I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

February, is also the month of the Lunar (Chinese) New Year where we get to celebrate with our family members and of course to get Angpaos! Fortunately for our family, we don't really have to travel outside of KL to balik kampung (returning to hometown) since the kampung (hometown) technically is where I'm staying now with my mom.

We used to go back to Dad's kampung when he was still alive decades ago but since his passing and not too long later, Grandma's passing; I stopped returning to Dad's kampung as my mom refused to go back (due to family dramas/conflicts - pretty normal stuff I guess) and I didn't want her to celebrate the Reunion Dinner alone every year.

Fewer Angpaos (Red Packet) for me I guess! Speaking of which, I typically don't open my Angpaos until a few years later anyway - always nice to find some spare cash sitting around since I was young 😛

At the very least, I was able to at least take a few days' worths of break and distance myself away from work, even if it is just for a little while. Managed to complete one of my long overdue to-do lists as well - visiting my sisters' place to complete the gaming PC setup for her (backstory: I decided to give away my underutilised old rig to my sister since I have only been using my new rig. Annyeong, my old rig!)

Now, going back to our usual monthly update for my finances and portfolios.

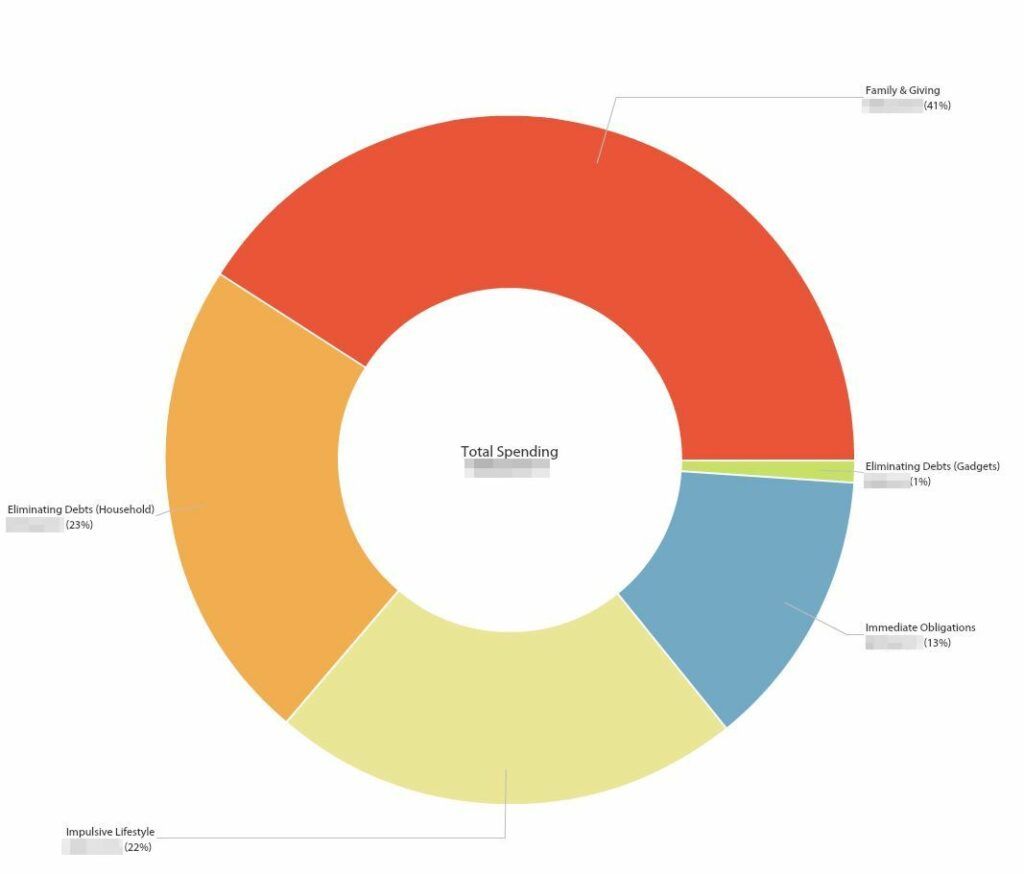

Spent a little bit more for my family this month as I decided to follow the past years' trend of giving my mom some extra "pocket monies" during the Chinese New Year (she prohibits me to call it Angpao since I am not married yet 🙄🤣).

Initially, there isn't much spending on my personal account in February as I stayed home most of the time - avoiding the Omnicron wave as much as I can 😛

But again, impulsively, I set myself on a purchase of an E-Ink Notetaking tablet (Supernote A6x, for those who're wondering) to replace my paper books and try to re-organise my life a little especially with the chaos happening at the workplace. Ironically, another push factor for this was that a digital tablet can easily be cleaned using sanitiser wipes (unlike real papers where I can't really "wipe" it without destroying the paper. Germophobia much!?)

Frankly, I tried a few different alternatives - like PostIt Notes, Digitally "Typed" Notes, Pictures/Photos, To Do Lists, etc. but nothing beats writing things down (even when generating ideas). But paper's a real headache when it comes to organising stuff once you run out of space (unlike digital notepads where we can still "move" things around after writing it).

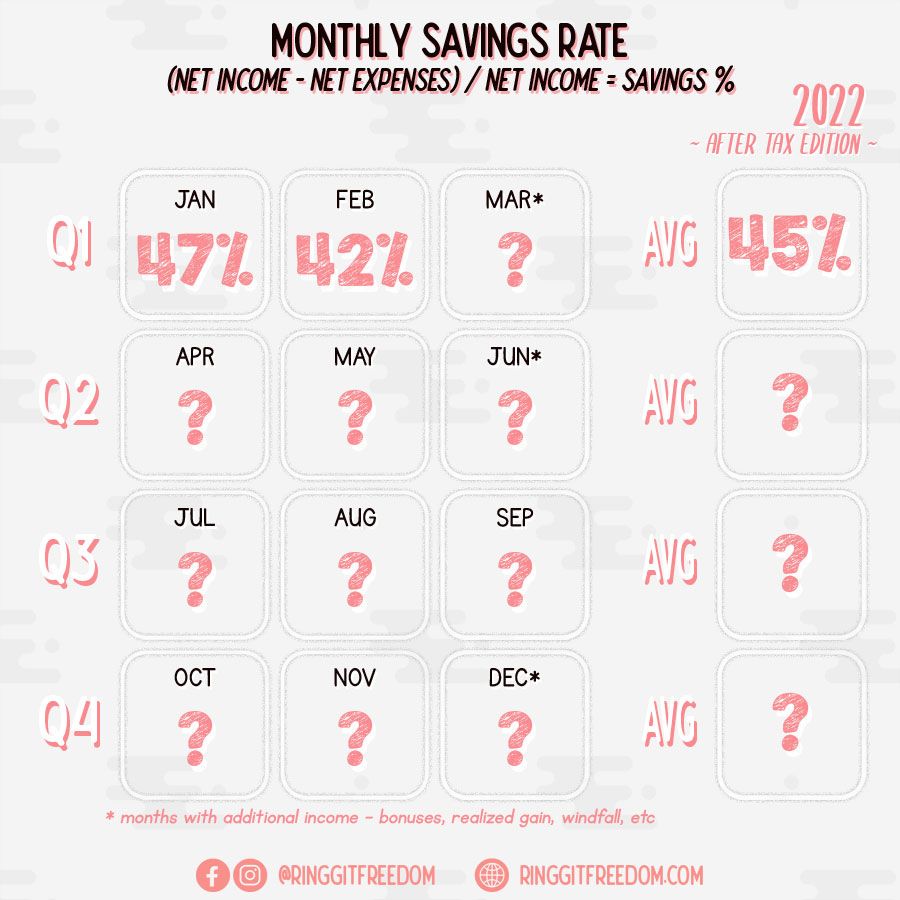

Let's hope that this little investment will be handy for my working life - otherwise it'd be a waste as the months' savings rate would have definitely been above 50% 😣

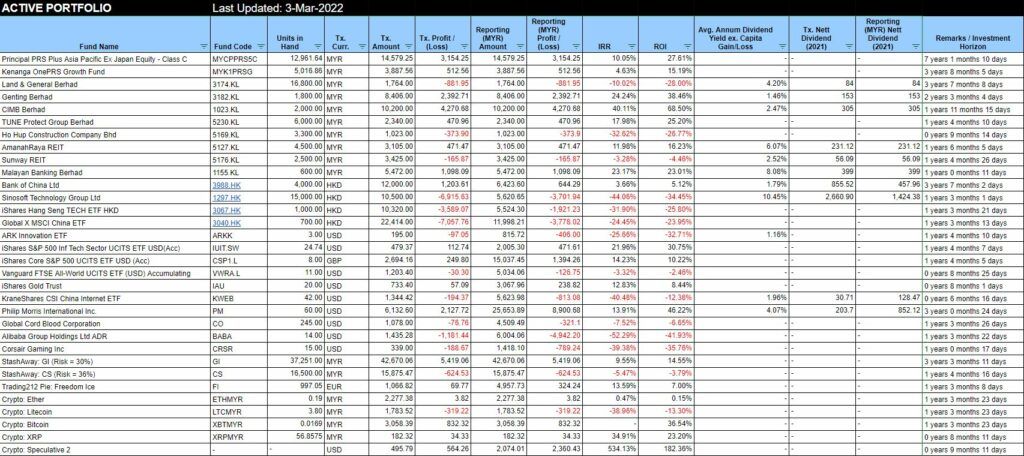

I didn't really have any transactions made during the month of February aside from my typical monthly investments of Dollar-Cost Averaging (DCA) into StashAway, PRS, Luno and Trading212. It is basically the usual boring investment month.

I did however receive a small amount of dividend from my holdings in SUNREIT, as part of their quarterly distributions. I also noticed that I have missed recording an incoming dividend payment in January 2022 so I've just captured it in February.

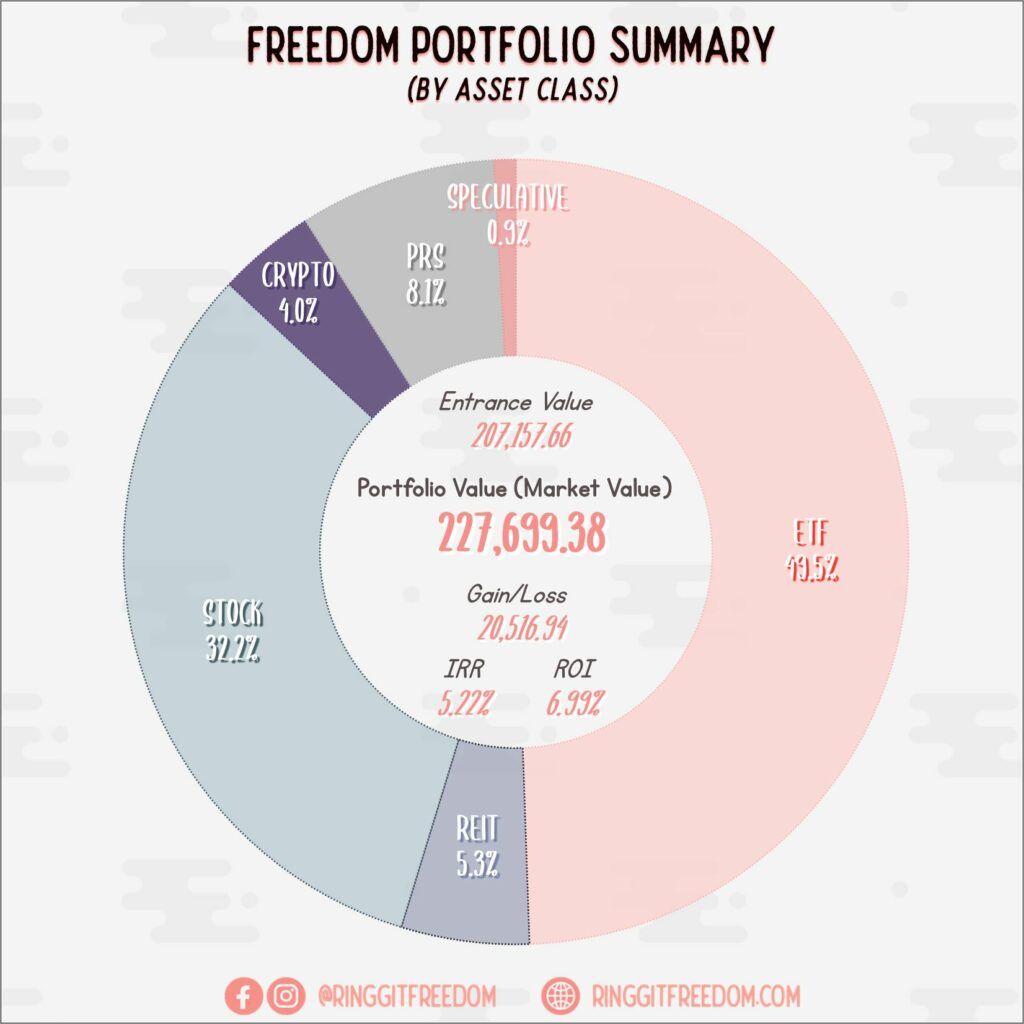

One thing's for sure though - my perseverance will be tested very soon, on whether if I can stick with my long-term investment philosophy considering that there are no signs of overall market conditions improving, especially in China (~30% of my portfolio).

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 7.45%

ROI: 11.38%

Profit/Loss: RM6,947.92

Active (Invested) Portfolio

IRR: 4.48%

ROI: 5.83%

Profit/Loss: RM13,569.02

True Cost: RM230,216.78

Total Value: RM243,887.84

Entrance Value: RM207,157.66

Portfolio Value: RM227,699.38

Nett Dividend (2022): RM 283.07

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie