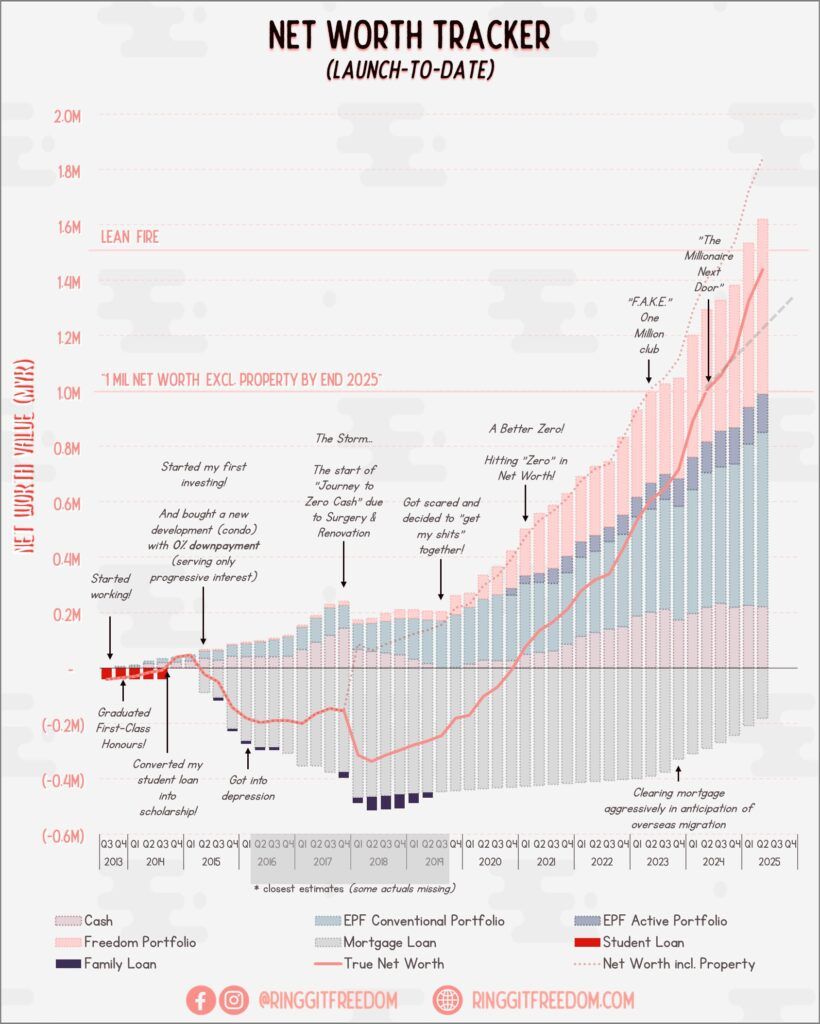

I'll be tracking my net worth growth here on this page, since the reinstallment of my "personal finances" mindset in late 2019 following my story here.

My net worth formula will EXCLUDE my primary residence that I’m staying in, in the essence that it generates all the expenses/liabilities with no ability to generate income – a concept popularised from Rich Dad, Poor Dad by Robert Kiyosaki.

I am happy to share that officially since June 2024, I have acquired my long-awaited "The Millionnaire Next Door" status for myself, joining many other millionaires in Malaysia and something that I've never thought that I'd achieve in my life.

Though, if we've ever crossed paths, I look like your typical next-door neighbour just enjoying her meals at any other random Kopitiams with affordable and most importantly, tasty foods and surely I won't go around broadcasting my balances. Which was why I insisted on maintaining my anonymity for safety purposes.

When it comes to tracking my investments (personal / EPF), with the market fluctuations everyday – it is almost impossible to track my net worth in an efficient manner.

Hence for my monthly monitoring, I solely rely on my YNAB budget data which captures only the invested amount AND realised gain/loss. In short, my net worth ignores market fluctuation until I actually realised the gain/loss OR during my annual review exercise (where I review my financial health in a more comprehensive manner).

I know it may not be in line with accounting standards – but I’m just more comfortable with this net worth formula as it does not feel inflated and also less work for me to “update” my budget - take this as the more conservative approach in estimating net worth.

I know some of you would prefer to use the standard accounting principles to include Property value in Net Worth Calculation - if so, just add RM400K to my Net Worth Value below as I only have one property in my name today.