Is Interactive Brokers really the best brokerage for us intending to invest abroad from Malaysia? Well, as with all things in life - IT REALLY DEPENDS.

I wrote a comprehensive comparison of few of the key international brokerage players in my previous post: Malaysia International Brokerage Comparison, feel free to check it out on my thought processes before arriving on Interactive Broker as my primary (international) brokerage. After all, "Best" is a very subjective word and in the end it really boils down to what we want.

Now, if you have decided to go ahead and get started with Interactive Brokers, let's run through some of the basics to get you up and running to invest through Interactive Brokers. To keep things easier to digest, I will be trying to simplify some of the chapters (i.e. funding) as much as possible - with detailed breakdown potentially explained in a separate post (if required) just to avoid drowning those whom just want to get started with international investing.

For sake of clarity, the Interactive Brokers account referred throughout the entire guide below is the Interactive Brokers: PRO account - as the "zero commission" LITE account is only available for U.S. Citizens and not available for us Malaysians. Zero commissions are nothing but merely an illusion anyway...

I hope this guide will be useful enough to get you from zero-to-hundred in accelerating your progress towards investing internationally!

I have actually done a pretty comprehensive comparison across quite a number of popular international brokerages in my previous post, but just as a quick recap on why Interactive Brokers are good for us Malaysians intending to invest abroad.

With their extremely low commissions (and margin interest, for those up for it) - it makes it extremely cheap and efficient especially for long-term buy-and-forget investors like myself. Just to illustrate the point:

Most other brokers charge either a higher commission or hide some of the costs by marking up the purchase price, resulting in a lack of transparency for us investors. Personally, I am using my IBKR account with access to the London Stock Exchange to buy ETFs domiciled in Ireland, such as CSPX or VWRA, to have a slightly reduced Withholding Tax applied on the receipt of the dividends (15% instead of 30%).

If you are interested in the details, head to my previous post on the comparison between various international brokerages. And if you're still not convinced, check out IBKR's very own overview page summarizing their key benefits. Remember to look only at IBKR PRO plan!

NO!

Interactive Brokers is not officially established in Malaysia, hence they are not governed nor approved by our Malaysia's Securities Commission and all of our accounts opened will be regulated directly by the institution we opened our account in.

For those thinking to open an account through our IB Singapore (since it's the closest neighbour governed by MAS), sorry to tell you but unfortunately, we cannot select which of IB's entities to govern our account during the application. The entity is assigned based on our legal residence which in the case of Malaysia, our account will be opened directly under Interactive Brokers LLC in the United States.

This also means that in case shit happens, there's nothing that the Securities Commission Malaysia can do to help us, other than going directly to the international bodies (i.e. US Securities and Exchange Commission, Commodity Futures Trading Commission). However, this is not much of a concern for me - to be frank I am quite comfortable with international regulatory bodies as they're mostly pretty strict, if not more, than our counterparts.

So if you are not comfortable with international regulatory bodies - you have no other choice but to stick with local brokerages with hefty costs just to invest abroad (plus all the "handling charges" and unfavourable "currency conversions"). Unfortunately, I don't see this changing anytime in the mid-to-long term as Malaysia needs to protect our local brokerage to ensure local companies' survival. With our company's size and capital in Malaysia, how can we compete directly against a Fortune 1000 company on such a global scale?

But if you want to utilise one of the most cost-effective (and also international reach) brokerages, then read on!

Fortunately, the entire account opening process is very easy and you won't need to visit any banks or sign any paper forms. In fact, the whole process seems simpler than how I have opened my IBKR account indirectly through Tradestation Global back in October 2020 as there's no middleman involved here.

Firstly, you'll need an IBKR account. You can directly visit the Interactive Brokers' Sign Up page* and proceed to create a login account with your unique username and password, and also complete the email verification process. Only when you have done this, you can proceed with filling up the lengthy account application form.

Just head to this link* to get started on the application process. You may get redirected to different countries' website for Interactive Brokers, depending on their server. As of writing, I sometimes get redirected to either their Hong Kong, Australia, or their Global server depending on timing/connection. Nevertheless, it doesn't really impact your application process so long as you select your resident country accurately (i.e. Malaysia for most of us).

Again, it does not matter which IBKR server they route you to - as Malaysians can only have our account governed directly by IB LLC in the States.

Once your email have been verified, you will be redirected to a login page asking you to key in your earlier username and password in order to proceed with Completing a Started Application process. The form itself can be quite lengthy so set aside at least 10-15 minutes to do it quietly. If you have to leave half way throughout the process, that's fine - just remember to "Save" it so that you can resume later by logging into IBKR again using the link in your email or their homepage.

As the application form itself is quite straightforward (and lengthy), I won't go too much into all the sections in this post but instead, I'll highlight a few key points in the next few chapters and common mistakes to make sure you DON'T MISS IT. Just for a quick overview, below are all the sections you need to fill up before completing the application form. Now you know why I said could be lengthy...

For those married with spouse / partner, joint account might be an interesting option where both parties have equal rights to access / manage the account in the event of death of one holders. However, there might still be legal / tax implications or requirements surrounding the will process to avoid dispute and it is best to consult estate planning services.

As I am still single with only my mom as dependent (with sufficient cashflow elsewhere for my mom to inherit in the event of my death), my account was set up as 'Individual' customer type. For those with experience with 'Joint Account', feel free to share it in comments below!

Whilst Passport is the "default" international document - Interactive Brokers seems to prefer our Malaysian NRIC as they can provide instant verification when you upload your identification document. I opened my account using NRIC without issues - irrespective of document you have selected, you need to submit photo of the identification document as part of the verification process.

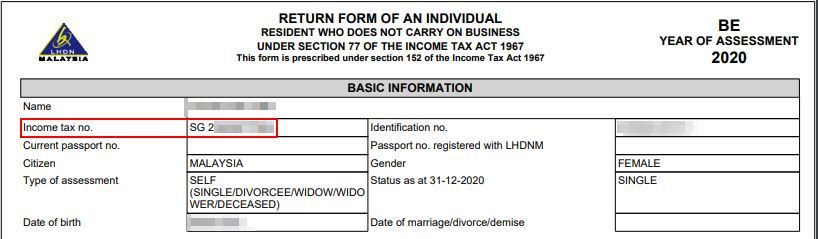

There's always confusion when it comes to TIN. Some thinks that Malaysia doesn't have one but it is wrong.

All Malaysian / Tax Residents whom are liable to report personal income tax will definitely have TIN - it's basically your LHDN Tax File Number. Don't ever skip this otherwise it might be deemed as attempt to escape taxes (though we Malaysians are lucky to have 0% capital gain tax). Input the tax number as per your file without space (e.g. SGxxxxxxxxxx for my case)

If you have multiple tax residency, make sure you highlight them as well (e.g. in-between transition during a Short Term Assignment in a overseas position). If in doubt, consult your tax agents.

This is another area most people (myself included) get confused. From my experience it serves mainly two purposes:

Personally, I pick USD as it is easier for me to manage (and also to do mental mathematics) - unless if one day MYR option appears there... If interested, you can read more about base currency here.

IMPORTANT: Remember your base currency - as it'll be one of the important point shown later during funding in / currency conversion processes

There are 3 types of account type here: Cash, Margin, or Portfolio Margin. For most of us, the discussion is mostly "Cash" vs "Margin" as these are much more accessible option as compared to the "Portfolio Margin" which has high net-worth requirement (read more).

Generally, you should always go for Cash Account option - unless you know what you're doing. Again, to re-iterate, never ever trade with other people's money unless you know what you are doing. Leverage is a double-edged sword as it can amplify both your returns and losses.

Nevertheless, their Margin account is very attractive with one of the lowest interest rate and personally I switched my account to 'Margin type' sometime in February 2021. On cash account, you can only place "Limit Orders" utilising the actual cash positions you have - meaning you'll have a pile of cash sitting in IBKR account doing nothing and I hated that. I don't trade on margins, but I use the Margin facility to place imaginary limit orders with a very low/attractive entry price and will only replenish cash whenever orders are filled - typically during a market crash.

Choose the minimum permissions you need - you can always revisit and add more later. Personally I just went with Stocks for US (including Fractional Shares), Hong Kong, China, Singapore and most importantly United Kingdom (for my Ireland-domiciled ETFs!).

Note that they requires investor with at least sound knowledge before approving your trade permissions, and may restrict investors from getting access to higher-risk vehicles without proper experience.

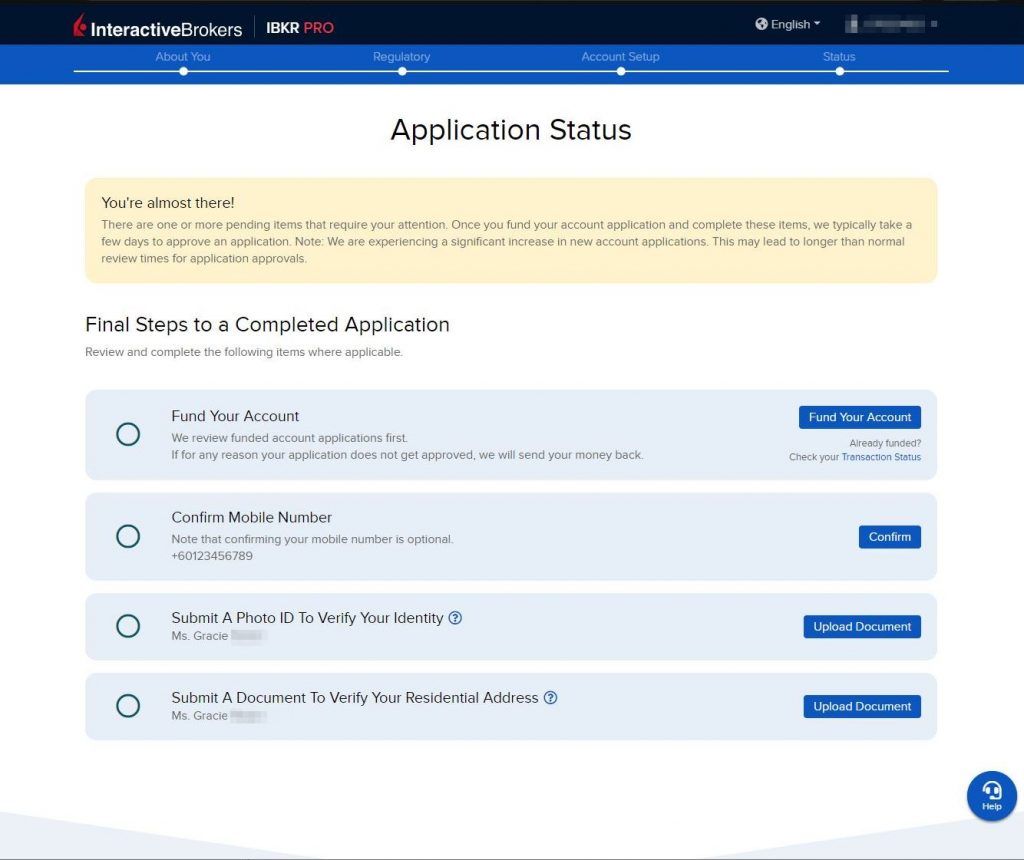

Once you have completed all the forms and signed all the agreements, you should be able to see your application status page where you need to submit supporting documents, fund your account, or verify your mobile number.

Depending on information provided earlier, there may be additional questions asked in this stage - for example, if they needed a better understanding on your income sources.

From my personal experience, I funded my account to speed up the application process, but because of the 1x rejection (due to unaccepted address verification document), the entire application process took me close to 4-5 working days after resubmitting my address verification document (could've been shorter if I didn't get rejected to begin with).

There are 3 common methods used by us Malaysians to fund our international brokerage account:

If you don't plan to withdraw any amounts from your Interactive Brokers account any time soon, then the easiest way is just use Wise and perform the transfer into your Interactive Brokers account. However, if you choose this method, there will be a few days of holding period where you cannot deploy the cash after the transfer. You may also be subjected to audit in months down the road (up to even 7++ months) where you will be requested to provide evidence and paper trail of your fund transfers.

Alternatively, if you're lazy for random audits down the road, or wants to avoid the holding period, you can also opt to open a Singapore Bank Account (fully online!) by following my guide here: Opening CIMB Singapore account without visiting Singapore for Malaysians. This will allow you to then transfer from Wise to your offshore Singapore account, followed by a local transfer using your Singapore account onto Interactive Brokers' Singapore account under your own name denominated in SGD. Through this method however, you'll need to perform a currency conversion within IBKR itself which will cost you $2 in commissions - no issues with exchange rates though as IBKR uses near real time spot-rate as the conversion basis.

I generally prefers Method 3, since it helps to ensure that all deposits into foreign brokers will always be under my own name (to keep money trails clean). Whilst you don't need an offshore account to invest internationally, I strongly recommend you to open one in case of future withdrawals as it would be the most efficient way to withdraw from IBKR. If you haven't have one - Singapore is the easiest way.

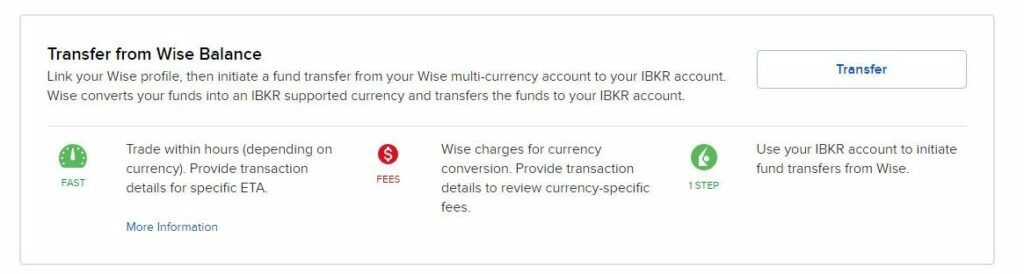

Now, to keep this guide simple, I'll only be illustrating Method 2 below as it is simply the easiest way for beginners and works for almost all international currencies (e.g. USD, EUR, GBP, HKD, etc.).

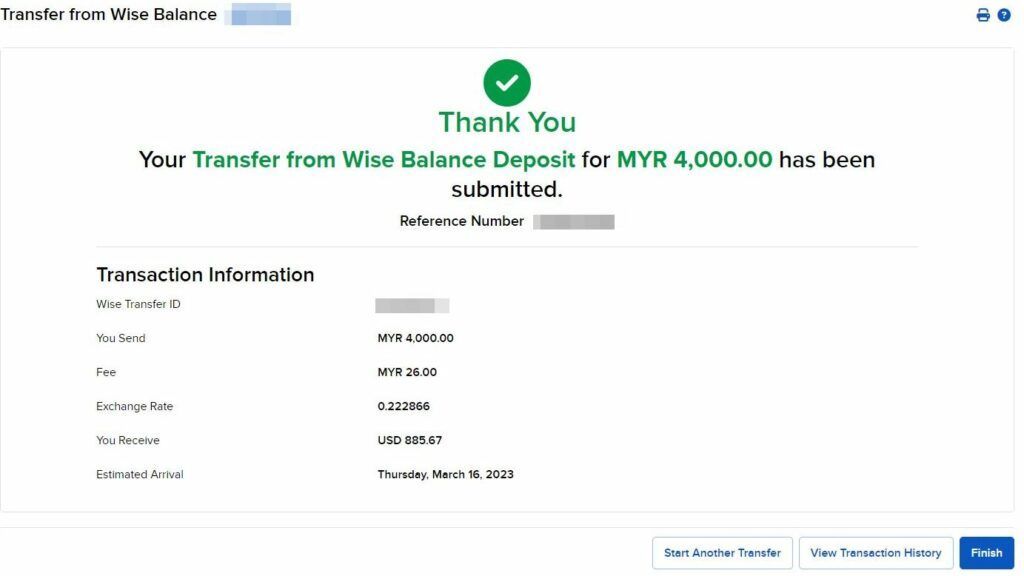

The recent update since March 2023 with direct integration between IBKR and Wise has also made this even easier to only a measly 3 steps to complete a transfer at low cost!

You can sign up using my referral link here**. I won't go through the details on the account opening step-by-step as it is relatively simple - sign up, complete verification, and you're good to go! Note that you MUST open a Wise account for this simplified Method 2 to work as only Wise have direct integration with IBKR.

You can also opt for other fintech players like BigPay, InstaReM, etc. depending on your preferences. I personally choose Wise as they typically the fastest transfer with competitive enough rates for most of the time. Though sometimes other Fintech players may have better rates - so there's no harm to compare rates before your transfer especially if you are using Method 3.

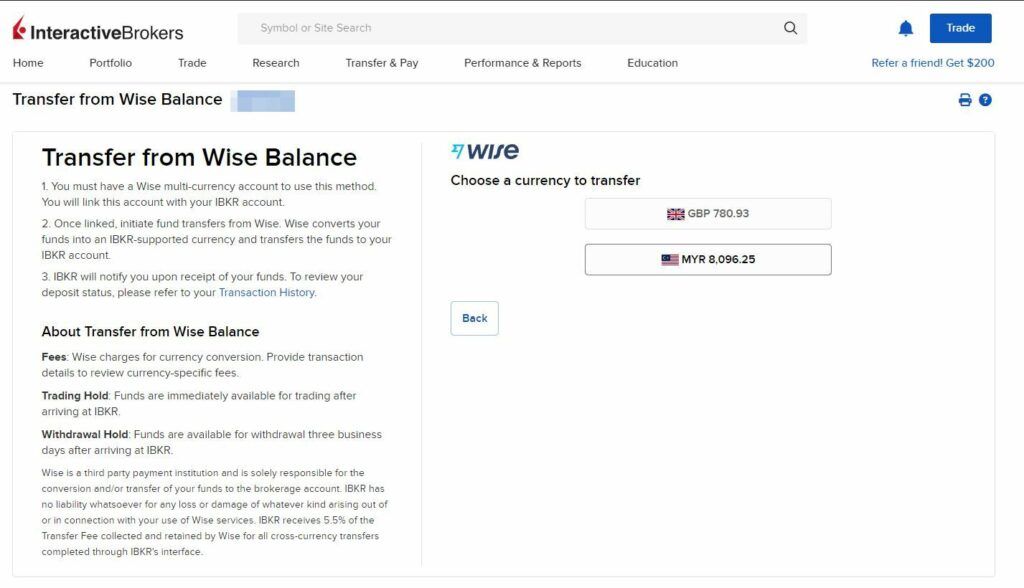

Login to your Interactive Brokers account. If your account application hasn't been approved yet, you can see the "Fund Your Account" button in your Application Status dashboard. Otherwise, if you already have a fully-activated account, just log-in and access the "Transfer & Pay" section and find the "Transfer Funds" button and you'll see this shiny new button to Transfer from Wise Balance

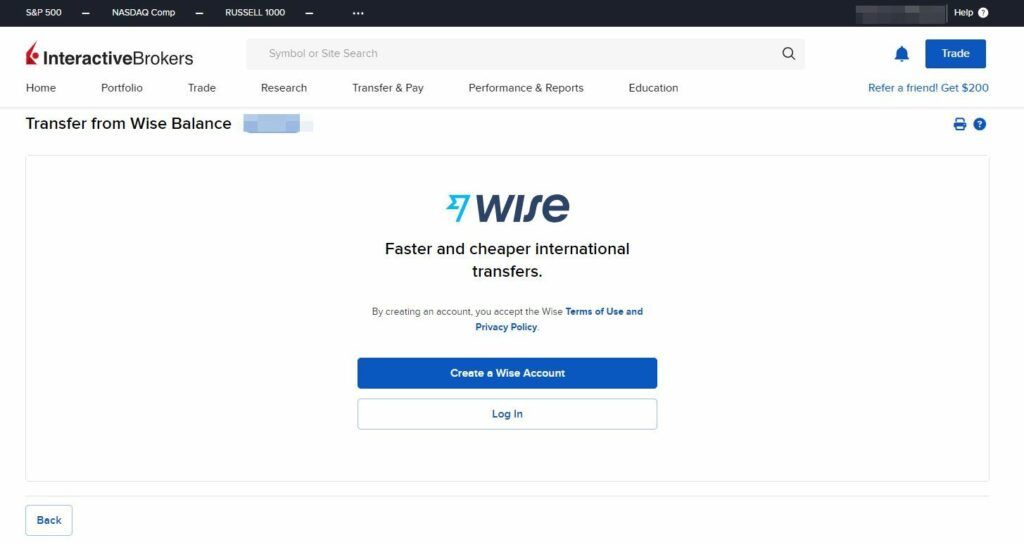

If you haven't linked your Wise account with your IBKR prior to this, you'll see a prompt to login into your Wise account. Simply log in to your Wise account created earlier and follow through with the steps until your account is successfully linked to your IBKR.

If you have successfully linked your Wise account to your IBKR account, whenever you choose the Transfer from Wise Balance option, you'll automatically see your balances in Wise directly within the IBKR page.

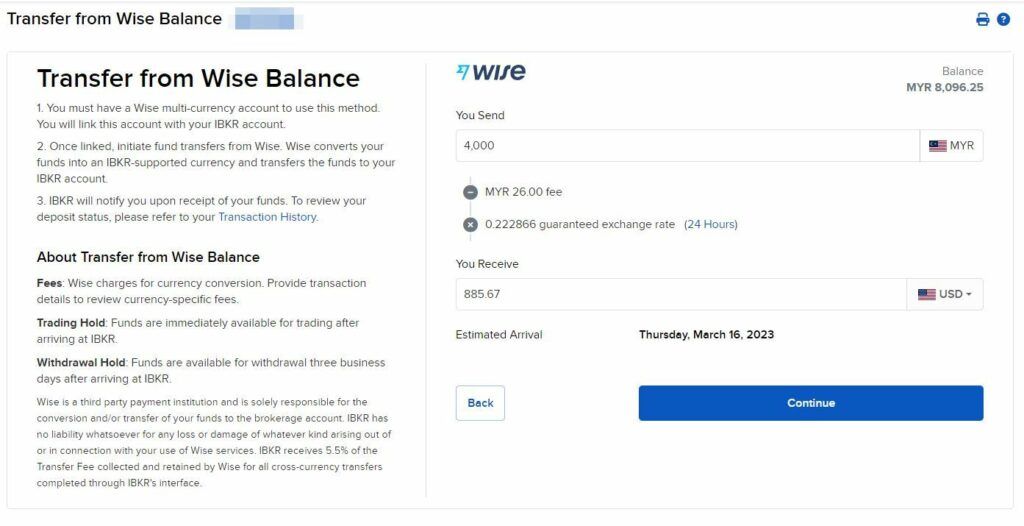

Ensure that you have enough funds in your Wise Account. If you don't have balances yet, just go back to Wise to initiate a topup via FPX (or any other currency). You can have balances in any currency as Wise will automatically do the conversion into your target currency. Personally, I top up directly into my Wise-MYR account.

All fees are handled on Wise, including whatever premiums that IBKR collects from Wise directly (approx. 5.5% premium on top of Wise's fee, inclusive). IBKR is not involved in this conversion process so they won't be charging you the $2 commission.

Yup. That's it, your transfer is done. If you take out the first-time setups, it's literally done in all single step within IBKR itself.

UPDATE 19 FEB 2022: With the recent Multi-Currency account made available for all Malaysians, another easier way if you opt for USD is just to enable Direct ACH Transfer for your Interactive Brokers account. Follow the similar step as above but select "USD" > "Direct ACH Transfer from your Bank" instead of the traditional "Bank Wire" method. This method is quicker as you don't even need to notify IBKR (aside from the first time set up!)

UPDATE 18 MAR 2023: With the recent addition of direct integration between IBKR and Wise, the steps to transfer are even easier and the article has been updated to reflect that. if you're interested still in the Direct ACH transfer, check out my other article here.

Login into Interactive Brokers via their homepage. Once your account is fully verified and approved, you will see a huge dashboard and hopefully without any errors (i.e. missing trading permissions). In case if there are some error messages, most likely your account setup has not been completed yet - perhaps wait for another business day (US timezone) and see how it goes, before contacting the IBKR Customer Support.

When everything is ready, before you start trading - make sure to change your account pricing model to Tiered Pricing instead of Fixed Pricing as it works better for most of us unless your trade size is huge enough to leverage the Fixed Pricing model.

It's a very complex topic but the key difference between the two is where the commissions charged in Tiered Pricing is gross before adding the clearing fees and exchange fees; whereas in Fixed Pricing everything is already net inclusive of commissions, clearing fees, and exchange fees. If you want, you can do a detailed calculation using information on their pricing page here or search their examples here.

To check or change your account pricing model, head over to your 'Account Settings' page and then select the 'IBKR Pricing Plan' setting button

Once you are done, select your preferred pricing model. Personally I am using Tiered Pricing as it makes the most sense and are cheaper than Fixed Pricing, at least until when I have ultra-high net-worth and make big fat trades...

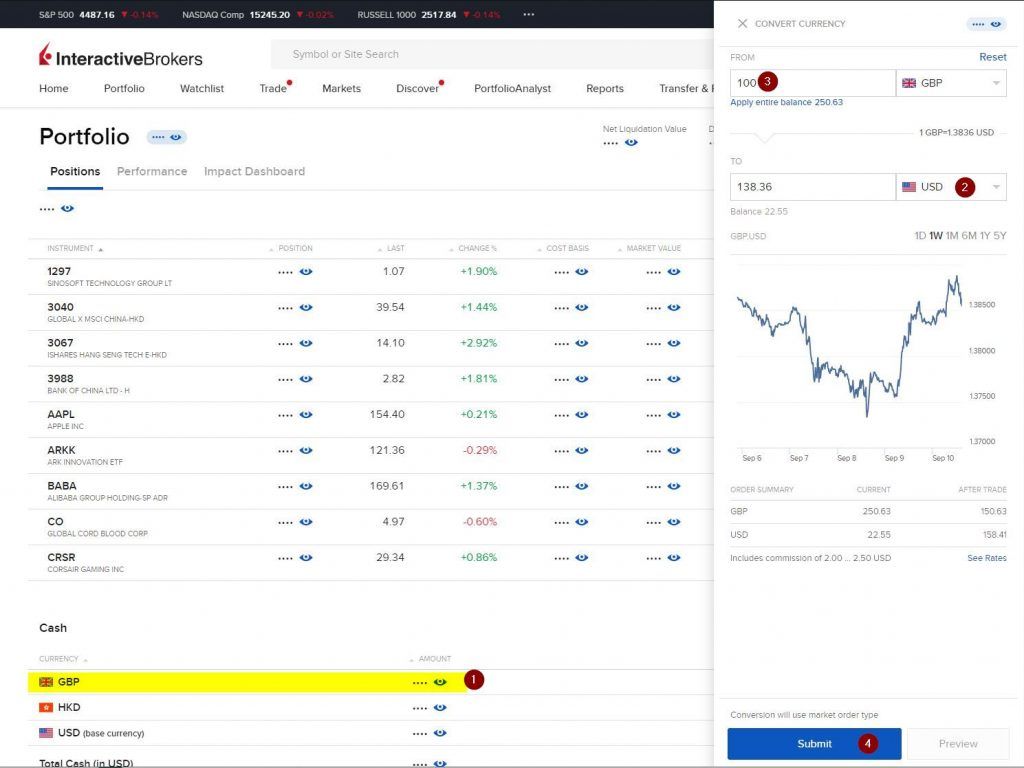

You can hold up to 26+ different currencies in Interactive Brokers, which was one of their strong selling point of dominant international presences. When you initiate a fund-in process, IBKR will store the amount you have transferred in its original currency. If the stocks / ETFs you intend to buy is different from your initially funded currencies, then you need to perform currency conversion within the IBKR itself.

To start the currency conversion within IBKR, just login to Interactive Brokers and select Convert Currency from the menu. Select the currency you currently own and convert it to your target currency, which will be used to purchase stocks / funds. Once confirmed, just submit the order and it will usually take a few seconds or minutes to fill-up the currency exchange order.

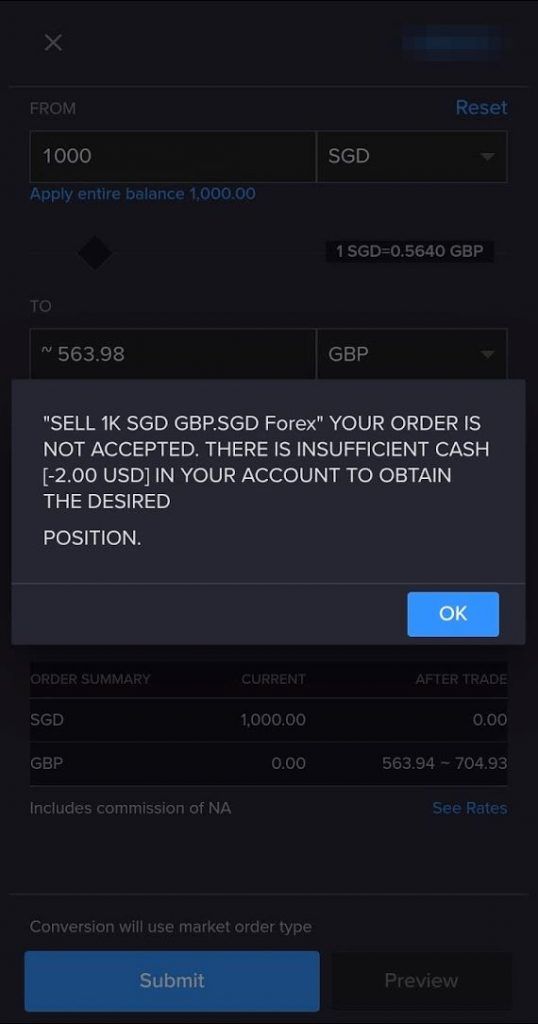

In case if you get some error message like "Your order is not accepted. There is insufficient cash [-2.00 USD] in your account to obtain the desired position." like below, then it means that your Base Currency do not have the sufficient amounts required to cover the FOREX commissions. So make sure to always fund your base currency first before anything else. Back then, I solved mine by converting some amounts into USD so that it has some balances to cover FOREX commissions.

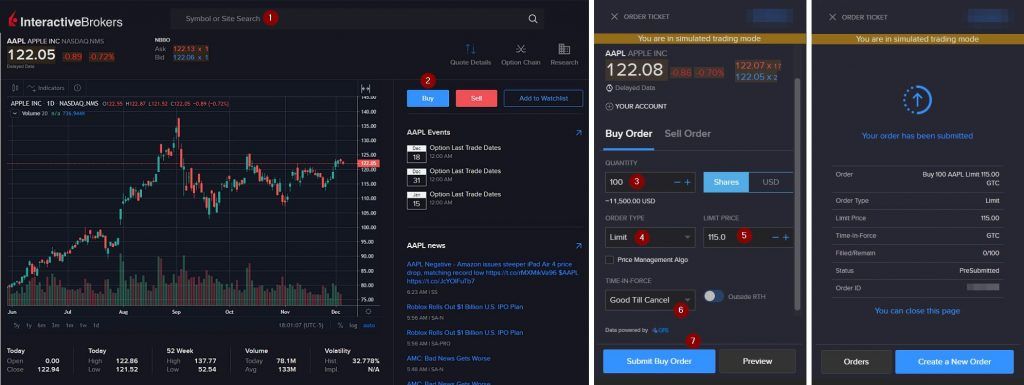

Once your account has sufficient funds (or if you're within margin limits), you can go ahead and place your order for your first stock (or ETF!). Buying stocks using their web app (or mobile app) is actually very simple - in 3 steps:

I hope this guide have been helpful in your journey to get started with opening an international trading account, tapping into the power of Interactive Brokers. Frankly I'm grateful to be able to utilise IBKR sooner than imagined, thanks to their initiative to remove inactivity fees back in July 2021.

As you can see from My Portfolio, I am a strong advocate for passive and long-term investing through ETFs, and IBKR's global access with spot-rate currency conversions, plus its low commission / fees structure is really a blessing for me.

Thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie

DISCLAIMER

This is NOT a sponsored post, but contains affiliate link where I may get rewarded when you sign up with my link and fulfils certain criteria.

* by using my Interactive Brokers sign-up link, you will be indirectly supporting my blog as I get a very small token of commission for every successful click by unique visitors.

** by using my Wise referral link, I will get 30 GBP for every 3 successful referrals when you complete your first transfer and part of the commissions will go to a non-profit community charity foundation.

PROMOTIONAL RELATIONSHIP DISCLOSURE FROM INTERACTIVE BROKERS

This content is provided by a paid Influencer of Interactive Brokers. Influencer is not employed by, partnered with, or otherwise affiliated with Interactive Brokers in any additional fashion. This content represents the opinions of Influencer, which are not necessarily shared by Interactive Brokers. The experiences of the Influencer may not be representative of other customers, and nothing within this content is a guarantee of future performance or success.

None of the information contained herein constitutes a recommendation, promotion, offer, or solicitation of an offer by Interactive Brokers to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy. Investment involves risks. Investors should obtain their own independent financial advice and understand the risks associated with investment products and services before making investment decisions. Risk disclosure statements can be found on the Interactive Brokers website.

Interactive Brokers is a FINRA registered broker and SIPC member, as well as a National Futures Association registered Futures Commission Merchant. Interactive Brokers provides execution and clearing services to its customers. For more information regarding Interactive Brokers or any Interactive Brokers products or services referred to in this video, please visit www.interactivebrokers.com.