I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

March's update came later than usual. I've procrastinated from completing this post since I started drafting it around end-of-March. Took me more than 2 weeks to finish it off, instead of the usual 2 days.

It seems that I'm again in a state of avoiding reality - spending time paralyzing myself in mindless games/videos after work. I'm not really sure why, but it does indeed feels like my brain telling me "enough is enough" - get out of the toxicity if you can't stand it anymore.

I'm earning very well, but I am not happy. Shouldn't I feel grateful instead!?!? And there goes the vicious cycle.

Now, going back to our usual monthly update for my finances and portfolios.

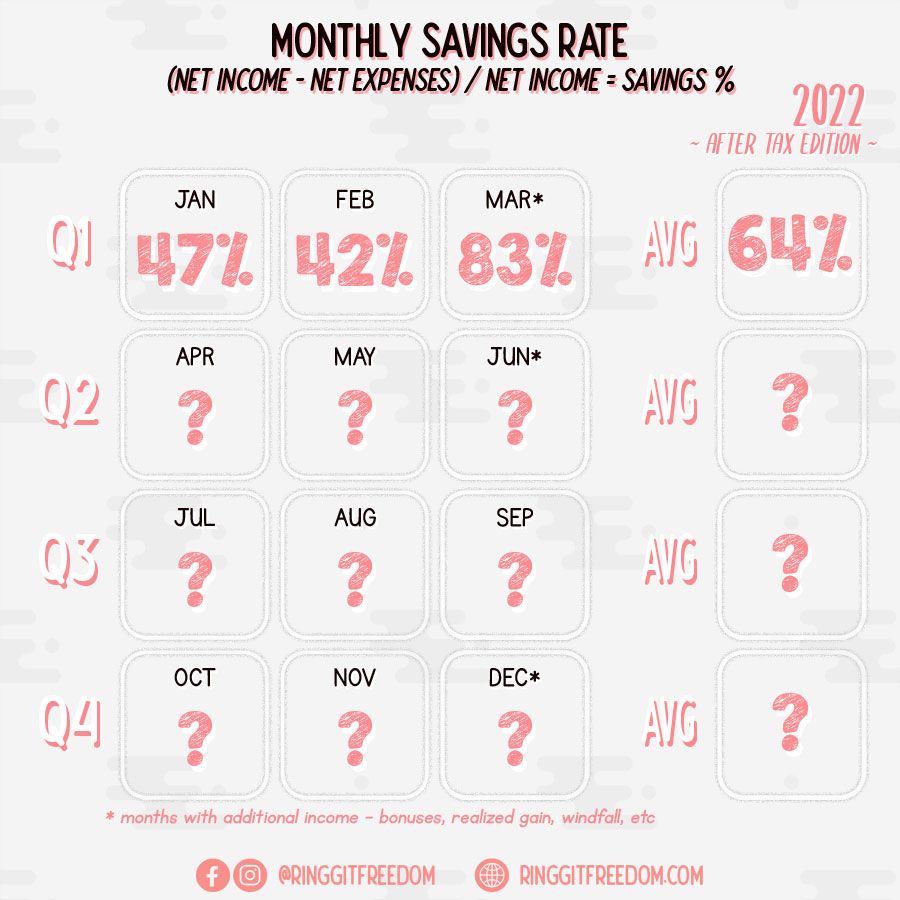

Similar to the same time year, this month's savings rate skyrocketed as I received my annual performance bonus. Yay!

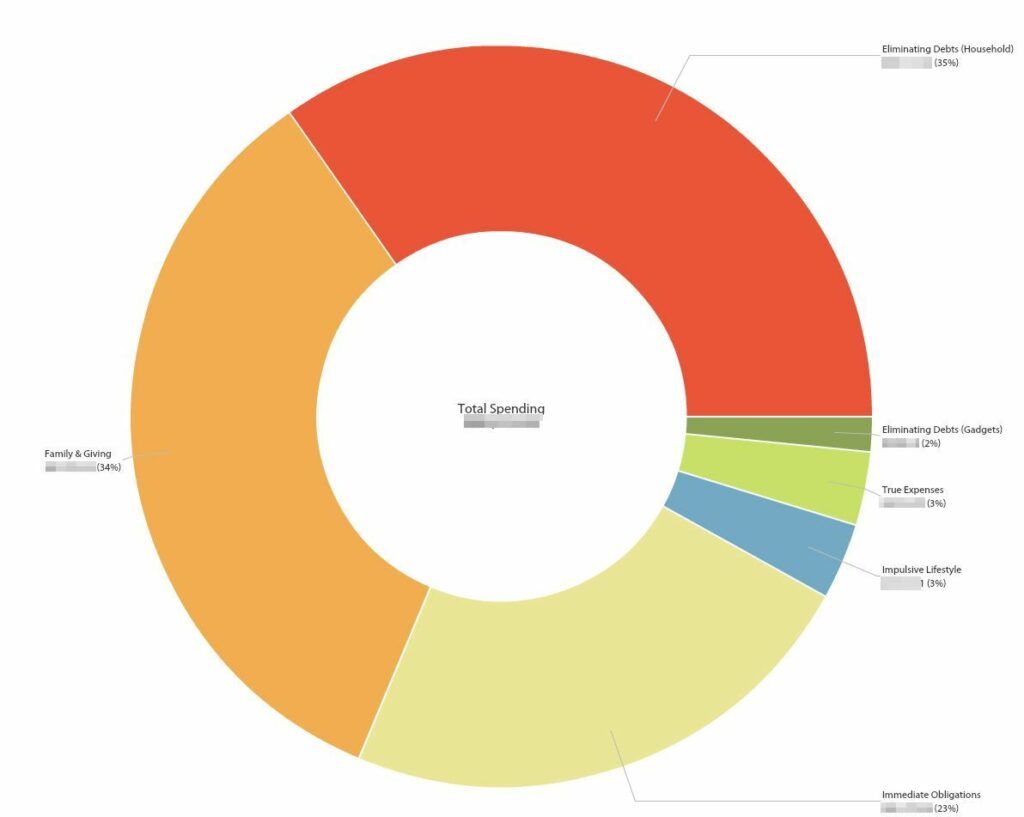

Since I overspent on my gadgets in Feb for my digital notetaking e-ink tablet, I decided to channel all of the excess income (on top of my monthly baselines) to either my investments or savings jar.

This obviously helped as I managed to boost my 12-months jar from the stagnant 73% to 93% achieved. Just a few more months to go to wrap up the jar and refocus back on my investments, hopefully, I don't need to touch the emergency funds anytime soon!

p/s the digital e-ink tablet is really awesome! I bring it everywhere I go now - to write things down both for work and personal. I bought the Supernote A5X for portability and it even has my name engraved on the pen! 😀

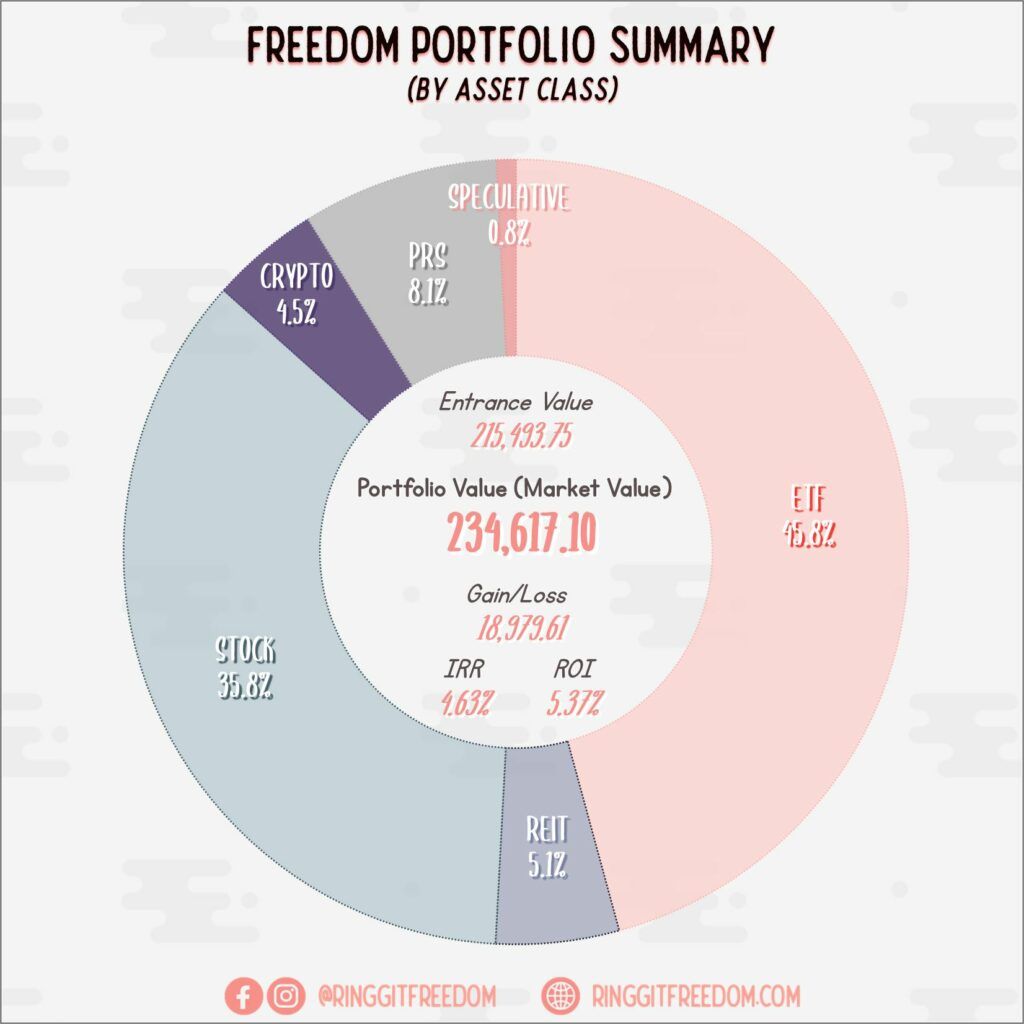

March is definitely an interesting month for my portfolio. Probably one of the few months with large portfolio movements.

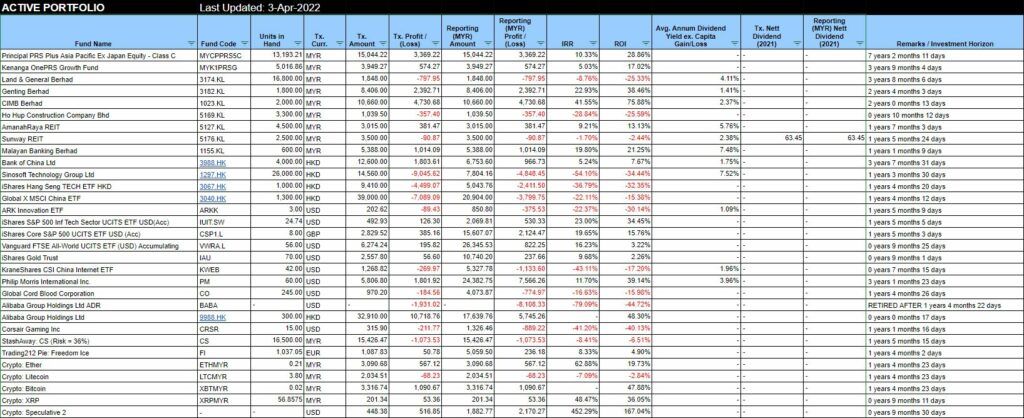

The ongoing crisis happening in Ukraine have sent shockwaves to the global economy, with uncertainties shooting up and this was evident in the early/mid-March where the global stock market took a hit, with some having it worse (e.g. China). Whilst I did not inject much of my fresh funds this month (to focus first on my emergency jar) aside from my typical monthly investment amounts; most of the injection comes from my StashAway relocation.

Whilst the storm of rage against StashAway have calmed down recently, and with their rationale explained during their webcast - "to reduce exposure to the unknown unknown's to realign portfolio's volatility against standard benchmarks"; I still find it a bitter pill to swallow as it goes against my wishes to maintain exposure in China.

Whilst I may be darn wrong in my decision in the long run (who knows, China stocks may never reclaim their glory due to CCP); I still hoped for a little more control in my own portfolio like the previous option where you can choose to opt-in/out from the re-optimizations.

This taught me a lesson that the only way to maintain most of my control is to go full DIY. Whilst this has been on my mind since 2 quarters ago (when my StashAway portfolio exceeded the RM30K mark, just nice for Wise's maximum allowable transfer size), I have been putting it off as I was lazy to execute my market exit & re-entry with minimum gap time so that I don't miss out on market opportunities by not "being there in the market". This KWEB-exit drama was the final nail to the coffin after the many rounds of re-optimization in a year.

You'll probably see it already in my portfolio, but my approach was quite straightforward where I split my funds withdrawn from StashAway 30% Portfolio into mixture of VWRA (All World ETF), 3040.HK (China ETF), and IAU (Gold) at a 60:20:20 split respectively.

Will I lose out more in the end, if StashAway's decision outperformed mine? Maybe. But will I regret it? Probably not - as I will have better sleeps at night knowing that my portfolio will be as lazy as I am - to sleep through the cycles.

While I won't go too deep into the how's of the entire withdrawal / re-investment process, I'd still like to shout out a few things that really helped to make the transition process a smooth one:

Having said all that, I am still not 100% out of StashAway. Whilst I will stop my DCA onto StashAway going forward (and only DCA-ing straight into my IBKR account), two of my small portfolio started last year (worth approx ~40%) will still remain in StashAway, just in case if I'm wrong 😉

About the same time with the StashAway-KWEB drama and also the Ukraine Crisis sending China stocks down south, there were also plenty of hoohahs going around the risk of China's stock getting delisted (including BABA). Since the price is darn low at this point (15 March), I decided to "swap" my Alibaba stocks from the US-listed BABA to Hong Kong-listed 9988.HK.

Unfortunately, I found out later that whilst IBKR supports the ADR Conversion Process seamlessly, the price tag is huge and we need to pay $500 US to convert ADRs into the secondary listings. This does not make sense for a small retail investor like me unless you are managing a multimillion portfolio. But I still wanted to do the swap with or without going through this ADR so I've decided to do it the classical way: to sell my BABA (hence realizing my losses) and quickly buy 9988.HK (starting another "portfolio").

Whilst BABA and 9988.HK are pegged at 1:8 ratio, where price gaps between the two are usually neglectable. At that point in time, I hold approx. 29 units of BABA which is equivalent to 232 units of 9988.HK.

Question is - "how do I minimize my potential unexpected losses/gains considering the market fluctuation at the time, especially when China stocks are going up (or down) by 10% +/- on a day-to-day basis?"

This is where my IBKR Margin Account saved my day, AGAIN!

Firstly, I made a buy order closer to the end-of-day Hong Kong time, for 300 units of 9988.HK at the price of 73.8 HKD each. This equates to buying BABA at approx 75.39 USD if we follow the 1:8 ratio between BABA:9988.HK.

After about 3-4 hours later, I made a similar market sell order at the start-of-day US time, on my existing 29 units of BABA at the price of 75.4 USD. Net-net, I did not lose any of my portfolio's worth other than paying approximately $10 US in transaction/currency conversion fees. Whilst it is still a risky move - as anything can happen in 4 hours nowadays, this is the best I could do to save $500 US.

As a matter of fact, BABA's price shot up from ~$75 to ~$100 the next morning so I literally dodged a bullet there. The best time to do these kinds of sell-and-buy is when markets are stable, but desperate time calls for desperate measures I guess. Been wanting to buy 9988.HK instead of BABA but the minimum 100 lot per transaction is not wallet-friendly at all :'(

This is still a work in progress (a long way to go) - but I decided to further simplify my portfolio as I did not have much time to track & manage my portfolio, especially the individual-stock picks. Over the next few quarters, I'll be trimming down my portfolio to only ETF's and selected dividend stocks, slowly selling the rest away (so that I have less things to monitor/worry about).

Surprisingly, EPF declared a 6.1% dividend for 2021. Yay to that!

Could've gotten most of it if I hasn't diluted part of my EPF's onto international funds as part of my portfolio rebalancing last year, but no regrets there as it was a conscious decision made. EPF, even after excluding the divested funds, are still making the majority in the totality of my portfolio (EPF Fund + Personal Freedom Fund).

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 6.31%

ROI: 9.50%

Profit/Loss: RM9,524.27

Active (Invested) Portfolio

IRR: 3.62%

ROI: 3.72%

Profit/Loss: RM9,455.35

True Cost: RM250,339.60

Total Value: RM260,048.17

Entrance Value: RM215,493.75

Portfolio Value: RM234,617.10

Nett Dividend (2022): RM 283.07

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie