The post Ringgit Freedom’s June 2025 Updates appeared first on Ringgit Freedom.

]]>My Life & Mental State

Work & Life

Things at work have definitely improved compared to the last few quarters. Whilst there'll never be a single day that are completely peaceful (at least not in our company) - but at least it's not as chaotic as before, allowing us to regain some of our headspaces.

If there's a small win that I want to celebrate recently, it'll be the 1st year anniversary of my Korean Learning journey - something that started very impromptuly due to IU concerts back in 2024.

At this stage, I am only putting in the minimum required efforts to keep the learning alive (2 to 4 hours per week) - it is good enough for now since I have no intention to further my educations or move to Korea. Just wanted to have enough basics to survive when I watch Korean Dramas - or when I travel. Speaking of travel, I've finally pulled the trigger (booked everything pretty last minute, too) for a 3-weeks solo trip in Korea, something that I've been wanting to do for a few years now but put away for whatever reasons.

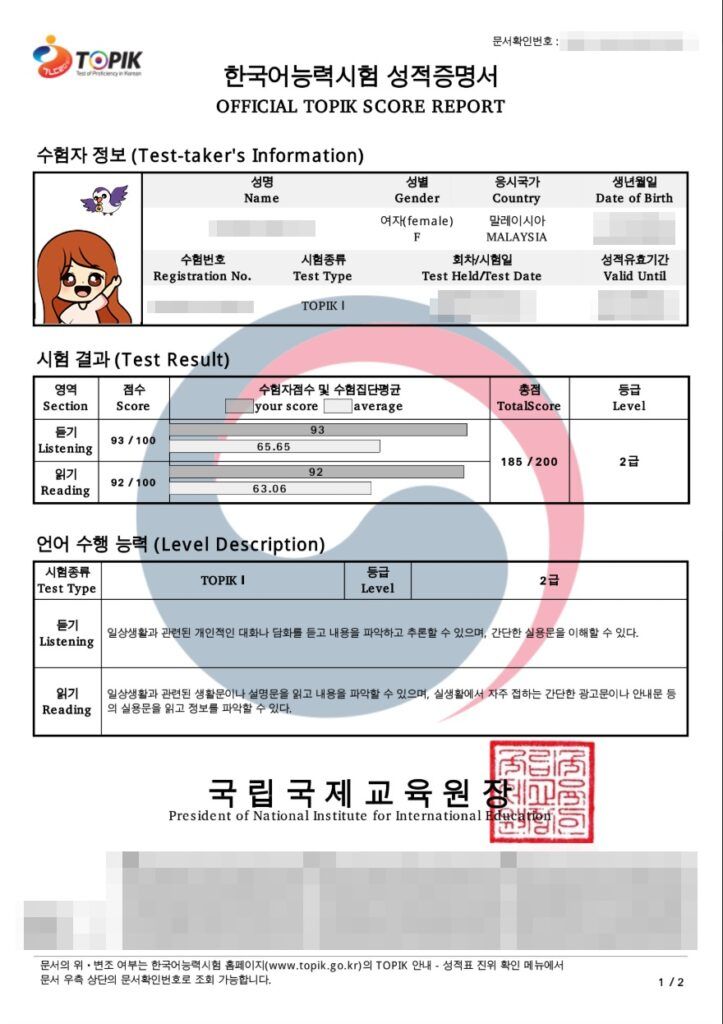

I was supposed to only go for the trip - AFTER receiving my TOPIK examination results to ensure that I've at least passed (as a reward for myself) but heck, might as well just go. Anyways, I sat for the 99th Malaysia TOPIK Exam back in April and surprisingly the exam were easier than anticipated - probably because I did quite some past year papers and also only took the TOPIK 1 examination which consists of Listening & Reading test components - without the dreaded Writing component (that I hated the most, ironically, as a blogger).

Halfway through my solo-trip holidays (not checking emails and all, obviously), my sister sent me a text to check my TOPIK results (which I couldn't without a laptop as they blocks all type of mobile/tablet devices, including "Desktop Mode" browsers 🫠). With her help, I received the good news below and continued on with my holidays 😛

Equipped with my broken Hangeul skill this time around, and also the ability to read Hangeul characters (not necessary knowing the meaning but helpful enough to take an educated guess 😂), I can definitely feel the improvements in Quality of Life for this trip as compared to all my previous Korea trips.

In the past, I had to use Papago for literally every social or non social situation but this time around, I only had to take it out very occasionally - mainly to check and make sure that I'm conveying the right message or constructing the correct sentences especially during stressful situations. But mainly it's to prepare the conversation "in my head" before it actually takes place to reduce the stress of doing live translation in my head during real conversations.

Whatever you do in Korea, forget about Google's suite as their app are pretty much lacking in South Korea. Personally I find Google Translate behaves oddly for Korean/Chinese/Japanese translations compared to Papago. Even Naver Map (or any other option like KakaoMap / T-Map really...) outperforms Google Map.

눈 깜짝할 사이에 한국어를 배운 지 일년이 됐어요!

한국어를 아직 잘 못하지만 조금 이해할 수 있어요.

한국에서 3주 여행동안 간단한 대화를 한국어로 했어요~

I still have thousands of photos unorganized and I'm also thinking if I should post them - on which Instagram account, or just leave it in my memory card/Google Photos... let's see when I have the mood to do it. Or should I just write a blogpost about the 3 weeks' trip, maybe with some financial breakdown? I don't know yet. Anyway, passing TOPIK examination wasn't the biggest win I had for Q2 of 2025. There's an even bigger win that came out of nowhere against all odds - and much earlier than anticipated too.

My Biggest Win

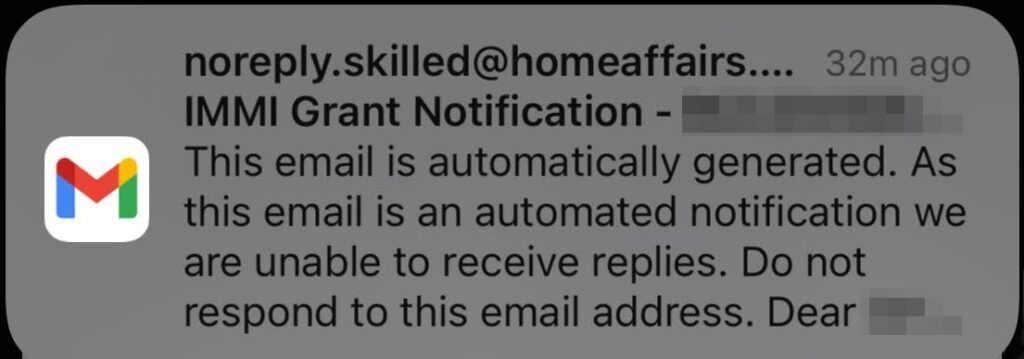

One of my biggest wins for this quarter, perhaps, is successfully securing my Permanent Residency from Australian Immigration Office since starting this journey almost two years ago in 2023. Imagine swiping down the Notification Centre and sees an email coming from [email protected] as someone whom are in midst of Visa Applications.

I went through all types of emotions in that split second - shocked, scared, denial, surprised, happy, crying, ... - you name it.

Quite frankly, I wasn't expecting the grant to happen so soon and was mentally prepared to gruellingly wait for another 12 months due to the delayed processing times. On one hand, I'm definitely grateful to finally stop living in an anxious state of waiting, but it came with some downsides too.

Whilst I've been mentally preparing myself to eventually quit my job just to physically move myself down south - facing the reality had proven to be much trickier when trying to balance it from different aspects of financial, career, and personal growth at the same time. Decisions would've been much easier if I was lacking in some (or all) of these aspects - as moving there will guarantee me a better life for sure. At my current stage in life, it'll probably be at least 2-3 steps back (or 4-7 years of setback using time as a measure) if I take that decision now.

Nevertheless - I'll eventually have to make decision one way or the another by end of the year as I'm not planning to give up my hard-earned Permanent Residency right after obtaining it. Will see what would be the best course of actions for me - not just from career/financial perspectives but more importantly my personal growth/desires. Meanwhile - I'll just continue to negotiate and find pathways whether with my current Employer or my future Employers, where ever life decides to take me to. Fingers crossed 🤞🏻.

Now, going back to our usual monthly update for my finances and portfolios.

My Financials

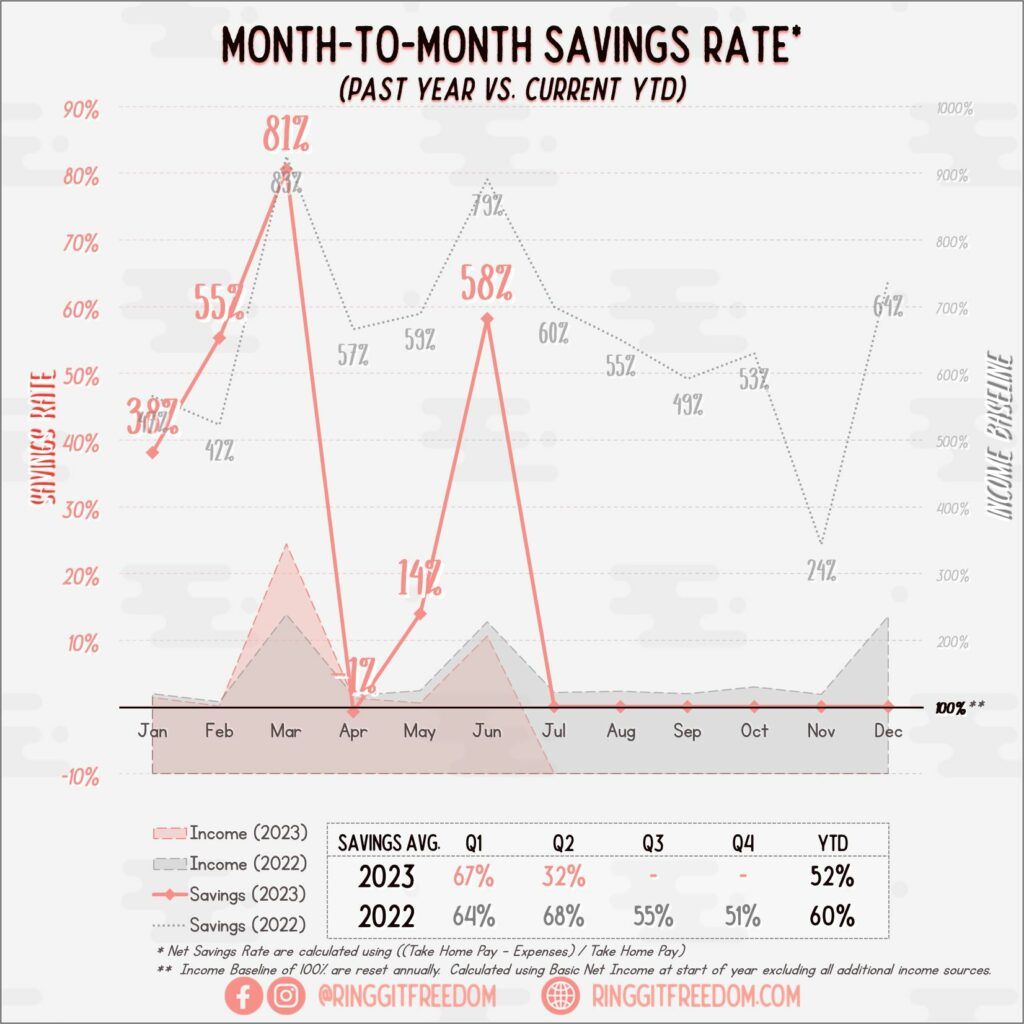

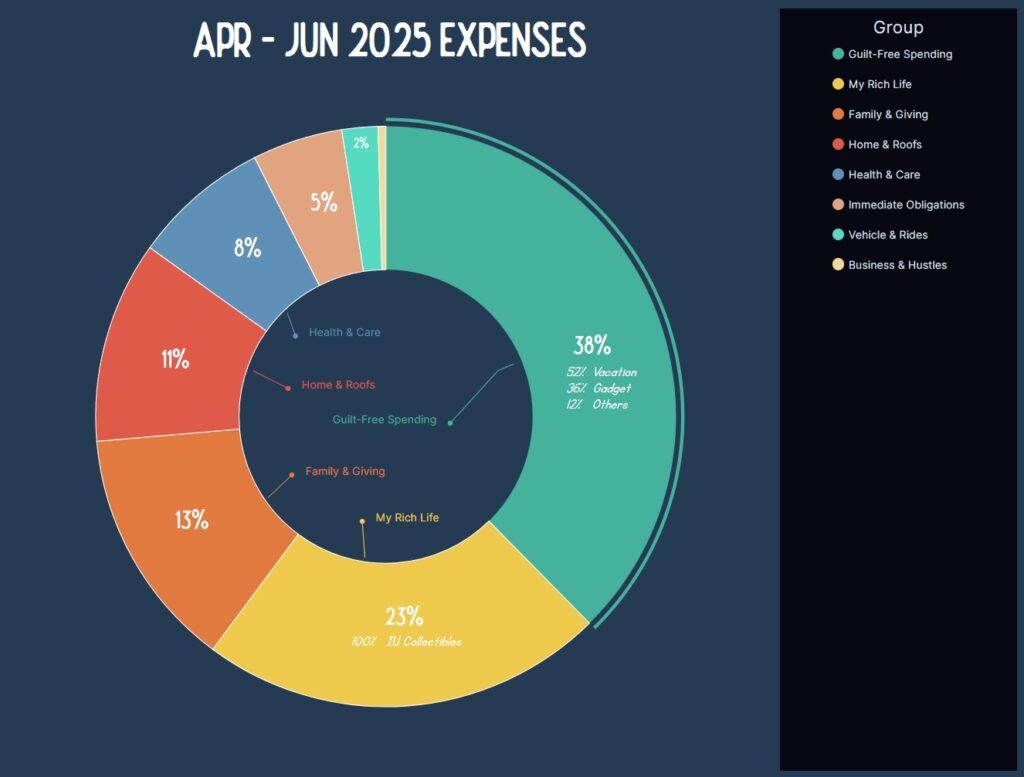

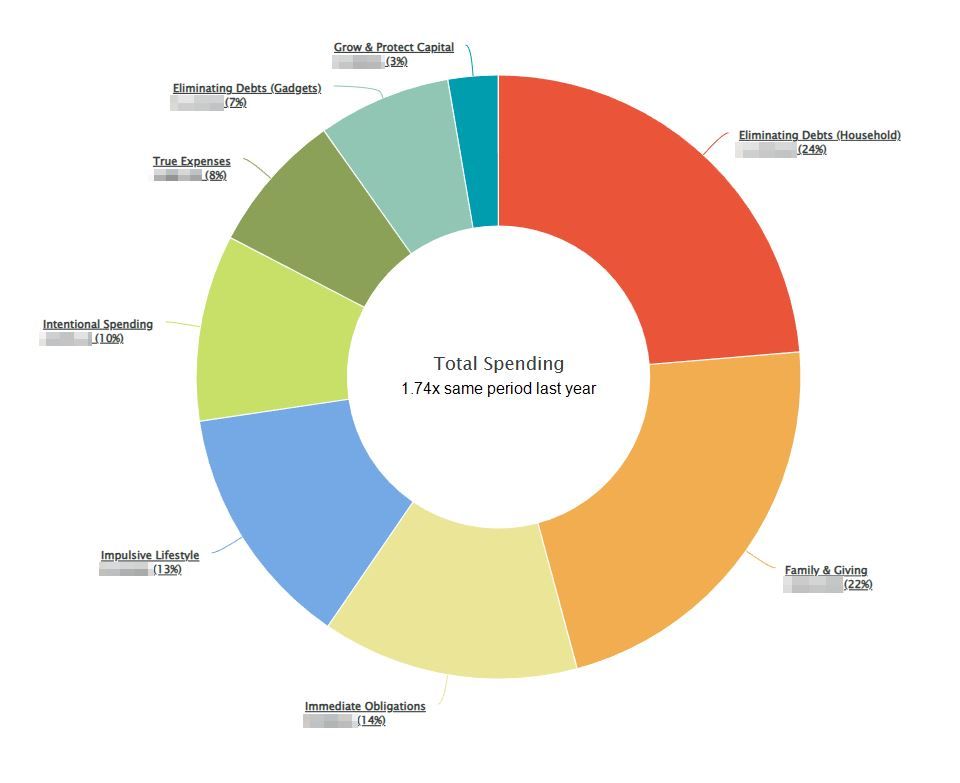

Whilst I've started my Quarter 1 strong, with solid savings rate and minimal leisure spendings, Quarter 2 is where I lost it all. I've pretty much lost my control with unbudgeted impulse purchases since before my Korea trip - with random gadget purchases to souvenir purchases during holiday and now even starting my own little (or massive?) collection of my idol's albums... guess who.

Part of me suspect that this is basically my subconscious acting up, where deep down inside I'm worried about eventually "losing" my current well-paid job should I pursue further on my migration pathways etc. - especially considering the higher tax rate and cost of living in Oz. I even checked against ChatGPT/Deepseek to explain my recent behaviours - and seems like it's a real possibility that I am lapsing exactly due to this. Not a good news for sure.

Whilst it's good that I hasn't gone into a debt yet with the recent impulsive purchase, if this goes on for just another month, I probably would start flowing into the negatives. I will have to take back control of my own finances - otherwise the efforts I put in the last 5 years would just go down into drain - just like that. Good thing is, the financial part of my had been awakened and have been calling out my impulsive behaviours whenever it happens - hopefully the situation will turnaround in my next quarter's updates.

On a completely unrelated note - here's one of my random discovery of IU's early days OST song that she sang before getting famous. Never knew how I've never stumbled into this beautiful piece throughout the last decade, no thanks to YouTube algorithm - for both hiding it from me during the entire last decade, and also randomly appearing in my feed recently.

Expenses

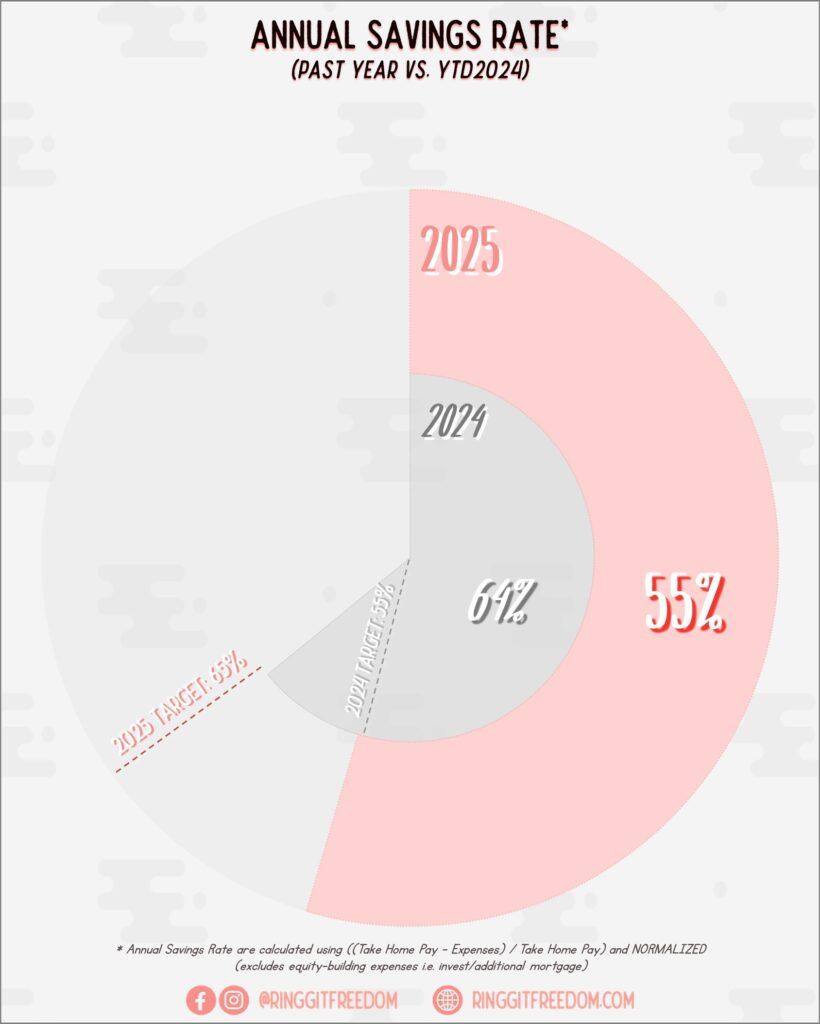

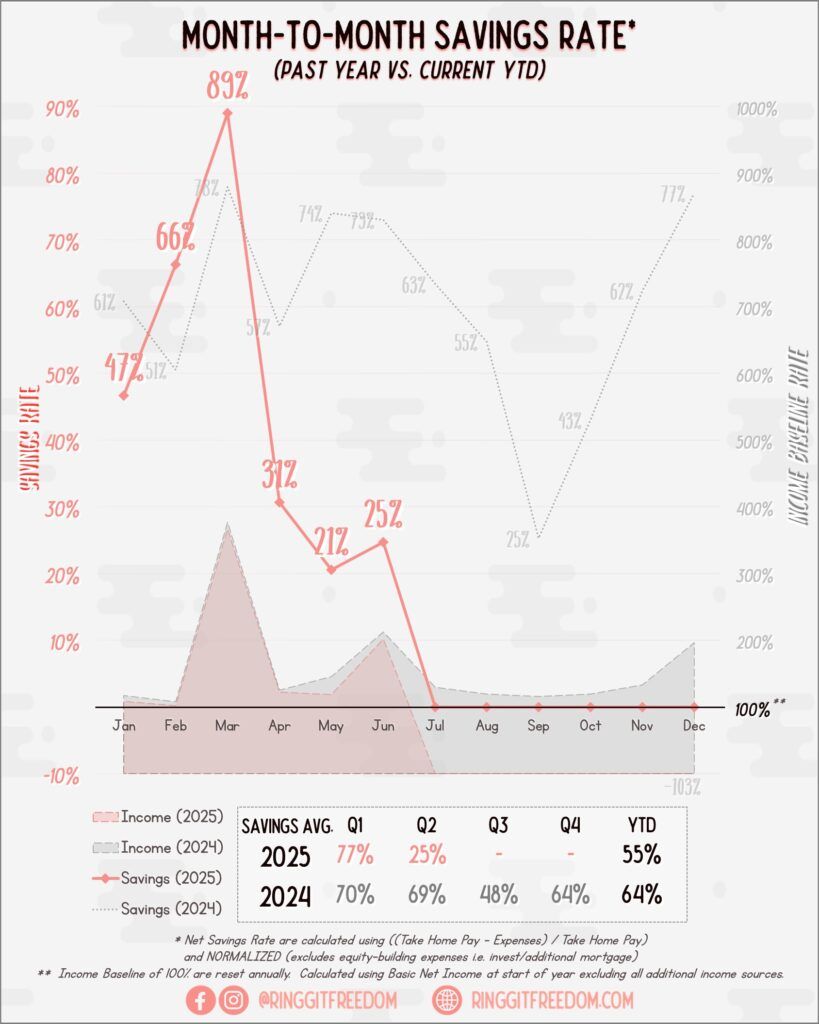

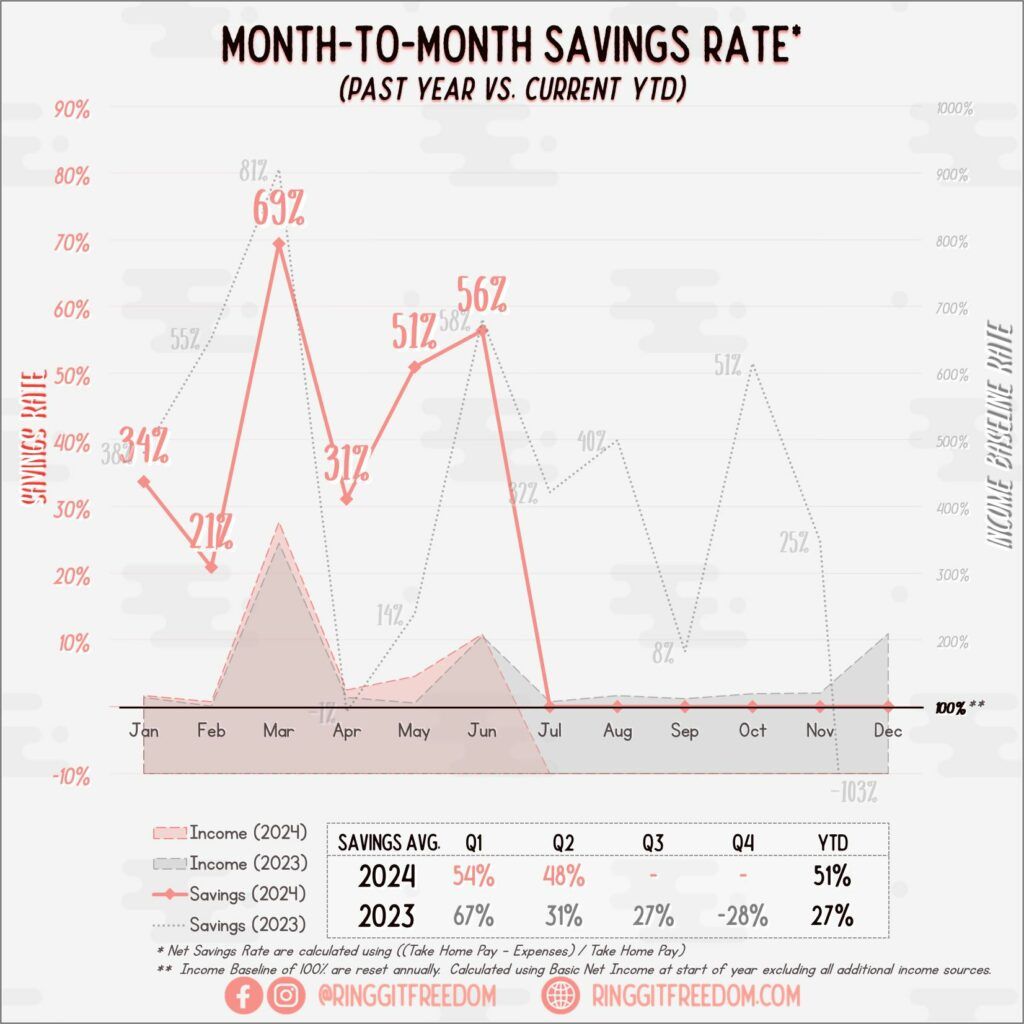

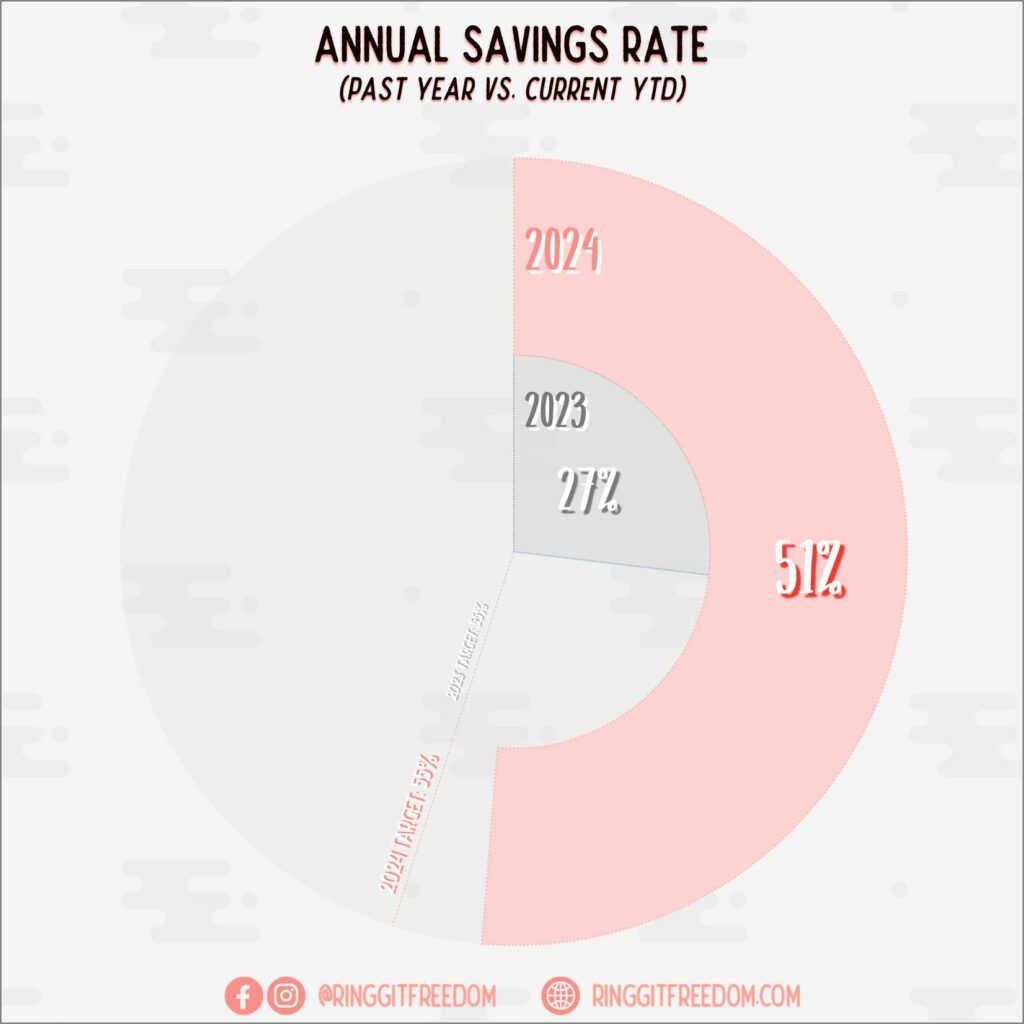

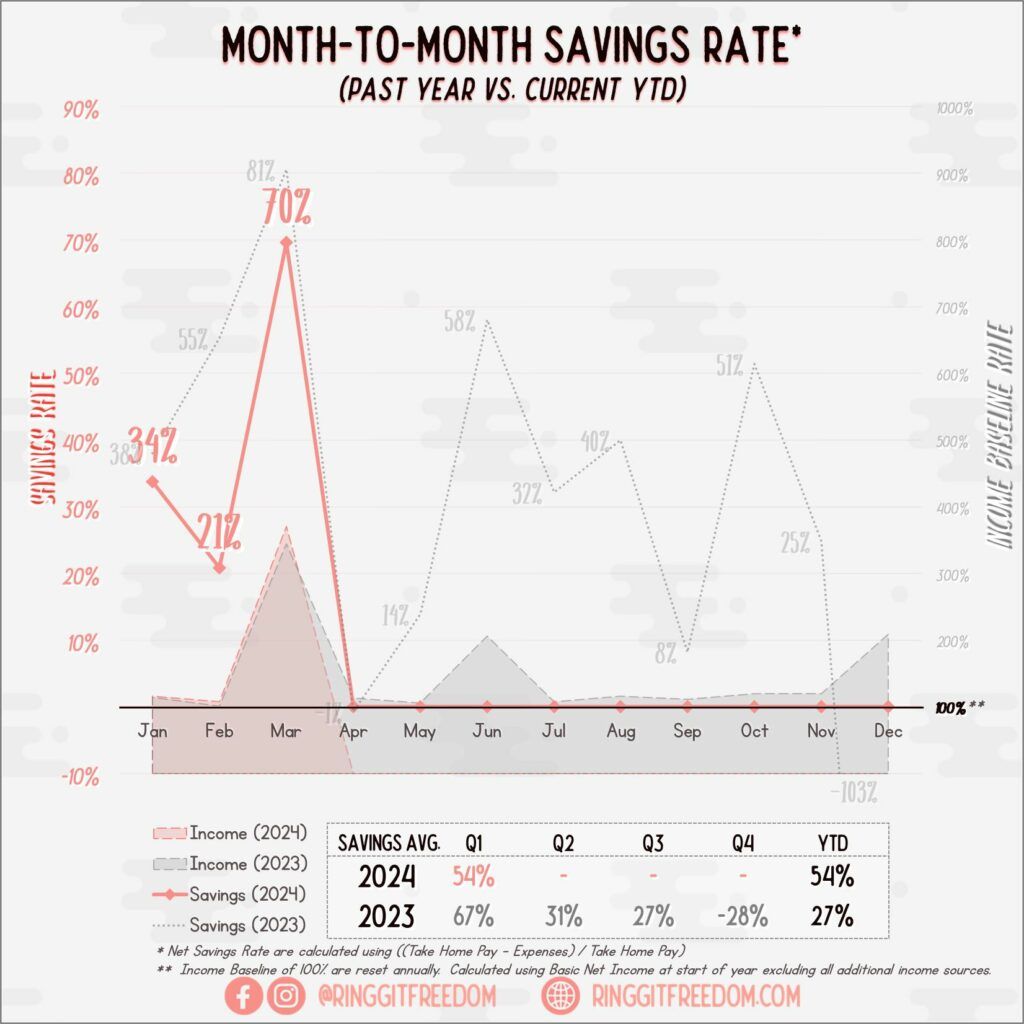

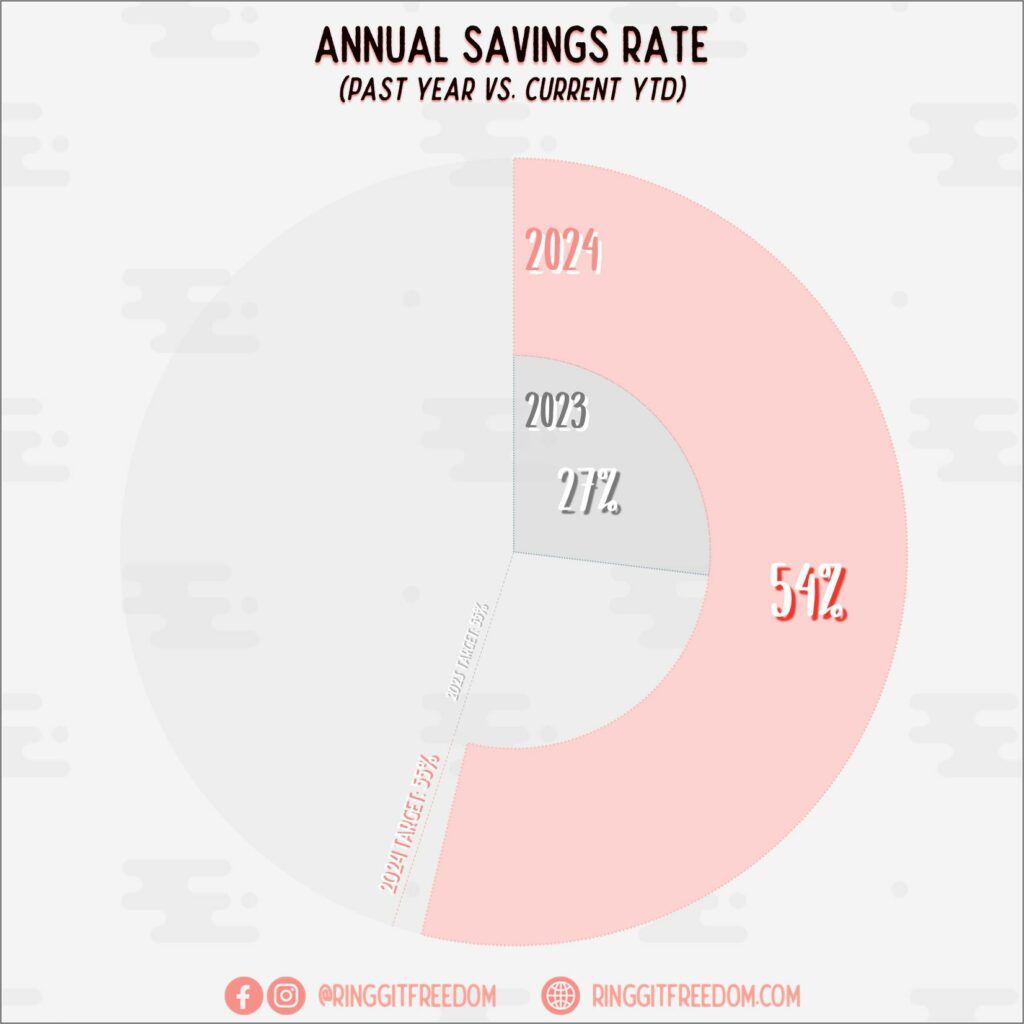

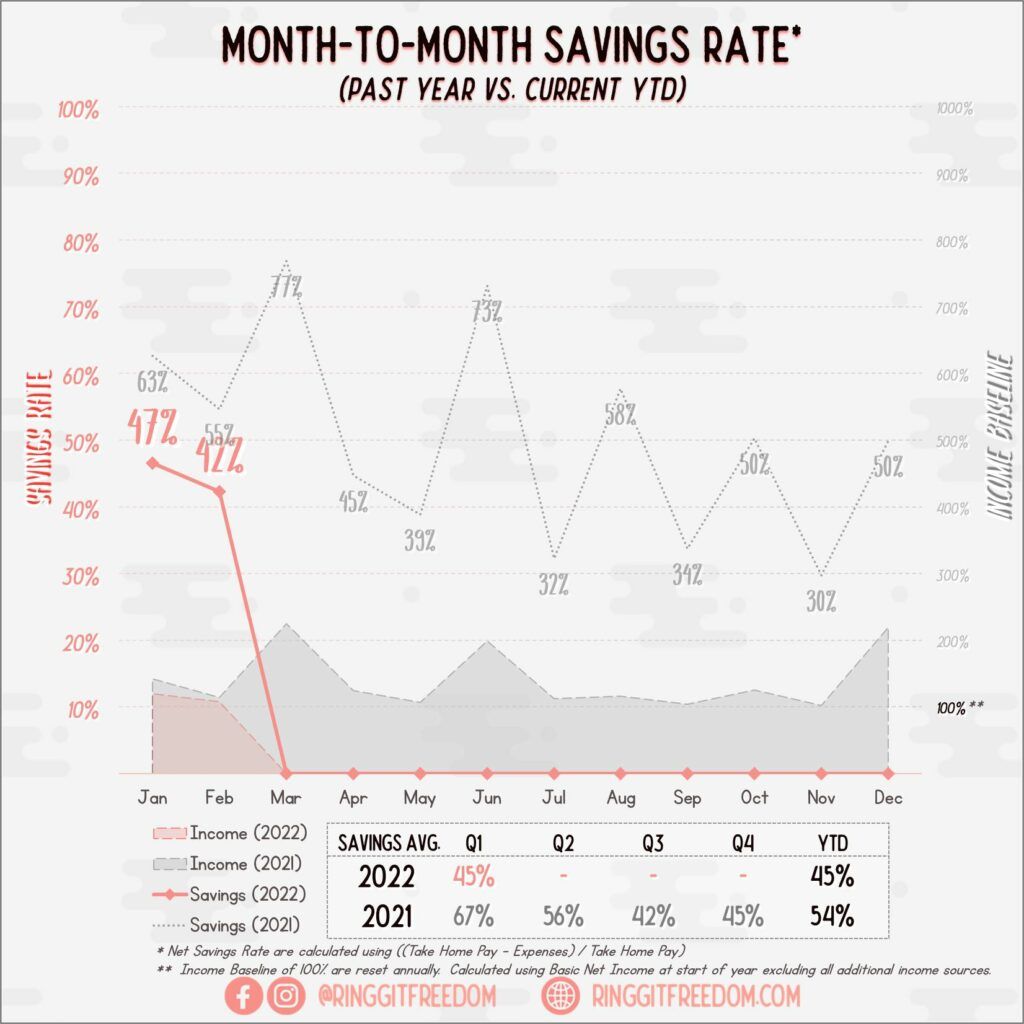

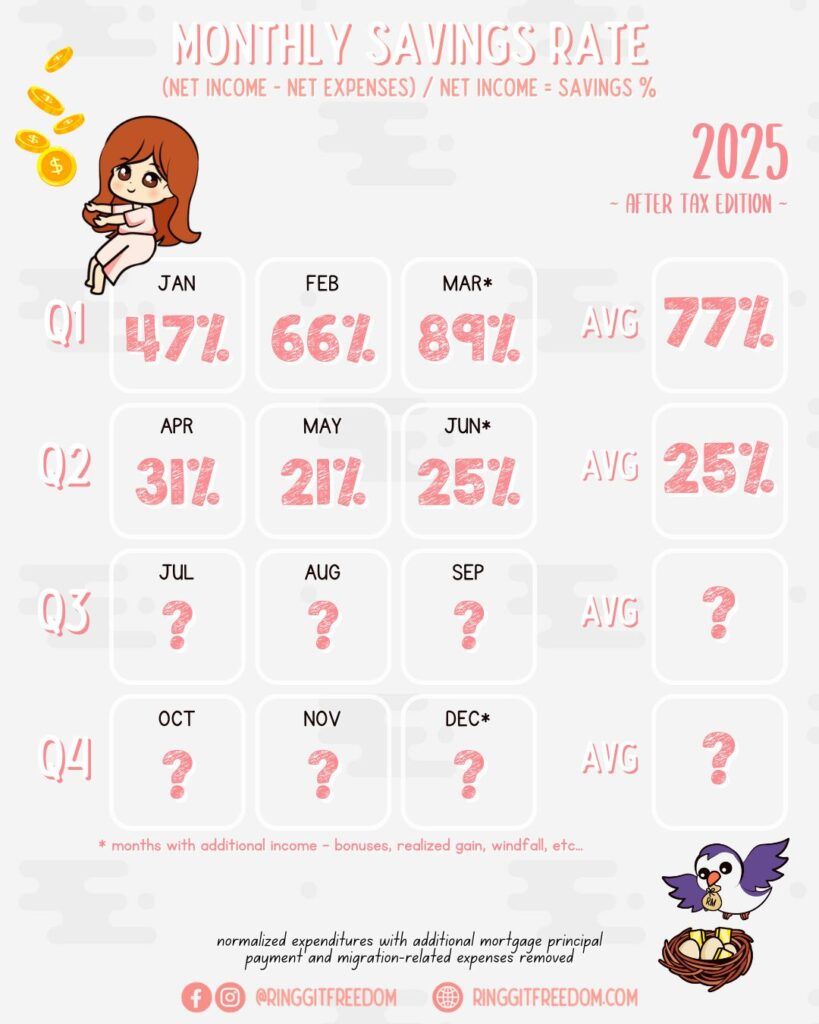

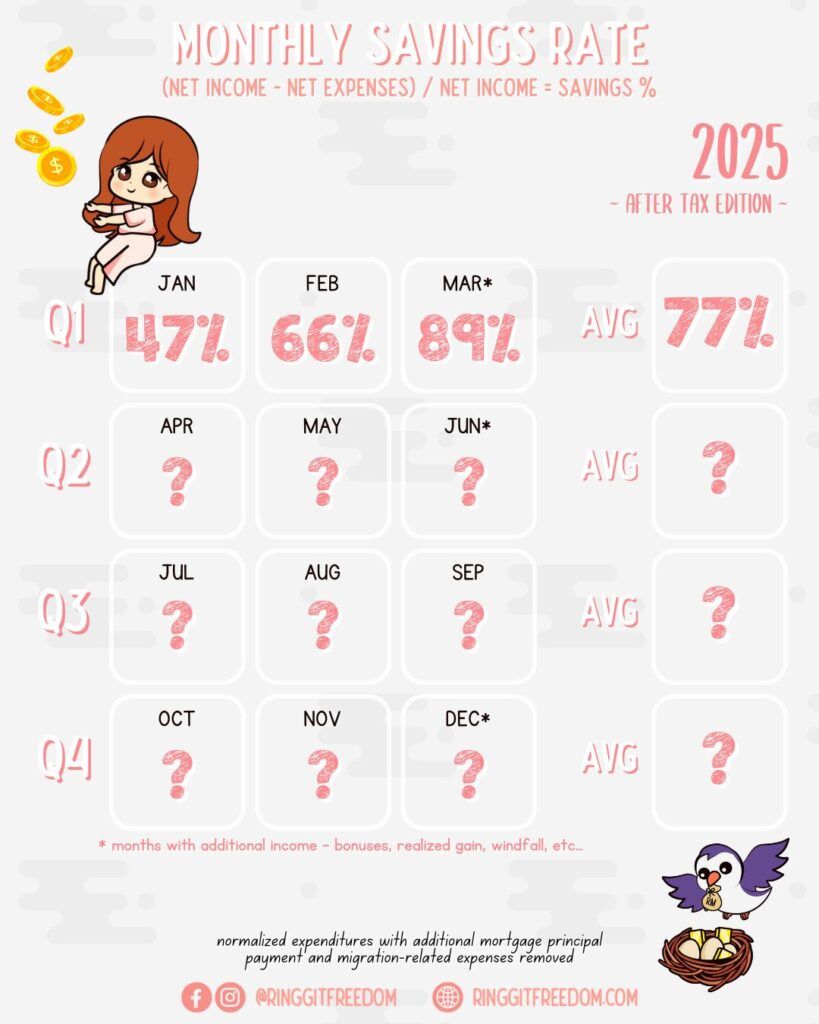

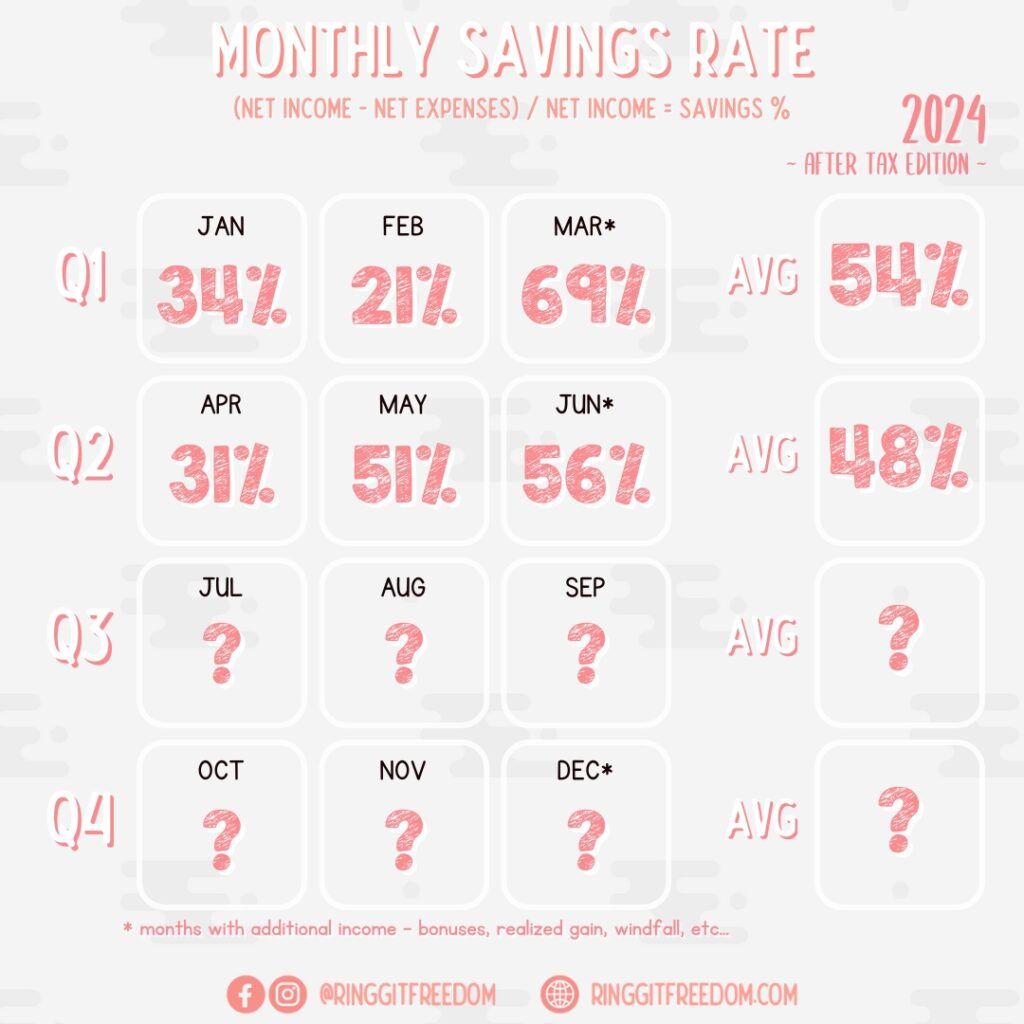

Savings Rate

Emergency Jar

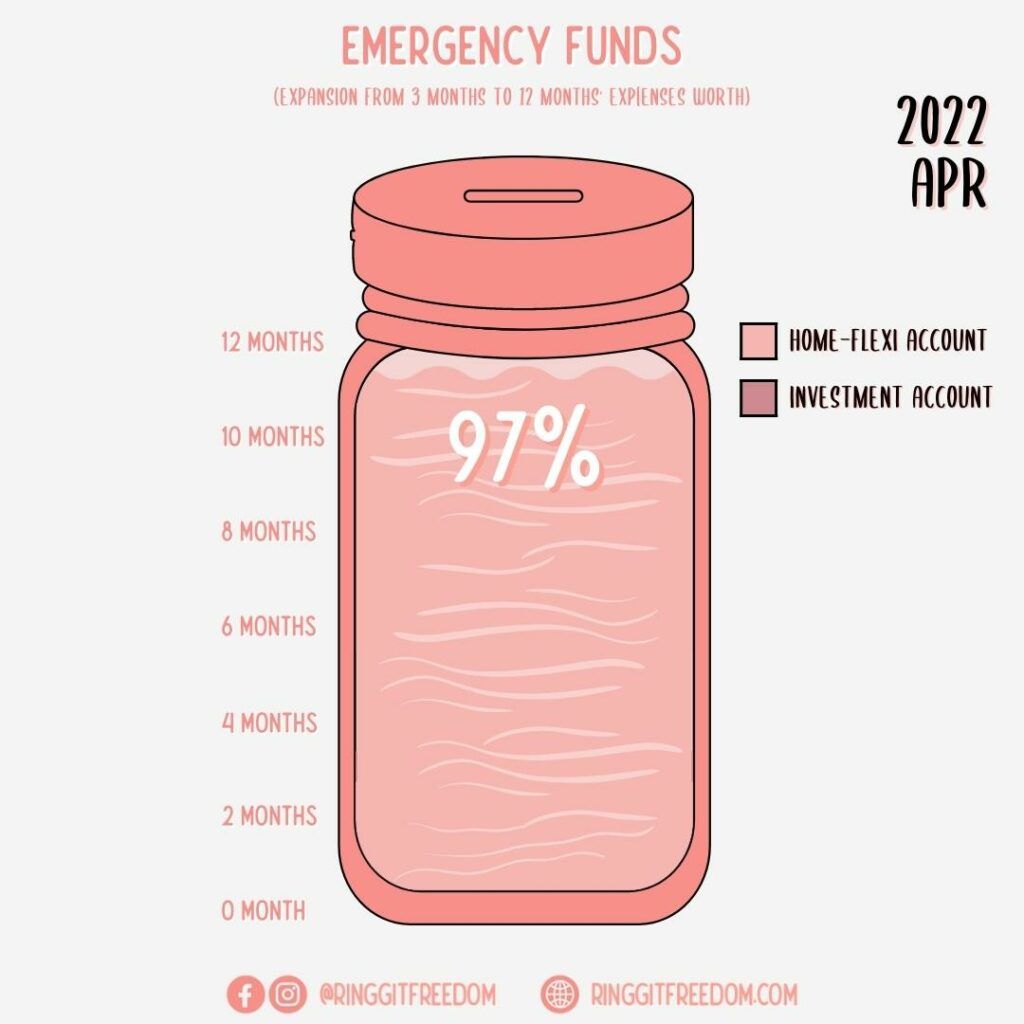

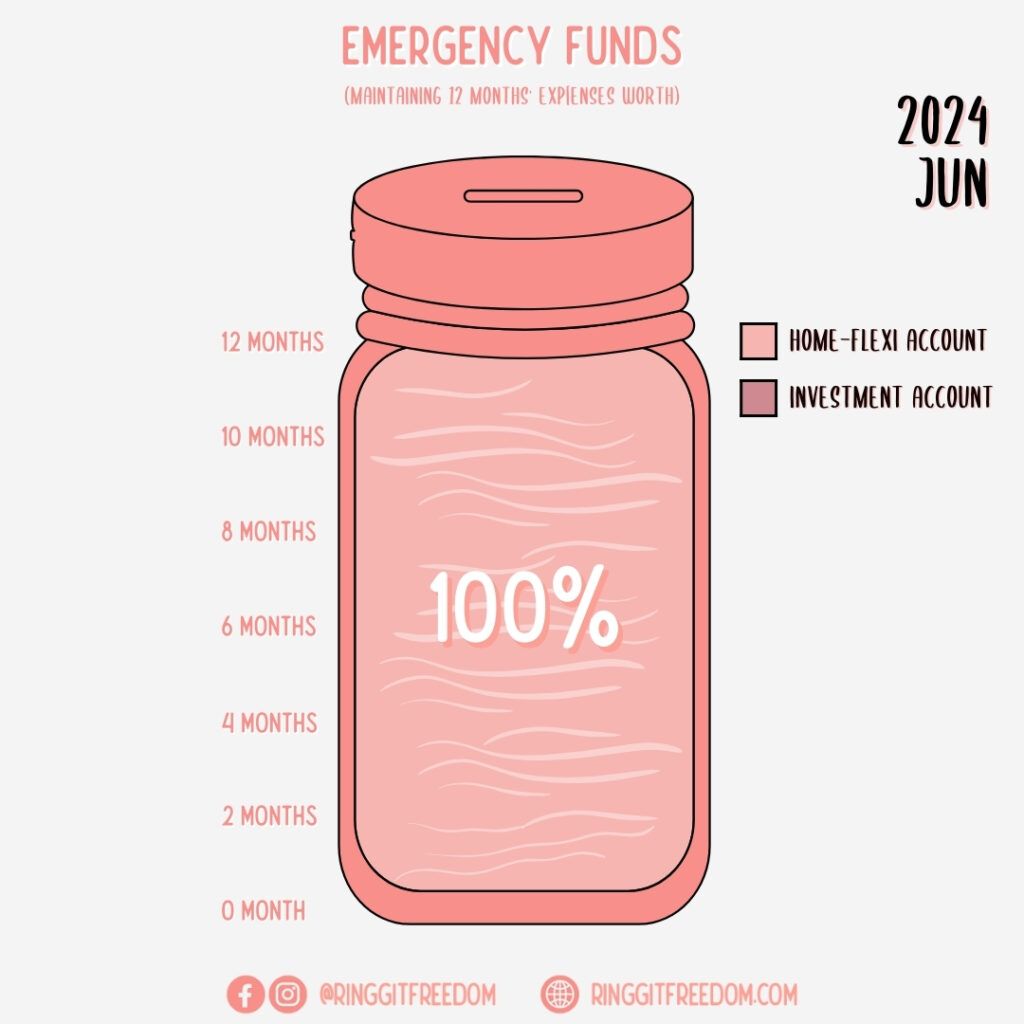

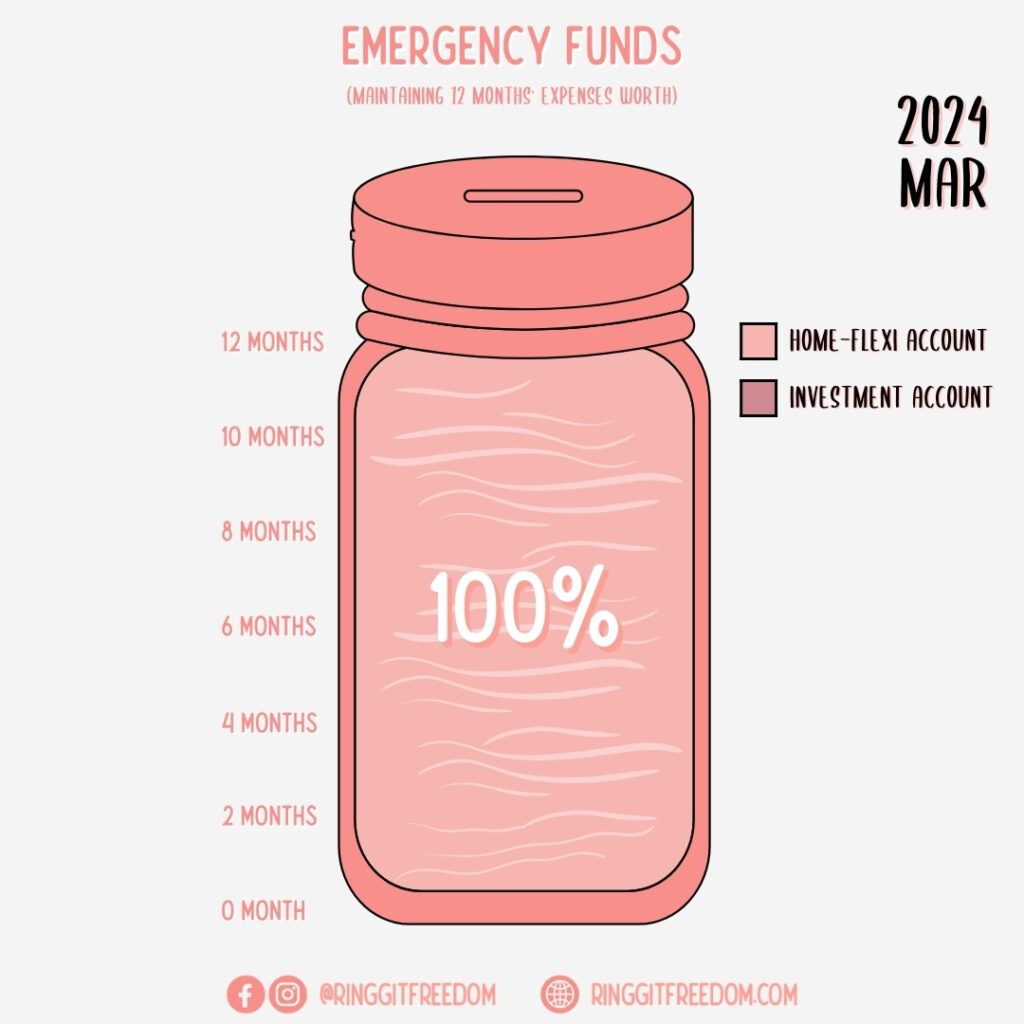

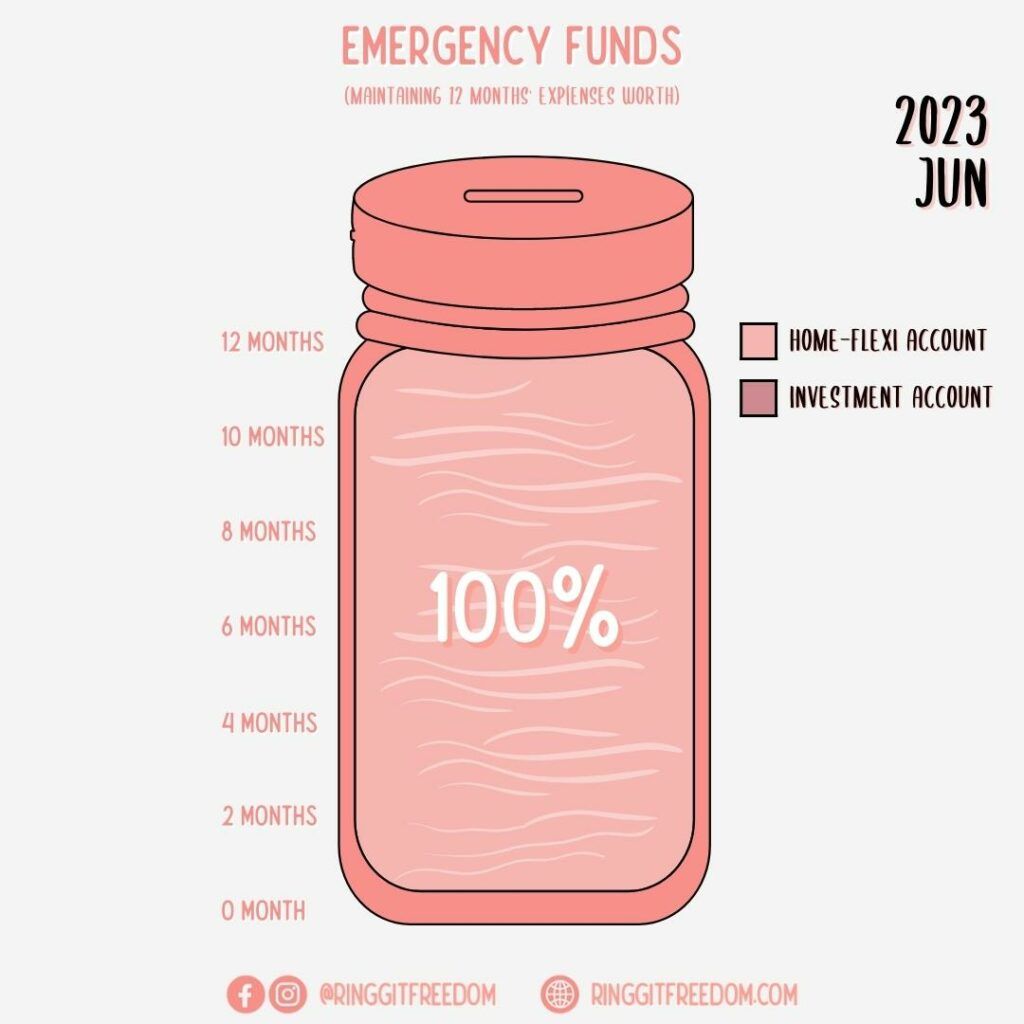

No changes to the Emergency Jar this quarter.

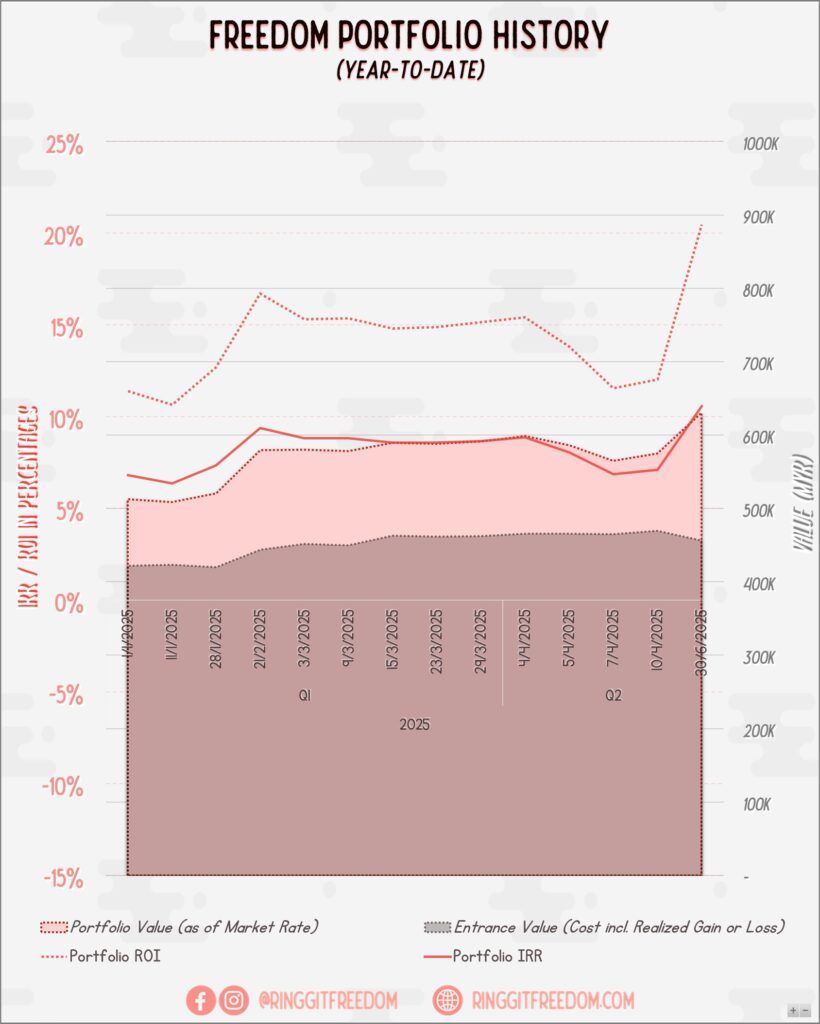

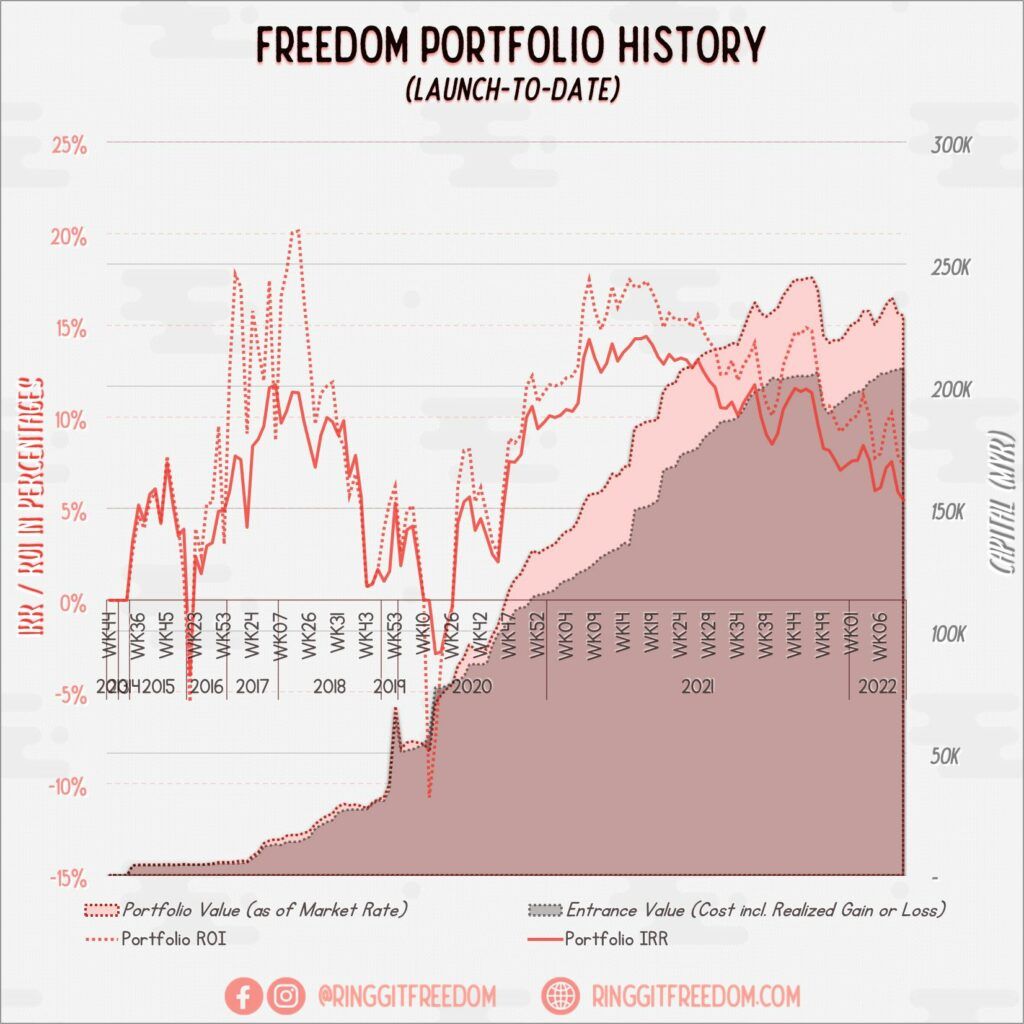

My "Freedom" Investments

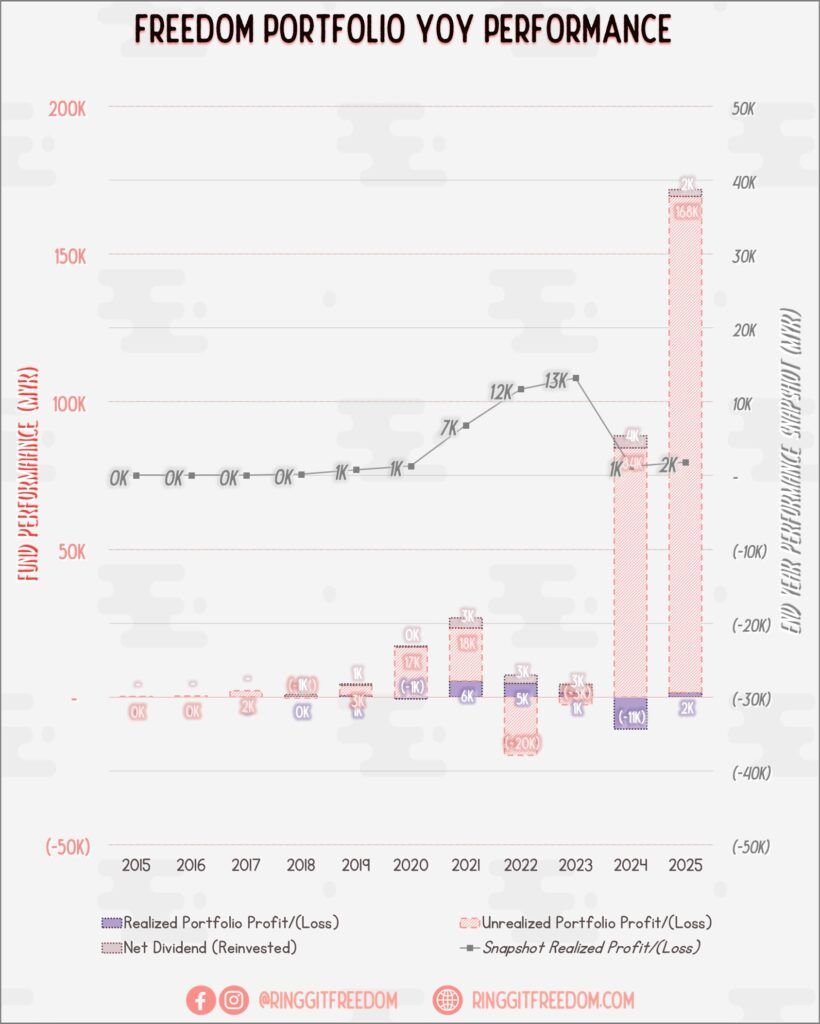

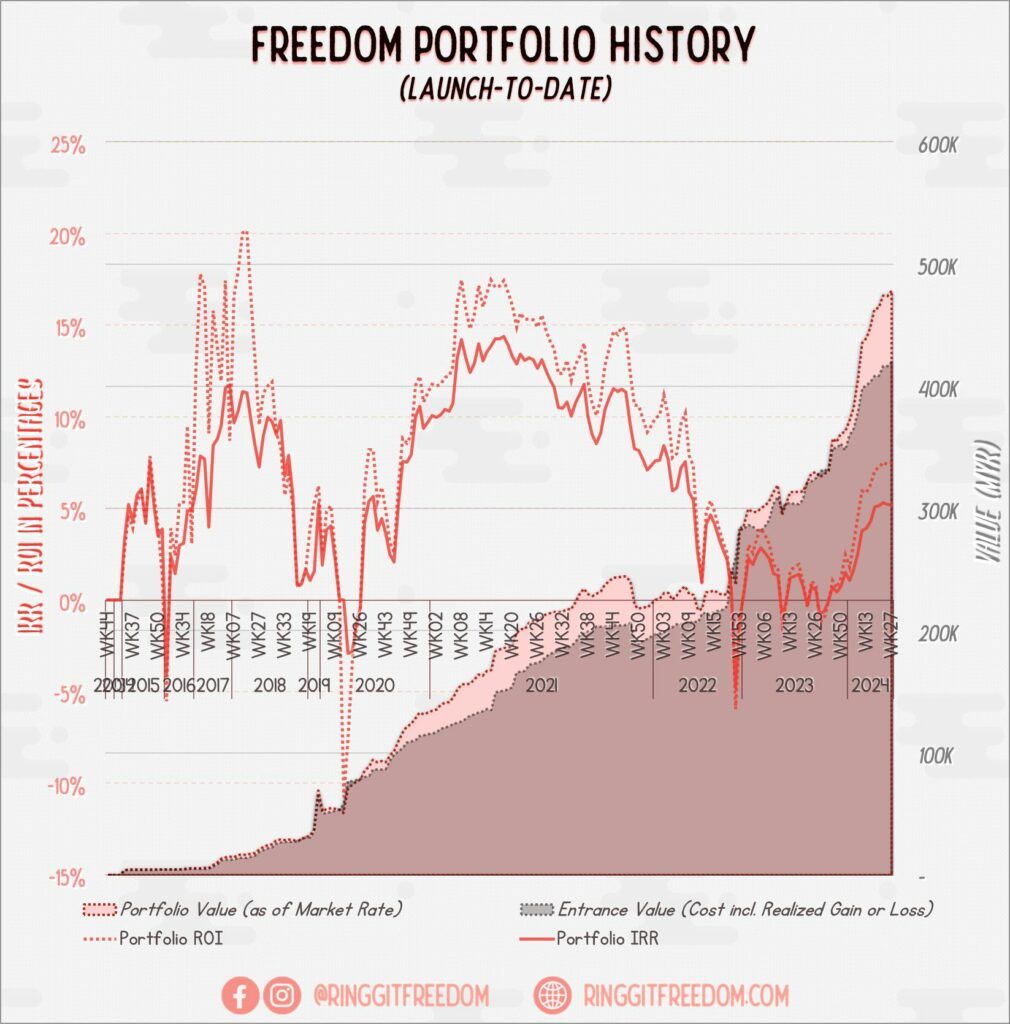

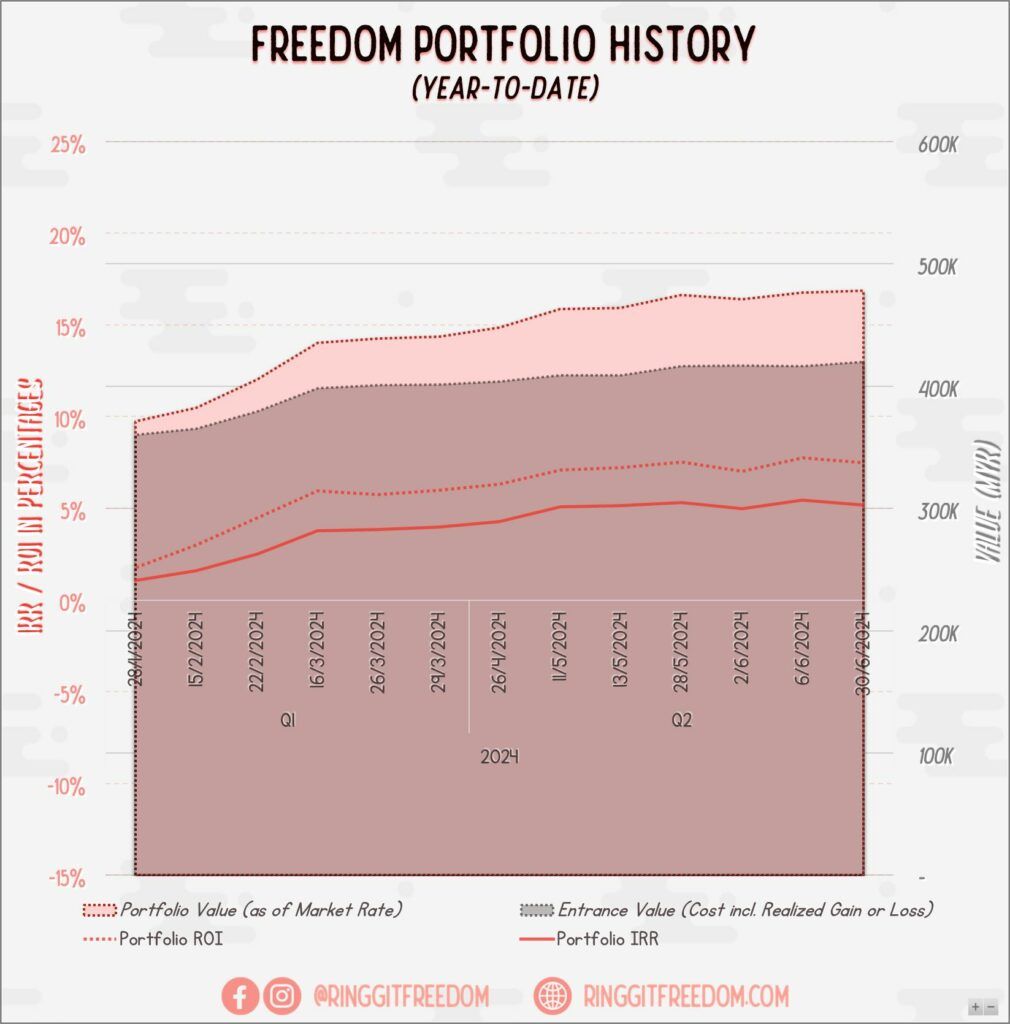

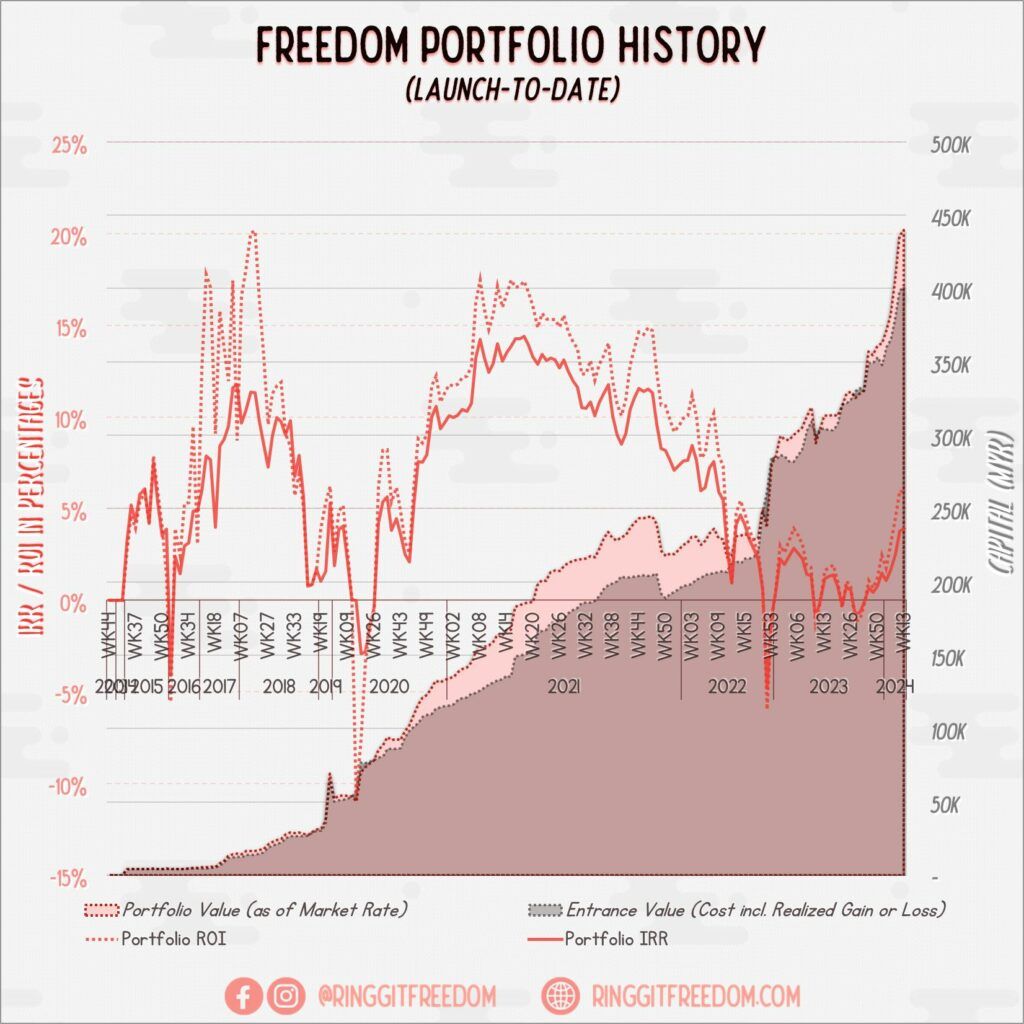

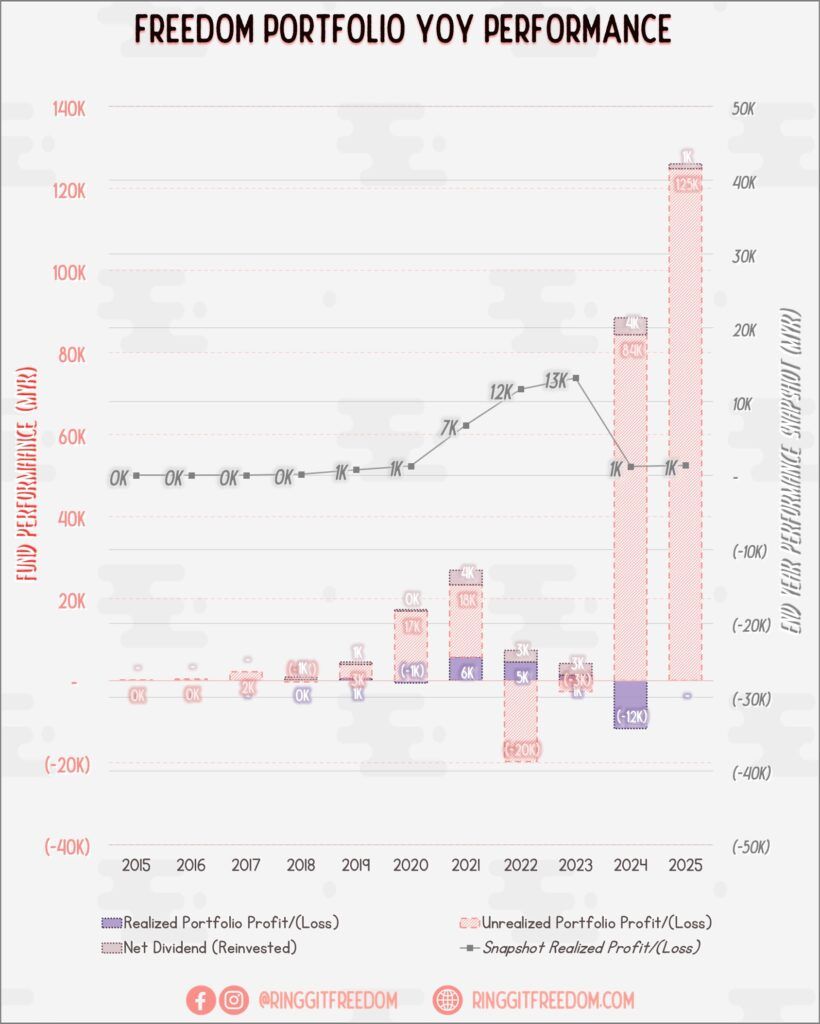

Performance

Activities

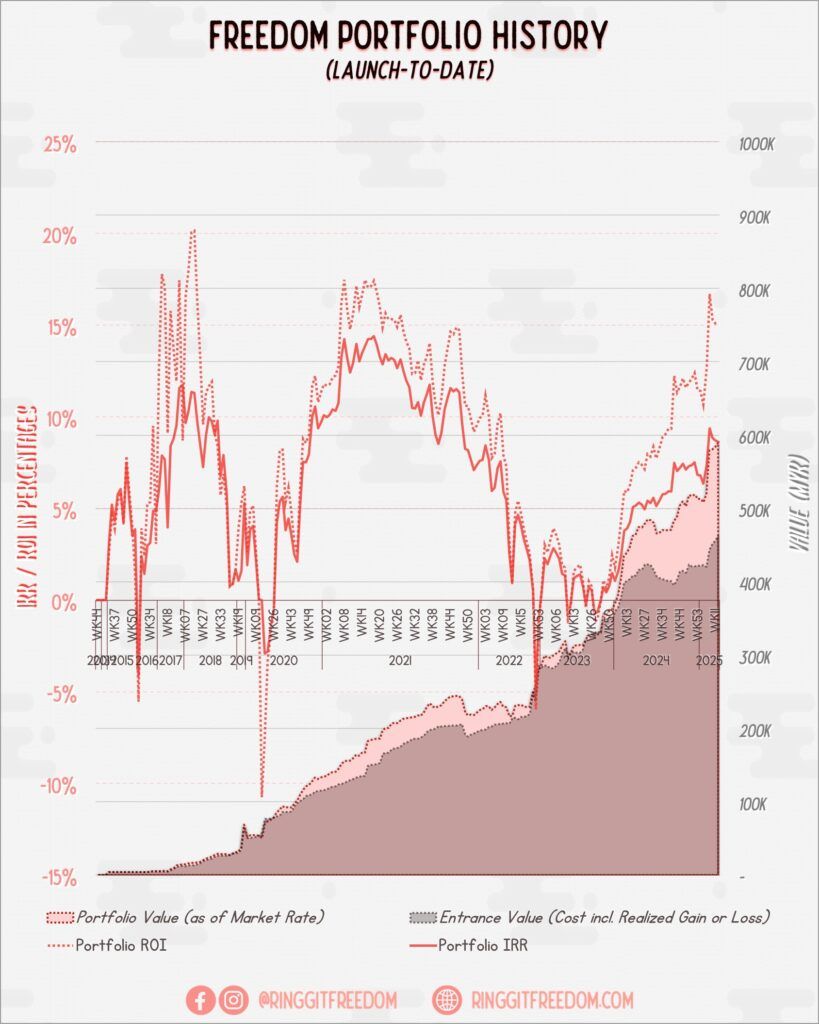

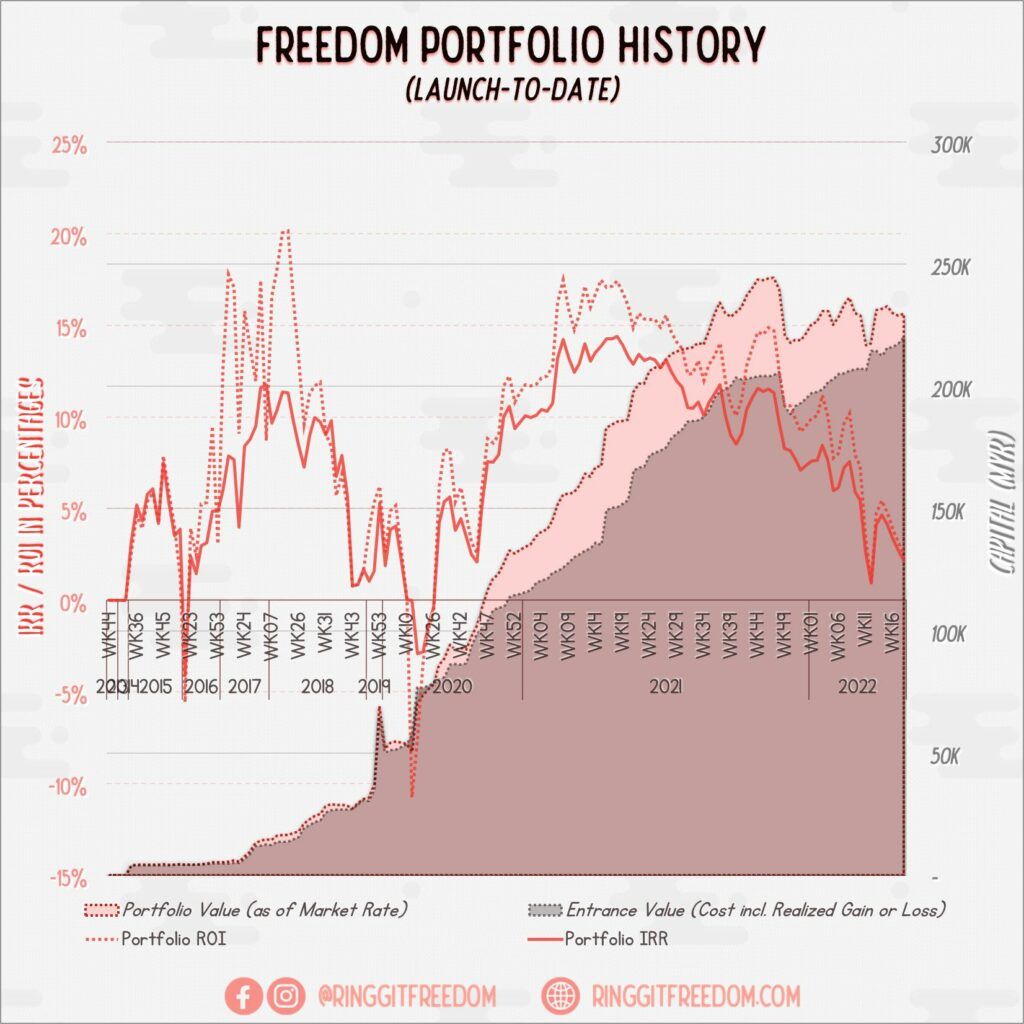

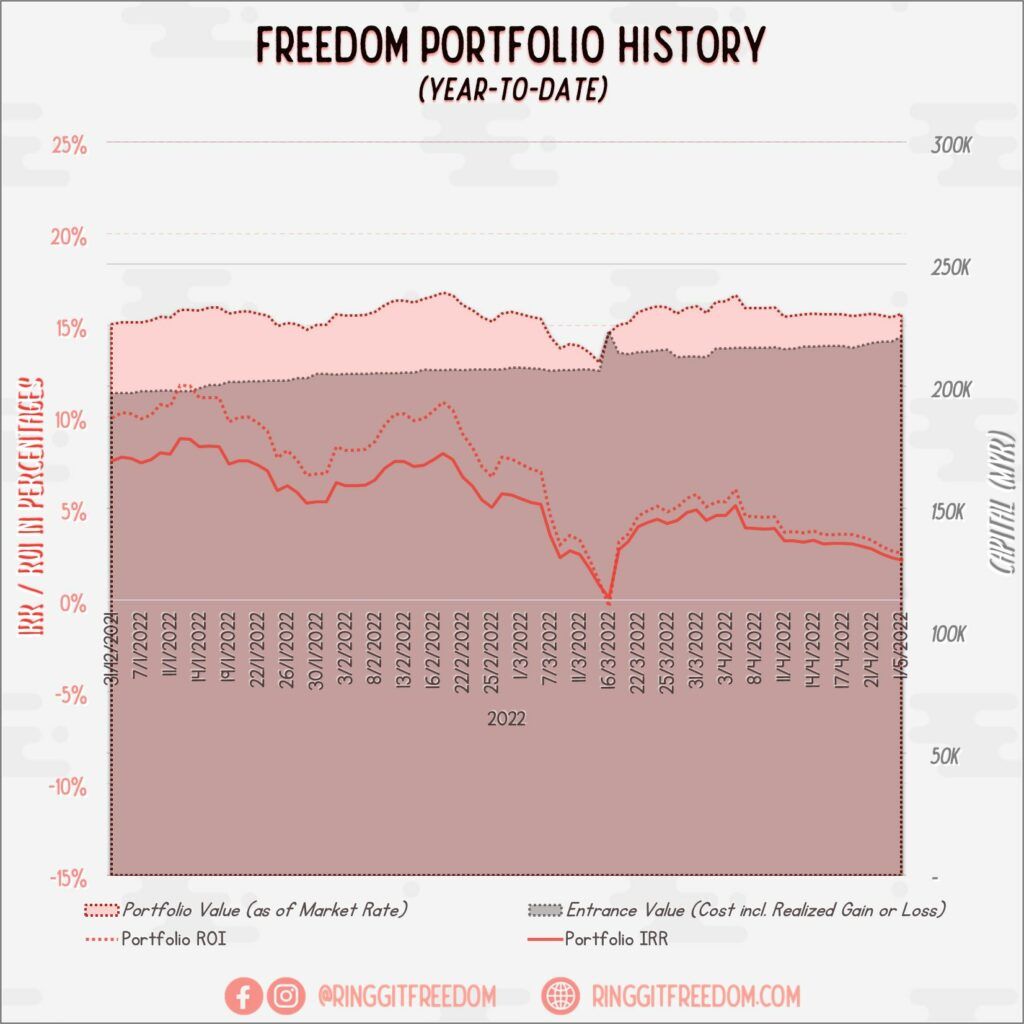

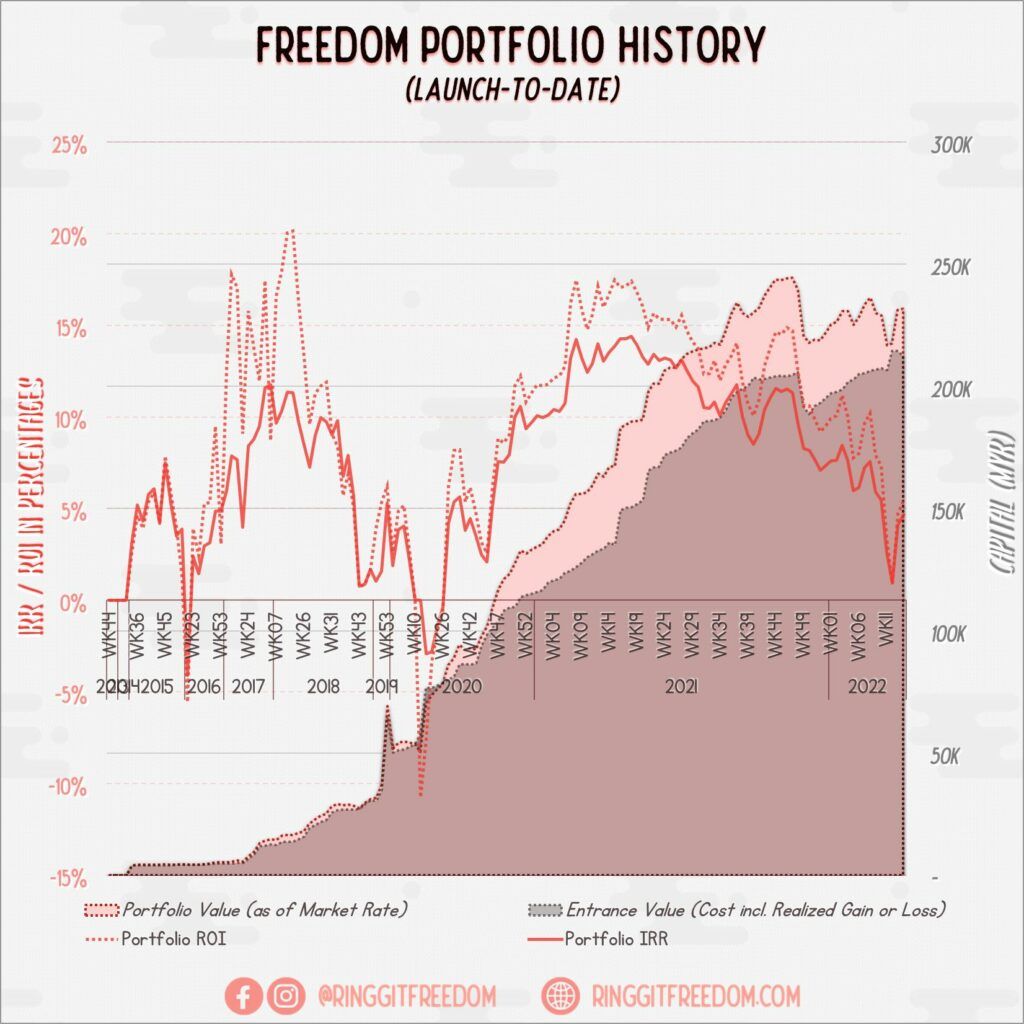

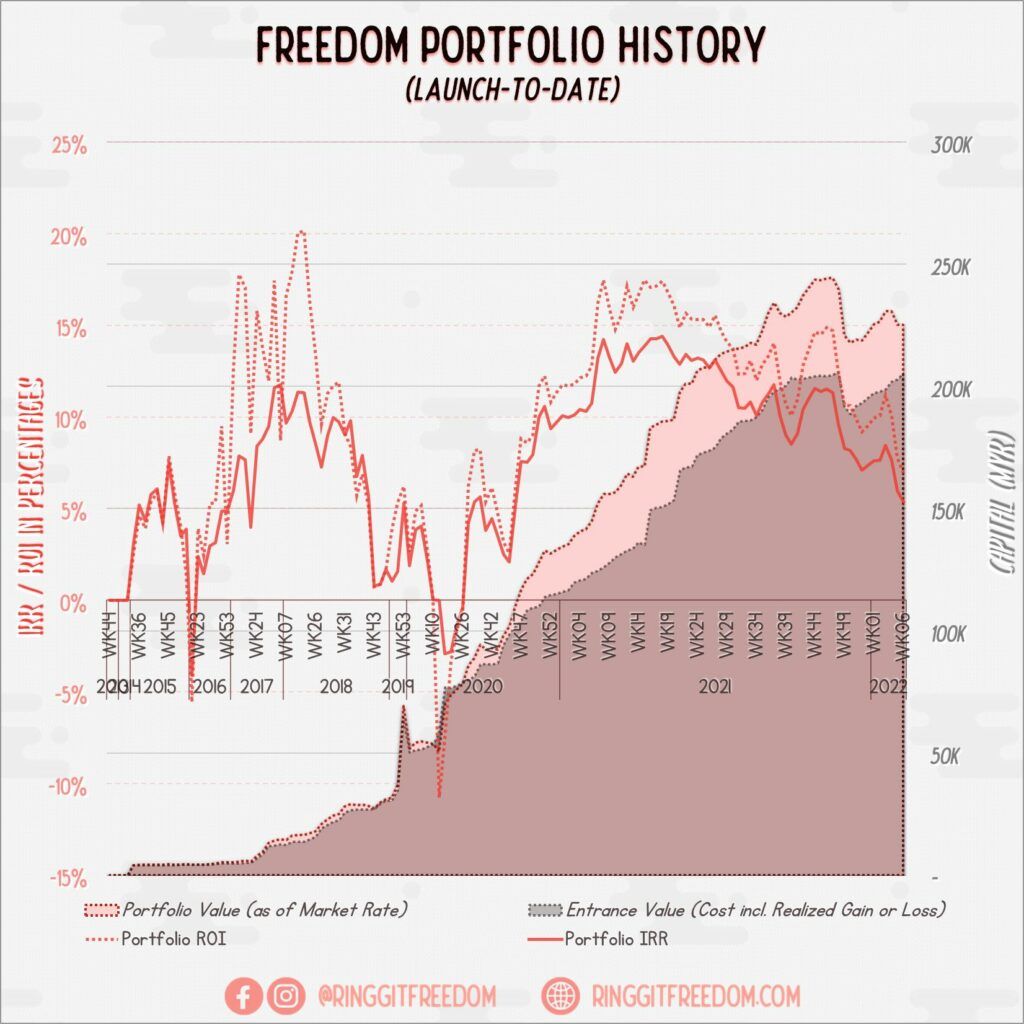

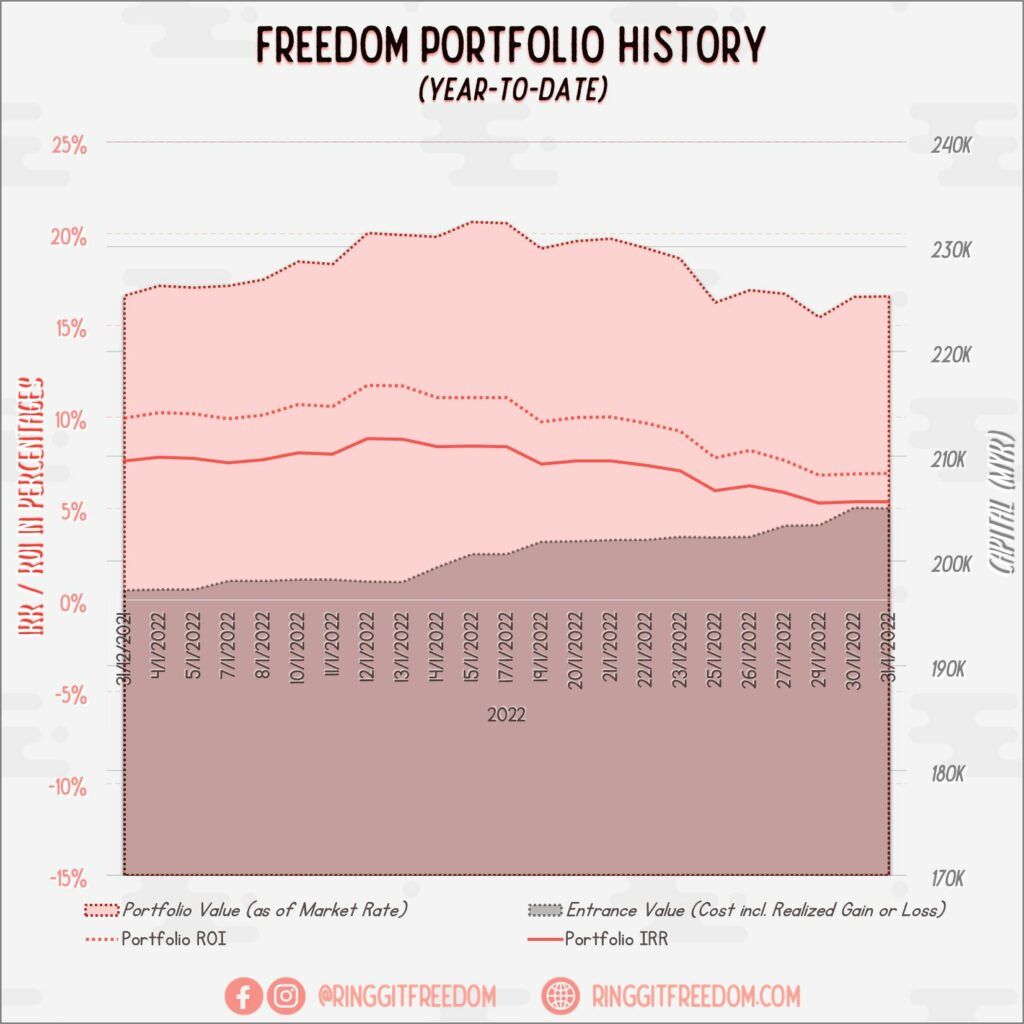

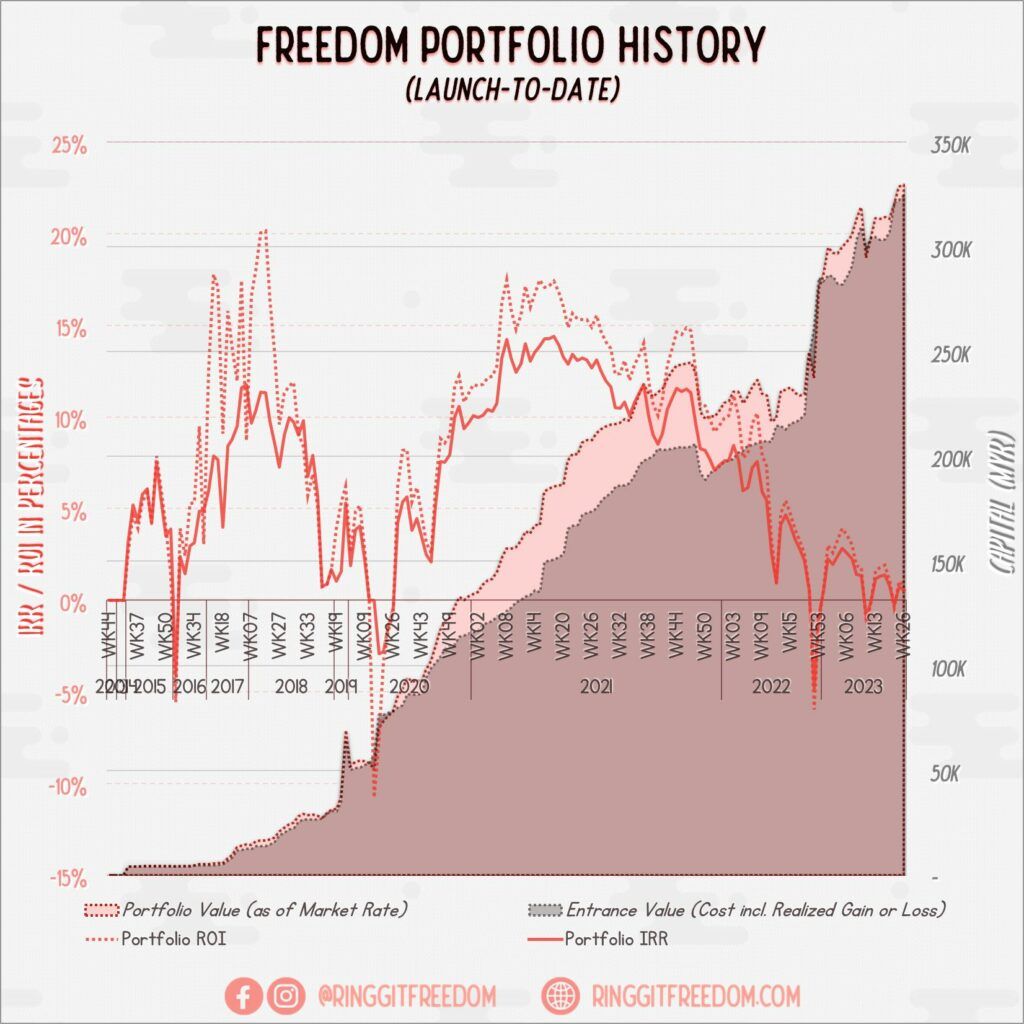

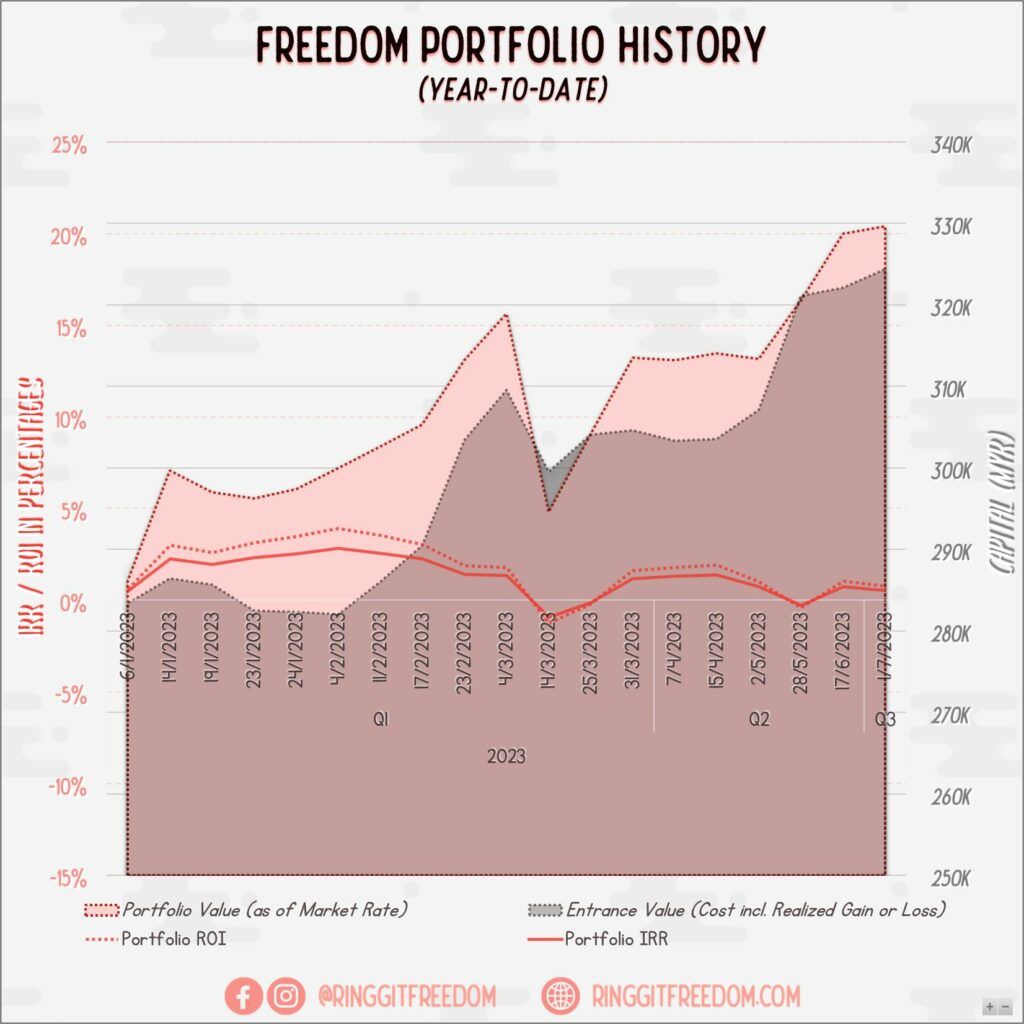

If you look at my charts above - you'll notice that I've basically turned a blind eye to whatever that's happening in the market. The last time I've updated my own excel portfolio tracker was like what, 2nd week of April? And zooooom, we're on the last week of June already.

Whether if Trump does something, or countries go into war, or random missiles exchange taking place across the globe - I basically did almost nothing to my portfolio. The quarterly (for cost transfer efficiency reasons) DCA continued to take place into my VWRA funds through my Interactive Brokers account.

Of course - market's also extremely hyped up at this moment with S&P500 again breaking its record high continuously so we're seeing a huge paper profit at the moment.

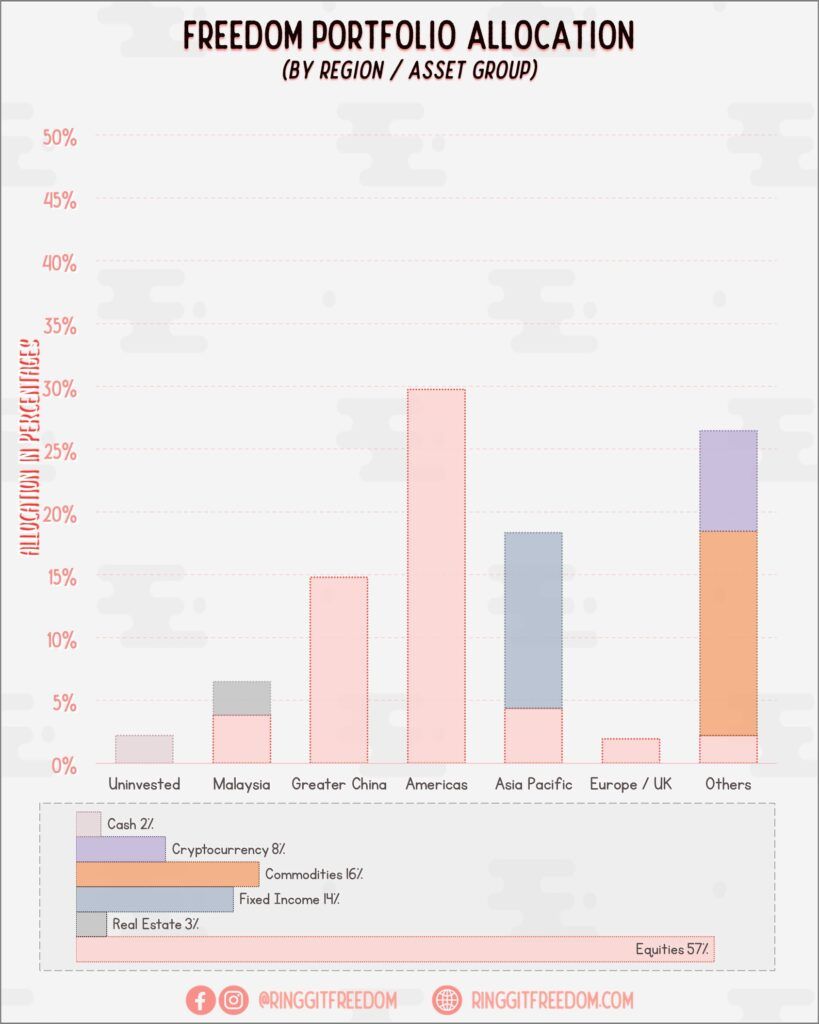

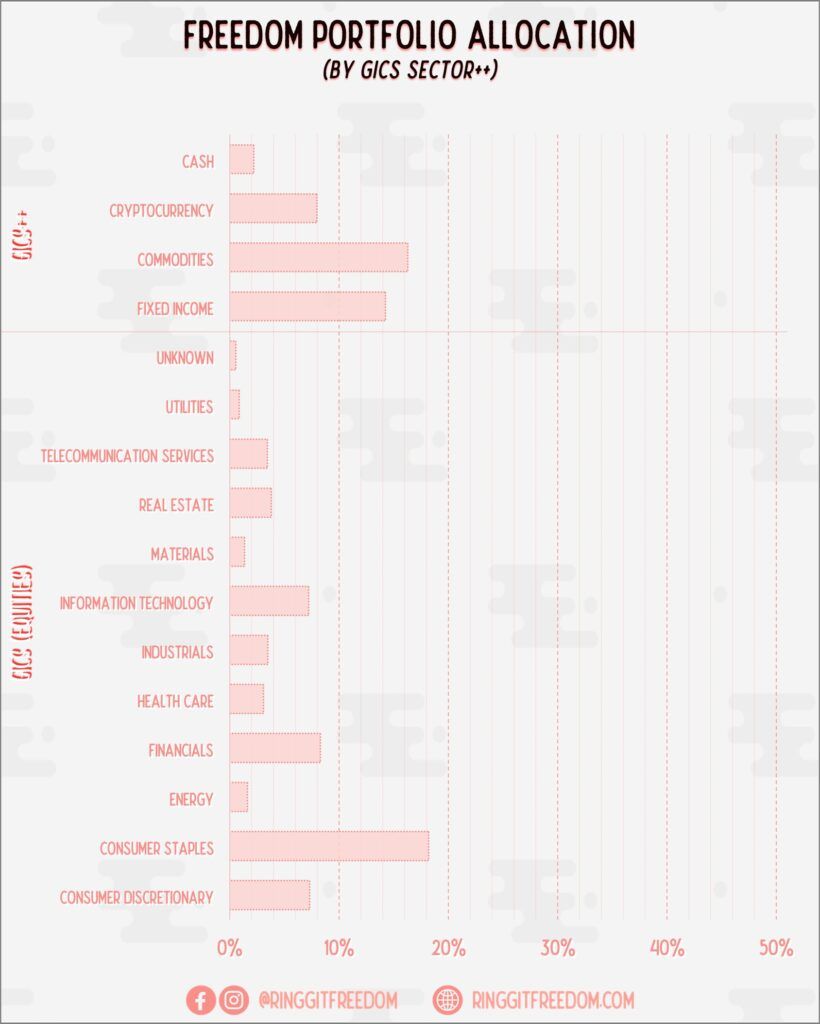

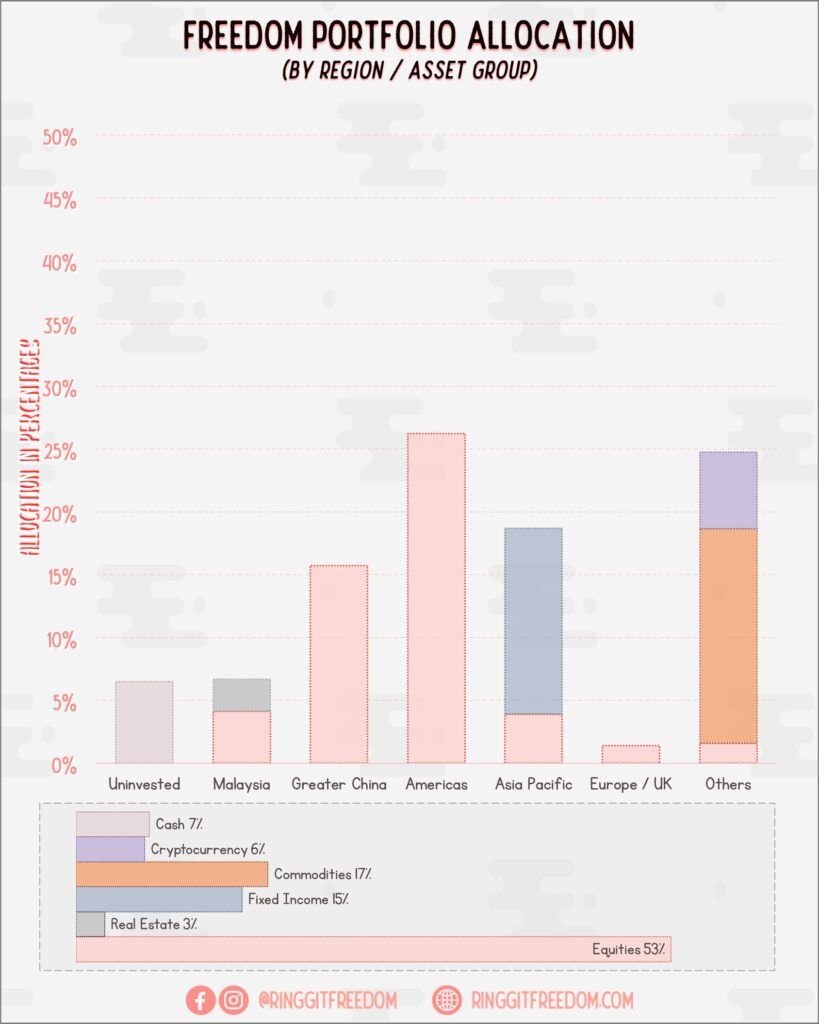

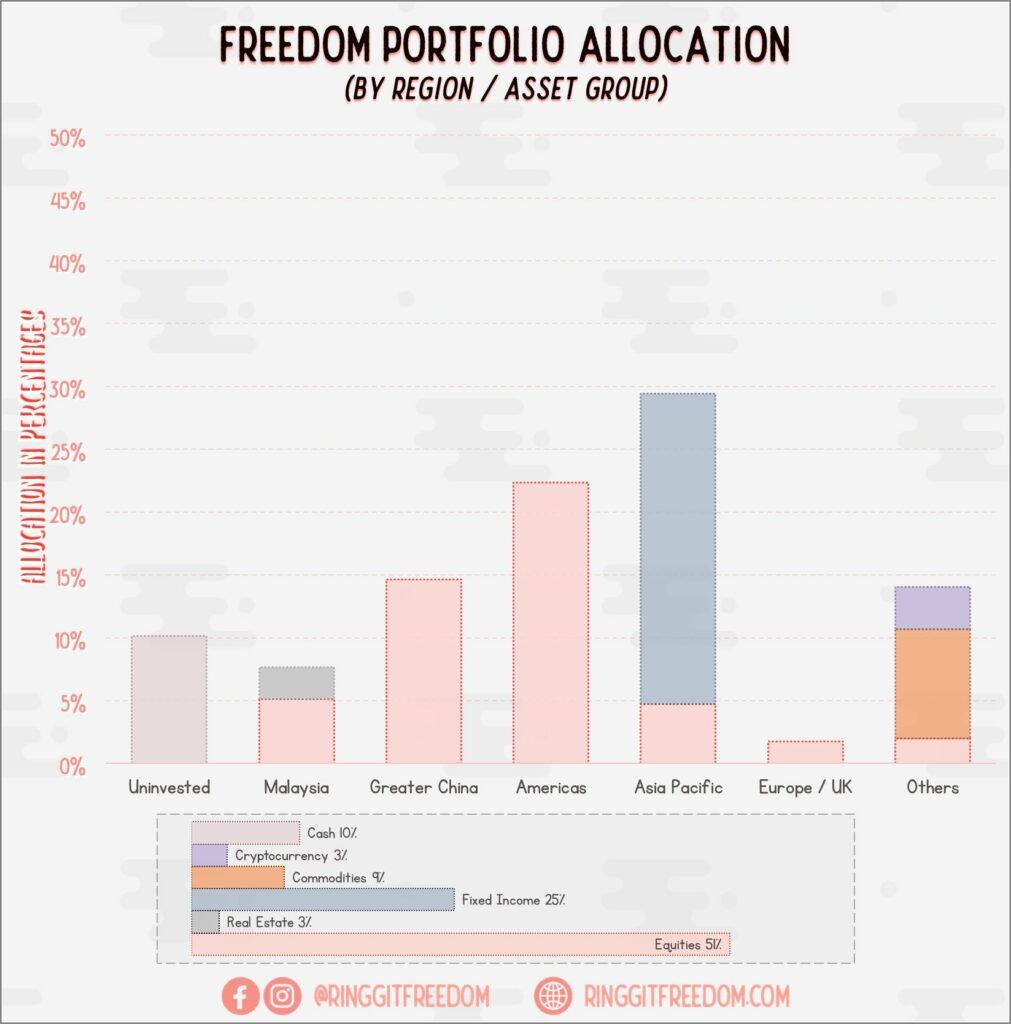

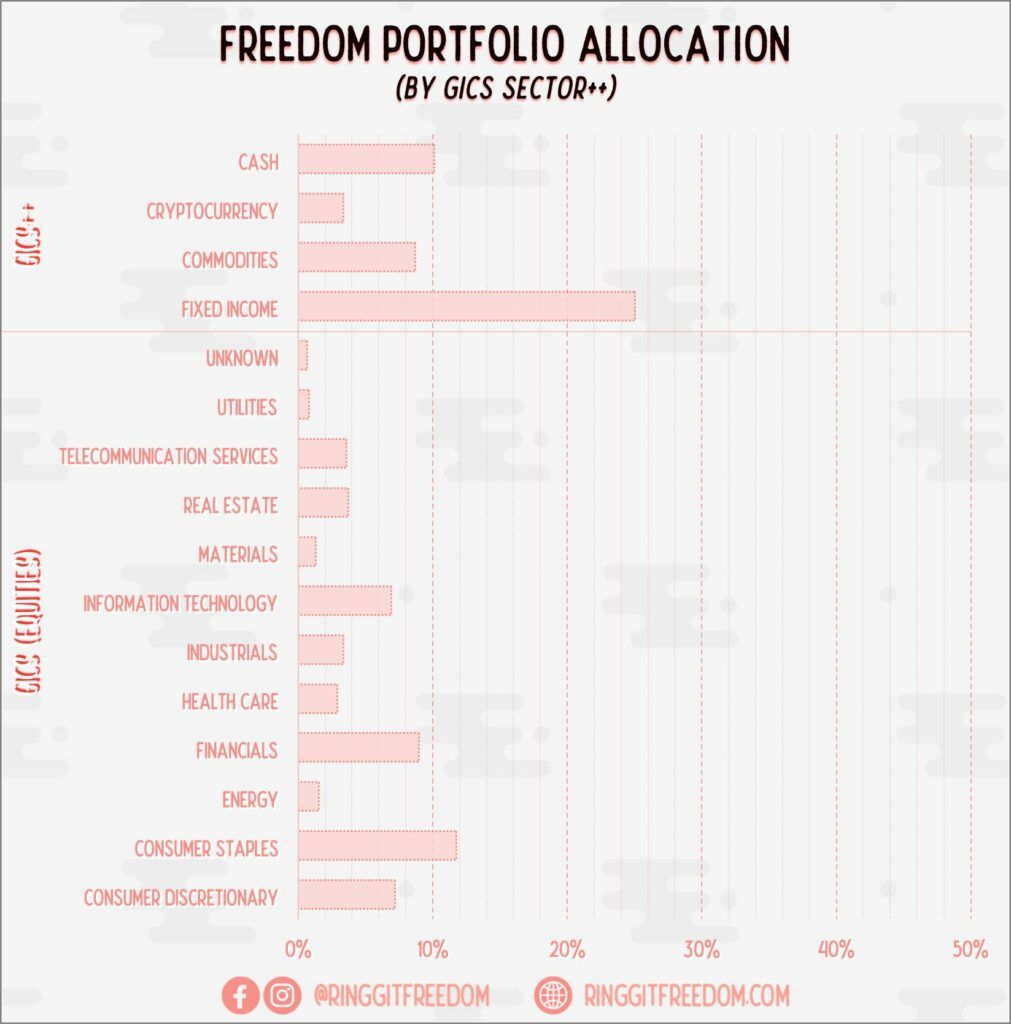

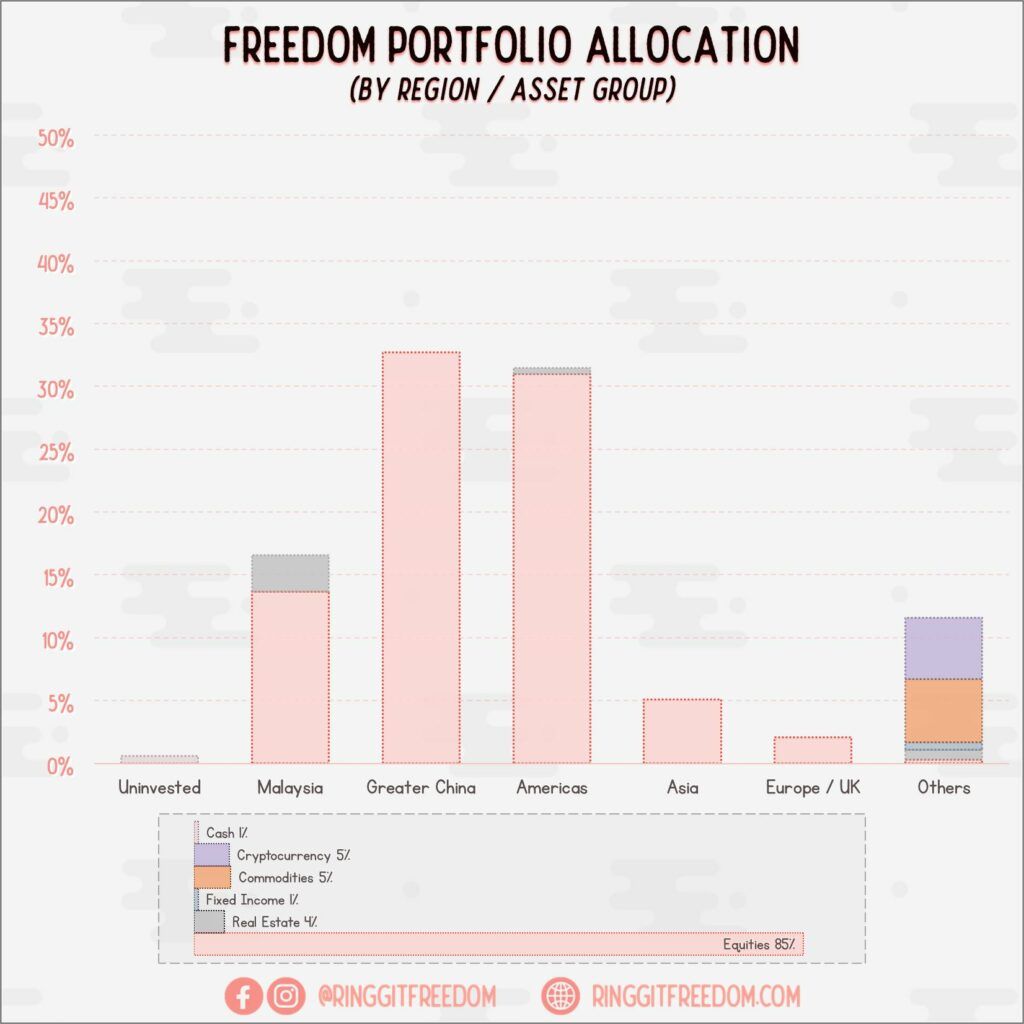

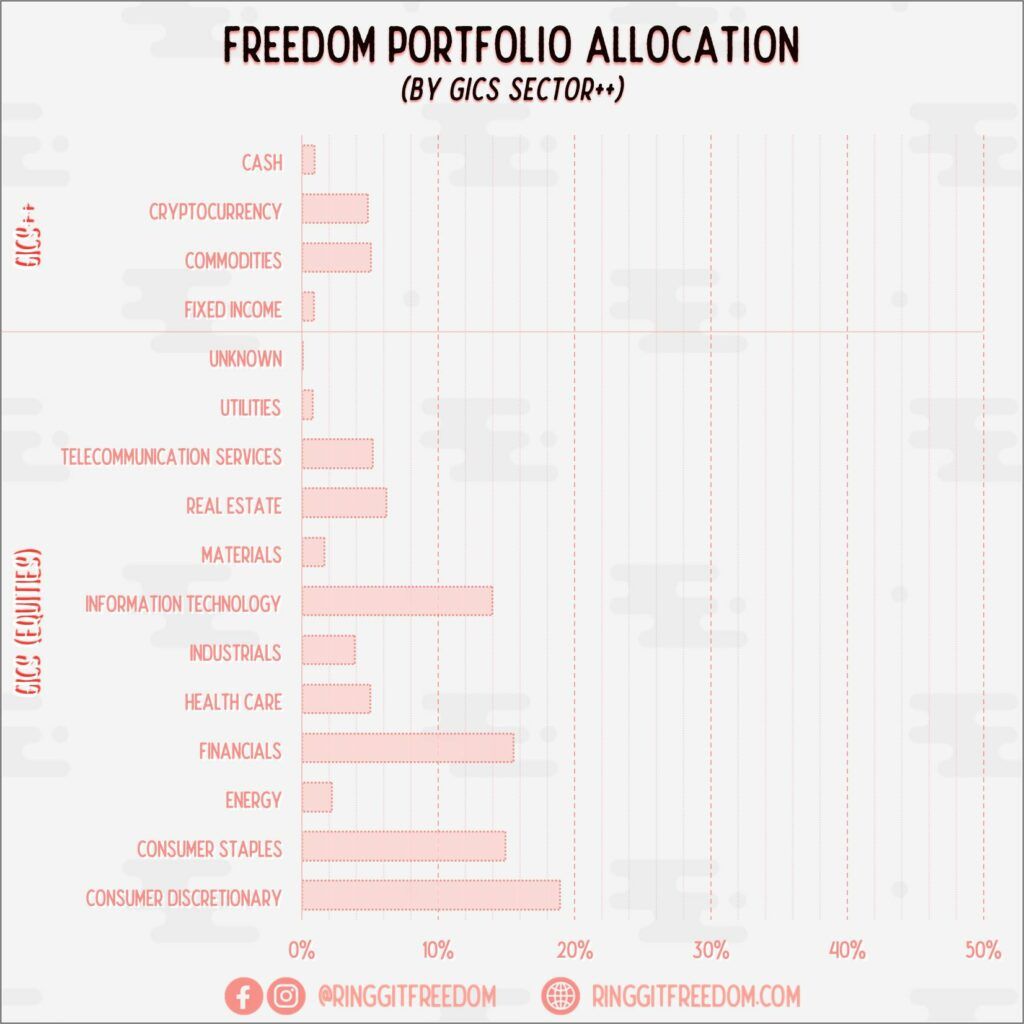

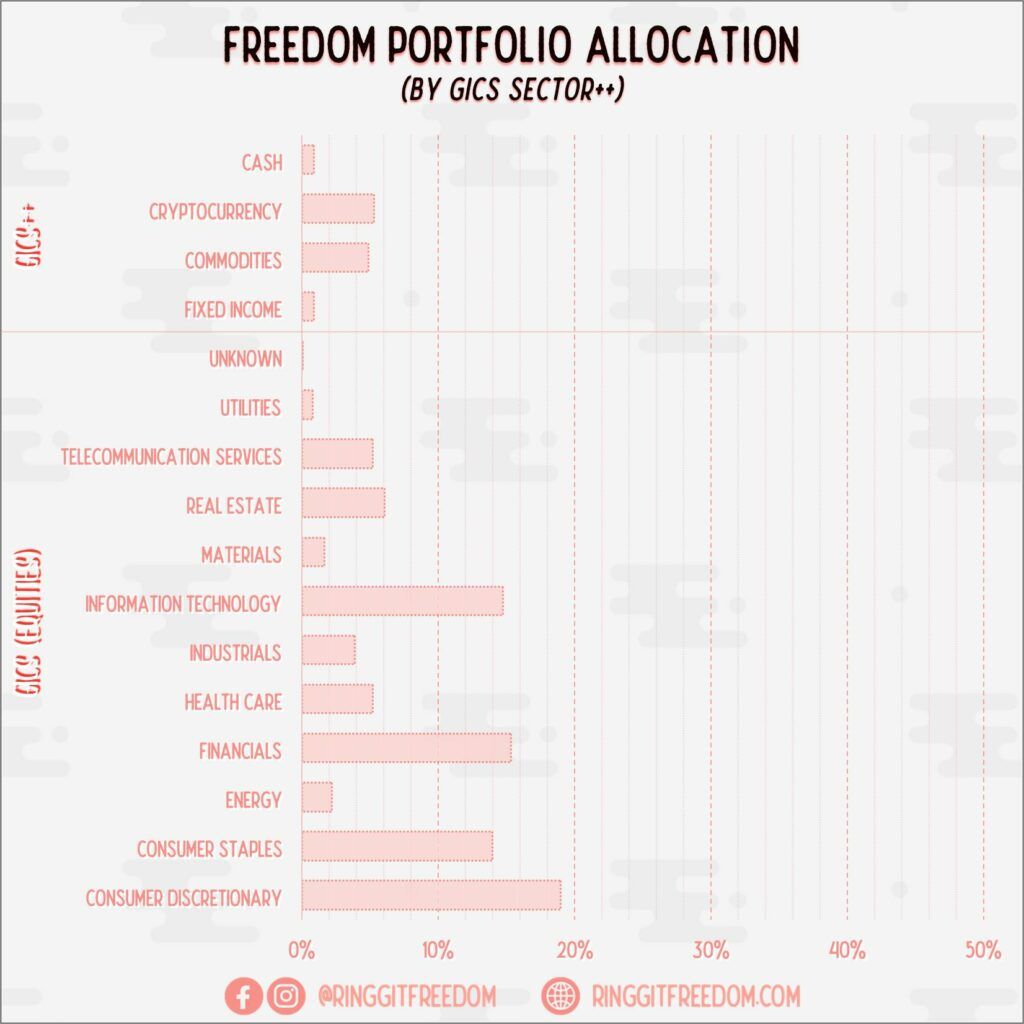

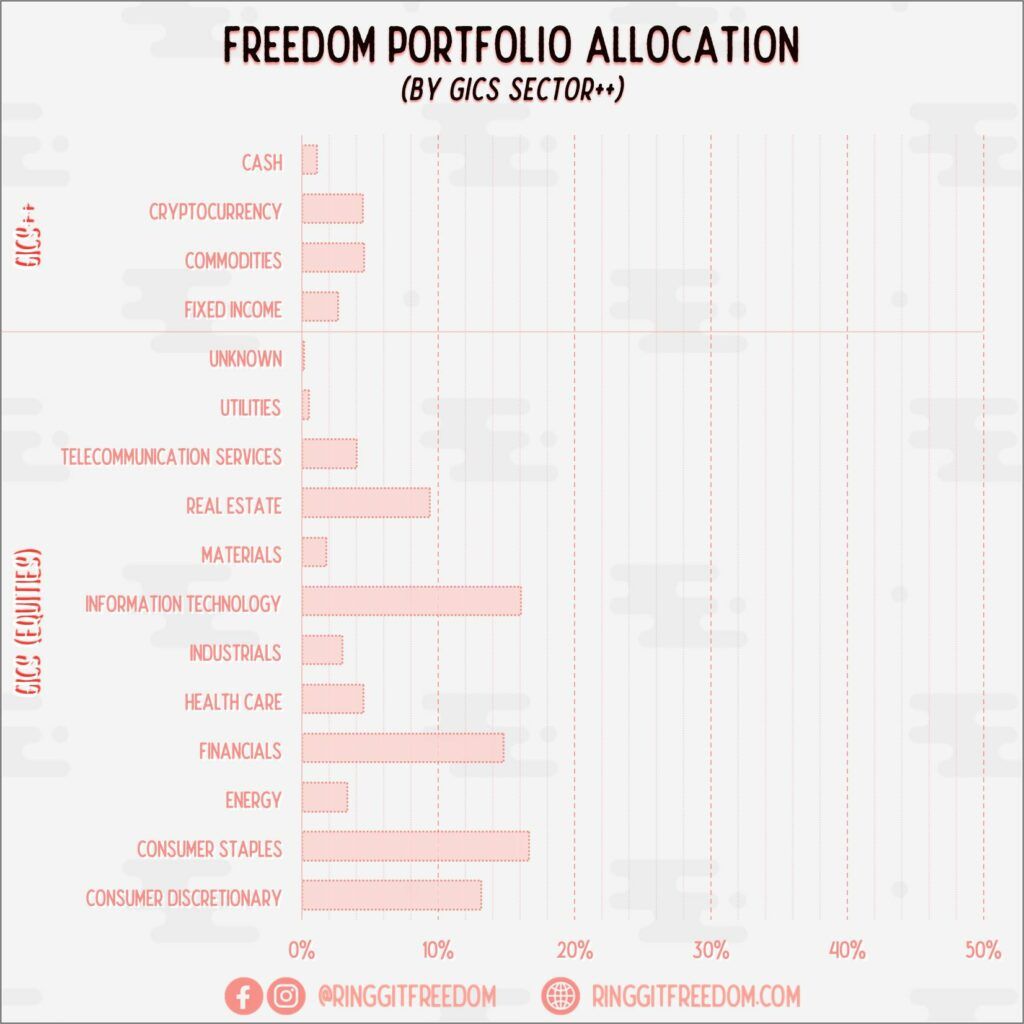

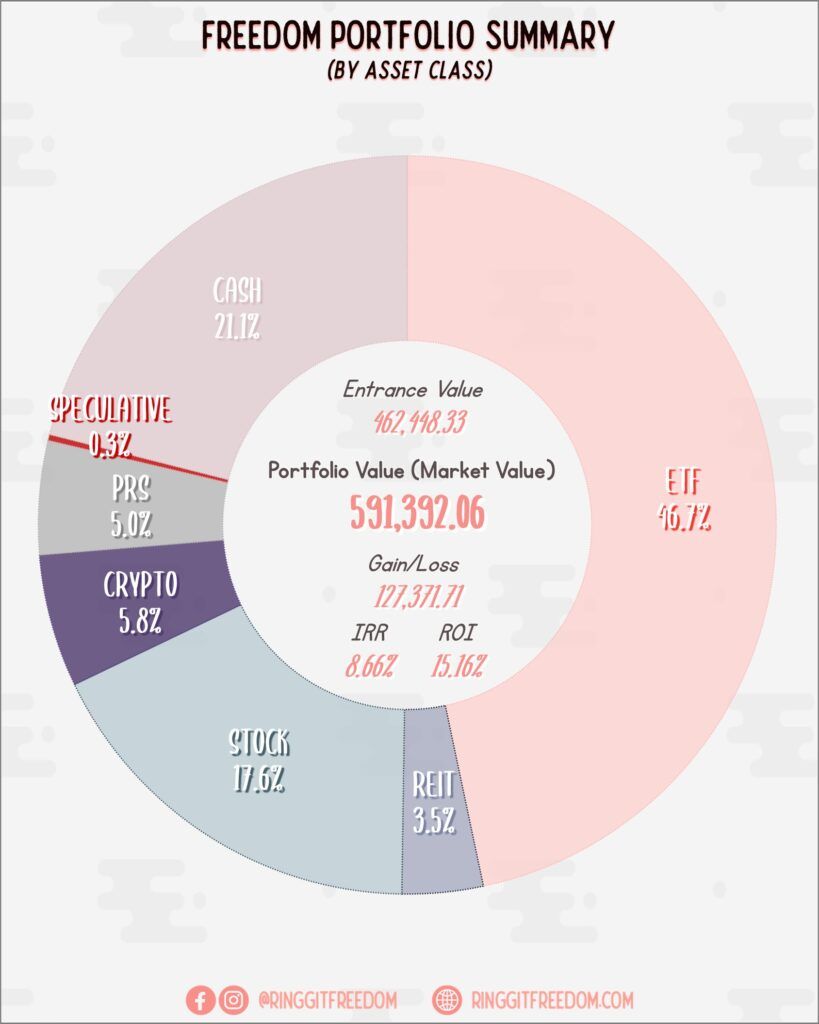

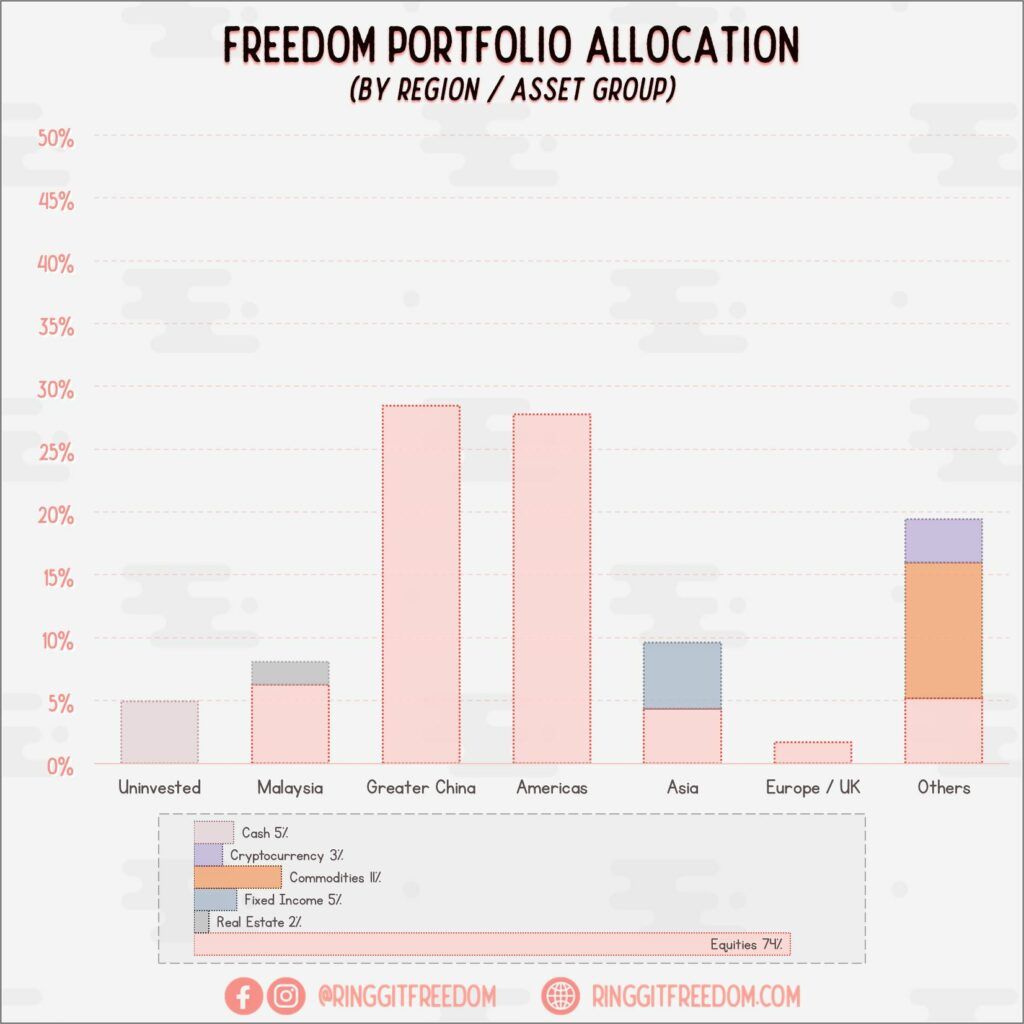

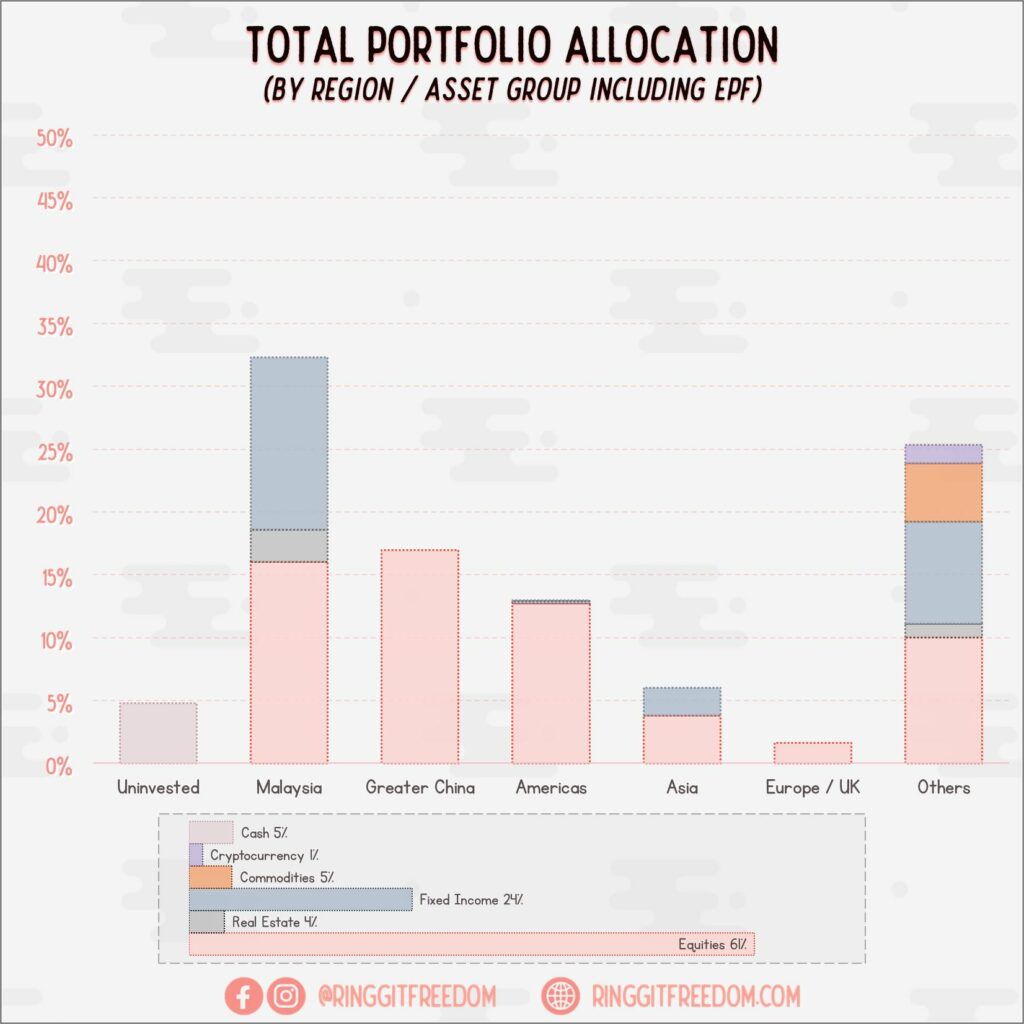

Allocation

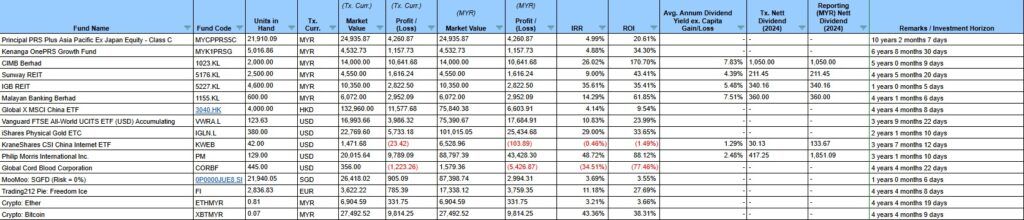

Snapshot as of 30 June 2025

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 0.37%

ROI: 0.51%

Profit/Loss: RM 1,828.88

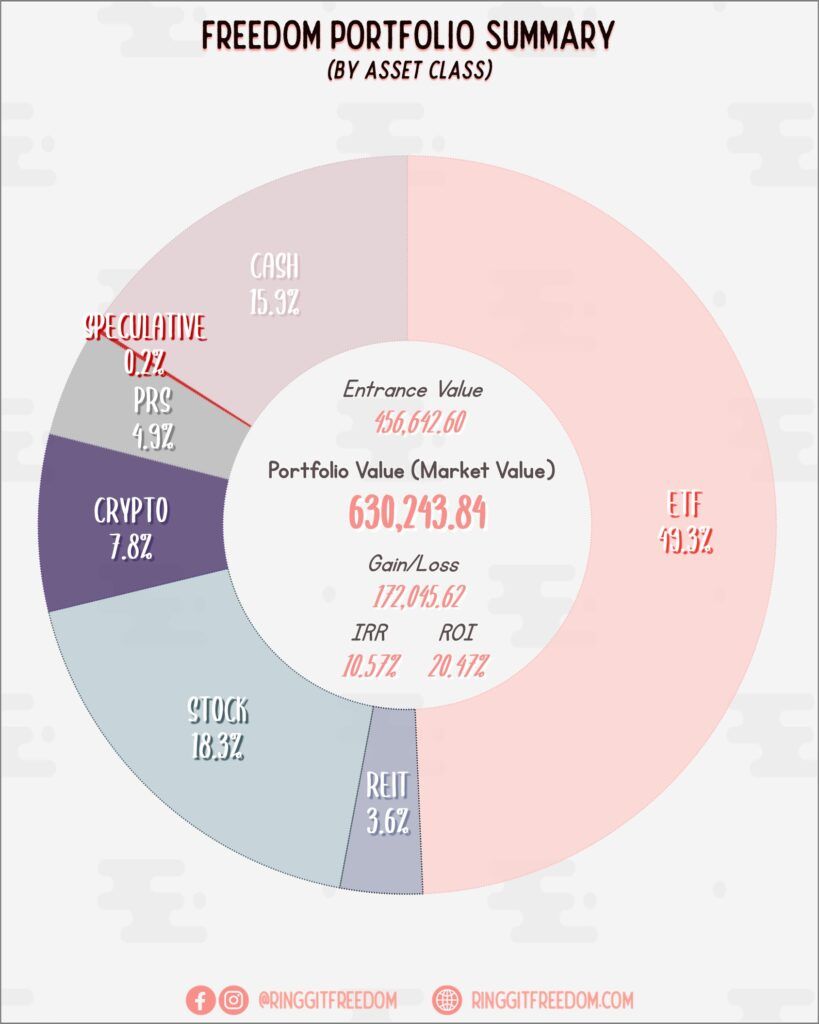

Active (Invested) Portfolio

IRR: 16.51%

ROI: 33.72%

Profit/Loss: RM 170,216.74

True Cost: RM 490,471.56

Total Value: RM 674,974.89

Entrance Value: RM 456,642.60

Portfolio Value: RM 630,243.84

Nett Dividend (2025): RM 2,191.06

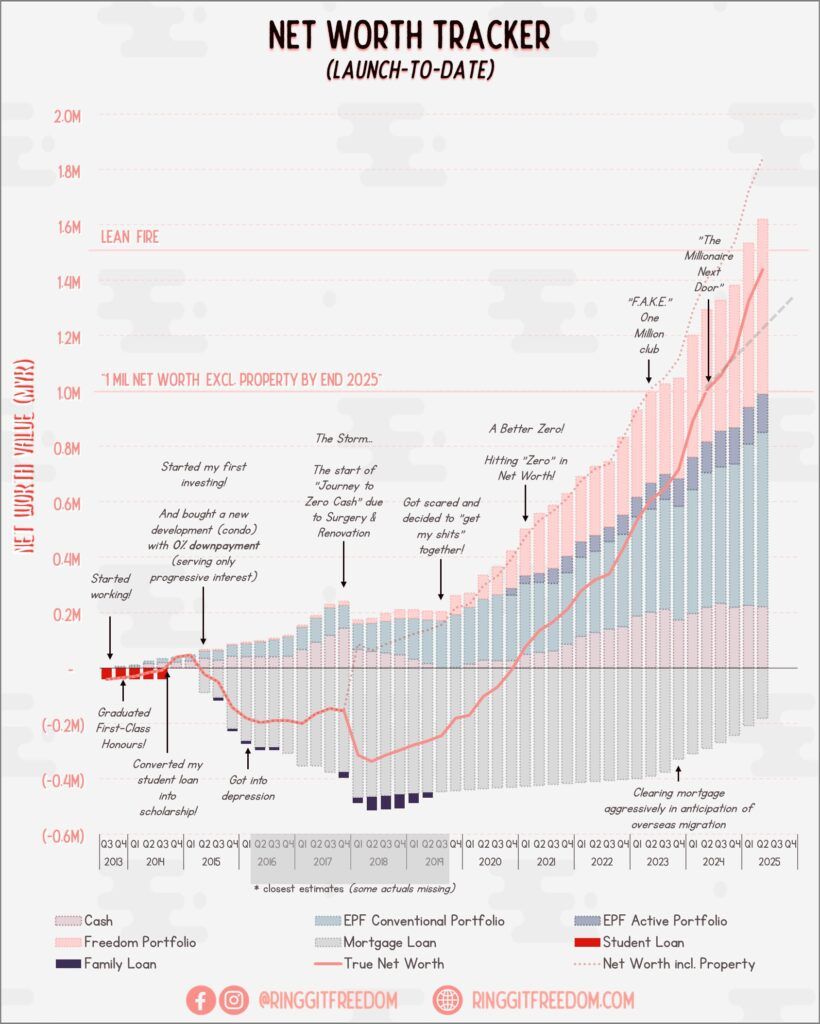

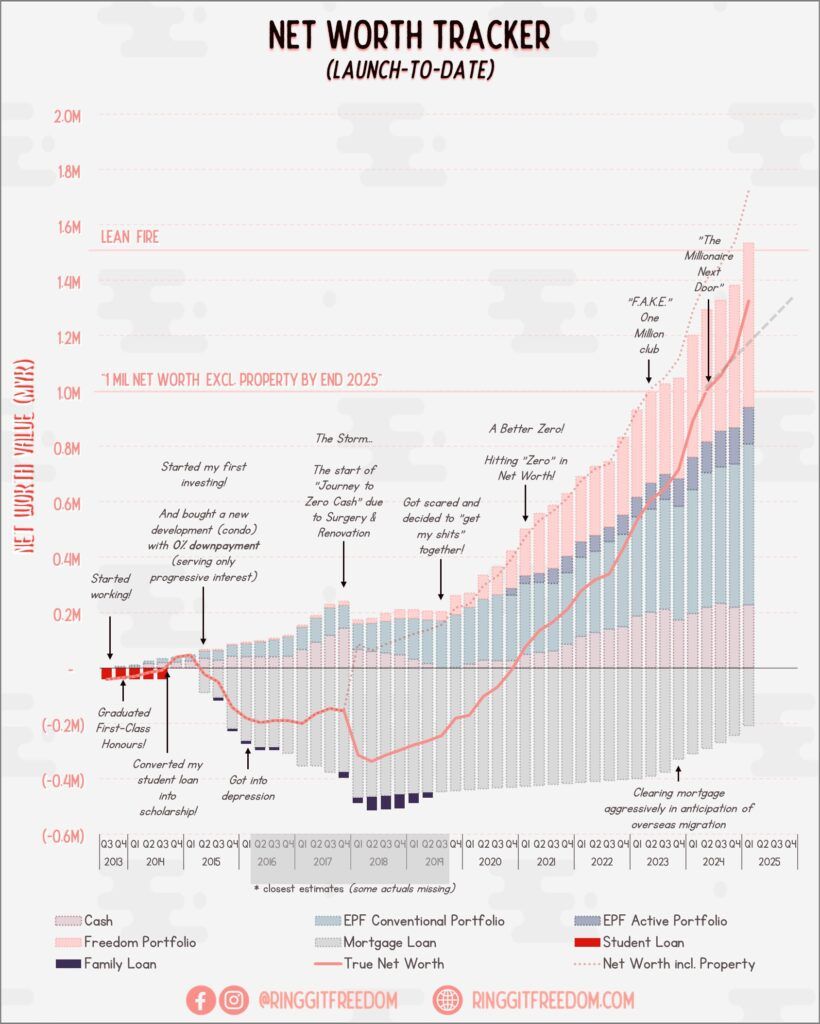

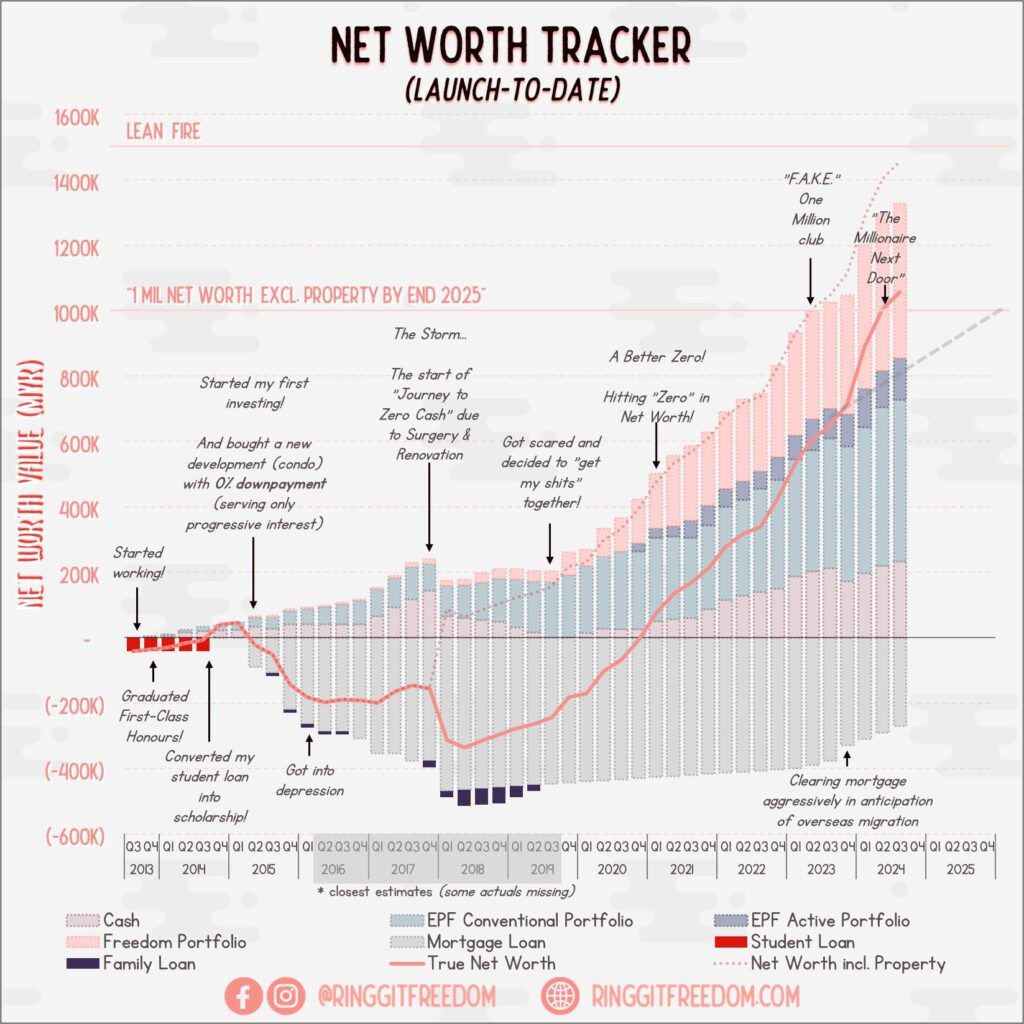

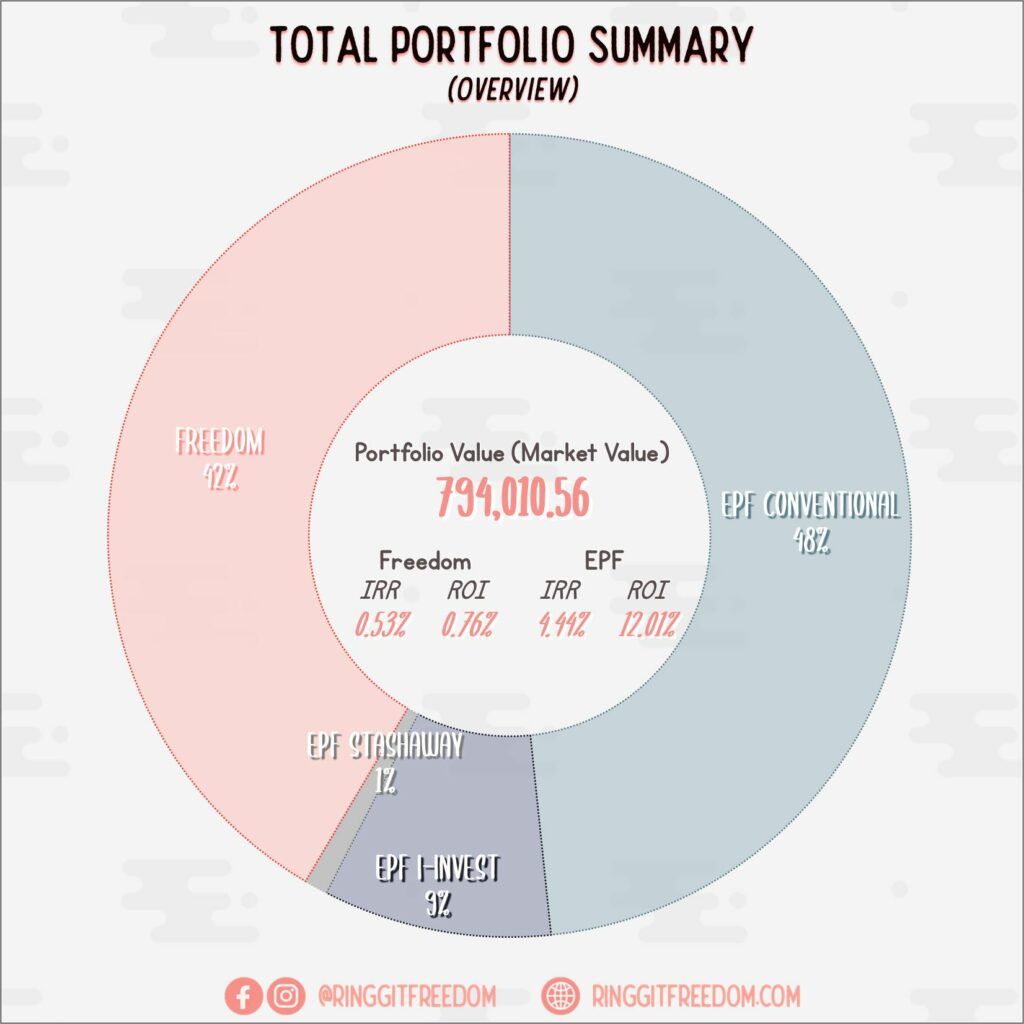

Net Worth Updates

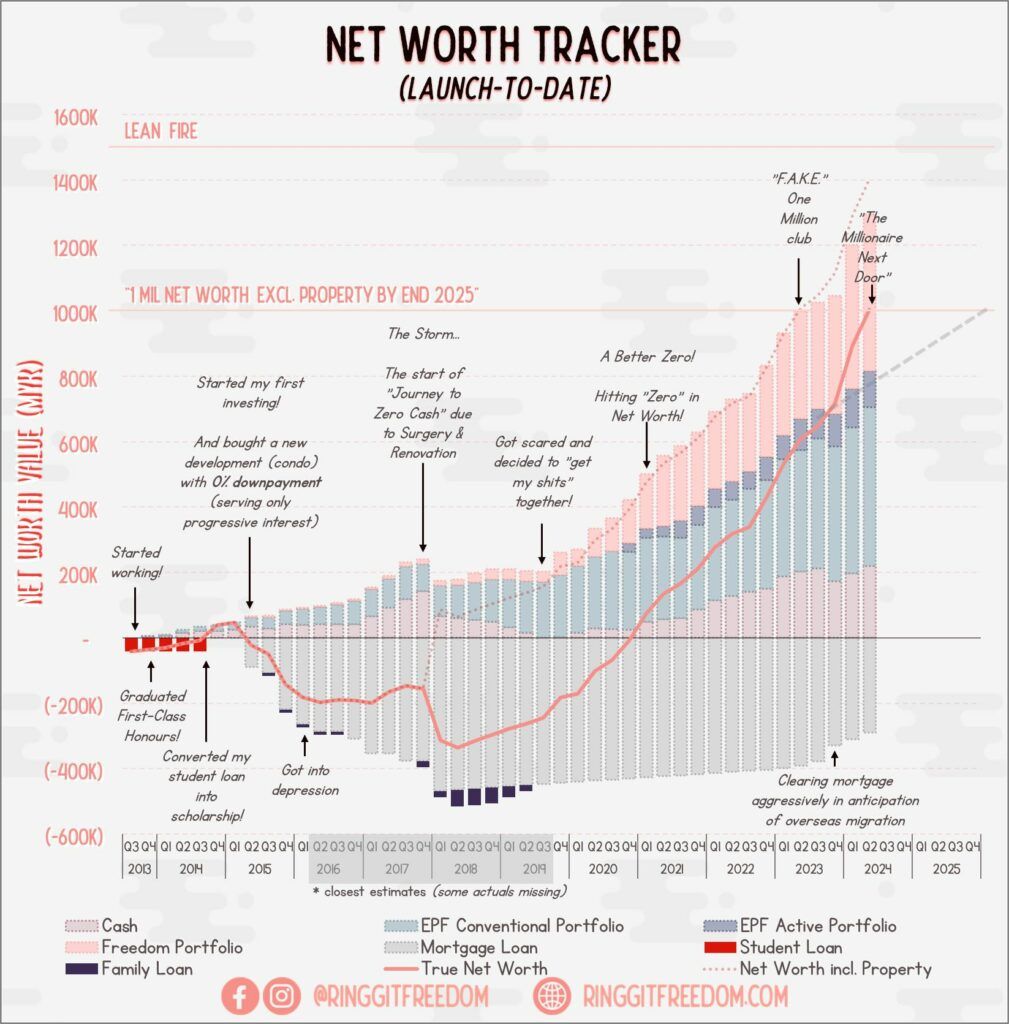

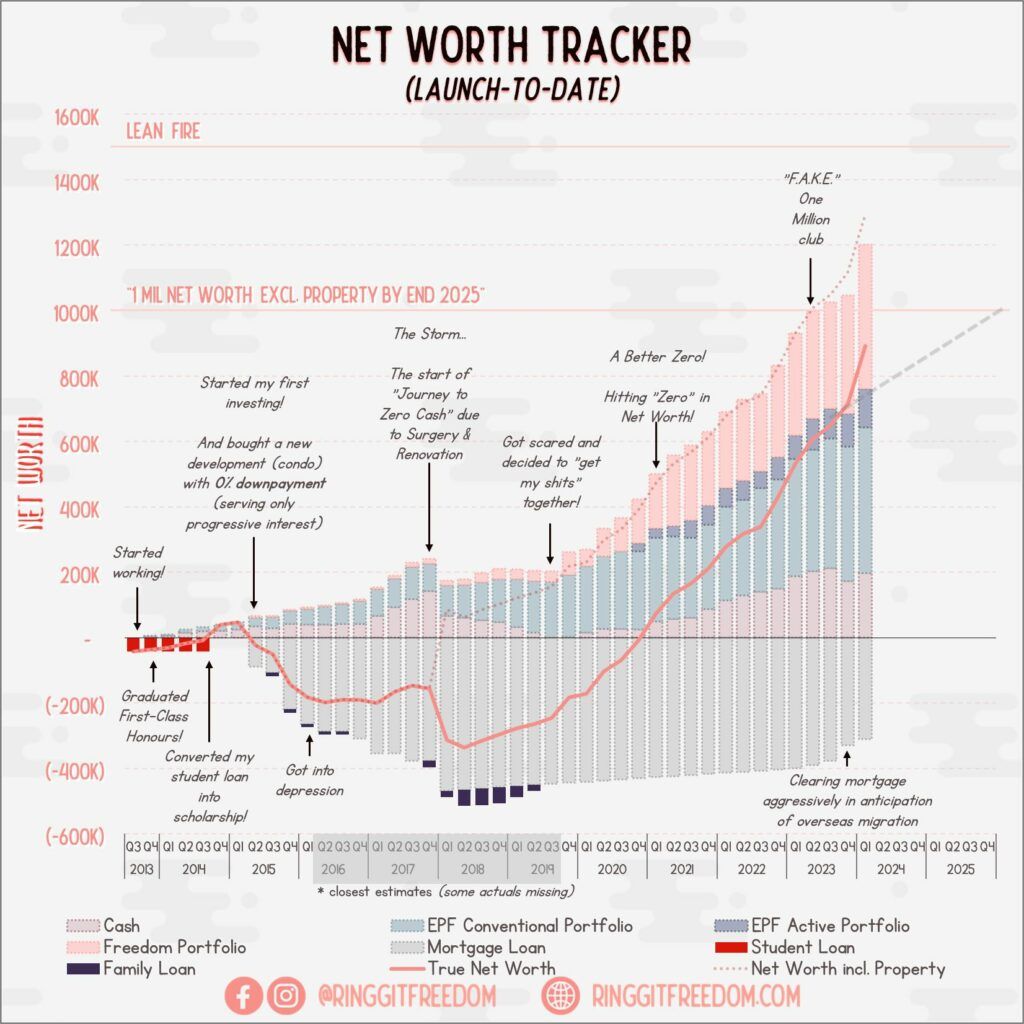

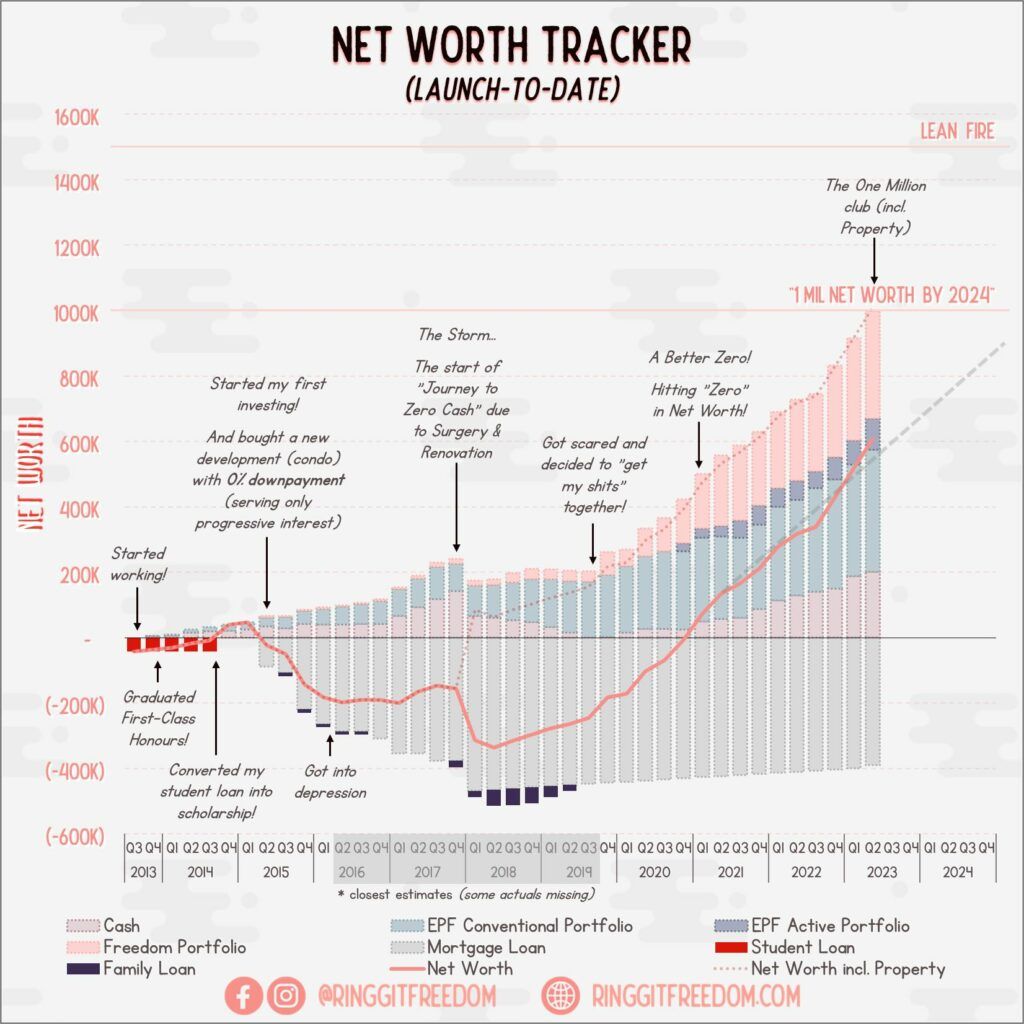

Despite my rather poor savings rate (disappointed with myself tbh) this quarter, I'm salvaged by the surprisingly good performance in the market. If market continues to rise at this pace, I'll probably be hitting my Lean FIRE target earlier than initially anticipated. Only time will tell where our net worth will stand by end of 2025.

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie

The post Ringgit Freedom’s June 2025 Updates appeared first on Ringgit Freedom.

]]>The post Ringgit Freedom’s March 2025 Updates appeared first on Ringgit Freedom.

]]>My Life & Mental State

Feels like yesterday that I just wrote my 2024 Year In Review and it's already March 😛 Quite frankly, Q1 2025 was still pretty hectic for me, at least until beginning of March, primarily due to a huge project at work which I'm overseeing.

Nevertheless, I never forgot to took some time off for myself and managed to catch the limited screening of IU Concert: The Winning during the limited screening period worldwide. In a way, it's for me to relive my regrets for not splurging last year when I given the chance to.

Other than that, it was pretty much just work, and/or festive celebrations with feasts here and there. Oh, and not to forget the constant juggle between getting some rest vs. doing Korean Class Homework/Past Year Test Papers vs. leisure gaming time for myself. Ugh, priorities!

P/S To my Muslim readers out there reading this, Selamat Hari Raya Aidilfitri, Maaf Zahir dan Batin.

Now, going back to our usual monthly update for my finances and portfolios.

My Financials

One quick caveat before we start our financials update - I've decided to simplify stuff a little especially when it comes to expenses & savings rate. In the past, I've always had to run two set of numbers - one 'standard' savings rate and another 'normalised' savings rate throughout year of 2023 & 2024.

The primary reason for this was due to the additional expenditures I've incurred as one-off investment to migrate overseas (immigration related expenses) and acceleration of my mortgage paydown plan (additional principal contributed to paydown mortgage principal faster).

However, since these were ultimately investment towards myself (one way or another) I've decided to take the same blanket treatment - just like how I've always excluded investment-related spendings outside of my Expenses / Savings Rate calculation.

Going forward, just like other investments, I'll be excluding immigration related expenses and additional principal paid to my mortgage from both Expenses & Savings Rate.

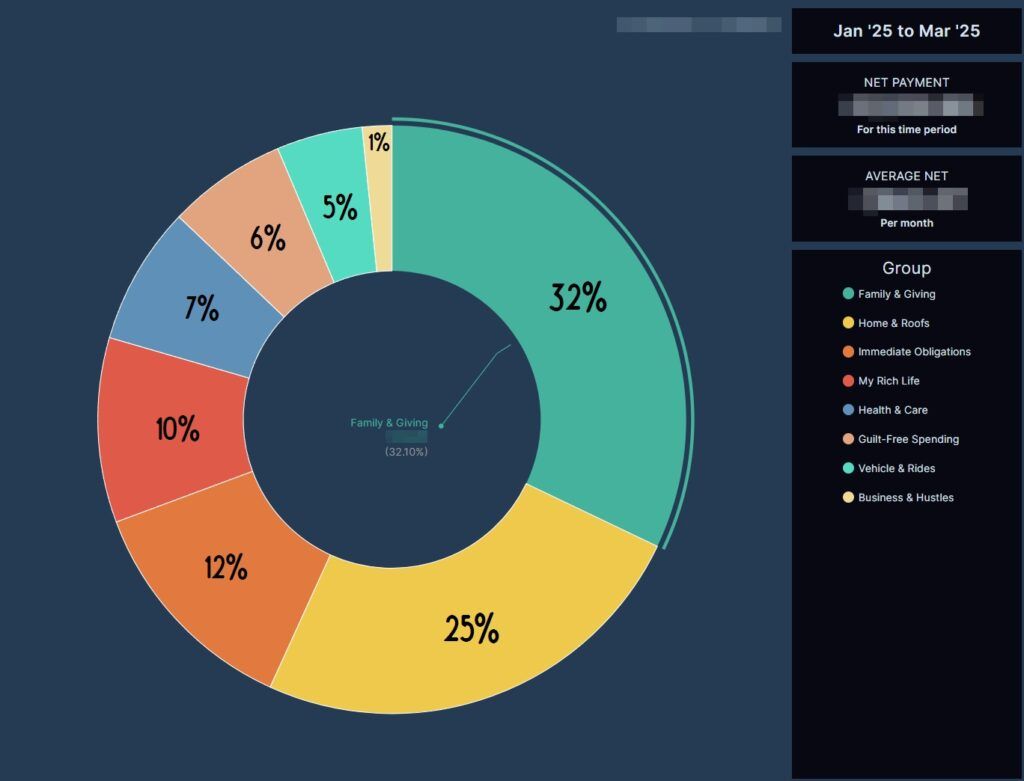

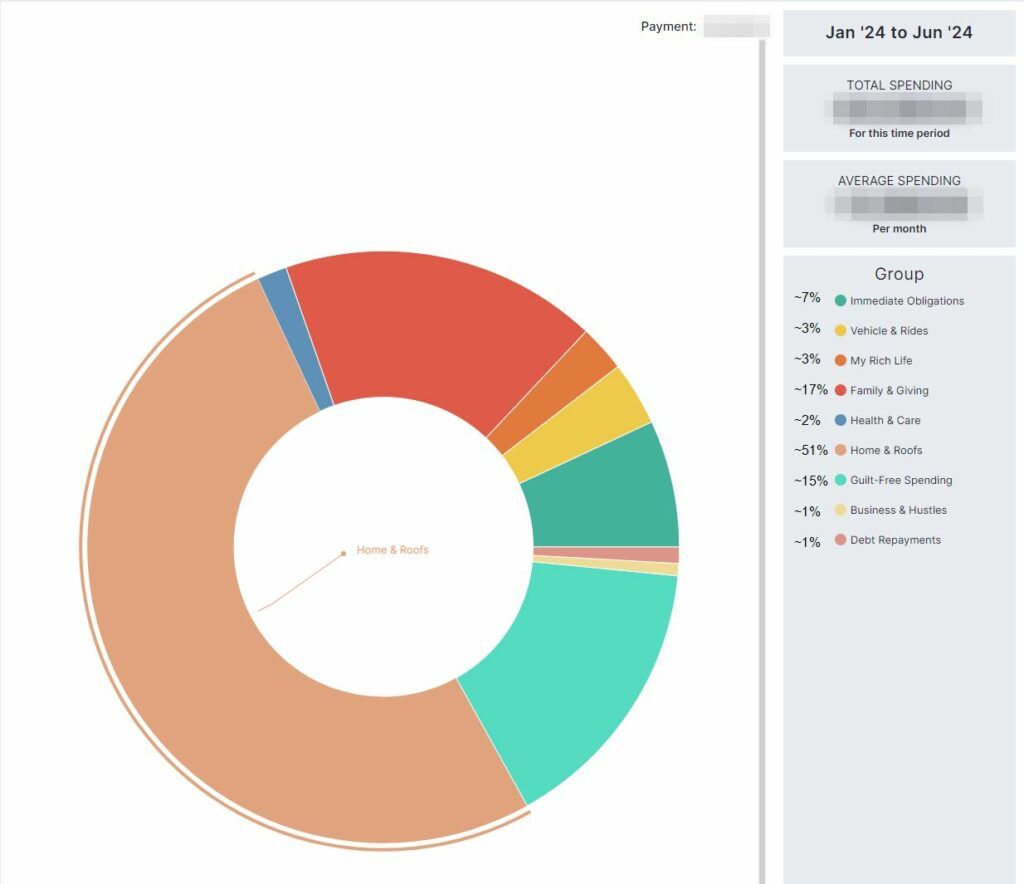

Expenses

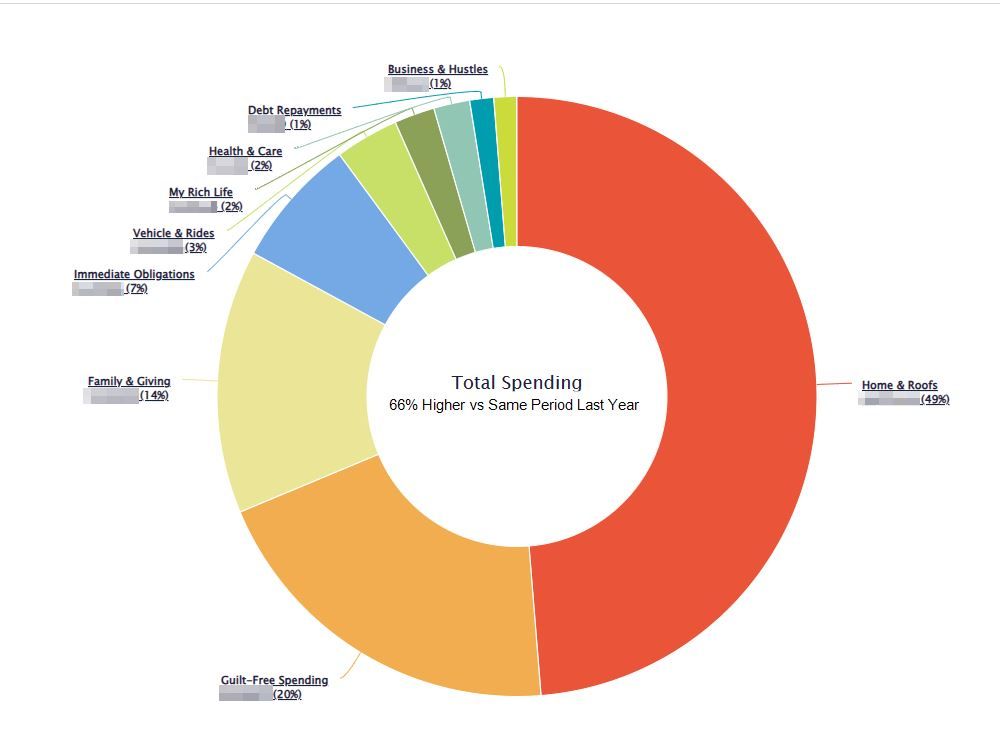

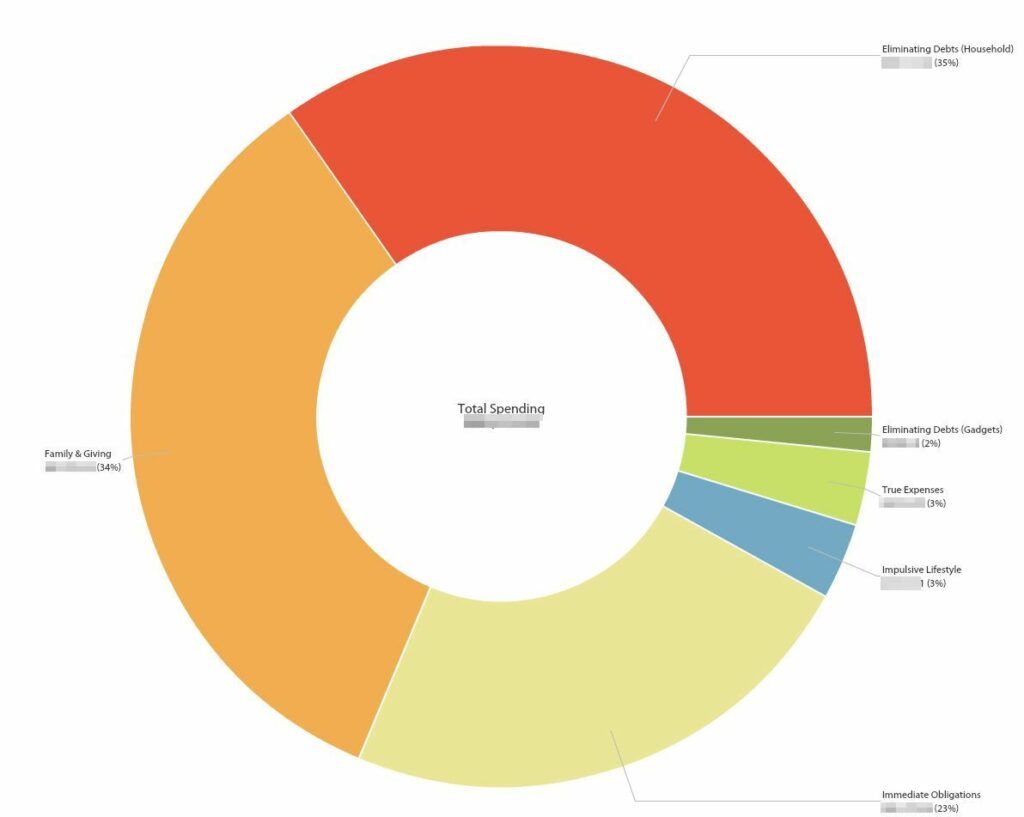

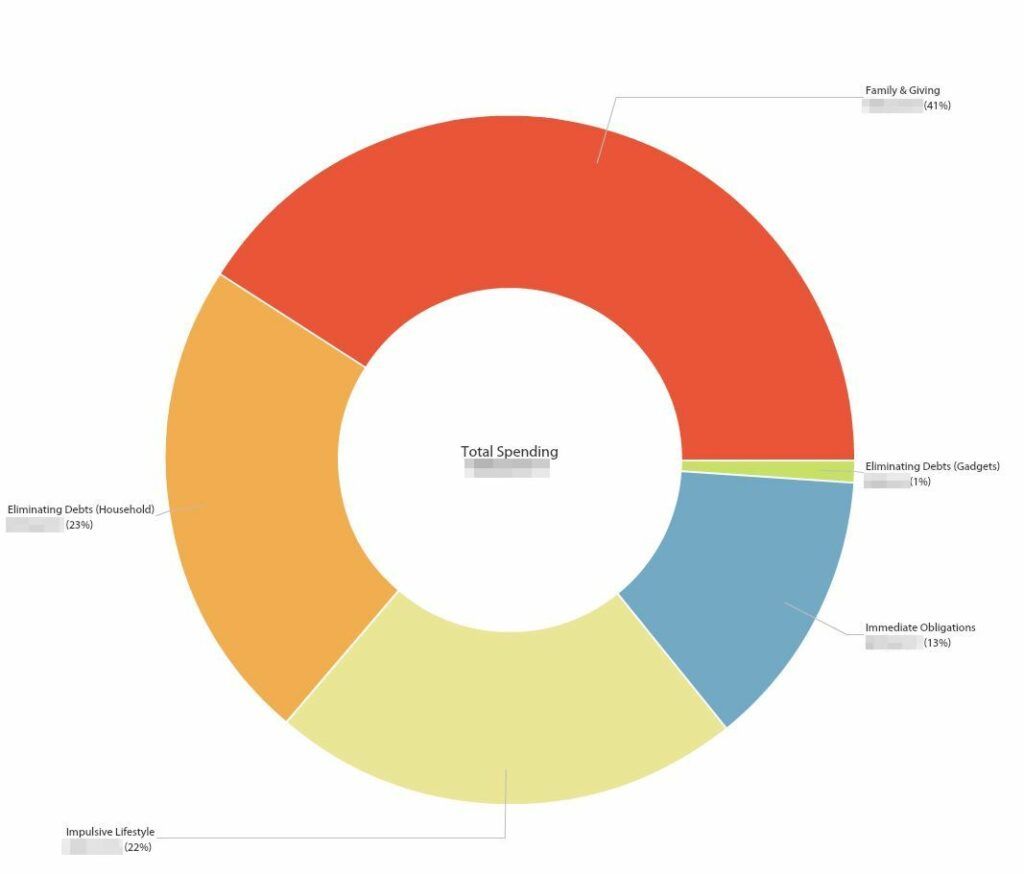

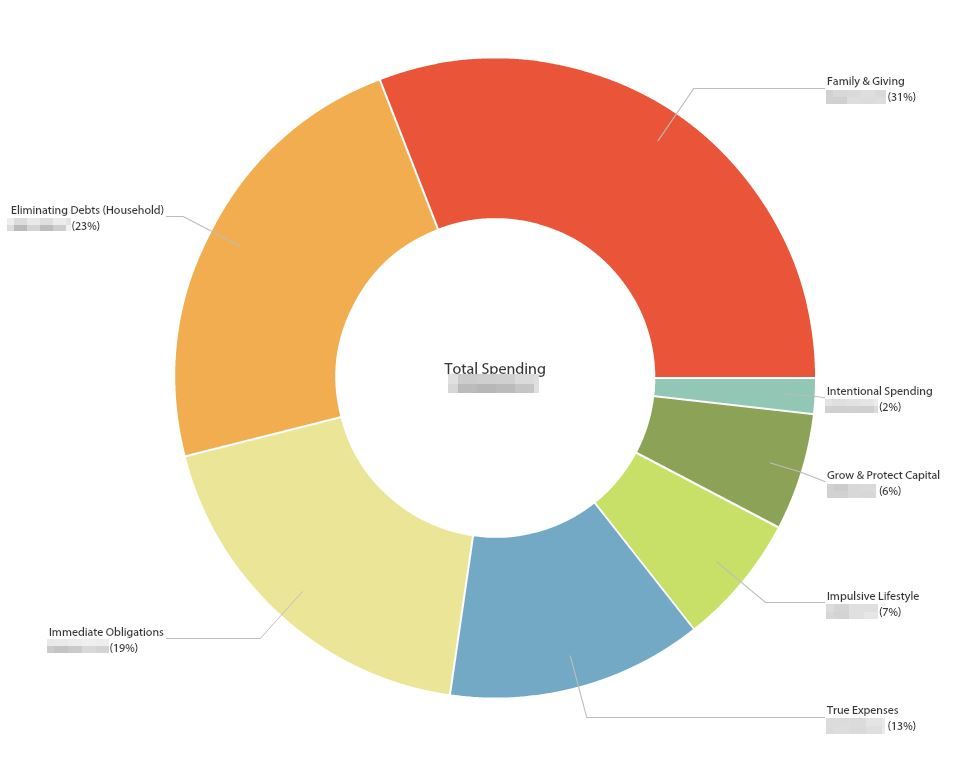

With the additional principal payments removed from the Expenses chart, it's pretty clear that a significant portion of my income goes towards my Family's spending (Allowance, Treats, Insurances, etc.) and of course not to forget the mandatory mortgage payments mandated by bank.

Aside from these two, my other expenditures remains relatively stable (and minuscule) considering my income.

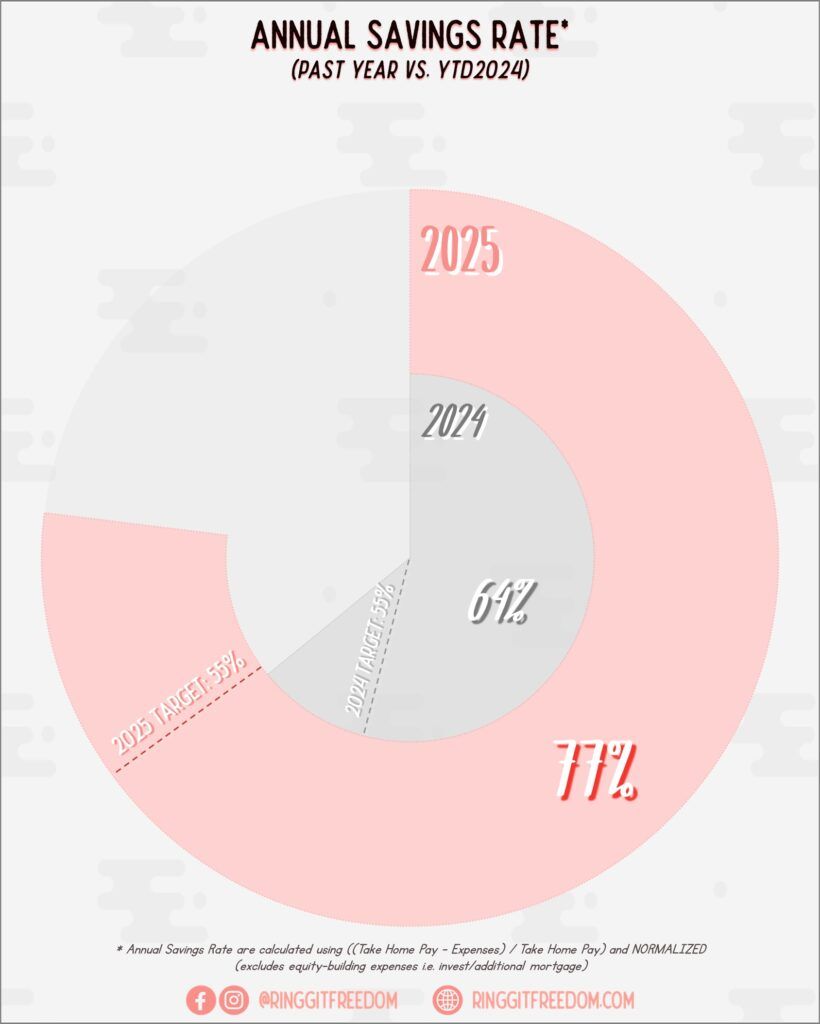

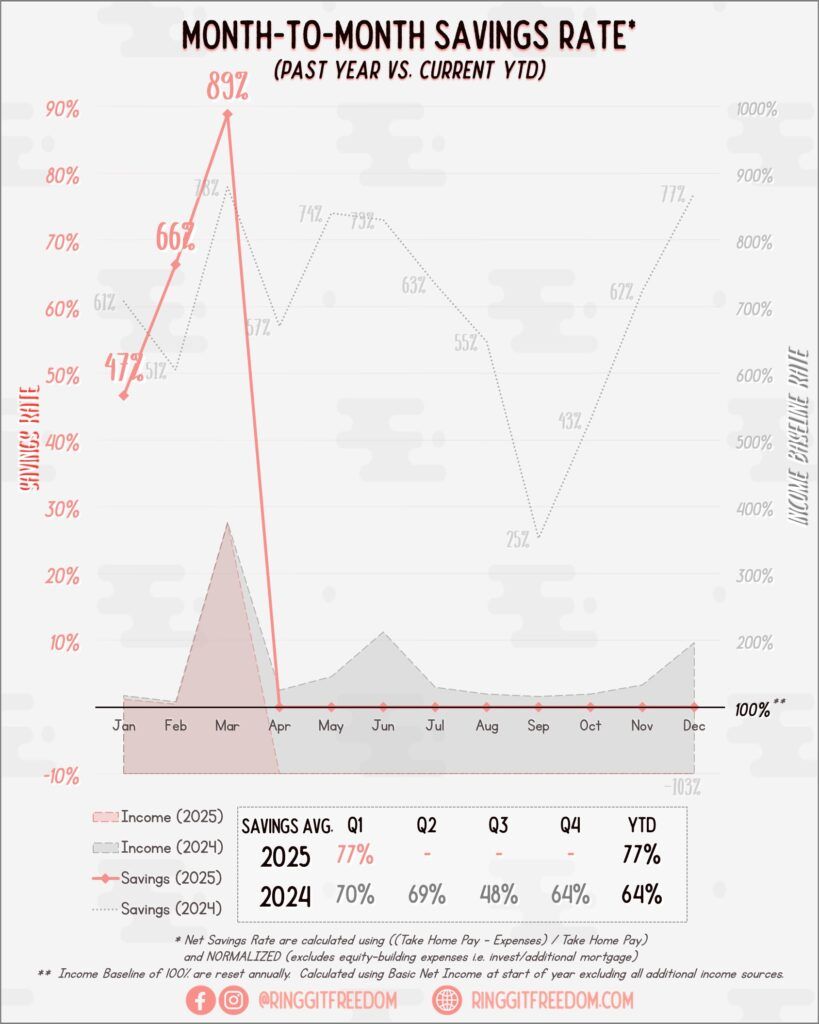

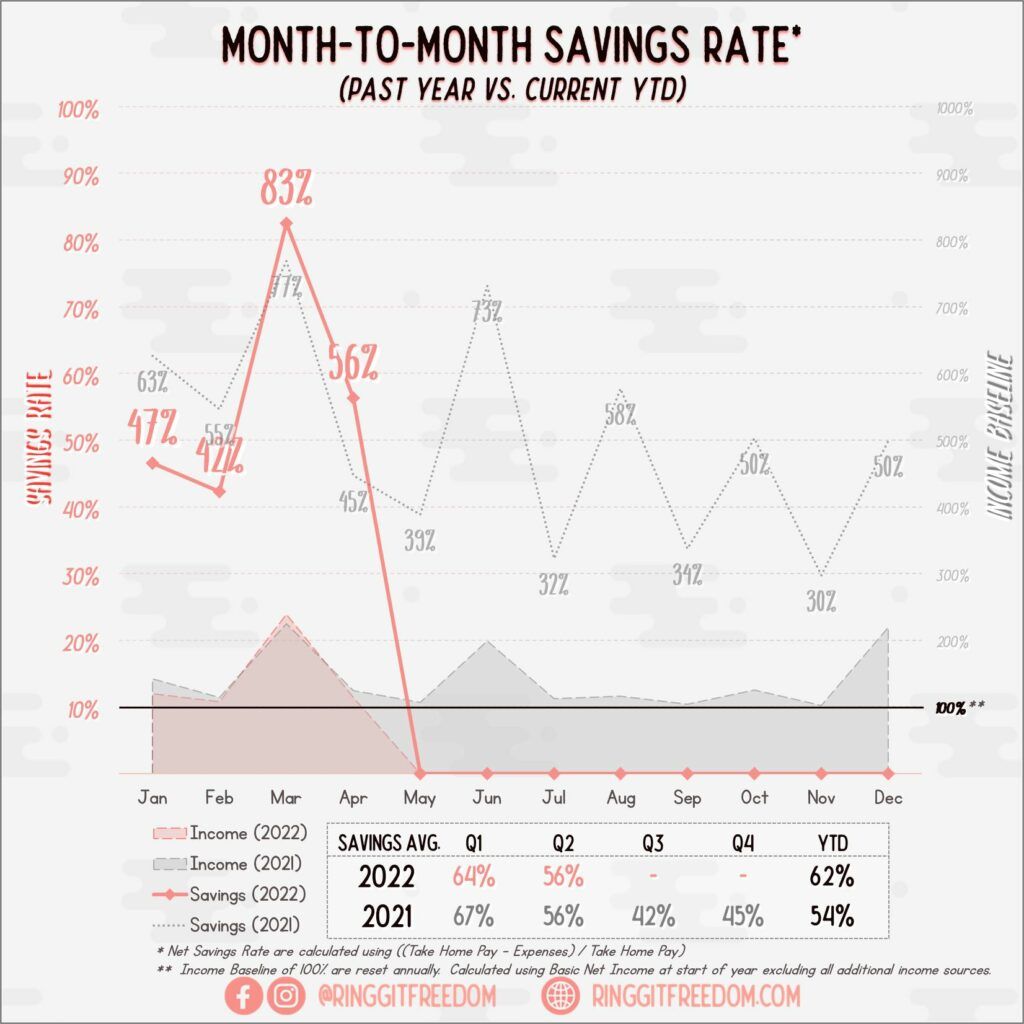

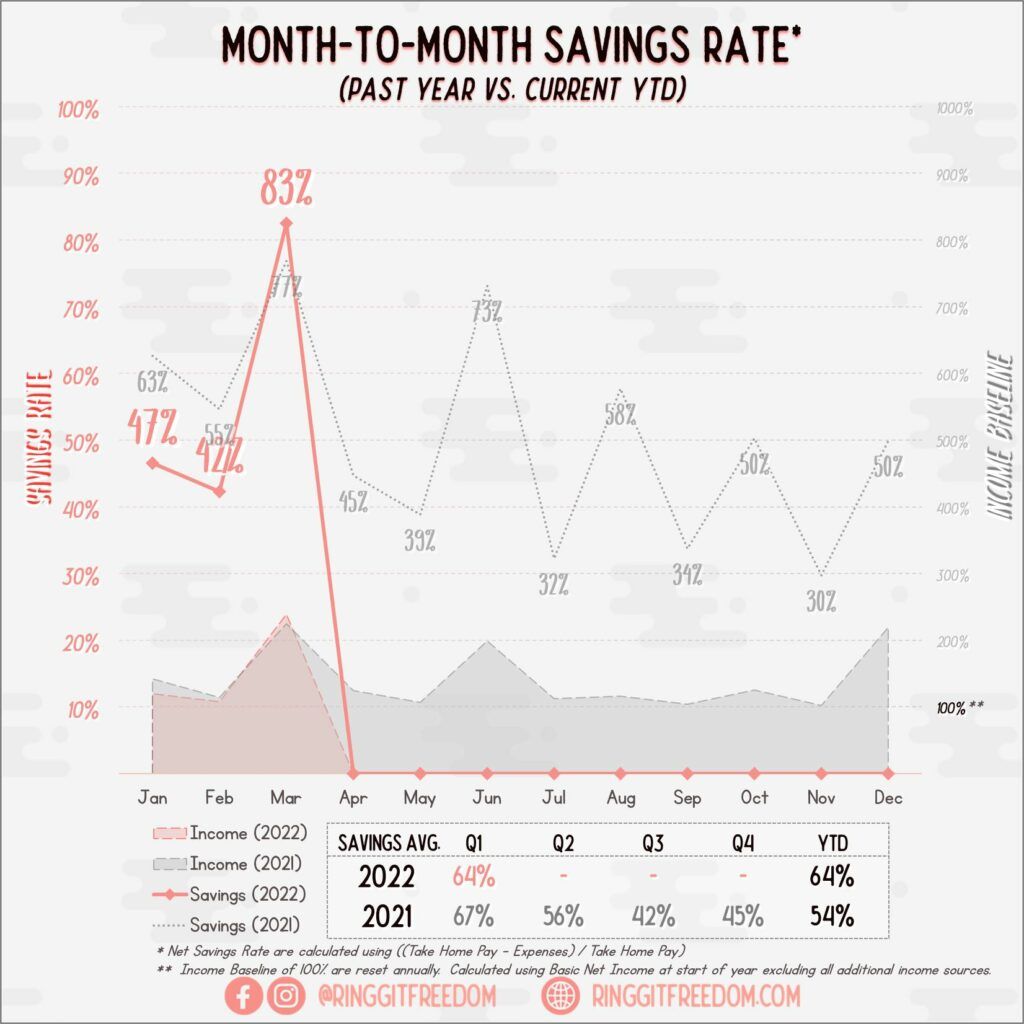

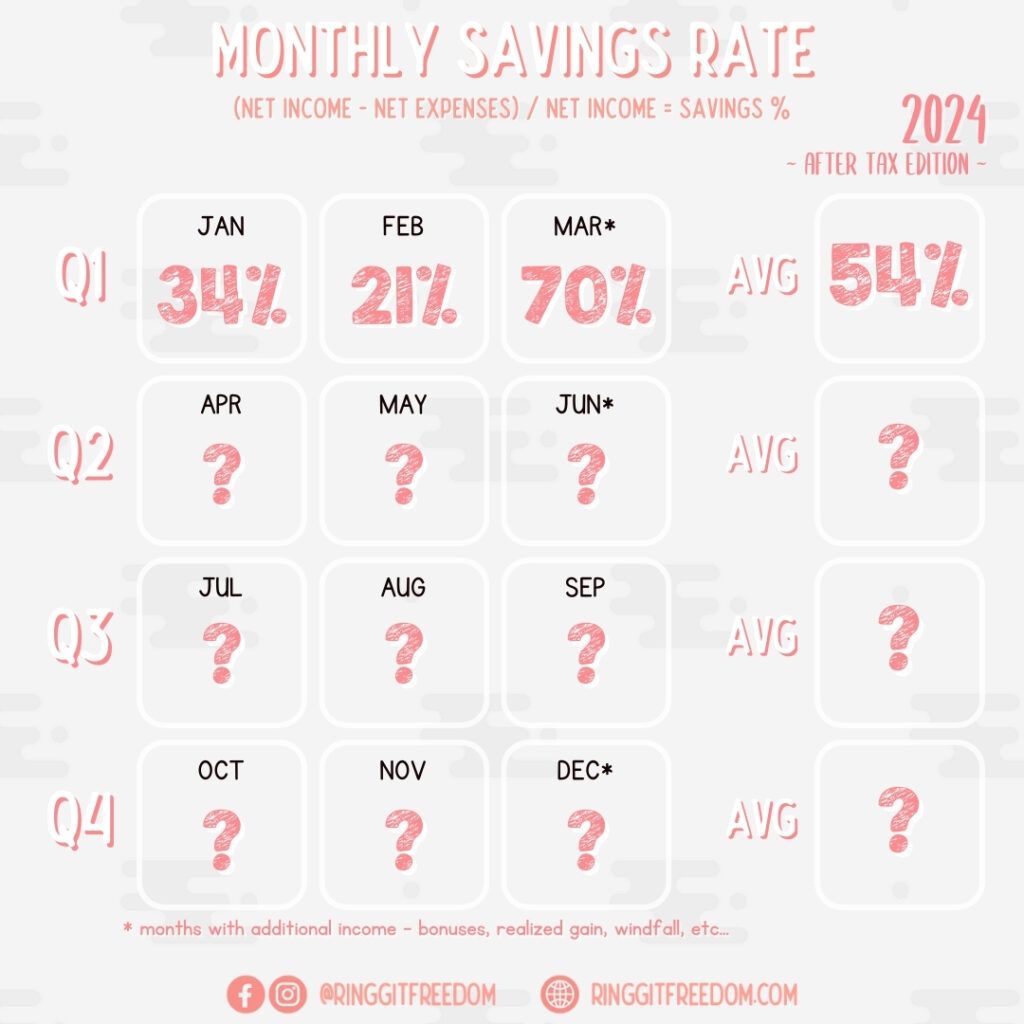

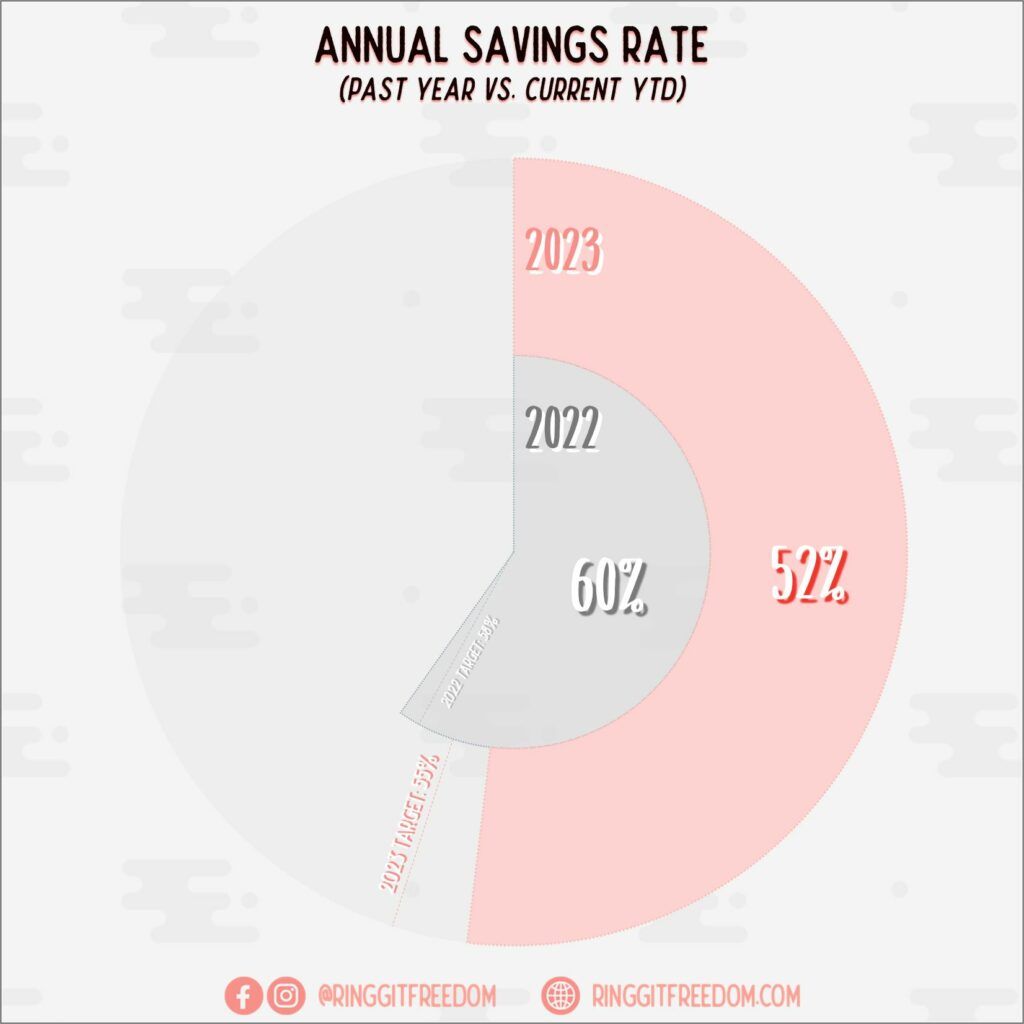

Savings Rate

I always enjoyed Quarter 1 of the year - not just for the festive seasons, but also the extra payday from various sources - Tax Refunds, EPF Dividends, or Performance Bonuses from last year. These spikes in income have helped me in last couple of years to accelerate my goals. Of course it goes without saying that majority of these "savings" are promptly invested - whether in forms of additional principal contributions to my mortgage loan or simply funding my Freedom Portfolio.

With these bonuses, we managed to start our Quarter 1 strong with year-to-date Savings Rate of 77%. As long as I keep up my habits for the next 9 months, even if simply by mimicking my last year's savings rate trending, we should be able to hit our target just fine.

Emergency Jar

No changes to the Emergency Jar this quarter.

My "Freedom" Investments

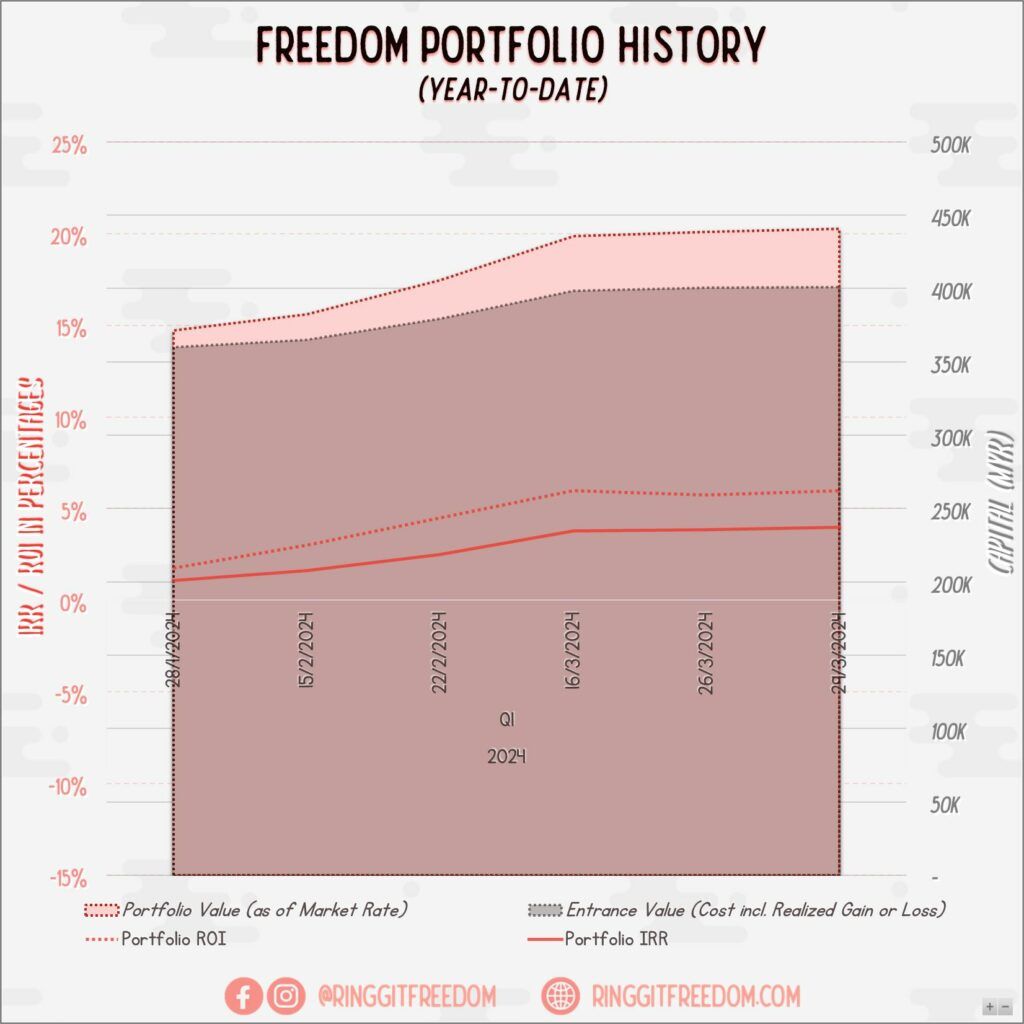

Performance

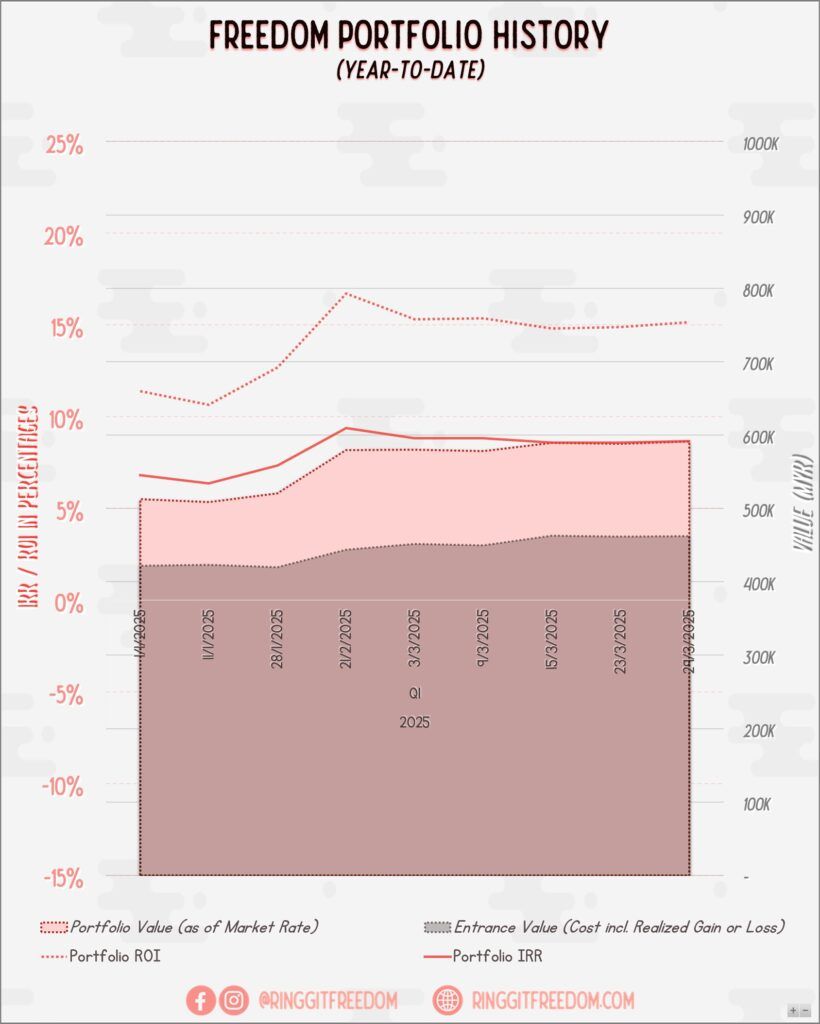

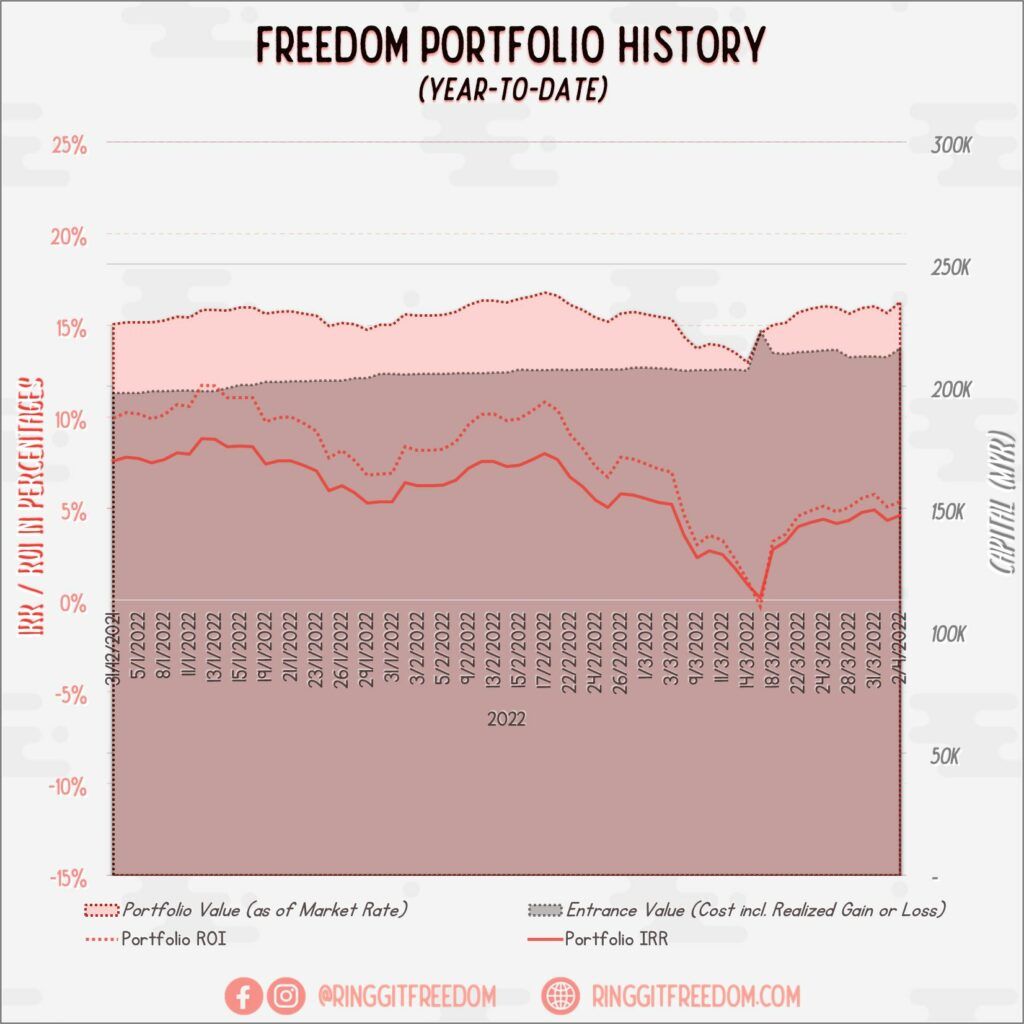

Last 3 months have been crazy ever since Trump took office - with never ending roller coasters' ride for stock market. On one hand, almost everything from SP500 to Gold to Bitcoin was creating new highs, then tumble, rise again and then tumble for a few rounds. Looking at the unrealized gain at this stage - it really really is taking a toll on me to NOT TAKE PROFIT AND CONTINUE HOLDING. Managed to buy some dips during the short Crypto Crash as well (basically undoing my "short" last year 😂)

Knowing that market cycles are cyclical and what goes up will come down (and vice versa), it's so tempting to just take some profits during the all time high so that I can scoop lows when it crashes again. But this definitely is against my investment philosophies, so am doing what I can through sheer willpower to try... not to touch my portfolio 😅😵💫

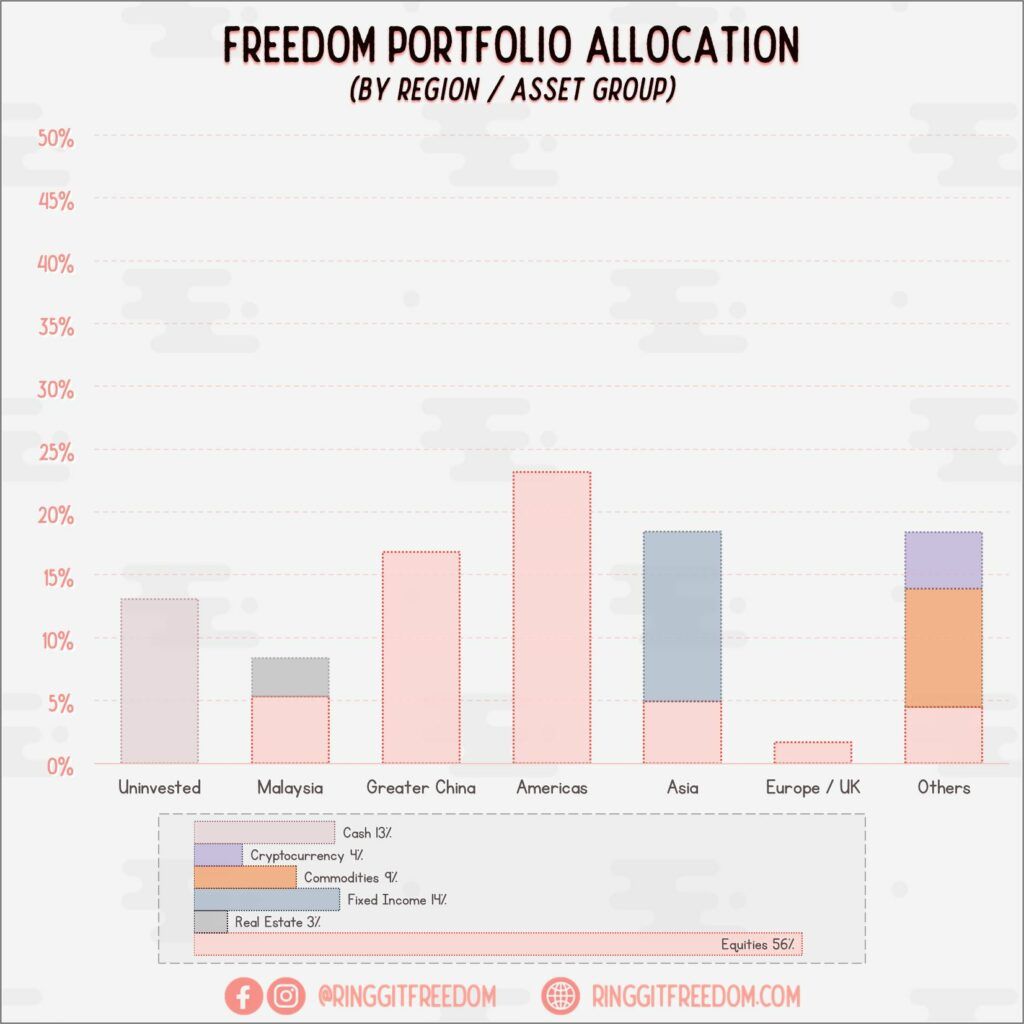

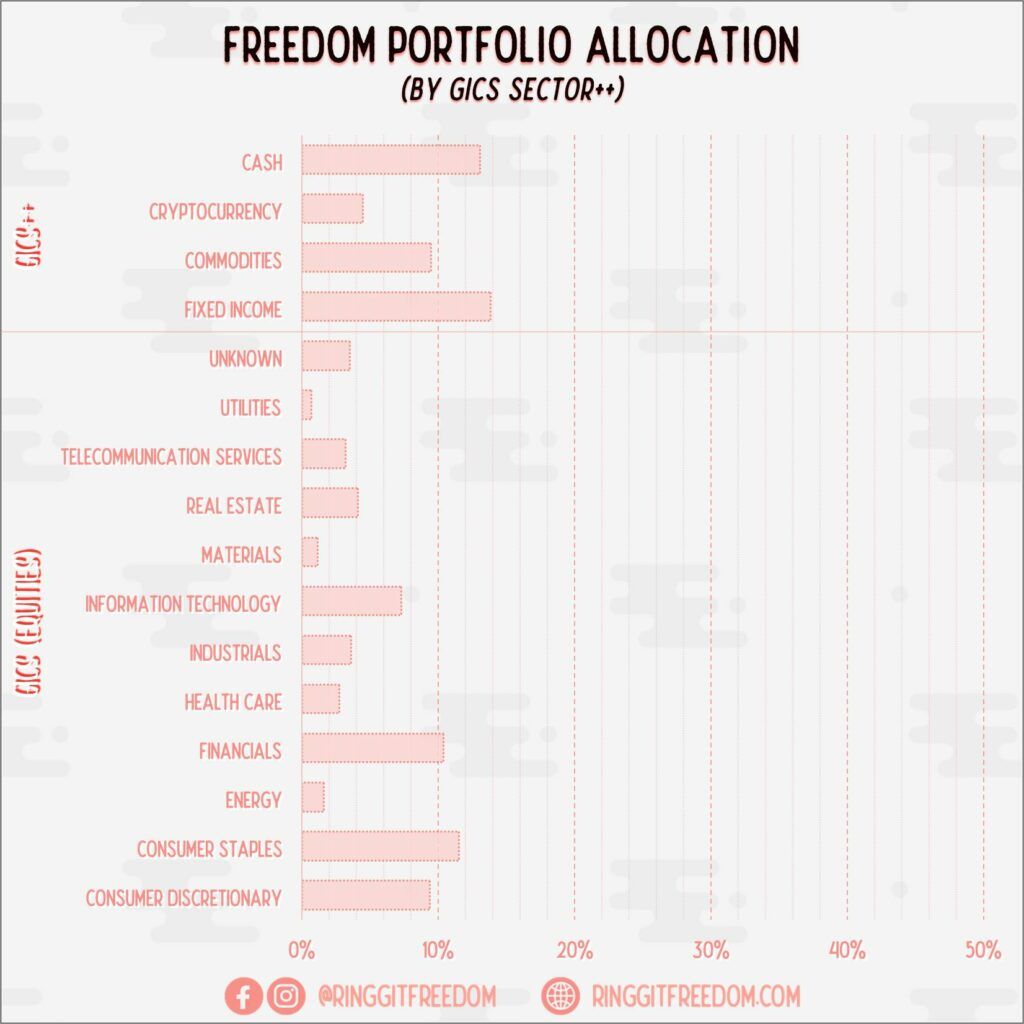

Allocation

Snapshot as of 30 March 2025

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 0.26%

ROI: 0.37%

Profit/Loss: RM 1,244.67

Active (Invested) Portfolio

IRR: 13.77%

ROI: 24.98%

Profit/Loss: RM 127,371.70

True Cost: RM 464,762.81

Total Value: RM 629,623.52

Entrance Value: RM 462,448.33

Portfolio Value: RM 591,392.06

Nett Dividend (2025): RM 1,209.07

Net Worth Updates

March's spike in Net Worth value always scare me - with various factors contributing to it from EPF's dividend announcement (hence recognition of values), to company's performance bonuses, and of course our not-so-beloved tax refunds. On top of it, we also have new market highs (despite the ongoing crashes) of my unrealised portfolio gains shooting up my net worth by almost 200K.

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie

The post Ringgit Freedom’s March 2025 Updates appeared first on Ringgit Freedom.

]]>The post Ringgit Freedom’s September 2024 Updates appeared first on Ringgit Freedom.

]]>My Life & Mental State

Quarter 3 in 2024 have been kind to me. I've started to create more pockets of time to spend some quality moments with my mom, amidst my chaotic working schedule.

Not just with family, I've also been spending quite some time (and money) in aspects of self-love and self-care. Went for a personal colour analysis session to better understand suitable colour (and fashion style) for myself and this gave me a good reason to start some spring cleaning exercise on my wardrobe.

Doing all these as a start so that I can learn to better appreciate both my natural beauty - and most importantly my flaws. Approaching it step by step seems like a good way to start, considering that I've never really "cared" too much about my skin or fashion. Gotta start taking care of my skin before it's too late!

And not to forget, finally, my braces are off too! Now I've gotta learn how to smile... confidently. Something that I've never done in my current lifetime.

On the not-so-bright side though - I had a chance to snatch some last minute ticket for IU HEREH ENCORE Concert @ Seoul as some people gave up / refunded their seats 72 hours before the concert. I was literally at the check-out page and was inputting my card details!

And what took it away? My own hesitation. I wasn't really sure if I could commit to such a last minute trip, and was also worried about the flight & accomodation price due to the short notice. In that span of the moment of checking flight ticket prices, the transaction got timed out and I lost my chance altogether :'). On one hand, it's a semi-good news where I avoided a financial disaster for September (you'll see why in a bit...) but on the other hand, the sad reality struck me as I instantly felt the regret of "not trying" than regret of "doing".

Guess this will be my mantra going forward - better regret for trying than to regret for giving up. Heck, I've even applied & secured K-ETA approval and was prepared to fly on a short notice... why the hesitation 🙁

Now, going back to our usual monthly update for my finances and portfolios.

My Financials

Expenses

I've decided to change the format a little. Rather than should Year-to-Date figures which is quite difficult to make comparisons to in later part of the years, I'll just do quarterly expenses review and only show the Year to Date in the final yearly review.

Just as the first two quarters of 2024, half of my expenses were actually put into my mortgage - both principal and interest included. If I can keep this up, it shouldn't take more than 5 years for me to write off my mortgage loan. May not be the best thing to do from financial numbers perspective, but I'm doing it anyway. The thoughts of being debt-free to me is priceless, no matter what the math says. Just treating it as a premium to be paid for peace of mind.

Aside from this, I've spent quite some figures (up to 20% of total expenses) on purchases for either myself or my family. For one, I've finally pressed the 'BUY' button and managed to get my mom an iPhone 15 - her first iPhone ever. This is also probably 3rd "new" phone she ever owned - with the first two "new" phone being sub-RM500 phones. Whilst she doesn't say it and kept nagging me on how I've wasted money on her, I can see her smile deep inside. That is definitely a worthwhile experience for me especially since she liked taking photos. Bought it right before iPhone 16 too - not the best, but god a pretty good deal at RM3100 for 256GB iPhone 15.

From another front - just as the last couple of years, September is usually my "spending" month where I splurge on self-care as I've mentioned in the opening of this post. Definitely should start tightening my spendings and bring it back in control - otherwise I'll be missing this year's saving rate target for sure...

Savings Rate

Yup. As explained earlier - September definitely is not looking good. As a matter of fact, the last couple of months weren't looking good as well. Quarter 4 will be the deciding moment on whether if I'll miss my savings goal target for this year

Emergency Jar

Nothing much to be said for the Emergency Jar - still there for the day that I wish will never come.

My "Freedom" Investments

Performance

Activities

Right before the end of September, China decided to do something which helped them to finally rally their stock markets, helping me to boost my portfolio value. At least my China ETFs are no longer in the red, which is a good sight after a depressing 3 years.

On the other hand, since I do have quite some subtiantial holdings denominated in foreign currencies like USD, SGD, and AUD - the recent strengthening of Ringgit (which is a good thing) definitely hit my portfolio hard. On paper, I'm losing at least 8% - 12% alone between the start of Q3 until today just from currency alone. But it's all on paper anyway so I don't really care. In any case, I am overweighted on MYR for sure, considering my EPF alone already exceeds the size of my self-managed Freedom Portfolio.

Good thing is that the US stock market index continues to rise so that kinda offset the "losses" too - but honestly not sure for how long. Everything feels overvalued nowadays.

Allocation

Snapshot as of 30 September 2024

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 0.44%

ROI: 0.67%

Profit/Loss: RM 1,971.97

Active (Invested) Portfolio

IRR: 12.49%

ROI: 20.26%

Profit/Loss: RM 82,282.73

True Cost: RM 366,513.82

Total Value: RM 487,698.67

Entrance Value: RM 386,803.42

Portfolio Value: RM 472,470.22

Nett Dividend (2024): RM 3,230.64

Oh - I've also just created this new chart and decided to add it to my blog as well - basically to show the Realized Gains/(Losses) and Dividends that I've received so far, in comparison to the paper gain/(losses) which are still unrealized to date.

Net Worth Updates

My net worth continues to climb this quarter - primarily attributed to the soaring stock market both in the US and China.

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie

The post Ringgit Freedom’s September 2024 Updates appeared first on Ringgit Freedom.

]]>The post Ringgit Freedom’s June 2024 Updates appeared first on Ringgit Freedom.

]]>My Life & Mental State

Although I wish things would slow down a little to give myself a breather in my work life, reality will often go against what we want. Work has been pretty chaotic the last whole quarter and I've been living it on a day-by-day basis, firefighting as I crawl through the day. This is taking a huge toll on my mental well-being again.

To make things worse, most of the friends that we've grown to become, as we joined the company together a decade ago, have left/resigned one by one to pursue alternative pathways. Can't wait to get out of it myself, too. Unfortunately, my way out of it is still far away as I await the Australian Government to (hopefully and eventually) grant me my permanent residency visa. Maybe I should really consider taking a sabbatical leave. In the end, what's the use of money if the price for it is healthy? Did anyone go through similar pathways?

On the personal front, I have IU to thank as she was one of the few reasons that held me together in one piece over the last few crazy months. Her concert shows were amazing and she is one of the few strong vocalists in today's generation. Had a great time at her concert, and will go again in the future should the opportunity arise. The best outcome isn't only the concert itself, though. She's so impactful, that seeing her trying to learn a few sentences of different languages in her World Tour Concerts to be able to make her fans happy across the world finally motivated me to push forward with my plans to improve my literacy in Korean, hoping that one day I'll be able to sing her songs in Hangul.

I've indicated a few times my interest in the Korean Language and tried at least 2 times on two separate occasions (the most recent being July 2021 as seen in my Instagram Story previously) but on all occasions, the motivation failed to last. This time around, I took classes and without realizing it, it's already been almost 3-4 months since I first started. Progression is shocking indeed when we give ourselves some space to look back.

Now, going back to our usual monthly update for my finances and portfolios.

My Financials

Expenses

Compared with the same period last year, my overall spending had increased by 1.14x. But when looking closer, most of the increase was due to the aggressive mortgage repayment strategy that I have started doing since last December. My leisure spending (non-essentials) was reduced by almost half vs. the same period last year. So far it's still pretty manageable and no alarms have been set off, yet.

Also for those of you who are sharp-eyed, yes, the expenses chart looked slightly different this time around as I've moved to a new budgeting app. Will write more about it in a separate post considering the dramatic shift that I've done, after being a loyal user of the previous app for more than a decade.

Savings Rate

Based on the current spending patterns, should be still on track to achieve the savings rate of 55% by year-end. Though the aggressive mortgage repayment plan has dragged down my savings rate, on the plus side I'll eventually accelerate my mortgage settlement and incur a lower interest rate in the long run.

Emergency Jar

No updates for the Jar - I've spent close to RM2.2k for various expenses incurred due to family emergencies - from medical to dental to car repairs. The jar gave me ample buffer to handle these surprises as they come, and it's worth every penny.

My "Freedom" Investments

Performance

Activities

Following my last quarter's update, I've finally pushed the buttons to start consolidating my portfolio to a few-fund portfolio, mainly driven by VWRA (World Stock Index Fund), 3040.HK (China Stock Index Fund), and IGLN (Gold Index Fund). The consolidation will be staggered throughout the next few years but over time, the goal is to reduce individual stock holdings except for some of those dividend stocks considering that there are no harm in having some (albeit minimal) cashflows from dividend receipt.

The US market is still soaring to new highs on a month-to-month basis, so that has helped to make my portfolio look green. Definitely thankful for that, considering that some of the consolidation mentioned above means that I'm locking in some of my losses (or transferring from single-stock to equivalent region index fund).

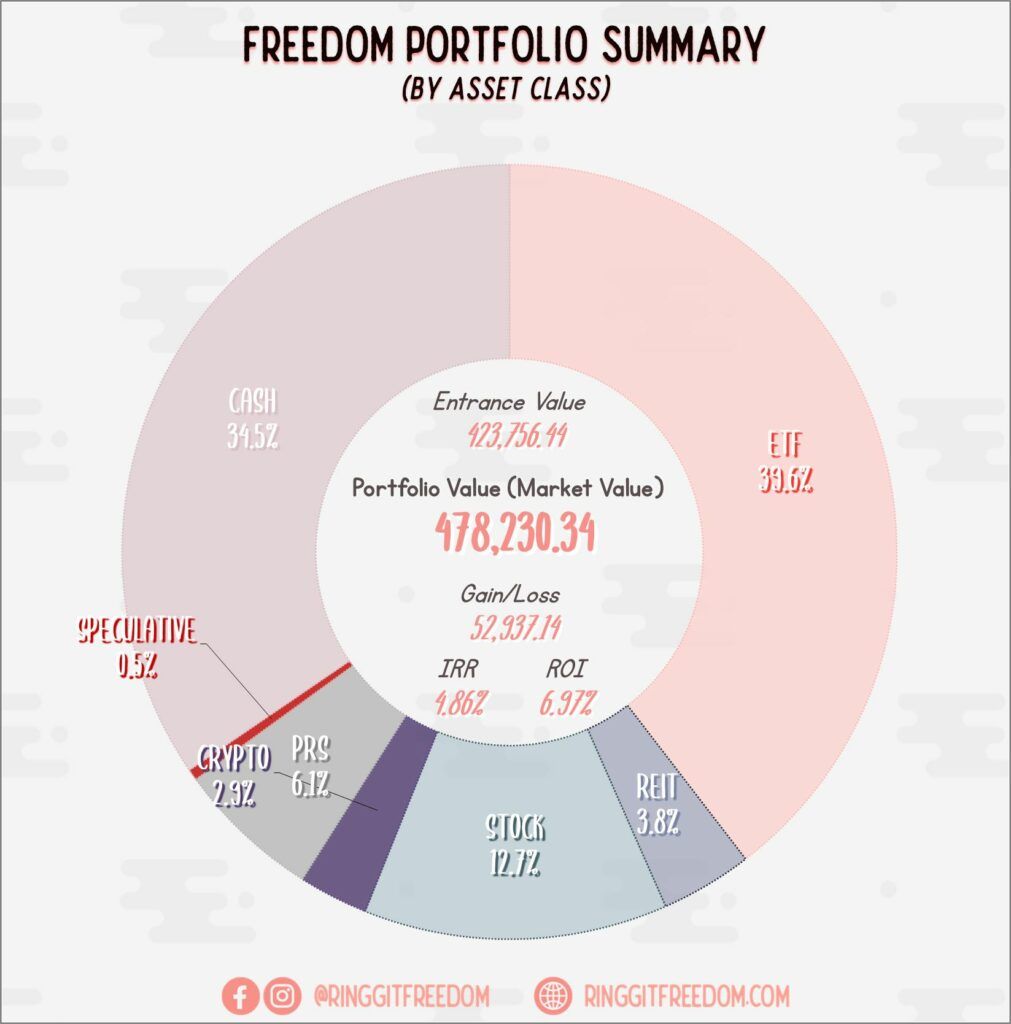

Allocation

My pile of cash-equivalents grew pretty big in recent months and I do not intend for it to go anywhere above 35% in my portfolio strategy. The struggle for me is mainly that in a high-interest rate environment and with global markets at an all-time high, it's mentally harder than I've imagined to practice what I always preach - time in the market rather than timing the market.

I'm still in the market though, with my quarterly transfers from MYR to USD for my scheduled recurring investment in VWRA. But no plans to dump all my cash / cash-equivalents into stock, yet.

Snapshot as of 30 June 2024

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 0.12%

ROI: 0.17%

Profit/Loss: RM552.01

Active (Invested) Portfolio

IRR: 8.92%

ROI: 11.87%

Profit/Loss: RM52,385.13

True Cost: RM391,172.55

Total Value: RM492,385.81

Entrance Value: RM423,756.44

Portfolio Value: RM473,230.34

Nett Dividend (2024): RM1,700.09

Net Worth Updates

This quarter marks the official celebration of my finally-acquired "millionaire" status. It was amazing how the whole US market and Cryptocurrency craze had managed to shoot up my net-worth value faster than my initial forecast. Ironically, in my updates last year I decided to shift the goalpost by 1 year, to achieving 1 million net worth by 2025 due to concerns of not achieving it this year, due to the lagging progress.

I'm going to celebrate this milestone, considering how far I've come since overcoming my life-changing depression in 2016/7 to who & what I am today. 🥳

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie

The post Ringgit Freedom’s June 2024 Updates appeared first on Ringgit Freedom.

]]>The post Ringgit Freedom’s March 2024 Updates appeared first on Ringgit Freedom.

]]>My Life & Mental State

I promise today's update will just be a short one - just wanted to give everyone a quick update since my last post in December 2023.

Life's been treating me good so far - that I managed to snag some IU concert tickets for myself & friends to finally attend her upcoming 2024 IU H.E.R. WORLD TOUR CONCERT IN KUALA LUMPUR. Expensive, yes. Probably one of the few artists/singers whom I'm willing to splurge on concert tickets ❤️

As committed last year to my 2024 Goals, I've also finally made plans and booked my hotel & flights for my upcoming holidays in Taiwan. Things were happy & well until the recent news hit on Hualien's Worst Earthquake in 25 years (that's where I was planning to go). Fingers crossed for the victims, and hopefully, the casualties are minimized.

Now, going back to our usual monthly update for my finances and portfolios.

My Financials

Expenses

I've spent 1.66x more compared to the same period last year - but this is primarily driven by the aggressive repayment plan that I've started since last year on my Home Mortgage Loan - as I'm trying to de-risk as much as possible considering my upcoming migration plans. Better to leave with minimal debt so that I have a fall-back plan back home. I'll probably detail more on this topic when if I finally decide to write about my migration plans.

Additionally, the commitment to the holiday plans required me to book some of the costs in advance (i.e. flights & hotel bookings) - which also contributed to the increase in my expenditures. As for the rest.

There were a few other spending within my budget limits - but mostly rounded off by the two biggest expenditures above so I won't be going through them.

Savings Rate

2024 is probably the year that I will be setting a new trend of savings rate for myself. Considering that more than half of my budget was allocated towards aggressive mortgage payments, my savings rate is impacted since I actualised the mortgage payments in my budget file ahead of payment schedules.

Emergency Jar

Nothing changed here - I'm still holding onto my 12-month emergency jar for the worst-case scenario (or opportunities) that may arise. Considering the ever-depreciating MYR currency, I'm definitely considering moving it from my MYR Home-Flexi account (approx. 4.5%/annum) to overseas FD with stronger currency (Maybe SGD?).

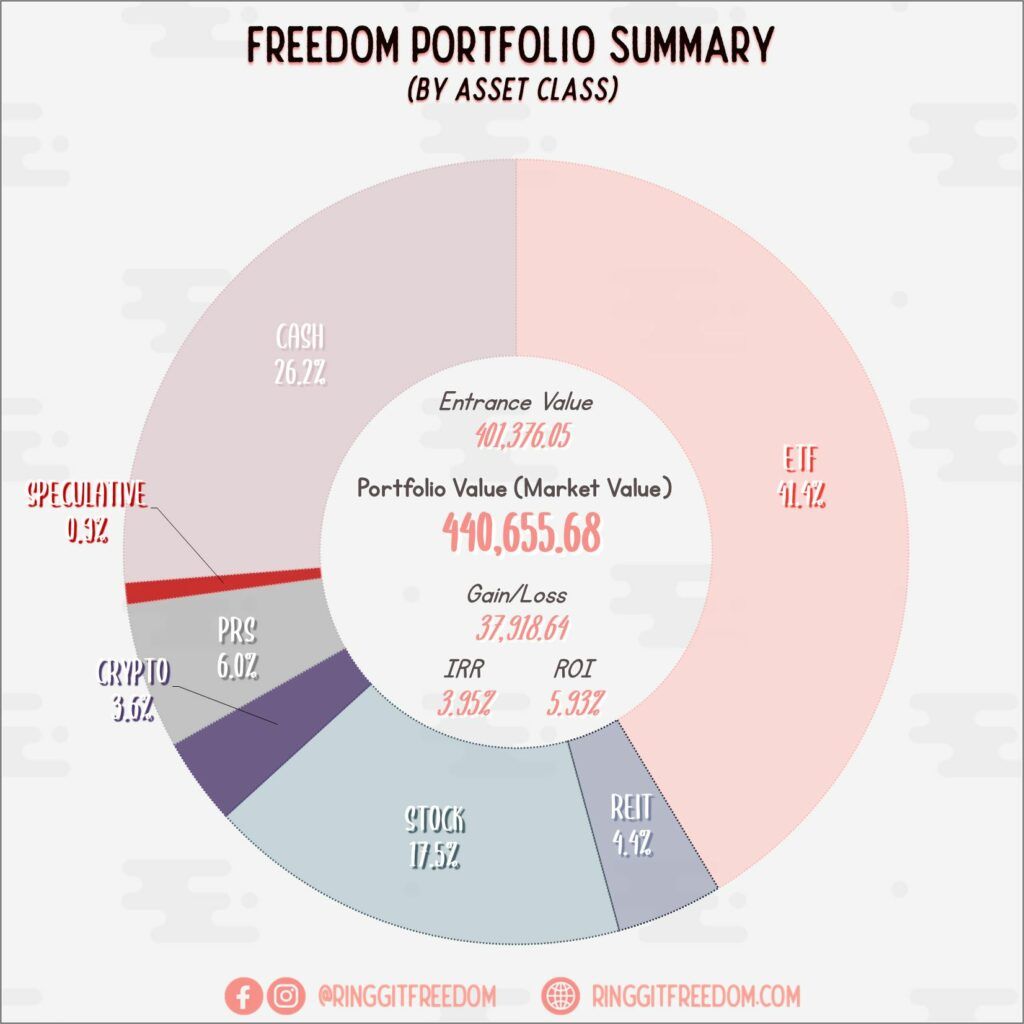

My "Freedom" Investments

Performance

I'm definitely happy with the ongoing upward trends both in the world of Cryptocurrency and US stocks. After approximately 3 years of depressing returns, I finally get to see some upticks in my overall portfolio. How long will this last? I don't know. Will just keep riding the investment wave.

One sad thing that had happened to my portfolio tho - two of my individual stock picks had either went through the process of delisting or privatisation, forcing me to sell my stocks and effectively locking in the losses in my portfolio permanently.

Lessons learnt: I am not suitable to pick individual stocks, value investing or not.

Allocation

Snapshot as of 31 Mar 2024

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 1.83%

ROI: 2.62%

Profit/Loss: RM5,012.29

Active (Invested) Portfolio

IRR: 4.87%

ROI: 7.25%

Profit/Loss: RM32,906.36

True Cost: RM420,145.23

Total Value: RM512,575.98

Entrance Value: RM401,376.05

Portfolio Value: RM440,655.68

Nett Dividend (2024): RM653.62

Net Worth Updates

With all that said - my net worth jumped quite significantly this quarter thanks to the surge in Portfolio Value, the release of KWSP Dividend 2023, as well as my windfall gains in March 2024. So far, I am still on track towards my goal of achieving 1 Million Net Worth by 2025. 🤞🏻

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie

The post Ringgit Freedom’s March 2024 Updates appeared first on Ringgit Freedom.

]]>The post Ringgit Freedom’s June 2023 Updates: Mid-Year Checkpoint appeared first on Ringgit Freedom.

]]>Table of contents

My Life & Mental State

Decided to do a mid-year checkpoint for this year since it has been almost half a year since I last shared an update on this blog (the quarterly numbers update at My Portfolio aside). Good time for me to also review my financial state since I've been sidelining it for a while.

Sometime around the end of last year, I decided that I will be taking 2023 slow and set almost zero achievement-oriented targets except for the annual savings rate. That actually worked well in my favour as it tremendously relieved me from the constant pressure of "I have not done this and that and that yet!", reducing the feeling of guilt and providing me the headspace needed to recalibrate my goals.

Whilst I won't deny that the year thus far has NOT been hustle-free even by slowing down (I actually achieved more), the switch of mindset from "I need to do X because I have to hit my targets" towards a more self-motivated "I need to do X because that's what I want and it aligns with my long term goals" actually helped me to achieve goals, or rather, drag my feet towards the right direction towards my goal, to say the least. One example is - I've finally gotten the PMP Certification which was long overdue since last year. Do I really want the cert? Maybe. But will it help with my long-term goal? Definitely. More on in the next sections later.

Sometime in mid-Feb to mid-March of this year, I finally acknowledged that my source of burnout last year was caused by several things - one of them being the constant pursuit of career growth whilst ignoring the fundamental sense of belonging/sense of freedom that I've always wanted. Don't get me wrong, the career growths that I've got are what got me here today, closer to the financial freedom that I've wanted. But I've come to realize and acknowledge the fact that financial freedom is only one of the many pillars in life that I want to have and they're not the single source of truth. Neither do careers.

Whilst I don't have the complete answer yet to what I want to achieve in the end, one thing that's clear for me is that I need a change. A change of environment - for the better or for the worse. I've always wanted to have a taste of life living overseas, outside of Malaysia where fundamental human rights are guaranteed even for the minorities, protected by the legalities unlike here back home. But I haven't been making hard progress, to take the actual steps forward, toward this goal and sadly I've only come to realize/accept it now.

The good thing is, I've finally started to take my baby steps forward to prepare for my migration to Australia. Will life really be better there? I don't know. But how else will I find out other than actually trying it? That's where the earlier mentioned PMP Certification helps me as it provides me with a baseline on jobs that I can potentially secure, at a bare minimum level.

Maybe I'll write a dedicated post on this topic someday, sharing the ups and downs of my journey towards this step, when I'm closer to achieving it. As of now, I'm barely starting and there are plenty more hurdles ahead of me. Let me know in the comments if you'd like me to write on this topic! If there's one thing I want myself to take away in the first half of this year - slowing down actually worked in my favour. Remember that, Gracie.

Now, let's go back to our half-year checkpoint for my finances and portfolios. Since I no longer post updates on a monthly basis, I've decided to tweak the format a little so that I can cover the first half of the year more comprehensively.

Mid-Year Checkpoint: My Savings Rate & Budget

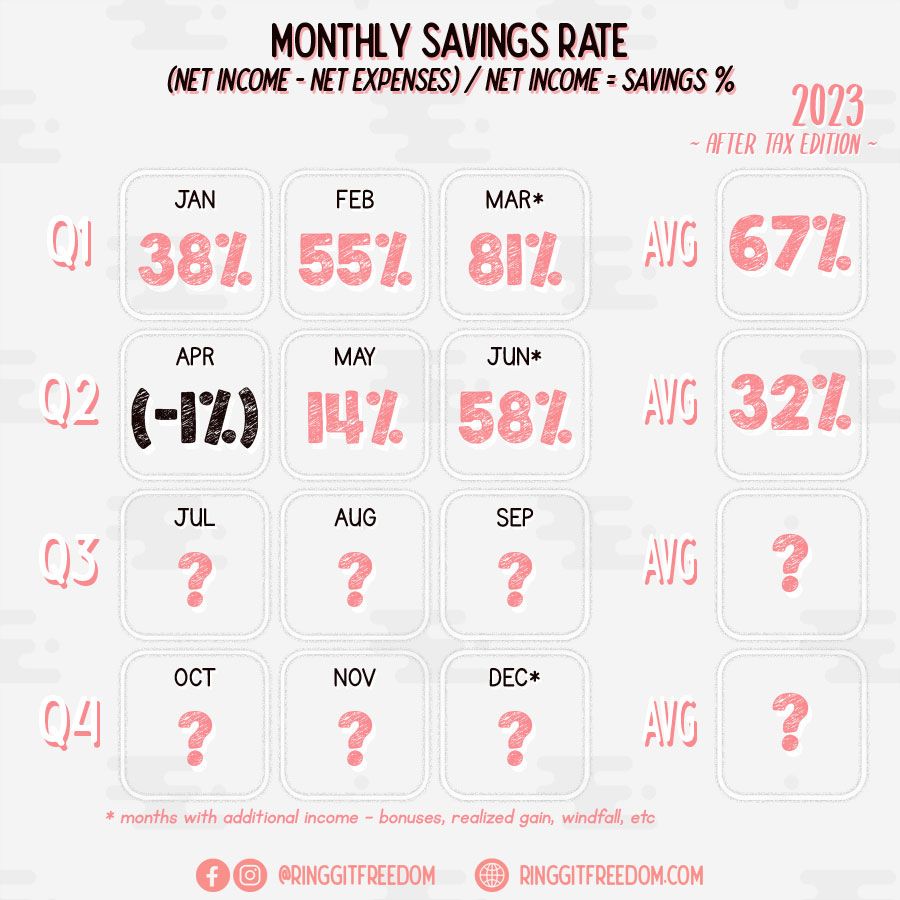

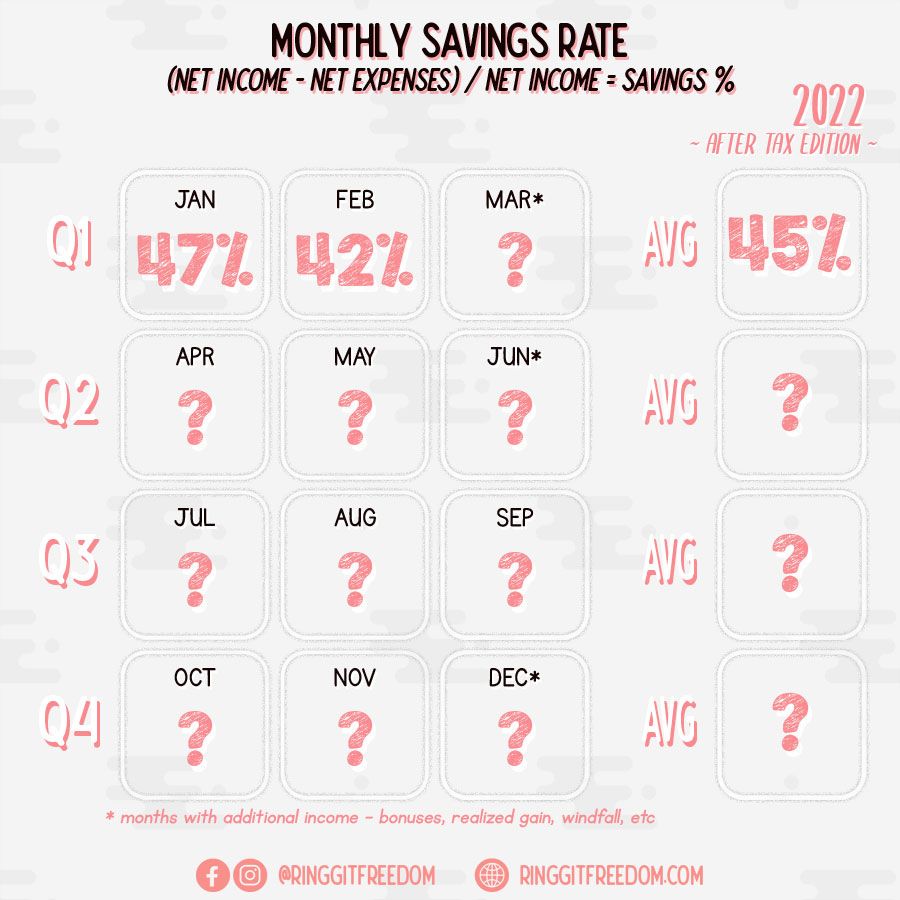

Savings Rate

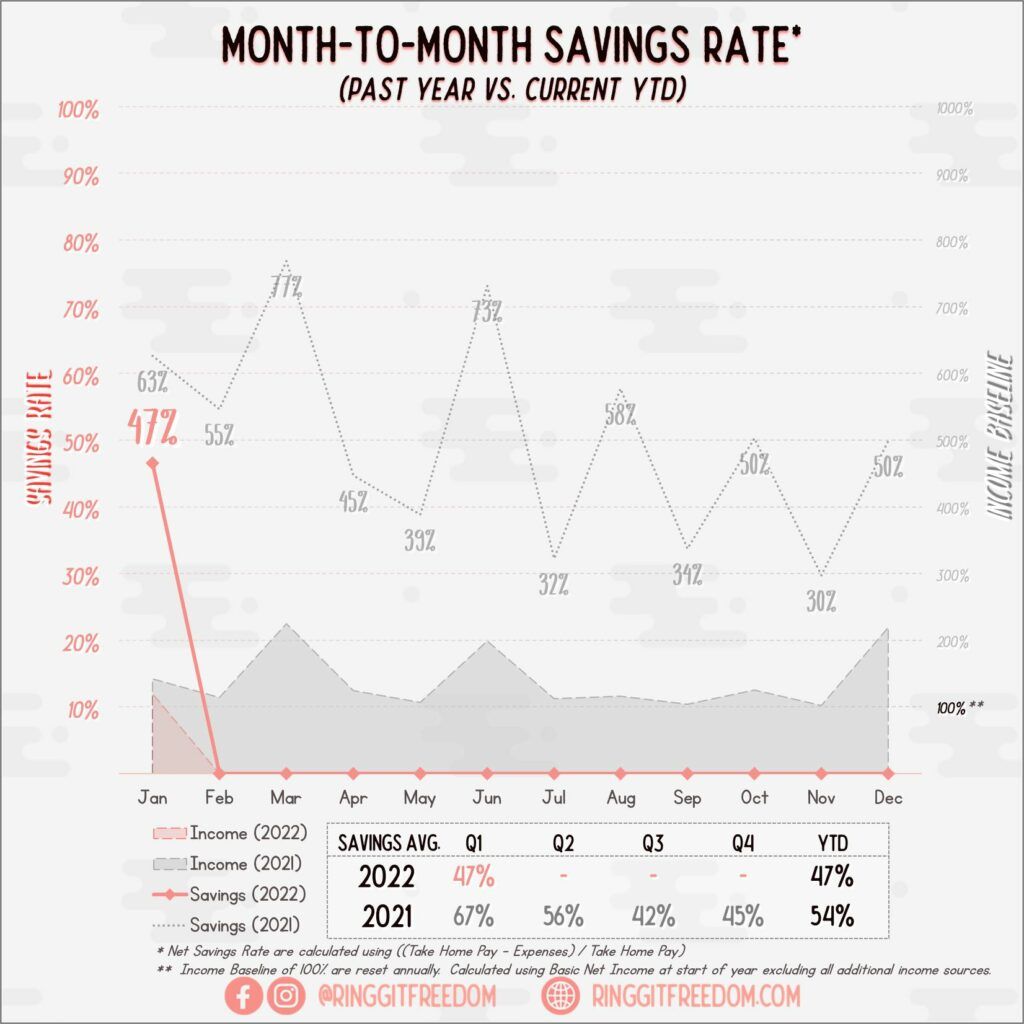

My savings over the last few months have been taking a hit really, especially since April. For the first time ever, I had a negative savings rate - to the point that I had to revise my Excel Template to be able to generate my monthly savings trendline without breaking major graphical components 😅

I don't have any other excuses other than poor control of my impulsive behaviour under stress. More details on the spending right next.

Will I still hit my target savings rate this year? I don't know - let's see. Only time will tell.

Expenses

I had to analyse my spending behaviours during the first half of the year when I was preparing to write this blog post. Whilst I was aware that I have been spending a lot recently, even the amount shocked me. I spent 1.74x more than last year when comparing the same period.

Approximately ~18% of my expenses during the first half of the year were spent on gadgets & games. A new VR fitness headset, a new graphics card for my computer, and some games/game credits purchase here and there. Also, I decided to write off my iPhone purchase last year and recognized its remaining balance expenses in full rather than the original plan to divide it across 36 months till Sep 2025 (due to 0% instalment plans).

What's not helping is also the dip into emergency spending occasionally when my extended family had injuries/emergencies requiring some help; big wedding ang-pao for one of my closest friend's marriage; and also the miscellaneous costs associated with my Australia migration journey. I'll have to keep a tighter belt, hopefully, over the next few months, and try to respect my zero-based budgeting principles (rather than spend and pray).

On the bright side - part of the major expenses are also spent towards my 2023's Goal and Objectives - to travel overseas for holidays.

Emergency Jar

Despite dipping into the Jar quite recently sometime in Feb/Mar, I managed to top it back up to 100% of my funded amount by the end of this month, keeping myself and my family protected from unforeseen events.

Mid-Year Checkpoint: Net-Worth Update

A quick snapshot of my net worth - having crossed the MYR 600K mark (or 1 million mark, if including the stake in my own-stay property). Am I proud of how far I have come compared to 10 years ago, being broke and poor? Definitely. But as I've come to the realization - financial freedom is only one of the many pillars in life that I treasure, and should not be the only thing that I blindly pursue (through career growth).

I will still definitely celebrate this moment (perhaps I have already done so - through the various "impulsive" spending behaviours the last couple of months); but I don't want to make this the only thing in life that I'm living for.

Also for those of you new here - you may be wondering why I explicitly exclude my own-stay property when calculating my net worth. The answer is simple - basically, the property generates many of the expenses/liabilities with no ability to generate income, tying my cash flow down – a concept popularised from Rich Dad, Poor Dad by Robert Kiyosaki.

Mid-Year Checkpoint: Portfolio Review

Funding

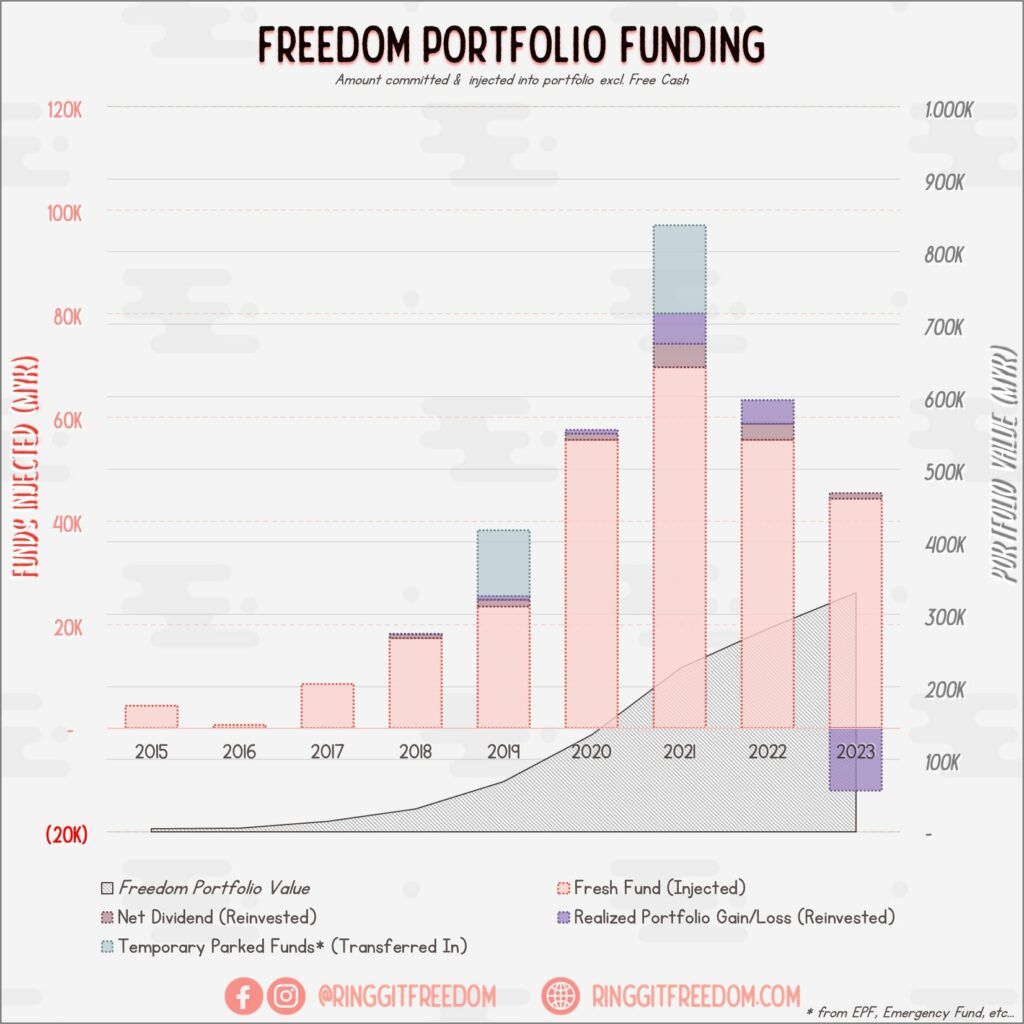

Truthfully, I did not pump in as much of my free cash flow into my Freedom Portfolio as I have initially planned for. I have slowed down the investments in my Freedom Portfolio and started diverting some of them to cash-ready assets - either as a sinking fund to pay down my mortgage in the near future or as a seeding fund for my upcoming migration to Australia. Knowing that I'll be needing lots of liquidity sooner than anticipated, I kept most of my cash in my full flexi mortgage account so that it is ready for use when needed.

To offset potential currency fluctuations (looking at you, MYR), I have also started to convert some of it into SGD/AUD when the exchange rate is in my favour (though rarely).

Performance

Overall, the portfolio still sits mostly near the zero zone, fluctuating between the +/- 2% range. It'll just be a slow year, or even decade, I guess.

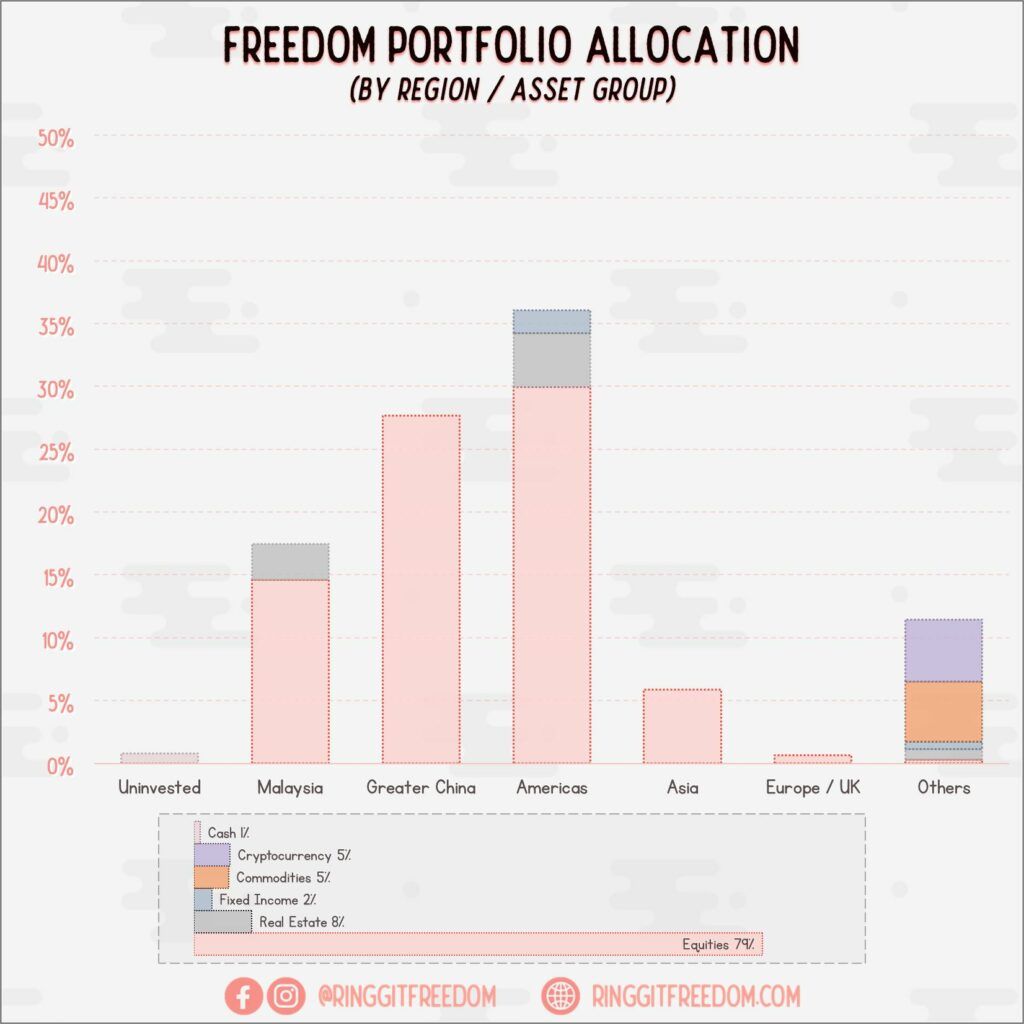

Allocation

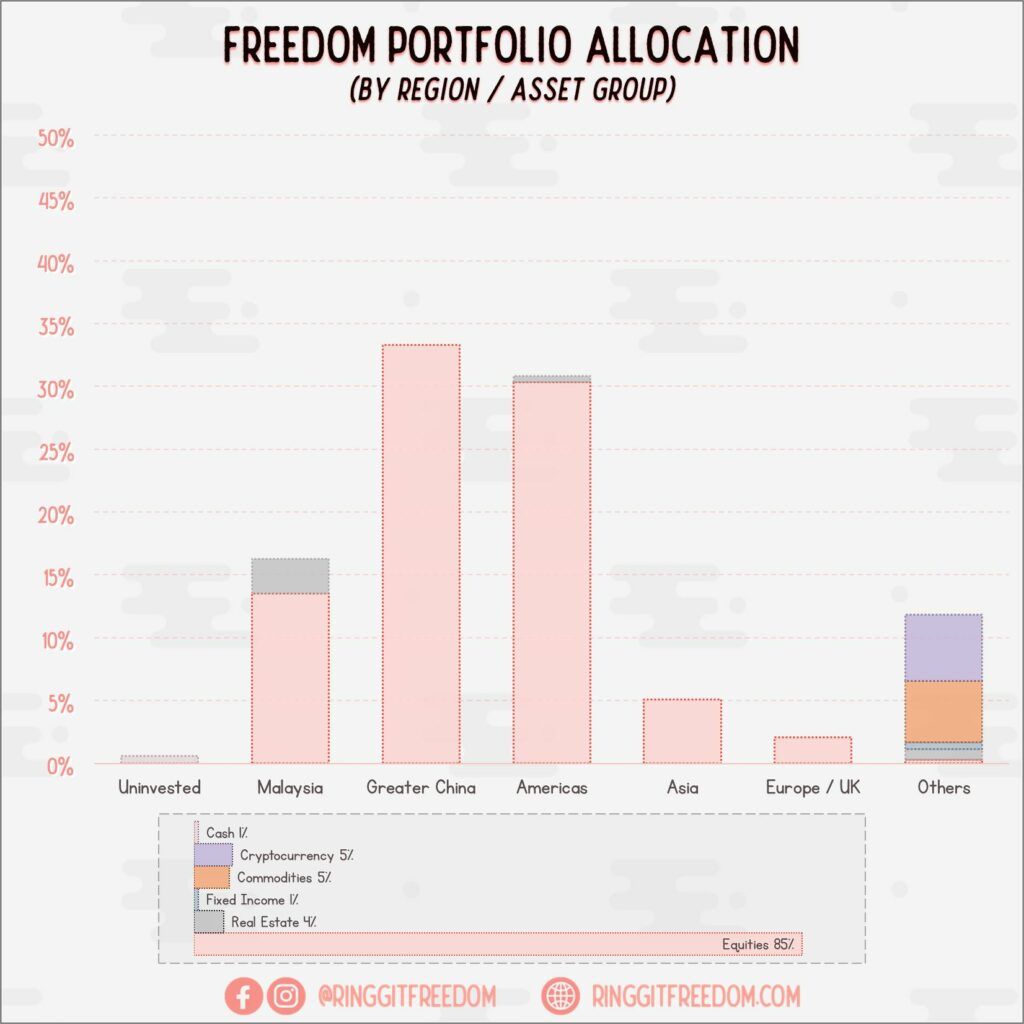

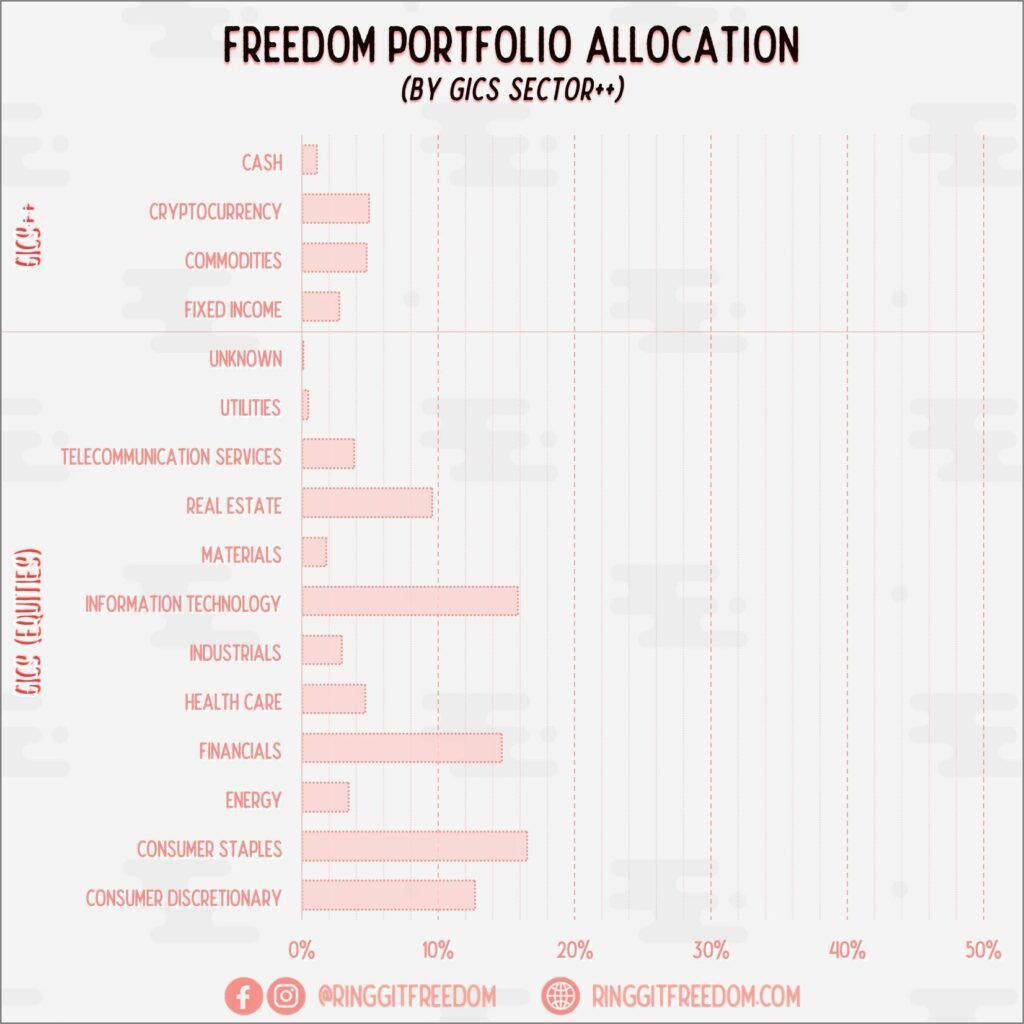

When looking at my portfolio allocation both inclusive or exclusive of EPF portfolio - I definitely have a higher allocation towards the Commodities (mainly Gold ETF) and Fixed Income (mostly SGD Fixed Deposit) market as a hedge, as compared to my all-in onto Equities market the last couple of year.

This could end up being a wrong decision on my part, fuelled by emotions (worry & fear), but that's what I need to feel comfortable with the ongoing volatility considering the huge expenses coming my way - potentially requiring way more liquidity than anticipated.

Perhaps - it is also the thought of potentially losing my current high-pay job, though voluntarily, to go on a new adventure, that freaks me out. Knowing that I will definitely quit my high-paying job soon - only question is when and how.

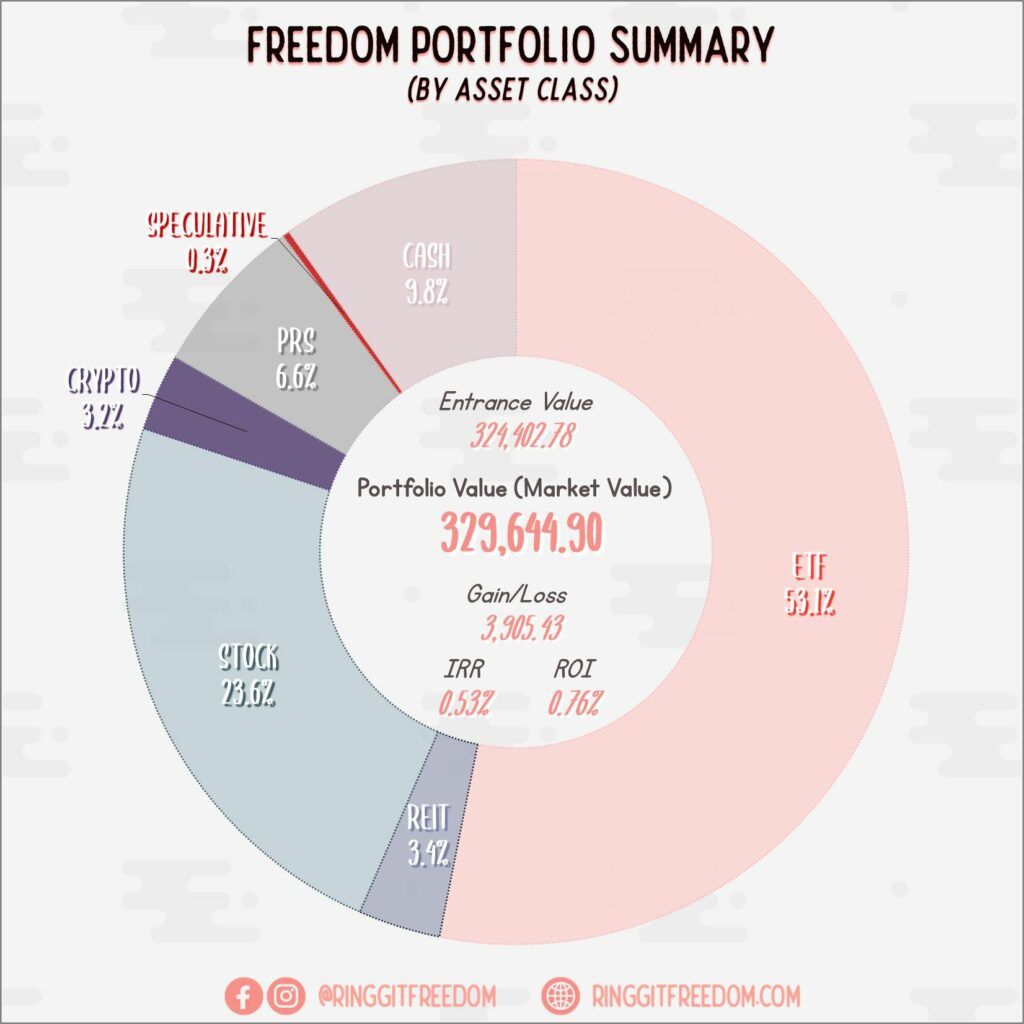

Portfolio Snapshot

Snapshot as of 30 June 2023

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 5.34%

ROI: 8.01%

Profit/Loss: RM10,410.10

Active (Invested) Portfolio

IRR: -(1.17%)

ROI: -(1.81%)

Profit/Loss: -(RM6,504.67)

True Cost: RM350,592.79

Total Value: RM360,596.13

Entrance Value: RM324,402.78

Portfolio Value: RM329,644.90

Nett Dividend (2023): RM1,126.61

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie

The post Ringgit Freedom’s June 2023 Updates: Mid-Year Checkpoint appeared first on Ringgit Freedom.

]]>The post Ringgit Freedom’s April 2022 Updates appeared first on Ringgit Freedom.

]]>My Life & Mental State

April's been a pretty hectic month for me.

On one hand, I'm trying to slowly adjust back to the reality of going back to the office after staying home for almost 2 years (minus the essential outings/groceries trip). Whilst the Company had been nice enough to give us flexibility to choose to return to office/work from home thus far, things are about to change in May (and have already taken effect by the time I publish this post) where all of us will have to return to office, except for Friday and one of our self-selected day.

On the other hand, I'm pretty much status quo in terms of my personal well being. I am generally more chill nowadays, using video games to recharge myself after a long day (or week) of workplace toxicity. Perhaps I'll end up quitting sooner than I initially planned, but whilst I still can take it - I'll continue the grind to accelerate my freedom plan and milk what I can (financially).

Maybe I am just not stern enough to push myself out of my comfort zone amidst the ongoing toxicity. But I guess there's only so much I can push myself where there'll always be a peak/bottom of performance following the cycle. I definitely don't want to get burned out again so I'll just take baby steps as I continue to go forward.

One interesting discovery I've made in April (sadly I didn't continue after that) was attending one of the doodling class. It was definitely a fun self-discovery exercise and also an eye opener for me as I never knew I could doodle using just simple shapes (without needing "art mastery" skills).

Now, going back to our usual monthly update for my finances and portfolios.

My Savings Rate & Budget

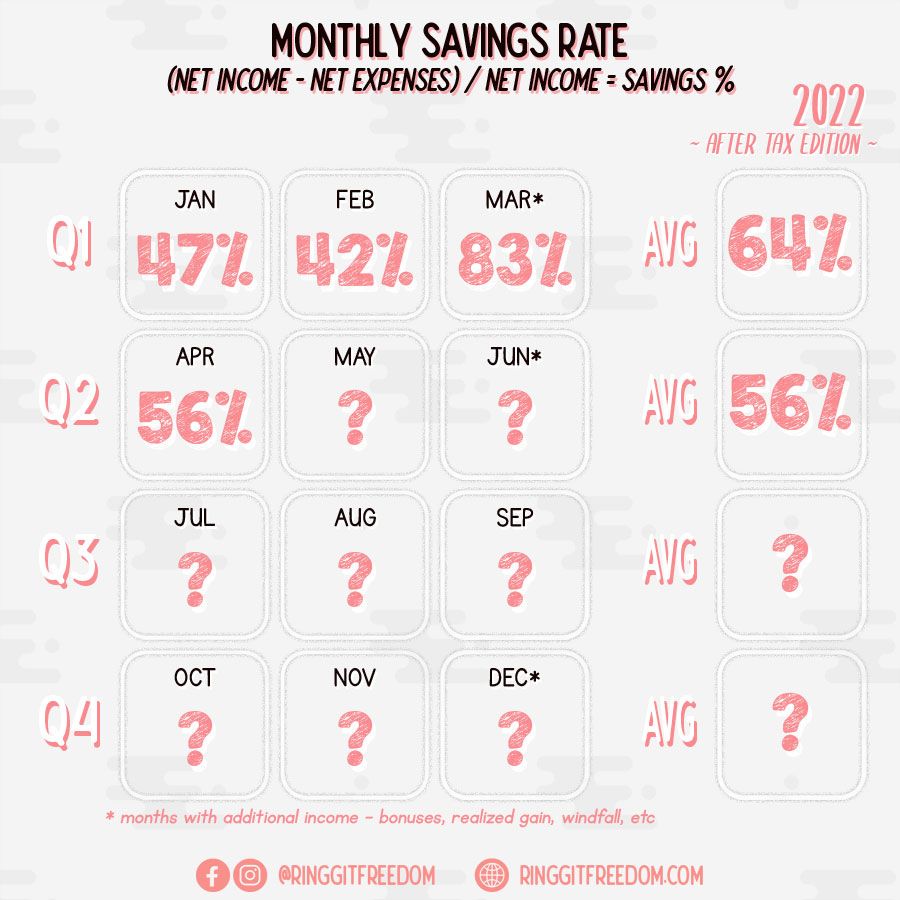

Savings Rate

Not much changes in terms of my spending towards family & personal commitments - but there were some leisure spending made in April for my gaming hobby. I basically found out (by chance) that a game I stopped playing years ago had released an expansion pack - so I decided to hop back in since I'm in the gaming mood nowadays 😛

Unfortunately through this exercise, I also found out that several of my PC parts were dying (slowly) and I ended up spending a small amount to buy a replacement part (spare RAM) helping me with my troubleshooting exercise, which unfortunately still wasn't the root of my PC problems. I ended up sending some other of my PC parts for warranty (2 months before they end, phew) which also means that I'm out of my gaming PC for the next 6-8 weeks. Thankfully I still have my Macbook (M1 Air) which I can do some "light" gaming with it

Frankly, I am quite tempted to just go out and buy the new PC parts to replace the potentially faulty hardware (and re-sell the old ones once they are fixed & returned to me by the manufacturer RMA process), but I'm feeling darn guilty if I do so - as I basically am breaking my own promise of budgeting. So let's see where we ended up going - you'll definitely see my savings rate drop if I choose to do so 😛

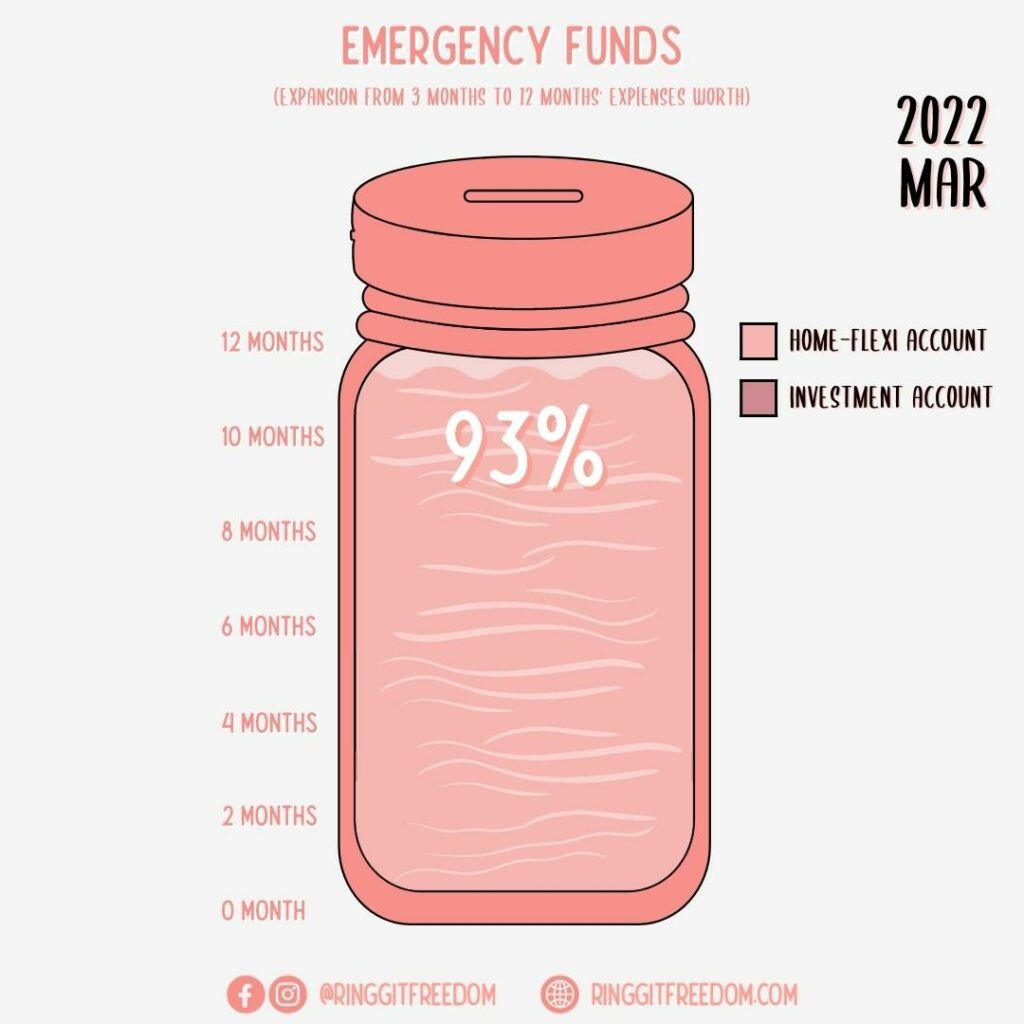

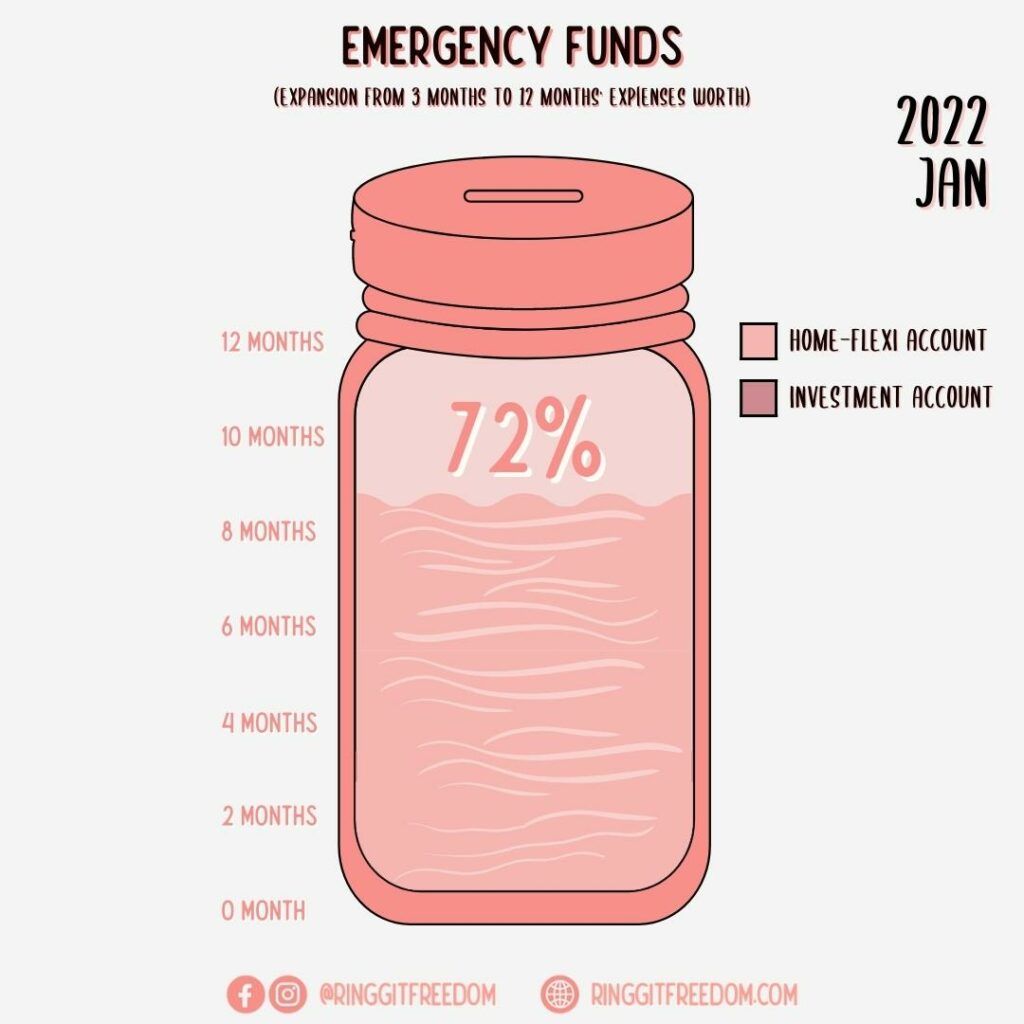

One good news (worth celebrating for, I guess?) is that I'm now almost reaching the end of my goal, of hitting the 12-months Emergency Jar target I've set for myself. Hopefully with this, it'll provide me with sufficient buffers in case if things turn south for me.

What happened to my Portfolio?

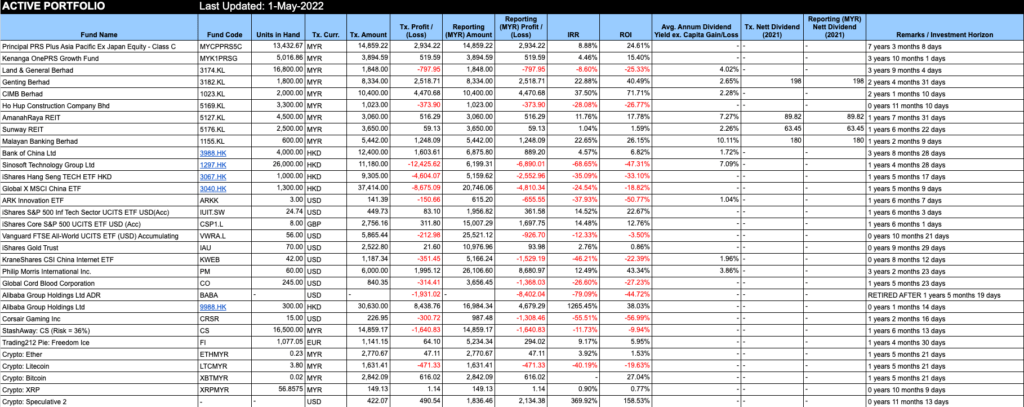

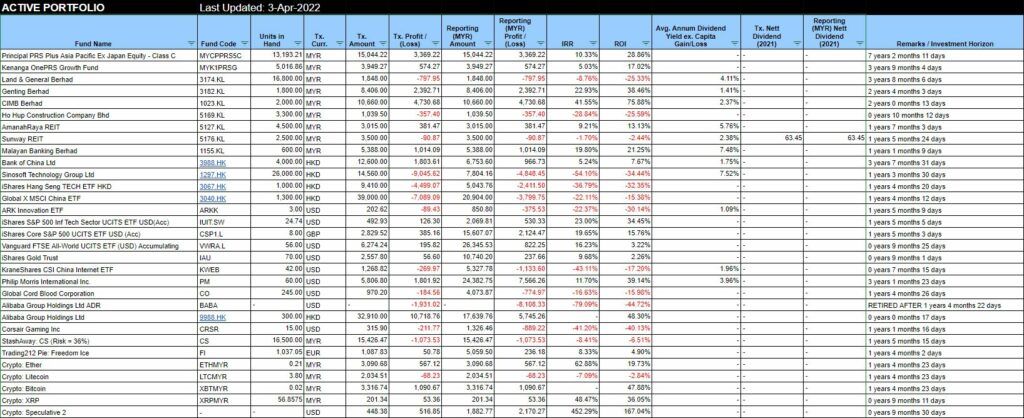

Investments

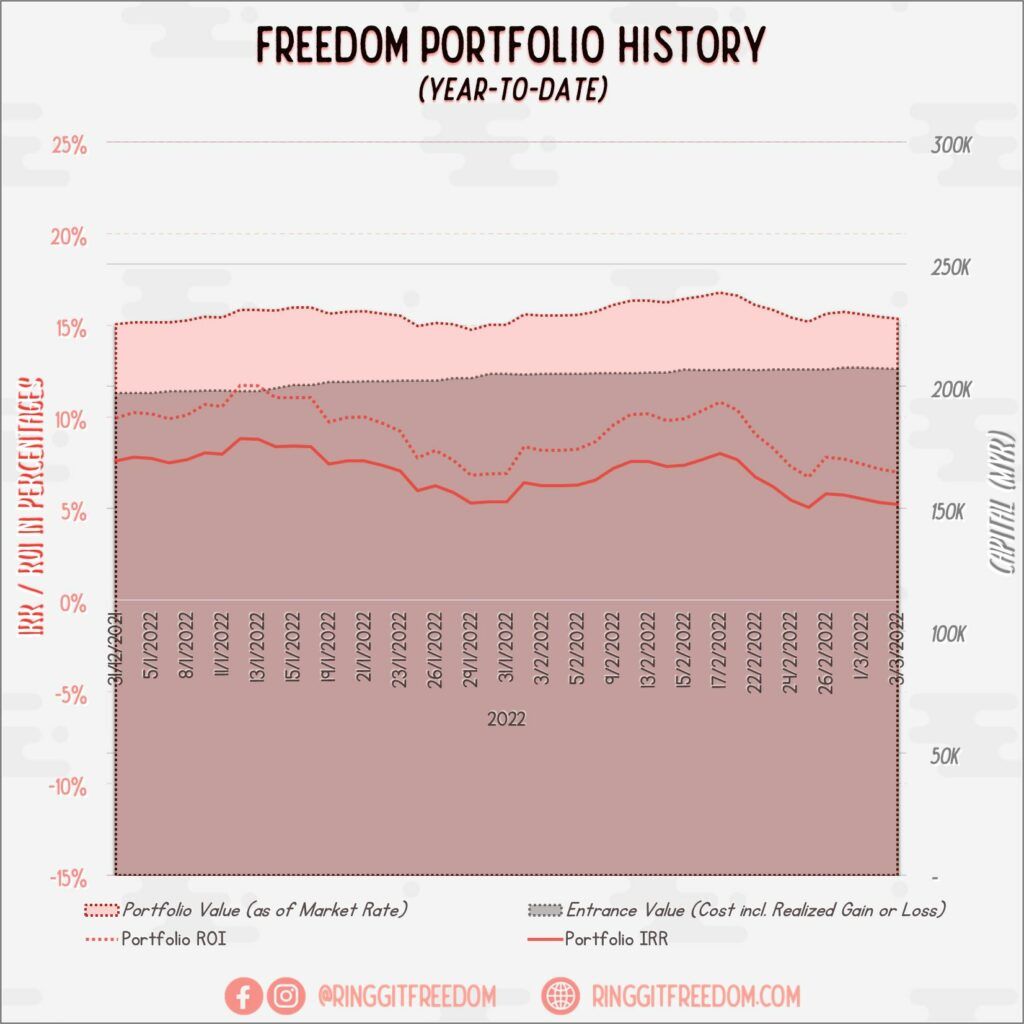

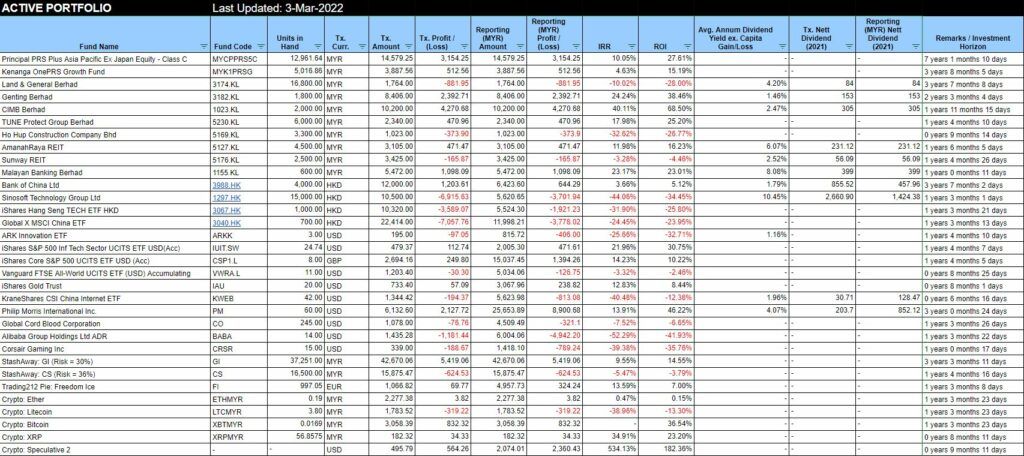

This year hasn't been a good so far, with my portfolio value continuing to tumble down especially some of my individual stock selections. This really have affected my confidence with self doubts starting to creep into my head. Well, I guess the only sensible thing to do now is just to continue sailing forward and see where the journey takes me.

No major investment have been made yet in April as I've forgotten to top up and do my usual monthly Dollar-Cost Averaging (DCA) exercise. Things were definitely easier back then when I was doing monthly DCA into StashAway, as I didn't need to think about it at all and the monies just get deducted automatically from my bank account. Thankfully, the smaller DCA's are still being deducted automatically (namely PRS, Luno and Trading212) but the amount are insignificant to mention.

Portfolio Snapshot

Snapshot as of 30 April 2022

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 6.36%

ROI: 9.59%

Profit/Loss: RM9,682.41

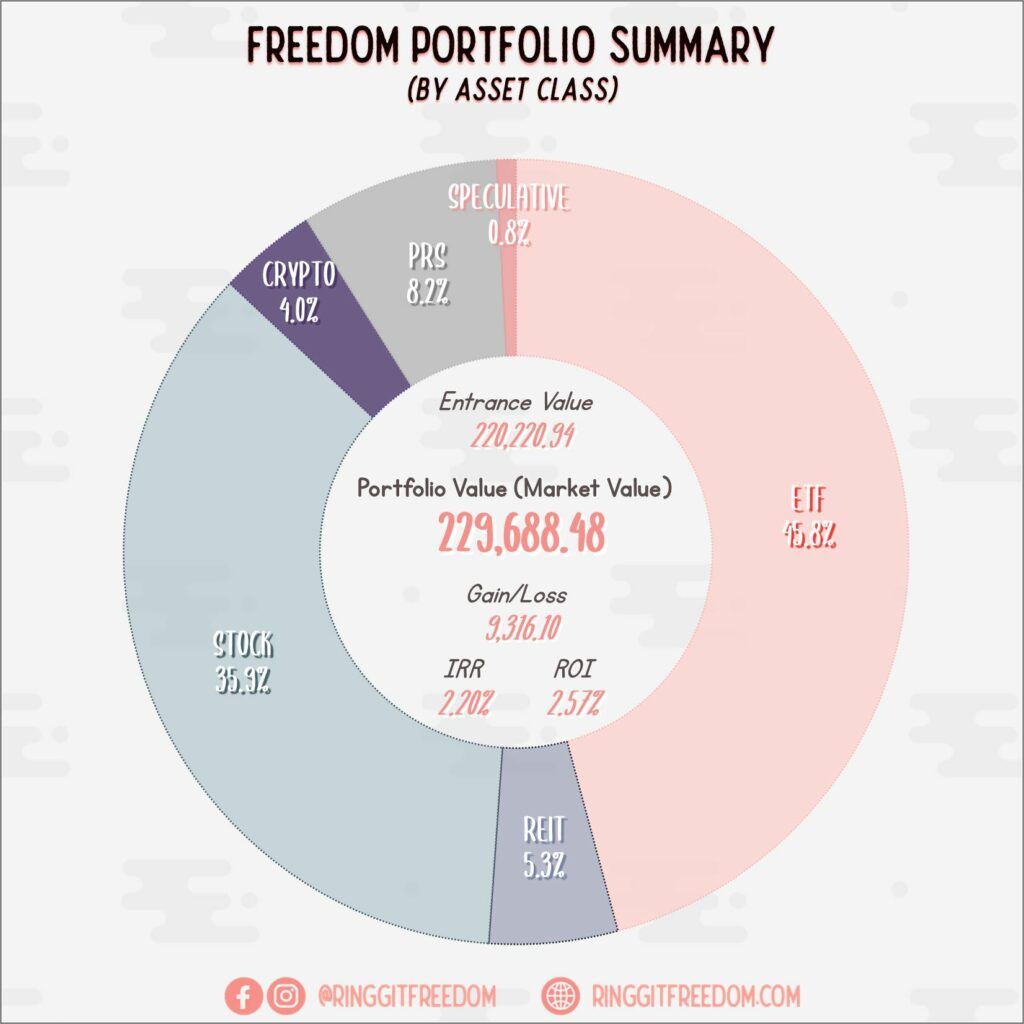

Active (Invested) Portfolio

IRR: -(0.13%)

ROI: -(0.19%)

Profit/Loss: -(RM366.30)

True Cost: RM256,492.69

Total Value: RM256,386.01

Entrance Value: RM220,220.94

Portfolio Value: RM229,688.48

Nett Dividend (2022): RM759.70

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie

The post Ringgit Freedom’s April 2022 Updates appeared first on Ringgit Freedom.

]]>The post Ringgit Freedom’s March 2022 Updates appeared first on Ringgit Freedom.

]]>My Life & Mental State

March's update came later than usual. I've procrastinated from completing this post since I started drafting it around end-of-March. Took me more than 2 weeks to finish it off, instead of the usual 2 days.

It seems that I'm again in a state of avoiding reality - spending time paralyzing myself in mindless games/videos after work. I'm not really sure why, but it does indeed feels like my brain telling me "enough is enough" - get out of the toxicity if you can't stand it anymore.

I'm earning very well, but I am not happy. Shouldn't I feel grateful instead!?!? And there goes the vicious cycle.

Now, going back to our usual monthly update for my finances and portfolios.

My Savings Rate & Budget

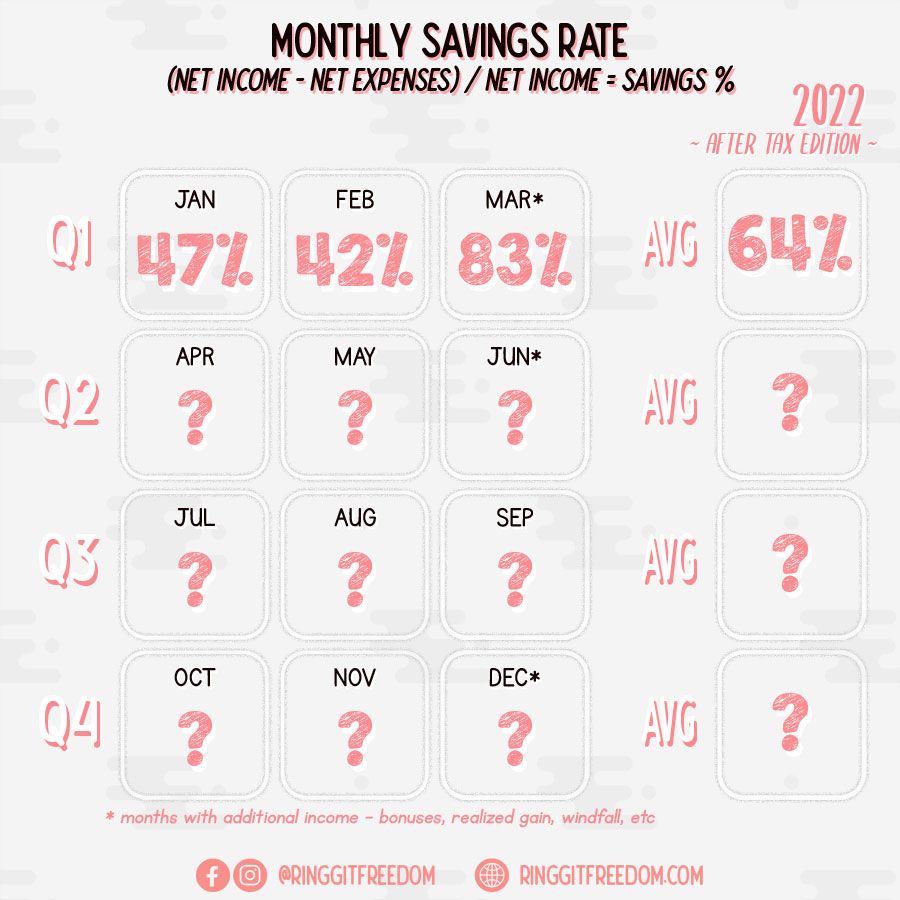

Savings Rate

Similar to the same time year, this month's savings rate skyrocketed as I received my annual performance bonus. Yay!

Since I overspent on my gadgets in Feb for my digital notetaking e-ink tablet, I decided to channel all of the excess income (on top of my monthly baselines) to either my investments or savings jar.

This obviously helped as I managed to boost my 12-months jar from the stagnant 73% to 93% achieved. Just a few more months to go to wrap up the jar and refocus back on my investments, hopefully, I don't need to touch the emergency funds anytime soon!

p/s the digital e-ink tablet is really awesome! I bring it everywhere I go now - to write things down both for work and personal. I bought the Supernote A5X for portability and it even has my name engraved on the pen! 😀

What happened to my Portfolio?

Investments

March is definitely an interesting month for my portfolio. Probably one of the few months with large portfolio movements.

Ukraine War and Volatility

The ongoing crisis happening in Ukraine have sent shockwaves to the global economy, with uncertainties shooting up and this was evident in the early/mid-March where the global stock market took a hit, with some having it worse (e.g. China). Whilst I did not inject much of my fresh funds this month (to focus first on my emergency jar) aside from my typical monthly investment amounts; most of the injection comes from my StashAway relocation.

StashAway's Re-optimisation (again!?)

Whilst the storm of rage against StashAway have calmed down recently, and with their rationale explained during their webcast - "to reduce exposure to the unknown unknown's to realign portfolio's volatility against standard benchmarks"; I still find it a bitter pill to swallow as it goes against my wishes to maintain exposure in China.

Whilst I may be darn wrong in my decision in the long run (who knows, China stocks may never reclaim their glory due to CCP); I still hoped for a little more control in my own portfolio like the previous option where you can choose to opt-in/out from the re-optimizations.

This taught me a lesson that the only way to maintain most of my control is to go full DIY. Whilst this has been on my mind since 2 quarters ago (when my StashAway portfolio exceeded the RM30K mark, just nice for Wise's maximum allowable transfer size), I have been putting it off as I was lazy to execute my market exit & re-entry with minimum gap time so that I don't miss out on market opportunities by not "being there in the market". This KWEB-exit drama was the final nail to the coffin after the many rounds of re-optimization in a year.

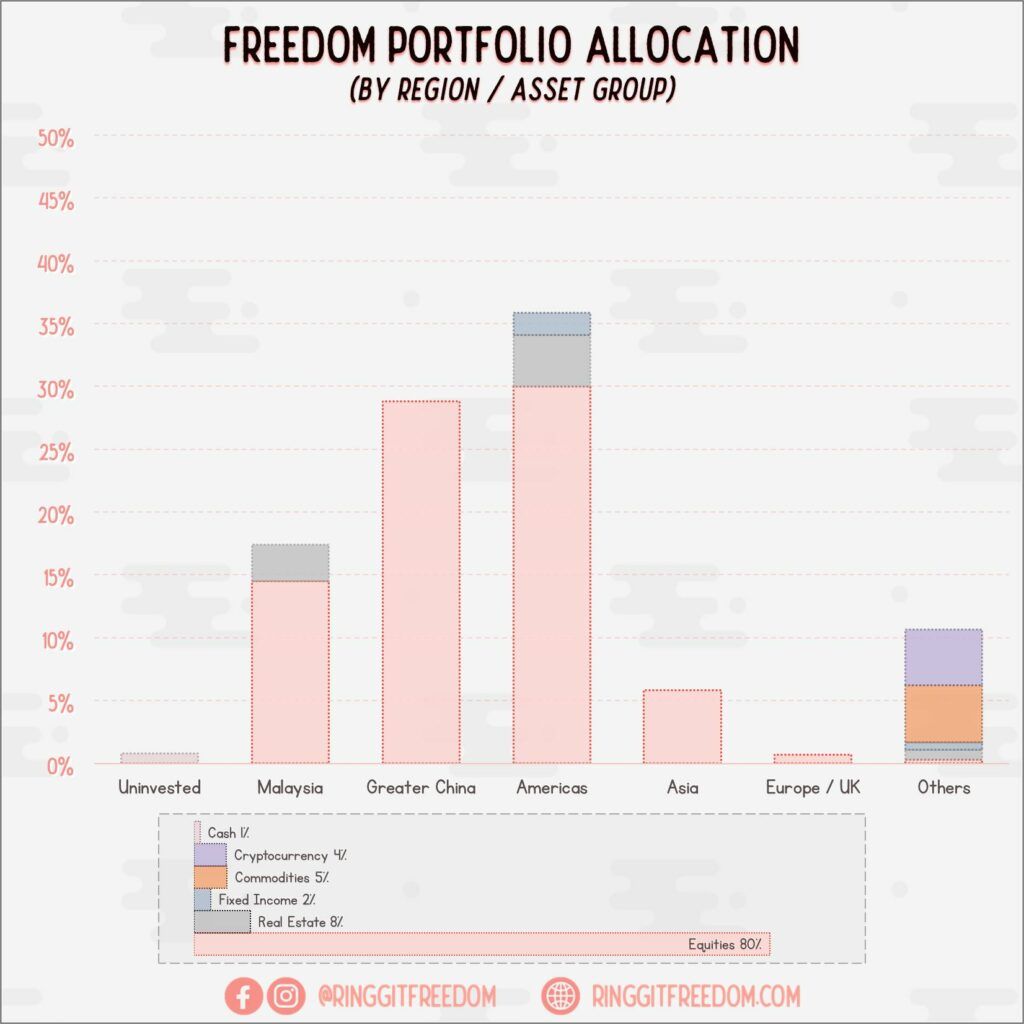

You'll probably see it already in my portfolio, but my approach was quite straightforward where I split my funds withdrawn from StashAway 30% Portfolio into mixture of VWRA (All World ETF), 3040.HK (China ETF), and IAU (Gold) at a 60:20:20 split respectively.

Will I lose out more in the end, if StashAway's decision outperformed mine? Maybe. But will I regret it? Probably not - as I will have better sleeps at night knowing that my portfolio will be as lazy as I am - to sleep through the cycles.

While I won't go too deep into the how's of the entire withdrawal / re-investment process, I'd still like to shout out a few things that really helped to make the transition process a smooth one:

- StashAway withdrawal took me approximately 3 days (submitted request to withdraw on 14 Mar and got my funds back on 17 Mar), similar to my previous small-sum withdrawal (portfolio closure) and this information helped me to manage my cashflow in the 3 days time (though not a huge issue since I have close to 8 months of emergency fund sitting in cash to offset the cashflow impact)

- Before the withdrawal was even complete, I initiated my buy-orders on Day 2 (15 Mar), which is about the same time when StashAway executes my portfolio sell-order. Whilst this probably is useless/neglectable when we zoom out 10 years later, this gave me a peace of mind to minimize transaction gaps in timing.

- Since I hasn't received cash yet (to re-inject back into my IBKR account), having my IBKR set as a Margin Account (with plenty of margin buffers) definitely helped here. If my IBKR was a Cash Account, I'd probably have to use some of my Emergency Fund cashflows to first fund my IBKR prior to purchase orders.

Having said all that, I am still not 100% out of StashAway. Whilst I will stop my DCA onto StashAway going forward (and only DCA-ing straight into my IBKR account), two of my small portfolio started last year (worth approx ~40%) will still remain in StashAway, just in case if I'm wrong 😉

BABA ADR Conversions

About the same time with the StashAway-KWEB drama and also the Ukraine Crisis sending China stocks down south, there were also plenty of hoohahs going around the risk of China's stock getting delisted (including BABA). Since the price is darn low at this point (15 March), I decided to "swap" my Alibaba stocks from the US-listed BABA to Hong Kong-listed 9988.HK.

Unfortunately, I found out later that whilst IBKR supports the ADR Conversion Process seamlessly, the price tag is huge and we need to pay $500 US to convert ADRs into the secondary listings. This does not make sense for a small retail investor like me unless you are managing a multimillion portfolio. But I still wanted to do the swap with or without going through this ADR so I've decided to do it the classical way: to sell my BABA (hence realizing my losses) and quickly buy 9988.HK (starting another "portfolio").

Whilst BABA and 9988.HK are pegged at 1:8 ratio, where price gaps between the two are usually neglectable. At that point in time, I hold approx. 29 units of BABA which is equivalent to 232 units of 9988.HK.

Question is - "how do I minimize my potential unexpected losses/gains considering the market fluctuation at the time, especially when China stocks are going up (or down) by 10% +/- on a day-to-day basis?"

This is where my IBKR Margin Account saved my day, AGAIN!

Firstly, I made a buy order closer to the end-of-day Hong Kong time, for 300 units of 9988.HK at the price of 73.8 HKD each. This equates to buying BABA at approx 75.39 USD if we follow the 1:8 ratio between BABA:9988.HK.

After about 3-4 hours later, I made a similar market sell order at the start-of-day US time, on my existing 29 units of BABA at the price of 75.4 USD. Net-net, I did not lose any of my portfolio's worth other than paying approximately $10 US in transaction/currency conversion fees. Whilst it is still a risky move - as anything can happen in 4 hours nowadays, this is the best I could do to save $500 US.

As a matter of fact, BABA's price shot up from ~$75 to ~$100 the next morning so I literally dodged a bullet there. The best time to do these kinds of sell-and-buy is when markets are stable, but desperate time calls for desperate measures I guess. Been wanting to buy 9988.HK instead of BABA but the minimum 100 lot per transaction is not wallet-friendly at all :'(

Portfolio Consolidation

This is still a work in progress (a long way to go) - but I decided to further simplify my portfolio as I did not have much time to track & manage my portfolio, especially the individual-stock picks. Over the next few quarters, I'll be trimming down my portfolio to only ETF's and selected dividend stocks, slowly selling the rest away (so that I have less things to monitor/worry about).

EPF Dividend

Surprisingly, EPF declared a 6.1% dividend for 2021. Yay to that!

Could've gotten most of it if I hasn't diluted part of my EPF's onto international funds as part of my portfolio rebalancing last year, but no regrets there as it was a conscious decision made. EPF, even after excluding the divested funds, are still making the majority in the totality of my portfolio (EPF Fund + Personal Freedom Fund).

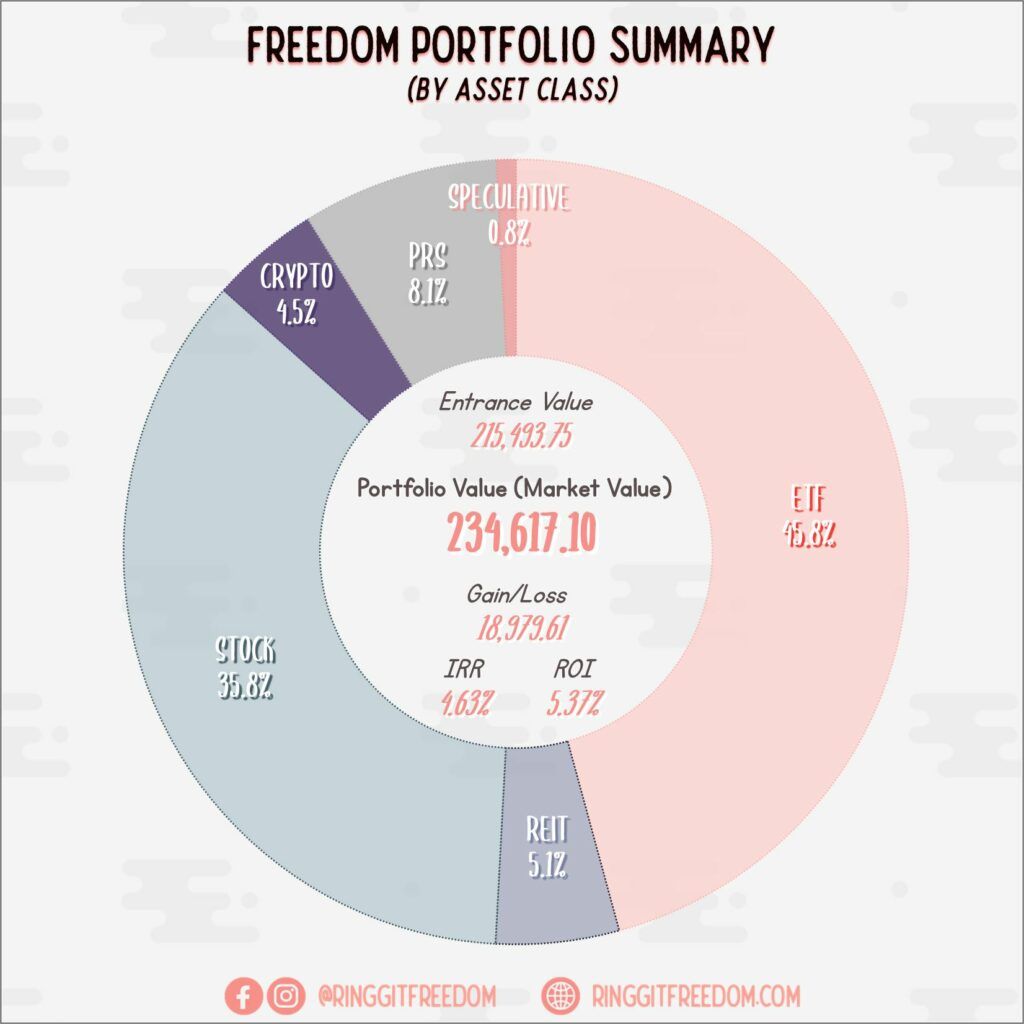

Portfolio Snapshot

Snapshot as of 31 March 2022

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 6.31%

ROI: 9.50%

Profit/Loss: RM9,524.27

Active (Invested) Portfolio

IRR: 3.62%

ROI: 3.72%

Profit/Loss: RM9,455.35

True Cost: RM250,339.60

Total Value: RM260,048.17

Entrance Value: RM215,493.75

Portfolio Value: RM234,617.10

Nett Dividend (2022): RM 283.07

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie

The post Ringgit Freedom’s March 2022 Updates appeared first on Ringgit Freedom.

]]>The post Ringgit Freedom’s February 2022 Updates appeared first on Ringgit Freedom.

]]>My Life & Mental State

February, is also the month of the Lunar (Chinese) New Year where we get to celebrate with our family members and of course to get Angpaos! Fortunately for our family, we don't really have to travel outside of KL to balik kampung (returning to hometown) since the kampung (hometown) technically is where I'm staying now with my mom.

We used to go back to Dad's kampung when he was still alive decades ago but since his passing and not too long later, Grandma's passing; I stopped returning to Dad's kampung as my mom refused to go back (due to family dramas/conflicts - pretty normal stuff I guess) and I didn't want her to celebrate the Reunion Dinner alone every year.

Fewer Angpaos (Red Packet) for me I guess! Speaking of which, I typically don't open my Angpaos until a few years later anyway - always nice to find some spare cash sitting around since I was young 😛

At the very least, I was able to at least take a few days' worths of break and distance myself away from work, even if it is just for a little while. Managed to complete one of my long overdue to-do lists as well - visiting my sisters' place to complete the gaming PC setup for her (backstory: I decided to give away my underutilised old rig to my sister since I have only been using my new rig. Annyeong, my old rig!)

Now, going back to our usual monthly update for my finances and portfolios.

My Savings Rate & Budget

Savings Rate

Spent a little bit more for my family this month as I decided to follow the past years' trend of giving my mom some extra "pocket monies" during the Chinese New Year (she prohibits me to call it Angpao since I am not married yet 🙄🤣).

Initially, there isn't much spending on my personal account in February as I stayed home most of the time - avoiding the Omnicron wave as much as I can 😛

But again, impulsively, I set myself on a purchase of an E-Ink Notetaking tablet (Supernote A6x, for those who're wondering) to replace my paper books and try to re-organise my life a little especially with the chaos happening at the workplace. Ironically, another push factor for this was that a digital tablet can easily be cleaned using sanitiser wipes (unlike real papers where I can't really "wipe" it without destroying the paper. Germophobia much!?)

Frankly, I tried a few different alternatives - like PostIt Notes, Digitally "Typed" Notes, Pictures/Photos, To Do Lists, etc. but nothing beats writing things down (even when generating ideas). But paper's a real headache when it comes to organising stuff once you run out of space (unlike digital notepads where we can still "move" things around after writing it).

Let's hope that this little investment will be handy for my working life - otherwise it'd be a waste as the months' savings rate would have definitely been above 50% 😣

What happened to my Portfolio?

Investments

I didn't really have any transactions made during the month of February aside from my typical monthly investments of Dollar-Cost Averaging (DCA) into StashAway, PRS, Luno and Trading212. It is basically the usual boring investment month.

I did however receive a small amount of dividend from my holdings in SUNREIT, as part of their quarterly distributions. I also noticed that I have missed recording an incoming dividend payment in January 2022 so I've just captured it in February.

One thing's for sure though - my perseverance will be tested very soon, on whether if I can stick with my long-term investment philosophy considering that there are no signs of overall market conditions improving, especially in China (~30% of my portfolio).

Portfolio Snapshot

Snapshot as of 28 February 2022

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 7.45%

ROI: 11.38%

Profit/Loss: RM6,947.92

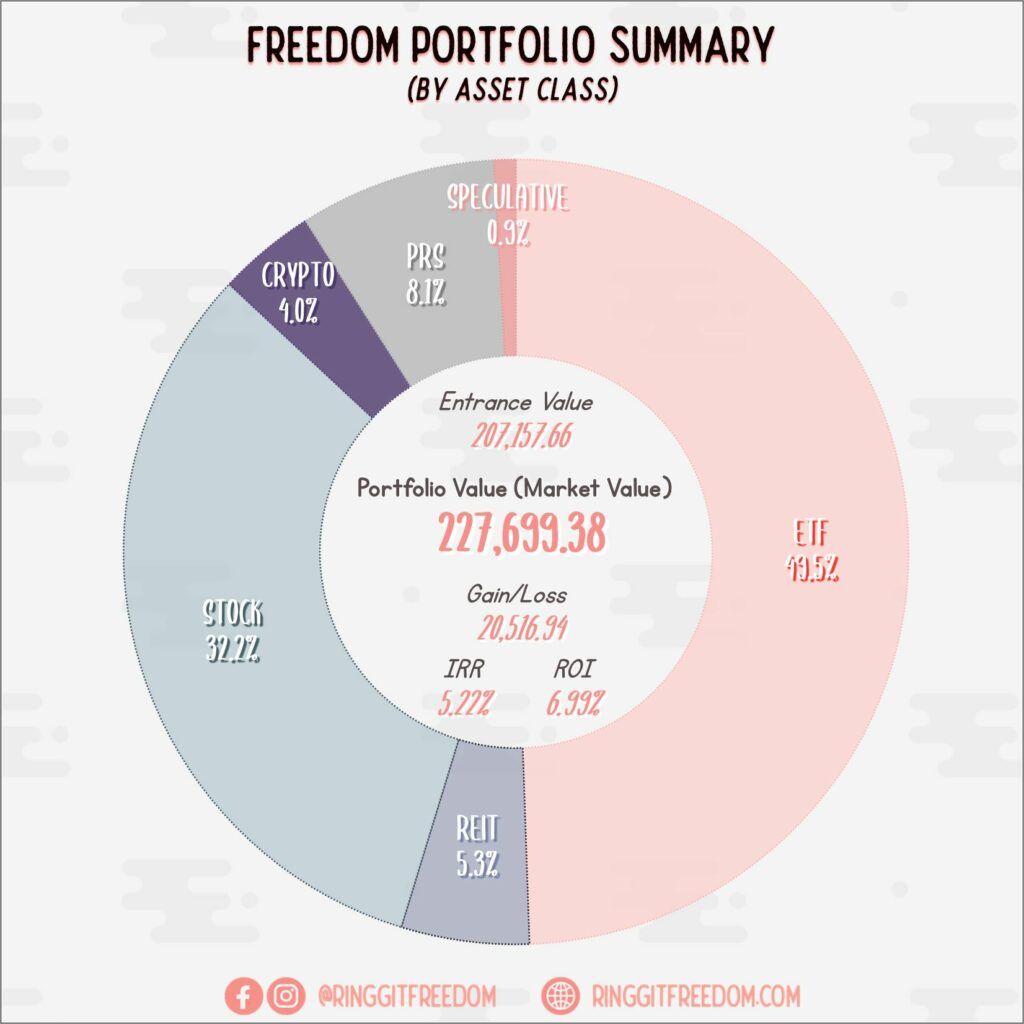

Active (Invested) Portfolio

IRR: 4.48%

ROI: 5.83%

Profit/Loss: RM13,569.02

True Cost: RM230,216.78

Total Value: RM243,887.84

Entrance Value: RM207,157.66

Portfolio Value: RM227,699.38

Nett Dividend (2022): RM 283.07

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie

The post Ringgit Freedom’s February 2022 Updates appeared first on Ringgit Freedom.

]]>The post Ringgit Freedom’s January 2022 Updates appeared first on Ringgit Freedom.

]]>My Life & Mental State

The month of January feels pretty short to me - especially since the month gets wrapped between two major holidays (first Christmas & New Year, then Lunar/Chinese New Year). I have also finally gotten the motivation to do a little bit of spring cleaning in my home, tidying up some of the messes that both myself and my mom created by hiding it in the new "cupboard" we installed in our living room (to store some of the household items).

I actually bought the cupboard sometime in June last year but my lack of motivation & procrastination managed to drag it for almost half a year, before finally mustering enough energy level to JUST DO IT! Took me more than a day to assemble it (and seek outside help) as the whole thing was too darn heavy and I can't even lift it up (even with my mom's help). For the record - the cupboard's taller than me at 120x32x180cm!

With the 3rd booster shot and easing of restrictions (yay, both myself and mom are "upgraded" with 3rd shots!), I finally brought my mom to taste some Korean BBQs that she has been requesting since 2019. Sadly, perhaps because of her tooth problems now, she can't seem to enjoy it as much as she could back then. Goes to show how time and age start taking away things that we love, bit by bit... really oughta spend more time with her while I still can 🙁

For myself, I definitely can't enjoy any of the feasts so long as it requires much biting or chewing - at least for another 2+ more years when I can be braces-free. 😬

Now, going back to our usual monthly update for my finances and portfolios.

My Savings Rate & Budget

Savings Rate

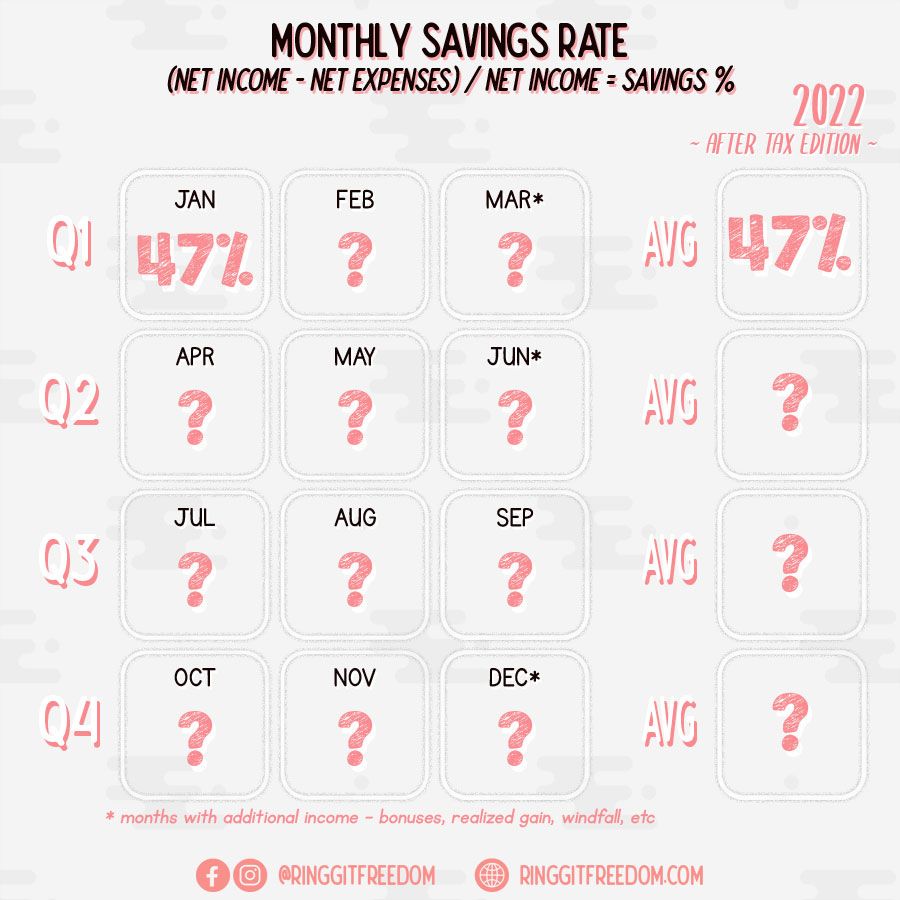

Compared to the last quarter of 2021, I have finally managed to further tone down my impulsive purchases and restabilise my overall monthly expenses. Whilst the savings rate for January 2022 is sitting at 47%, slightly below 50%; it's not too bad considering that this years' January income is closer to the baseline of normal month with no significant awards unlike back in 2021.

I made a few purchases here and there *cough CNY preps cough* - things like new clothes/purse; but were mostly within my monthly limits of overall leisure fund. There are also some trades done with preloved goods where I sold one of my underutilised flat hair iron, some extra bucks for my leisure purchases. Gotta start rebuilding my leisure funds for the coming months!

The best part of the deal was getting myself a Pre-loved 24" Folding Bike from my neighbour at just RM100 - something that I've always been keen to own. Now that I finally have my own bike again, I just need to look for my missing motivations to exercise...

There's also another dipping into my emergency fund ("Grow & Protect Capital") this month as my mom finally got her Fake Teeth (Dentures) completed. Since I don't have any other budget categories to charge these costs to, Emergency Fund it is! :P.

Because of this, there isn't much growth when it comes to my Emergency Jar fund this month. I'm still sitting at 72% target which translates to approximately 8 and a half-month worth of buffers. Will definitely get it to 100% (12 months buffer) by end of 2022!

What happened to my Portfolio?

As if the ongoing China Crash since the second half of last year wasn't enough - the US market seems to have finally started to show signs of the market correction. At this phase, I'll probably be in the reds (negative return) in a few months time if this continues 😀 Though frankly, I'm not very worried as my horizon is 10+ years.

Decided to put a little bit more of my monies this month into investment (instead of focusing only on my Emergency Jar) so there were quite a few activities taking place, aside from my typical monthly investments of Dollar-Cost Averaging (DCA) into StashAway, PRS, Luno and Trading212.

Crypto Crash

During the continuous downturn of cryptocurrencies during the month of January, I've decided to further top up some of my holdings within the crypto space to buy the dip. Though at this juncture, crypto still plays a very small part in my overall portfolio strategy.

Experimental "Pies"

Back in February 2021 last year, I decided to create two experimental funds just for the fun of it - you may have noticed the two "LULZ" funds in my portfolios disclosure section. The experiments were meant to be a little fun activity amidst all the seriousness of managing an investment portfolio, just to have a little fun but not expecting to earn (or lose) much, with only EUR 112 at stake.

But first, a little back story on how the two funds (pies) were created:

- The first one's named "Trading212 LULZ: Magic Formula", is really nothing but that Magic Formula taken from The Little Book That Beats the Market by Joel Greenblatt where ~20 stocks will be selected as long as it matches the criteria of buying good companies at bargain prices. I literally just finished reading the book during that month and decided to give it a try. Problem is - how do I know if this performed good enough, or badly, with what benchmark to use!? That's where second portfolio comes into the rescue.

- The second one's named "Trading212 LULZ: Ringgit Random", and as its name implies - these are nothing but ~10-20 completely random stocks I personally have selected, when scrolling through the Trading212 platform. Given my nature of insecurity, most of the random stocks I selected are MNC's which are pretty renowned internationally, with a few other random stocks. Somehow, most of them happens to be in O&G industry which was pretty depressed last year...

In the end, I managed to close the two pies with a profit of +11.86% (or 13.24% annualised) for the first pie and +31.47% (or 35.47% annualised) for the second pie. This turned the little seed money of EUR 112 into approximately EUR 136 towards the end of the experiment.

Whilst it started merely as a LULZ (fun) exercise, there were a few takeaways for me as well, which further reinforces my philosophies of investing:

- In a bull market's run, everyone can be a genius - even monkeys (my pie #2 is definitely a non-thought through ones)

- Price is what you pay for; but value is what you get (never pay more than the companies' worth)

- Luck plays a part - but is this sustainable / replicatable? Probably no.

For now, I have moved all of the earnings/seeding funds of EUR 136 back into my primary pie, which is also made up of ~20 stocks which I believe will be here to stay in the next few decades.

Will I re-run this experiment again in the future? Probably - it's definitely a fun exercise while it lasted! At least it introduced some levels of fun amidst my boring "buy-and-forget" kind of investment style.

Portfolio Snapshot

Snapshot as of 31 January 2022

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

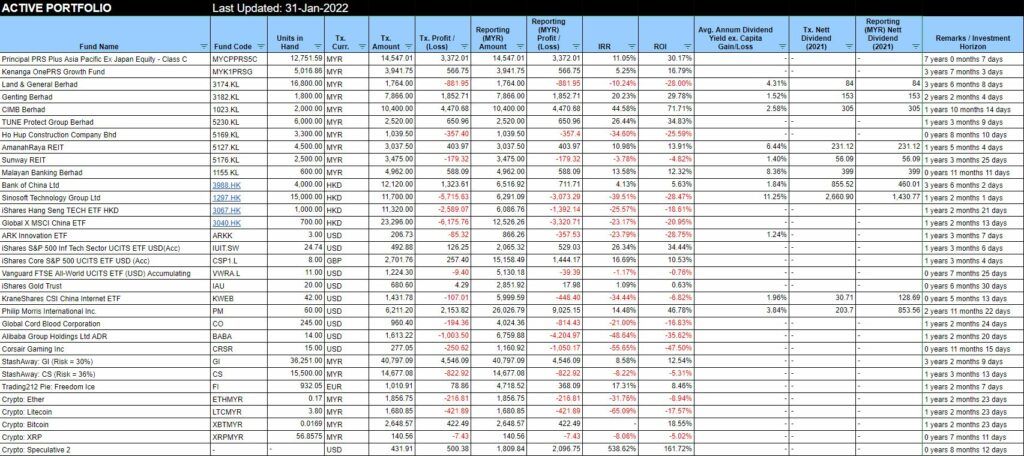

Sold (Retired) Portfolio (accumulative)

IRR: 7.46%

ROI: 11.39%

Profit/Loss: RM6,966.89

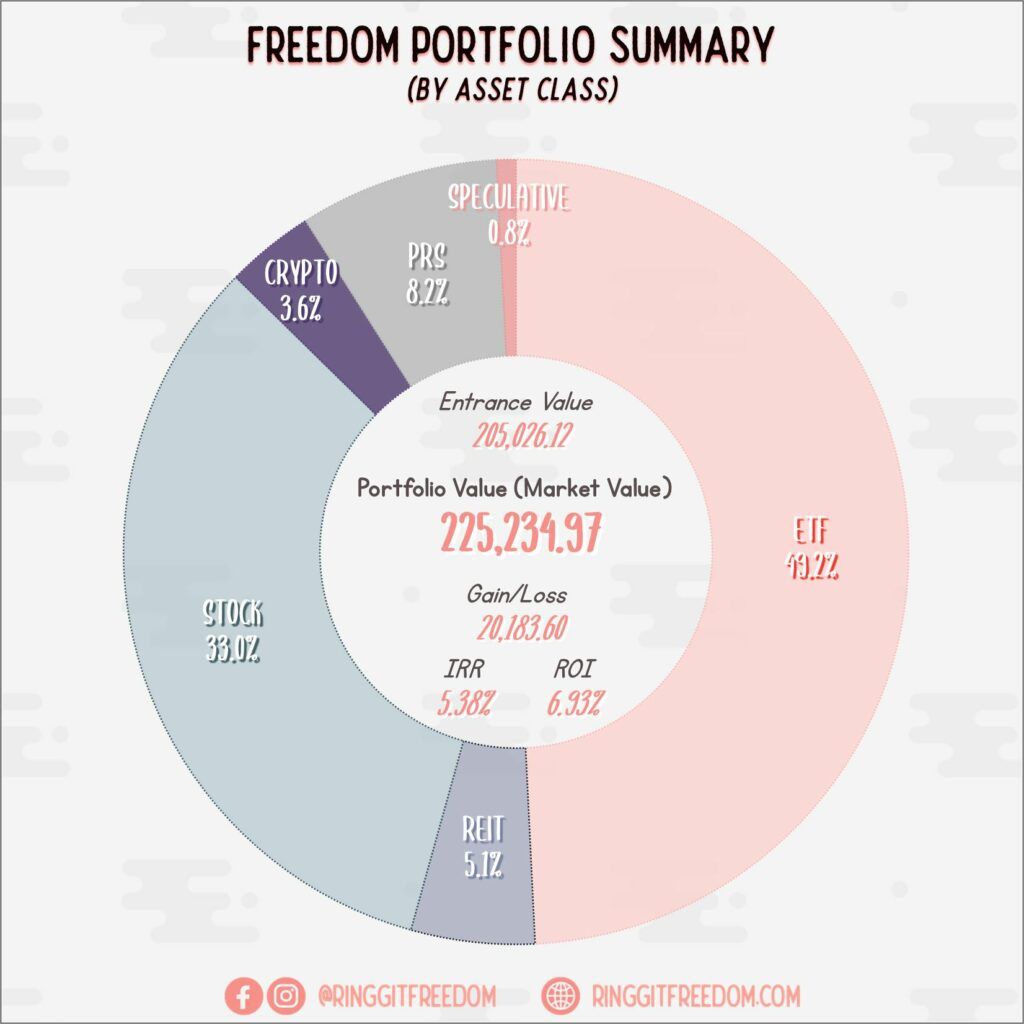

Active (Invested) Portfolio

IRR: 4.64%

ROI: 5.74%

Profit/Loss: RM13,216.72

True Cost: RM227,867.92

Total Value: RM241,187.22

Entrance Value: RM205,026.12

Portfolio Value: RM225,234.97

Nett Dividend (2022): RM -

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie

The post Ringgit Freedom’s January 2022 Updates appeared first on Ringgit Freedom.

]]>