I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

Decided to do a mid-year checkpoint for this year since it has been almost half a year since I last shared an update on this blog (the quarterly numbers update at My Portfolio aside). Good time for me to also review my financial state since I've been sidelining it for a while.

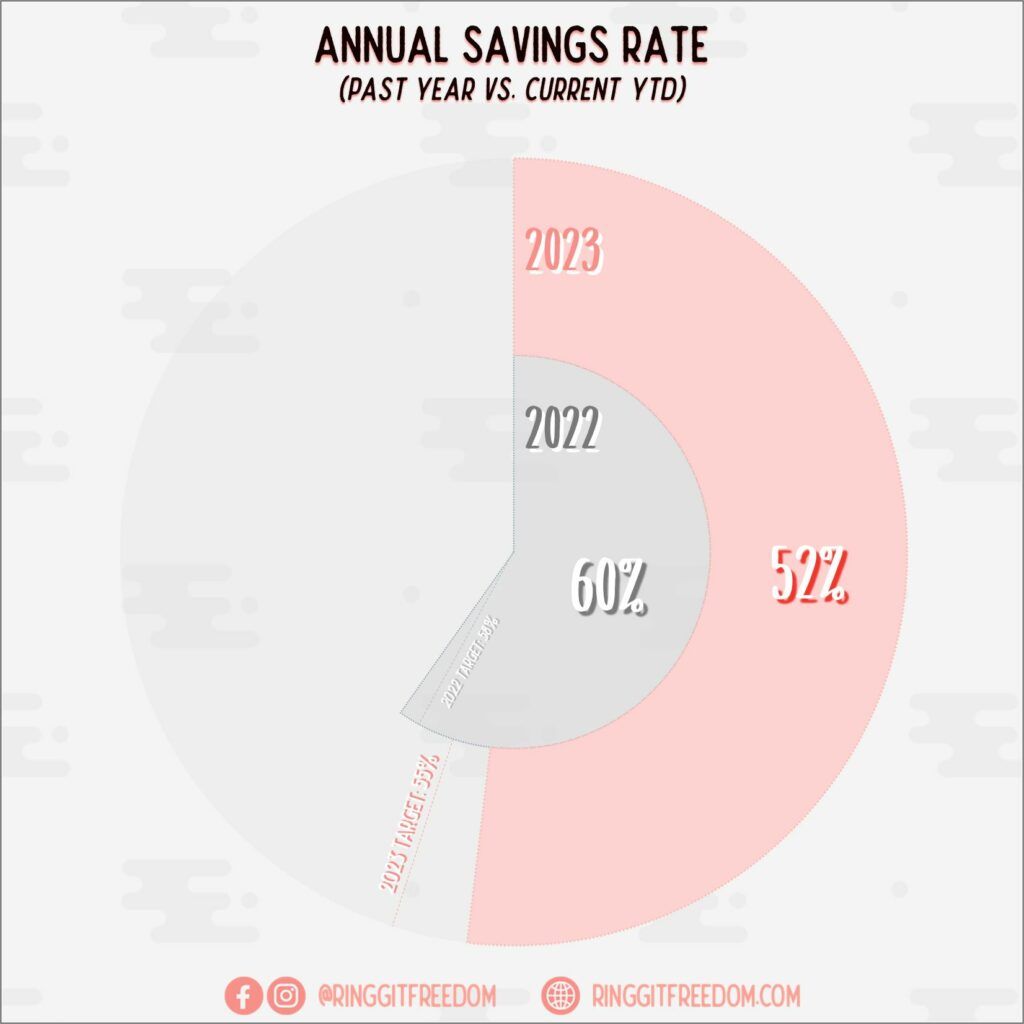

Sometime around the end of last year, I decided that I will be taking 2023 slow and set almost zero achievement-oriented targets except for the annual savings rate. That actually worked well in my favour as it tremendously relieved me from the constant pressure of "I have not done this and that and that yet!", reducing the feeling of guilt and providing me the headspace needed to recalibrate my goals.

Whilst I won't deny that the year thus far has NOT been hustle-free even by slowing down (I actually achieved more), the switch of mindset from "I need to do X because I have to hit my targets" towards a more self-motivated "I need to do X because that's what I want and it aligns with my long term goals" actually helped me to achieve goals, or rather, drag my feet towards the right direction towards my goal, to say the least. One example is - I've finally gotten the PMP Certification which was long overdue since last year. Do I really want the cert? Maybe. But will it help with my long-term goal? Definitely. More on in the next sections later.

Sometime in mid-Feb to mid-March of this year, I finally acknowledged that my source of burnout last year was caused by several things - one of them being the constant pursuit of career growth whilst ignoring the fundamental sense of belonging/sense of freedom that I've always wanted. Don't get me wrong, the career growths that I've got are what got me here today, closer to the financial freedom that I've wanted. But I've come to realize and acknowledge the fact that financial freedom is only one of the many pillars in life that I want to have and they're not the single source of truth. Neither do careers.

Whilst I don't have the complete answer yet to what I want to achieve in the end, one thing that's clear for me is that I need a change. A change of environment - for the better or for the worse. I've always wanted to have a taste of life living overseas, outside of Malaysia where fundamental human rights are guaranteed even for the minorities, protected by the legalities unlike here back home. But I haven't been making hard progress, to take the actual steps forward, toward this goal and sadly I've only come to realize/accept it now.

The good thing is, I've finally started to take my baby steps forward to prepare for my migration to Australia. Will life really be better there? I don't know. But how else will I find out other than actually trying it? That's where the earlier mentioned PMP Certification helps me as it provides me with a baseline on jobs that I can potentially secure, at a bare minimum level.

Maybe I'll write a dedicated post on this topic someday, sharing the ups and downs of my journey towards this step, when I'm closer to achieving it. As of now, I'm barely starting and there are plenty more hurdles ahead of me. Let me know in the comments if you'd like me to write on this topic! If there's one thing I want myself to take away in the first half of this year - slowing down actually worked in my favour. Remember that, Gracie.

Now, let's go back to our half-year checkpoint for my finances and portfolios. Since I no longer post updates on a monthly basis, I've decided to tweak the format a little so that I can cover the first half of the year more comprehensively.

My savings over the last few months have been taking a hit really, especially since April. For the first time ever, I had a negative savings rate - to the point that I had to revise my Excel Template to be able to generate my monthly savings trendline without breaking major graphical components 😅

I don't have any other excuses other than poor control of my impulsive behaviour under stress. More details on the spending right next.

Will I still hit my target savings rate this year? I don't know - let's see. Only time will tell.

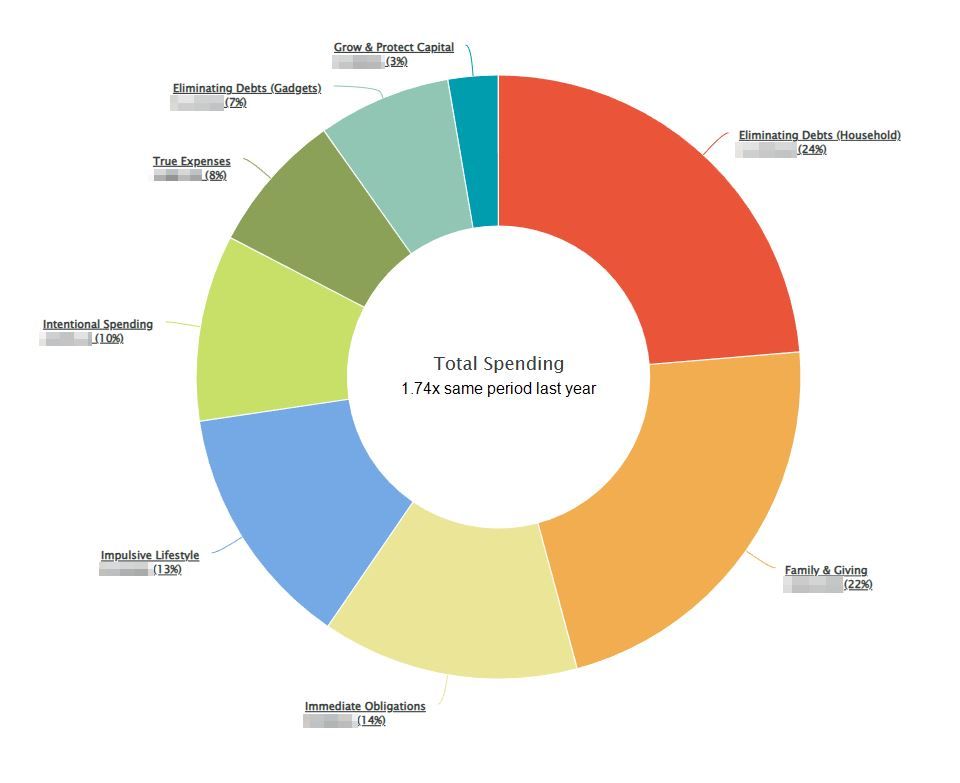

I had to analyse my spending behaviours during the first half of the year when I was preparing to write this blog post. Whilst I was aware that I have been spending a lot recently, even the amount shocked me. I spent 1.74x more than last year when comparing the same period.

Approximately ~18% of my expenses during the first half of the year were spent on gadgets & games. A new VR fitness headset, a new graphics card for my computer, and some games/game credits purchase here and there. Also, I decided to write off my iPhone purchase last year and recognized its remaining balance expenses in full rather than the original plan to divide it across 36 months till Sep 2025 (due to 0% instalment plans).

What's not helping is also the dip into emergency spending occasionally when my extended family had injuries/emergencies requiring some help; big wedding ang-pao for one of my closest friend's marriage; and also the miscellaneous costs associated with my Australia migration journey. I'll have to keep a tighter belt, hopefully, over the next few months, and try to respect my zero-based budgeting principles (rather than spend and pray).

On the bright side - part of the major expenses are also spent towards my 2023's Goal and Objectives - to travel overseas for holidays.

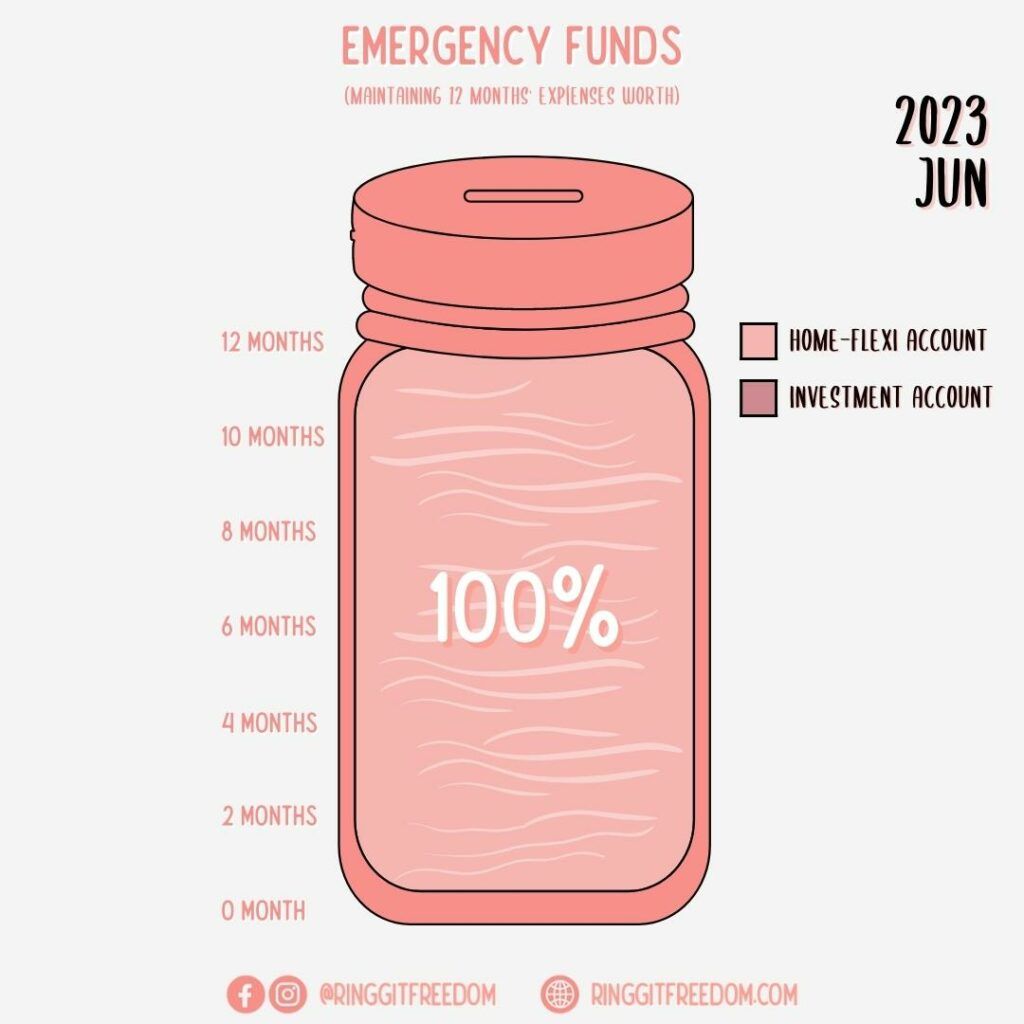

Despite dipping into the Jar quite recently sometime in Feb/Mar, I managed to top it back up to 100% of my funded amount by the end of this month, keeping myself and my family protected from unforeseen events.

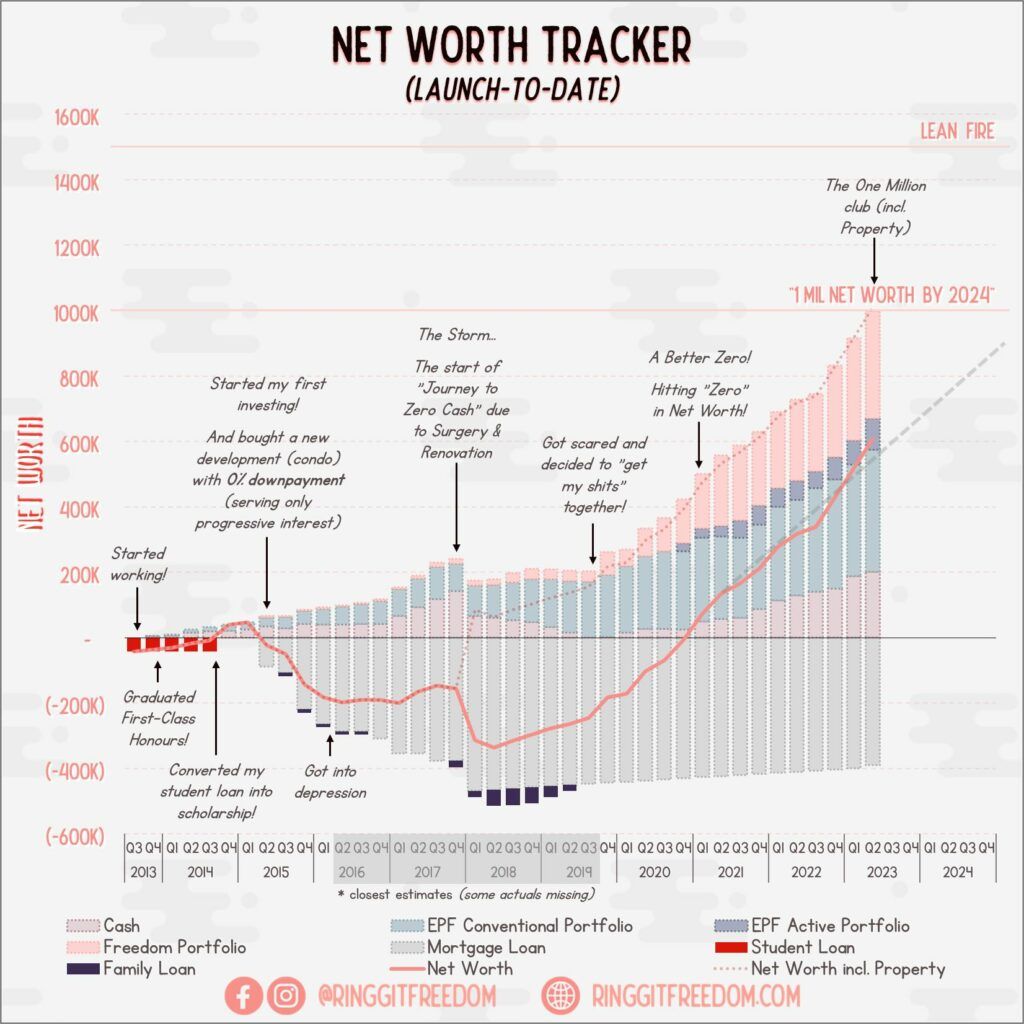

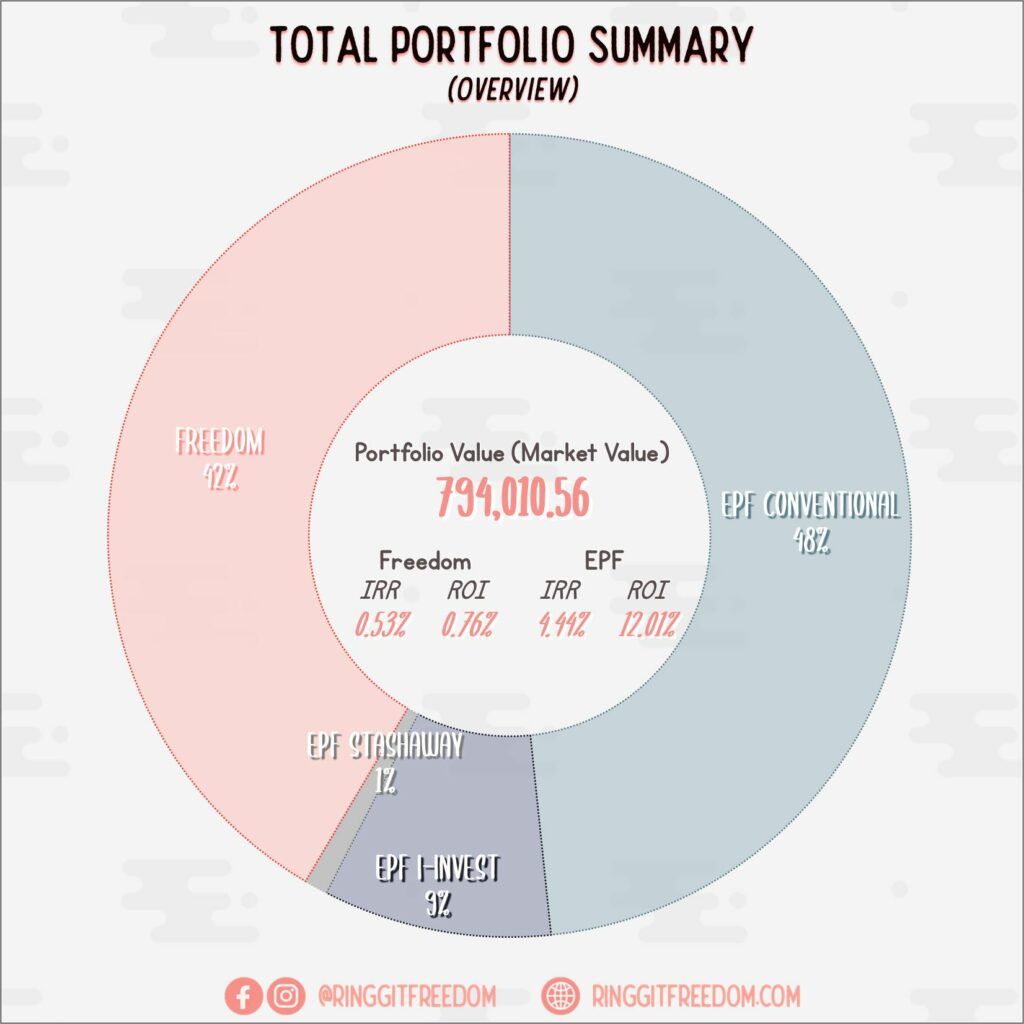

A quick snapshot of my net worth - having crossed the MYR 600K mark (or 1 million mark, if including the stake in my own-stay property). Am I proud of how far I have come compared to 10 years ago, being broke and poor? Definitely. But as I've come to the realization - financial freedom is only one of the many pillars in life that I treasure, and should not be the only thing that I blindly pursue (through career growth).

I will still definitely celebrate this moment (perhaps I have already done so - through the various "impulsive" spending behaviours the last couple of months); but I don't want to make this the only thing in life that I'm living for.

Also for those of you new here - you may be wondering why I explicitly exclude my own-stay property when calculating my net worth. The answer is simple - basically, the property generates many of the expenses/liabilities with no ability to generate income, tying my cash flow down – a concept popularised from Rich Dad, Poor Dad by Robert Kiyosaki.

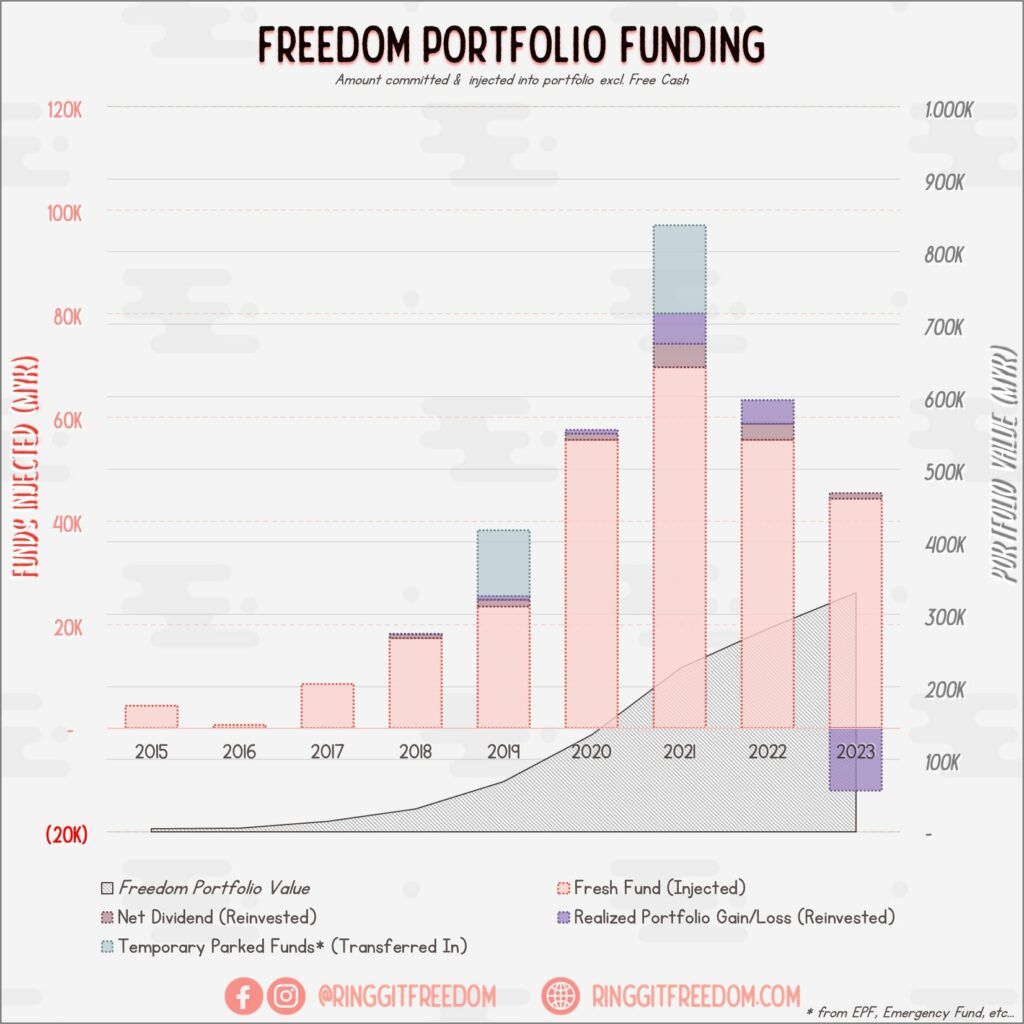

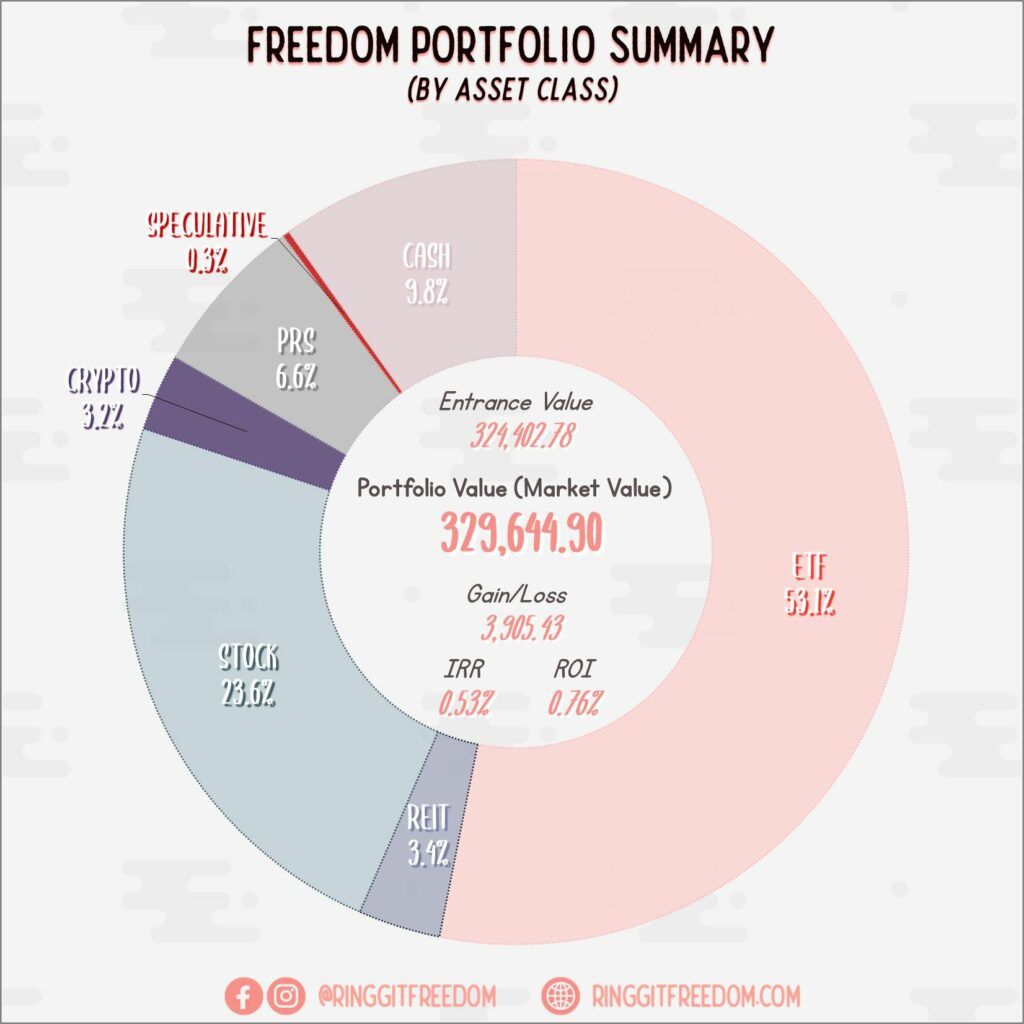

Truthfully, I did not pump in as much of my free cash flow into my Freedom Portfolio as I have initially planned for. I have slowed down the investments in my Freedom Portfolio and started diverting some of them to cash-ready assets - either as a sinking fund to pay down my mortgage in the near future or as a seeding fund for my upcoming migration to Australia. Knowing that I'll be needing lots of liquidity sooner than anticipated, I kept most of my cash in my full flexi mortgage account so that it is ready for use when needed.

To offset potential currency fluctuations (looking at you, MYR), I have also started to convert some of it into SGD/AUD when the exchange rate is in my favour (though rarely).

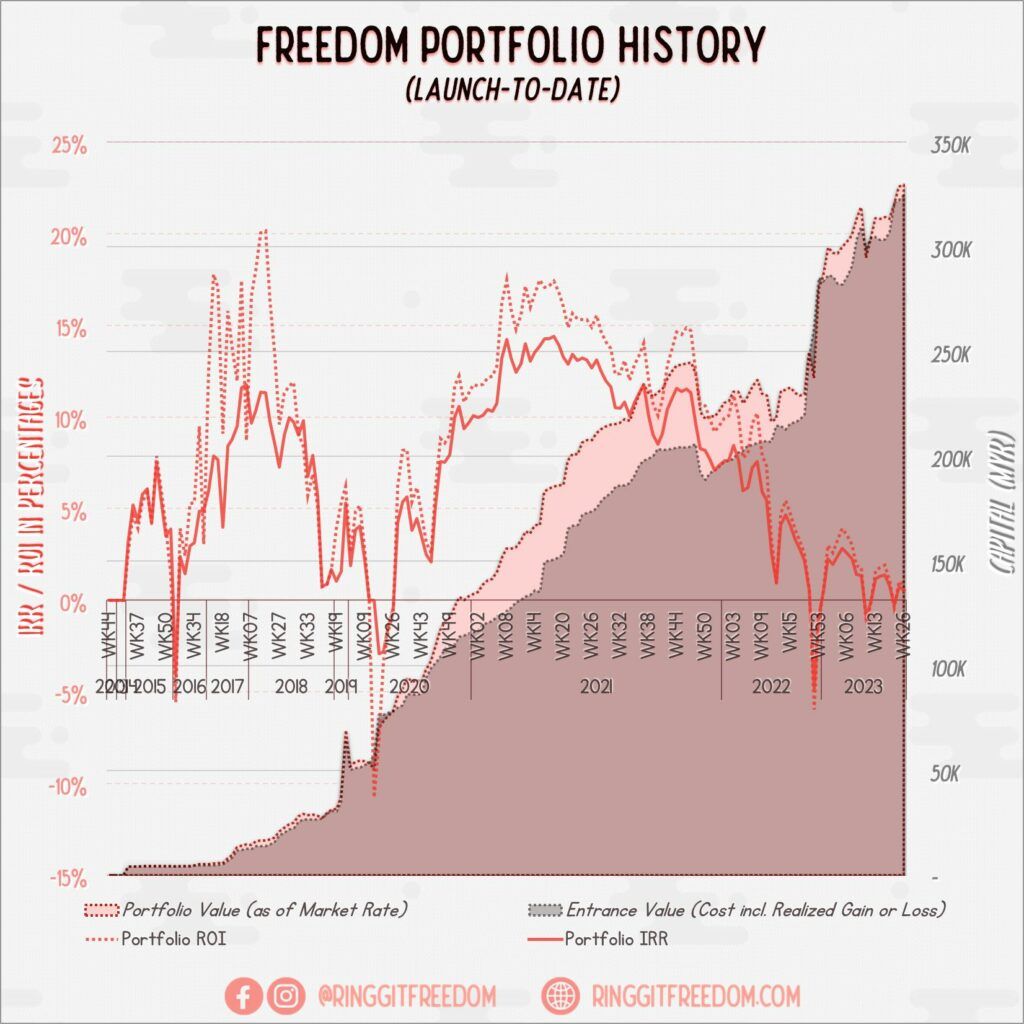

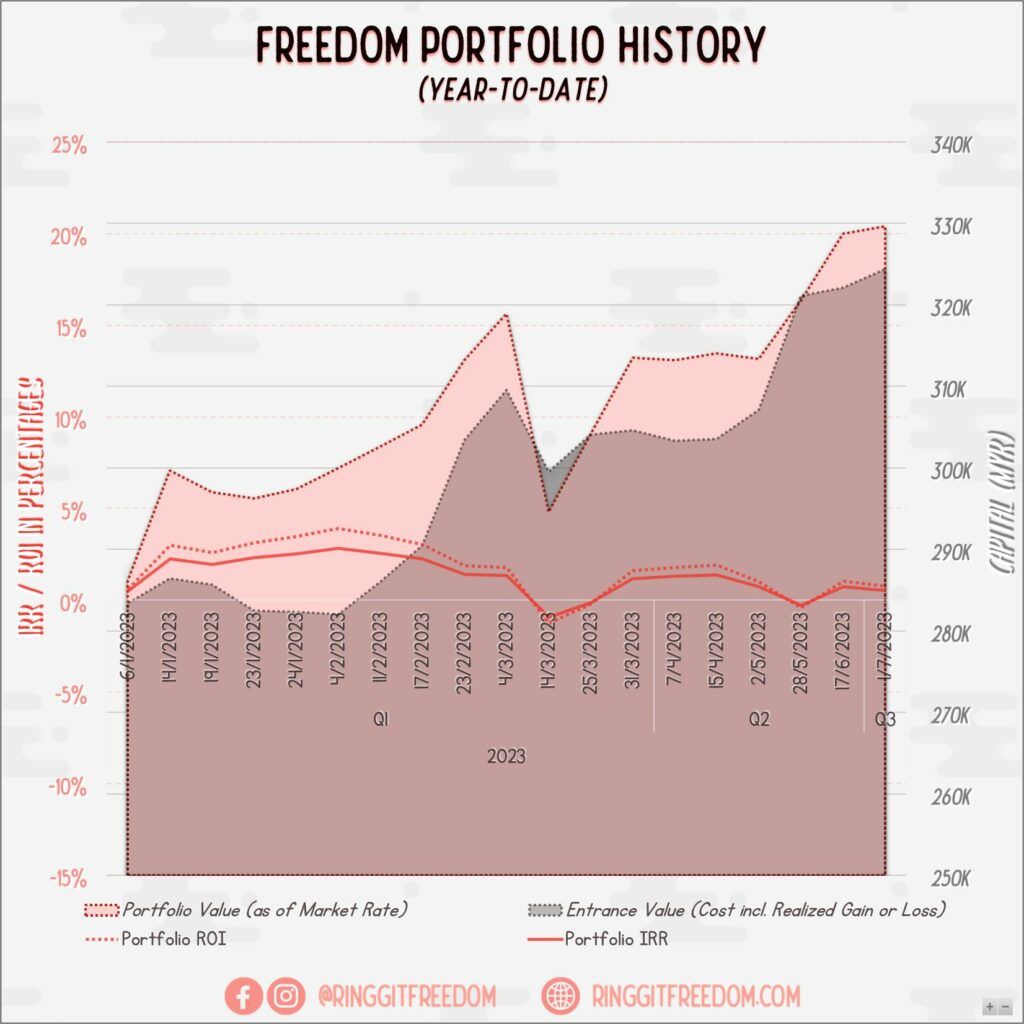

Overall, the portfolio still sits mostly near the zero zone, fluctuating between the +/- 2% range. It'll just be a slow year, or even decade, I guess.

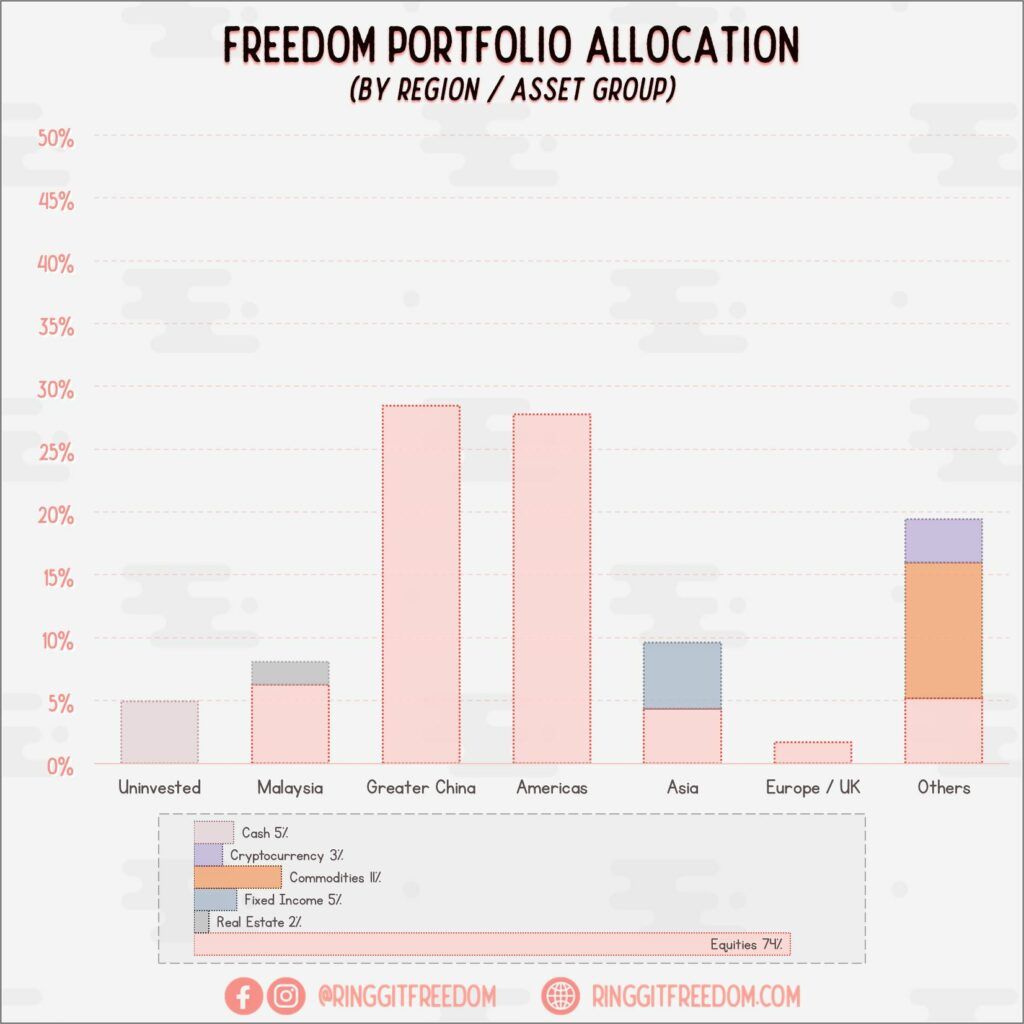

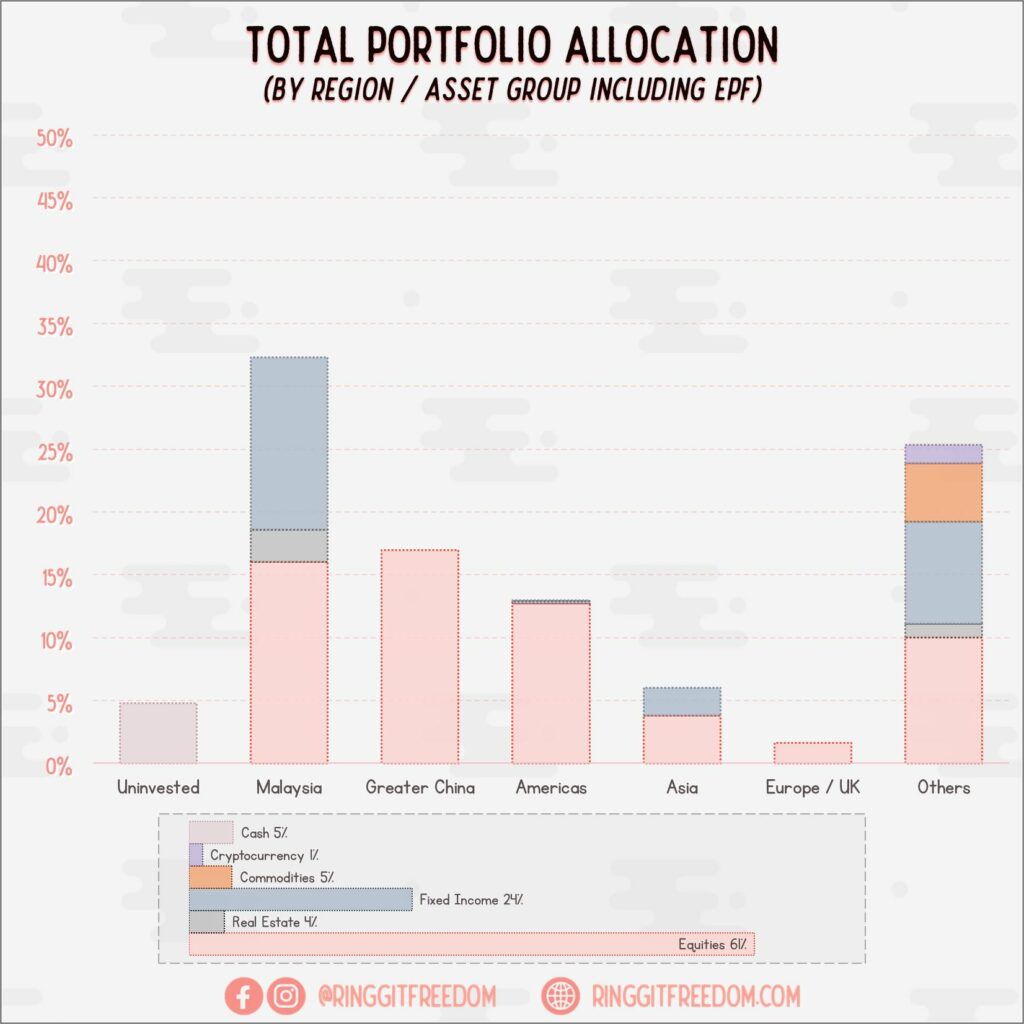

When looking at my portfolio allocation both inclusive or exclusive of EPF portfolio - I definitely have a higher allocation towards the Commodities (mainly Gold ETF) and Fixed Income (mostly SGD Fixed Deposit) market as a hedge, as compared to my all-in onto Equities market the last couple of year.

This could end up being a wrong decision on my part, fuelled by emotions (worry & fear), but that's what I need to feel comfortable with the ongoing volatility considering the huge expenses coming my way - potentially requiring way more liquidity than anticipated.

Perhaps - it is also the thought of potentially losing my current high-pay job, though voluntarily, to go on a new adventure, that freaks me out. Knowing that I will definitely quit my high-paying job soon - only question is when and how.

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 5.34%

ROI: 8.01%

Profit/Loss: RM10,410.10

Active (Invested) Portfolio

IRR: -(1.17%)

ROI: -(1.81%)

Profit/Loss: -(RM6,504.67)

True Cost: RM350,592.79

Total Value: RM360,596.13

Entrance Value: RM324,402.78

Portfolio Value: RM329,644.90

Nett Dividend (2023): RM1,126.61

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie