After scrutinising all my investments and associated fees recently, I have made a decision that there is a strong need to explore new international brokers which can satisfy my needs, most importantly fees when it comes to cross-border trading.

I hope that this written guide will help you to also shape your thoughts process to find the "right one" for you. I strongly believe that everyone's circumstances and priorities are different, hence there will never be a perfect one-size-fit-all solution, not in todays' world at least.

Truth to be told - I already have access to international markets and I didn't really need another one because I wanted to access US/Hong Kong/Global markets. I needed it for other reasons.

Prior to ending my short-term assignment in Hong Kong sometime back in 2017, I've decided to open up my Fundsupermart Hong Kong account which provided me first-hand exposure to Hong Kong & US Markets.

Back then, like many of us, I turned a blind eye to the fees calculation, assuming that HKD$50 per trade (Hong Kong) is cheap and fees wouldn't matter as much since I won't be actively trading overseas.

Maybe that was not the real reason - I was lazy - so lazy to to do my research during my last few months/weeks in Hong Kong and since I've been with Fundsupermart Malaysia for years, I decided to go back to them without second thought.

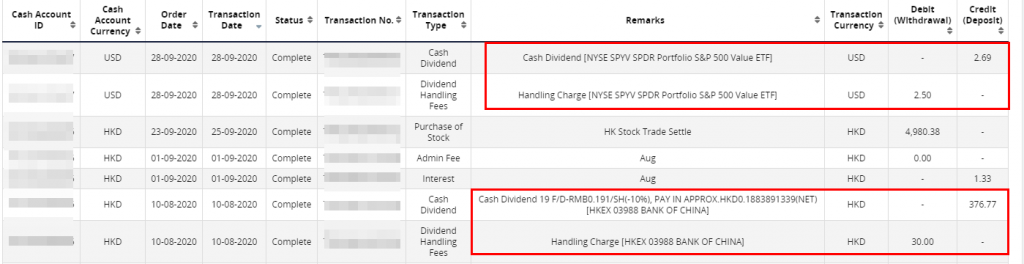

It was a bad decision which costed me some monies, but thankfully not for long (again I wasn't actively investing overseas yet). I only found out this year when looking at my Cash Transactional History that there were "Dividend Handling Fees" charged for every dividend I have received. And the rate? HKD$30 for my Hong Kong stocks and US$2.50 for my US stock.

Whilst it was still "acceptable" for my Bank of China stock with approx. ~92% retained dividends; the same could not be said for my US stock where I merely retained ~8% of the dividends after fees and witholding tax (story for another day).

This got me thinking - there has to be some bigger brokerage house in Hong Kong, or International Market, which are willing to accept a small retail investor like myself but still providing competitive rates.

Frankly speaking, my filtering criteria is so strict that by the time I completed answering all of my own questions, there's only a handful of brokerage house remaining for my deep-dive analysis (less than 3) hence the decision was so much easier.

I had to start somewhere, but it was truly overwhelming when I first tried to look for the one. So I decided to introduce some structured selection process which will also help my thinking, making a more informed decision rather than going only with my gutfeel.

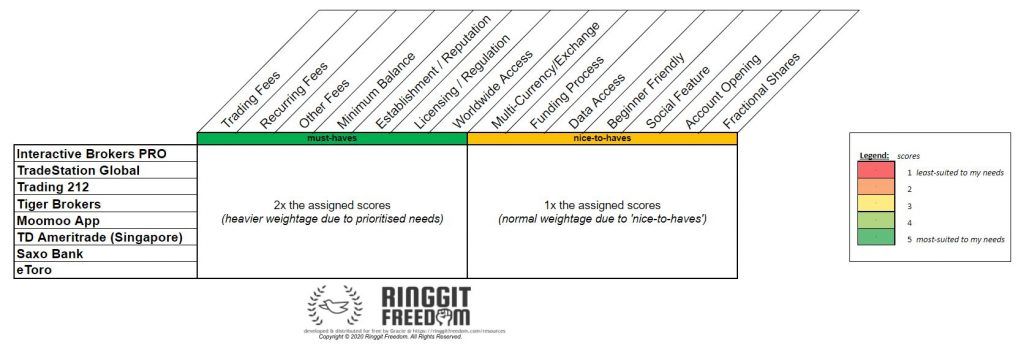

To make my life easier, I have created an excel spreadsheet to compare all of the above criteria, giving a rating between 1 - 5 for each of the requirements with 'must haves' weighting double of the 'nice-to-haves'. If you are interested to do a similar comparison yourself, feel free to download/make a copy of the Brokerage Comparison Sheet.

At a glance, you can see that I only shortlisted 3 potential options for my usage completely based entirely on my personal preferences, priorities and circumstances. In case if you are wondering on the scaling process for each of criteria (column) -

Here's a little legend chart to simplify the explanation. Again, feel free to to download/make a copy of the Brokerage Comparison Sheet if you are interested to do a similar comparison yourself. In the end - you have to select the brokerage that FIT YOUR NEEDS the most, and not mine! There will never be a "one-size-fit-all" solution.

Before going to the shortlisted ones, I ought that most of you would be curious why are some of the popular choices amongst Malaysians are dropped?

This was amongst the first choice that I have heard and looked into when I first started seeking out for international trading. The main reason of dropping it is simple - while they are being regulated by established monetary authorities, they lack worldwide access.

It may have worked if I were only looking for US-only trading but I am not - I have my Hong Kong portfolio which I plan to move out of Fundsupermart Hong Kong as previously explained.

They're also a fairly new player established in 2006 - innovation is good, Whilst they are regulated, but I want to be 200% sure when it comes to placing my money for long-term.

p/s if you're still keen to sign up and you'd like to support me, feel free to use my referral link to get free $50 upon successful deposit

This was the second choice that I was looking into, after hearing it from colleagues of mine where she and her husband have been using thinkorswim by TD Ameritrade Singapore for a while and had good experiences.

Main reason of dropping out? Their hassle funding process - direct USD funding from own-account, leaving myself with no other choice than International Telegraphic Transfer which I absolutely loathed.

Another minor pain-point was the $3,500 minimum deposit and $25 withdrawal fees which I do not want to deal with in the future. Let's also not forget that their account opening is painfully slow, with some waiting for months since submitting their documents.

This was really a tough choice for me to drop - I really liked their user-friendly interface, their lower-fees (except US stocks) when compared to TradeStation Global, and leverages the same backbone of Interactive Broker.

Main reason of dropping them? They're new player established less than 5 years ago and are still in the "investment / acquisition" stage and have just became profitable this year. Still, they're a strong contender and I will revisit them in years to come, but for now, I'll have to let them pass for the same reason I let eToro go.

Another challenge is how they deal with different currencies - regardless of what currency you choose to "fund" in with them, the destination is always in Singapore which means if we want to transfer funds (e.g. HKD) to my HKD bank account, I'll be incurring hefty FOREX fees imposed by the banks during the withdrawal process.

While I liked the Moomoo App and have everything accessible within the mobile app - interactive & detailed charting, technical & fundamental analysis, integrated news aggregator, level 2 real-time data for the US market - whilst still maintaining relatively competitive commission models.

Unfortunately, due to my very specific needs of having investments in Ireland-domiciled ETFs through London Stock Exchange (as part of my long-term passive investment strategy), I won't be able to enjoy the Moomoo App at this juncture unless they decided to include LSE in the future.

Their presence in Singapore, with local bank accounts accepting inward SGD transfer have definitely helped to speed up all kind of investment funding, whilst keeping the fees incurred due to foreign exchange relatively low - by using our own Singapore account which Malaysians can easily open and Fintech services like Wise to keep all the cost low. Unlike some of the international brokers, at least we are not forced to go through telegraphic transfers from Malaysia just to fund our account and get slapped by expensive fees / unfavourable exchange rates aye?

Well - let's just say that the minimum deposit of $10,000 put me off almost immediately and I didn't even bother looking further (except for when compiling the chart above :P)

With the latest developments, I will be placing TradeStation Global as a KIV candidate - well, we never know when IBKR will go back on their words and start imposing monthly fees again.

Long story short, TradeStation Global is the introducing broker for Interactive Brokers, kind of like partner-in-crime if you put it that way. They are basically leveraging most if not all functionality (except fractional shares) which are offered by IBKR PRO, but with zero monthly fees or minimum deposit* required in portfolio size or cash equivalents.

VERDICT: Potential alternative international brokerage to hold all my core portfolios, positioned for long-term investing if IBKR PRO is no longer an option.

* UPDATE 18 DECEMBER 2020: Tradestation Global just increased the minimum holdings to USD2,500 effective 1 December 2020 for new customers.

* UPDATE 9 JULY 2021: Tradestation Global have also removed the minimum deposits required as a response to IBKR's latest developments. However, with IBKR removing the requirements for minimum deposit and monthly fees, the only reason to go for TradeStation Global is if you prefer to trade actively and prefers to use their TradeStation Desktop App since both does not charge monthly fees.

That leaves us with only 2 contenders and there's just no comparison anymore. When I first wrote this article back in 2020, there was still a further shortlisting process between IBKR vs. TSG but even that comparison is no longer relevant with the latest removal of inactivity fees from Interactive Brokers.

I liked this the most - as it ticks all of my checkboxes ranging from market coverage to low commissions. With the latest developments effective 1st July 2021, the dreaded monthly $10 inactivity fees are finally removed and it makes it a no-brainer choice for my brokerage decision.

With my semi-passive long-term investing style, this would be a perfect fit as most of my purchases would be buy-and-forget(hold) and only checking in once in a while, to top up or rebalance my portfolios.

One downside is - without zero commissions, even if I want to allocate a small portion for active trading (to learn new stuff), it wouldn't be worth the commissions paid.

The only reason I temporarily dropped IBKR back then was due to the $10 inactivity monthly fees as I didn't have $100,000 portfolio holdings yet, and I do not trade actively (<5 trades per quarter) - hence I have been going through the TradeStation Global route back then.

VERDICT: Primary international brokerage to hold all my core portfolios, positioned for long-term investing

You probably have imagined it already - this is where Trading 212 comes to the rescue. Whilst they are relatively new and established only in 2004, for a supplementary "active trading account", the risk appetite would be greater, since this would likely only attribute to <1% of my portfolio holdings.

With zero-commission trading, access to US stocks with Fractional Shares and zero-withdrawal fees, a minimum deposit of $1; this is perfect for my "playground portfolio" for some active tradings without incurring any fees. Plus, with their "Auto Pie" feature, I can basically create my own "Ringgit Freedom ETF" (which is basically a random mixups :P)

There are some downsides which I haven't figured out yet but I'll find out more in the future - concerns surrounding the process to fund the account with the lowest-possible-fees (since they have limited currencies support) or withdrawing from the account with lowest-possible-fees (since they only transfer to own-named accounts)

VERDICT: Secondary US brokerage to hold my playground portfolios, positioned for short-term trading. Though I won't be really active here as it is mostly for learning only.

* UPDATE 24 DECEMBER 2020: Trading212 just announced that effective from 4 January 2021, they will be introducing a lifetime limit on free deposits via all payment methods other than Bank Transfers. Deposits via these methods will remain fee-free until we have deposited €2,000 in total. A fee of 0.7% will apply thereafter.

* UPDATE 9 JULY 2021: Although I have "disqualified" TradeStation Global in the latest update following the zero-inactivity fees from IBKR, the below section can still be interpreted if in the event we fall back into TradeStation Global someday - as the features are mostly the same with minor differences.

I know some of you would still be interested in some comparison in details, or explanations on why I went with the above choices. I'll try to address them in this chapter for each of the laid out categories, mostly focusing on Interactive Brokers (IBKR) as my primary broker for now (with TradeStation Global as backup in case if IBKR resumes charging for monthly inactivity fee)

The whole process of opening an account with Interactive Brokers may seem daunting at first - but it's really easy, especially compared to the TradeStation Global's registration process which are slightly more tricky since it involtwo-party and the communication isn't clear at times. In both cases, all you need to do is just to fill up online forms, submit a few attachments to verify your identity & address, fund your accounts and you're good to go!

Back then, I had to open my Interactive Brokers account via TradeStation Global account (before the zero-inactivity fee announcement in July 2021), and it was so frustrating as there were several redirection, and no email notifications throughout the process until after the account was opened. Had I not paid extra attention to the progress and follow through by saving the link, username and password, I might not even be sure if my account was opened at all 😛

For those who'd like to follow a step-by-step guide, I have written a pretty comprehensive guide for both Interactive Brokers and TradeStation Global respectively - be sure to check them out!

Speaking of funding - you might have recalled my previous post of opening a CIMB Singapore account, and that was basically a precursor prior to me opening an IBKR/TSG account.

There are few ways to do it when it comes to account funding, but with my typical kiasi / conservative mentality, I decided to play it safe by ensuring that when it comes to paper trail, it is as clean as it get hence when given the options to fund my overseas investment account, I will always opt for own-name transfers whenever possible.

Example: My Personal Account > IBKR Account

The only time I'll be willing to use third-party name transfers are when I initiate transfers between my own accounts across different countries.

Example: My Malaysia Account > TransferWise > My Singapore Account or My Hong Kong Account

Doing it the safer way have a price to pay as well - since I need to incur double currency conversion, from Ringgit to Transit Currency (SGD/HKD), and subsequent funding it into IBKR and if needed, convert to another currency using their real-time spot rate, sometimes cheaper than what you see on Google.

Good news is - IBKR do accept 3rd party named transfer from the likes of TransferWise or InstaRem, though they reserves the right to audit your paper trail at random, so just be ready with your bank statements to prove the money trail if you happen to be audited by them.

For those who'd like to follow a step-by-step guide, I have written a pretty comprehensive guide for both Interactive Brokers and TradeStation Global respectively - be sure to check them out!

Since Interactive Brokers have been pretty established (more on that later), they have presence or office in some of the world's major markets - such as Hong Kong, Australia, UK, Singapore, US, etc., which also means that they will have a local bank account in those countries.

Whilst I'm not sure how broad is their presences for local bank accounts, one thing I am sure is both HKD and SGD local transfers are included. That basically means that I can choose one of two routes (Hong Kong or Singapore) if I ever need to fund my IBKR account, whilst paying minimal foreign transfer fees thanks to cheap international transfers via Wise.

This is mainly made possible thanks to their multi-currency holding (up to 22 different major currencies, incl. HKD and SGD), and a real spot-exchange rate with zero markup on exchange rate, though they will charge you a flat $2 per currency conversion.

For example, if I choose to fund my account through HKD,

Speaking of which, whilst they do not have access to every single stock exchanges in the world *cough* Malaysia KL Stock Exchange is not there *cough*; they have a respectable number of stock exchanges included. My primary ones for now would be US Stocks, London Stocks, Hong Kong Stocks and maybe Singapore Stocks.

For those of us whom opens an account directly with Interactive Brokers, the account would be opened directly under Interactive Brokers LLC in the United States and hence governed by the relevant regulatory bodies there such as US Securities and Exchange Commission or Commodity Futures Trading Commission. Note that the IB entity is assigned based on our legal residence which in the case of Malaysia, it will always be under IB LLC unless you have opened your account through other means (i.e. via TradeStation Global).

However, if you open your Interactive Brokers account through TradeStation Global (UK) as the introducer, you've probably guessed it - the counterpart is basically Interactive Brokers (UK) which both of them are regulated by Financial Conduct Authority (FCA) in the United Kingdom.

In both cases, our securities are held and managed indirectly by Interactive Brokers (in separate accounts from IB entity's book), and hence my primary focus will naturally be on them. You can check their financial statements here (UK) or here (US).

Here's my take in summary: They're cash rich, have no long-term debts, separates our assets from their company, and have survived through financial storms between 1978 - 2020, with strong guiding principles ensuring investors' protection.

One of the main reason why I decided to go with Interactive Brokers.

Now let's talk about the elephant in the room - Fees.

Fees have always been one of the top reasons which eats into your long-term profits, compounded. So if there's one thing that must be transparent, it would be the fee structure.

Just to quickly recap, below are the fees in a nutshell and you can visit the TradeStation Global pricing page and Interactive Brokers' pricing page to find out more.

It might be slightly confusing since there's two pricing tables/source but just remember this - if you applied via TSG, all pricing will follow TSG model, except if you took-on additional subscription / features from IBKR themselves. If you apply directly with IBKR, just follow IBKR's pricing which typically has the lowest. Remember to select Tiered pricing unless you trade in 6-digit USD every single trade!

IBKR by itself operates on a "subscription model", providing everyone with essential / basic access to its core functionalities such as delayed quote, fundamental reports and analysis, access to use Desktop App / Web App / Android App / IOS App, etc.

For everything else optional or nice to have, such as Level 2 data (real time quote / stock charts per stock market), they offer it as an ala-carte add-on subscription. Kinda like Netflix (basic) plan providing you access to view / stream on one device, allowing you to go up in functionalities as you pay more, except that it is on ala-carte basis hence providing you with more freedom. if you want Netflix (4K) but only 1 device, you cannot - since it is already bundled in their 4K package.

If you are applying via TradeStation Global as the introducer broker, there will be some limitations set by Interactive Brokers preventing you from accessing some of the features - and the only one I have noticed so far is Fractional Shares being disabled in our accounts.

I will elaborate more in the in-depth Interactive Brokers' guide in my future postings but for now, let's just say that their web-application and mobile-app is actually not too bad.

Definitely not the most fluid User Interface (UI) / User eXperience (UX), but good enough for me to navigate on my own without watching any videos or tutorials.

Phew.. this have really been a long post. I always thought that it will be a short one but I just can't stop adding more of my thoughts, but I hope that this have provided you at least with some insights on how I rationalised on my selection of international brokerage, before finally landing on Interactive Brokers as my primary choice of brokerage (with TradeStation Global as a backup in the event IBKR reactivates their monthly inactivity fee). I still keep my Trading 212 as my supplementary active trading for US markets/DIY ETFs via Pie Feature

As with all things in life, do your own comparison and find out what's best for you - as your circumstances, preferences, priorities or thresholds may be different than mine. Regardless of which, I hope that the general selection criteria would still be able to help you to choose.

Here are some of the detailed walk-through which might be useful for you to kickstart your journey:

Thanks for reading and I will see you again in my next post!

If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie