. There are many different approaches to this – some go crazy down to the cents level tracking for all expenses across all different bank accounts or credit cards; while some take a higher-level approach ensuring that majority of the expenses are captured, in a granular or aggregated approach which are more lenient.

Honestly there’s no right or wrong to both approach, as both will work so long as you don’t get burnt out from going too hardcore; or going too lenient to the point that you can no longer trust your budget. I have been at both of the extreme ends of the spectrum and trust me, you won’t like it there.

When I finally renewed my motivation, I made it clear to myself that I will maintain the balance, closer to the “lenient” side, whilst ensuring that all granular items are still captured and only aggregate certain low-value-high-effort items (example: toll/parking/petrol are all lumped under “Transportation”) so that I don’t get burnt out and stop mid-way again.

Personally, I am a huge fan of zero-based budgeting as it will always ensure that no pennies are left unturned. What does it even mean? Well it’s summarised in one sentence really:

Doesn’t matter if the “job” (purpose) is to pay the bills, put food on table, building emergency reserves, investing, entertainment, gifts, or any other categories. Every single cents that comes to you must be accounted for. Nothing more, nothing less. Yep, including your bonuses.

Want to buy a fancy dress? Well make sure there’s budget left in “Clothing” category.

Want to pamper yourself for a good meal out? Well make sure there’s budget left in “Meals”.

Not enough budget? Then you have to make a choice to trade-off something and reduce budget in other categories.

Not willing to trade-off? Then increase your income so you can SPEND more (though it would be better if you save/invest those extra income instead of spending it)

When you first start with zero-based budgeting, it is completely normal that you accidentally left out some big-ticket-items which are either recurring on less frequent basis (e.g. vehicle maintenance, home assessment tax / cukai pintu, road tax, etc.) or unexpected events (e.g. vehicle repair, blown electrical fuse, burst pipes, etc.).

That’s where zero-based budgeting truly shines. Rather than having a “generic pool” of spare money where you draw as and when required (and it’s all drawn out before you know it), you estimate how much would these cost on a yearly basis, then dividing it by 12 months. Doesn’t matter if your car needs repair this month, always allocate the fixed amount of budget into this category so that when the time comes and you need it, it’s already funded for you.

Example:

My decade-old Proton Persona requires approx. ~RM200 half yearly for oil change; and perhaps there’ll be random broken parts which requires RM200 every quarter or so.

Convert these into yearly total:

(RM200 x 2) + (RM200 x 4) = RM1200

Then, convert it into monthly budget:

RM1,200 / 12 = RM100 per month

From that point onward, no matter the circumstances, I will always allocate at least RM100 onto my “Vehicle Maintenance” category for a peace of mind. Rinse and repeat for other similar categories – Personal Care, Birthday Gifts, Angpaos, Gadgets, Salon, etc.

Don’t worry about it when you first started and underestimated some of the items; or if some expenses just decided to hit you out of the blue sooner than expected. Just go with the flow and fund it from other category (trade-off) as an interim and quickly move on. The key is, all your income are budgeted for. NO MORE, NO LESS.

Literally what the graffiti said. With debts, compound interest is working AGAINST you. And this is especially bad if we’re talking about debts like outstanding credit card bill, which the interest rates can go as high as 18% p.a.

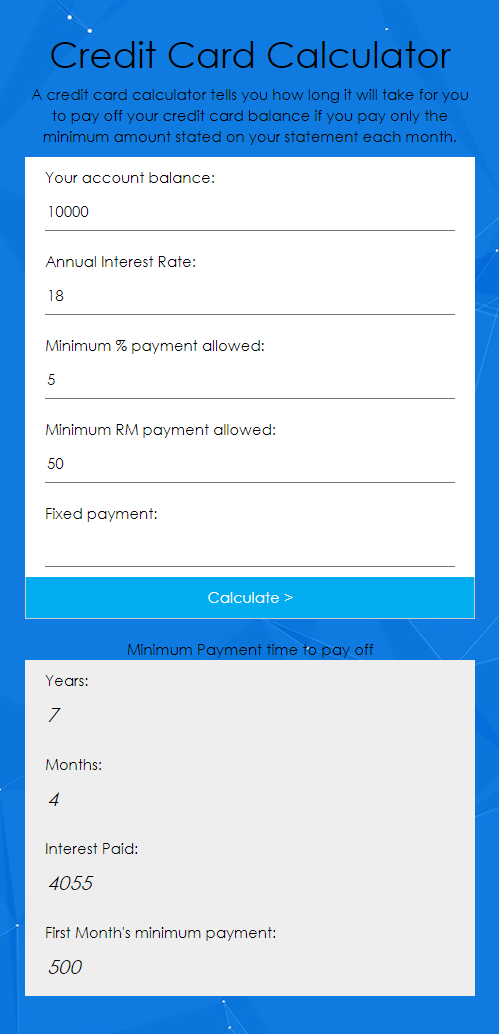

These interests (working against you) will just tear you apart, bit by bit. Not convinced? Try using this AKPK Credit Card Calculator:

Assuming outstanding balance of RM10000, making only minimum 5% payment (or RM50, whichever is higher), it will take you up to 7 years 4 months just to completely pay off the debt, with a total interest of RM4055 (making the total payment RM14055) which is ridiculous.

So if you have any debts which charges you crazy effective interest rate, then make it your first priority to pay down all these debts before even thinking about saving / investing. Your banks may sometimes choose to list things on simple interest rate as it will look more attractive (than effective interest rate), so be wary of those traps as well.

Having said that, there are some “healthy debts” which you can deprioritise first (i.e. mortgage loans) so that you can focus on protecting your capital or building your wealth, as these debts usually have lower interest rate than what you can potentially gain from building a safe buffer (emergency funds) or building your wealth (investment returns). It is not worth to dump all your extra monies into the mortgage and put zero into savings/investments – unless your investments are providing returns below your mortgage interest rates.

Once your unhealthy debts are settled for, it’s time to build a buffer so that you won’t end up falling back on big bad debts. The reason to build the cushion after (rather than before) is so that you won’t be penalised during this process if you have already settled the big bad (expensive) debts, otherwise you will lose faster than you can save thanks to the enormous interest rates charged on your debts.

The general rule of thumb is to build at least 3 to 6 months worth of monthly essential expenses which you can live of and survive when the time comes, such as during pandemic times of the COVID-19 where record number of job losses are happening worldwide.

You might be pondering where you should keep these funds? Two things for sure:

Once you have built up your emergency funds which are liquid and accessible at the time of needs, ensure that you are adequately covered with medical insurance – unless you can save faster than the medical fees’ inflation rate, chances are most of us (myself included) will have to rely on medical insurance to hedge against a risk we cannot afford to have. Same thing goes for Mortgage Insurance which usually we are requested to buy MRTA, MLTA, or equivalent sum of Life Insurance to hedge against the total mortgage. Personally, I went with Level Term Life Insurance so that in case if I change property, the insurance will still “follow” me (as it’s not pegged against the property itself) and the cost are similar with a MLTA insurance.

Just make sure not to go too crazy with insurance. Example of craziness in my humble opinion: buying life insurance for kids or retired parents. Why? Typically they don’t generate incomes at those stages, and are our dependants. In the event of death, while it will cause catastrophic disaster and takes a toll on our mental and emotional well-being, we’d most likely still be fine financially as long as we have been prudent with our expenses and built up enough buffers.

If you have followed through Stage 1: Know Your Expenses up till Stage 3: Protect Your Capital, you should be sitting on quite a comfortable buffer by now with:

In previous chapter I briefly mentioned on how we should avoid investments via insurance whenever possible and one of the main reason is cost. Just to illustrate the point, below is a very simplistic comparison between “investing” via Insurance Savings Plan vs. Roboadvisors in Malaysia. I won’t even go to other approaches here to keep it short and simple:

Assuming that we start with RM0 capital, with conservative return rate of 6% per annum compounded on a conservative yearly basis; whilst consistently topping up at the beginning of next year for the amount of RM12000 per annum.

Throughout the 40 years, the top-up amount and annual return remains unchanged, yet the fees add up and eat onto your portfolio size in the longer run. So to recap, you would want to allow compound interest to WORK FOR YOU, not against you.

Please, if you ever plan to save and invest for whatever reasons – unborn child’s education plan, retirement funds, whatever those are – take your money and put it somewhere else like StashAway with ~0.8% annual fees plus ~0.2% ~ 0.4% fund expense ratio (depending on ETF), making it approx ~1.2% fees per annum

Heck, even if you don’t trust me or feel skeptical about StashAway, which you shouldn’t, as they are licensed by Securities Commission of Malaysia; then go for self-service Unit Trust/Mutual Funds like FSMOne by IFAST Capital.

It’s still gonna be more expensive than StashAway since they charge 0%~2% upfront initial cost, with 1%~2% annual fees such as fund expense ratios, platform fees; but still cheaper than your typical agent-based Unit Trust with 6% upfront initial cost and same annual fees.

In the long run at Year 40, the differences of DIY Unit Trust against Insurances Saving Plan is measly ~9%, so I still will not recommend this as your primary vehicle. There’s still advantage if you’re only in it for the short term (Year 10), as it has ~30% upside vs. Insurances Saving Plan as the effectiveness only starts dwindling down from Year 10 onward given the the recurring annual fees and upfront sales charge.

It has been a pretty long one – so to recap, if you are lazy like me, or simply have no time to study the stock market; just invest in passive funds via ETF; and the easiest no-fuss approach in Malaysia today is via StashAway. Avoid insurance agents / unit trust agents for investments as fees will really add up in the long run. If you’re here for more advanced approach to have even finer control / international reach on the ETF selections, stay tuned as I’ll be posting more articles on local / international trade soon and will link it separately, since this article is tailored more for beginners to personal finance.

Doesn't matter whether if the quote is true - typically one shall not expect for something in return when they're giving out. Giving and Sharing can be in many forms, doesn't necessary need to be of monetary value.

The form doesn't matter as long as it fills you. Some may argue that one can only give after achieving financial freedom, and that's not true. We can always either start small, or start with something that doesn't cost us money.

If you're at this stage, congratulations! You have already achieved the Financial Independence (FI) stage where you already have your passive income consistently covering your needs beyond your retirement as long as you stick with your planned lifestyle.

Nevertheless, always remember that it is important to enjoy life as we only live once. Don't ever let the money game stop you from enjoying life - life is more than the numbers in our bank account 🙂

The only difference between Stage 6 and Stage 7 is where at this point, you have so much money that you'll highly likely won't be able to finish spending throughout your entire life. This is the time to stop sweating the small stuff and spend if you have to (but responsibly).

Enjoy life, help others and do charity, do what you've always dreamt to do. This is exactly why Stage 0 is so important as you wouldn't want to spend all the efforts to arrive at this stage, but have no clue what to do with the rest of your life.

If there comes a day when I achieve this stage, you'll probably be seeing me travelling around the world more often to experience different cultures, different weathers, and different experiences across the world. And on normal days? I will probably be reading books, gaming away, or perhaps by then, taking care of my young adults 😀

I know this article have really been a long one, and if you’ve read up to this point – I truly appreciate your time and I hope that these small steps would be of useful to you.

If you have any other suggestions, feel free to let me know in the comments below or email me at [email protected]. I will also be periodically revisit some part of the articles and expand further, perhaps in the form of bite-sized blog posts to dive deeper on certain topic – as I won’t be able to cover everything in depth in this section.

See you around on my next post!

Cheers,

Gracie