I still remember vaguely back in my university days, when I had to apply for a CIMB Prepaid Master Card and was so happy when I finally have my own card to make payments online since I needed it to shop for games from Steam or stuff from Amazon.

With zero income as a student back then, I didn't really have any other choice as Credit Card were not an option for me without proper income documentation. Forget about Supplementary Card too as my mom definitely did not qualify for even a basic credit card with her inconsistent income barely covering our monthly expenses on a cash basis. Maybe it's a good thing that she wasn't exposed to credit cards back then, allowing her to stay frugal...

Author's note: Sadly, this has been sitting in my draft since 2022 Mar and it took more than a year to have it finally reviewed and published. By the time of publishing, Wise has already done their rebranding and IBKR has launched a new partnership directly with Wise - better late than never, I guess!

Things have definitely changed in the last decade with more and more digitalization taking over the world - with us consumers benefiting from a variety of payment options in our hands, maximising the potential benefits we can reap from financial service providers or merchants.

However, despite all these revolutions, one thing that still consistently bothered me was the hefty exchange rates imposed by banks on overseas card transactions - be it virtually or physically. Whenever we transact internationally, banks would impose a premium exchange rate (above-market rates) plus some fixed fees of 1% - 2.5% on the total price, resulting in at least a 2% - 4% premium paid when transacting internationally.

Thankfully, things changed for me when BigPay (by AirAsia Group) first launched their Prepaid Master Card in Malaysia sometime back in 2018, and I first got the taste of transacting internationally with amounts almost matching the rates that we usually see in Google - something that was never seen with banks in Malaysia.

Whilst my usage of cards internationally has reduced greatly with more companies opting for regional-based pricing (e.g. Steam now sell games in Ringgit Malaysia, with different pricing tier vs. international markets) - FinTech cards are still my #1 choice when transacting internationally out of my own pockets. The only exception, perhaps, is when I travel internationally under Company's budget for a few reasons - credit limit, grace period, insurance and of course points/mileage accumulation.

On the other hand, as I continued investing and dollar-cost averaging into my international ETF holdings, I have to move my money abroad quite frequently - sometimes monthly, sometimes quarterly; converting my Ringgit Malaysia (MYR) into respective Foreign Currencies.

In order to maintain an offshore account under our own name to receive monies from our international brokerage should we choose to withdraw in the future, we will have to go through several hoops just to get it done, with most of us Malaysians ended up opening our own Offshore CIMB Singapore Account to avoid hefty foreign telegraphic transfer fees since most brokerages like Interactive Brokers do not have a presence in Malaysia.

Thankfully, all these are about to change now with Wise Multi-Currency Account enabled for us Malaysians granting us easy access to owning multiple offshore accounts since 2022!

For those of you who have been following me, or have read my other posts - you'd probably notice that I always advocate for FinTechs like Wise or InstaReM or BigPay when it comes to performing Foreign Transfers - as it is simply cheaper than doing so with local banks for majority of us - unless we have access to "premier" or "exclusive" rates offered by banks.

Wise Payments Malaysia Sdn. Bhd. is regulated under the laws of Malaysia as a licensed remittance, money-changing and e-money issuance business. They first launched under the name of TransferWise Malaysia Sdn. Bhd. in 2019, offering Malaysians a cheap, easy and fast way to transfer monies abroad but sometime in 2020, they had to shut down part of their service offering - then "Borderless Account", leaving us Malaysians with only option to send money abroad but no access to obtain international bank details from TransferWise (except legacy users).

Thankfully, all the wait is now over and Wise Malaysia finally have relaunched their "Borderless Account" service in Malaysia since early 2022, now known as the Wise Multi-Currency Account. What's so good about this is that - you can now have access to maintain an offshore bank account without even the need to go through the traditional banking route such as the CIMB Singapore account for Malaysians since it's much more accessible with fewer restrictions in place - such as no minimum first deposit or no minimum maintenance balance required.

However, can Wise Multi-Currency Account replace 100% of the traditional offshore banking accounts? Let's take a quick look at Wise SGD Currency Account vs. CIMB Singapore Account vs. Maybank Singapore Account below:

| Wise SGD Currency Account | CIMB Singapore Account | Maybank Singapore Account | |

| Minimum Initial Deposit | SGD$0 | SGD$1,000 | SGD$1,000 |

| Minimum Balance | SGD$0 | SGD$0 | SGD$500 |

| Fees (below min. balance) | n/a | n/a | $2/month fall-below fees |

| Fees (inward Local Transfer) | FREE | FREE | FREE |

| Fees (outward Local Transfer) | SGD$0.93 fixed fee | FREE | FREE |

| Fees (inward Int'l Telegraphic Transfer) | n/a - receive payments in local currencies from local banking partners | SGD$0 - waived | $10 - read more |

| Fees (outward Int'l Telegraphic Transfer) | Transparent Variable Fee starting from 0.4% | Traditional bank's TT charges starting from SGD$30 | Traditional bank's TT charges starting from SGD$20 |

Of course, the above comparison is merely singling out Wise's SGD Currency account just to have a fair comparison with CIMB/Maybank Singapore Account. Wise today allows Malaysians to have an account balance in either AUD, CAD, EUR, GBP, HUF, MYR, NZD, SGD, TRY, or USD (non-wire) and receive payments for FREE, just like a local.

In reality, Wise's Multi-Currency account allows you to have access to offshore accounts beyond just Singapore, with no fees except for some outward transfers as there'll be some fees charged depending on the currency. You can check out their pricing details here. Just be wary if you plan to use their EUR account details to hold monies for the long term as there'll be an annual fee of 0.4% once you hold EUR 15,000 or higher for more than 3 days, due to the negative interest rate in Eurozone.

With Wise's Multi-Currency facility relaunched in Malaysia officially, they now also allow Malaysian users to request a debit card linked to the Multi-Currency Accounts (all of it!) at a low cost of RM13.70. This gives you the ability to spend your account balances with a competitive exchange rate which are pretty close to the exchange rate we usually see on Google - and are on par with BigPay's rate (sometimes beating it).

If you happen to travel overseas, you can also opt to withdraw cash directly from ATM, using Wise Debit Card. However, at this juncture, the fees & limits seem to be less attractive as compared to BigPay's offering

| Wise Debit Card | BigPay Prepaid Card | |

| up to RM8,600 | Daily Withdrawal Limit | 10 withdrawals daily up to RM10,000 |

| 2 free withdrawals monthly, up to RM1,000. Withdrawal above free limits will incur RM5 fixed fee + 1.75% variable fee (read more) For currencies we are not holding, there'll be an additional 0.24% - 3.69% conversion fee charged | ATM Withdrawal Fees | Local: Flat RM6 per withdrawal Overseas: Flat RM10 per withdrawal or 2.00% variable fee per withdrawal, whichever is higher (read more) Note: only flat RM10 charged for overseas withdrawal until further notice |

Whilst Wise's card is usable, it gets a little difficult to keep track of the potential fees charged especially when there are cross-currency conversions simply due to the fact that you can hold 50+ different currencies in the account. For now, whilst I already have received the Wise Debit Card, am actually not that keen to use it unless and if BigPay/AirAsia goes bankrupt tomorrow leaving me no other choice for competitive international spending (Revolut, where are you??)

To me (and perhaps many of you out here), this would be one of the most frequent use cases that we'll be using when it comes Wise: simply converting our Ringgit Malaysia into international currencies for investment purposes, depositing into our Interactive Brokers account. The availability of Wise's Multi-Currency Account also means that we, as investors, now have an array of options to choose from and decide how we want to fund our IBKR accounts, whichever more convenient/cheaper for us.

I'll be covering two ways to fund your IBKR account using Wise, with the first one being the more conventional method of sending money (via ACH Direct Deposits) and second one being the recently-launched Wise-IBKR Integration.

If you still don't have a Wise account, just open one here. You'll first need Wise account before you can proceed with the rest of these steps.

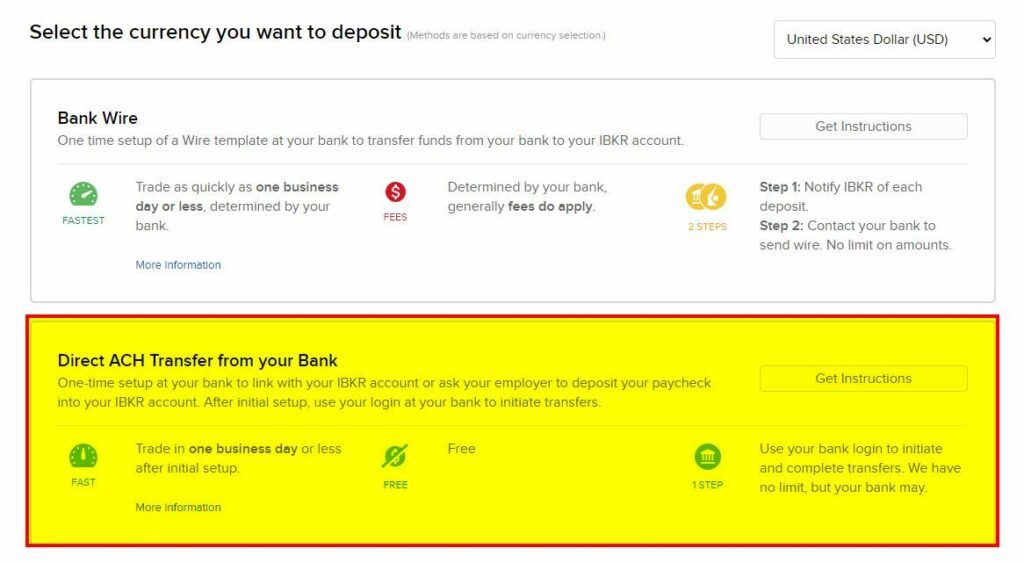

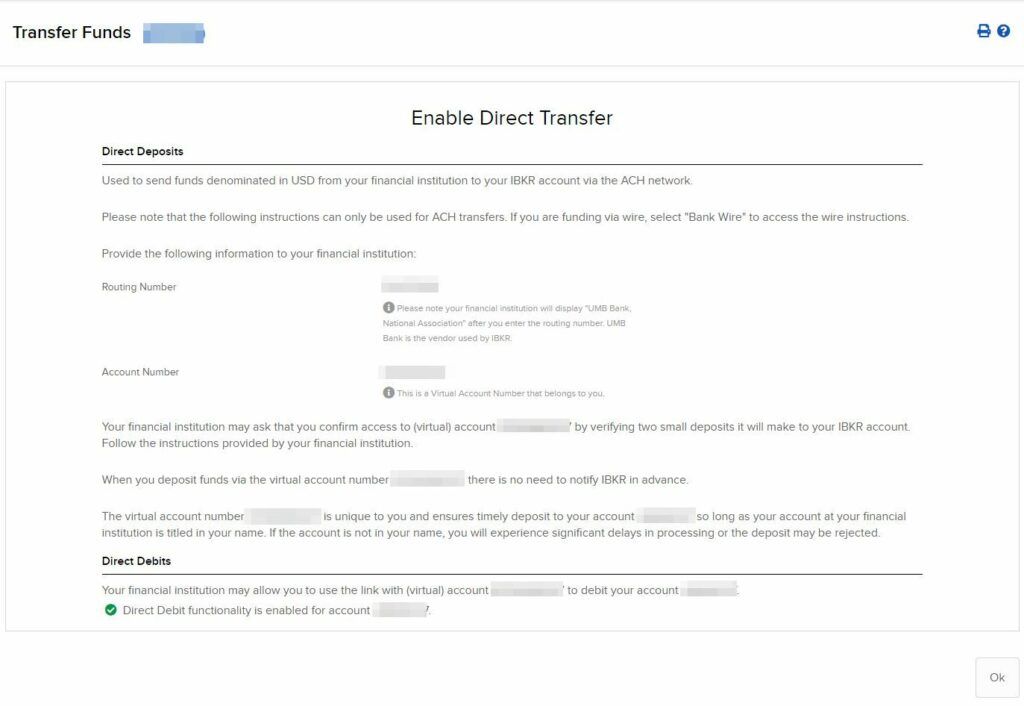

First of all - we need to get our individual ACH Virtual Bank Account details from Interactive Brokers, which are associated with our account. With this, we'll need to send monies directly to this "recipient" (virtual account) with no prior notification required on IBKR's end in the future (unless IBKR changed your virtual account details).

To get your virtual account details, simply login into your Interactive Brokers account. If your account application hasn't been approved, you can see the "Fund Your Account" button in your Application Status dashboard. Otherwise, if you already have a fully-activated account, just log-in and access the "Transfer & Pay" section and find the "Transfer Funds" button.

Select "Direct ACH Transfer from your Bank" and Get Instructions. This will show you a dedicated routing number and virtual account number unique to your own IBKR account. DO NOT SHARE THIS WITH ANYONE!

You only need to do this the first time (or when IBKR notifies you of them changing their virtual account details).

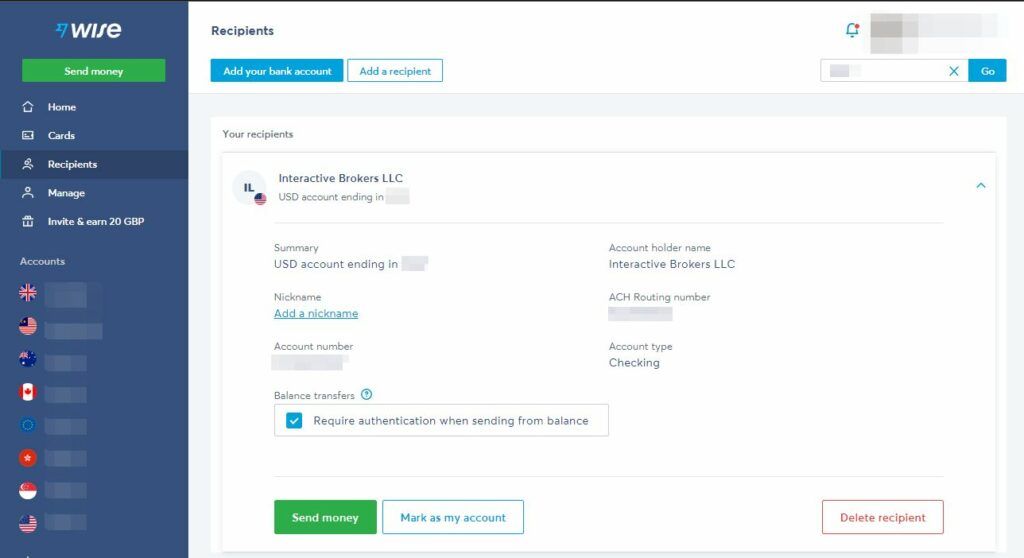

Using the above ACH Virtual Bank details unique to you, you can now add a new Recipient in Wise and save those details as your favourite 3rd Party Business Recipient. Doing this allows you to have easy fund-in in the future as your Wise account will have direct access to deposit into IBKR through the ACH network.

You only need to do this the first time (or when IBKR notifies you of them changing their virtual account details).

Once you have established the direct deposit linkage, you can now proceed to fund your Wise USD account. Simply access your USD Account Balance (with account details) and "Add Money" into it. Alternatively, you can also fund your Wise MYR account then convert it internally into Wise USD account - the fees are roughly the same.

If you do not see USD Balance in your Wise Account, that's probably because you have not opened the account yet - simply click "Open an account" and select USD currency and you're done!

In the below example, I topped up first onto my Wise MYR account and then converted it onto my Wise USD account.

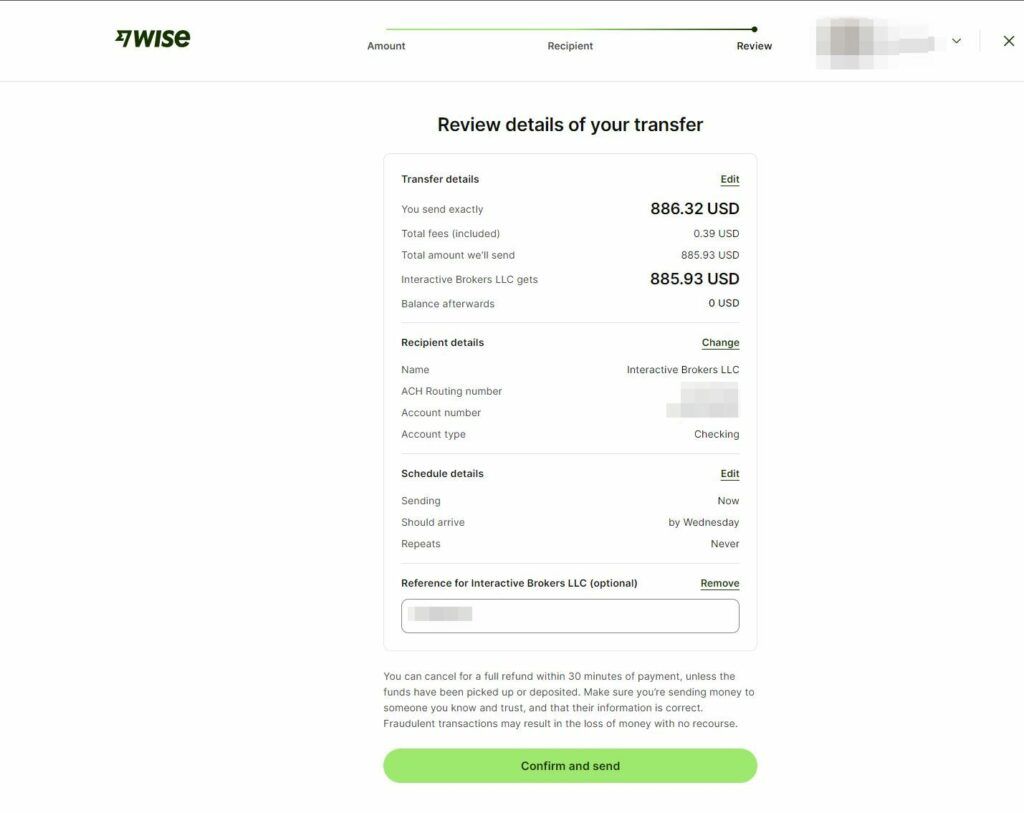

Once you have funded your Wise USD Currency Account, just hit the "Send" button in the account, select the previously added recipient (Interactive Brokers), and complete the transfer. There should be some charges by Wise to send the money - but it should be okay since you no longer need to pay USD$2 to IBKR later to do currency conversions (assuming you're investing in USD) and the rates from Wise are pretty competitive as well.

Remember to add your IBKR Reference Code during the confirmation screen. Unfortunately, this information is not stored in the Recipient Template in Wise so we just have to remember to do it every time we make a transfer to avoid rejections. In my experience, it took me usually a couple of working hours for the transfer to complete with funds reflected in IBKR for my usage, depending on the time I initiate the transfer.

As you can see, one of the benefits of ACH Direct Deposits (only for USD) is that you no longer have to notify IBKR of your individual transfers. If you are performing a standard Wire Transfer from Wise to IBKR (e.g. in GBP or HKD), there'll be an additional step where you will have to notify IBKR of your incoming deposits. NEVER EVER perform Wire Transfers for USD as there'll be a USD$7.50 charge by Wise.

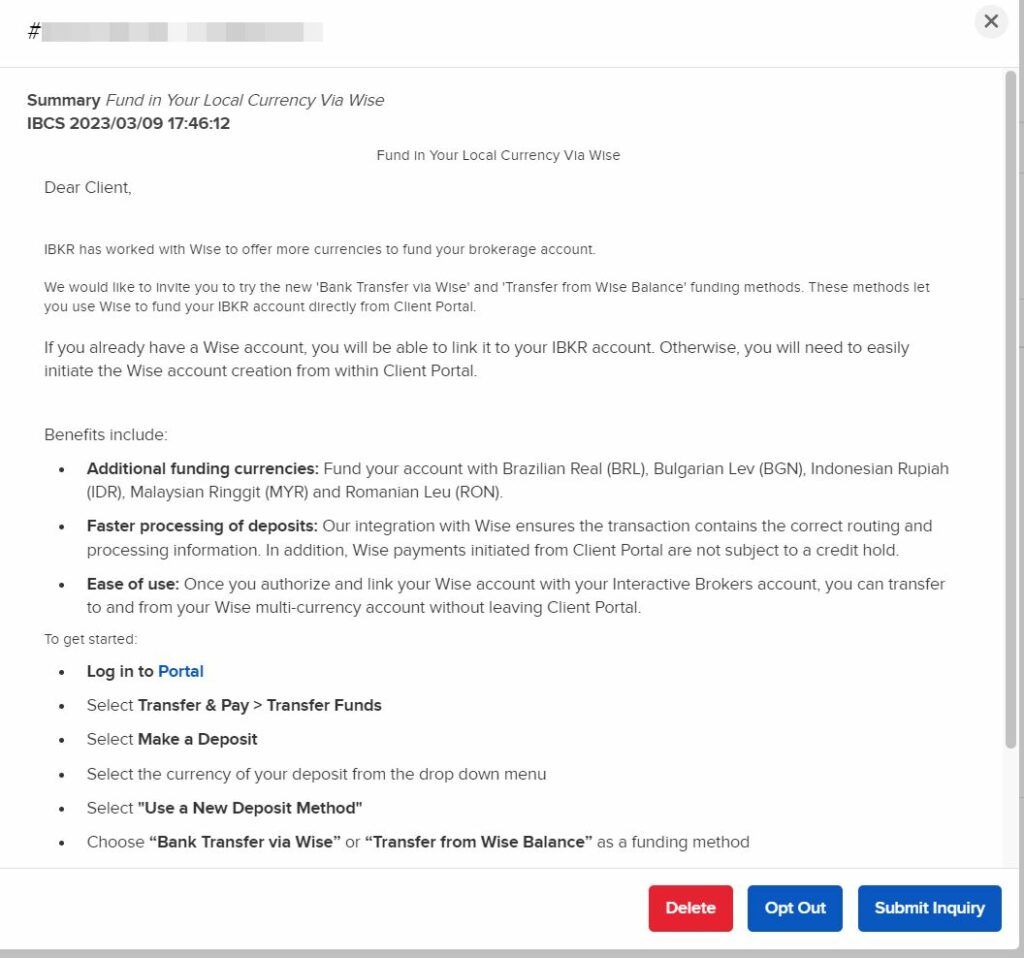

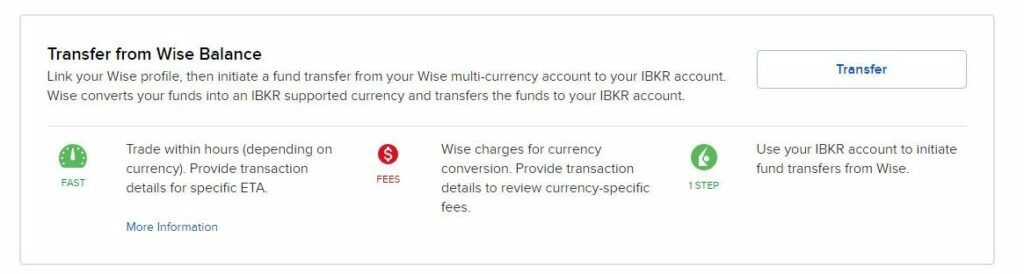

If you still find what you're reading so far to be cumbersome, trust me, you'll love this even more - as it totally eliminates many of the steps with a simple few clicks transfer directly within your IBKR itself (minus the first-time setup)

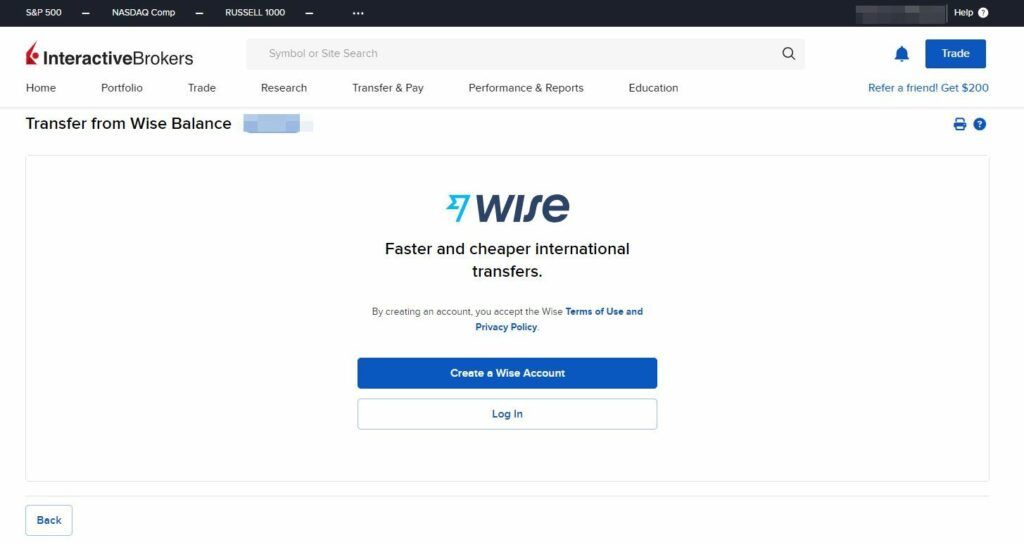

Similar to earlier examples, simply login into your Interactive Brokers account. If your account application hasn't been approved, you can see the "Fund Your Account" button in your Application Status dashboard. Otherwise, if you already have a fully-activated account, just log-in and access the "Transfer & Pay" section and find the "Transfer Funds" button and you'll see this shiny new button to Transfer from Wise Balance

If you haven't linked your Wise account with your IBKR prior to this, you'll see a prompt to login into your Wise account. Simply log in to your Wise account and follow through with the steps until your account is successfully linked to your IBKR.

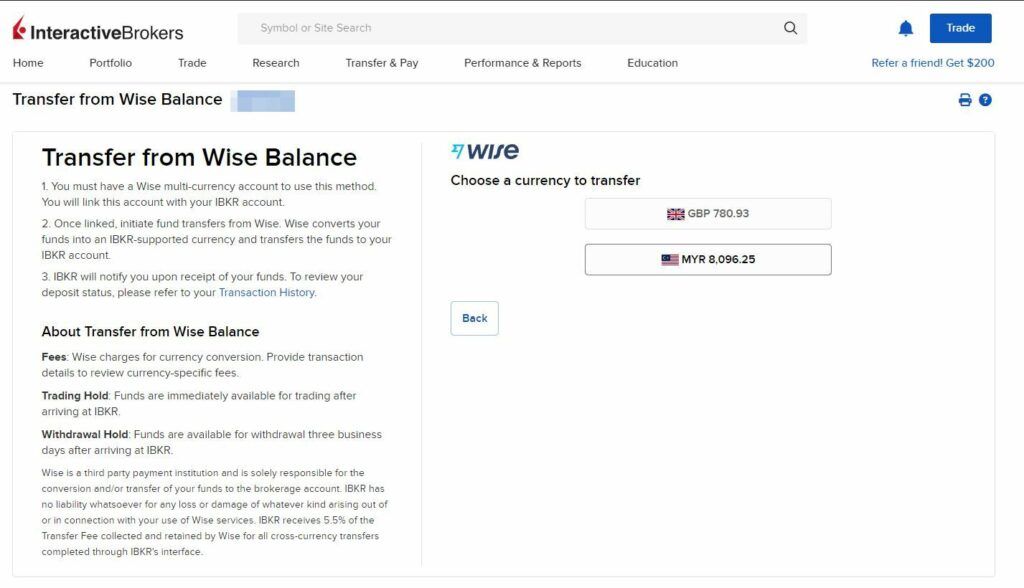

If you have successfully linked your Wise account to your IBKR account, whenever you choose the Transfer from Wise Balance option, you'll automatically see your balances in Wise directly within the IBKR page.

Ensure that you have enough funds in your Wise Account. You can have balances in any currency as Wise will automatically do the conversion into your target currency.

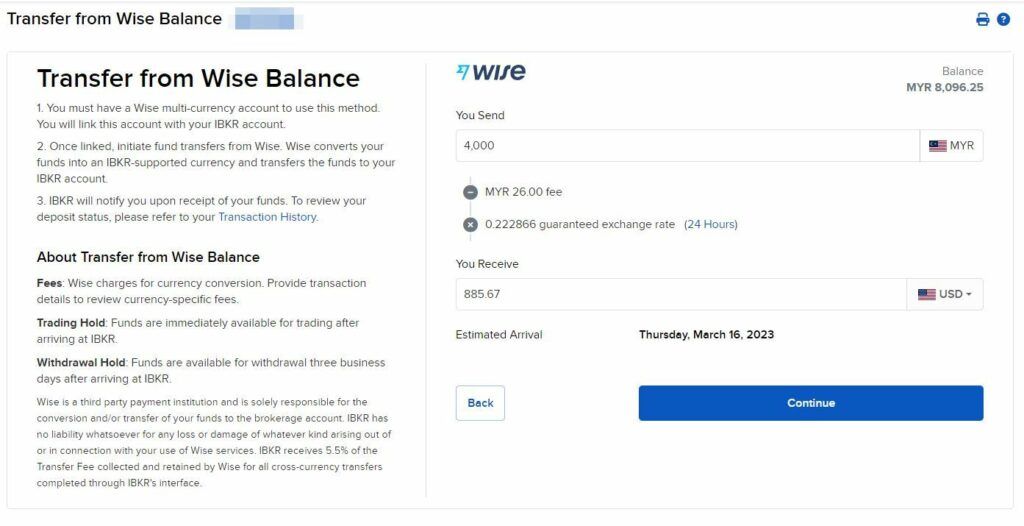

All fees are handled on Wise, including whatever premiums that IBKR collects from Wise directly (approx. 5.5% premium on top of Wise's fee, inclusive). IBKR is not involved in this conversion process so they won't be charging you the $2 commission.

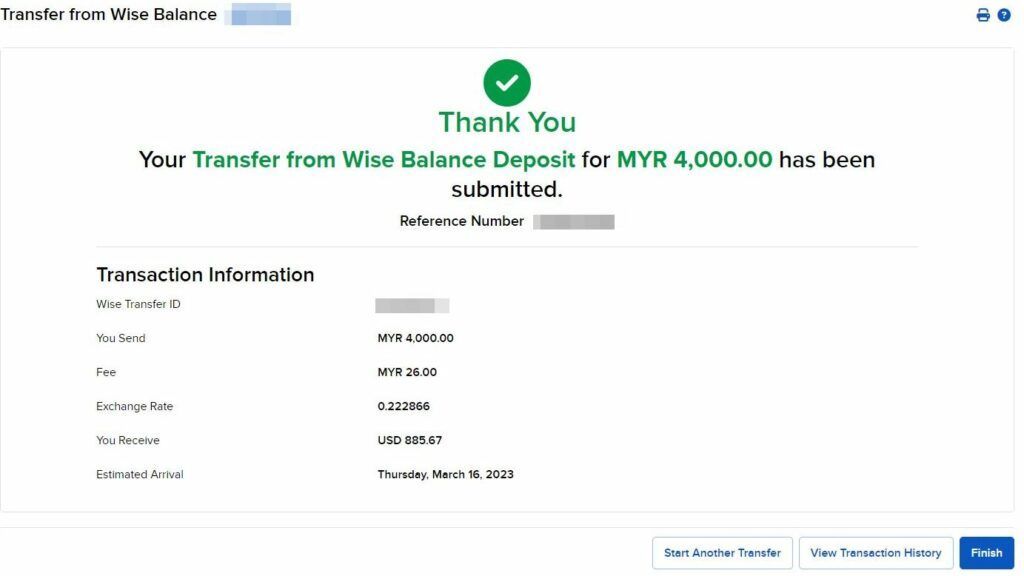

Yup. That's it, just two simple steps. In fact, just one if you minus the steps needed for first-time setup.

Seriously, both are solid options - just go with whatever you're more comfortable with. For the sake of science, I did a simultaneous transfer of RM4,000 with both options only a few milliseconds apart from each other just to compare the exchange rates and fees - at first glance, Option 2 seems to incur a higher fee, perhaps due to the 5.5% commissions take by IBKR for every successful Wise Balance transfers.

The amount however is negligible so unless you're min-maxing, it shouldn't matter much. Just look at the two transfers I've done (within seconds apart today)

| Option 1 (Wise to IBKR via ACH Direct Deposits) | Option 2 (Transfer from Wise Balance within IBKR) | |

| RM 4,000 | Starting Amount in MYR | RM 4,000 |

| USD 886.32 | Conversion from MYR to USD | USD 885.67 |

| USD 0.39 | Sending Fees from Wise to IBKR | n/a |

| USD 885.93 | Final Amount Received in IBKR in USD | USD 885.67 |

As you can see, for RM4000 worth of transfers, the differences between the two options are only USD 0.26 (which is approx. RM1 even with today's terrible USD rates). To put things in perspective, both options incur ~0.7% loss in FOREX fees as compared to Google rate at the same time.

So really, just choose either option 1 or 2, whichever you're more comfortable with and move on!

So this begs the question - with Wise Multi-Currency Account enabling us easy access to offshore accounts, do we still need to open a CIMB Singapore account when it comes to investing abroad through Interactive Brokers?

In my opinion - you don't really need to, since Wise Multi-Currency Account basically opens up all the other funding possibilities through "other" offshore accounts like USD (for US stocks) or GBP (for GBP-denominated London-listed ETFs). Even if you have plans to withdraw funds from IBKR - with Multi-Currency Account options through Wise, you can easily open and use the USD/GBP Local Bank details to receive your proceedings, then send it back to Malaysia through Wise's send money feature.

The only strong reason to open CIMB Singapore is perhaps when you need to do frequent transfers to a Singapore Local account (e.g. working in Singapore or investing heavily in the Singapore market) and you'd want to enjoy Local FAST transfers with zero fees vs. fixed-fee charged by Wise for all outward transfers.

Another perspective on opening the CIMB Singapore account is if, we have reasons to believe that Wise will cease to exist or close its Multi-Currency account for Malaysians again just like back in 2020s when they abruptly stopped offering their service to new users in Malaysia.

But if your sole reason to have a foreign offshore account is purely for investment purposes via Interactive Brokers, with the newly launched IBKR-Wise Integration the easiest and simplest way is just open a Wise Multi-Currency Account and be done with it.

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie

p/s in case if you'd like to support me, feel free to use my Wise referral code here and part of the commissions will go to a non-profit community charity foundation.

p/s.2. comments disabled on this post due to amount of bot spams