I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

"February", the month of Lunar New Year for 2021 came to an end just like that.

2021 have beaten all my past years' record on getting the least number of angpaos throughout the festive season - with only ONE angpao added to the tally (thanks mom! ?)

To add some spices to my future monthly updates - I've decided to do the gamer style of unlocking achievements. Maybe I should create a dedicated page to list down all these unlocked achievements... ?

Nothing out of ordinary this month, as I've been staying home all the time except during grocery trips hence the aggressive saving rates.

Except for the special angpao given to my mom during Lunar New Year (although I'm still single), everything else pretty much gets redirected into my sinking budget, emergency jar or investment portfolio.

One particular achievement that I have been looking forward for MONTHSSSS was to hit my Zero Net Worth. I'm so happy to finally hit it - moreso during the auspicious month of Lunar New Year! ?

I'm one of the very few odd ones that choose to recognise my primary residence as $0 asset value since it only significantly creates liabilities and expenses on my monthly cash flow, generating no income. Guess I was heavily influenced by Rich Dad, Poor Dad...

There has been more activities this month on my overall portfolio.

As my favourite investing style is to order-and-wait / buy-and-forget, sometimes I just like to set my limit orders for my stocks at my desired price point and wait for it to fill.

Unfortunately with Cash Accounts for IBKR, the cash will always be sitting in IBKR account doing "nothing" until the order actually fills and I absolutely hated it. After giving some thoughts, I have decided to just convert my account into Margin Accounts and solve this problem once and for all. This way, I can place my limit orders without first having the cash in IBKR account and keep it elsewhere (e.g. my flexi account) and only fund it into IBKR when order fills.

Having said that, I am still enforcing myself to invest/trade with only cash in my hand and never on leverage so it's more-so like a Payment Term than Borrowing really (like how I typically leverage credit card as a tool)

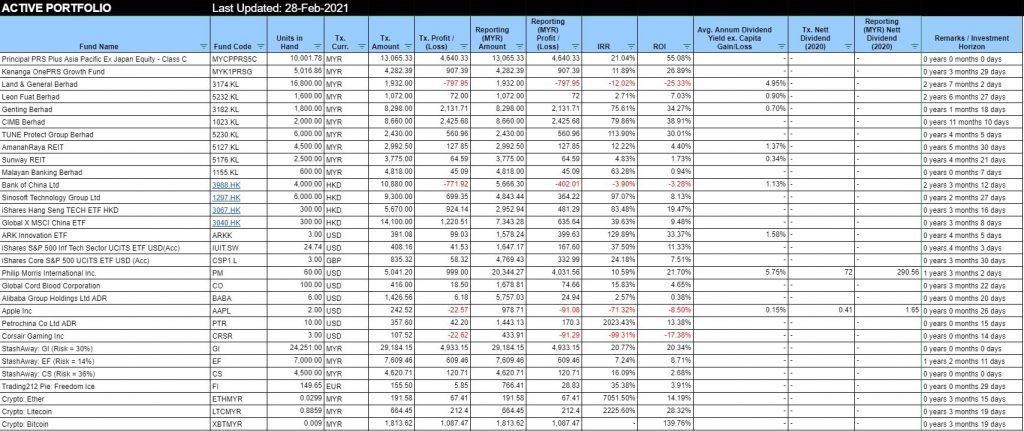

Finally bought into Maybank after selling my positions of ARBB - I really liked how ARBB transformed themselves successfully from a timber company to an IT company. But their never-ending growth of Accounts Receivable with 180+ days of payment terms just worries me hence I decided to just take the 36% profit for now and continue observing. Maybe it's a bad decision from my side, who knows...

For some of the leftover cash which I deployed into IBKR last month but have yet to spent, I've finally bought into few stocks incl. Apple, Corsair, PetroChina, and more Sinosoft based on current valuations (maybe except AAPL).

As for my typical monthly DCA, I have introduced slight changes from February onwards where I will start to chip in a very low double-digit Ringgit into Bitcoin on a weekly basis.

This way, I can still maintain a slight holdings (<3%) of cryptocurrency to tap into the frenzy (or crash) but without overexposing myself in both of the cases.

At this stage I'm still not convinced too go big on cryptocurrency, but are convinced enough to have a consistent tiny bits of weekly DCA to build up the holdings but without significantly harming my portfolio.

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 4.13%

ROI: 7.35%

Profit/Loss: RM2,592.82

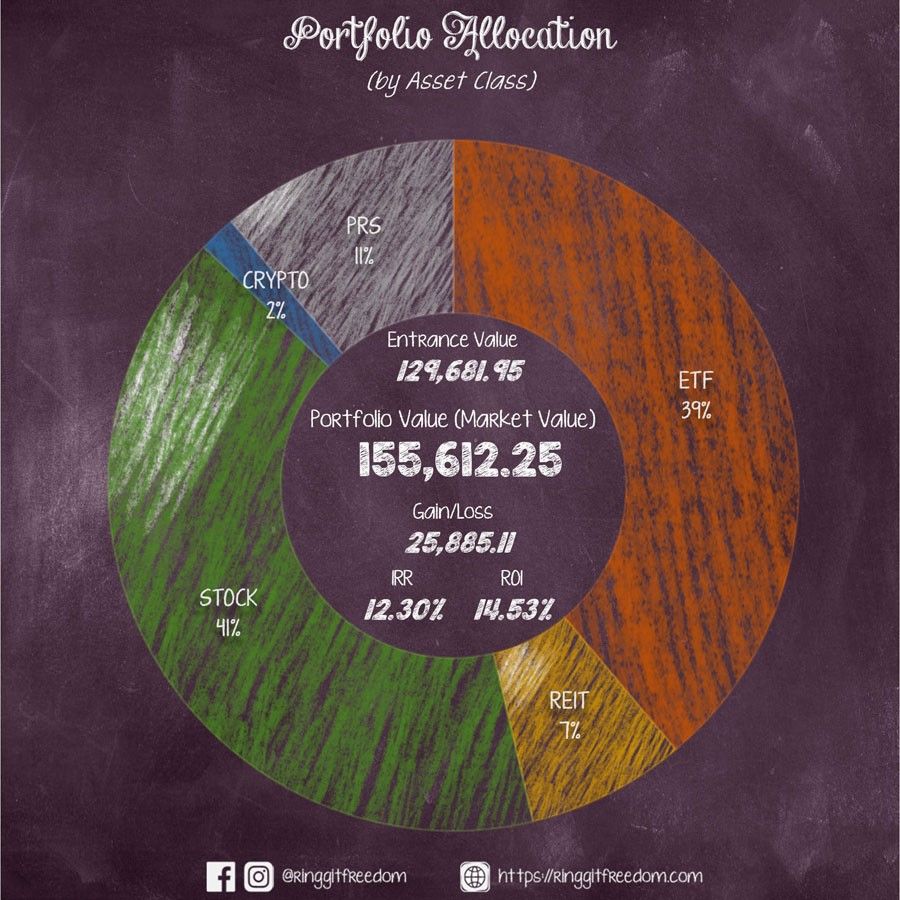

Active (Invested) Portfolio

IRR: 16.59%

ROI: 16.30%

Profit/Loss: RM23,292.29

True Cost: RM142,861.17

Total Value: RM166,200.11

Entrance Value: RM129,681.95

Portfolio Value: RM155,612.25

Nett Dividend (2021): RM290.56

On a side note, I spotted an error when comparing the # units of PRS vs. my Fundsupermart Malaysia and noticed that I have forgotten to record the income distribution for my PRS fund. Hence there was a temporarily drop in value for my PRS holdings in January's report. Gosh, I really hate these "income distributions" as it serves no purpose for me other than creating additional tasks for me to input in excel ?.

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie