I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

The month of January feels pretty short to me - especially since the month gets wrapped between two major holidays (first Christmas & New Year, then Lunar/Chinese New Year). I have also finally gotten the motivation to do a little bit of spring cleaning in my home, tidying up some of the messes that both myself and my mom created by hiding it in the new "cupboard" we installed in our living room (to store some of the household items).

I actually bought the cupboard sometime in June last year but my lack of motivation & procrastination managed to drag it for almost half a year, before finally mustering enough energy level to JUST DO IT! Took me more than a day to assemble it (and seek outside help) as the whole thing was too darn heavy and I can't even lift it up (even with my mom's help). For the record - the cupboard's taller than me at 120x32x180cm!

With the 3rd booster shot and easing of restrictions (yay, both myself and mom are "upgraded" with 3rd shots!), I finally brought my mom to taste some Korean BBQs that she has been requesting since 2019. Sadly, perhaps because of her tooth problems now, she can't seem to enjoy it as much as she could back then. Goes to show how time and age start taking away things that we love, bit by bit... really oughta spend more time with her while I still can 🙁

For myself, I definitely can't enjoy any of the feasts so long as it requires much biting or chewing - at least for another 2+ more years when I can be braces-free. 😬

Now, going back to our usual monthly update for my finances and portfolios.

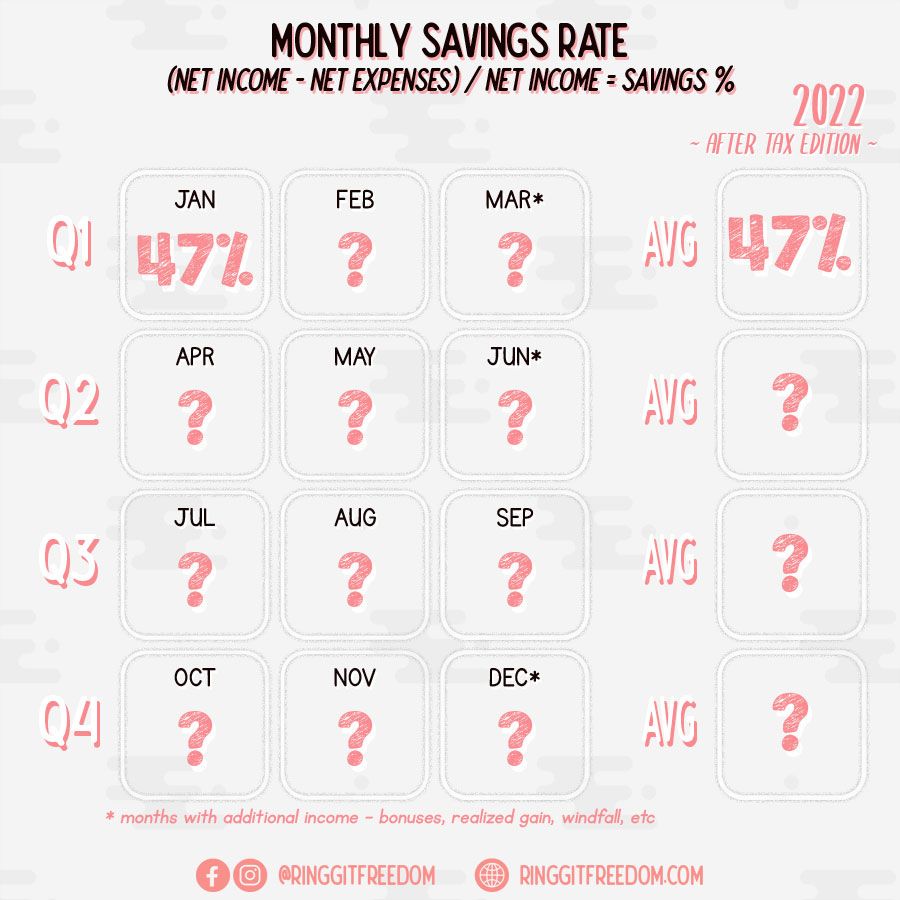

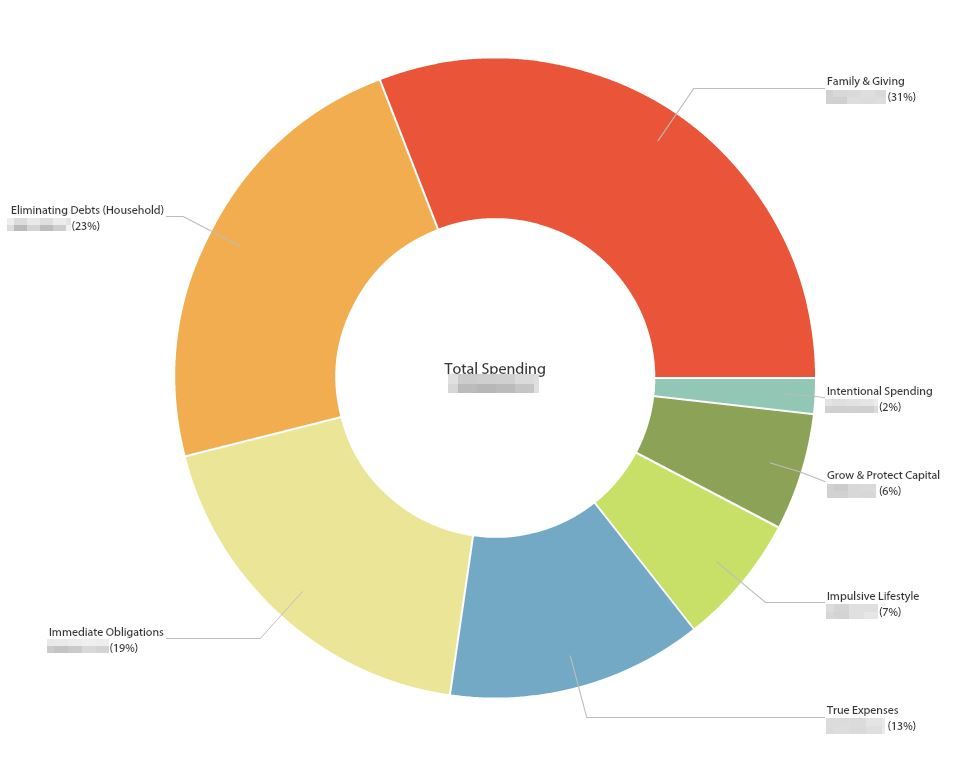

Compared to the last quarter of 2021, I have finally managed to further tone down my impulsive purchases and restabilise my overall monthly expenses. Whilst the savings rate for January 2022 is sitting at 47%, slightly below 50%; it's not too bad considering that this years' January income is closer to the baseline of normal month with no significant awards unlike back in 2021.

I made a few purchases here and there *cough CNY preps cough* - things like new clothes/purse; but were mostly within my monthly limits of overall leisure fund. There are also some trades done with preloved goods where I sold one of my underutilised flat hair iron, some extra bucks for my leisure purchases. Gotta start rebuilding my leisure funds for the coming months!

The best part of the deal was getting myself a Pre-loved 24" Folding Bike from my neighbour at just RM100 - something that I've always been keen to own. Now that I finally have my own bike again, I just need to look for my missing motivations to exercise...

There's also another dipping into my emergency fund ("Grow & Protect Capital") this month as my mom finally got her Fake Teeth (Dentures) completed. Since I don't have any other budget categories to charge these costs to, Emergency Fund it is! :P.

Because of this, there isn't much growth when it comes to my Emergency Jar fund this month. I'm still sitting at 72% target which translates to approximately 8 and a half-month worth of buffers. Will definitely get it to 100% (12 months buffer) by end of 2022!

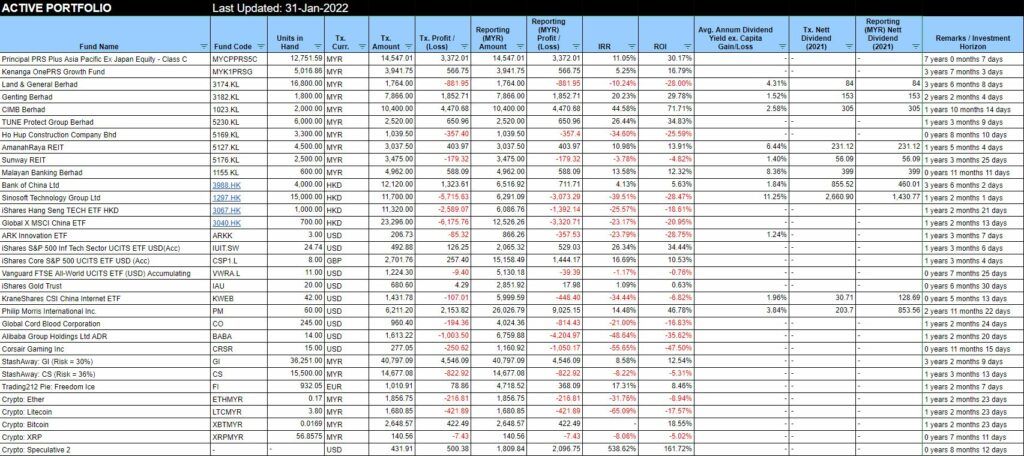

As if the ongoing China Crash since the second half of last year wasn't enough - the US market seems to have finally started to show signs of the market correction. At this phase, I'll probably be in the reds (negative return) in a few months time if this continues 😀 Though frankly, I'm not very worried as my horizon is 10+ years.

Decided to put a little bit more of my monies this month into investment (instead of focusing only on my Emergency Jar) so there were quite a few activities taking place, aside from my typical monthly investments of Dollar-Cost Averaging (DCA) into StashAway, PRS, Luno and Trading212.

During the continuous downturn of cryptocurrencies during the month of January, I've decided to further top up some of my holdings within the crypto space to buy the dip. Though at this juncture, crypto still plays a very small part in my overall portfolio strategy.

Back in February 2021 last year, I decided to create two experimental funds just for the fun of it - you may have noticed the two "LULZ" funds in my portfolios disclosure section. The experiments were meant to be a little fun activity amidst all the seriousness of managing an investment portfolio, just to have a little fun but not expecting to earn (or lose) much, with only EUR 112 at stake.

But first, a little back story on how the two funds (pies) were created:

In the end, I managed to close the two pies with a profit of +11.86% (or 13.24% annualised) for the first pie and +31.47% (or 35.47% annualised) for the second pie. This turned the little seed money of EUR 112 into approximately EUR 136 towards the end of the experiment.

Whilst it started merely as a LULZ (fun) exercise, there were a few takeaways for me as well, which further reinforces my philosophies of investing:

For now, I have moved all of the earnings/seeding funds of EUR 136 back into my primary pie, which is also made up of ~20 stocks which I believe will be here to stay in the next few decades.

Will I re-run this experiment again in the future? Probably - it's definitely a fun exercise while it lasted! At least it introduced some levels of fun amidst my boring "buy-and-forget" kind of investment style.

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 7.46%

ROI: 11.39%

Profit/Loss: RM6,966.89

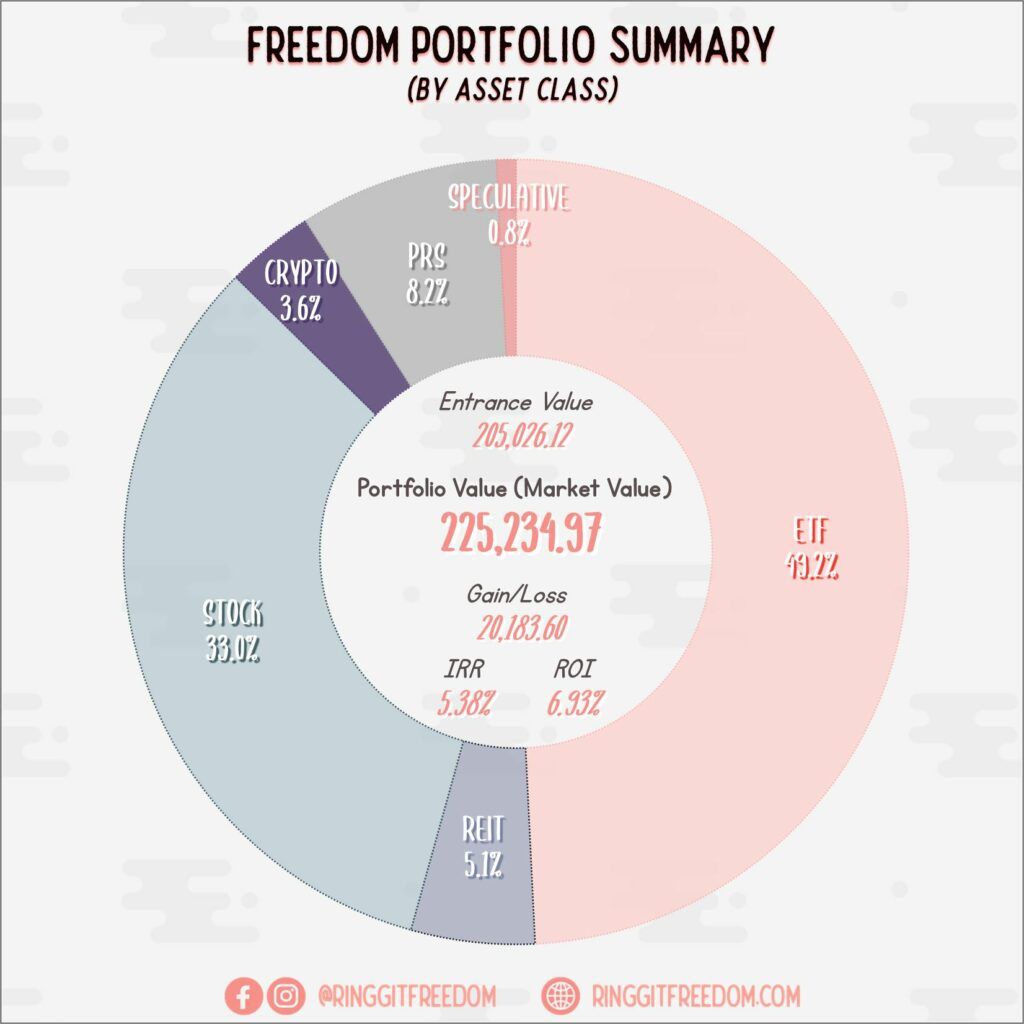

Active (Invested) Portfolio

IRR: 4.64%

ROI: 5.74%

Profit/Loss: RM13,216.72

True Cost: RM227,867.92

Total Value: RM241,187.22

Entrance Value: RM205,026.12

Portfolio Value: RM225,234.97

Nett Dividend (2022): RM -

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie