Taking the lessons learnt during the year 2022, I've decided to approach this year at a more sustainable pace so that I don't get burnt out again. And who've known that slowing down in life, actually took me further?

It may sound cringe at first (trust me, I felt the same way too at first) - but slowing down DID take me further. How so, you may ask?

Being the career-focused woman that I am, can you imagine that I rejected a lateral promotion/movement, for the first time in my life?

This career opportunity would've allowed me to expand my career horizontally with bigger responsibilities had I accepted it in the first place, allowing me to further expand my growth, at the price of my mental energy. The usual me would've jumped at any growth opportunities with zero hesitation - after all, career growth equals potential better pay/experience, which would've benefitted me in the long run for sure.

However, taking the first few months of the year to introspect, I've known what I wanted in life, at least directionally. Whilst potential career growth is nice, it doesn't fit into the bigger picture of what I want to piece out of my life. The puzzle simply doesn't fit and goals do not align.

Don't get me wrong though, amidst the economic instabilities in recent years, I'm very thankful that my company still plays a huge part in building up my career, investing significantly in my personal growth, as well as rewarding me financially. It's just that rather than walking a path decided by others, I've decided to create my own path.

Am I still in the same company that I was working with over the last decade? Yes. But I've come to accept the fact that I may have to eventually give up all the glories and titles, as well as financial incentives, to create my pathways going forward. I'll probably delve deeper into this topic in the future when things are more or less cast in stone. Still too early to say anything for now as I didn't want to count the chickens before they hatch 🙂

Mental health-wise, in case it's not obvious enough already - I am feeling better, so much better compared to 2022 and 2021 with better clarity of mind. All I want is just to slow down my pace in life, be there in the present and do whatever I feel like doing (or not doing) without being guilt-tripped. And take small steps, day by day, towards the end-game that I want to achieve beyond just the numbers.

After all, Slow and Steady wins the race, eh? I guess life is truly a marathon and not a sprint...

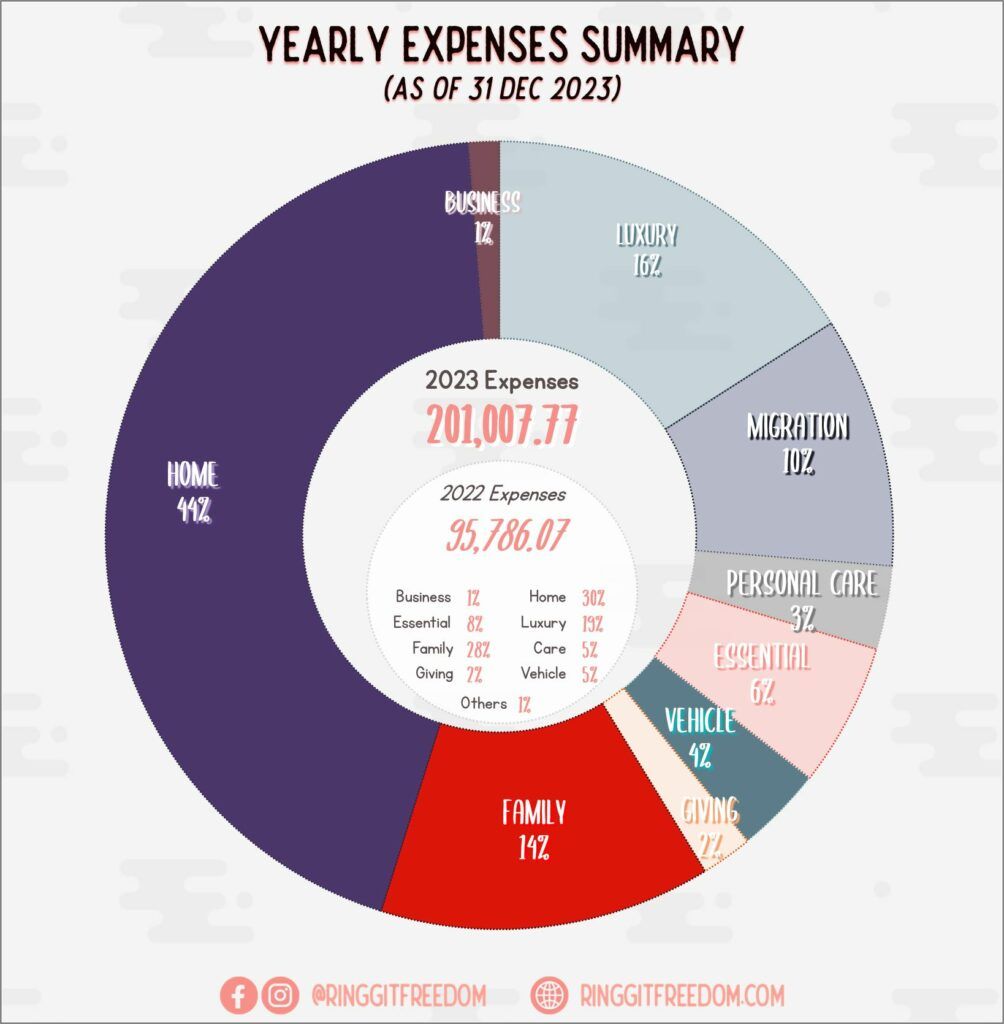

I was actually in shock when I did my financial closing this year.

I know I wanted to cut myself some slack and give myself some window to breathe and live life as it is, instead of living life in numbers. But I wasn't ready to see an increase of WHOPPING 110% IN TOTAL ANNUAL EXPENSES!!! With more than double my total spending last year.

I mean, take a look at this. Who wouldn't be shocked simply by glancing at the summary below? Pretty sure I nearly had a heart attack...

Being the Detective Pikachu that I am - I decided to delve deeper into the numbers.

To my relief, I found out that whilst there has been an increase in my overall expenditures, it is still within a much more reasonable and expected range, considering my relaxed spending requirements (following Ramit Sethi's "Living a Rich Life" bible) plus a few vacation trips that I took throughout 2023.

Much of the increase in my overall expenditures is caused by either (1) paying down my mortgage quicker, or; (2) one-off expenditures related to migration overseas (and still barely scratching the surface so far). Both of these are utilizing the buffers in my budget which I've built over the last 2 years in their respective categories.

It's a long topic by itself - but long story short, the surge of expenditures in these two categories is related to the decision I've made personally to migrate overseas in the near/mid-term. I'll have a post dedicated to the whole story of migrating overseas when the time is right.

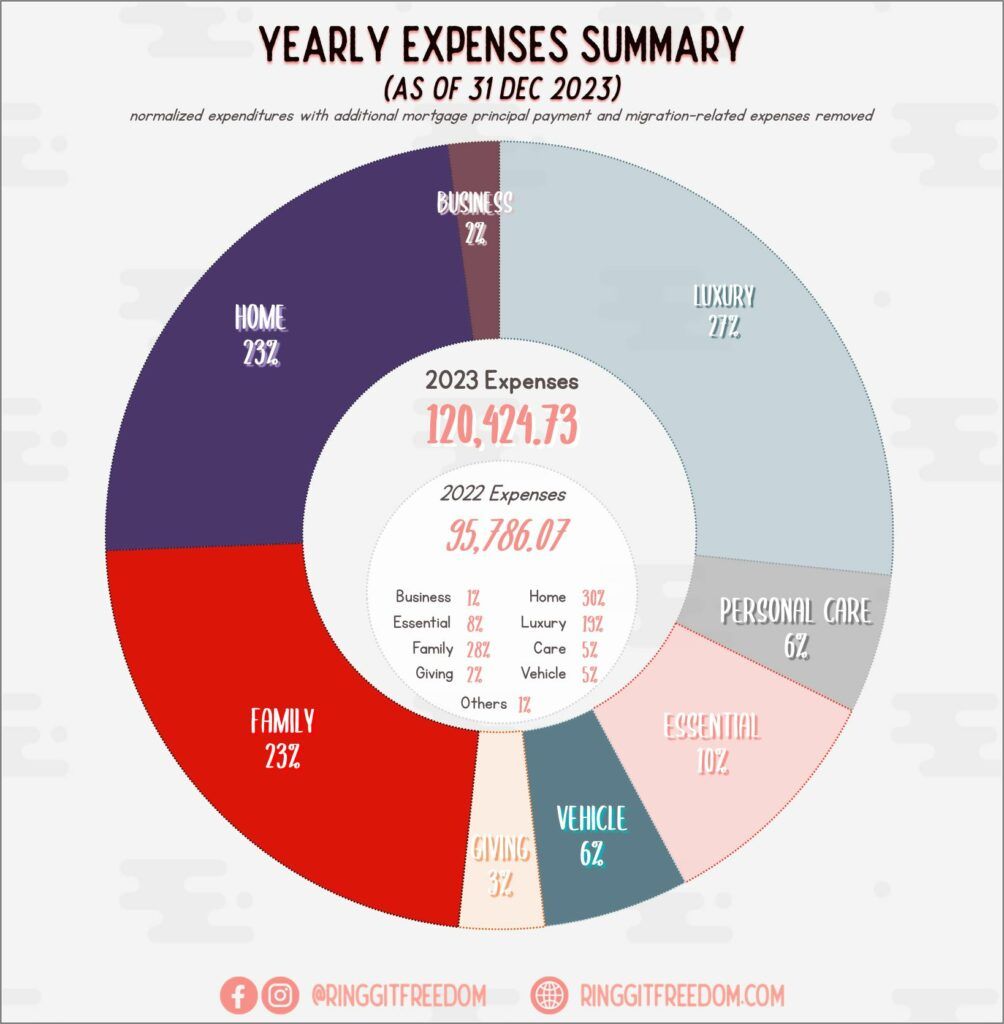

But as far as analyzing my expenditures this year, when I normalize my spending and exclude these two expenditures, the figures are much more reasonable and less scary in my opinion.

Anyway, after normalizing the expenditures, it's rather easy (and obvious) to tell where the huge spike came from. I mean, I can better stomach an increase of 26% in overall expenditures as compared to 110%, especially knowing for a fact that 11% out of the 26% increase comes from travelling alone with the rest scattered throughout other categories.

If I double-click my overall expenditures (of ~200K MYR) in 2023, just to give a full picture:

This is the biggest block of my expenditure this year - sucking up most (not all, thankfully) of my budget buffers built up over the last two years. As I plan to migrate overseas in the near/mid-term, I decided to derisk my overall financial portfolio and try to pay down as much as possible on my only debt obligations before I plunge into the unknown-unknowns.

After all, no one knows if things will go south when I decide to migrate overseas and lose my solid career back home in Malaysia (as well as financial rewards), hence the driving factor for me to make this decision to pay up the mortgage sooner rather than later.

These additional mortgage principal repayments are on top of what I'm already paying on a month-to-month basis, which is a separate ~RM21.9k by itself, made up of mandatory principal + interest repayments. The whole point is to pay my mortgage sooner than the original 35-year mortgage plan.

For clarity, these figures (~RM59.9k) are excluded from the normalized version of the yearly expenses.

Migration is a loooooooooooooong game, more than what I anticipated initially. Again, more details on this topic in the future when the time is right.

But long story short, to be allowed to migrate to Australia I'll first need a Visa - be it an Employer-sponsored Working Visa or Independent Skilled Regional Working Visa or Independent Skilled Permanent Residency Visa.

Before I can even qualify to express my interest in these Visas, I need to sit through a bunch of assessments/tests to prep my profile and pray for my profile to get selected. Of course, these expenditures do include consultation with Migration Lawyers.

For clarity, these figures (~RM20.7k) are excluded from the normalized version of the yearly expenses.

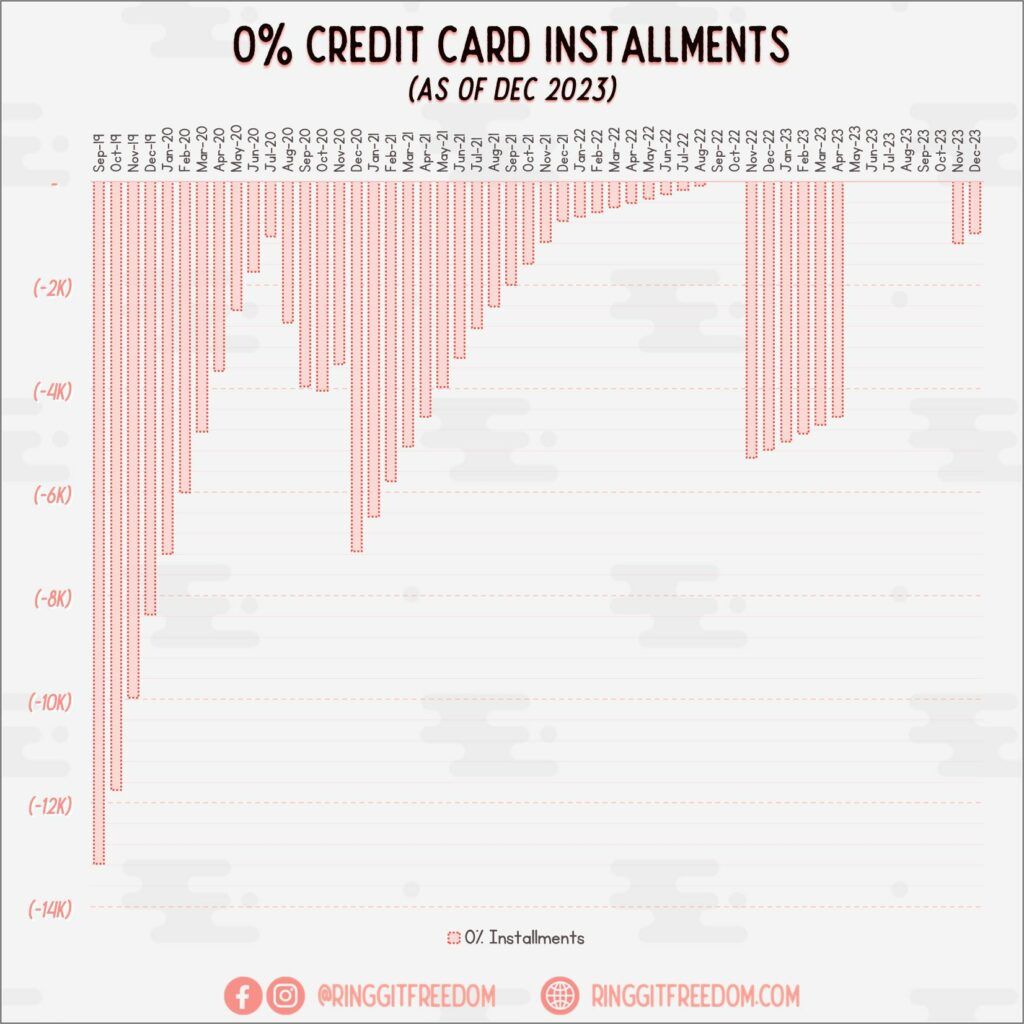

I bought an iPhone 14 Pro last year and decided on a whim to put it on my 0% Installment Plan - but this year, when consolidating/closing down my unused credit cards, I had to pay it down in full (~5k) resulting in actualizing the costs this year, rather than the initial plan of paying it down over 3 years.

I've also spent quite a bit on upgrading my PC with a few parts purchased (~3.5k), and spending on the not-too-new Meta Quest 2 thinking I'd be using it to exercise daily (~3k). It worked for about two months but when I stopped exercising for a few weeks due to health issues, I couldn't restart my habits since then >.<. To add salt to the wound, Meta announced their Quest 3 series a few months after I bought mine.

This gadget category is a long-lasting problem that I need to crack - as it stands right now, the spending is still too impulsive driven with no proper plans for it. Next year onwards, I'm going to try out a "savings goals plan" (in my YNAB budget) for buying gadgets, rather than not having any plans at all to control my impulsive gadget-buying behaviours.

I had crafted a goal end of last year, to visit at least one overseas country and enjoy my holiday break this year. Something that I've never done since 2019 before COVID-19 shut down international borders.

The result? I ended up spending almost 3 weeks in Australia to meet up with my best friend there and disconnect myself from the world... the reality. Gosh, I never knew taking a long (proper) break to recharge was so good. Now I wonder what I've been doing the last couple of years to burn off my leave just like that.

The bill could've been much higher, if not for the accommodation provided by my friend.

At least the numbers went down this year eh? It is still my sole copium method to get through my days, by enjoying/immersing myself in games. At least I don't smoke, so I guess it's kinda justified to spend on games heh. For smokers, that's equivalent to approximately one pack every two days 😛

As mentioned earlier - I paid off my iPhone's 0% plan in full but towards year-end, added another small 0% purchase of a Dyson Hairdryer (~RM1.2k) as my mom's hairdryer needed a replacement.

Again - same as last year, I took the shortcut way out to make my impulsive purchase (at least I tell myself it's for my mom, so it's worth it, to feel less guilty about it) via 0% plans rather than making a plan for it. Pun intended.

This year was a bit tricky to analyze due to the surge in expenditures due to the additional principal repayments for my mortgage and also one-off costs related to migration. As covered in the Expenses section above, I'll have to share two versions of the savings rate.

If we look at the first set of charts, it is pretty scary as I've only managed to save approximately ~27% of my annual net income, with an out-of-bound dip in December where I spent double my net income that month.

However, if we delve deeper and exclude the additional mortgage repayments / migration-related expenses; the savings rate is rather healthy - right on track against the target of a 55% Savings Rate which I've set out for 2023 previously.

One thing's for sure though, my actual monies are "kinda gone" since I've already allocated it to pay down my mortgage (but I can withdraw anytime if needed leveraging the zero-penalty fully flexi facility) and actual expenditures on visa-related matters, so I'll be using the actualized 27% savings rate as my baseline for 2023.

I won't punish myself for "not hitting the target", though. Since the monies are spent on things that I want, aligning with "My Rich Life" goals, and are planned for. These monies were saved from 2021-2022 exactly for these purposes, anyway.

I'll let you be the judge here - should my savings rate be 27% or 56% for 2023? Let me know in the comments below!

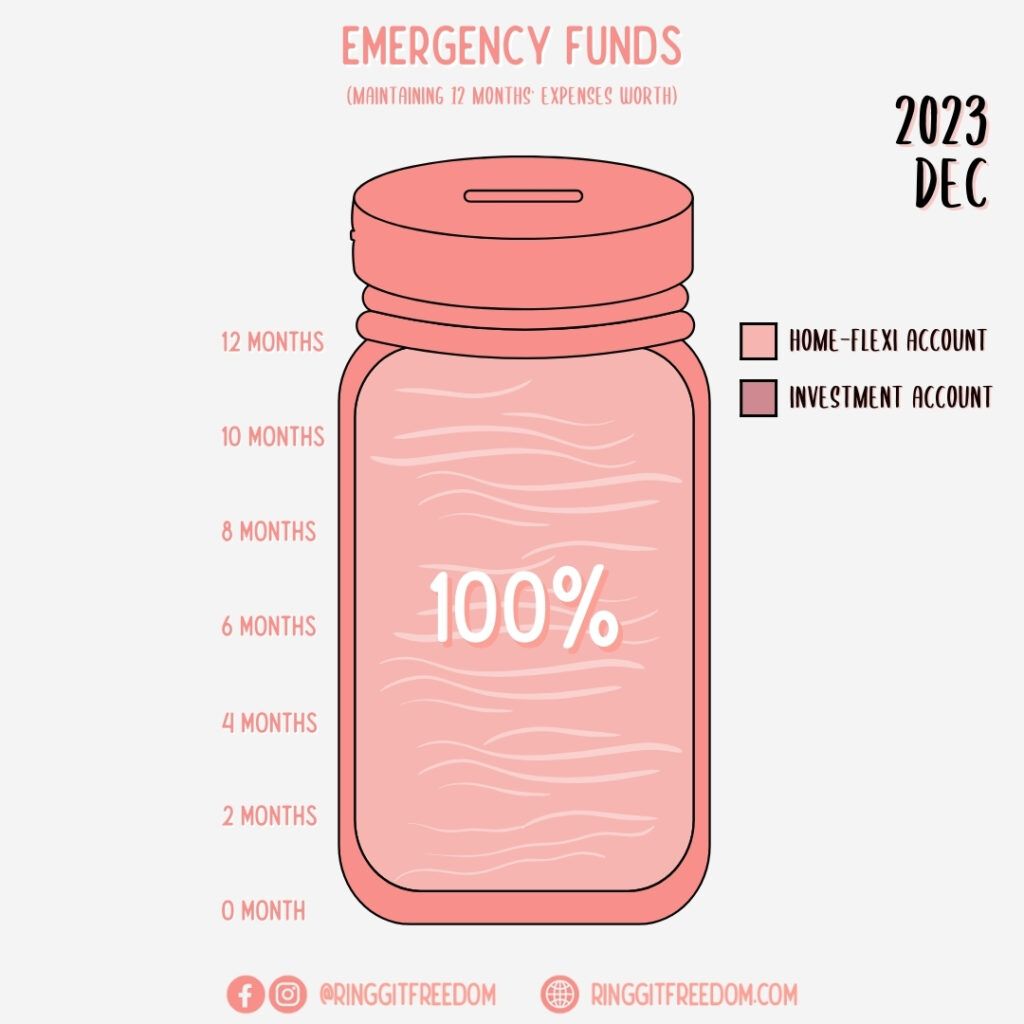

Pretty much the status quo here since my Ringgit Freedom’s June 2021 Updates: Mid-Year Checkpoint when I decided to expand my emergency jar from 6 months' expenses worth to 12 months' expenses worth.

Unlike the past year's review, I'll be reviewing both my "Freedom" portfolio followed by my "Total" portfolio which is inclusive of EPF-managed funds.

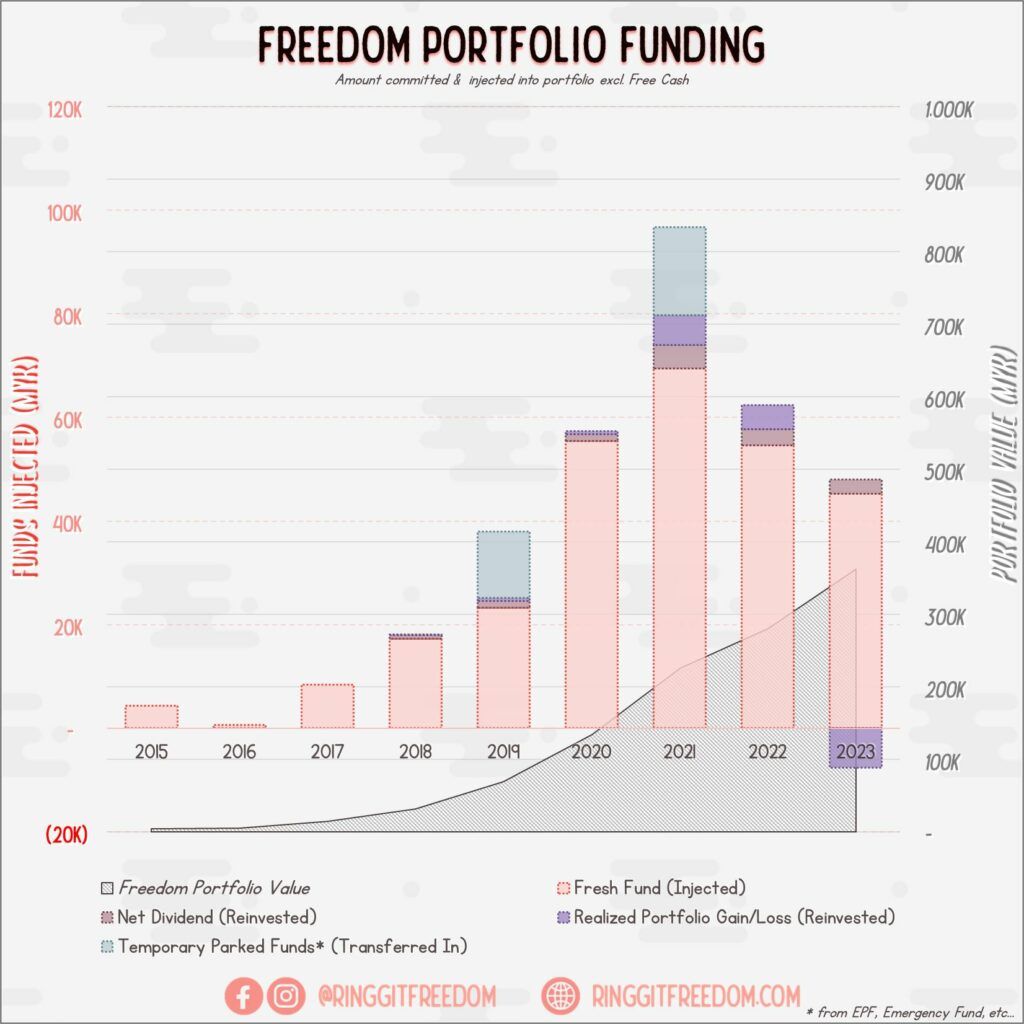

This year continued the downward trend since 2021, with slightly under ~RM50K contribution as of the end of 2023. The main factors are related to migration as well - with most of my free cash flow aggressively channelled to the additional principal repayments on my mortgage, there simply isn't enough excess cash flow to invest aggressively.

The lack of discipline and being forgetful doesn't help either (since I no longer have an auto debit facility) - without an automated mechanism put back in place I ended up noticing that I'll attempt to "time the market", going against my advice to others to focus on time in the market rather than trying to time the market.

Well, I've with the introduction of Recurring Investments by Interactive Broker, hopefully, I can at least regain my consistency when it comes to investing throughout 2024.

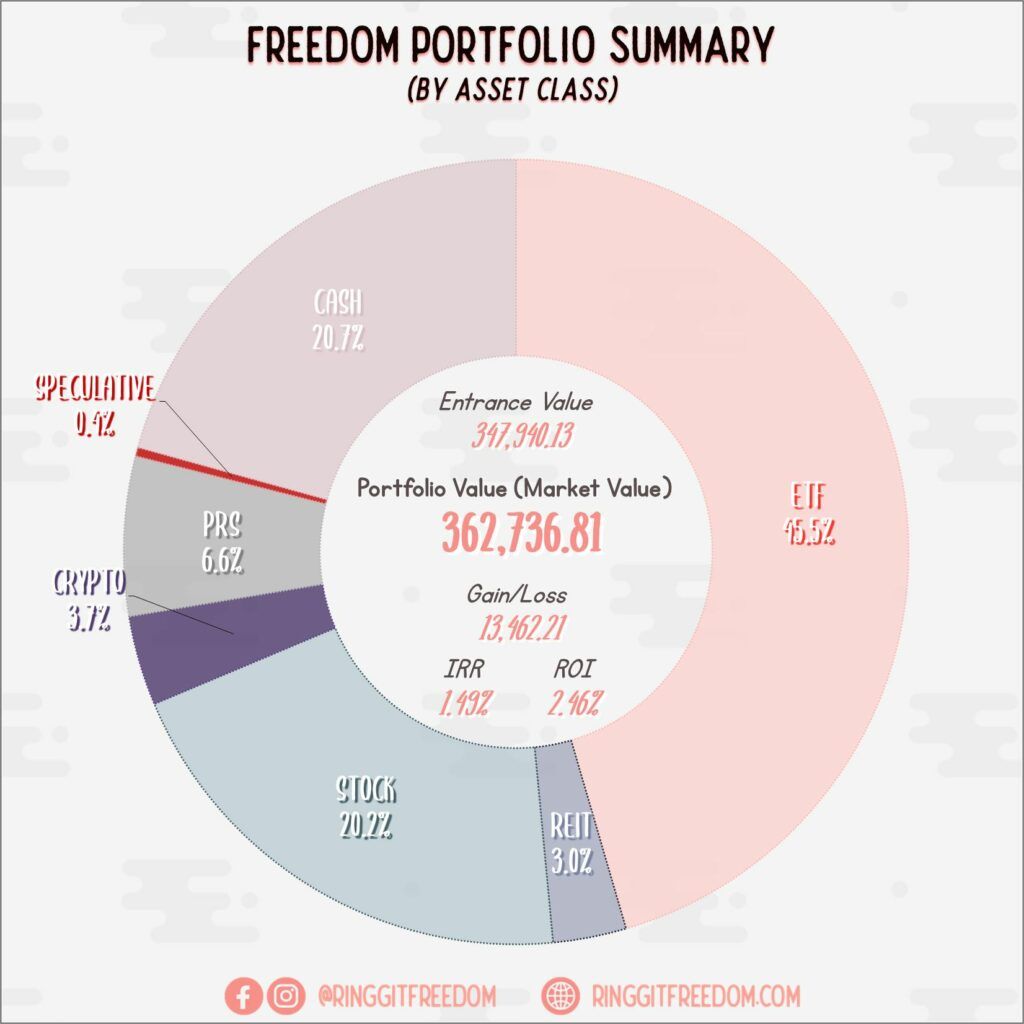

Truth be told, I'm not that happy with my portfolio performance this year. I can feel some of the burnt based off decisions I've committed to, approximately two years ago. Maybe I would've done better off just having a single-stock portfolio (VWRA) and left it stacked since then.

My portfolio barely maintained a breakeven with the gains on the US sides counterbalanced by losses stacked up on my China holdings and some of the questionable individual stock picks I've done in the past.

Lessons learnt tho - I'm NOT the type for picking individual stocks, except for some of those blue-chip dividend stocks. Am I doubtful of my decisions made? Yes. But I also know that it's all only a paper loss and the tide may (or may never) turn so I'll choose to stick my gun for now. Let's see how long my resolve can last me.

If you haven't noticed already, yes, my cash pile actually grew and almost doubled its size compared to 2022 December.

Reason for cash accumulation? I'm still waiting for an opportunity to jump back into (yes I know I shouldn't time the market) and on the other hand, I was trimming the number of holdings I had in my portfolio (one at a time) but hasn't really bought-back into the market yet. On the plus side, these cash are held in currencies other than MYR, so there's a bit of the hedging effect there too, so not all is lost.

My individual stock holdings are shrinking in size - sadly, not due to consolidation of portfolio but rather wiped-out values of some of my stock - such as the ongoing BABA (9988.HK) saga, the wipeout of value stocks (on paper previously), etc. The losses are painful, and I've yet to cut them off yet. But I've learnt very well that I'm NOT SUITABLE for stock-picking, except for dividend stocks which I'm pretty proud of my selections so far.

My freedom portfolio is almost 9 years old 🥳 and can you imagine that I'm only getting 1.5% return (IRR) out of it!?!? On a more serious note, if factoring only my realized portion of my portfolio, it'd sit at ~5.5% IRR which is not too bad, comparable to EPF but with much more effort required. It's the unrealized portion of my active portfolio (heavily influenced by the China downturn) that drags down my performance.

On the longer-term view, I still hope that I won't be too far off in terms of correctness. Like why would I wish myself to be wrong and lose money!? In any case, I still refuse to go all-in US-only so VWRA and ONLY VWRA with ~60% US and 40% Rest of World is my answer going forward.

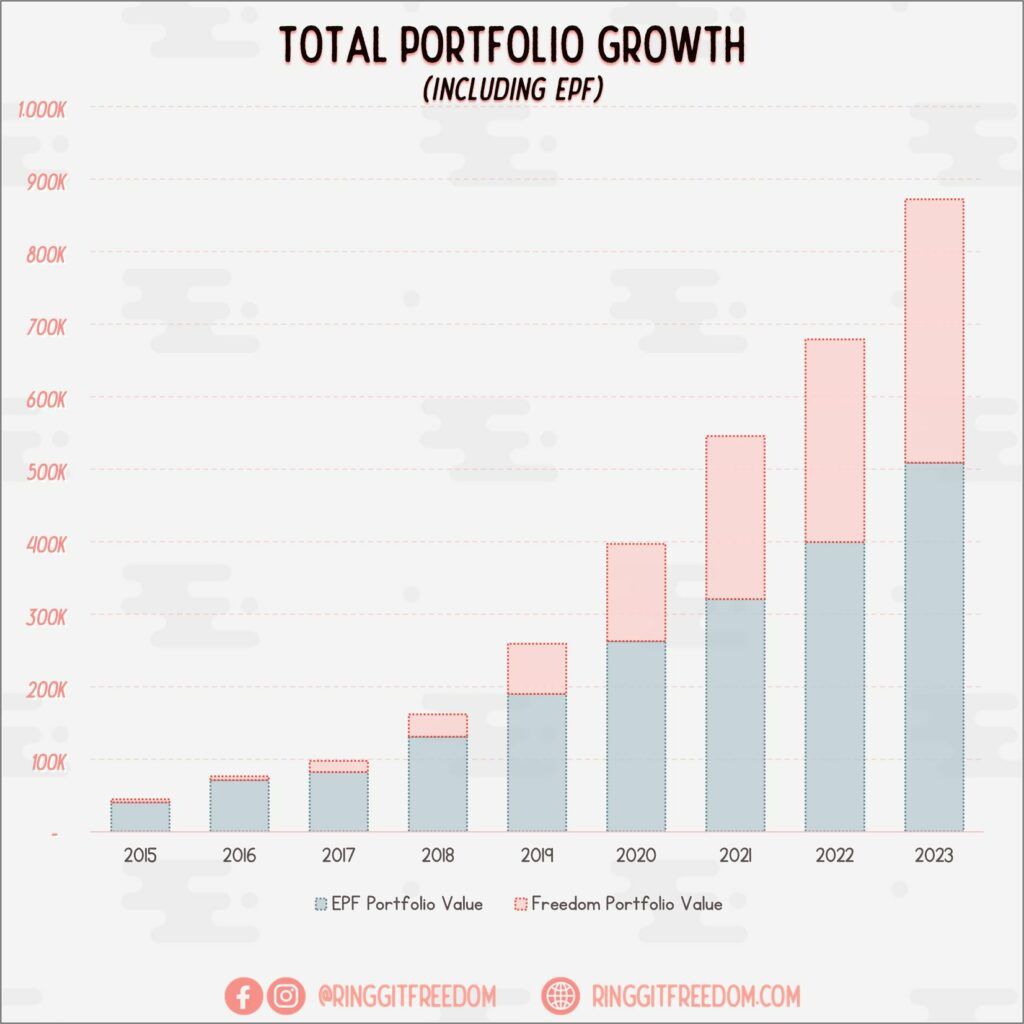

This is probably my first time having a dedicated section by itself, to allow for a holistic view of my true total portfolio after factoring in the monstrous EPF holdings. In the initial years I didn't want to include these in my review as the numbers are heavily mismatched between my Freedom Portfolio vs. EPF Portfolio but now that the numbers are much closer, I think it's the best time to introduce it.

Of course, EPF being EPF, there isn't much to talk about really - especially since we have not even received our 2023 dividends yet.

Rather than the controllable "funding" amount, I guess showing the overall growth would make more sense here. After all, EPF contributions are mandatory for all salary makers anyway. Here you can still see that funds in my EPF still outweigh whatever I hold & invest personally outside of the EPF ecosystems.

Similar to the Freedom Portfolio performance history earlier, except with EPF bits overlayed on top of it. Still not accurate tho, as we're still missing the dividend rate announcement from EPF Malaysia. Chart will be re-adjusted later in March/April once the final rates are announced - as I usually backdate the recognition in my portfolio resulting in a "Heartbeat" spike every year for EPF's performance.

In the holistic view of my portfolio allocation, the rather-low allocation in the US definitely caught my attention. Will definitely need to get the ratios back up to maintain balance between the two (China:US).

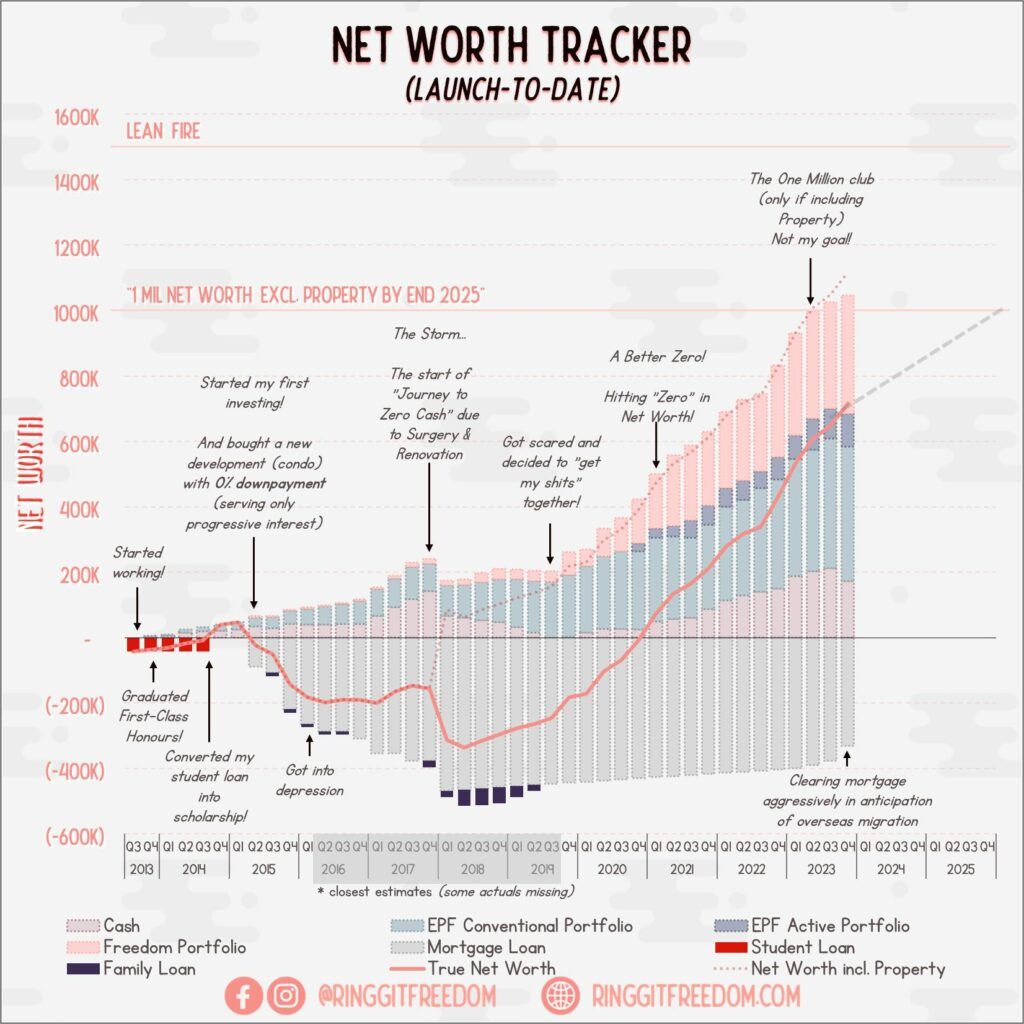

Amidst a chaotic year of 2023 with some precursors to life-changing decisions in the coming short to mid-term, I'm still very proud of what I have achieved - of course eternally grateful to my Company for building me up and investing in myself - both learning and financially. My current net worth sits at approximately ~RM720K.

Just in case for those who are reading my year review for the first time - for my net worth calculation, I typically exclude the primary residence that I’m currently staying in, in the essence that it generates all the expenses/liabilities associated with home-ownership with no ability to generate income. Even if I choose to sell it, there'll be heavy costs associated with it when time is not on my side so I took an aggressive $0 value assumption for such primary residence.

This concept was popularised by Robert Kiyosaki's Rich Dad Poor Dad. However, I know that some of you, especially finance enthusiasts and/or accountants would prefer to stick with the standard accounting principles so there's also an additional dotted line for that which accounts for my home value based on past transaction values with a haircut of ~10% for miscellaneous fees associated with sales of a home.

As you can see, my "1M2024" (achieving 1mil net worth using my formula by end of 2024) goalpost has been shifted to 1 year later a.k.a "1M2025" to create some space for myself.

For eagled-eyed ones, you would also notice that I no longer generate my 15-year net worth forecast as there are simply too many variables given my decision to migrate. I could end up 10 years poorer rolling back my progress so far once I take the migration decision and execute it, who knows?

In 2023, I've set rather simple goals to counter the burnt-out experience I've faced in 2022:

Goal #1: Achieve at least 55% Annualised Savings Rate

Similar to last year - this is hopefully an easy one to achieve by riding on the savings momentum whilst not over-depriving myself to focus only on saving but forget to enjoy life.

Goal #2: Arrange 1x Overseas Trip for Holidays

Perhaps something that I've missed the most is to travel overseas and just go adventure around. I don't know where to go yet, perhaps Korea or Australia? The purpose is really only to divert my spending on experience rather than more and more things.

Goal #3: Finding/Regaining My "Ikigai"

Perhaps the most important goal of them all. I've been losing my motivation and staying depressed for a little far too long, and I needed a new "goal" to look forward in life - something beyond grinding on the hamsters wheel.

For too long, I have focused on and only on tangible goals such as career progression, making and preserving monies, buying tangible stuff, progressing further in career to make more monies, etc.

Read more: 2022 in Review: An Autopilot Year

That's it. Those were indeed the only goals I had set for myself last year, clearing my headspace to ensure that I can capitalize on moments as I unlock "new" opportunities, goals or objectives utilizing those free headspace.

Similar to 2022, I wanted to celebrate what we have achieved this year, in no particular order 🥳

In the spirit of simplicity and don't fix what ain't broken, I hereby copy-pasta my goals from last year with a low-effort plan! Jokes aside, with potential migration that needs to be accounted for, it is better for me to keep things simple

Similar to the last few years - this is hopefully an easy one to achieve by riding on the savings momentum whilst not over-depriving myself to focus only on saving but forgetting to enjoy life. I oughta to be more specific here as well since I foresee the ongoing momentum to beat down my mortgage extremely aggressively in 2024, coupled with potential one-offs due to migration expenditures.

The 55% Annualised Savings Rate here will be benched against the normalized savings rate to ensure consistency over the last 5 years

I truly enjoyed the 3-weeks break I had this year for a proper holiday. I never thought I would enjoy them. Whilst I'm not sure if I can afford another 3-weeks holidays this year, I'm looking forward to plan for another true holiday, perhaps bringing my mom to Hong Kong (still trying to persuade her otherwise, there really isn't much to see in Hong Kong and she's been there twice already...) or somewhere else?

Beating down my mortgage with additional principal repayments is one of those backup plans - if all else fails, at least that'll be the source of my cushion to allow me enough time to recuperate without being forced to liquidate my investment portfolios. That will be something that I'll continuously work on over the next year.

What's more important tho, perhaps closer to the end of 2024, is to craft a move-out plan with more granularities by further refining my current high-level timelines. I'll need to start researching on nitty gritty so that I won't have to scramble at the last minute to decide where to stay, where to work, submit resumes everywhere hoping to nail a new job in a foreign land, etc.

The next few years would possibly be yet another pivotal moment in my life, if not the biggest one.

Whilst I'm looking forward to changes that I've been eagerly waiting for, I'm equally worried for my future as well.

Truth be told, I've been living in a very comfortable position for far too long. With good pay and a solid career in my hand, at least for the foreseeable decade, I can easily just cruise through another 10 years and based on the forecast I've done previously, I think I would've easily crossed the RM4mil - RM6mil net worth mark, simply just by cruising through life/work.

But I know by now that this is not the life I want to have in the next decade. Maybe it's just the whole "grass is greener on the other side" that I'm feeling right now, that drives me to move out of Malaysia. But maybe it's also true - that the other side can offer me things/status/sense of security that Malaysia never can. One day, I promise to share everything - including the personal motivational factors driving this change for myself and when the time comes, maybe you can be the judge too, and tell me about my decision. Only when the time, after the "D-Day", so that I will not waver.

Throughout the article, you may notice that I've used Ramit Sethi's "Living a Rich Life" reference. Just to call out early on, I am in no way affiliated with him and I don't think Ramit even knows my existence :D. It just happened by chance when I stumbled upon his (video) podcasts on my YouTube Recommendation feed and I loved his method of "budgeting" as part of it resonated well with me, on how to design my "rich life" (the exact life that I want) and budget/spend on it without feeling guilty - something that I've been experimenting with but struggled to find the perfect way around it.

At least, this is one of the puzzle pieces I've found that may or may not solve what I want to achieve in the long run - to design and own "My Rich Life". I know what I'm going for, and I'm also aware of the risks ahead of me. At the end of the journey, I may potentially take some hit in my financials, or even lose all of my decades' worth of hard work resetting back to zero (or at worse, negatives). But I still want to try - at least that way, I won't be stuck in a position of guilt & regrets for not trying in the future.

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

Cheers,

Gracie