I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

I promise today's update will just be a short one - just wanted to give everyone a quick update since my last post in December 2023.

Life's been treating me good so far - that I managed to snag some IU concert tickets for myself & friends to finally attend her upcoming 2024 IU H.E.R. WORLD TOUR CONCERT IN KUALA LUMPUR. Expensive, yes. Probably one of the few artists/singers whom I'm willing to splurge on concert tickets ❤️

As committed last year to my 2024 Goals, I've also finally made plans and booked my hotel & flights for my upcoming holidays in Taiwan. Things were happy & well until the recent news hit on Hualien's Worst Earthquake in 25 years (that's where I was planning to go). Fingers crossed for the victims, and hopefully, the casualties are minimized.

Now, going back to our usual monthly update for my finances and portfolios.

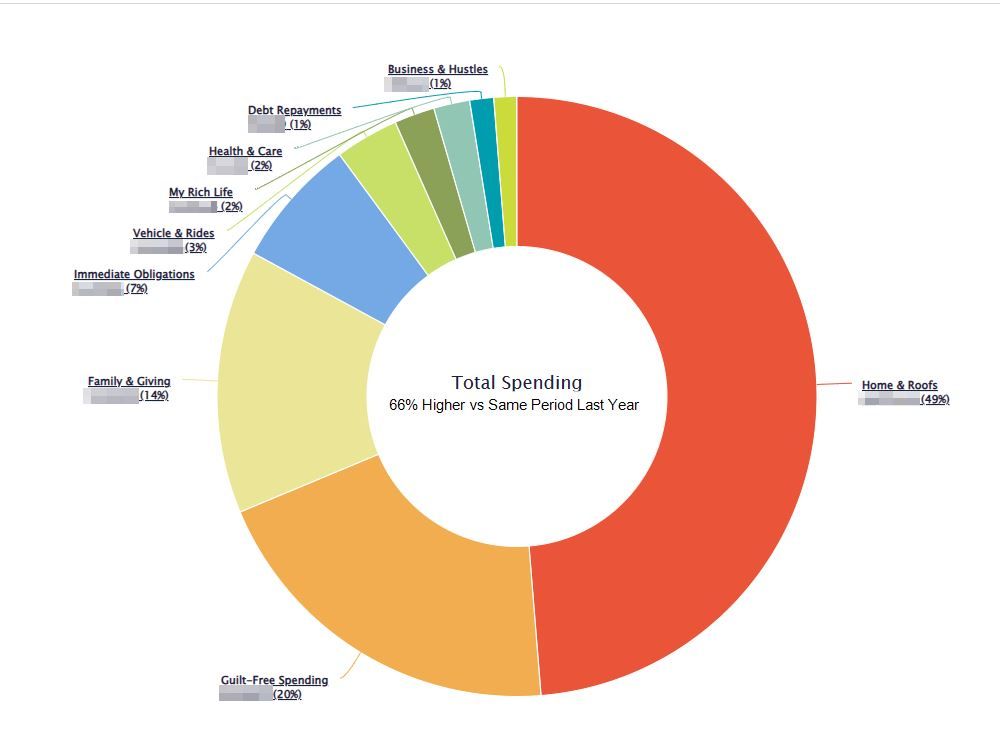

I've spent 1.66x more compared to the same period last year - but this is primarily driven by the aggressive repayment plan that I've started since last year on my Home Mortgage Loan - as I'm trying to de-risk as much as possible considering my upcoming migration plans. Better to leave with minimal debt so that I have a fall-back plan back home. I'll probably detail more on this topic when if I finally decide to write about my migration plans.

Additionally, the commitment to the holiday plans required me to book some of the costs in advance (i.e. flights & hotel bookings) - which also contributed to the increase in my expenditures. As for the rest.

There were a few other spending within my budget limits - but mostly rounded off by the two biggest expenditures above so I won't be going through them.

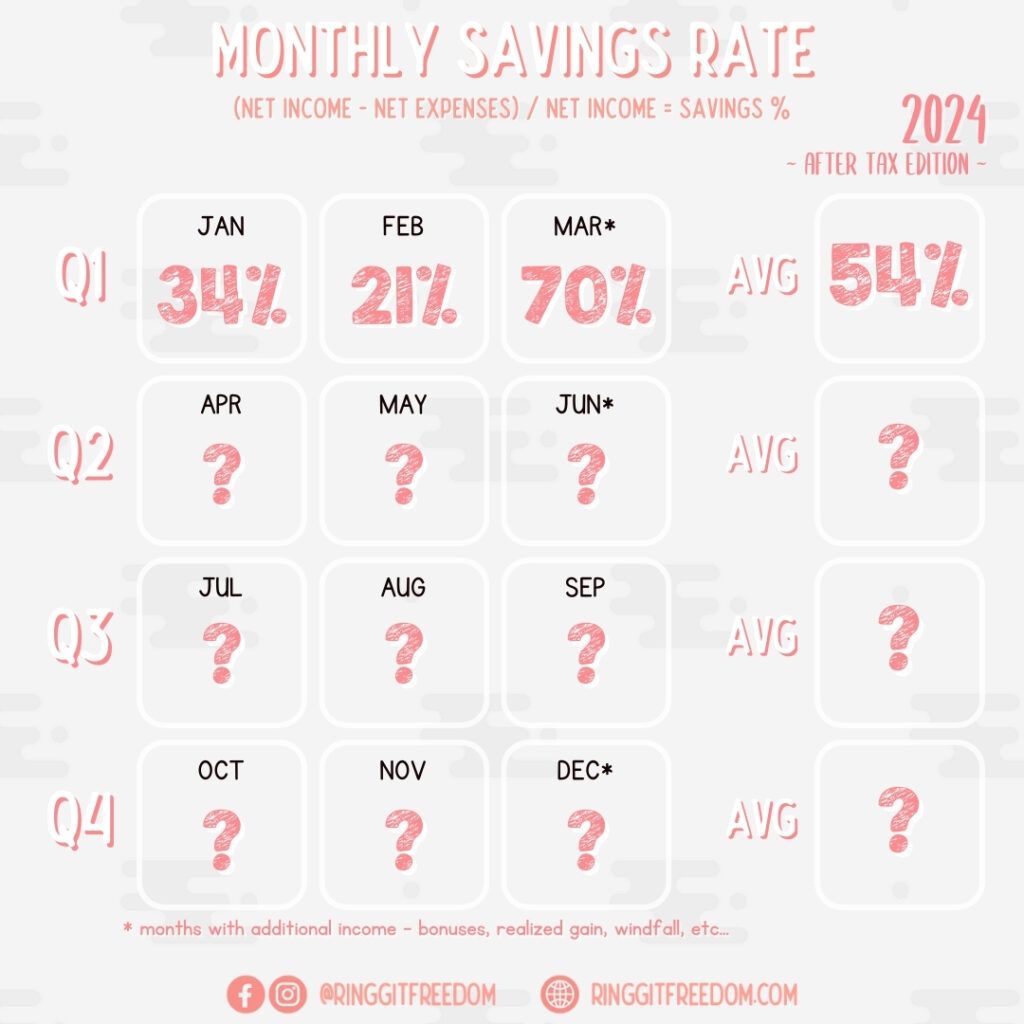

2024 is probably the year that I will be setting a new trend of savings rate for myself. Considering that more than half of my budget was allocated towards aggressive mortgage payments, my savings rate is impacted since I actualised the mortgage payments in my budget file ahead of payment schedules.

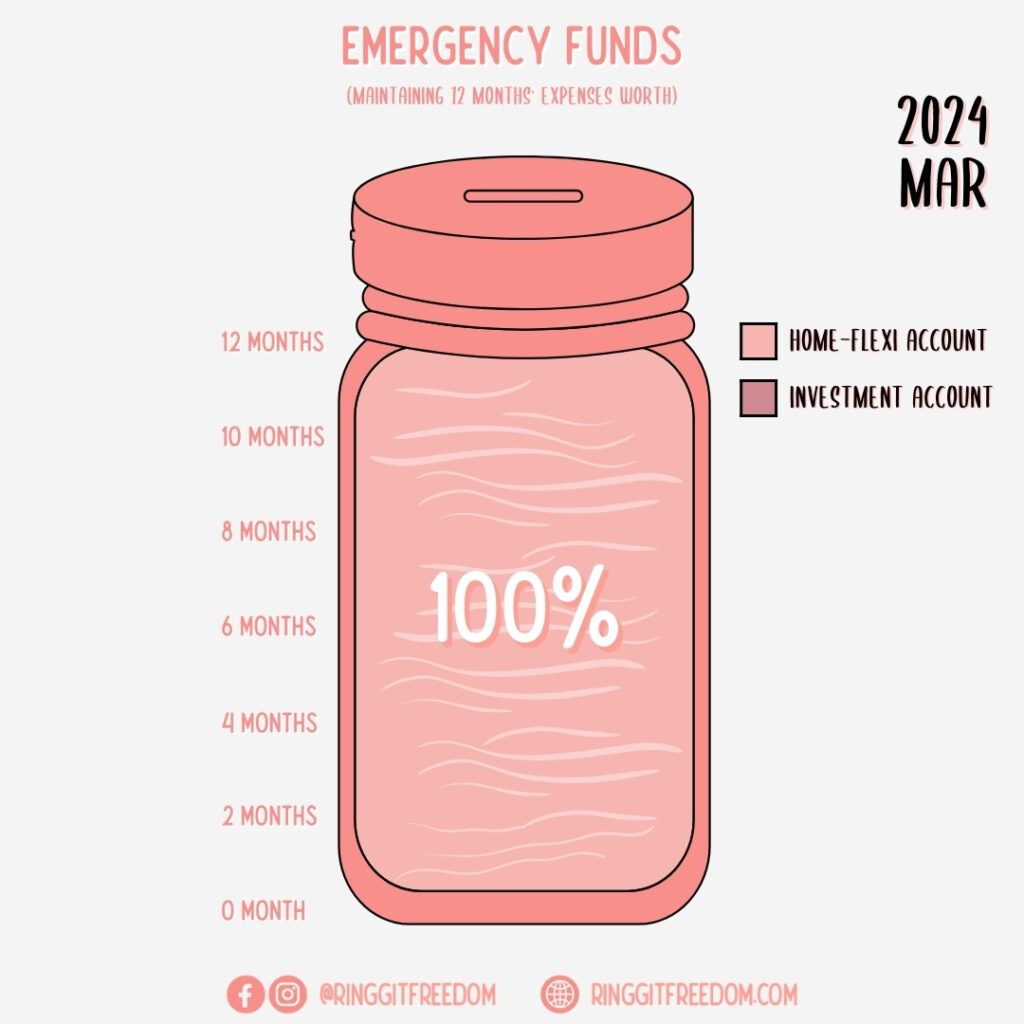

Nothing changed here - I'm still holding onto my 12-month emergency jar for the worst-case scenario (or opportunities) that may arise. Considering the ever-depreciating MYR currency, I'm definitely considering moving it from my MYR Home-Flexi account (approx. 4.5%/annum) to overseas FD with stronger currency (Maybe SGD?).

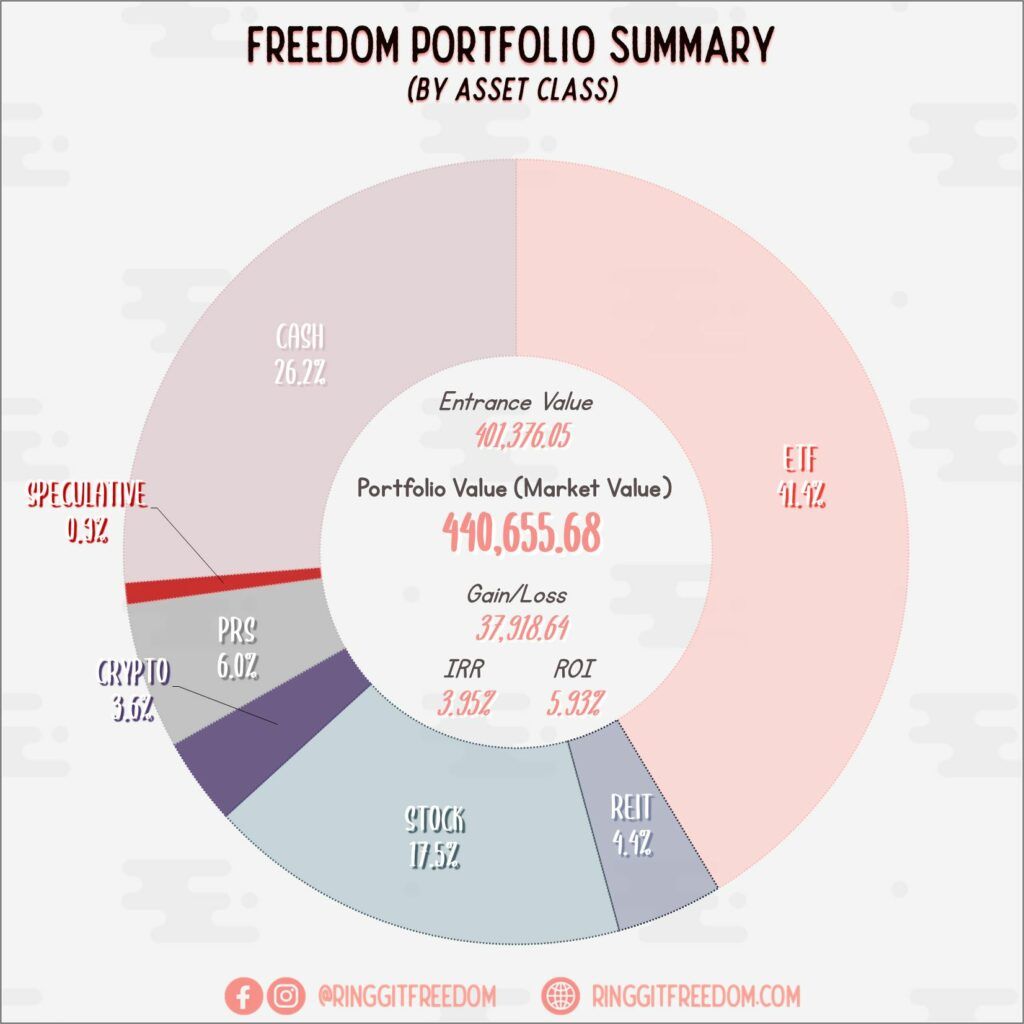

I'm definitely happy with the ongoing upward trends both in the world of Cryptocurrency and US stocks. After approximately 3 years of depressing returns, I finally get to see some upticks in my overall portfolio. How long will this last? I don't know. Will just keep riding the investment wave.

One sad thing that had happened to my portfolio tho - two of my individual stock picks had either went through the process of delisting or privatisation, forcing me to sell my stocks and effectively locking in the losses in my portfolio permanently.

Lessons learnt: I am not suitable to pick individual stocks, value investing or not.

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 1.83%

ROI: 2.62%

Profit/Loss: RM5,012.29

Active (Invested) Portfolio

IRR: 4.87%

ROI: 7.25%

Profit/Loss: RM32,906.36

True Cost: RM420,145.23

Total Value: RM512,575.98

Entrance Value: RM401,376.05

Portfolio Value: RM440,655.68

Nett Dividend (2024): RM653.62

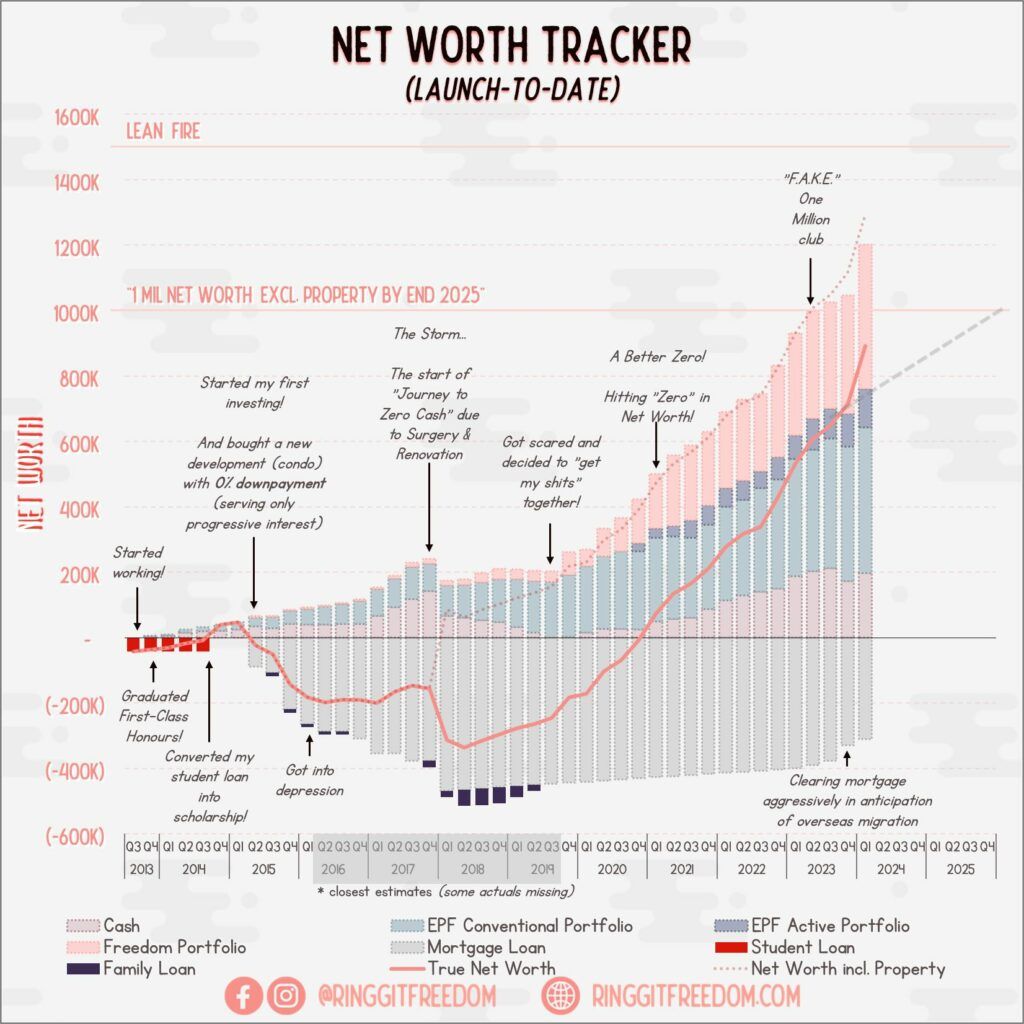

With all that said - my net worth jumped quite significantly this quarter thanks to the surge in Portfolio Value, the release of KWSP Dividend 2023, as well as my windfall gains in March 2024. So far, I am still on track towards my goal of achieving 1 Million Net Worth by 2025. 🤞🏻

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie