I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

April's been a pretty hectic month for me.

On one hand, I'm trying to slowly adjust back to the reality of going back to the office after staying home for almost 2 years (minus the essential outings/groceries trip). Whilst the Company had been nice enough to give us flexibility to choose to return to office/work from home thus far, things are about to change in May (and have already taken effect by the time I publish this post) where all of us will have to return to office, except for Friday and one of our self-selected day.

On the other hand, I'm pretty much status quo in terms of my personal well being. I am generally more chill nowadays, using video games to recharge myself after a long day (or week) of workplace toxicity. Perhaps I'll end up quitting sooner than I initially planned, but whilst I still can take it - I'll continue the grind to accelerate my freedom plan and milk what I can (financially).

Maybe I am just not stern enough to push myself out of my comfort zone amidst the ongoing toxicity. But I guess there's only so much I can push myself where there'll always be a peak/bottom of performance following the cycle. I definitely don't want to get burned out again so I'll just take baby steps as I continue to go forward.

One interesting discovery I've made in April (sadly I didn't continue after that) was attending one of the doodling class. It was definitely a fun self-discovery exercise and also an eye opener for me as I never knew I could doodle using just simple shapes (without needing "art mastery" skills).

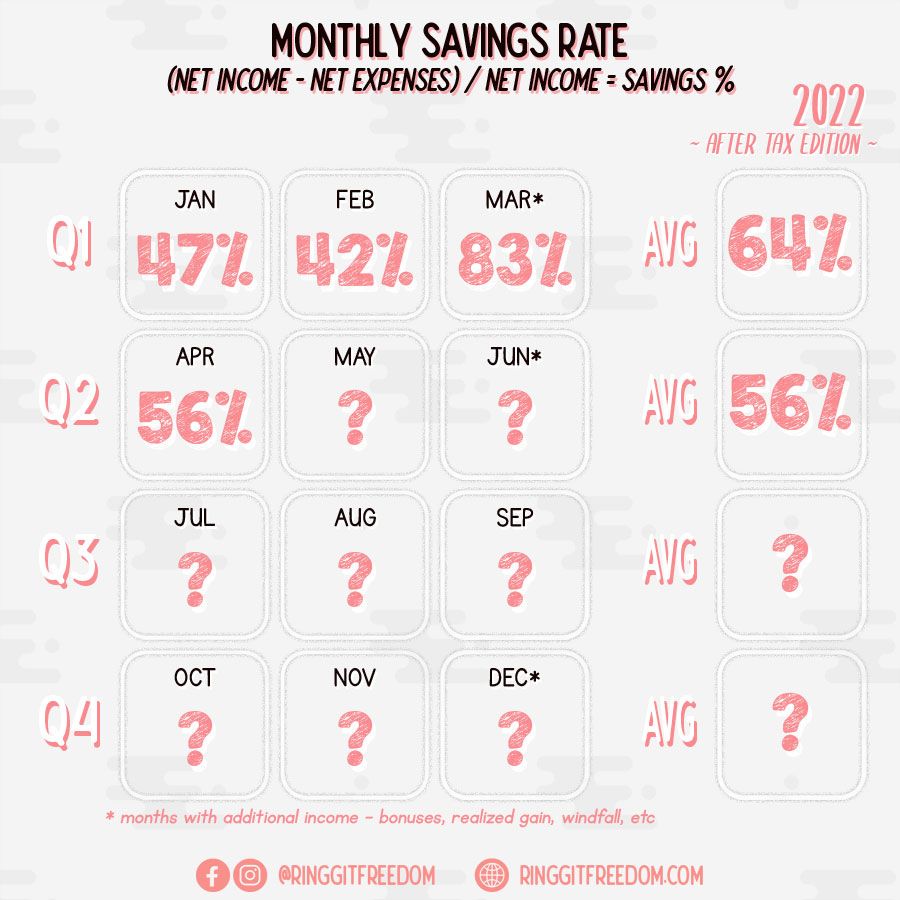

Now, going back to our usual monthly update for my finances and portfolios.

Not much changes in terms of my spending towards family & personal commitments - but there were some leisure spending made in April for my gaming hobby. I basically found out (by chance) that a game I stopped playing years ago had released an expansion pack - so I decided to hop back in since I'm in the gaming mood nowadays 😛

Unfortunately through this exercise, I also found out that several of my PC parts were dying (slowly) and I ended up spending a small amount to buy a replacement part (spare RAM) helping me with my troubleshooting exercise, which unfortunately still wasn't the root of my PC problems. I ended up sending some other of my PC parts for warranty (2 months before they end, phew) which also means that I'm out of my gaming PC for the next 6-8 weeks. Thankfully I still have my Macbook (M1 Air) which I can do some "light" gaming with it

Frankly, I am quite tempted to just go out and buy the new PC parts to replace the potentially faulty hardware (and re-sell the old ones once they are fixed & returned to me by the manufacturer RMA process), but I'm feeling darn guilty if I do so - as I basically am breaking my own promise of budgeting. So let's see where we ended up going - you'll definitely see my savings rate drop if I choose to do so 😛

One good news (worth celebrating for, I guess?) is that I'm now almost reaching the end of my goal, of hitting the 12-months Emergency Jar target I've set for myself. Hopefully with this, it'll provide me with sufficient buffers in case if things turn south for me.

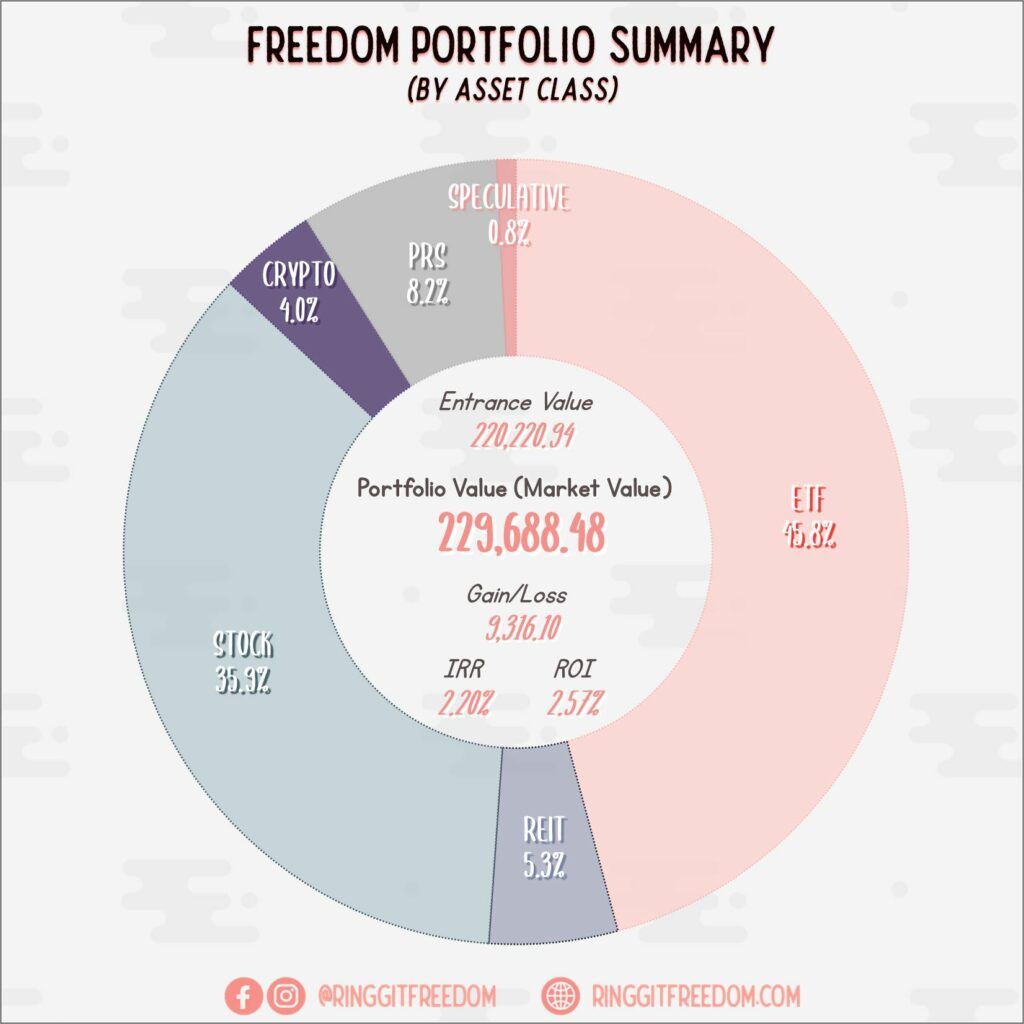

This year hasn't been a good so far, with my portfolio value continuing to tumble down especially some of my individual stock selections. This really have affected my confidence with self doubts starting to creep into my head. Well, I guess the only sensible thing to do now is just to continue sailing forward and see where the journey takes me.

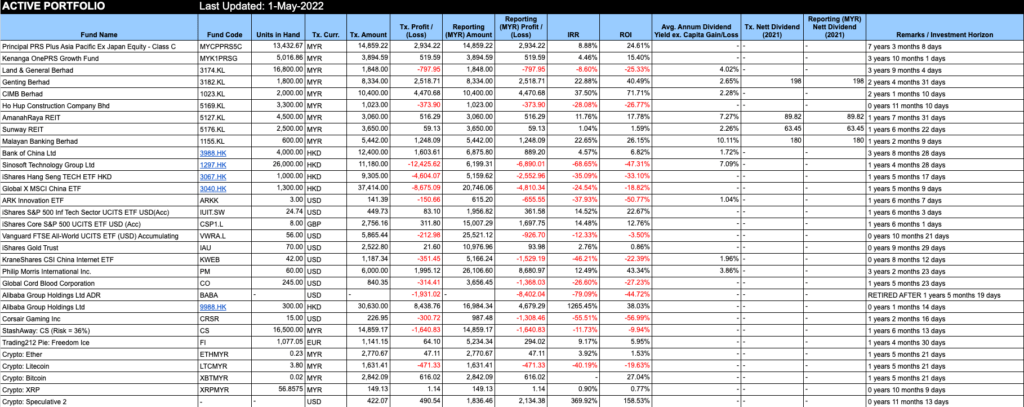

No major investment have been made yet in April as I've forgotten to top up and do my usual monthly Dollar-Cost Averaging (DCA) exercise. Things were definitely easier back then when I was doing monthly DCA into StashAway, as I didn't need to think about it at all and the monies just get deducted automatically from my bank account. Thankfully, the smaller DCA's are still being deducted automatically (namely PRS, Luno and Trading212) but the amount are insignificant to mention.

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 6.36%

ROI: 9.59%

Profit/Loss: RM9,682.41

Active (Invested) Portfolio

IRR: -(0.13%)

ROI: -(0.19%)

Profit/Loss: -(RM366.30)

True Cost: RM256,492.69

Total Value: RM256,386.01

Entrance Value: RM220,220.94

Portfolio Value: RM229,688.48

Nett Dividend (2022): RM759.70

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie