The post Ringgit Freedom’s June 2025 Updates appeared first on Ringgit Freedom.

]]>My Life & Mental State

Work & Life

Things at work have definitely improved compared to the last few quarters. Whilst there'll never be a single day that are completely peaceful (at least not in our company) - but at least it's not as chaotic as before, allowing us to regain some of our headspaces.

If there's a small win that I want to celebrate recently, it'll be the 1st year anniversary of my Korean Learning journey - something that started very impromptuly due to IU concerts back in 2024.

At this stage, I am only putting in the minimum required efforts to keep the learning alive (2 to 4 hours per week) - it is good enough for now since I have no intention to further my educations or move to Korea. Just wanted to have enough basics to survive when I watch Korean Dramas - or when I travel. Speaking of travel, I've finally pulled the trigger (booked everything pretty last minute, too) for a 3-weeks solo trip in Korea, something that I've been wanting to do for a few years now but put away for whatever reasons.

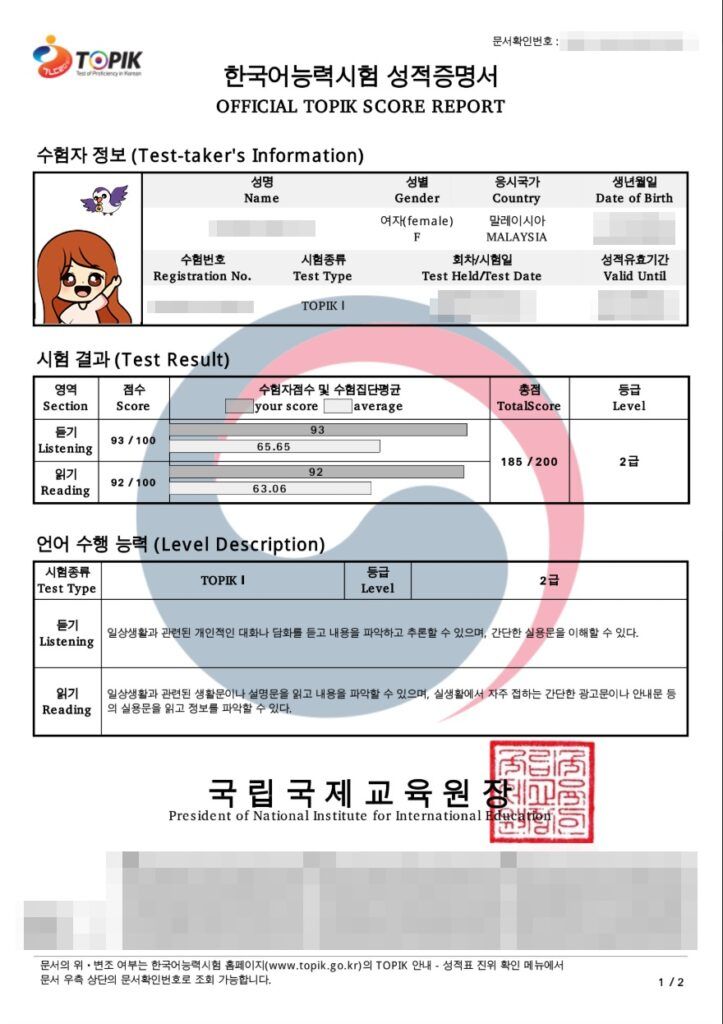

I was supposed to only go for the trip - AFTER receiving my TOPIK examination results to ensure that I've at least passed (as a reward for myself) but heck, might as well just go. Anyways, I sat for the 99th Malaysia TOPIK Exam back in April and surprisingly the exam were easier than anticipated - probably because I did quite some past year papers and also only took the TOPIK 1 examination which consists of Listening & Reading test components - without the dreaded Writing component (that I hated the most, ironically, as a blogger).

Halfway through my solo-trip holidays (not checking emails and all, obviously), my sister sent me a text to check my TOPIK results (which I couldn't without a laptop as they blocks all type of mobile/tablet devices, including "Desktop Mode" browsers 🫠). With her help, I received the good news below and continued on with my holidays 😛

Equipped with my broken Hangeul skill this time around, and also the ability to read Hangeul characters (not necessary knowing the meaning but helpful enough to take an educated guess 😂), I can definitely feel the improvements in Quality of Life for this trip as compared to all my previous Korea trips.

In the past, I had to use Papago for literally every social or non social situation but this time around, I only had to take it out very occasionally - mainly to check and make sure that I'm conveying the right message or constructing the correct sentences especially during stressful situations. But mainly it's to prepare the conversation "in my head" before it actually takes place to reduce the stress of doing live translation in my head during real conversations.

Whatever you do in Korea, forget about Google's suite as their app are pretty much lacking in South Korea. Personally I find Google Translate behaves oddly for Korean/Chinese/Japanese translations compared to Papago. Even Naver Map (or any other option like KakaoMap / T-Map really...) outperforms Google Map.

눈 깜짝할 사이에 한국어를 배운 지 일년이 됐어요!

한국어를 아직 잘 못하지만 조금 이해할 수 있어요.

한국에서 3주 여행동안 간단한 대화를 한국어로 했어요~

I still have thousands of photos unorganized and I'm also thinking if I should post them - on which Instagram account, or just leave it in my memory card/Google Photos... let's see when I have the mood to do it. Or should I just write a blogpost about the 3 weeks' trip, maybe with some financial breakdown? I don't know yet. Anyway, passing TOPIK examination wasn't the biggest win I had for Q2 of 2025. There's an even bigger win that came out of nowhere against all odds - and much earlier than anticipated too.

My Biggest Win

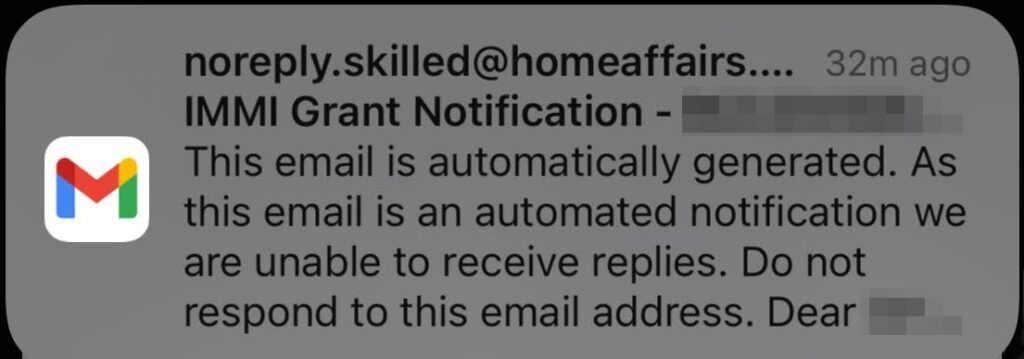

One of my biggest wins for this quarter, perhaps, is successfully securing my Permanent Residency from Australian Immigration Office since starting this journey almost two years ago in 2023. Imagine swiping down the Notification Centre and sees an email coming from [email protected] as someone whom are in midst of Visa Applications.

I went through all types of emotions in that split second - shocked, scared, denial, surprised, happy, crying, ... - you name it.

Quite frankly, I wasn't expecting the grant to happen so soon and was mentally prepared to gruellingly wait for another 12 months due to the delayed processing times. On one hand, I'm definitely grateful to finally stop living in an anxious state of waiting, but it came with some downsides too.

Whilst I've been mentally preparing myself to eventually quit my job just to physically move myself down south - facing the reality had proven to be much trickier when trying to balance it from different aspects of financial, career, and personal growth at the same time. Decisions would've been much easier if I was lacking in some (or all) of these aspects - as moving there will guarantee me a better life for sure. At my current stage in life, it'll probably be at least 2-3 steps back (or 4-7 years of setback using time as a measure) if I take that decision now.

Nevertheless - I'll eventually have to make decision one way or the another by end of the year as I'm not planning to give up my hard-earned Permanent Residency right after obtaining it. Will see what would be the best course of actions for me - not just from career/financial perspectives but more importantly my personal growth/desires. Meanwhile - I'll just continue to negotiate and find pathways whether with my current Employer or my future Employers, where ever life decides to take me to. Fingers crossed 🤞🏻.

Now, going back to our usual monthly update for my finances and portfolios.

My Financials

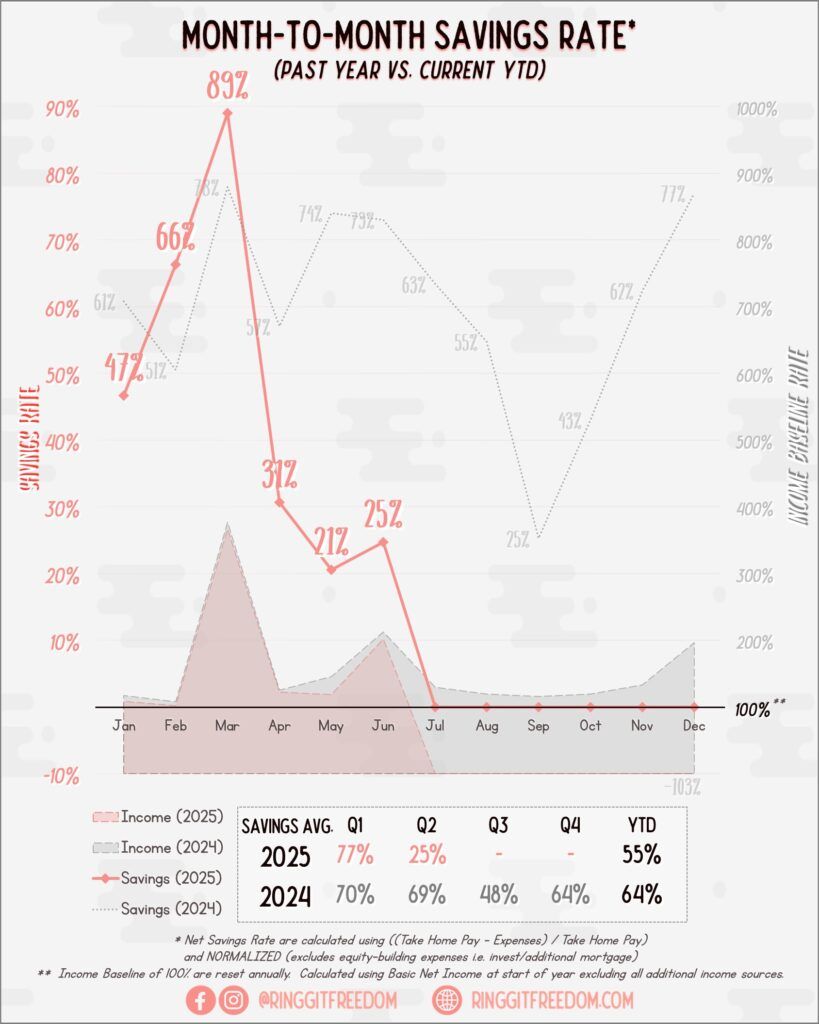

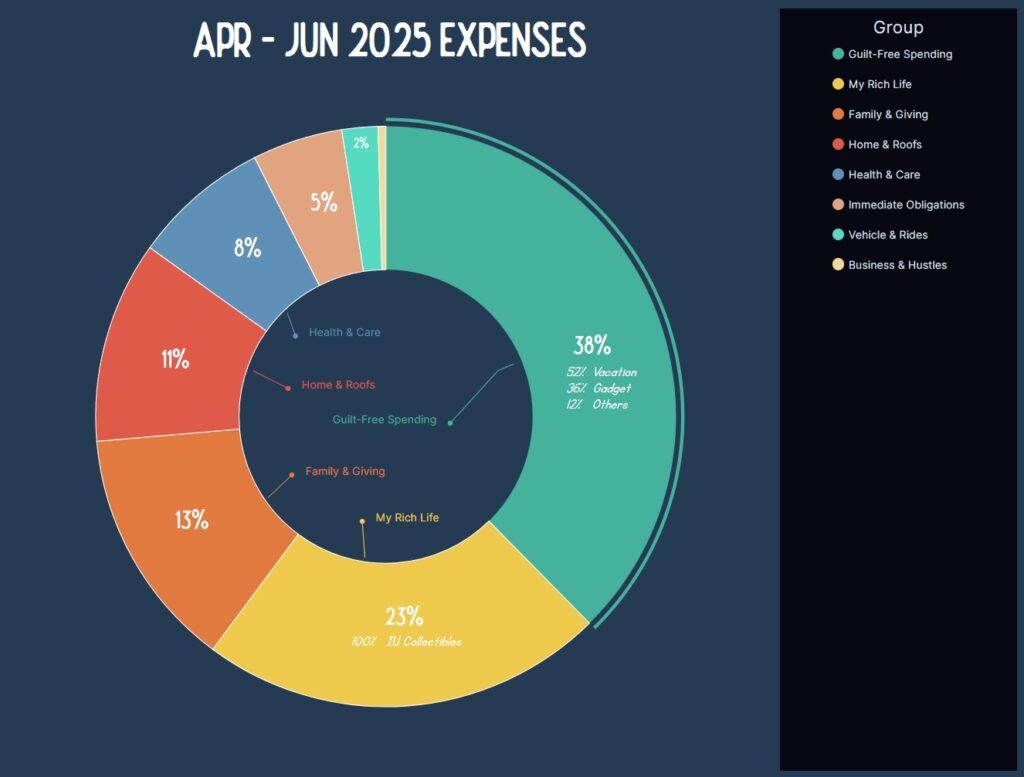

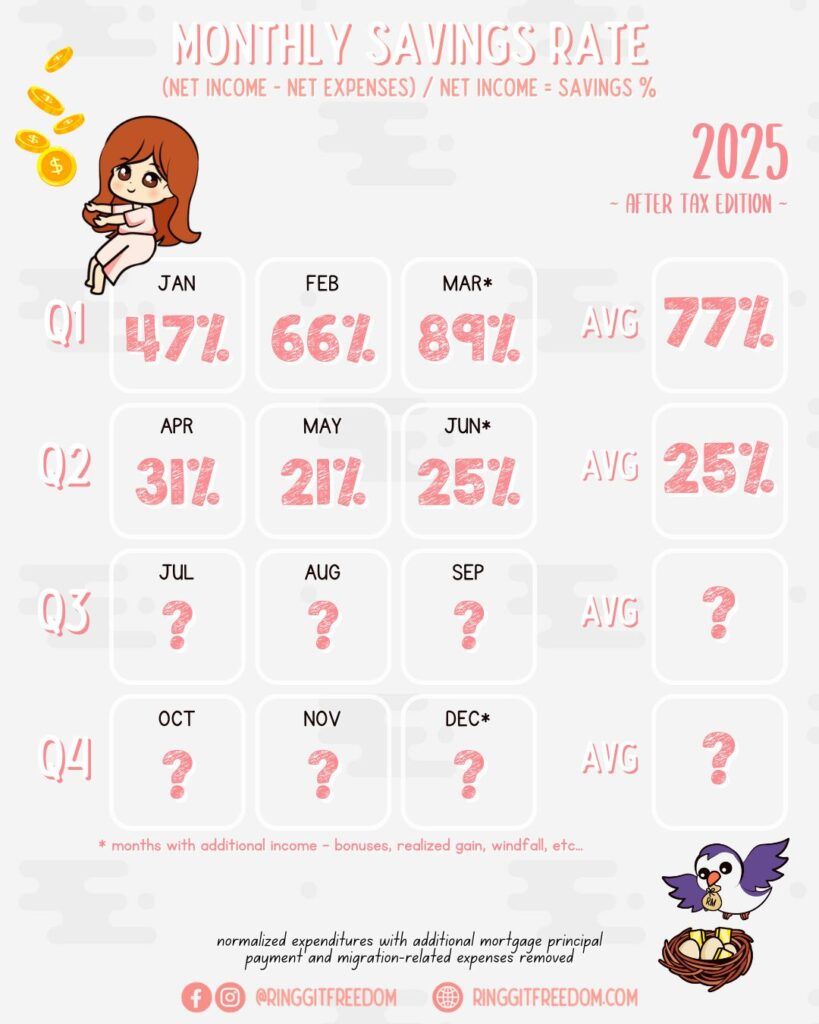

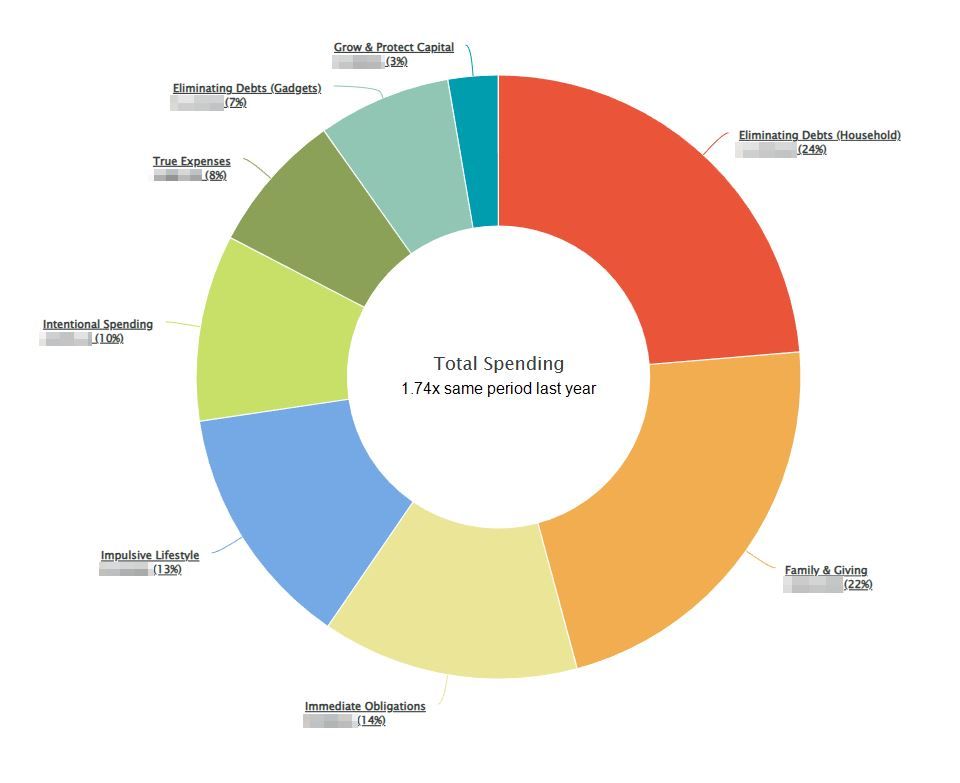

Whilst I've started my Quarter 1 strong, with solid savings rate and minimal leisure spendings, Quarter 2 is where I lost it all. I've pretty much lost my control with unbudgeted impulse purchases since before my Korea trip - with random gadget purchases to souvenir purchases during holiday and now even starting my own little (or massive?) collection of my idol's albums... guess who.

Part of me suspect that this is basically my subconscious acting up, where deep down inside I'm worried about eventually "losing" my current well-paid job should I pursue further on my migration pathways etc. - especially considering the higher tax rate and cost of living in Oz. I even checked against ChatGPT/Deepseek to explain my recent behaviours - and seems like it's a real possibility that I am lapsing exactly due to this. Not a good news for sure.

Whilst it's good that I hasn't gone into a debt yet with the recent impulsive purchase, if this goes on for just another month, I probably would start flowing into the negatives. I will have to take back control of my own finances - otherwise the efforts I put in the last 5 years would just go down into drain - just like that. Good thing is, the financial part of my had been awakened and have been calling out my impulsive behaviours whenever it happens - hopefully the situation will turnaround in my next quarter's updates.

On a completely unrelated note - here's one of my random discovery of IU's early days OST song that she sang before getting famous. Never knew how I've never stumbled into this beautiful piece throughout the last decade, no thanks to YouTube algorithm - for both hiding it from me during the entire last decade, and also randomly appearing in my feed recently.

Expenses

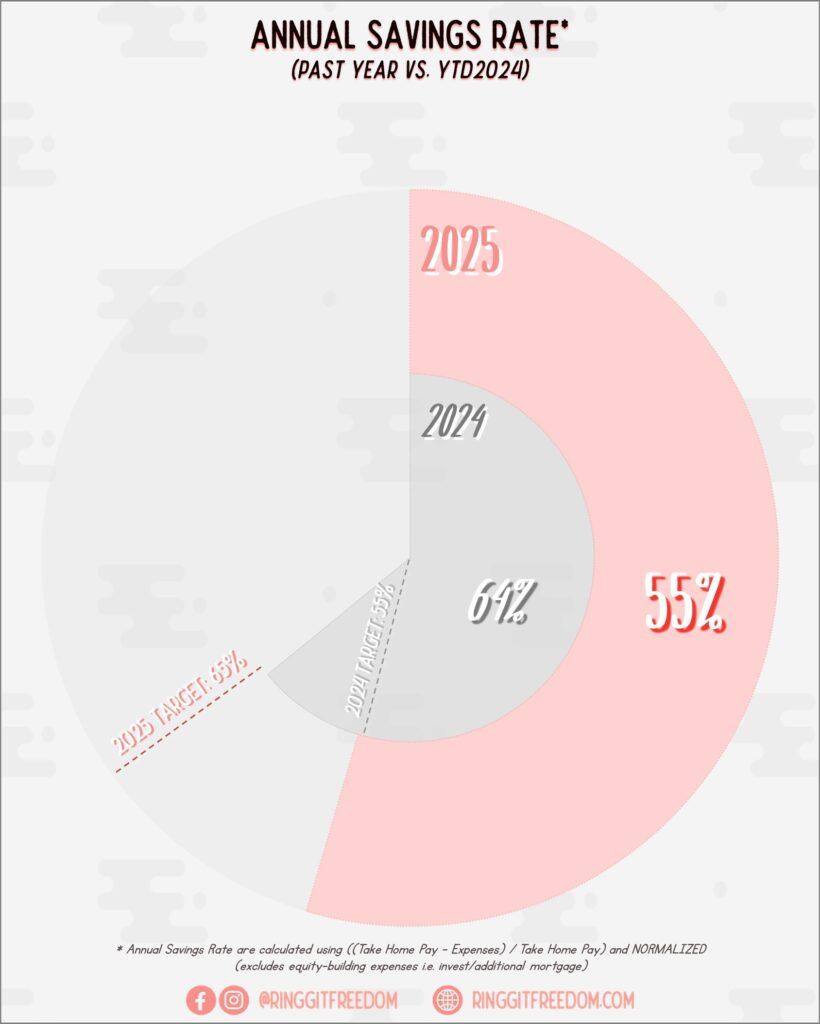

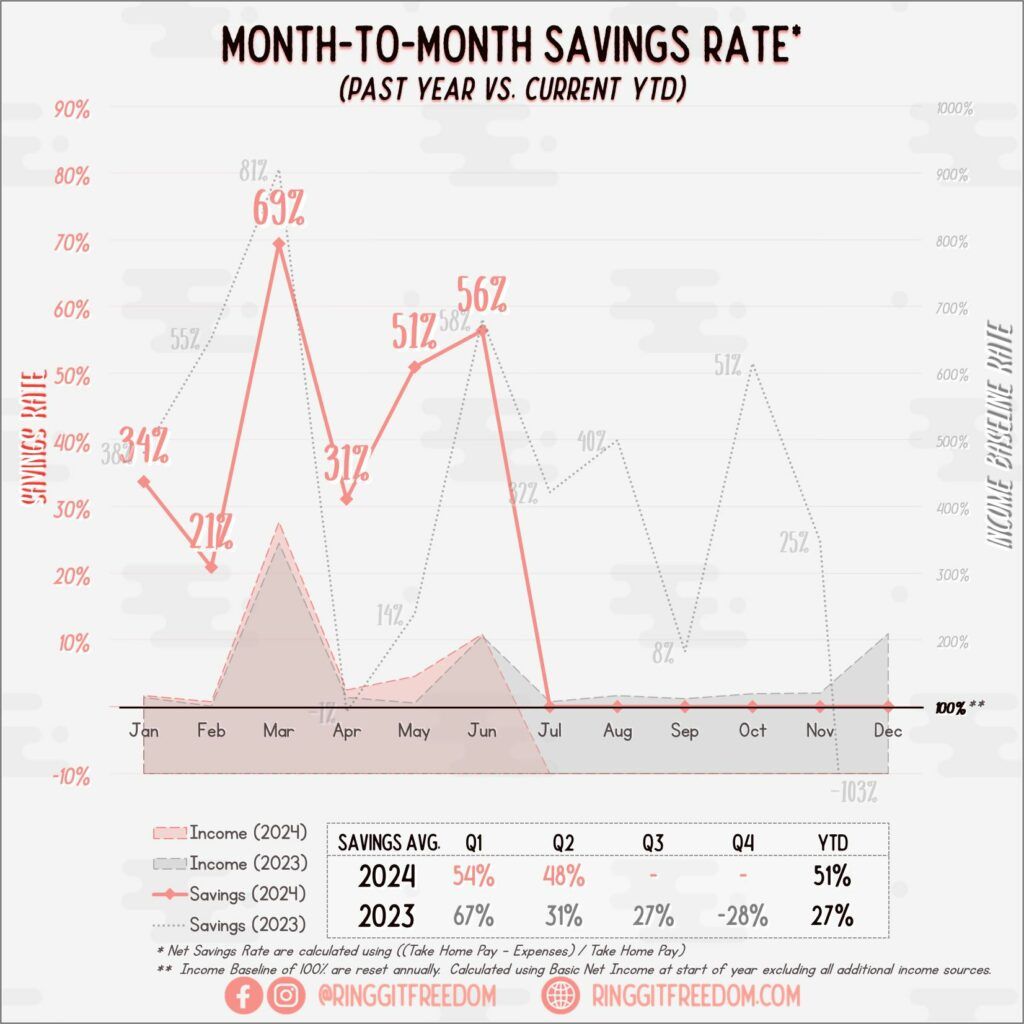

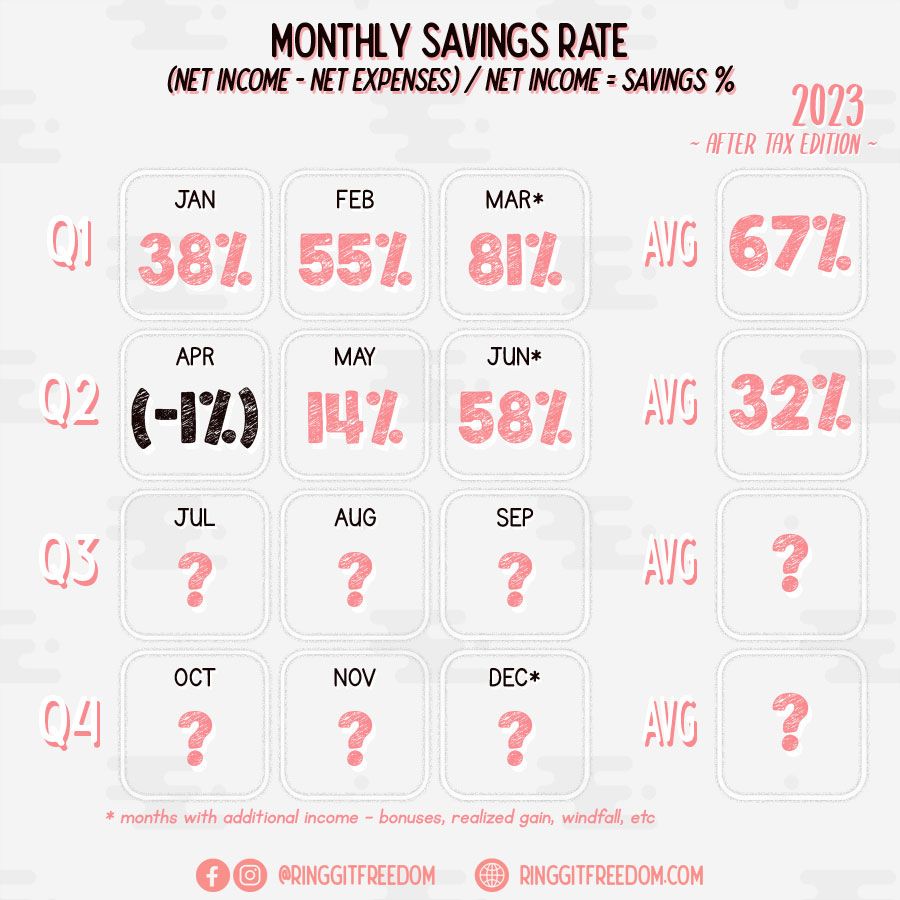

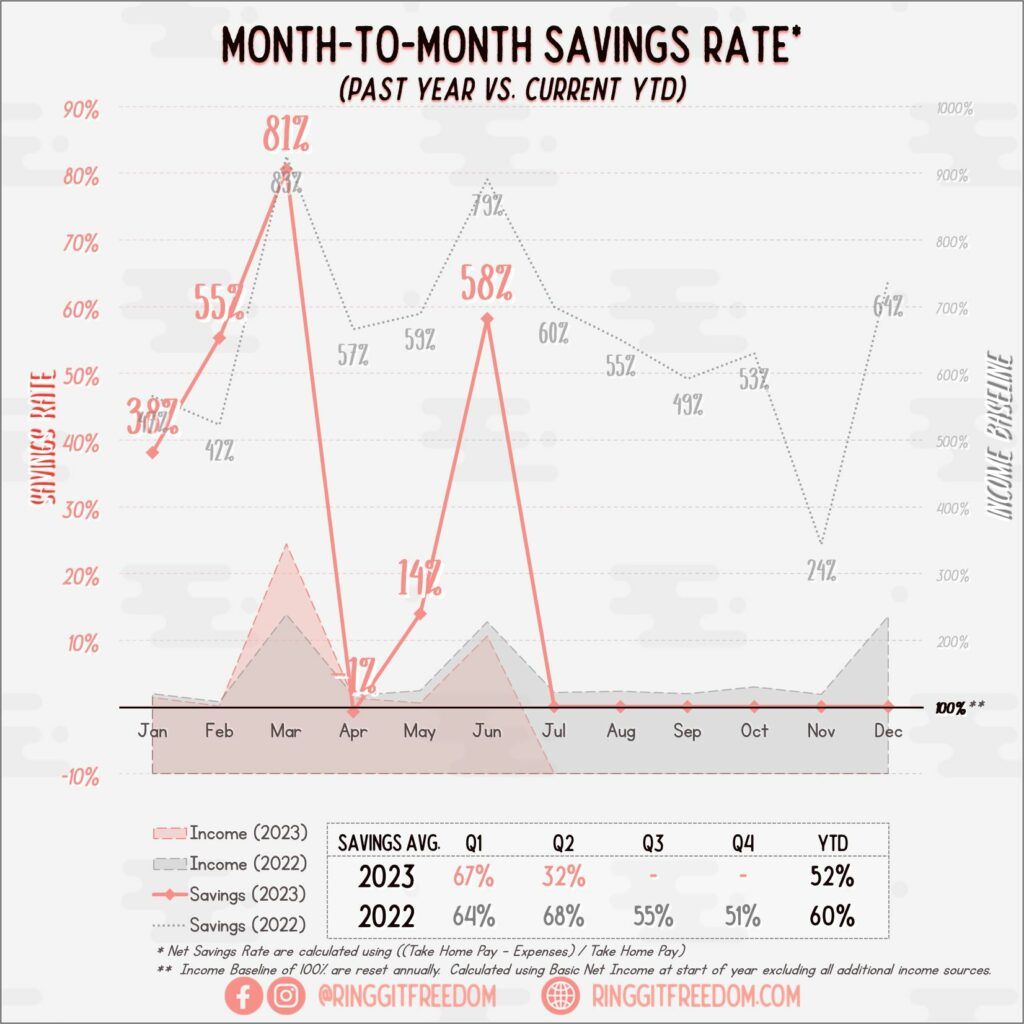

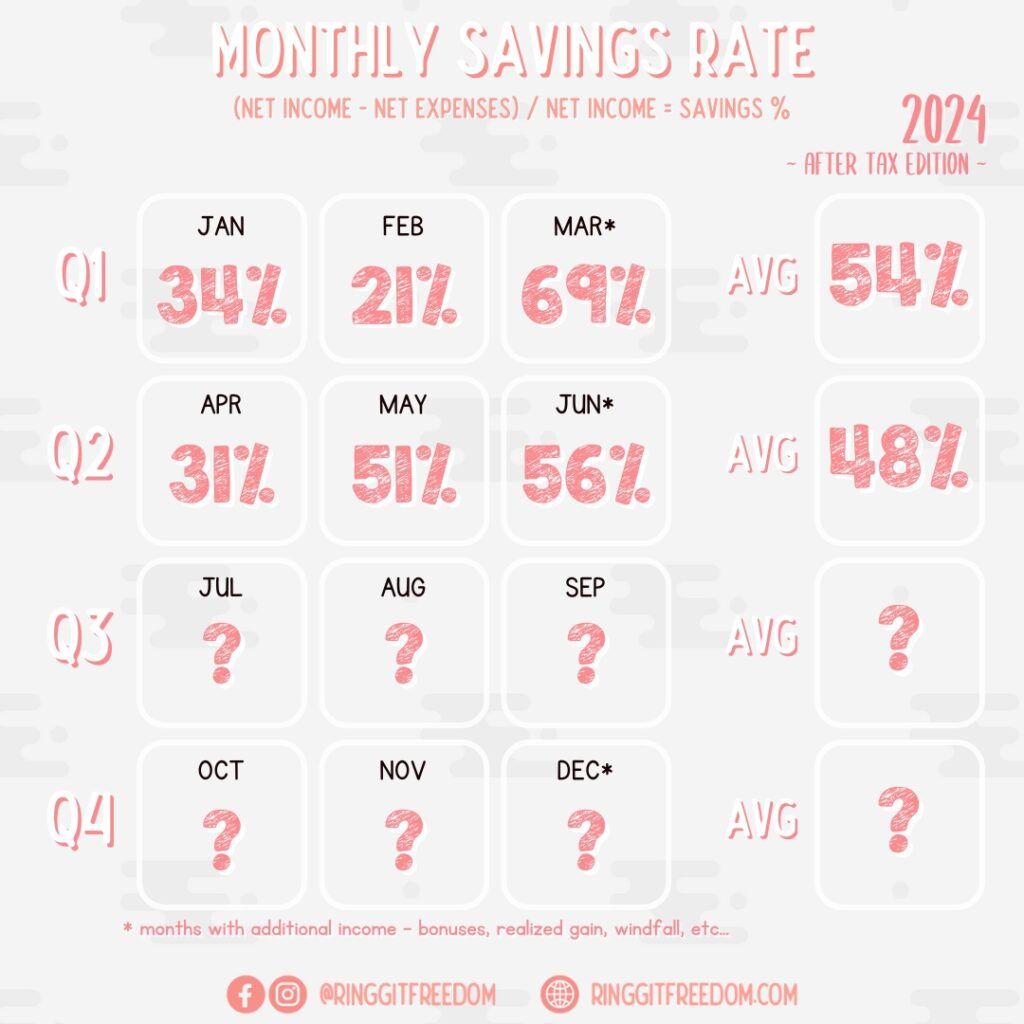

Savings Rate

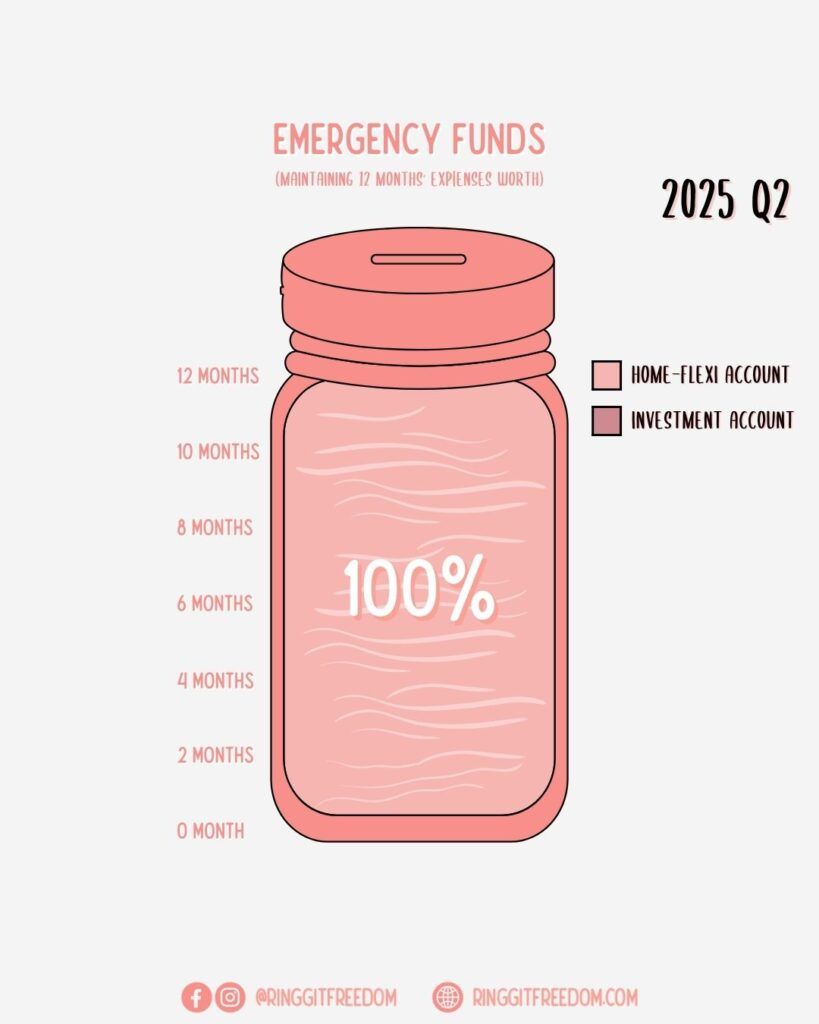

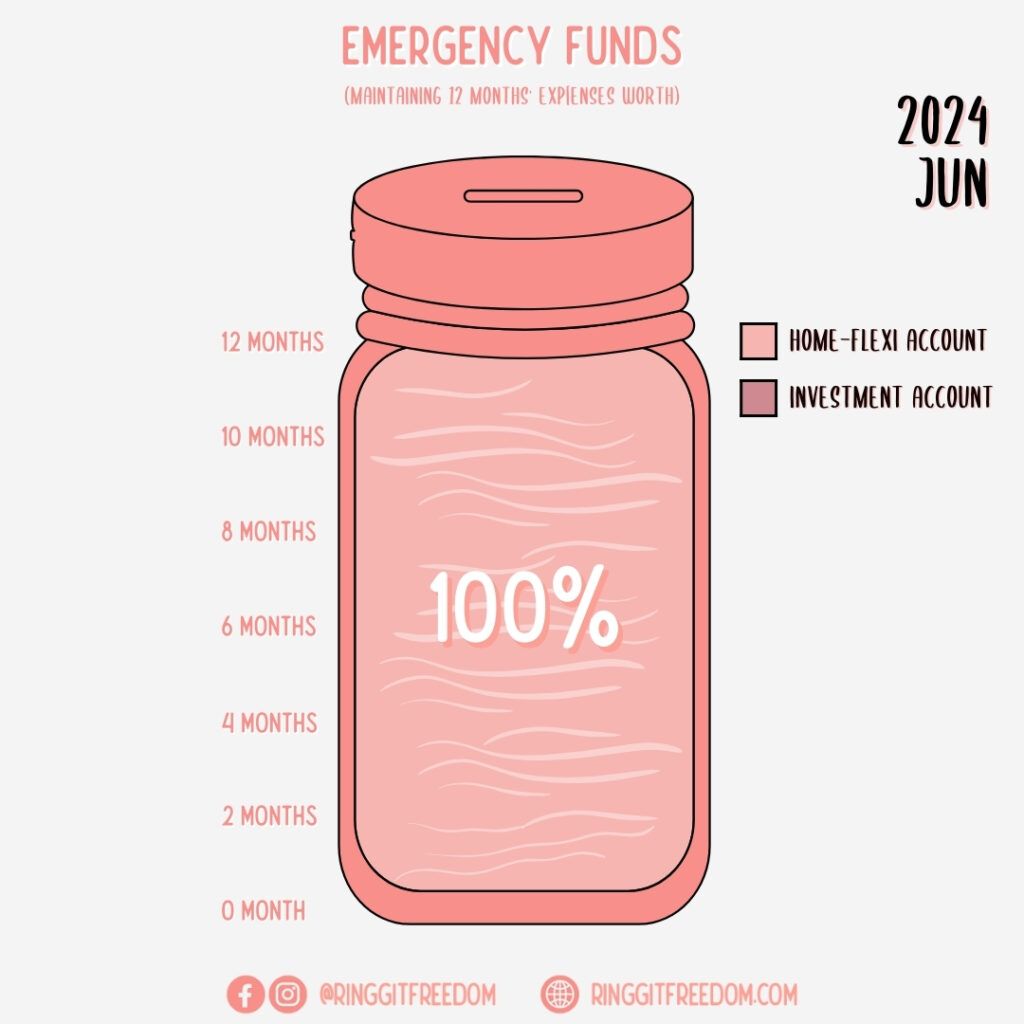

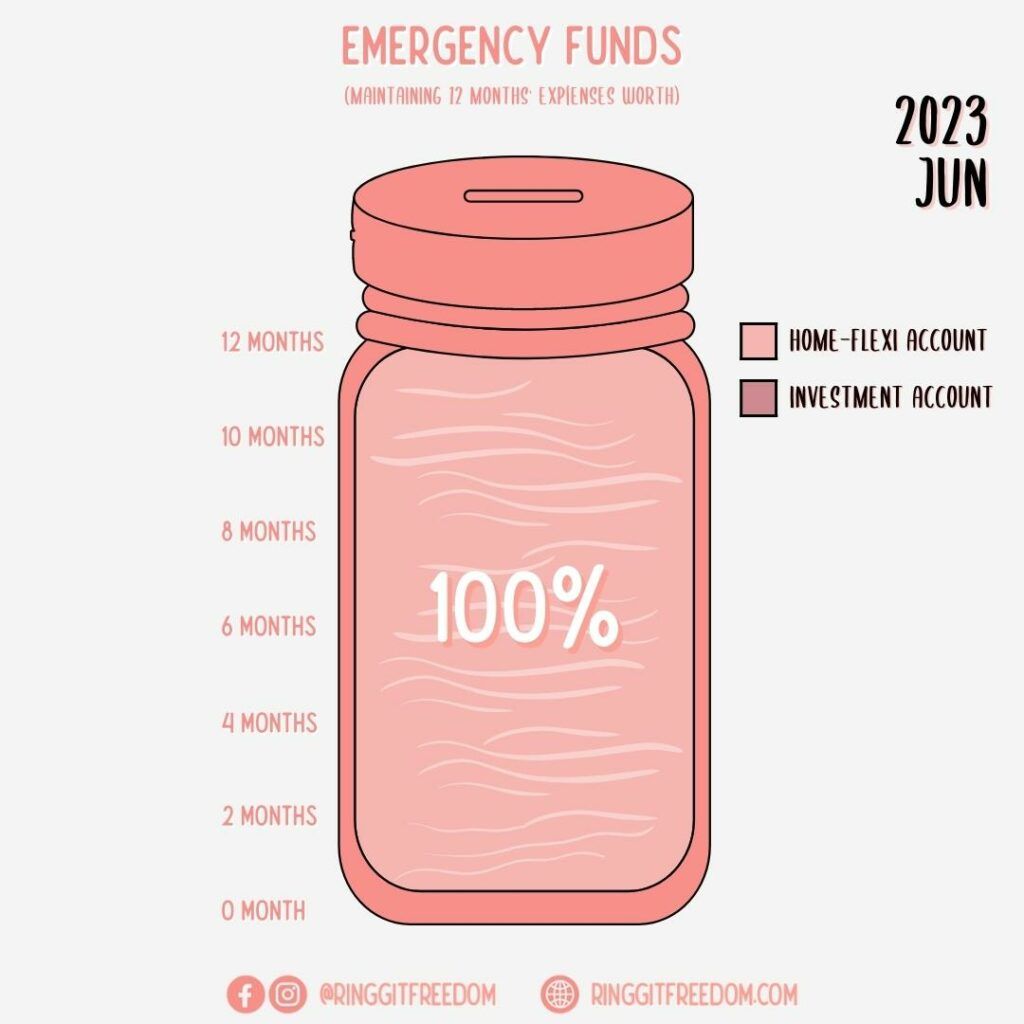

Emergency Jar

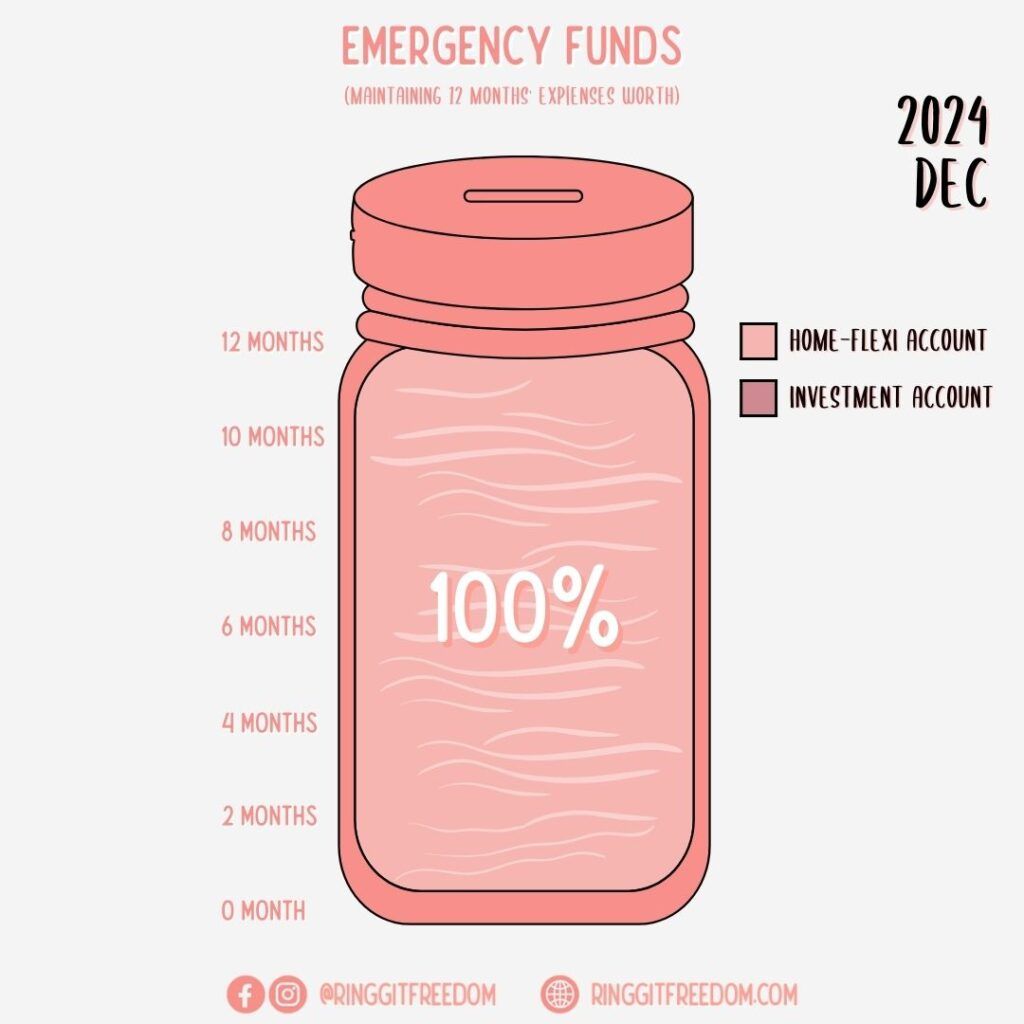

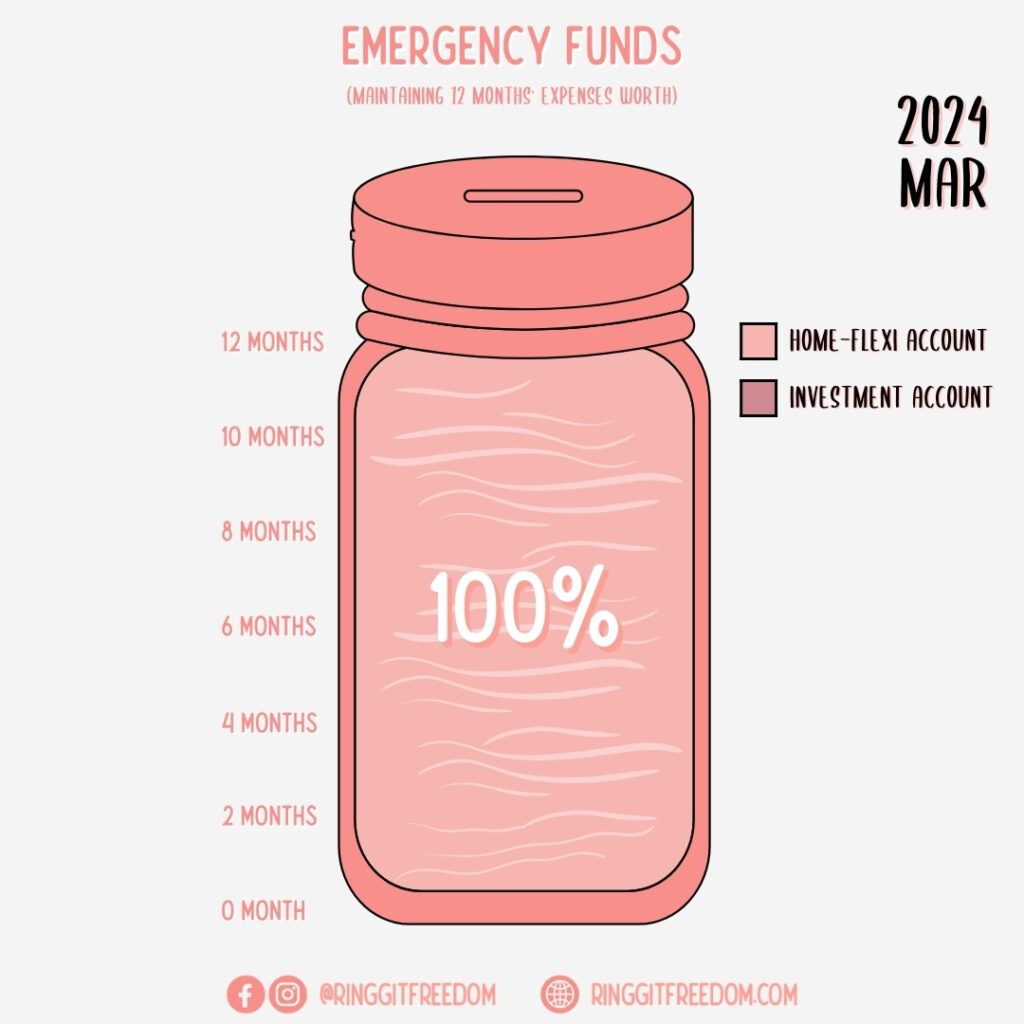

No changes to the Emergency Jar this quarter.

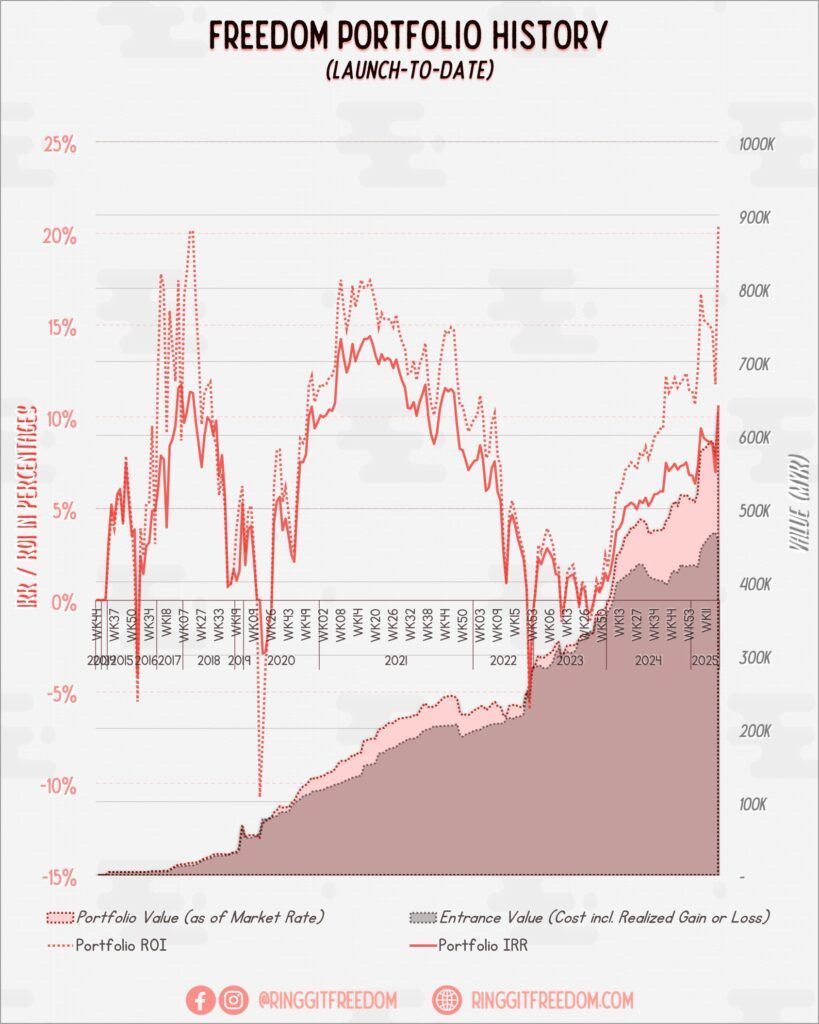

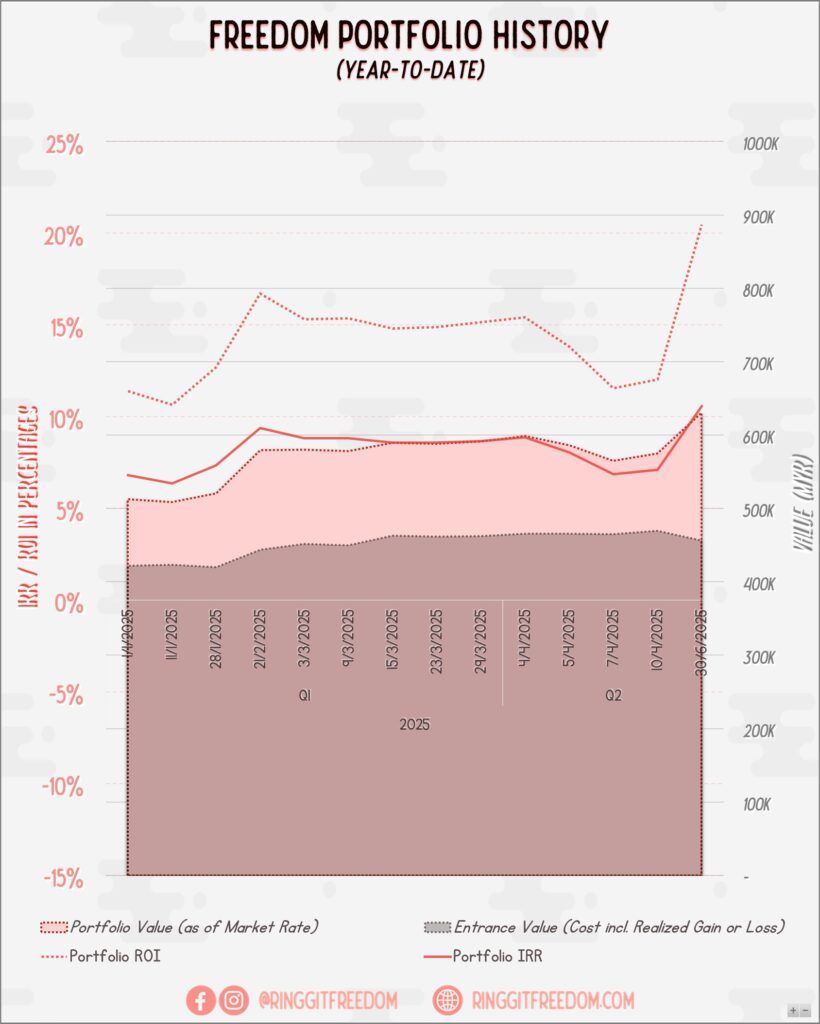

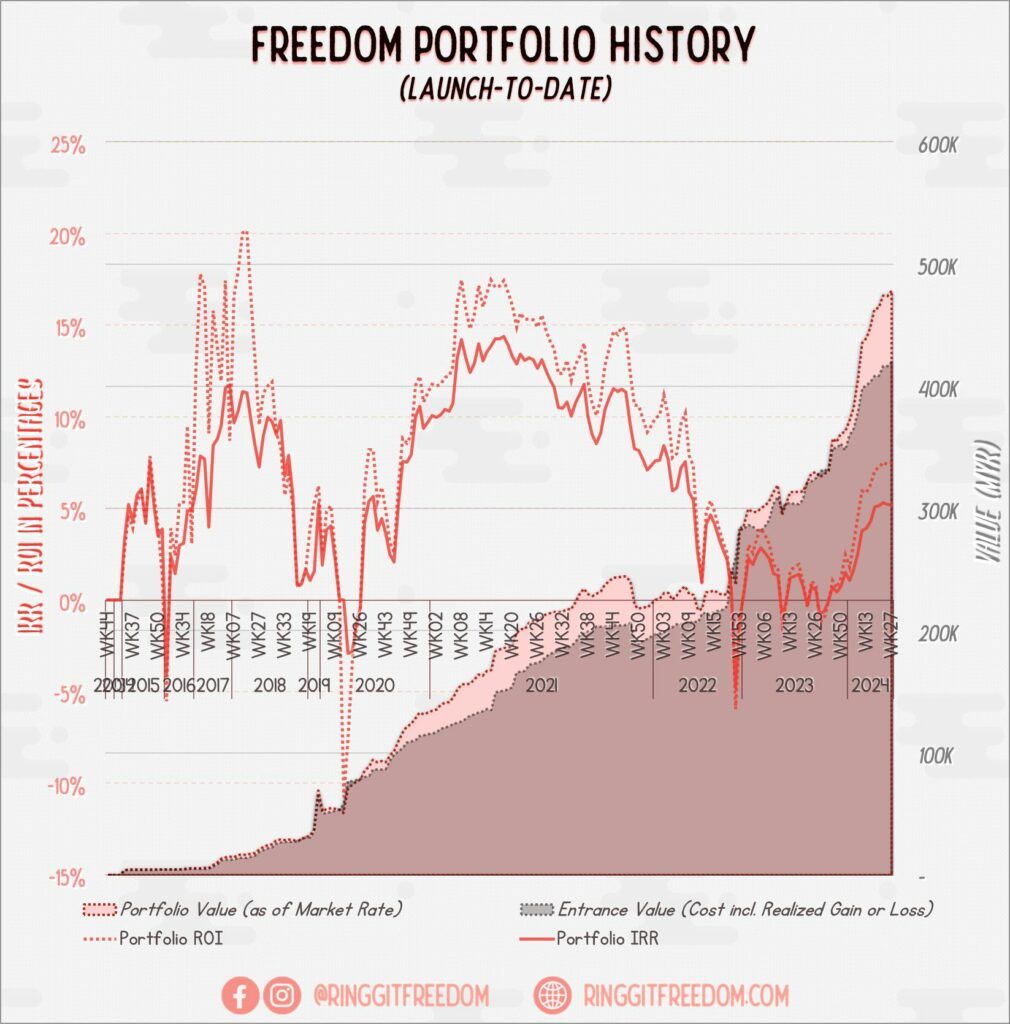

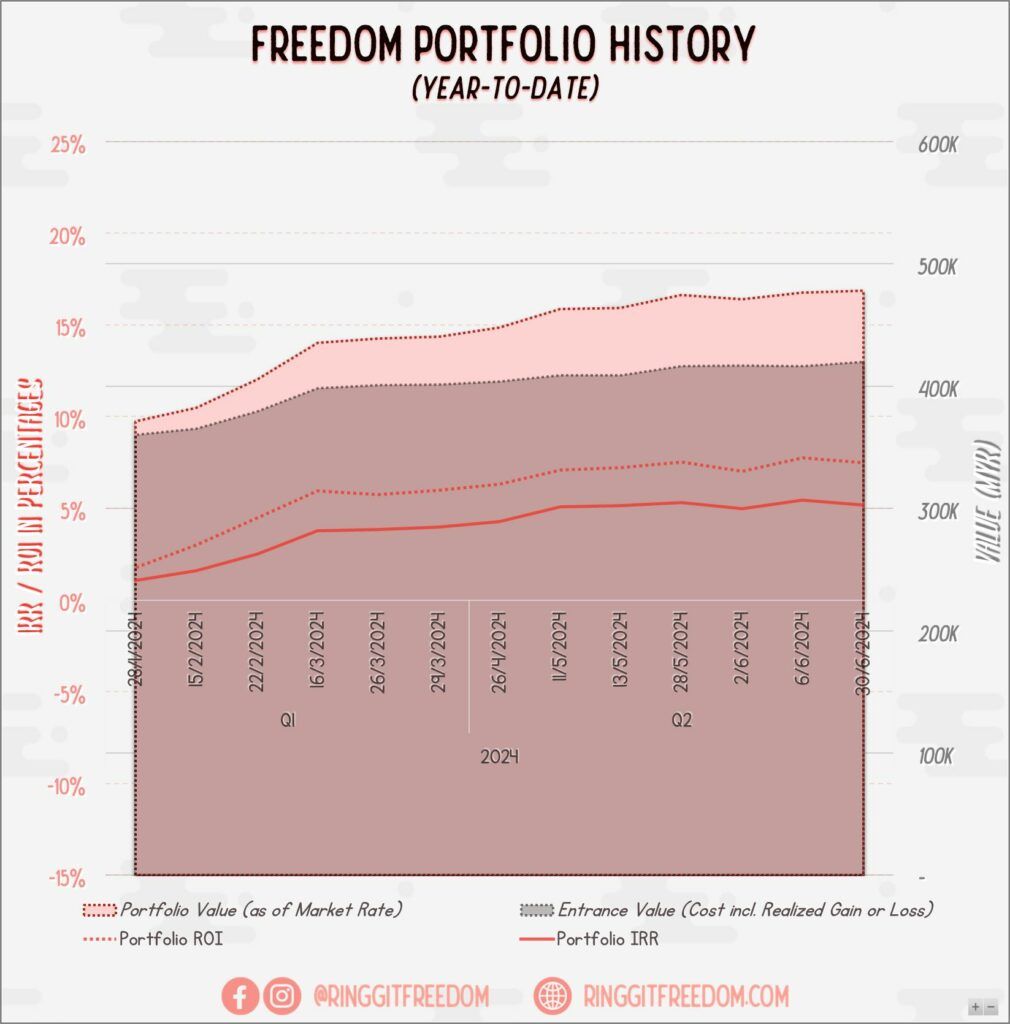

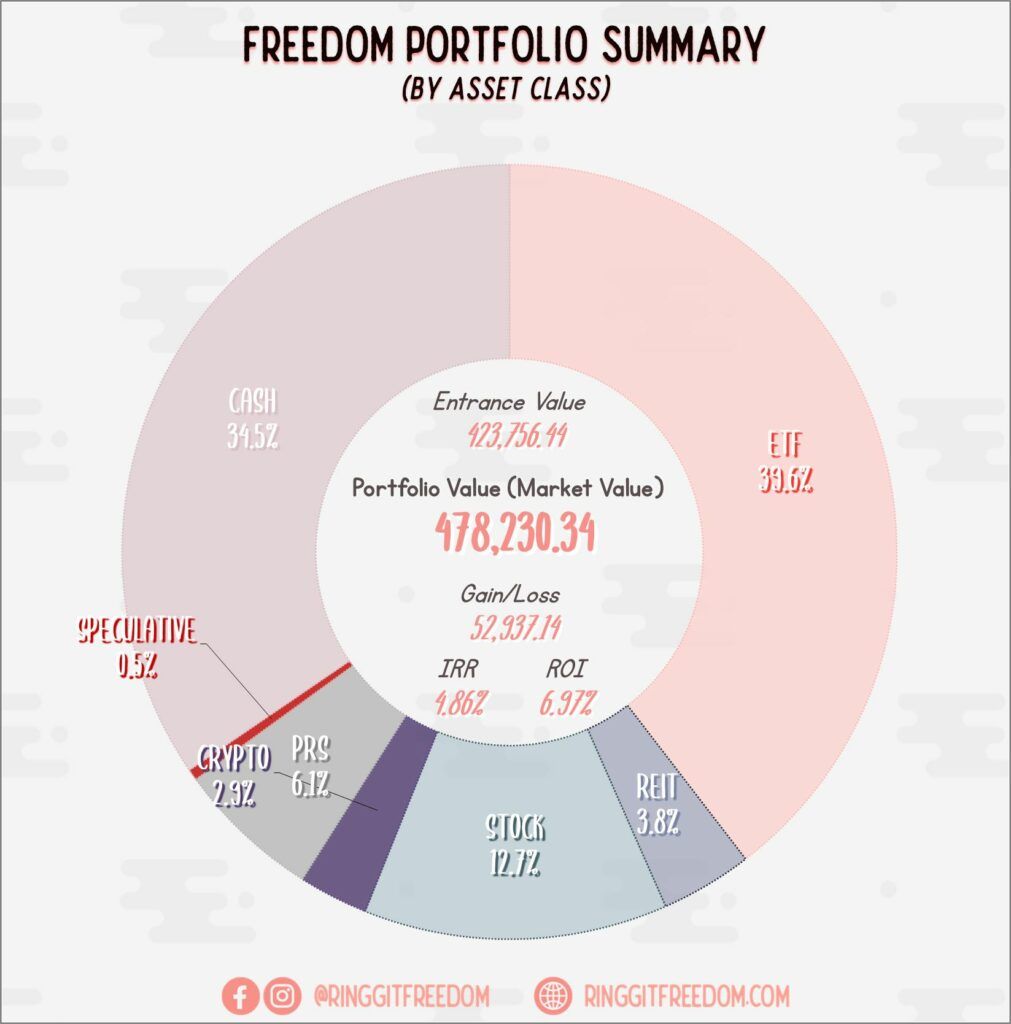

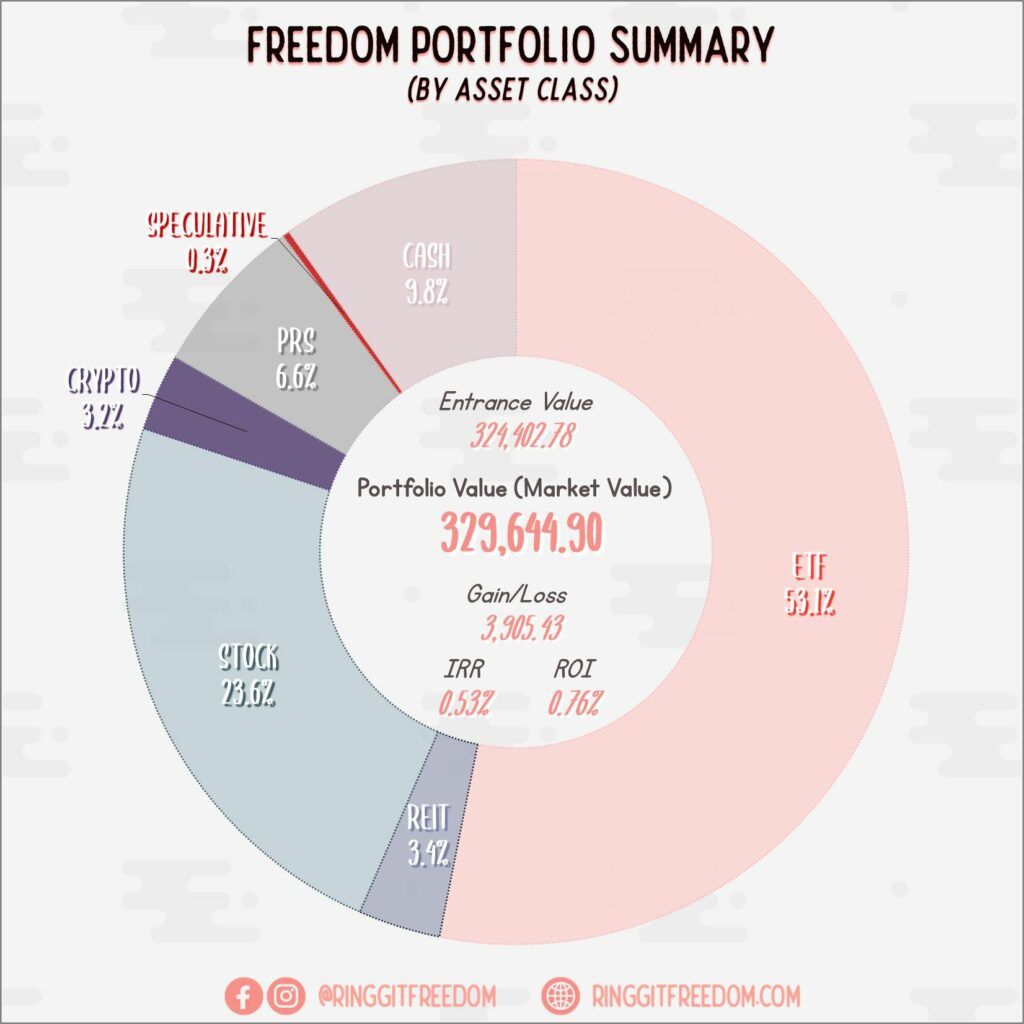

My "Freedom" Investments

Performance

Activities

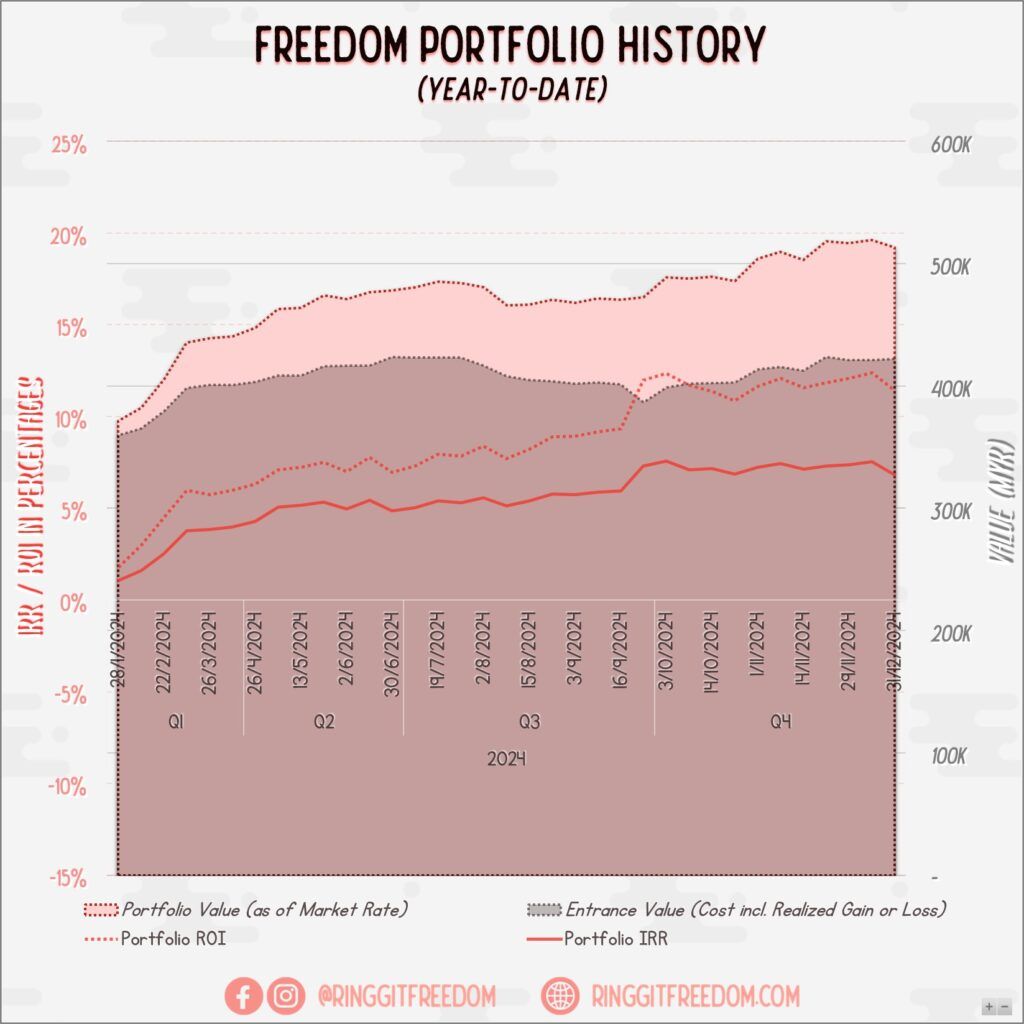

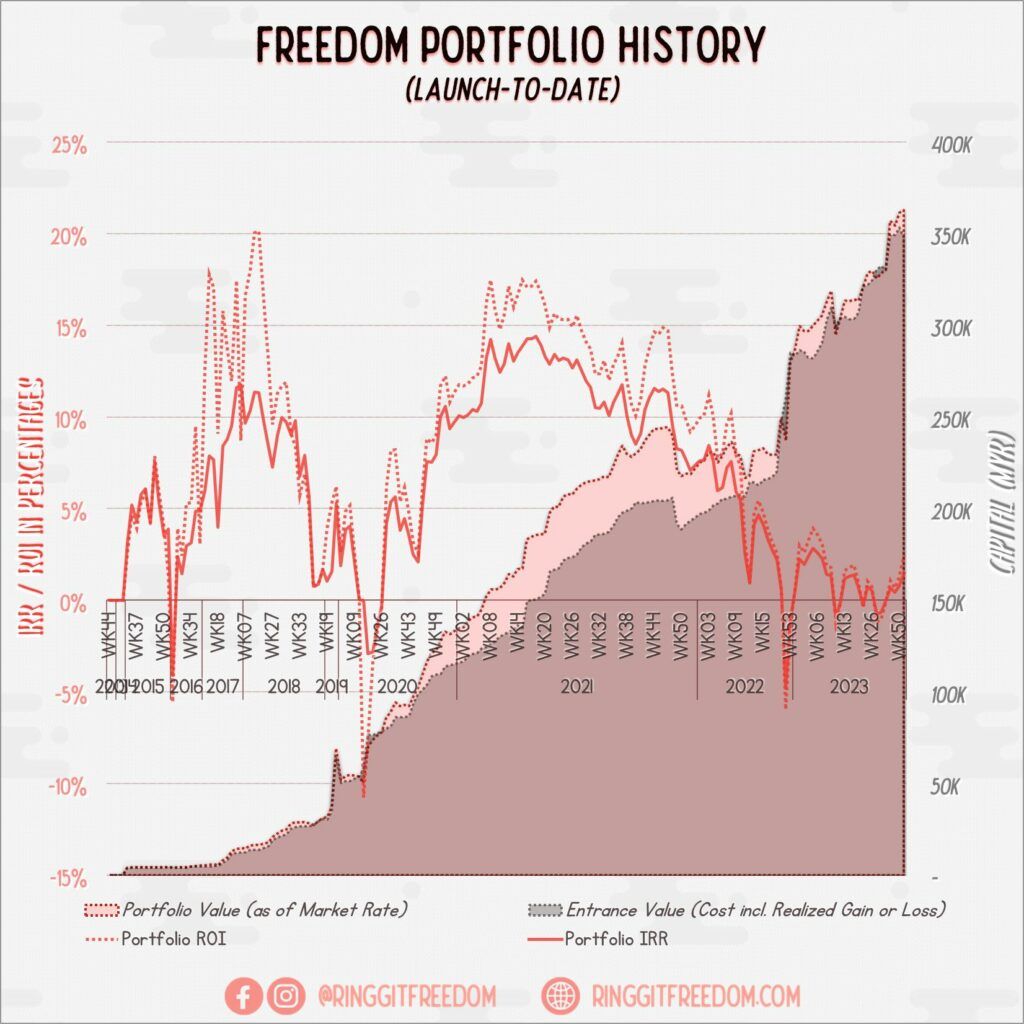

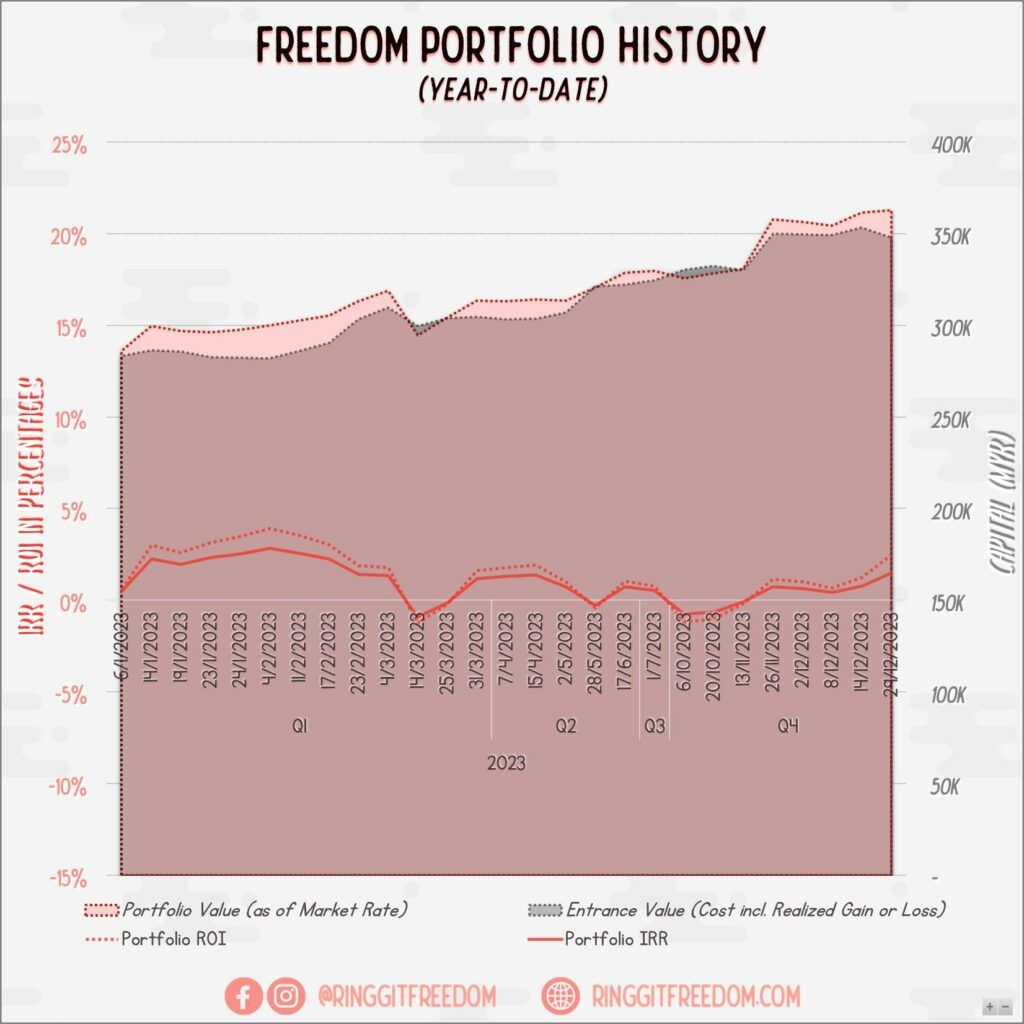

If you look at my charts above - you'll notice that I've basically turned a blind eye to whatever that's happening in the market. The last time I've updated my own excel portfolio tracker was like what, 2nd week of April? And zooooom, we're on the last week of June already.

Whether if Trump does something, or countries go into war, or random missiles exchange taking place across the globe - I basically did almost nothing to my portfolio. The quarterly (for cost transfer efficiency reasons) DCA continued to take place into my VWRA funds through my Interactive Brokers account.

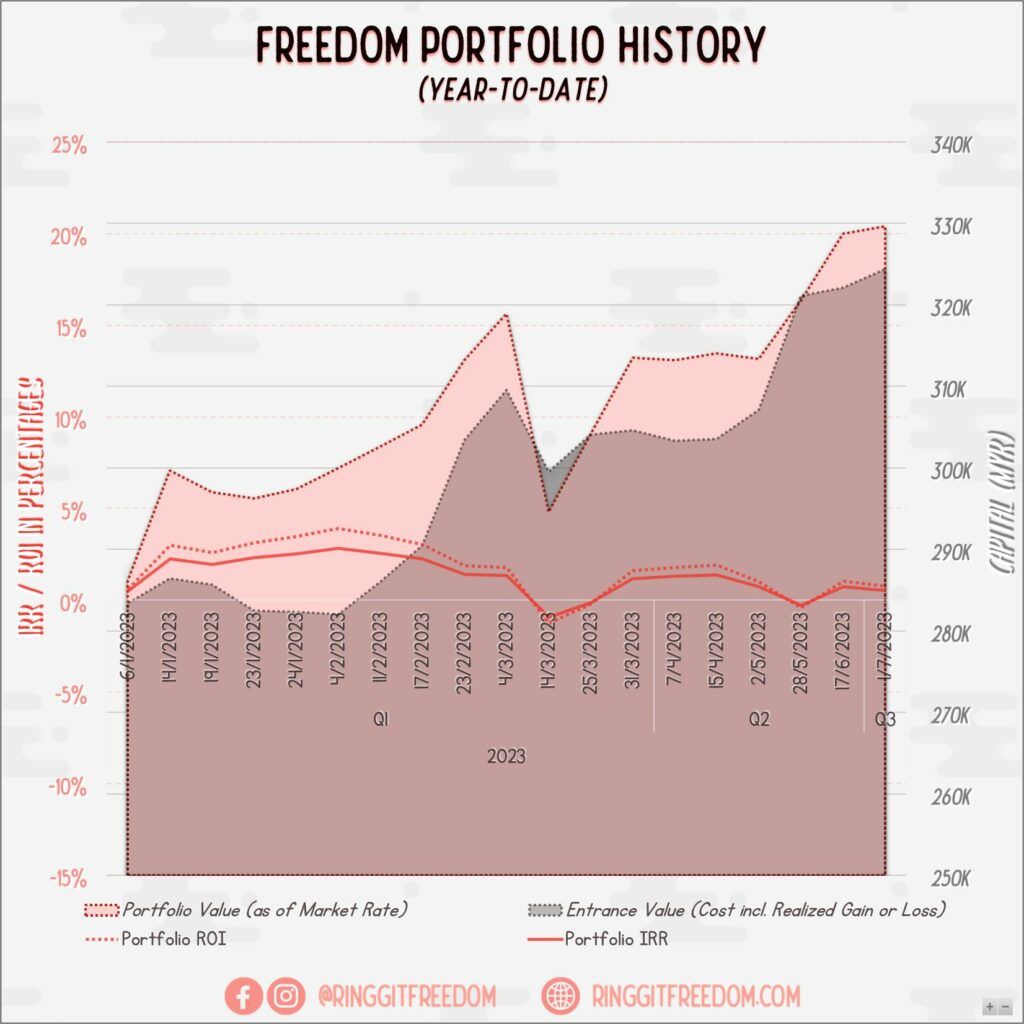

Of course - market's also extremely hyped up at this moment with S&P500 again breaking its record high continuously so we're seeing a huge paper profit at the moment.

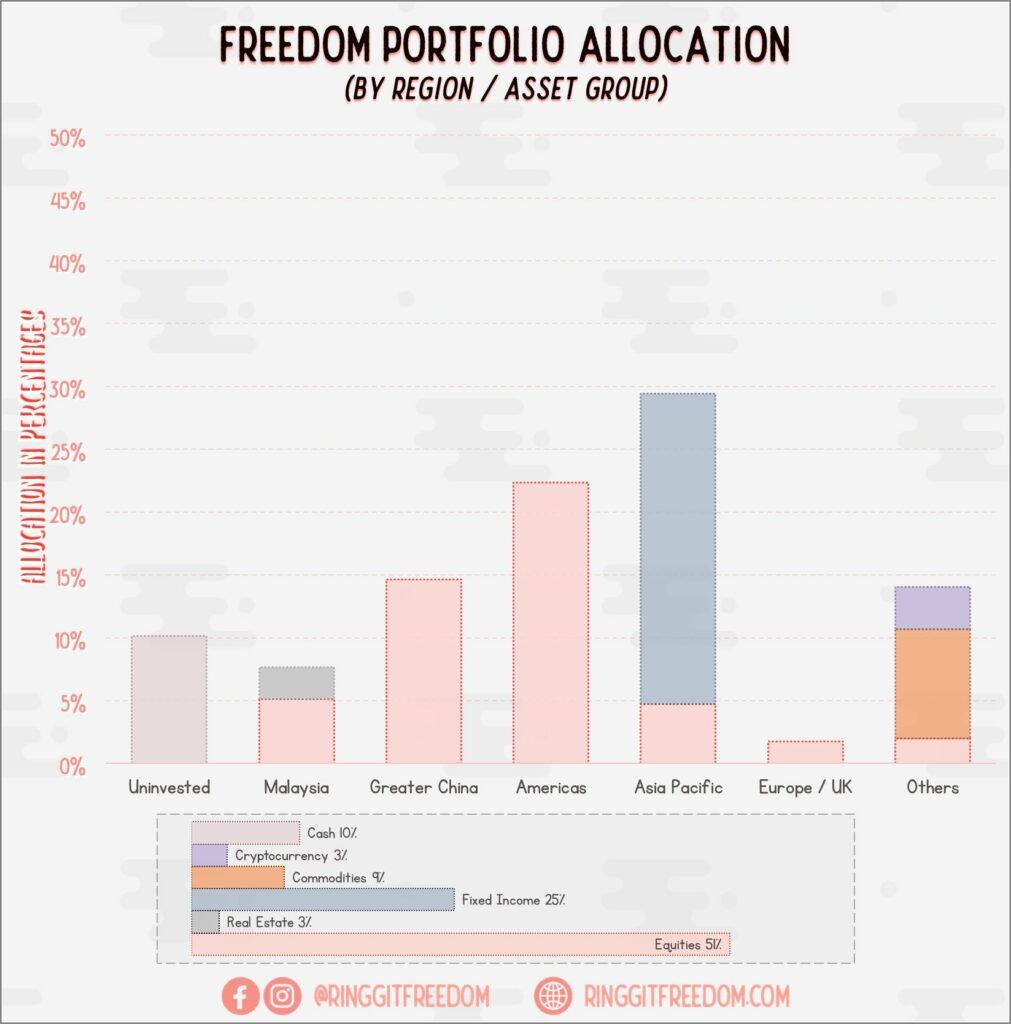

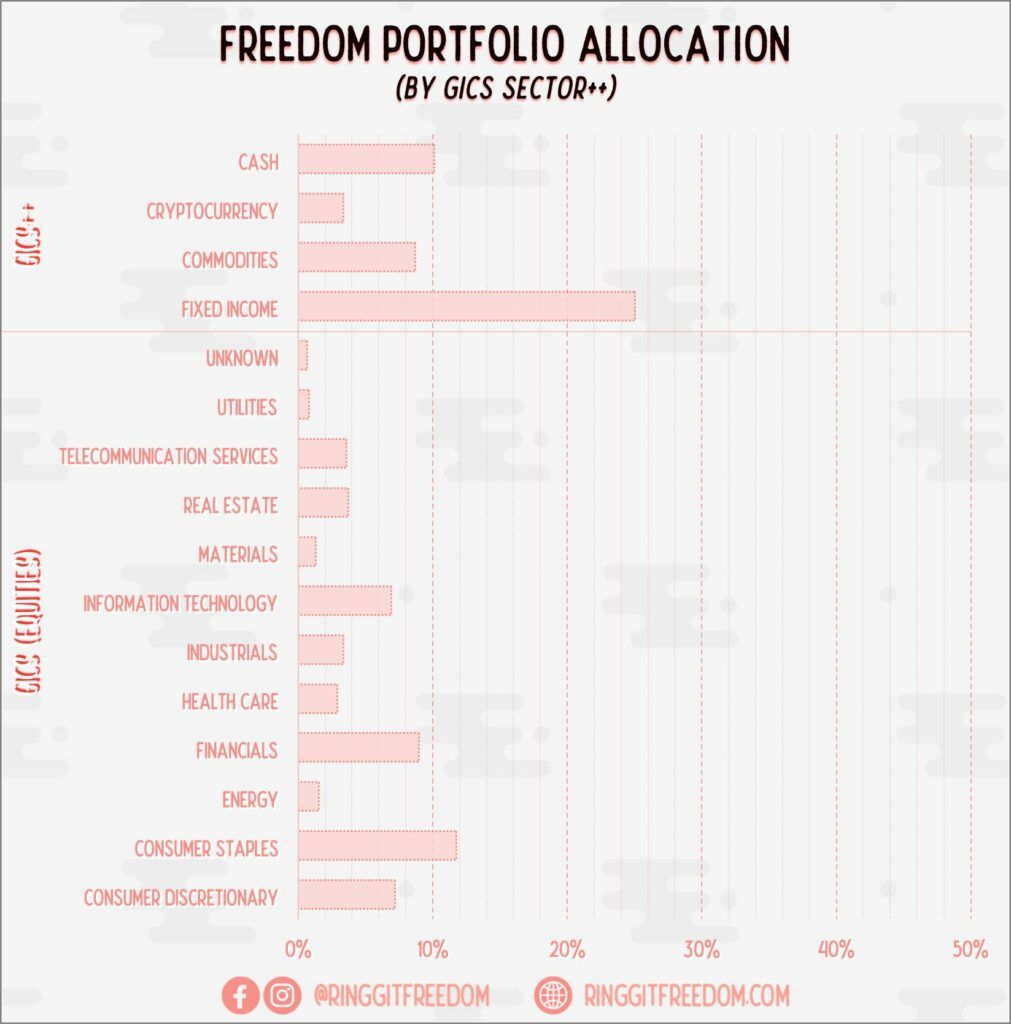

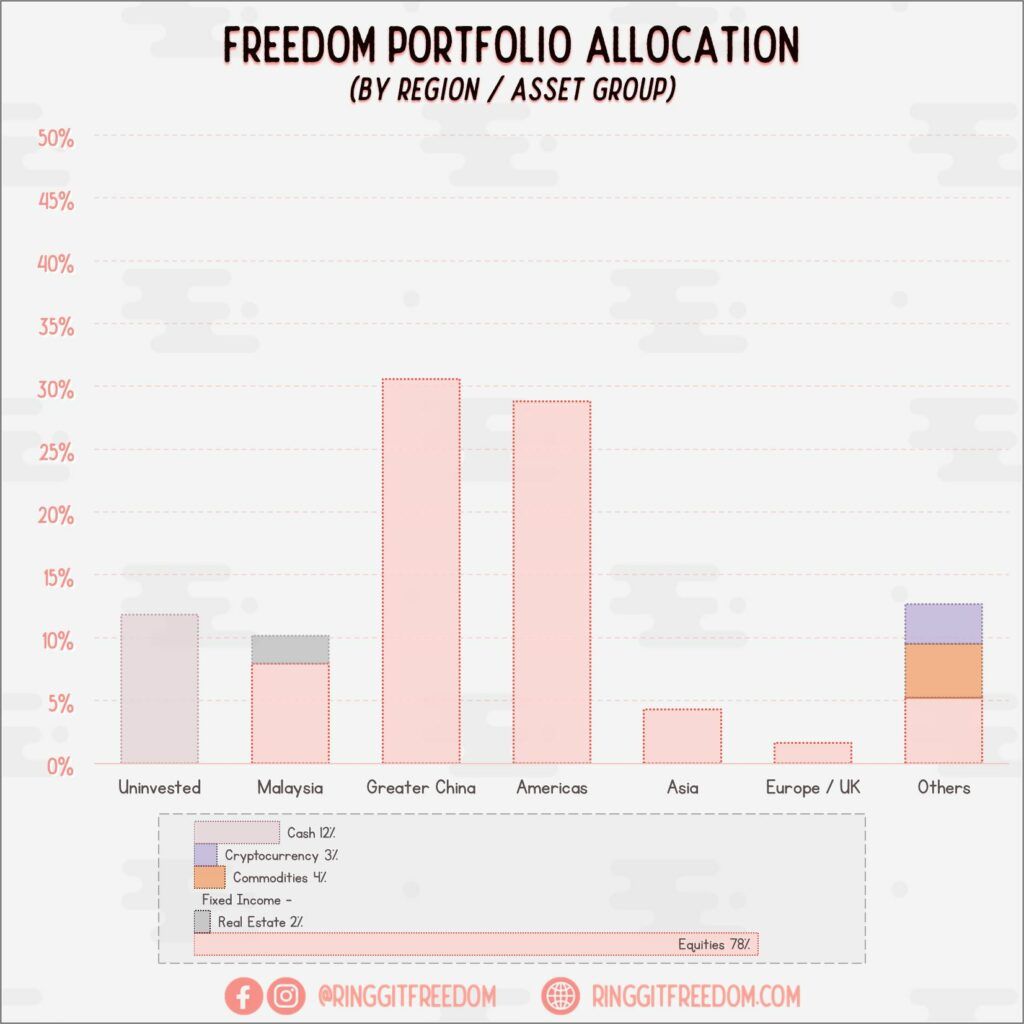

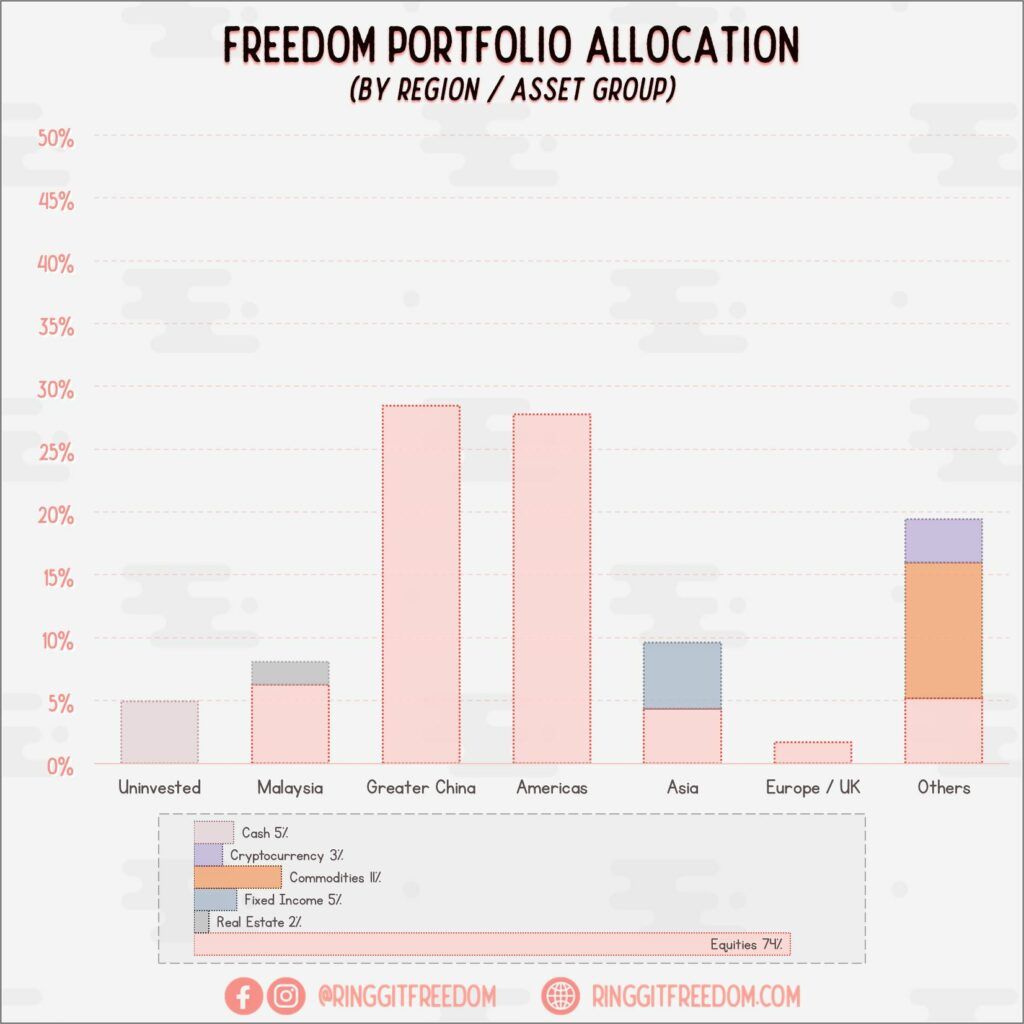

Allocation

Snapshot as of 30 June 2025

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 0.37%

ROI: 0.51%

Profit/Loss: RM 1,828.88

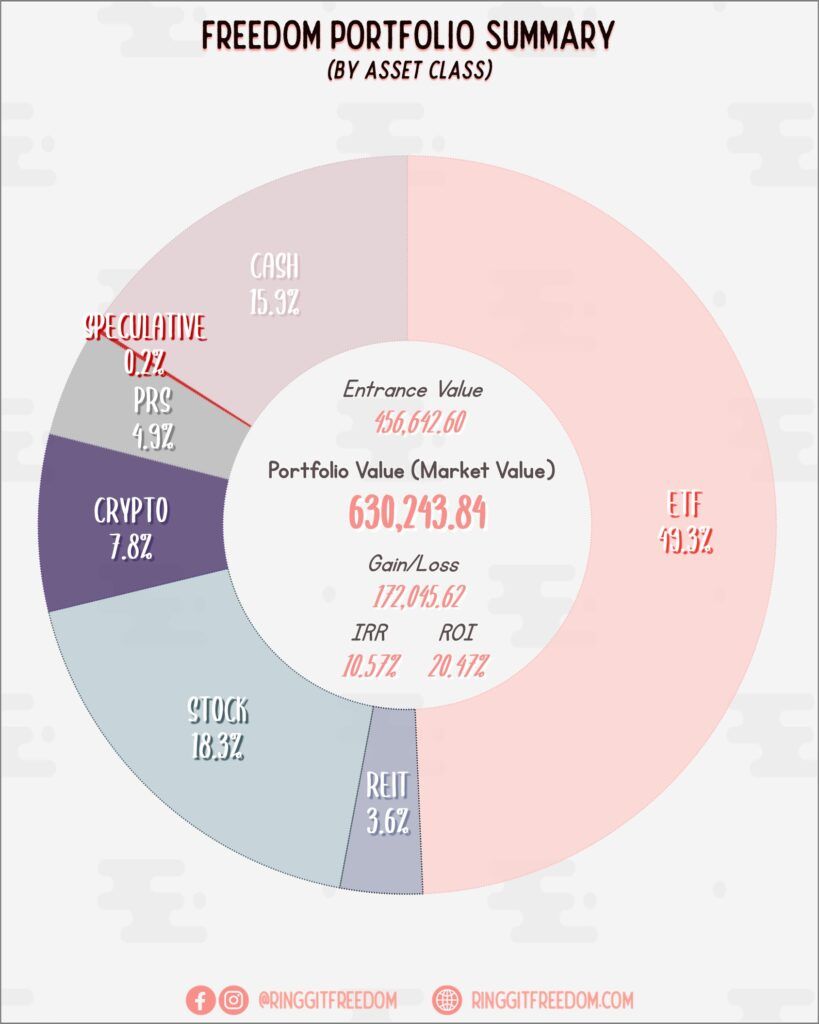

Active (Invested) Portfolio

IRR: 16.51%

ROI: 33.72%

Profit/Loss: RM 170,216.74

True Cost: RM 490,471.56

Total Value: RM 674,974.89

Entrance Value: RM 456,642.60

Portfolio Value: RM 630,243.84

Nett Dividend (2025): RM 2,191.06

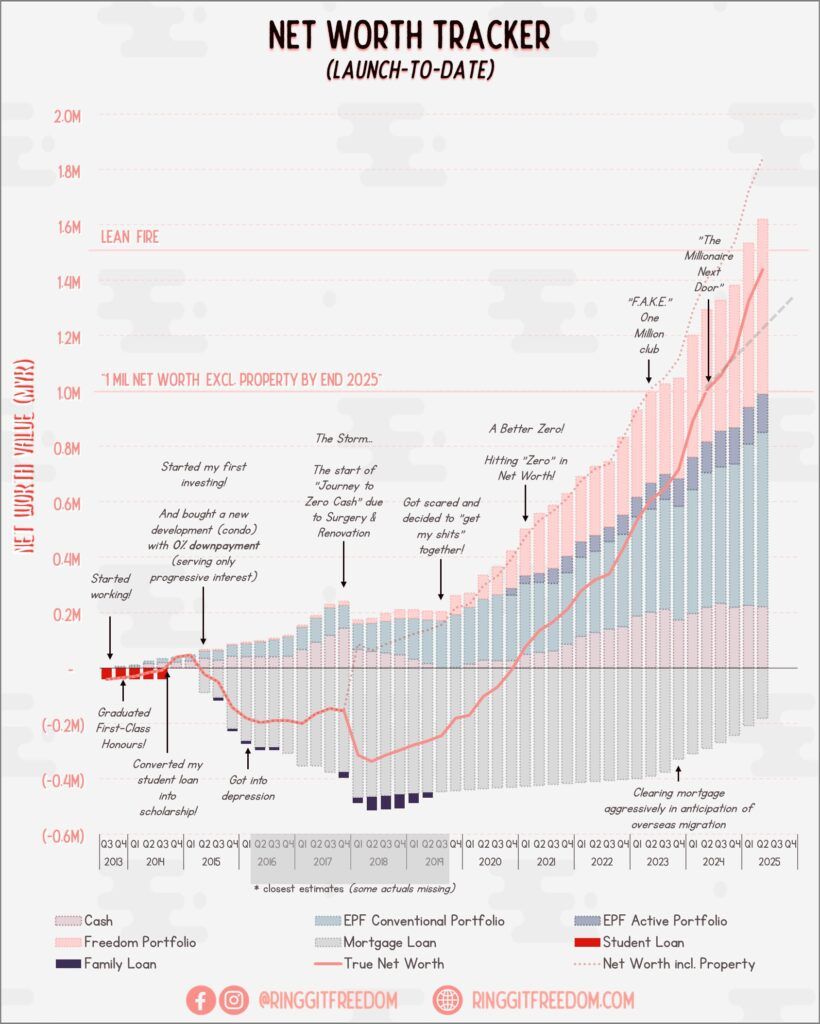

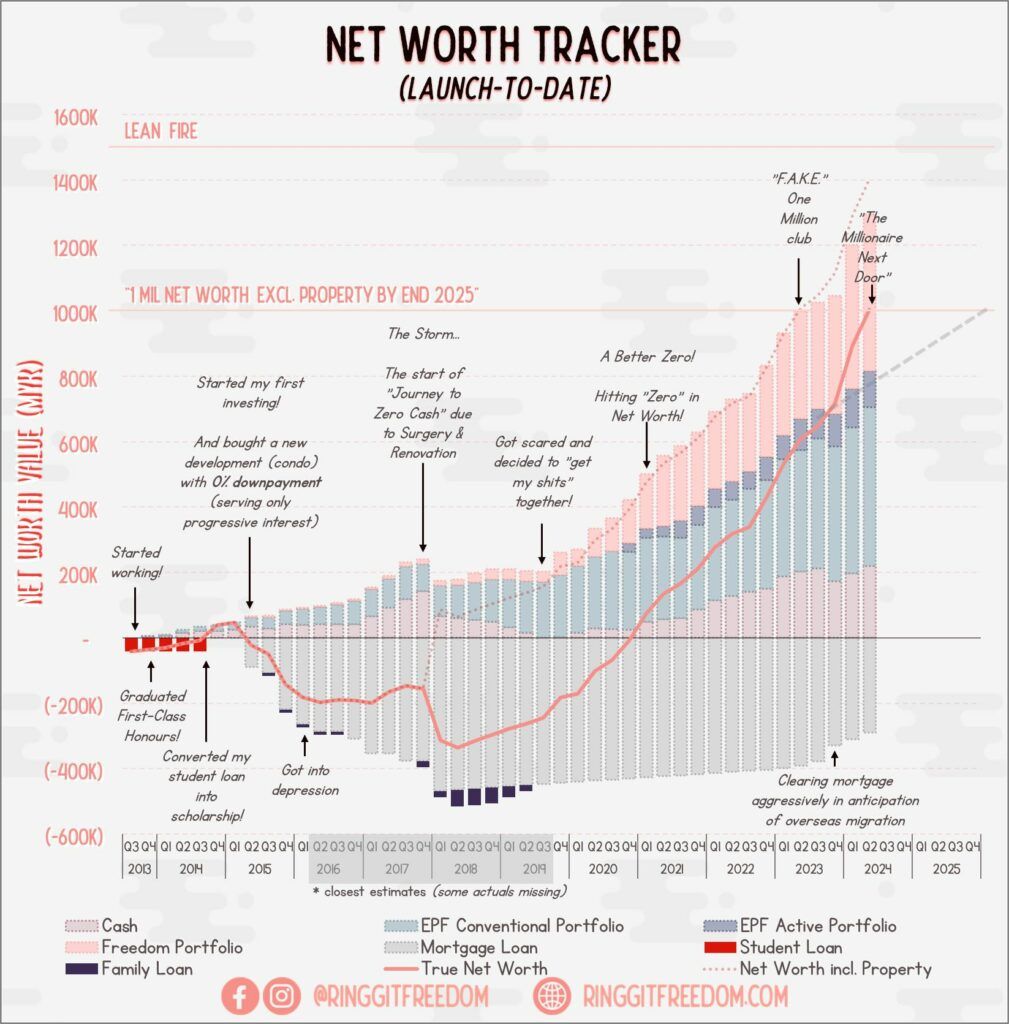

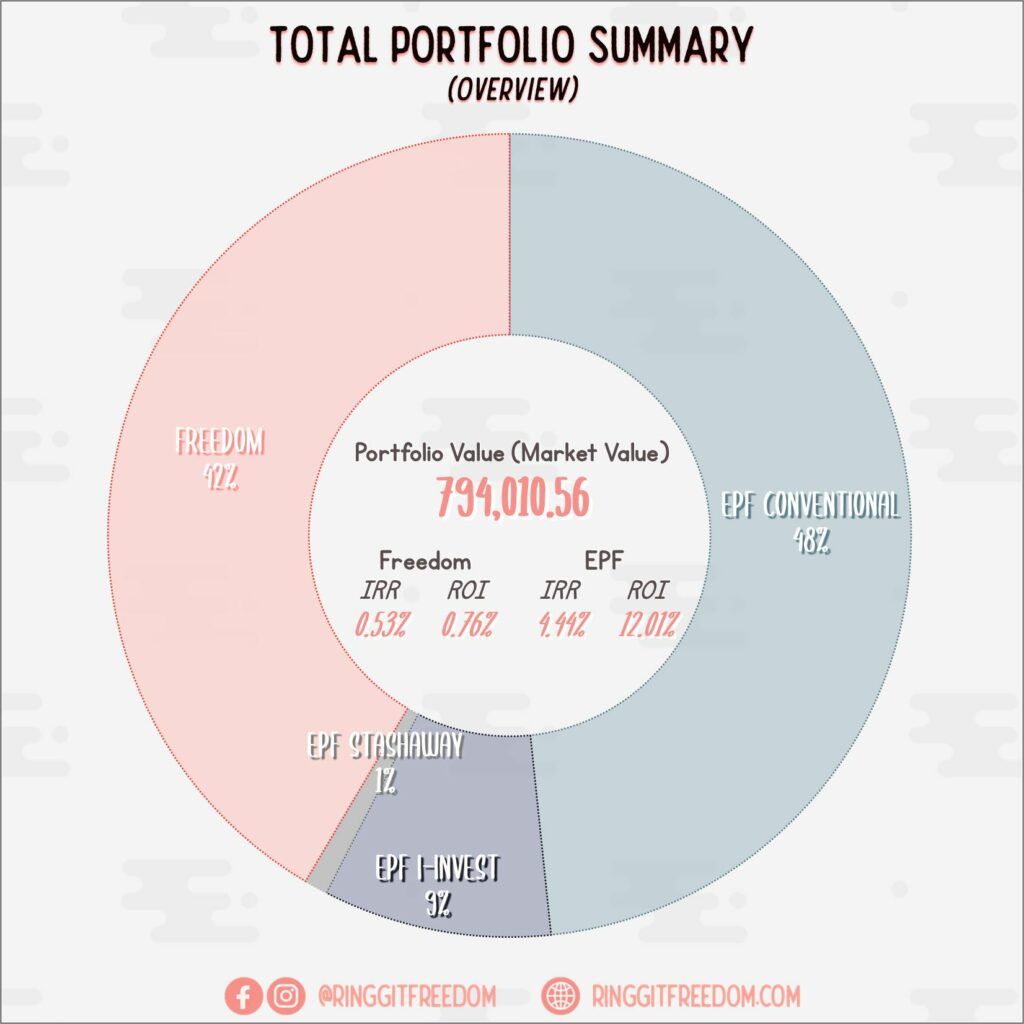

Net Worth Updates

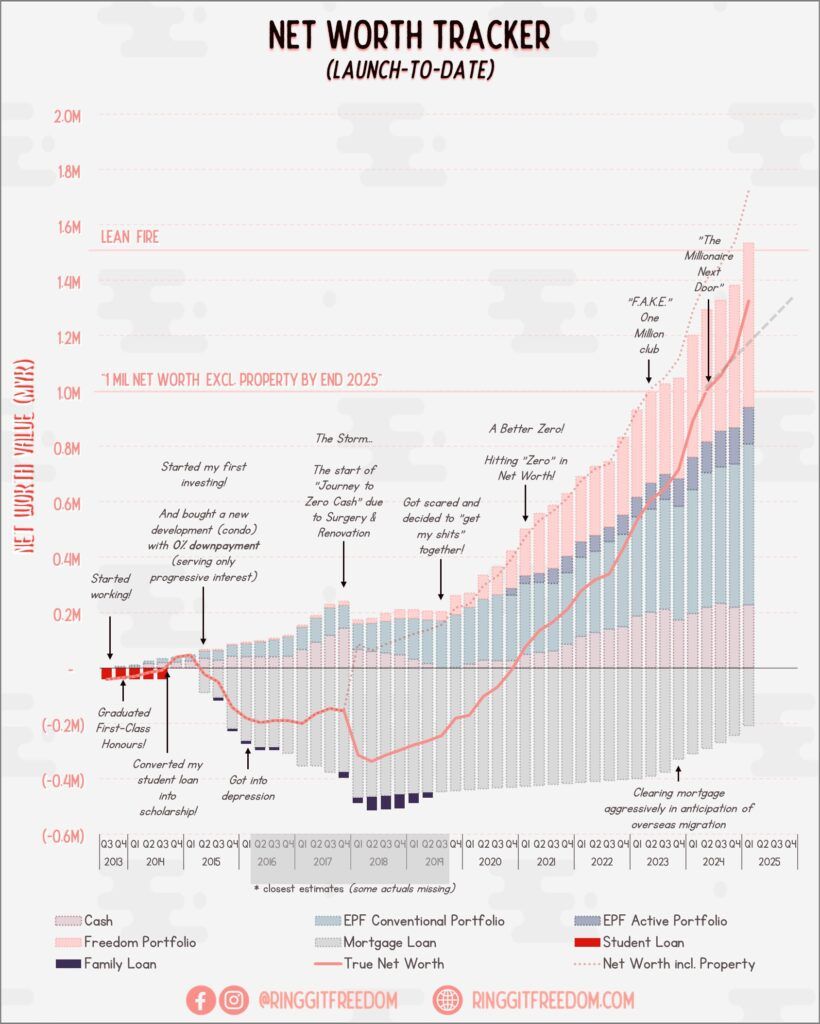

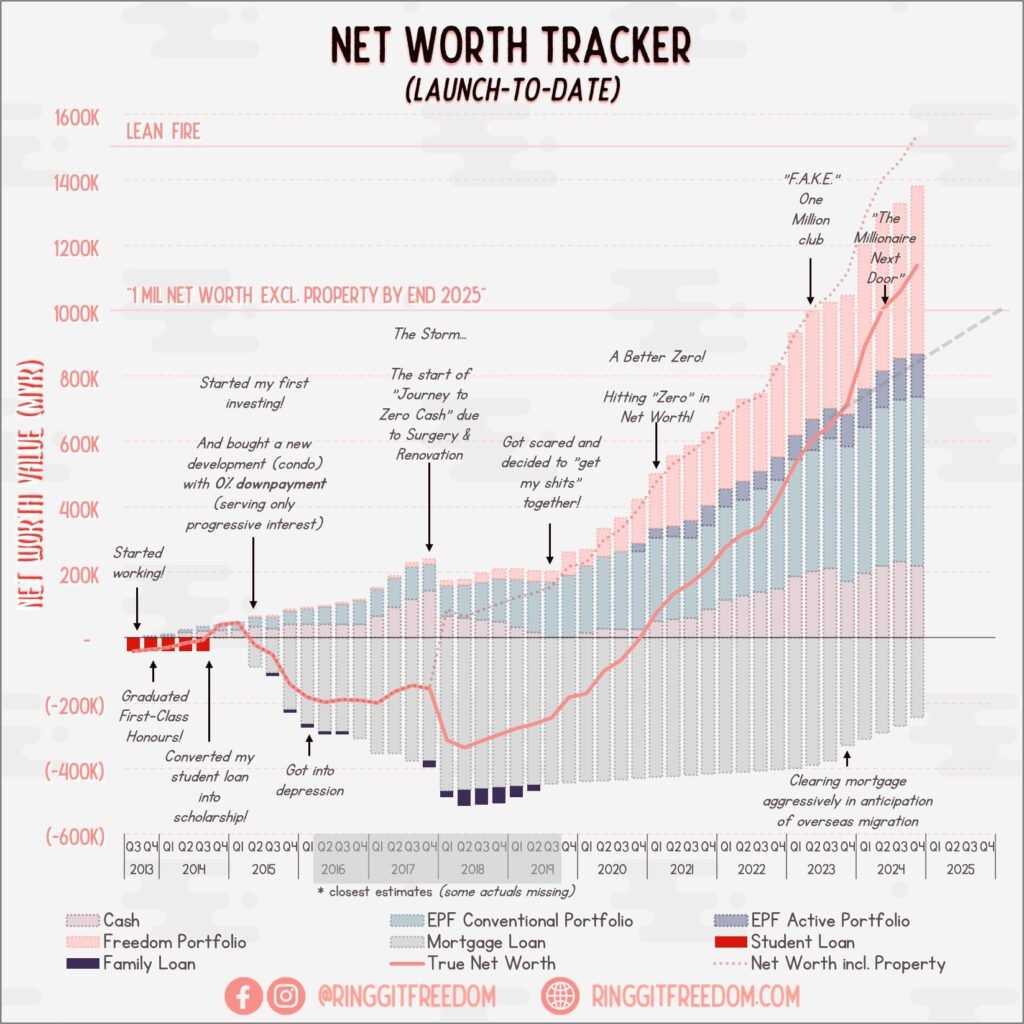

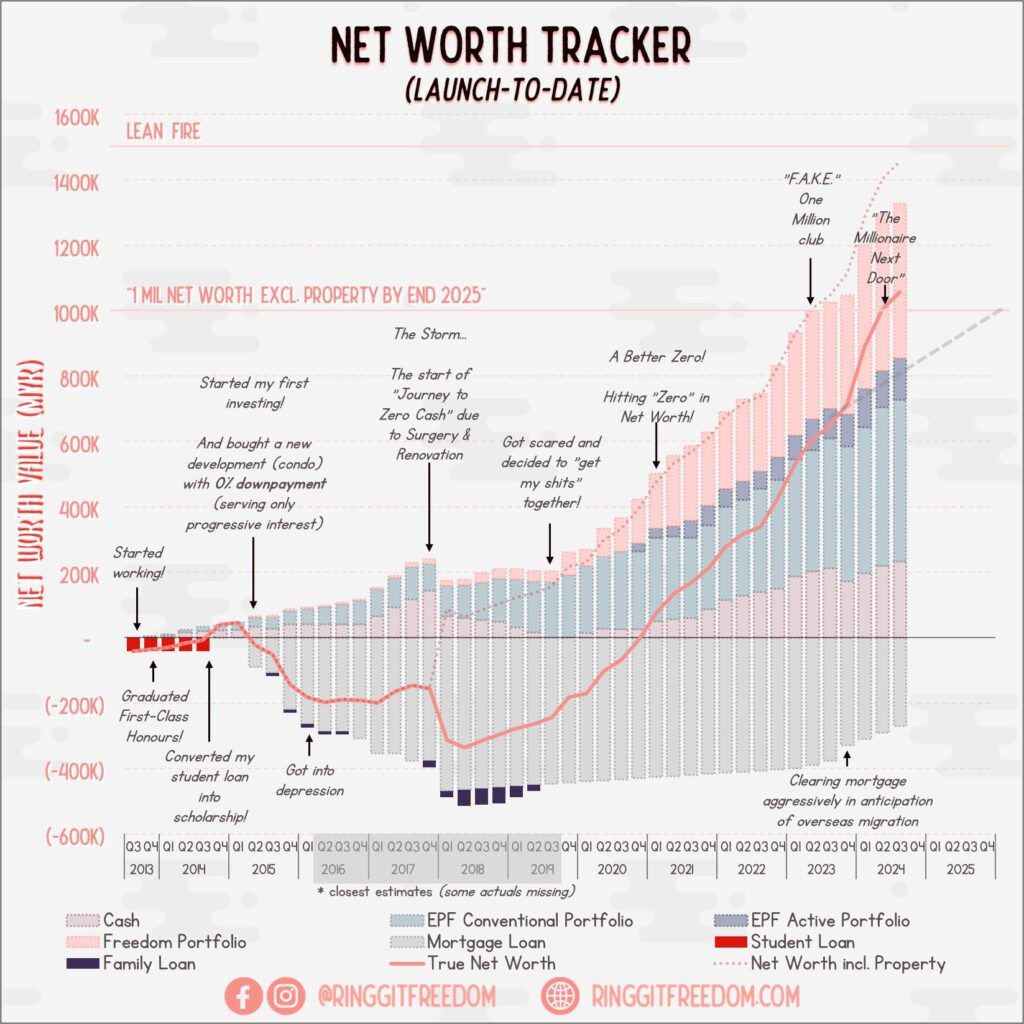

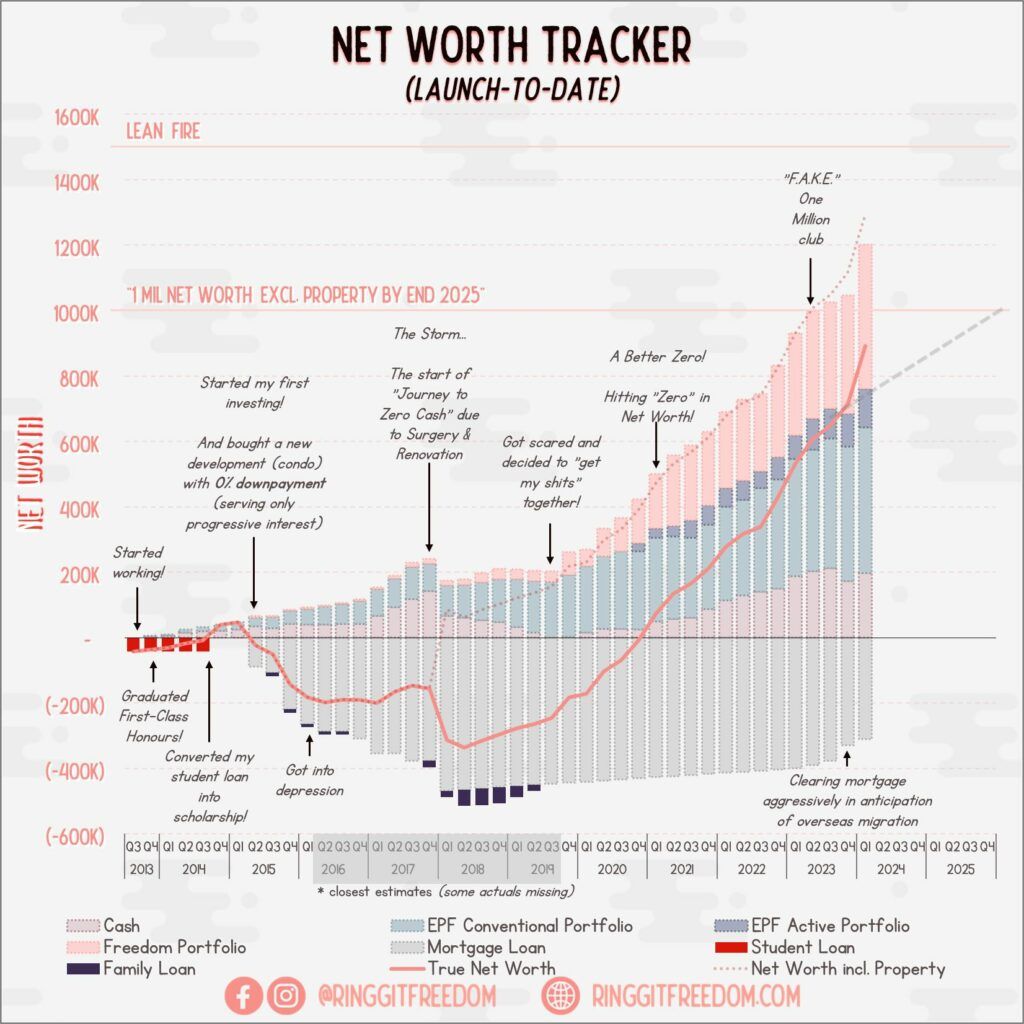

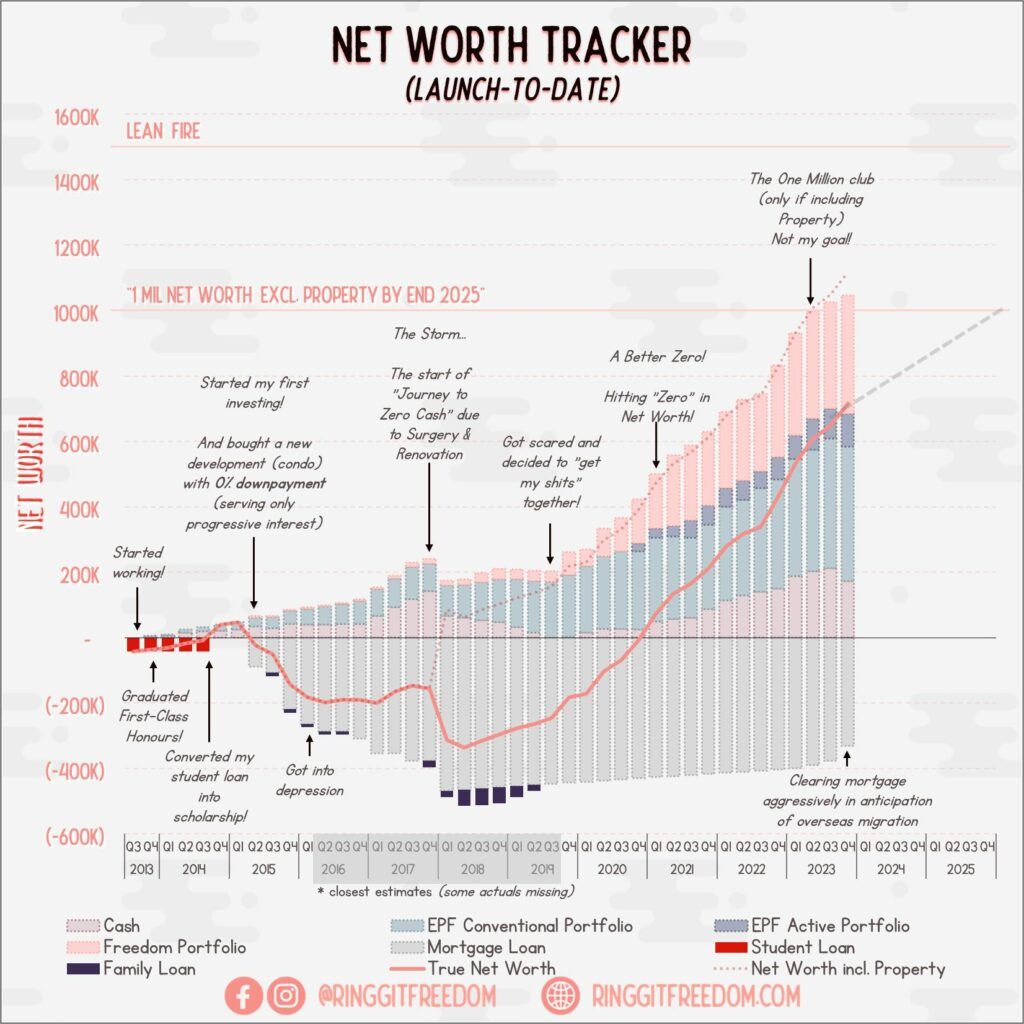

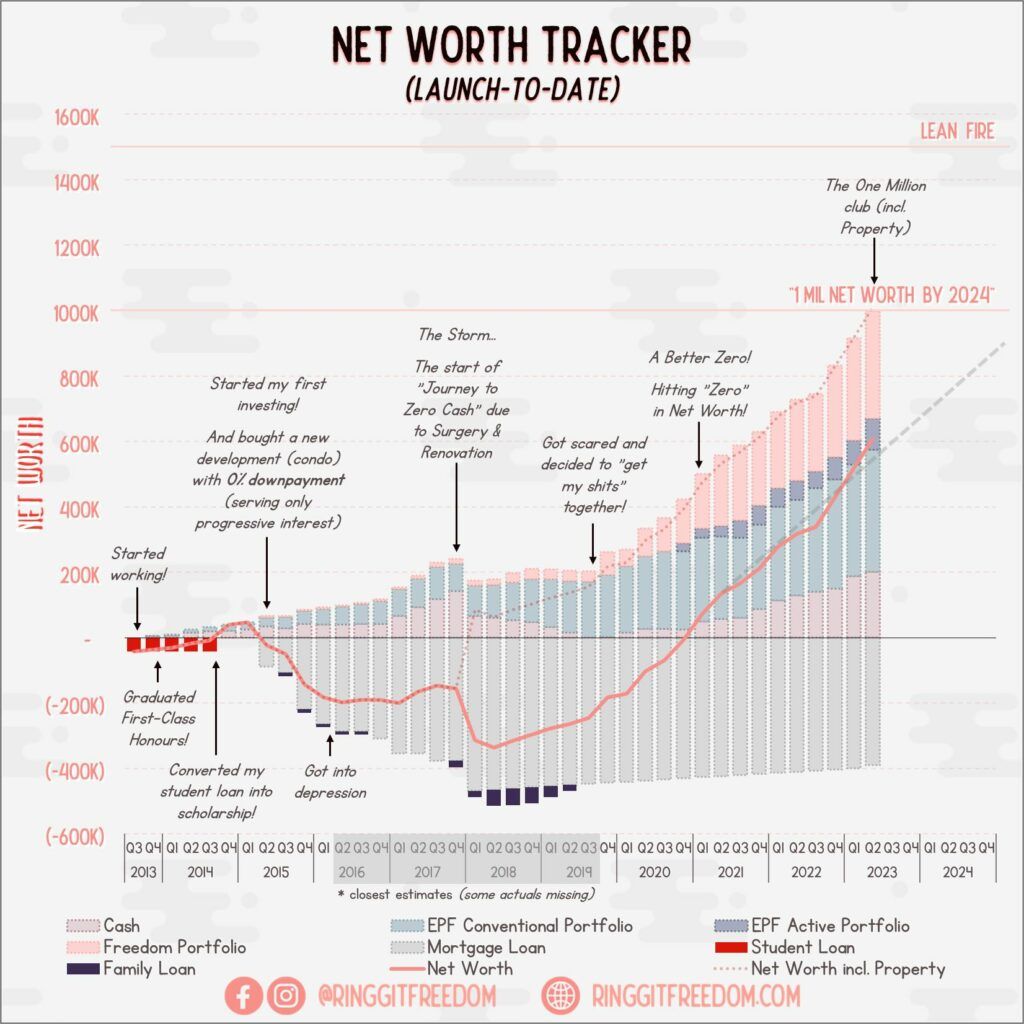

Despite my rather poor savings rate (disappointed with myself tbh) this quarter, I'm salvaged by the surprisingly good performance in the market. If market continues to rise at this pace, I'll probably be hitting my Lean FIRE target earlier than initially anticipated. Only time will tell where our net worth will stand by end of 2025.

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie

The post Ringgit Freedom’s June 2025 Updates appeared first on Ringgit Freedom.

]]>The post Ringgit Freedom’s March 2025 Updates appeared first on Ringgit Freedom.

]]>My Life & Mental State

Feels like yesterday that I just wrote my 2024 Year In Review and it's already March 😛 Quite frankly, Q1 2025 was still pretty hectic for me, at least until beginning of March, primarily due to a huge project at work which I'm overseeing.

Nevertheless, I never forgot to took some time off for myself and managed to catch the limited screening of IU Concert: The Winning during the limited screening period worldwide. In a way, it's for me to relive my regrets for not splurging last year when I given the chance to.

Other than that, it was pretty much just work, and/or festive celebrations with feasts here and there. Oh, and not to forget the constant juggle between getting some rest vs. doing Korean Class Homework/Past Year Test Papers vs. leisure gaming time for myself. Ugh, priorities!

P/S To my Muslim readers out there reading this, Selamat Hari Raya Aidilfitri, Maaf Zahir dan Batin.

Now, going back to our usual monthly update for my finances and portfolios.

My Financials

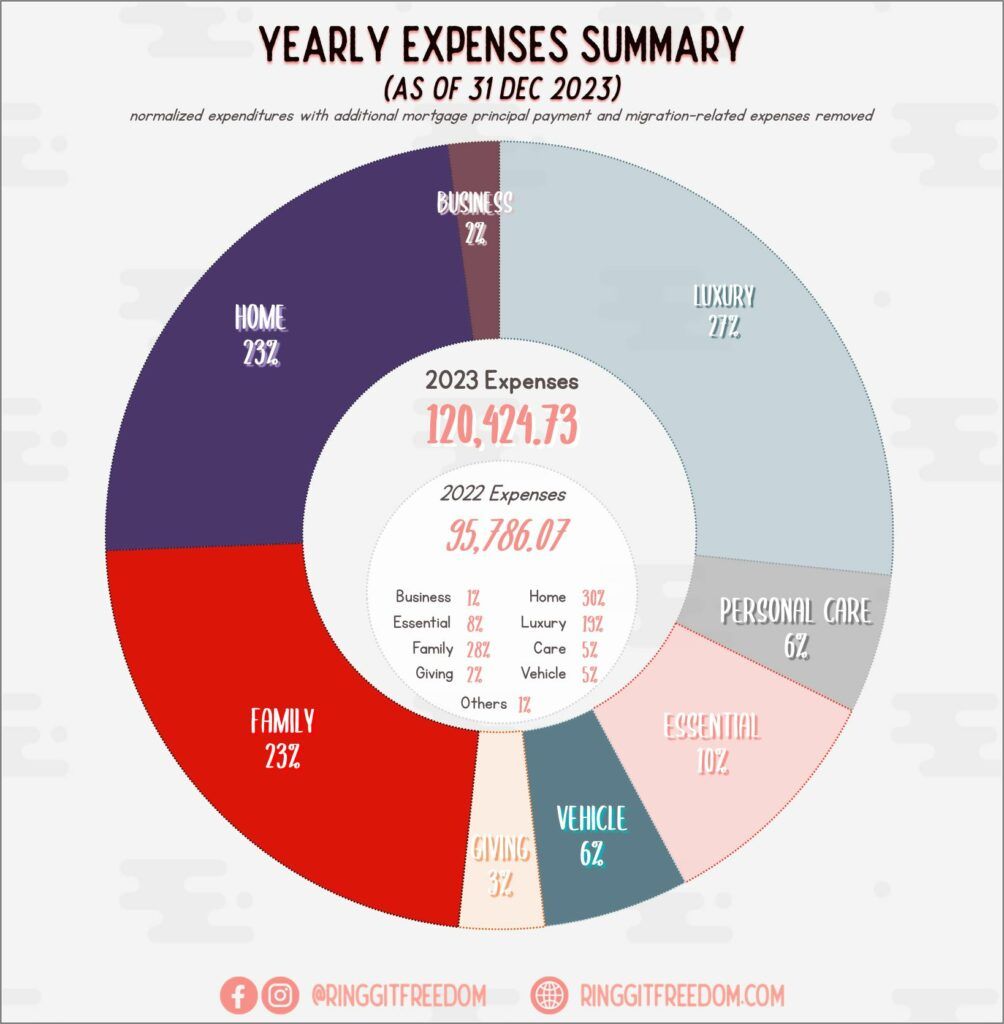

One quick caveat before we start our financials update - I've decided to simplify stuff a little especially when it comes to expenses & savings rate. In the past, I've always had to run two set of numbers - one 'standard' savings rate and another 'normalised' savings rate throughout year of 2023 & 2024.

The primary reason for this was due to the additional expenditures I've incurred as one-off investment to migrate overseas (immigration related expenses) and acceleration of my mortgage paydown plan (additional principal contributed to paydown mortgage principal faster).

However, since these were ultimately investment towards myself (one way or another) I've decided to take the same blanket treatment - just like how I've always excluded investment-related spendings outside of my Expenses / Savings Rate calculation.

Going forward, just like other investments, I'll be excluding immigration related expenses and additional principal paid to my mortgage from both Expenses & Savings Rate.

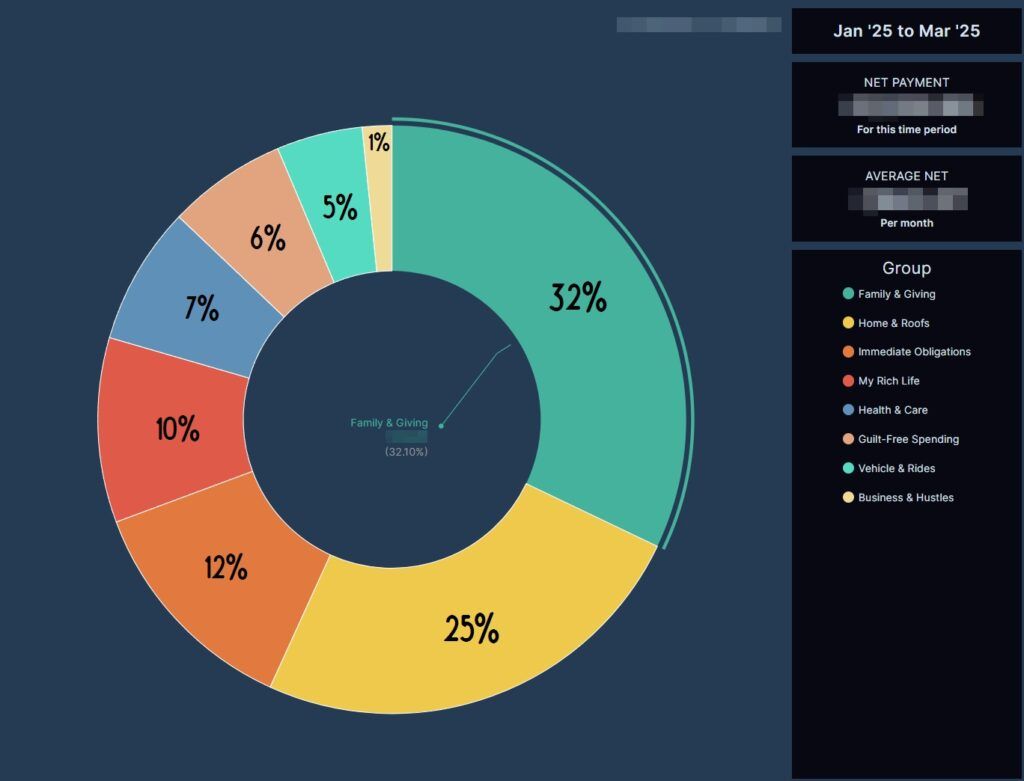

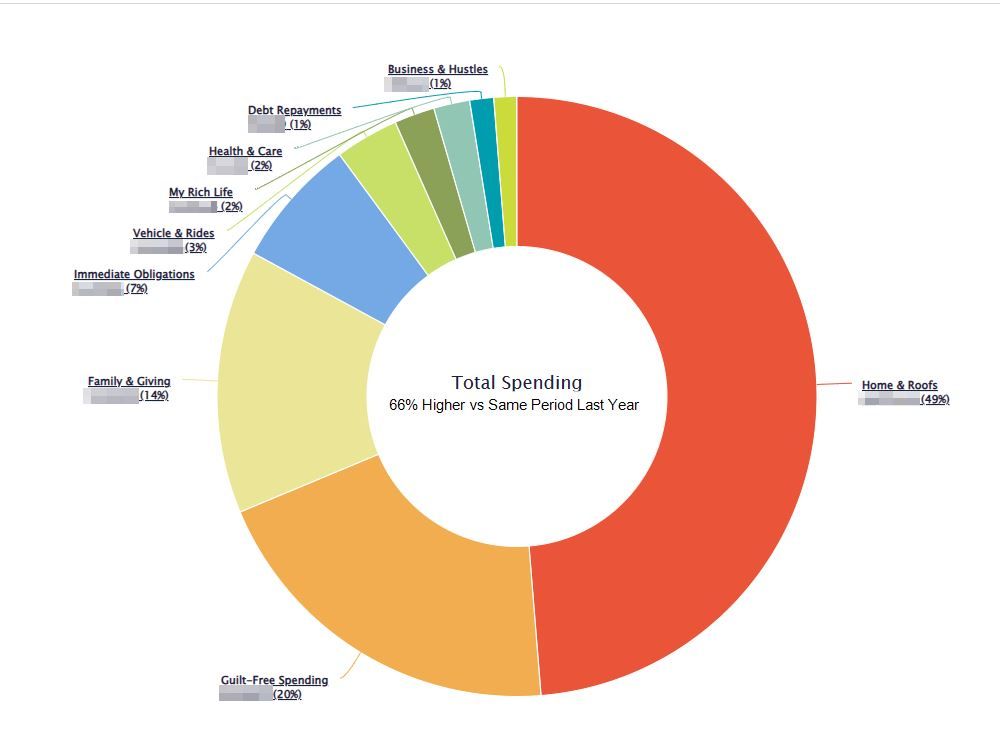

Expenses

With the additional principal payments removed from the Expenses chart, it's pretty clear that a significant portion of my income goes towards my Family's spending (Allowance, Treats, Insurances, etc.) and of course not to forget the mandatory mortgage payments mandated by bank.

Aside from these two, my other expenditures remains relatively stable (and minuscule) considering my income.

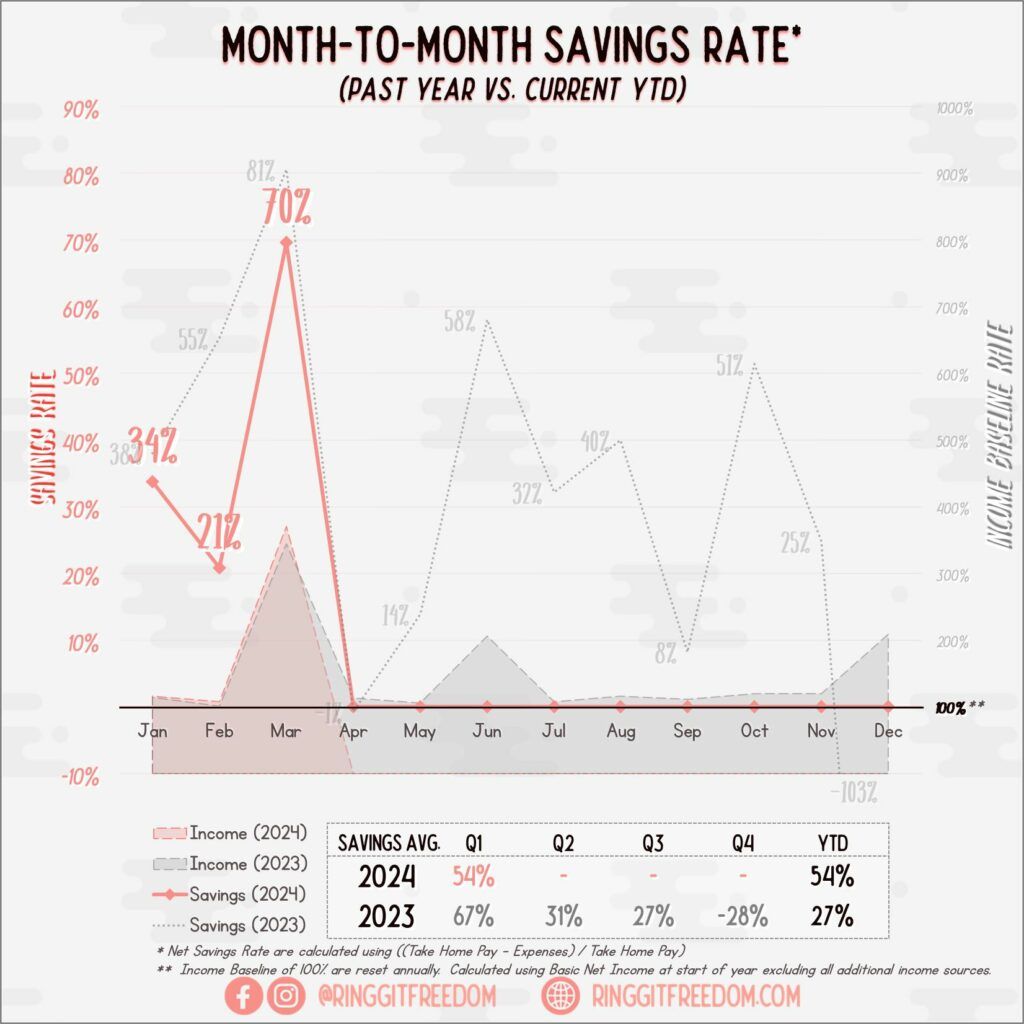

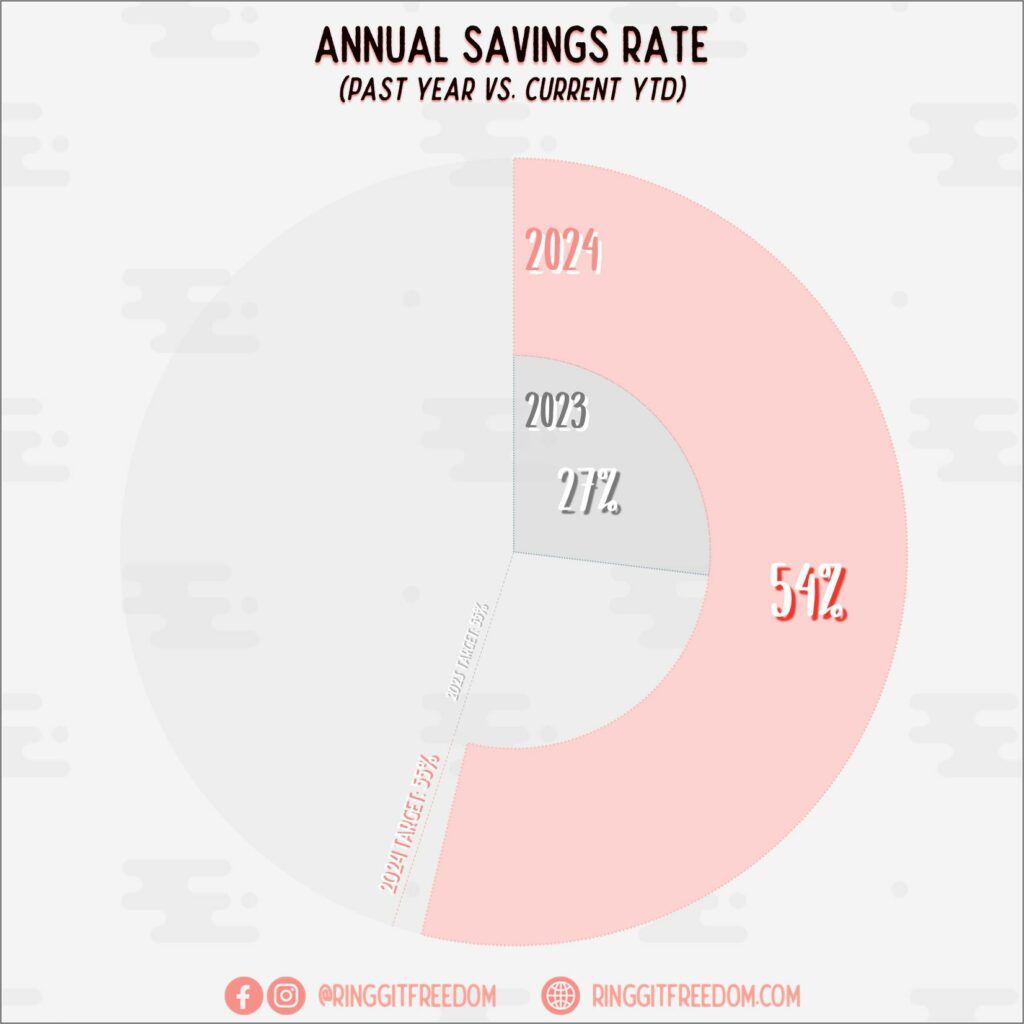

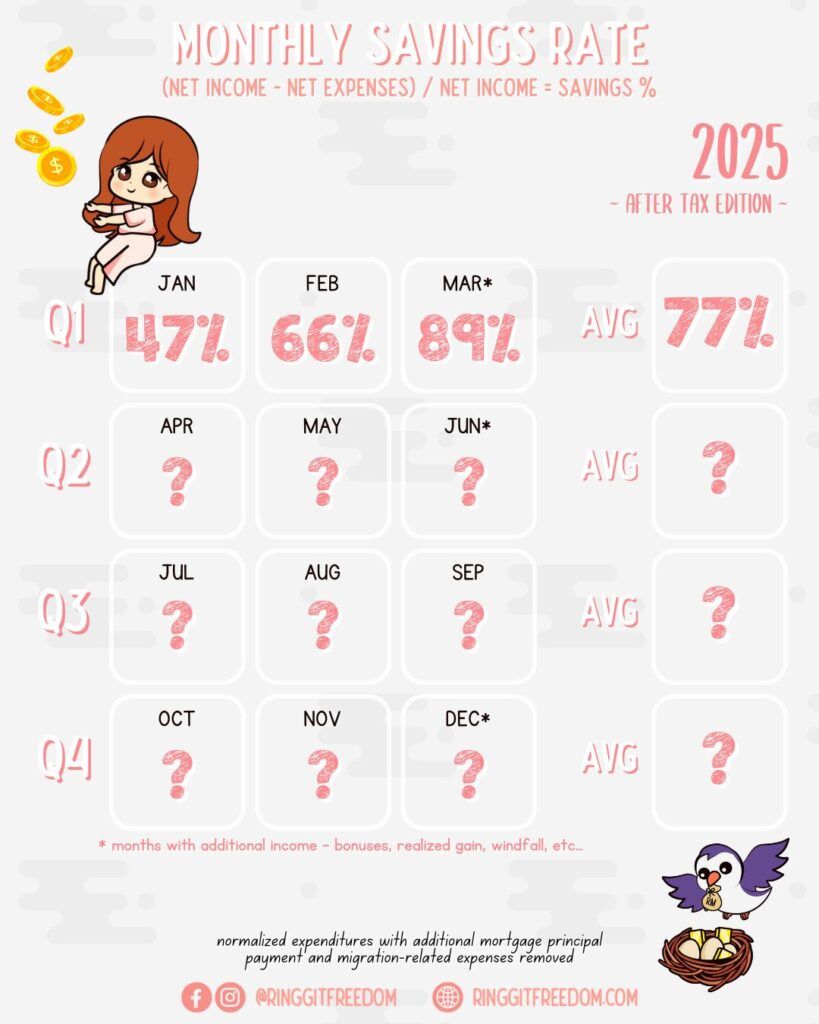

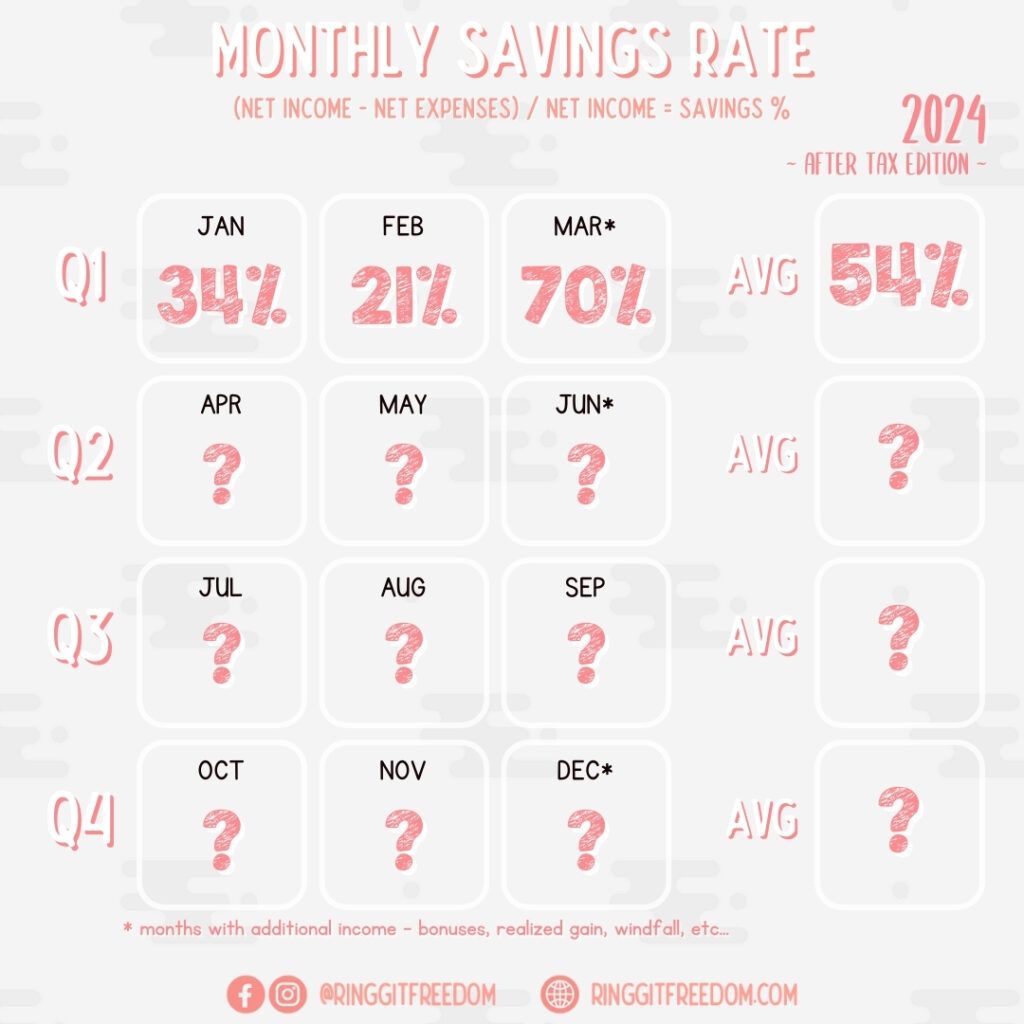

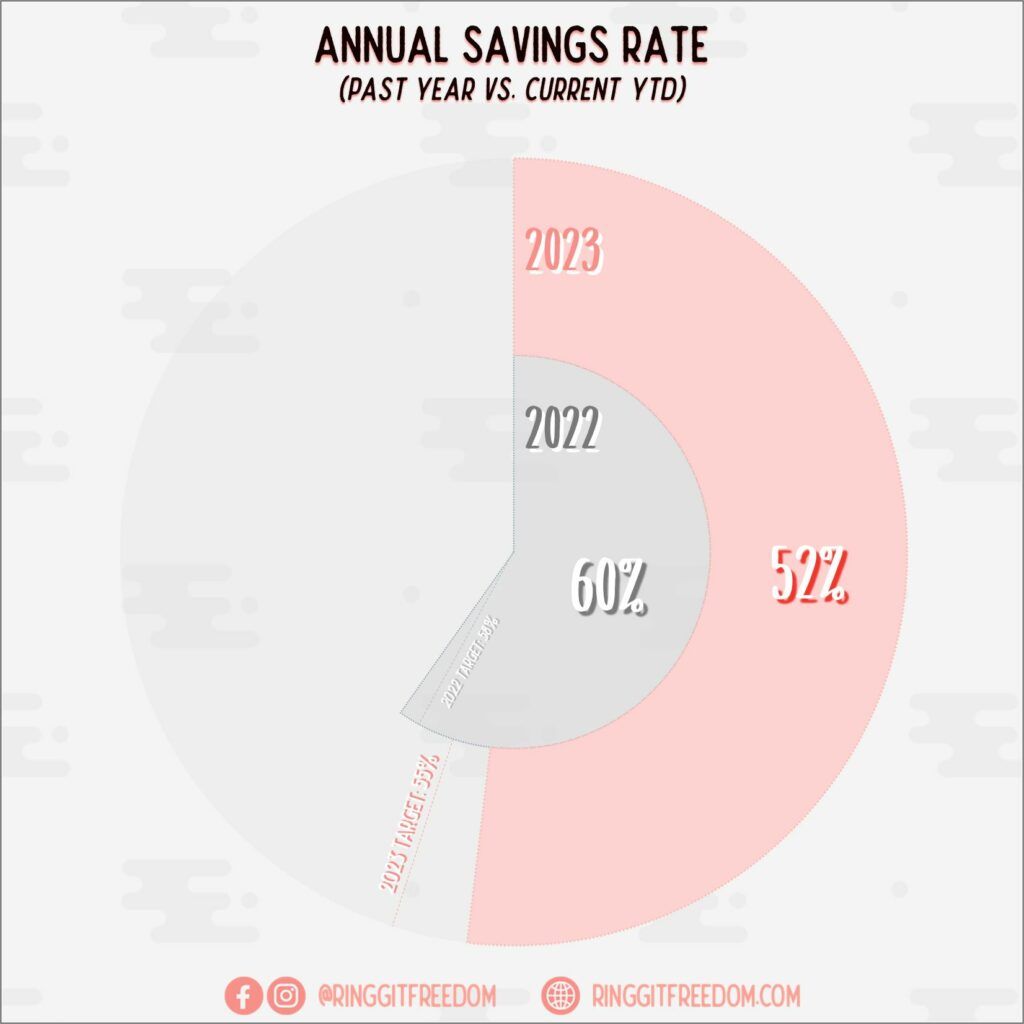

Savings Rate

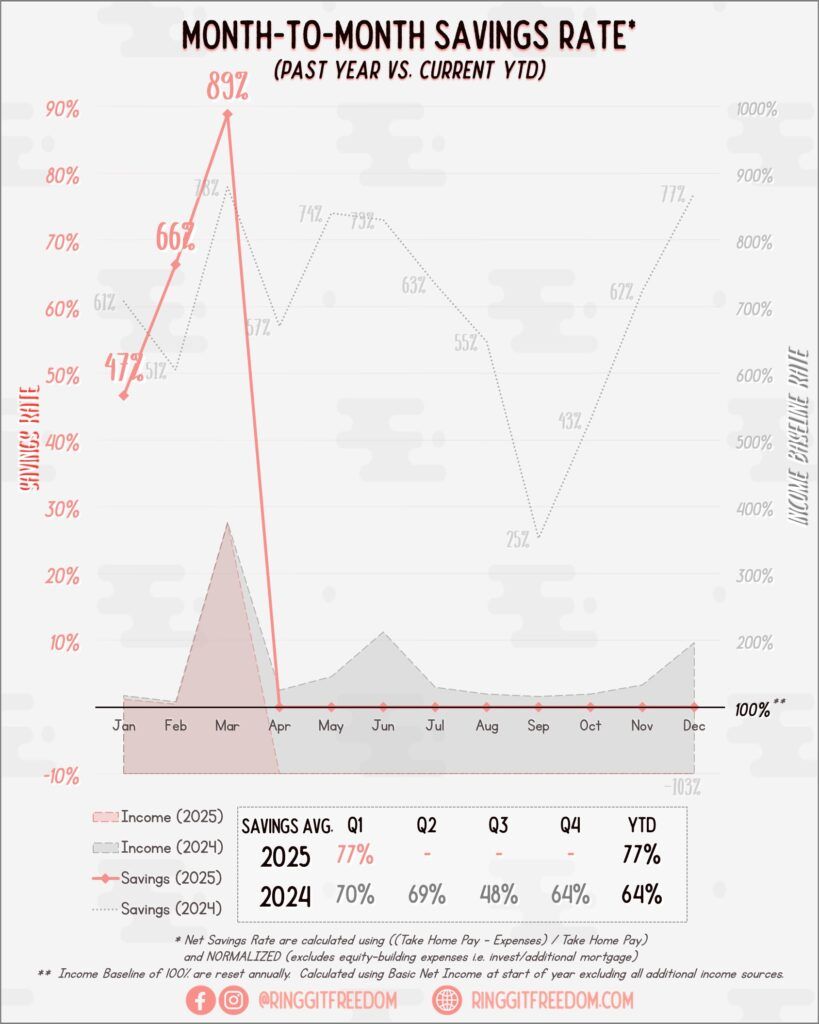

I always enjoyed Quarter 1 of the year - not just for the festive seasons, but also the extra payday from various sources - Tax Refunds, EPF Dividends, or Performance Bonuses from last year. These spikes in income have helped me in last couple of years to accelerate my goals. Of course it goes without saying that majority of these "savings" are promptly invested - whether in forms of additional principal contributions to my mortgage loan or simply funding my Freedom Portfolio.

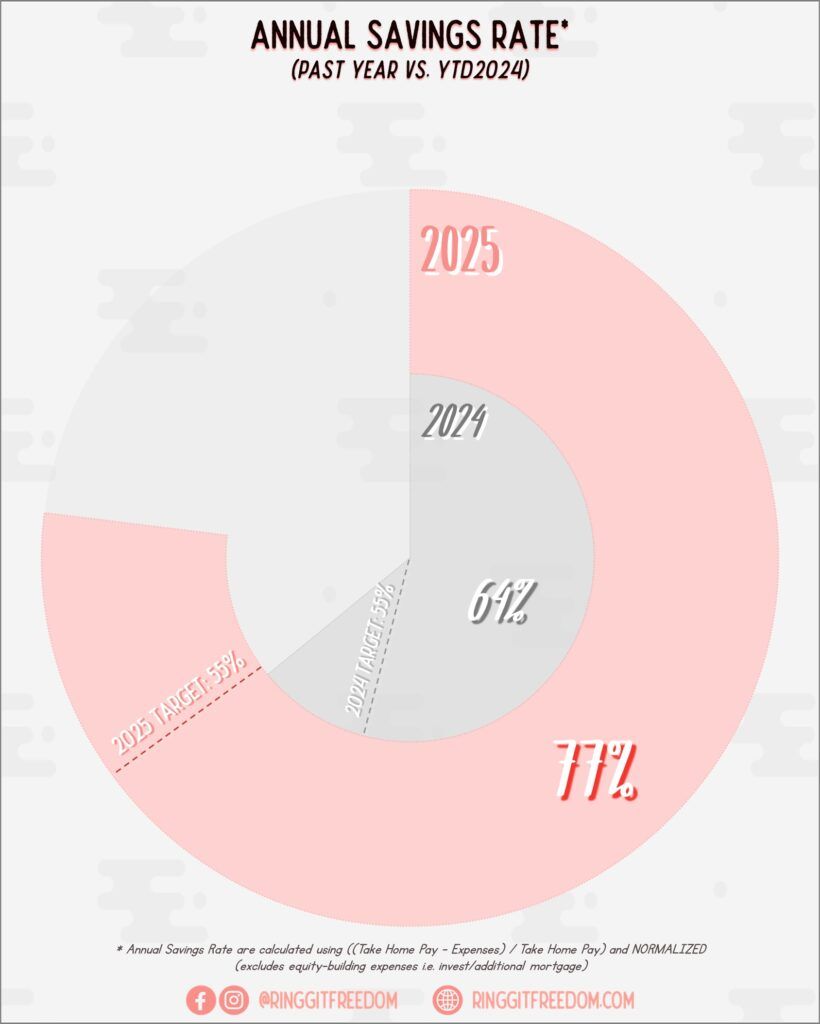

With these bonuses, we managed to start our Quarter 1 strong with year-to-date Savings Rate of 77%. As long as I keep up my habits for the next 9 months, even if simply by mimicking my last year's savings rate trending, we should be able to hit our target just fine.

Emergency Jar

No changes to the Emergency Jar this quarter.

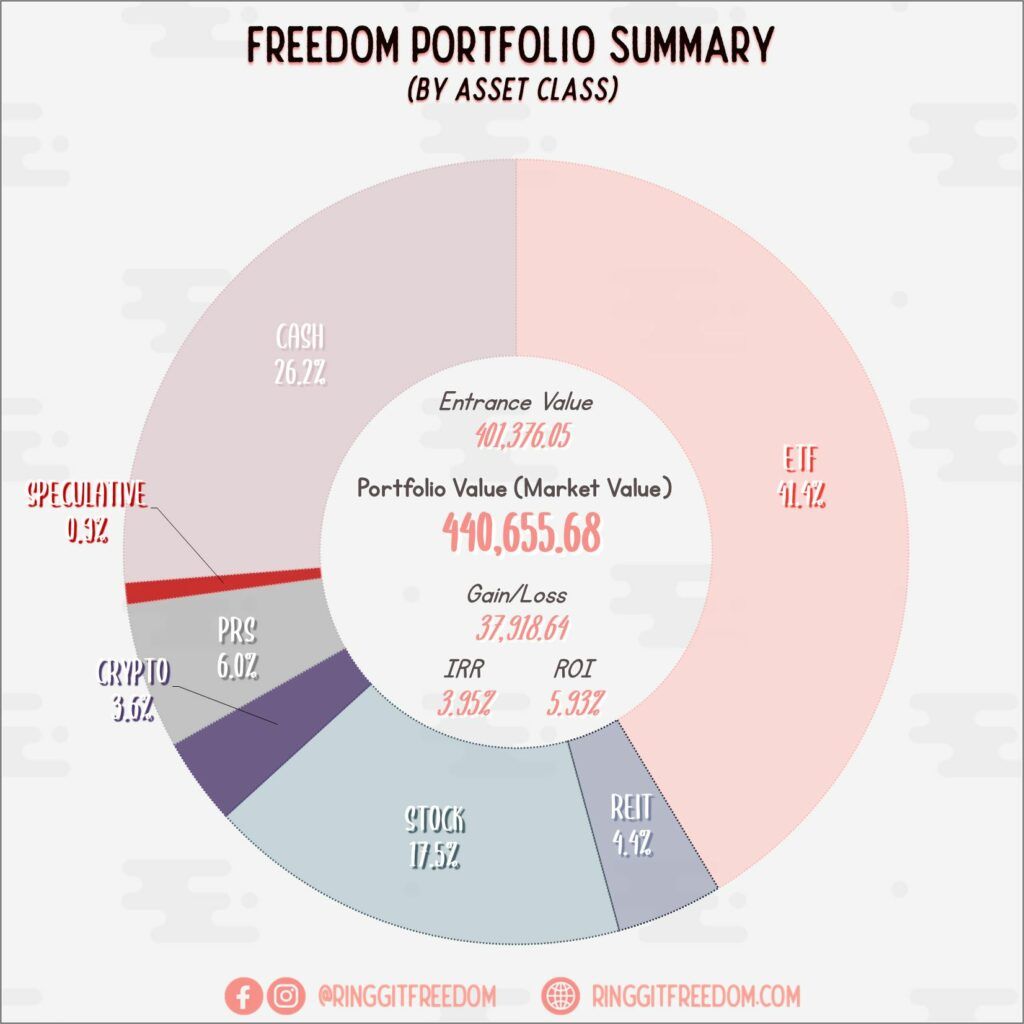

My "Freedom" Investments

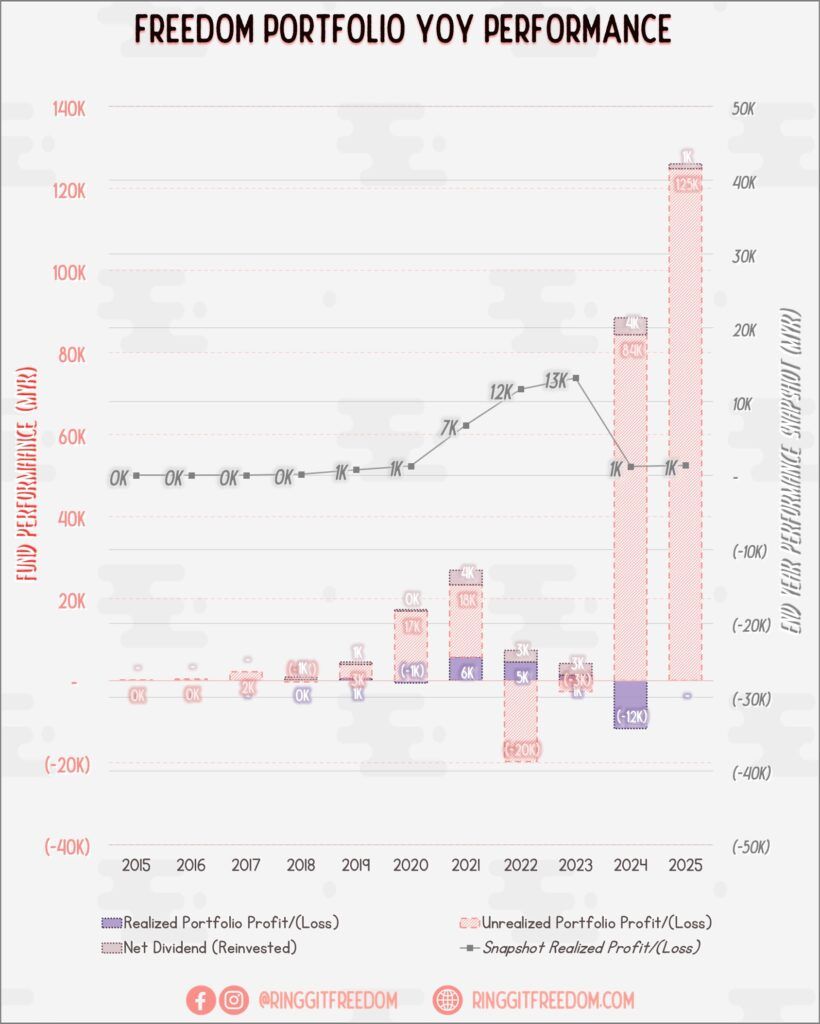

Performance

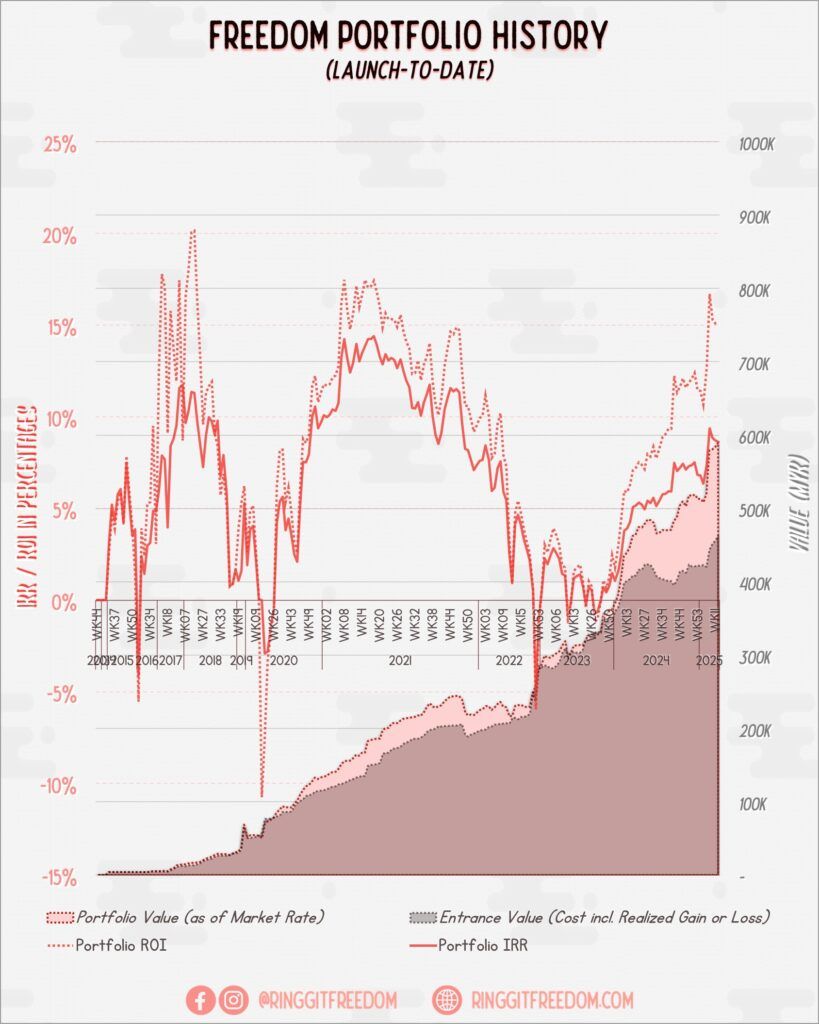

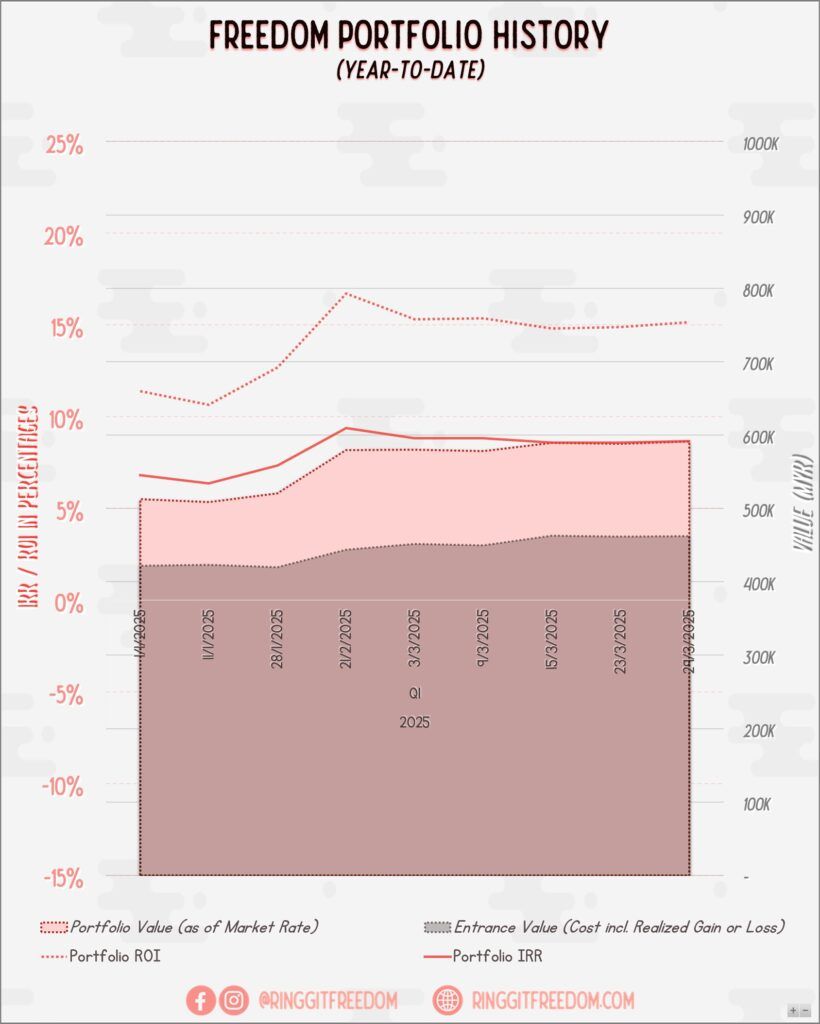

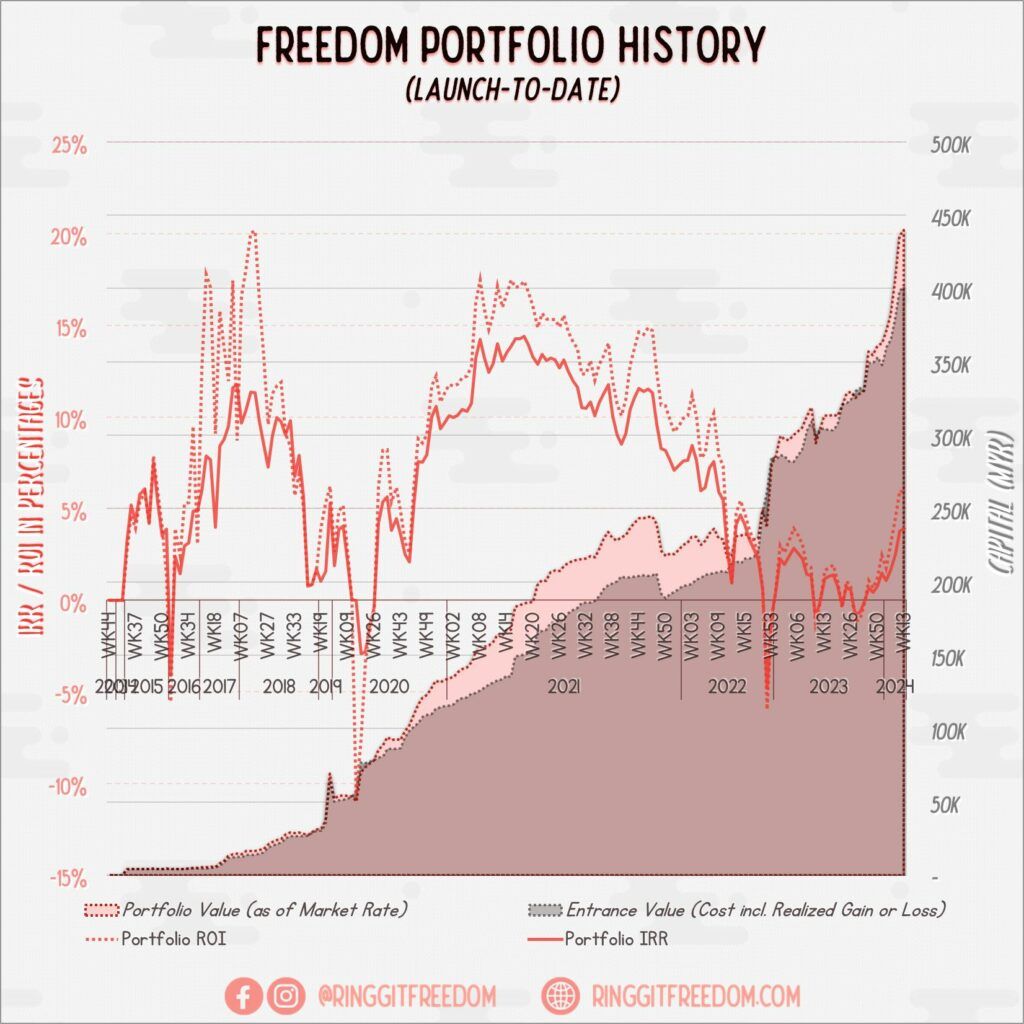

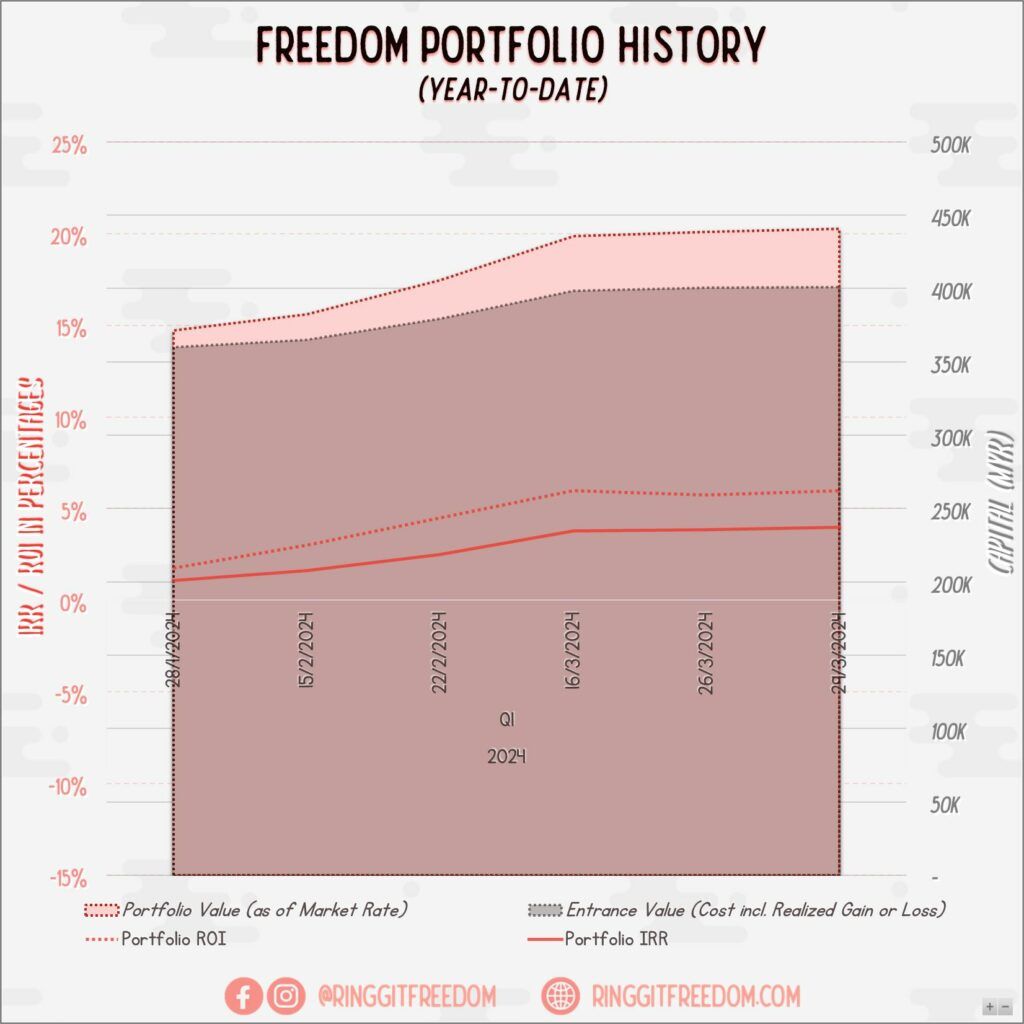

Last 3 months have been crazy ever since Trump took office - with never ending roller coasters' ride for stock market. On one hand, almost everything from SP500 to Gold to Bitcoin was creating new highs, then tumble, rise again and then tumble for a few rounds. Looking at the unrealized gain at this stage - it really really is taking a toll on me to NOT TAKE PROFIT AND CONTINUE HOLDING. Managed to buy some dips during the short Crypto Crash as well (basically undoing my "short" last year 😂)

Knowing that market cycles are cyclical and what goes up will come down (and vice versa), it's so tempting to just take some profits during the all time high so that I can scoop lows when it crashes again. But this definitely is against my investment philosophies, so am doing what I can through sheer willpower to try... not to touch my portfolio 😅😵💫

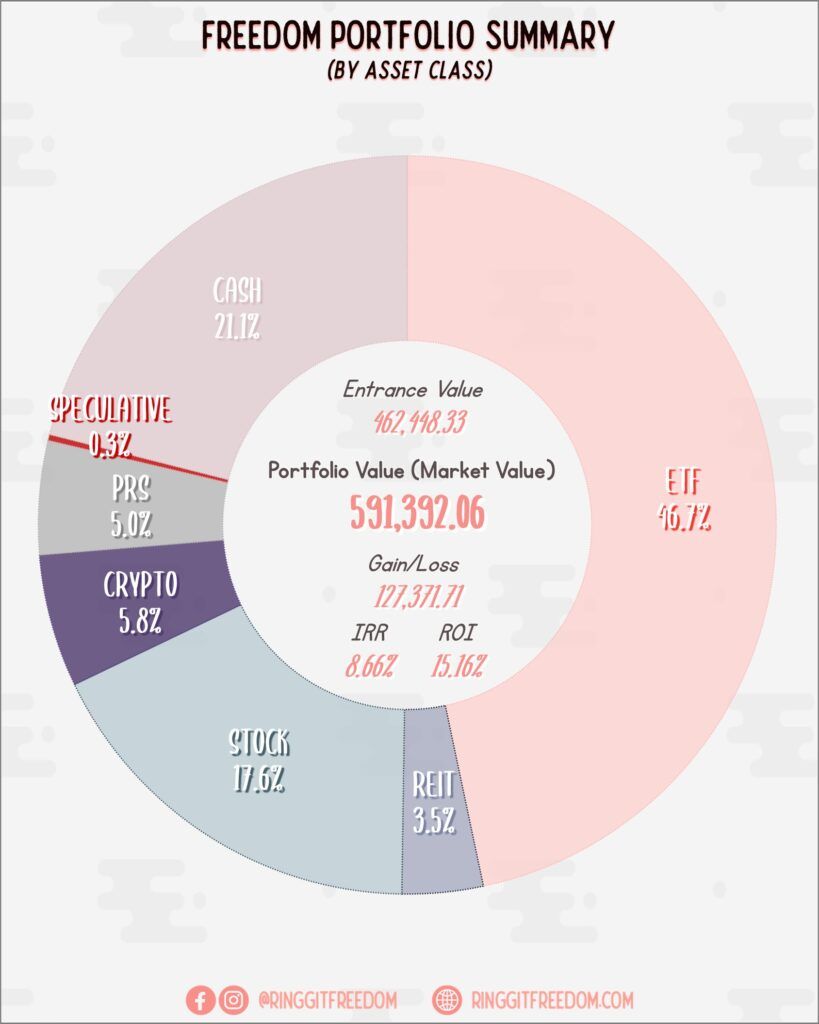

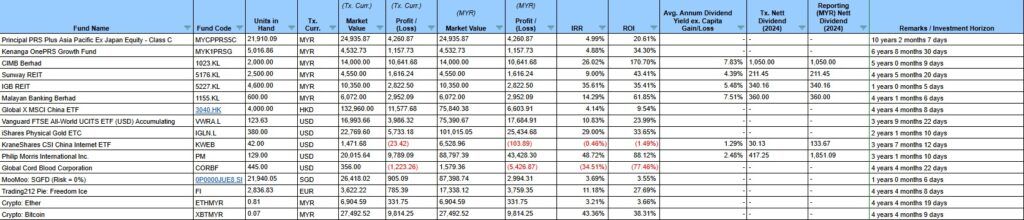

Allocation

Snapshot as of 30 March 2025

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 0.26%

ROI: 0.37%

Profit/Loss: RM 1,244.67

Active (Invested) Portfolio

IRR: 13.77%

ROI: 24.98%

Profit/Loss: RM 127,371.70

True Cost: RM 464,762.81

Total Value: RM 629,623.52

Entrance Value: RM 462,448.33

Portfolio Value: RM 591,392.06

Nett Dividend (2025): RM 1,209.07

Net Worth Updates

March's spike in Net Worth value always scare me - with various factors contributing to it from EPF's dividend announcement (hence recognition of values), to company's performance bonuses, and of course our not-so-beloved tax refunds. On top of it, we also have new market highs (despite the ongoing crashes) of my unrealised portfolio gains shooting up my net worth by almost 200K.

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie

The post Ringgit Freedom’s March 2025 Updates appeared first on Ringgit Freedom.

]]>The post 2024 in Review: The Gap Year appeared first on Ringgit Freedom.

]]>Things got very hectic (read: chaotic) at workplace with a large scale project with at least 50 project members involved cross-functionally & across the globe. As much as I wanted to empower my team and other departments, unfortunately there are still significant dependencies on me (and my knowledge) hence unconsciously my attention shifted back to my works/careers (and of course not forgetting to take breaks in between to recharge). In the end, it was tiring, but still rewarding to see the accomplishments after almost 9 months of hell.

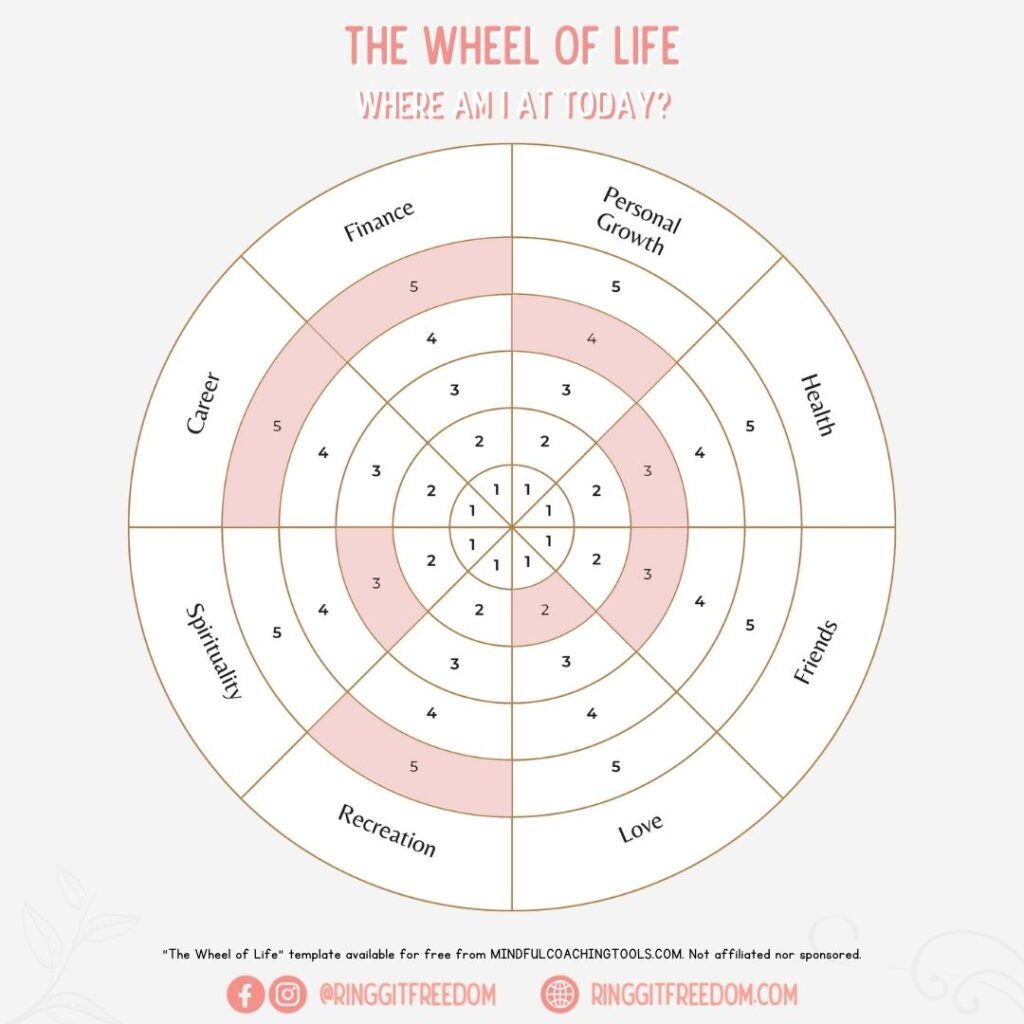

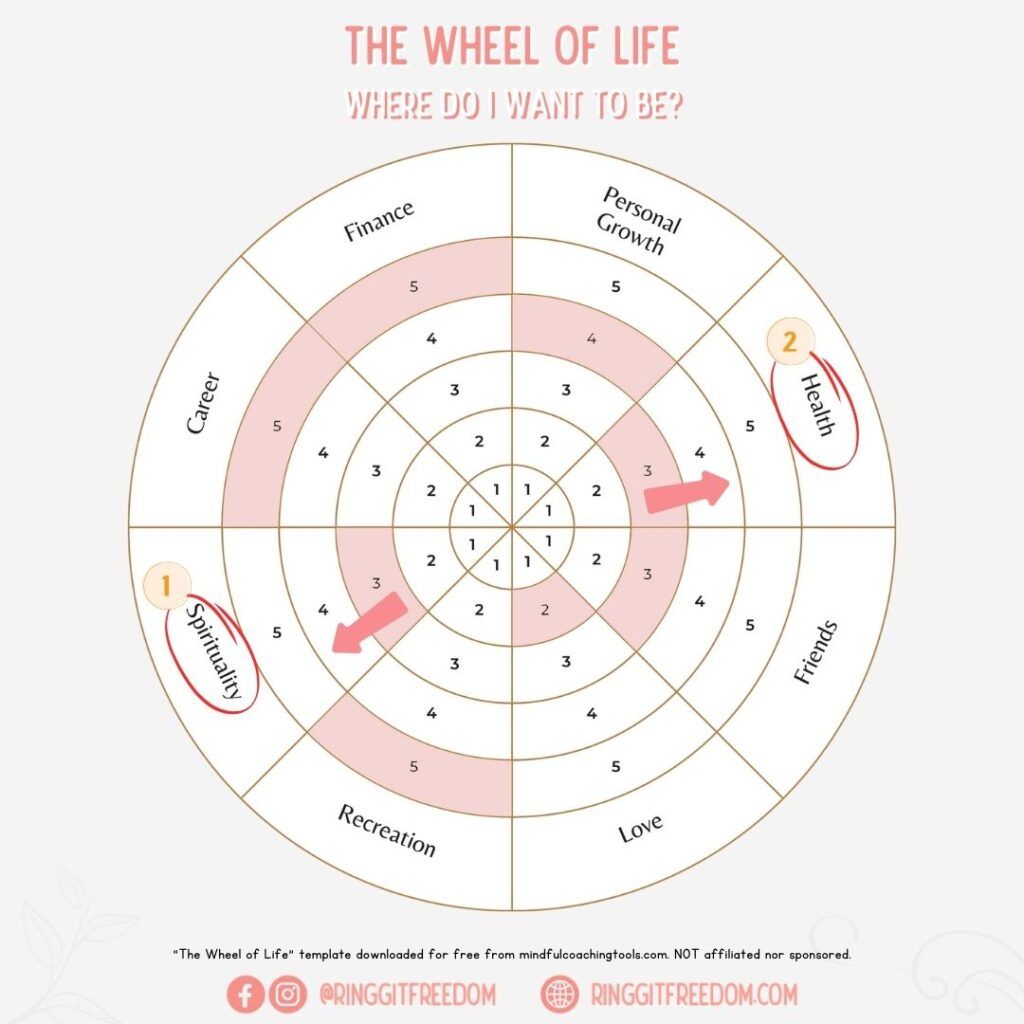

At initial glance, it felt to me that time just flew by, just like that, another year has passed, and nothing much was achieved. Now that I finally get some time to have peace/quiet moments, here I am - writing my (belated) reflection for 2024. And this year, I'm going to try out a new tool that my coach had shared with me when I had the opportunity to work with one to help me to accelerate growth in both personal and career space.

The "Wheel of Life" was to help provide better clarity on where I am at today, and determine what I would like to focus on next. When doing the exercise, it was very clear to me where I had excelled in (and also areas requiring "some" work on). What's tough for me was the middle-tier ones as I was hesitating the most, before choosing a "safe" mid-ground answer. There's plenty of free template online so I just found this one pretty simple to use (and also had generous free license), so feel free to use any templates that you see fit. How it works is that I'll be doing a self-rating from 1 to 5 in each category, with ONE (1) being really unsatisfied and FIVE (5) indicating that I'm over the moon.

Through this exercise I was able to recalibrate my thoughts into respective areas and take a more holistic view when assessing my 2024. In no particular order,

- Career & Financials: These two areas continues to be my area of strength, consistently over the last 5 year (or decade I should say?) that unlocked many possibilities previously unattainable for our household. Despite the career burn-out two/three years ago, I've found ways to navigate past those and happy that things at work no longer affect me as much as before. Shits are still happening, but I've found ways to acquire my own peace.

- Personal Growth: This is definitely one of the coping mechanism to acquire my peace amidst chaotic environment. For me, learning Korean throughout 2024 was the solution. It gave me something to look forward to, beyond just working for $ in life. Still no where close from having conversations in Korean, but happy that I'm able to watch Korean shows without subtitles and understand at least half the context. It'll get bettern, someday... that's how I learnt Cantonese back as a kid 😛

- Recreation: A bit too high over the moon I must say 😛 But can't complain as it is my only way to "let out", especially with my extremely strong introversion. It's fine as long as it works, I guess?

- Love (Family) & Friends: Not my strong suit for sure as I shy away from reaching out to people. Even until today, my "social connection" relies mainly on others reaching out to me first, which I know is not good. Definitely something that I need to consciously work on. Love wise - it's mainly family for now, to push myself to spend more (quality) time with my mom whilst she's still healthy.

- Health: Definitely not in the best shape with my current lifestyle. Was contemplating between "2" and "3" but decided that "2" would be too harsh, considering that I did put in conscious effort in avoiding sugar and unhealthy food. Though I still can't completely eliminate junk food. God damned cravings...

- Spirituality: An area that I've slightly improved the last two years, but still need a lot to work on. Especially with regards to my purpose of living and identifying my "Ikigai".

Now with the broad overview assessment out of the way, let's take a deeper dive on our finances before regrouping on the broad topic of goals setting & achievements!

Table of Contents

My Financials

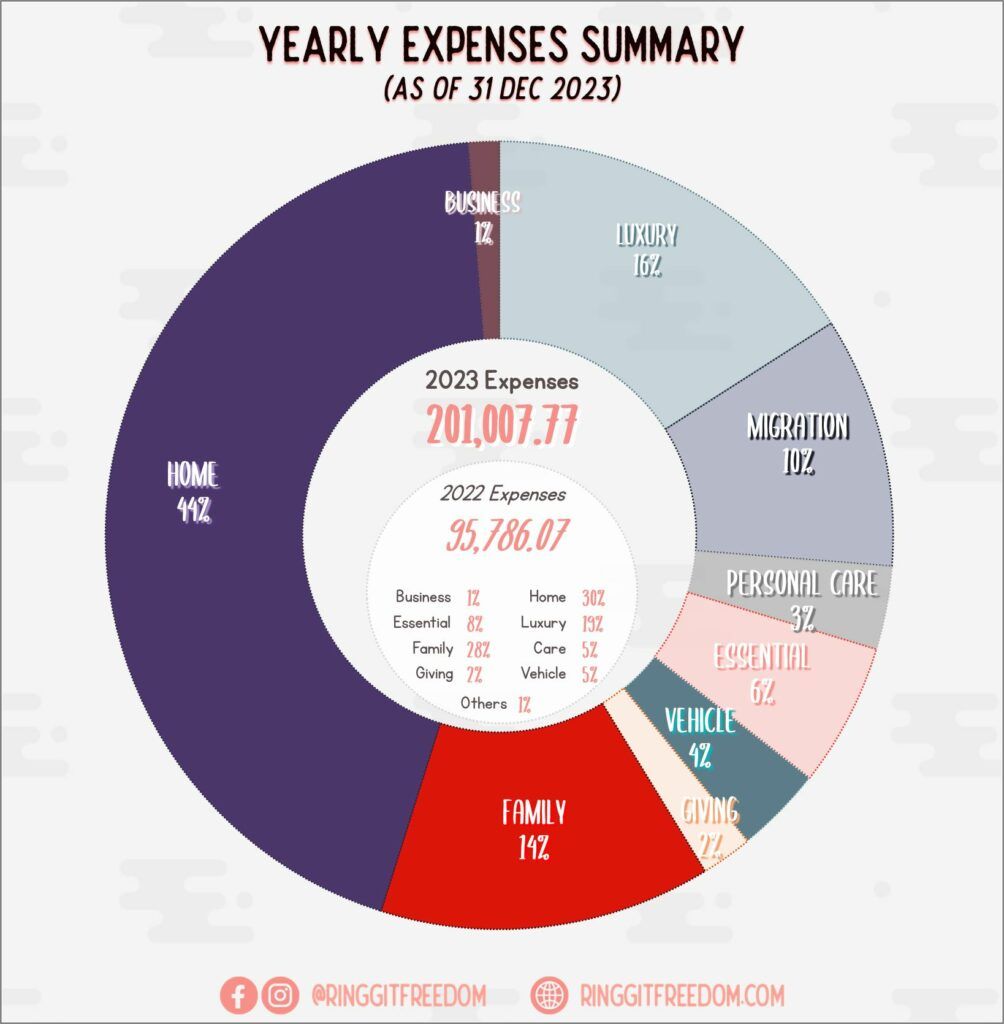

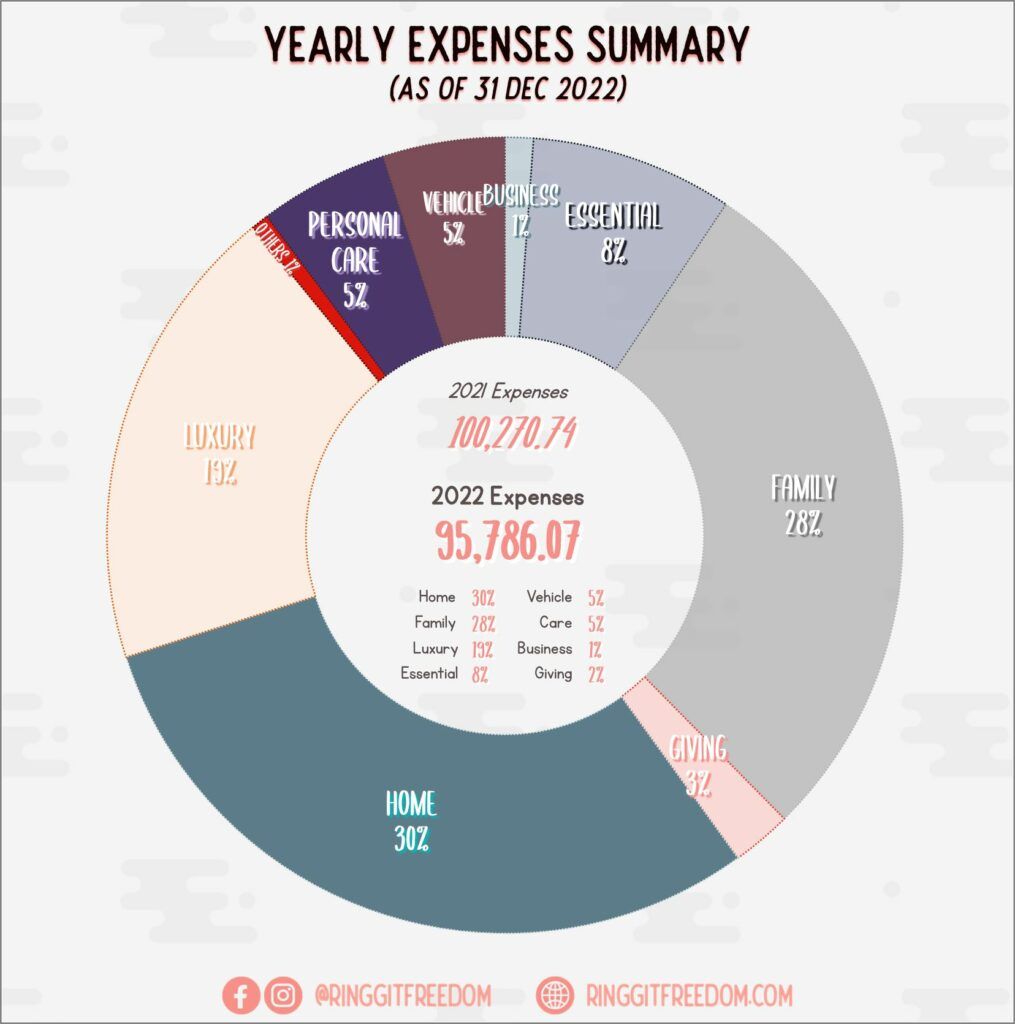

Expenses

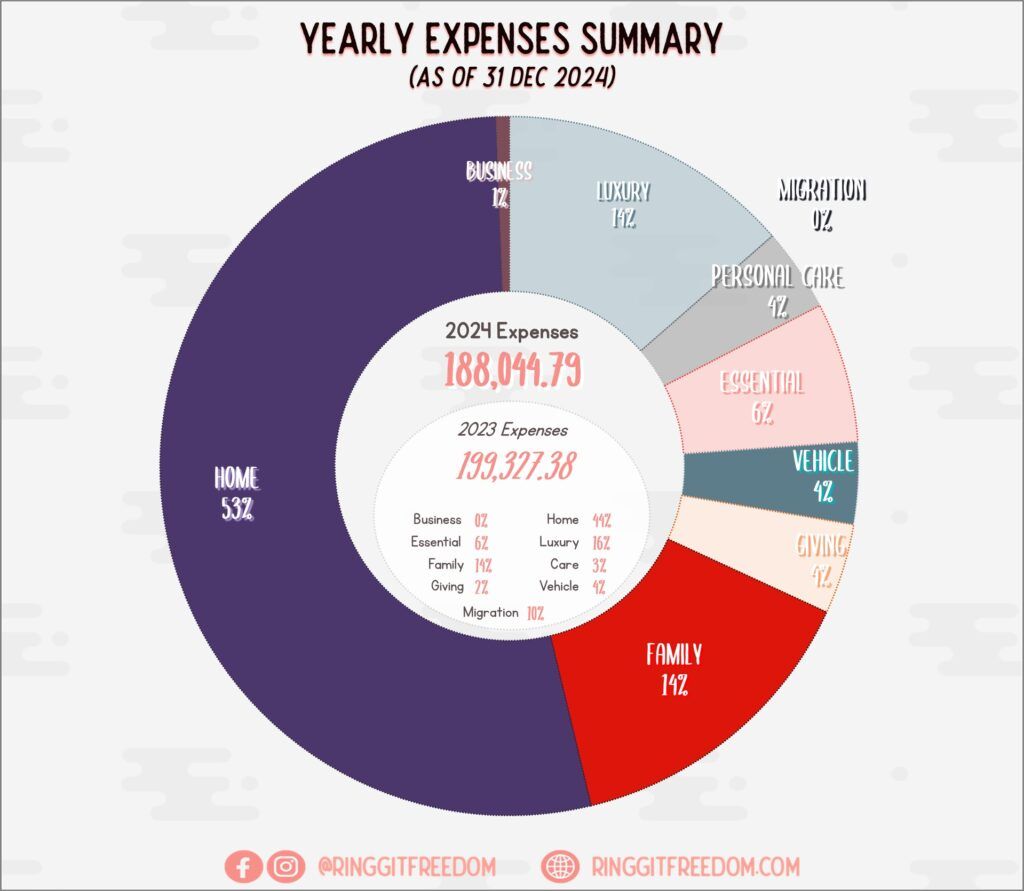

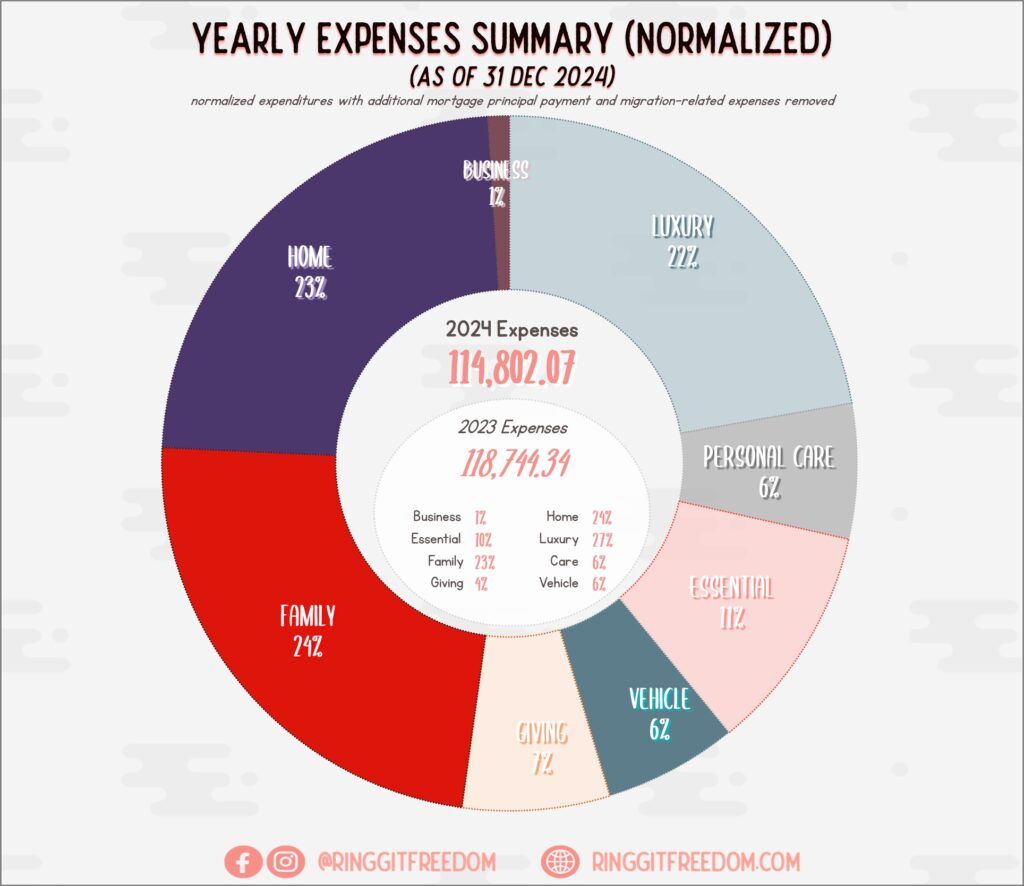

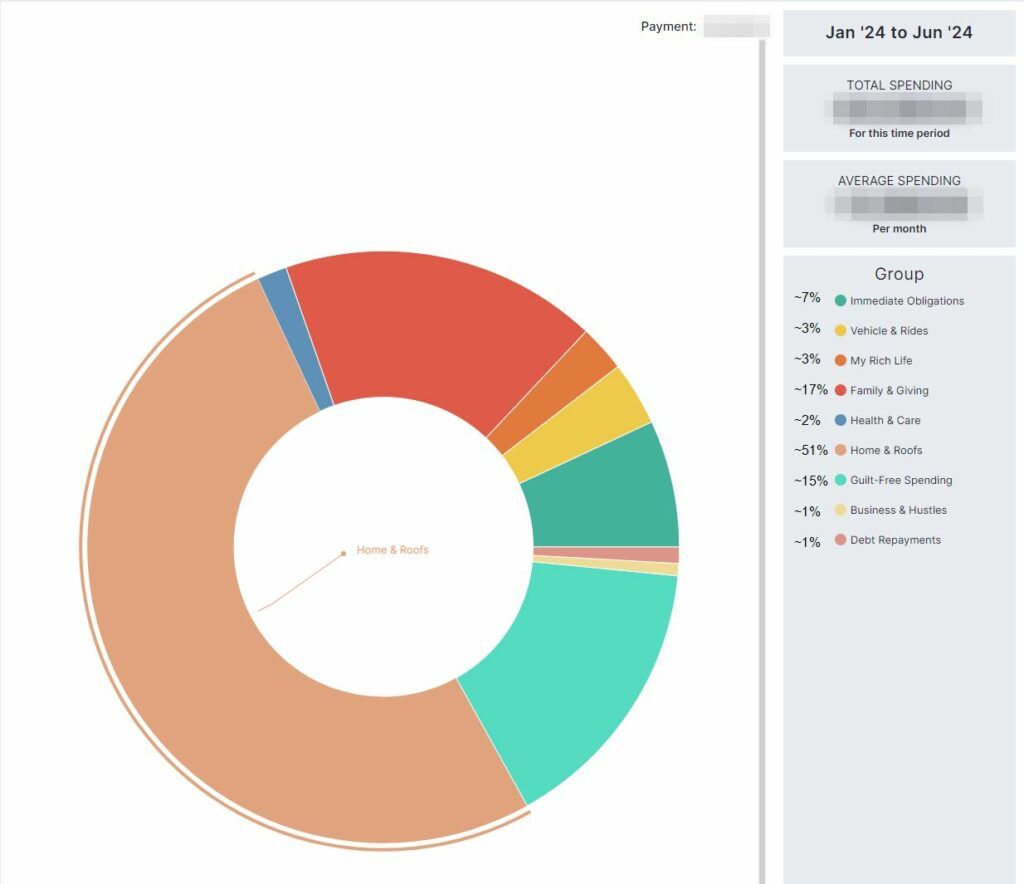

From a quick glance, my overall expenses in 2024 actually reduced slightly by -5% in comparison to last year's spending, totalling at 188k MYR throughout 2024. Just as last year, the bulk of the spending went into paying down my mortgage as part of my decision since 2023 to accelerate my debt settlements.

To enable comparison between years, I've created a normalized chart where one-off capital "expenditures" such as Additional Mortgage Payment or Migration Fees were removed. From there, the same trend of -5% reduction in spending were observed, which is a good sign.

Ideally the expenses can go down even further, if the time calls for it. But at this stage, as with my motto - I want to maintain a healthy balance between maximising savings vs. enjoying life.

If I double-click deeper into the ~188K MYR expenditures last year, we can spot a very similar trend vs. 2023 where some of top spenders were:

Home: Mortgage Payments ~RM17.8k + Additional Principal Repayments ~RM73.2k

Definitely makes up the largest of my expenditures so far. On the plus side, the additional ~73K I've put in this year helped to accelerate my equity building plan to safeguard my potential futures in case if my migration plan puts a huge dent on my finances.

If I keep at this pace, I'll probably be able to be debt-free in another 3-4 years time, that's assuming I haven't migrated yet to Australia by then. Speaking of migration, this was also another reason why I was able to put in much more (% wise) into my Mortgage than last year - since I did not incur any migration-related expenses in 2024.

For clarity, only the default mortgage payments of (~RM17.8k) are included in the normalized version of the yearly expenses.

Family: Family Allowances, Emergencies, and Insurances ~RM27.0k

Nothing much to delve deeper here - mainly to cover the cost of living, including insurances, for my family members. Not to mention also the occasional mini-emergencies here and there such as dental visits and hospital visits for my mom. Being the eldest in our family, my money was never truly mine, but family's. I wish my sister understood my burden sooner, but all good now that she has finally realized it after a decade later.

Luxury: Holiday Travels with Family ~RM11.8k

Since 2023, I've made a promise to at least travel once per year, capping the spends around RM10-12k per annum for travelling. Last year, I've brought my family to Taiwan. Frankly, the hardest part was actually convincing my mom to give Taiwan a try - she is so stubborn, just like me (or should I say I am stubborn headed just like her...).

I brought her to Hong Kong a couple years back and since then, she have been reminiscing the moments there and wanted to go back. But as we spent quite a couple of weeks there in Hong Kong already - there isn't much left to see. Plus hearing experiences from my ex-colleagues or friends whom are still there in Hong Kong - it's different now. Which was why I wanted to show her other parts of the world whilst she can still travel - and Taiwan was selected (for cultural similarities and budget reasons).

The best part? I'm having a bit of dejavu moment now since returning from our trip. Now she's always reminiscing moments in Taiwan and wants to go back there again - and meanwhile, I'm trying to convince her to explore a different country with me, be it Japan or Korea... saga to be continued. 😂

Giving: Family Gifts/Treats ~RM7.8k

The amount I spent last year on gifts/treats mainly for my family (and occasionally friends) have almost doubled in comparison to year 2023, resulting in this new category taking over the top 5 expenditures spot. Good thing is, hopefully it's just one-off as half of this amount were spent on the iPhone 15 that I bought for my mom paid in full.

Luxury: Gadgets, iPad and Computer Parts ~RM6.1k

Significant improvement vs. year of 2023 - whilst still (very) impulsive, I managed to exercise a little bit more self-control here and spent only half the amount I've spent in 2023. Plenty of rooms for improvement for sure - but the experiment of setting a sinking category to "fund" my impulsive gadget purchase definitely helped to mitigate some impacts (though amount is still insufficient).

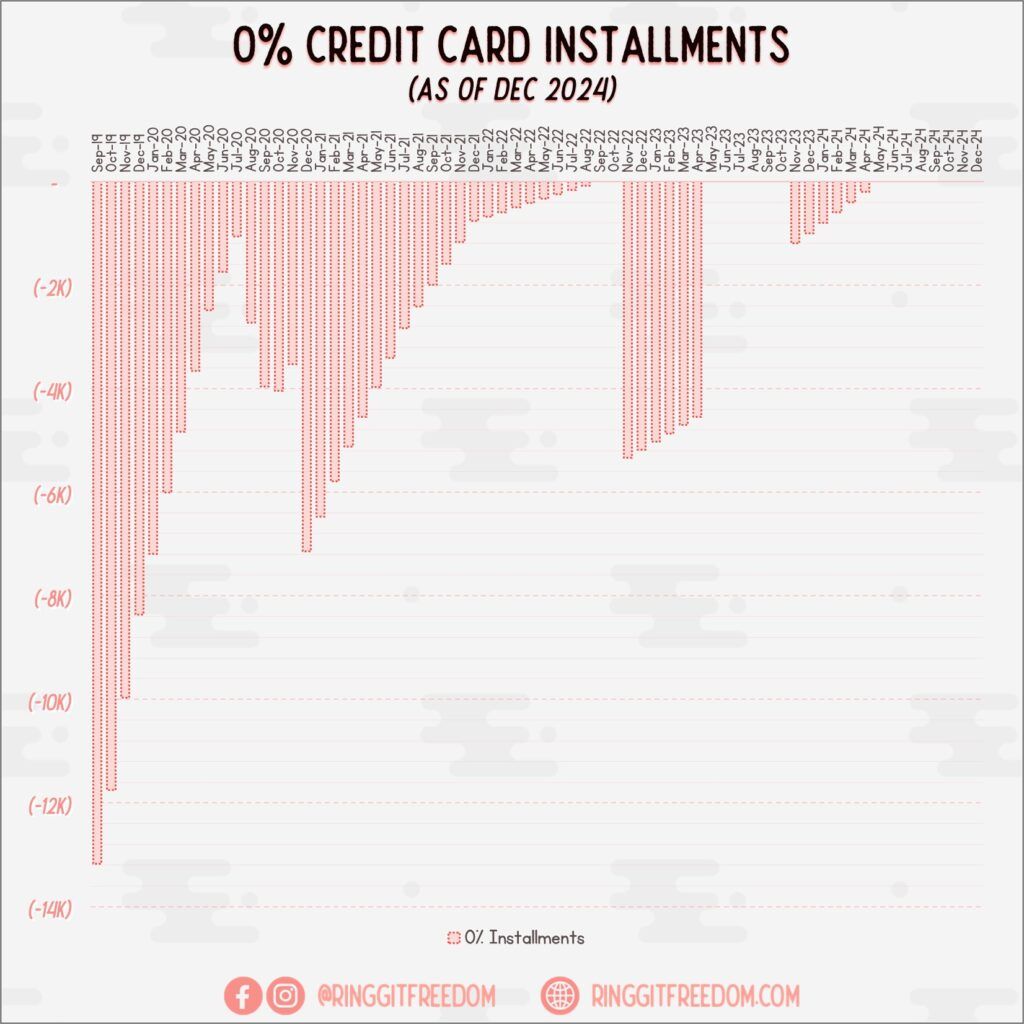

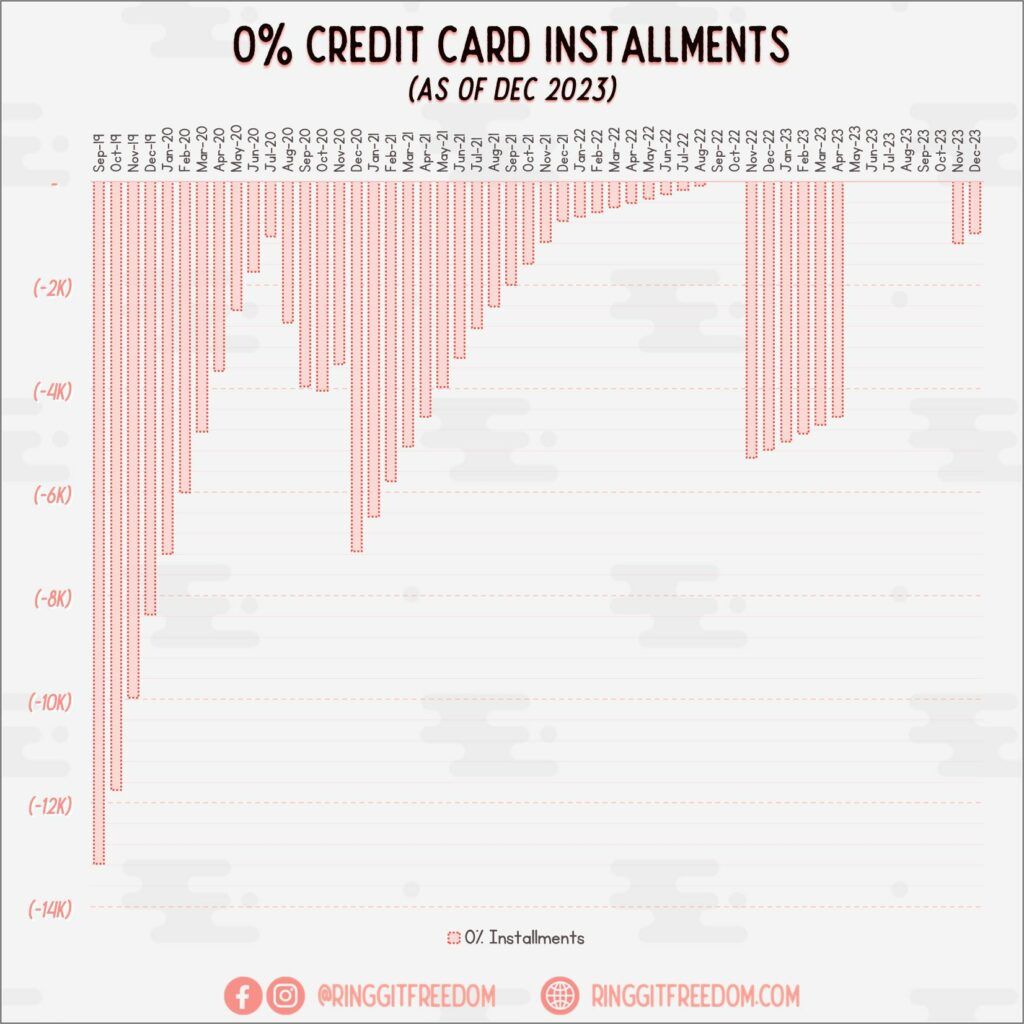

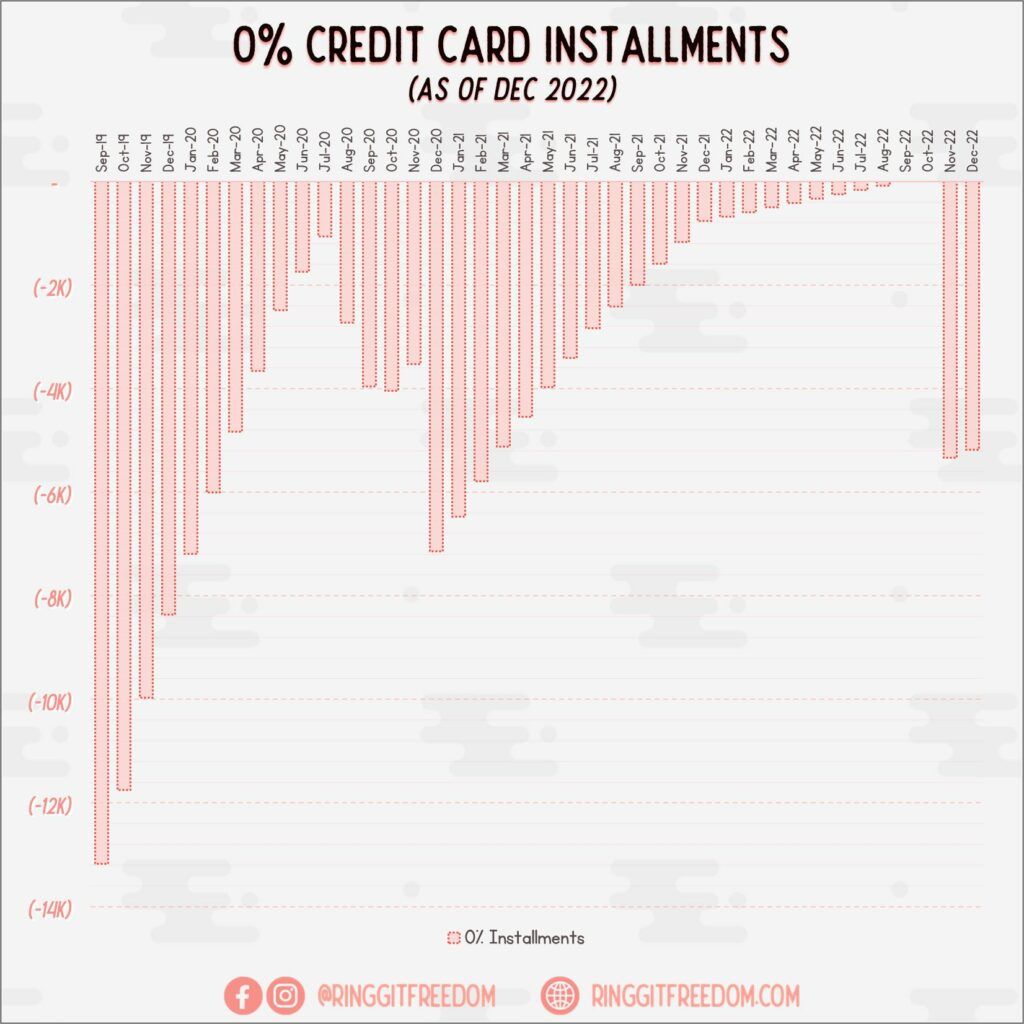

0% Debts

Paid of all my outstanding 0% Credit Card Instalments plan for my mom's hairdryer bought last year. And thankfully since then I managed to NOT utilise this facility for my purchases. Hopefully the trend continues in 2025 💪🏻

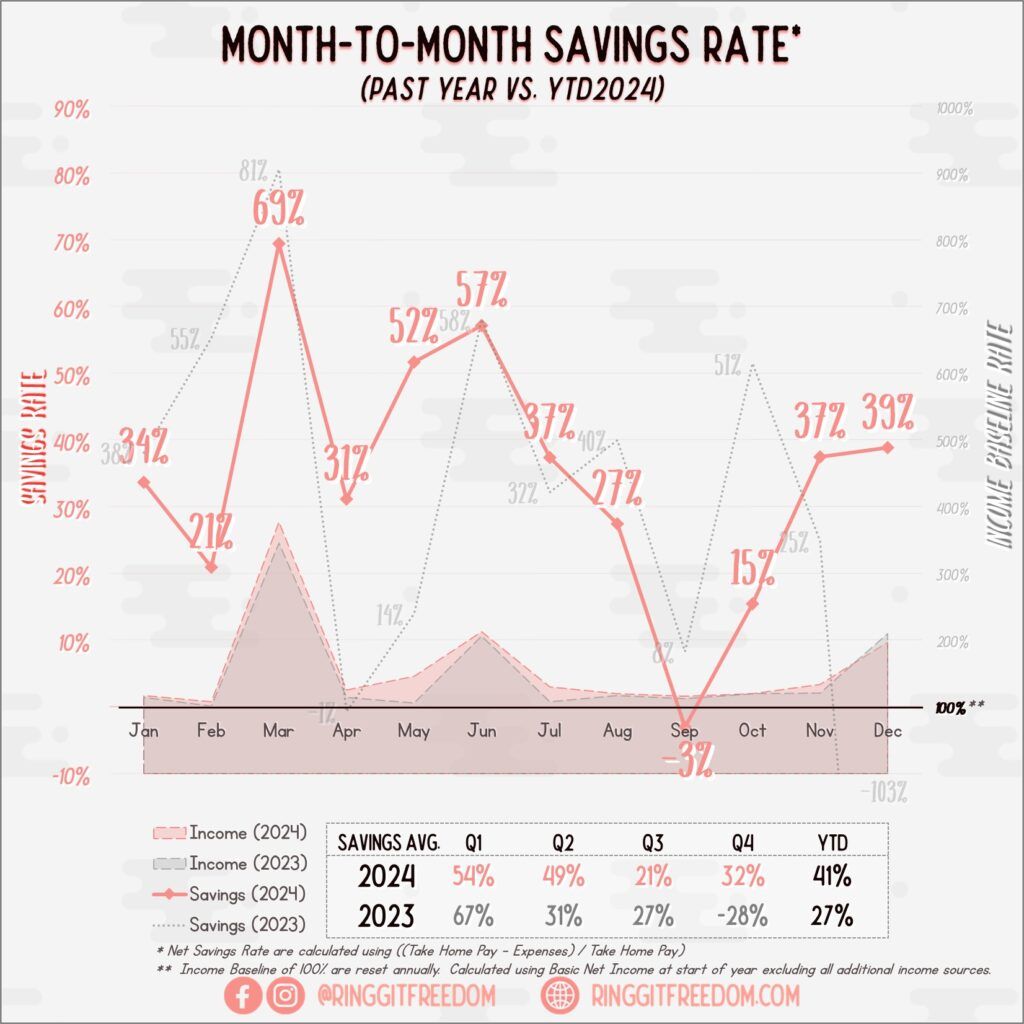

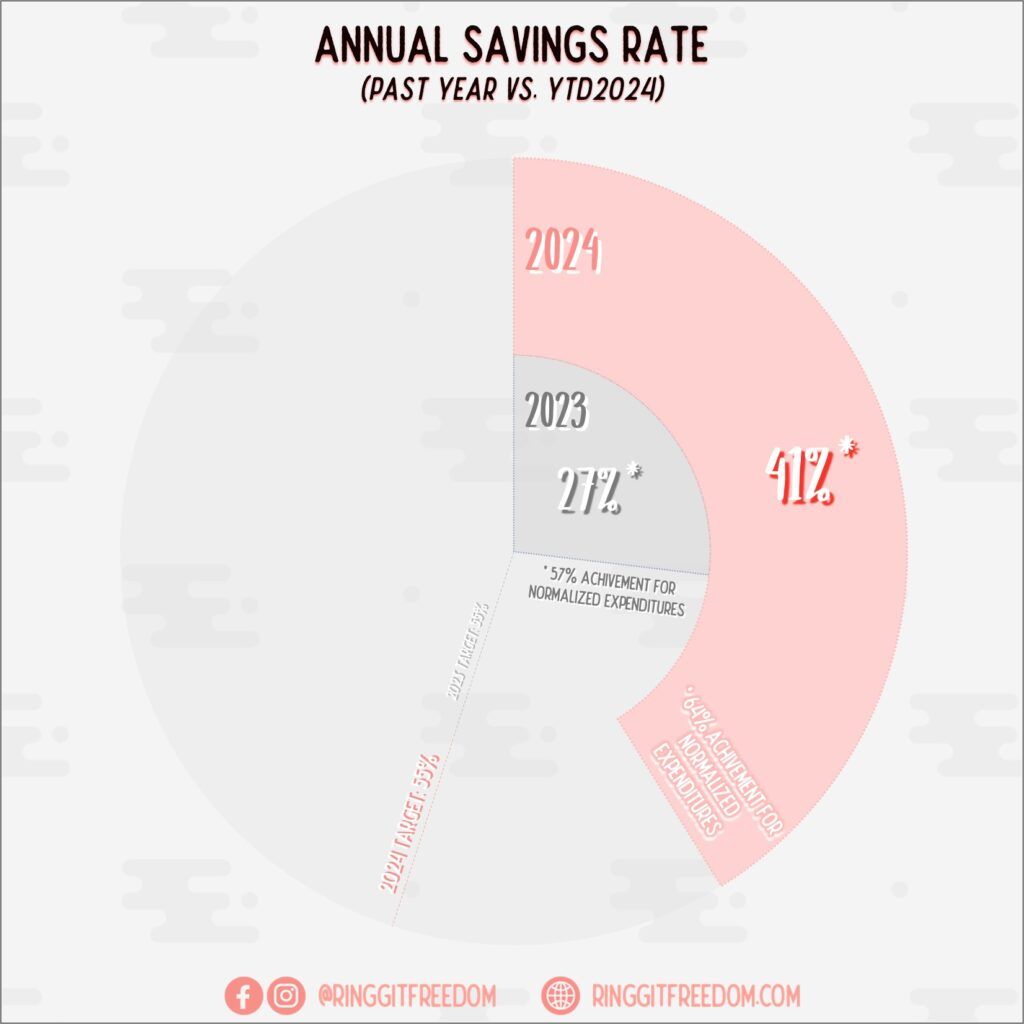

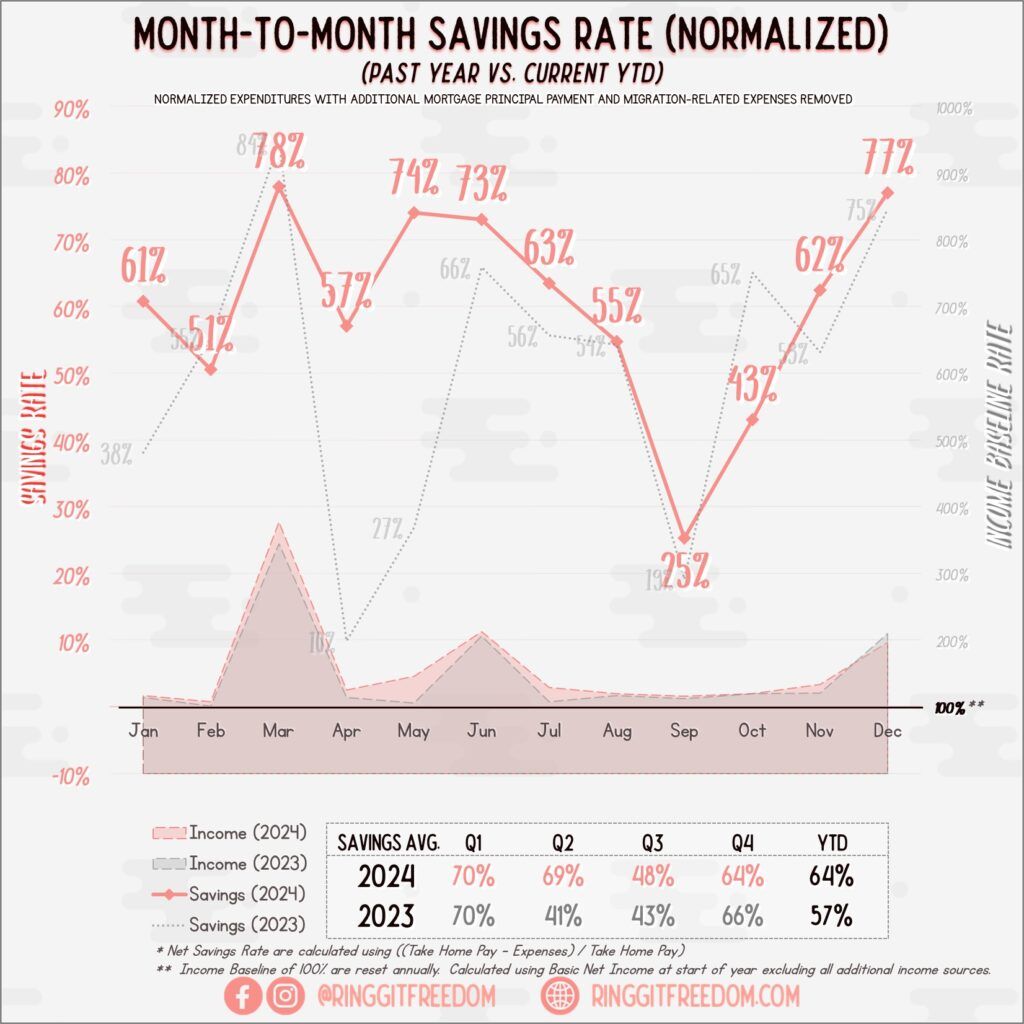

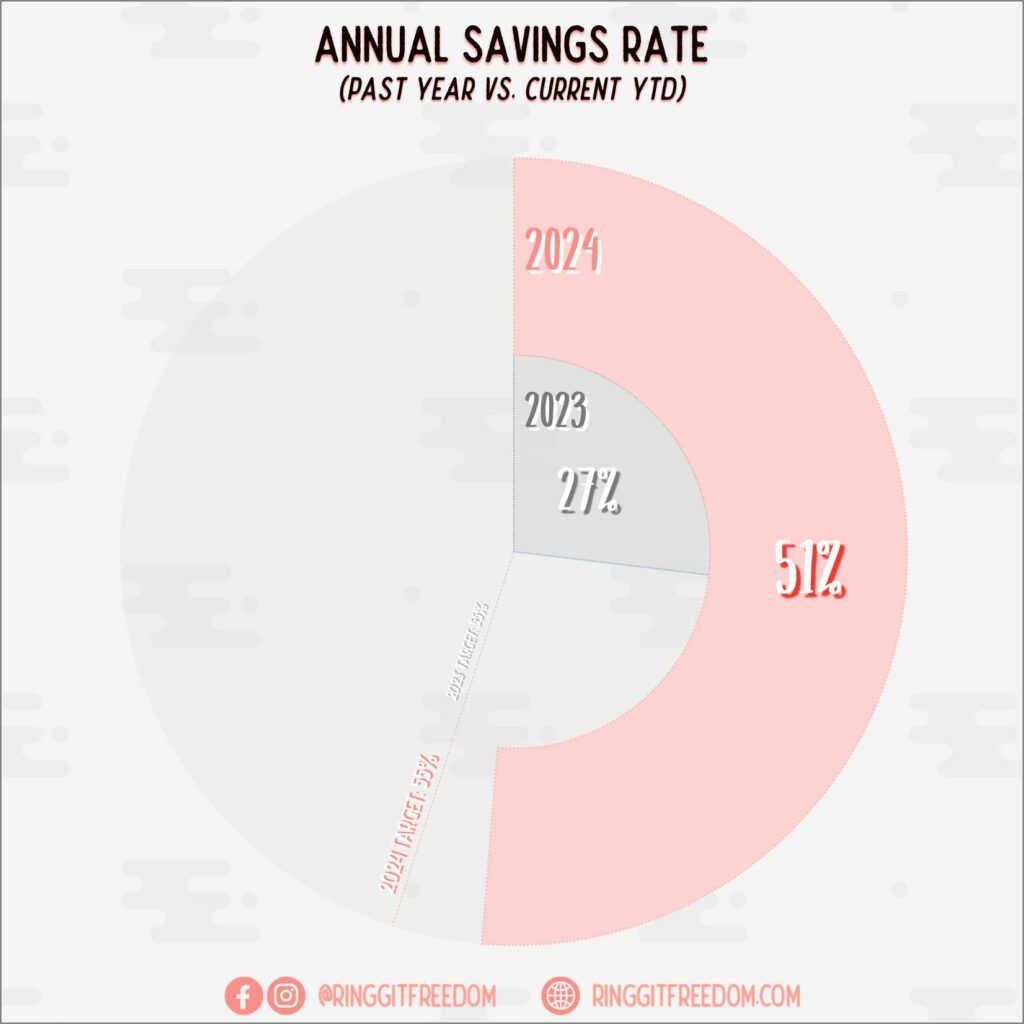

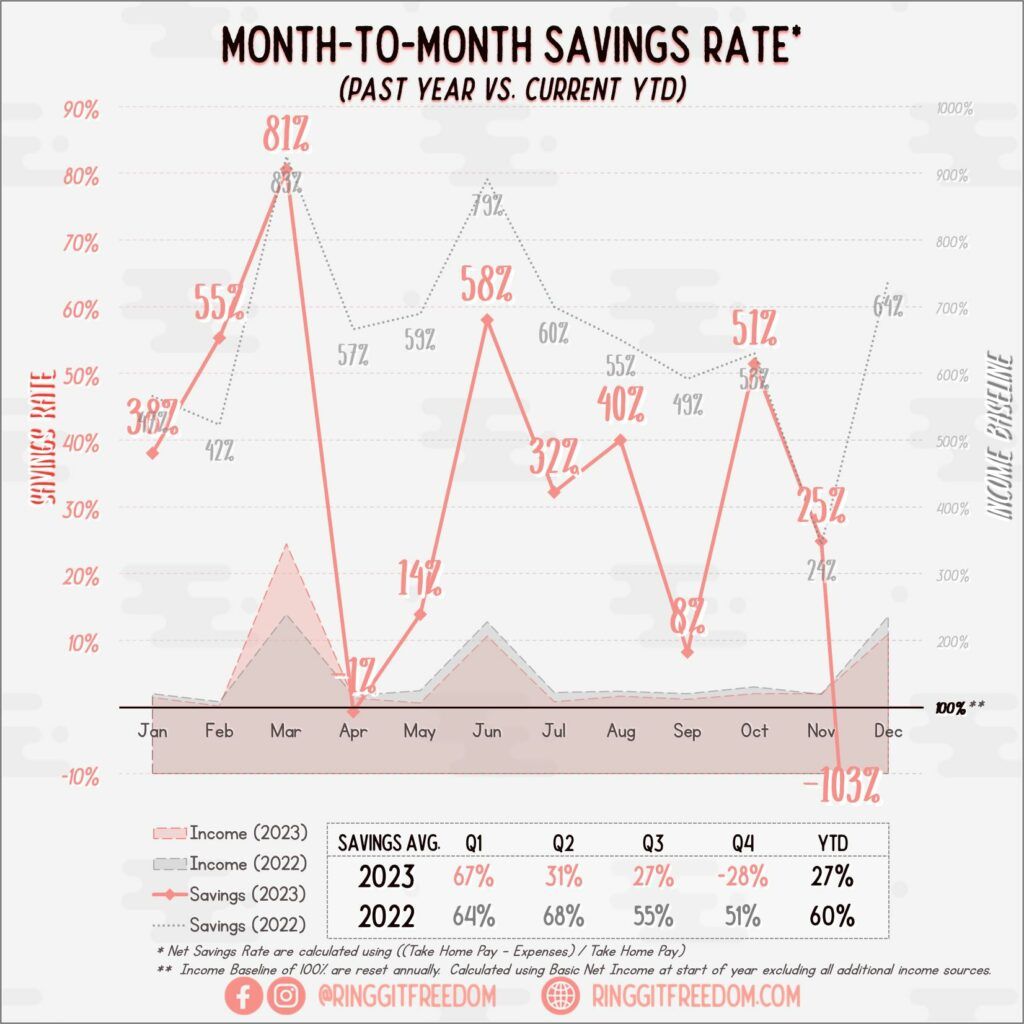

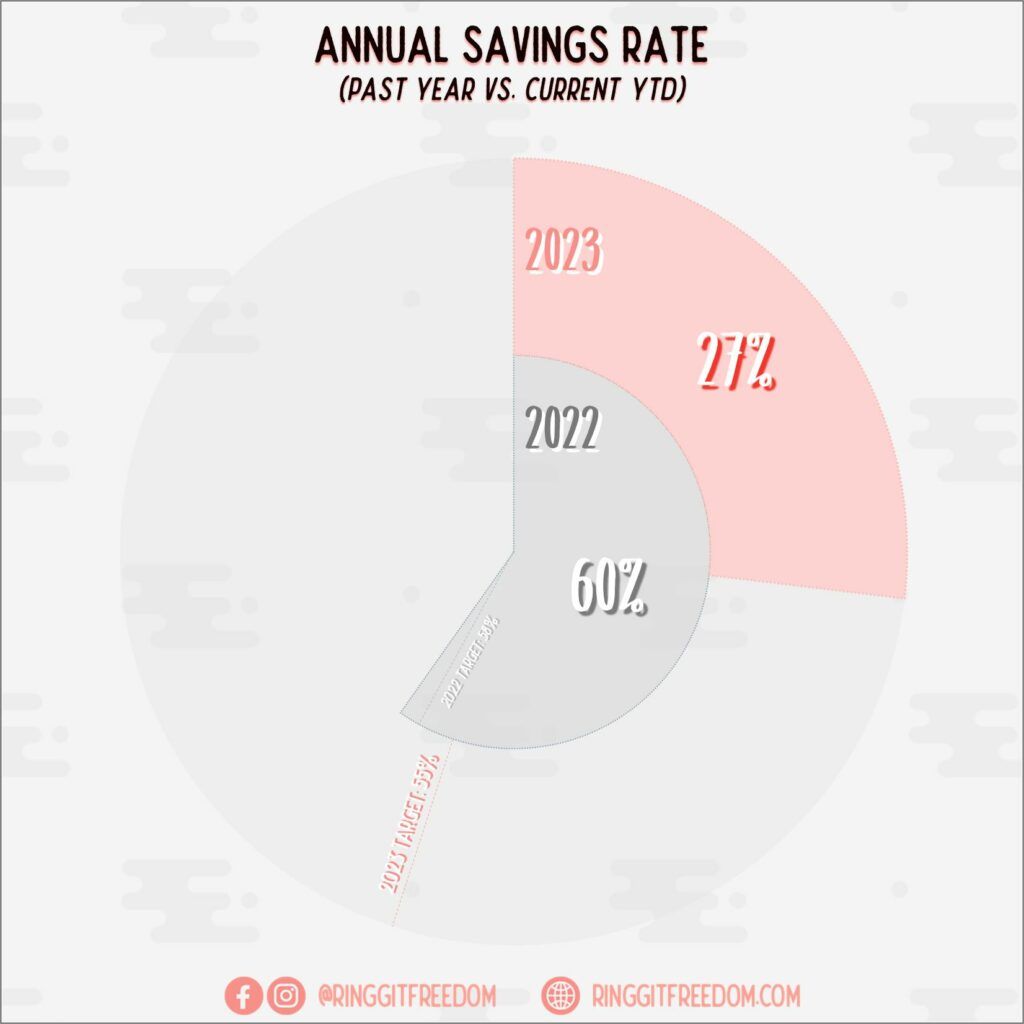

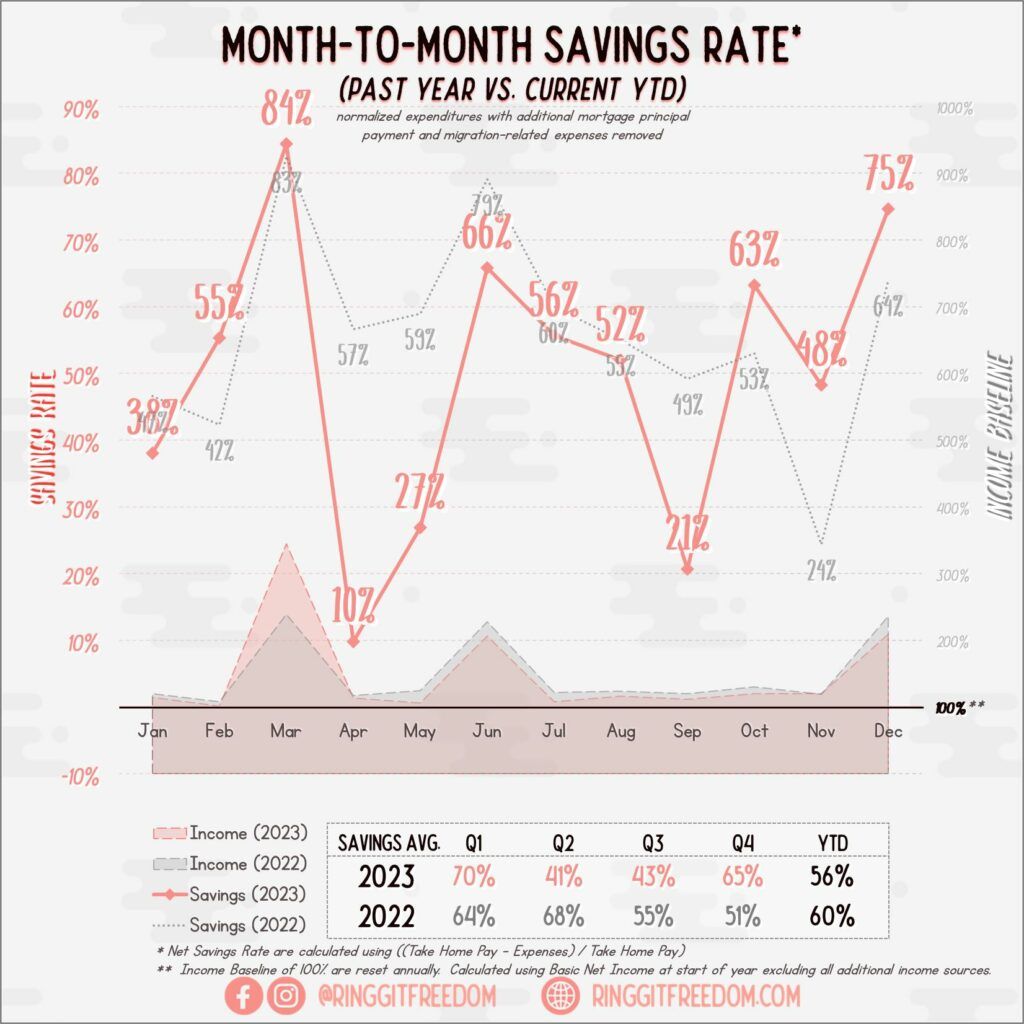

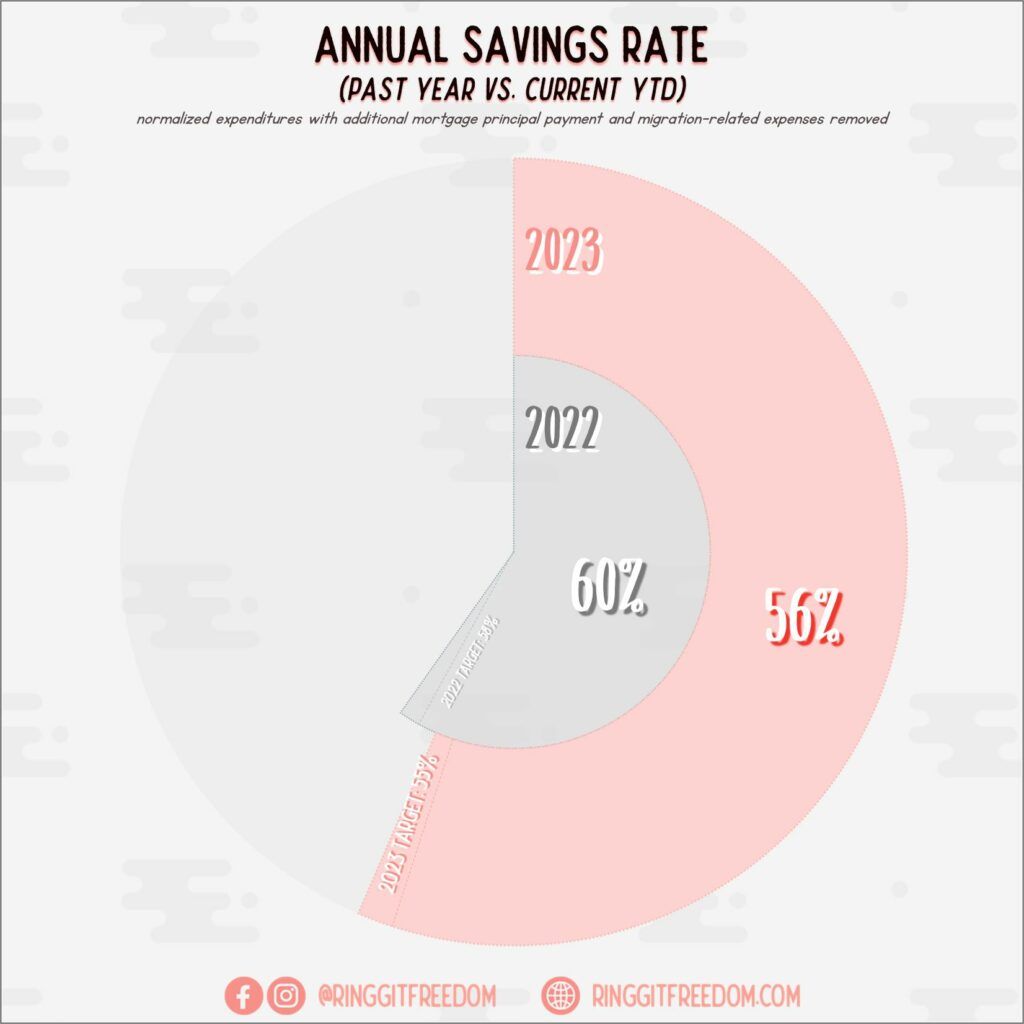

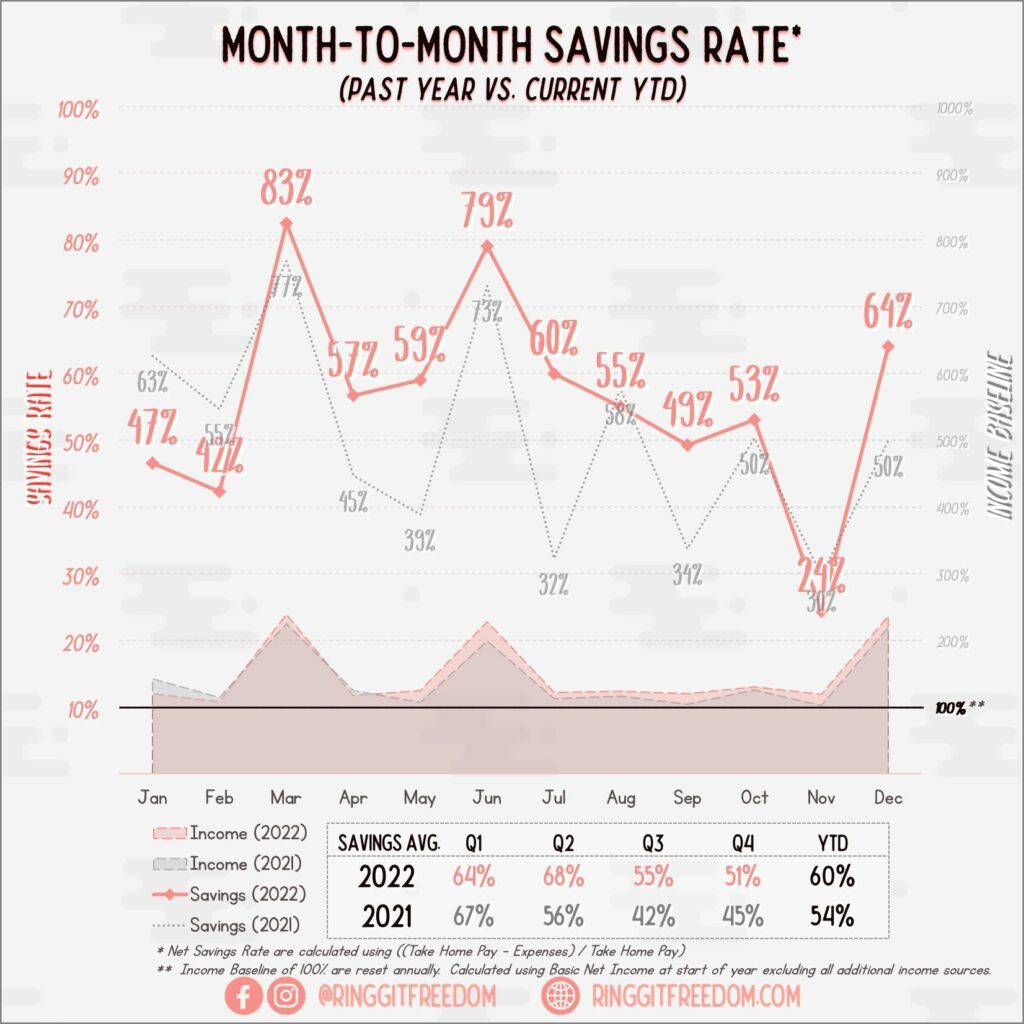

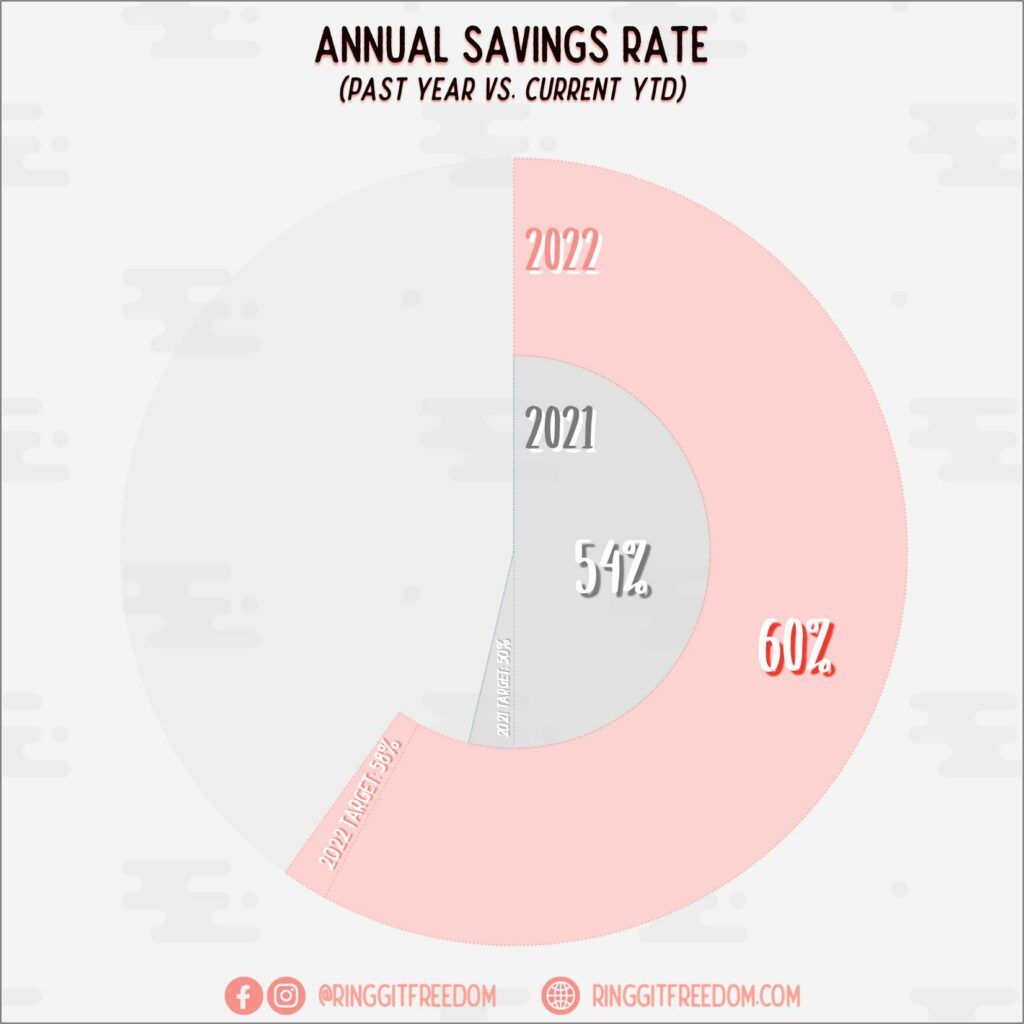

Savings Rate

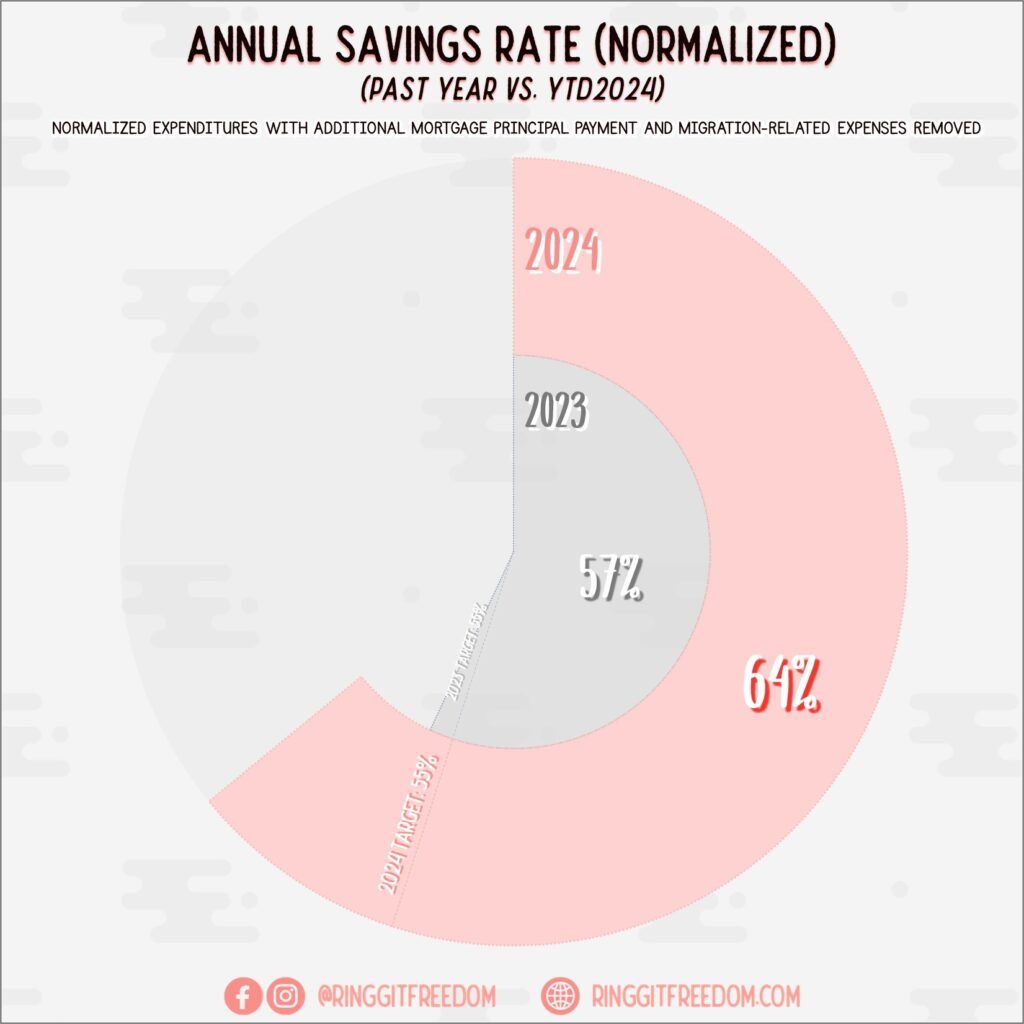

Just like last year, I had to prepare two different savings rate chart to help with my own analysis and exclude the additional principal repayments on my mortgage as those are building up my long term equity - exactly the same concept where I excludes all activities related to investment from my expenses tracking.

The first set of chart focuses on general savings rate (which includes additional principal repayment as expenditures) whereas the second set of chart focuses on normalized savings rate (excluding additional principal repayments).

From a quick glance, 2024's savings rate are definitely much more consistent even from the first chart alone. But if we dive deeper into the second chart, the savings rate has definitely improved tremendously due to the "forced savings" that I have mandated throughout the year - in the forms of additional principal repayment.

As with the last few years - September is usually where things get a little bit out of control where I would spend more than usual - typically for my holidays / travels / shopping spree during my birthday month. Nevertheless, the normalized savings rate in 2024 definitely have exceeded even my own expectations all thanks to my aggressive mortgage repayment strategy - something I can continue to ride on during 2025.

Emergency Jar

Pretty much the status quo here since my Ringgit Freedom’s June 2021 Updates: Mid-Year Checkpoint when I decided to expand my emergency jar from 6 months' expenses worth to 12 months' expenses worth. Nothing much to write here - spent a few bits here and there (mom's dental) but very quickly replenished it soon after (usually within the next month).

My "Freedom" Investments

Let's first start with reviewing the performances of our Freedom Portfolio.

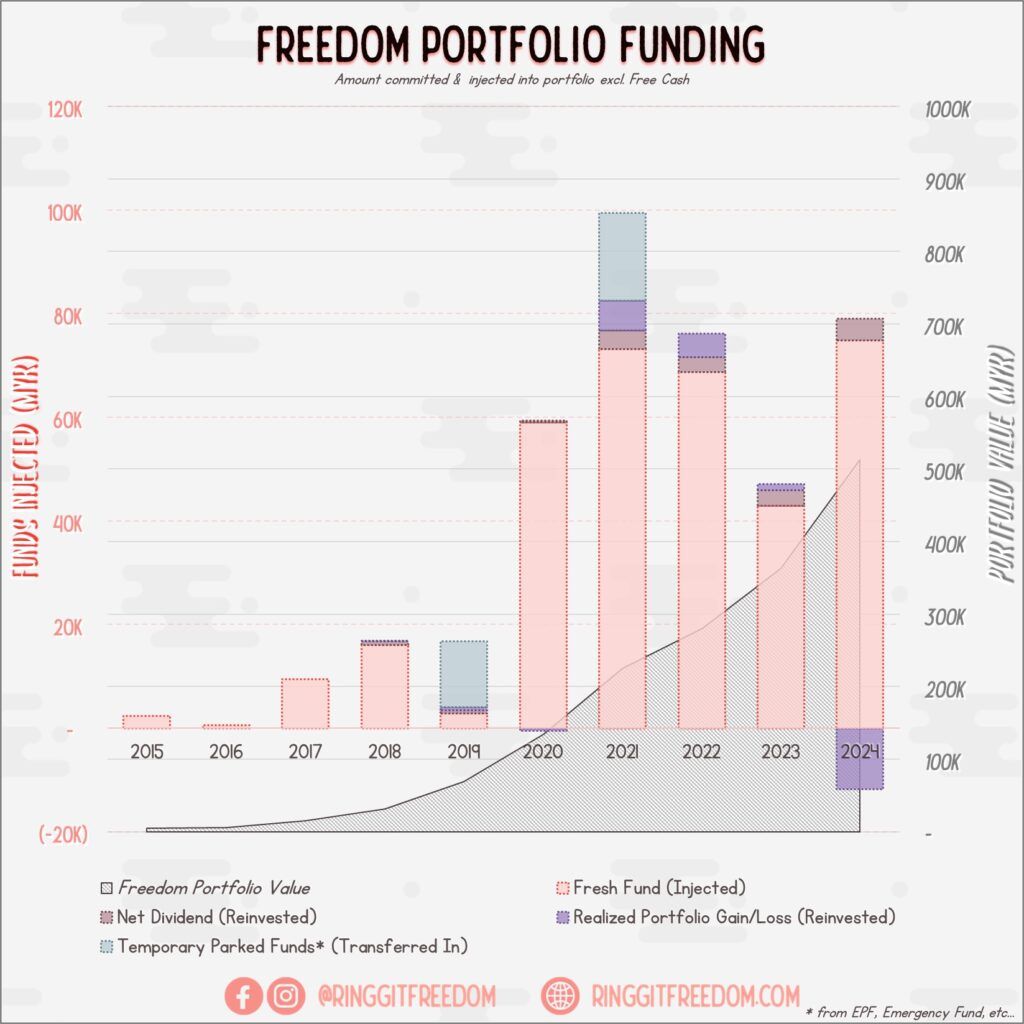

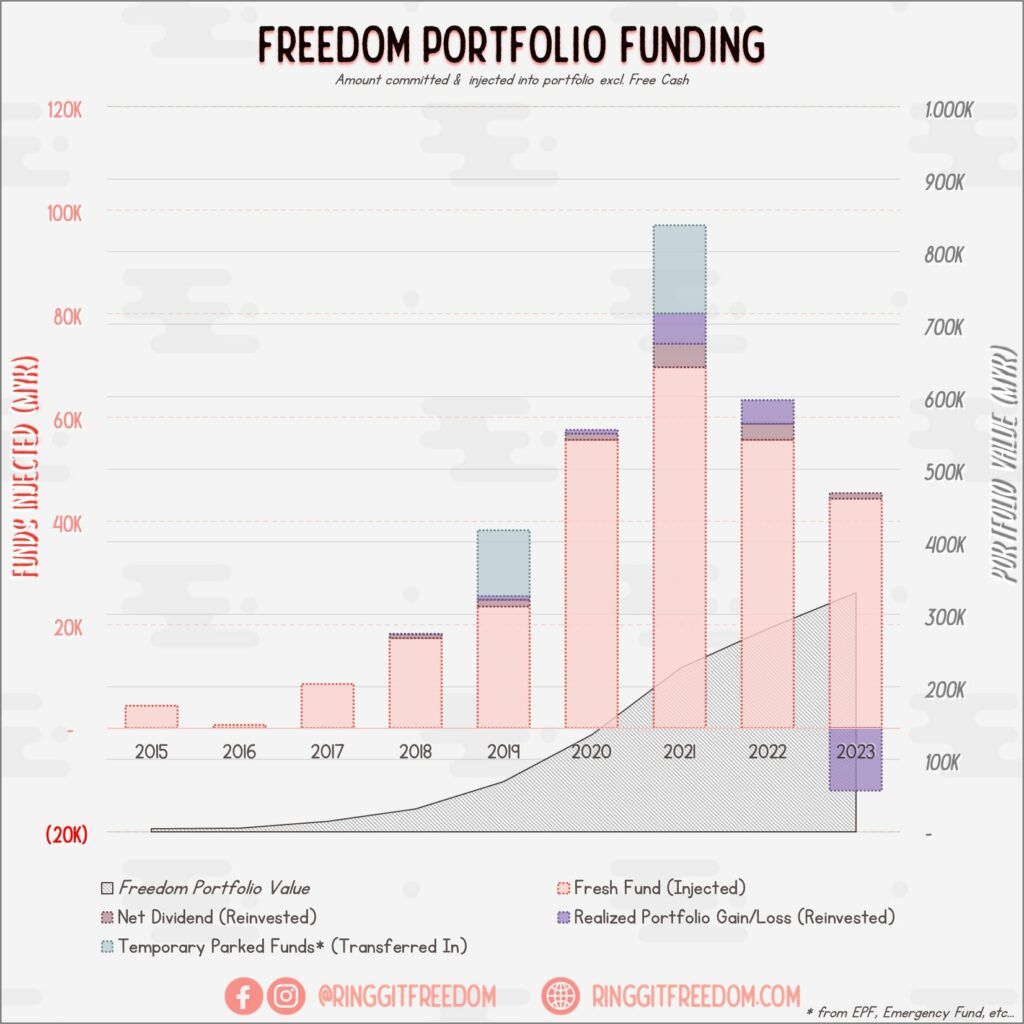

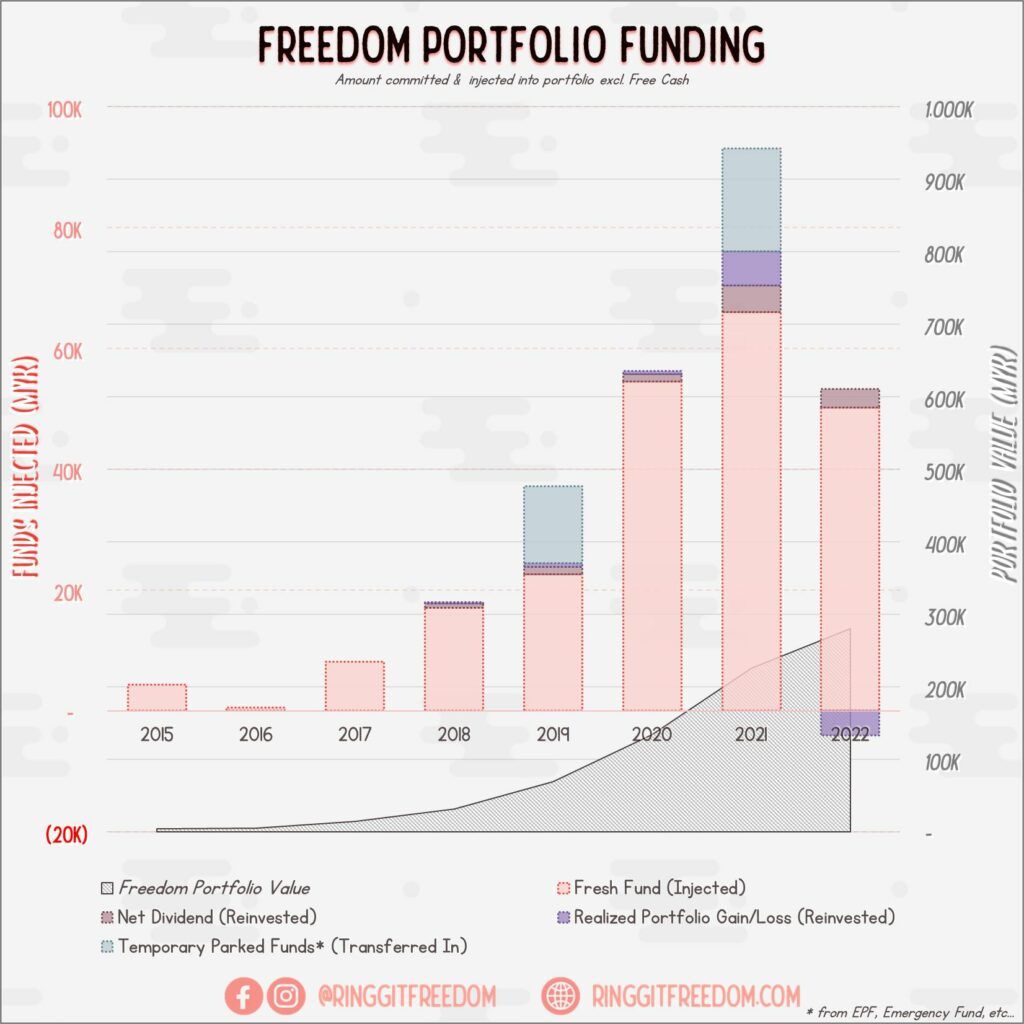

Funding

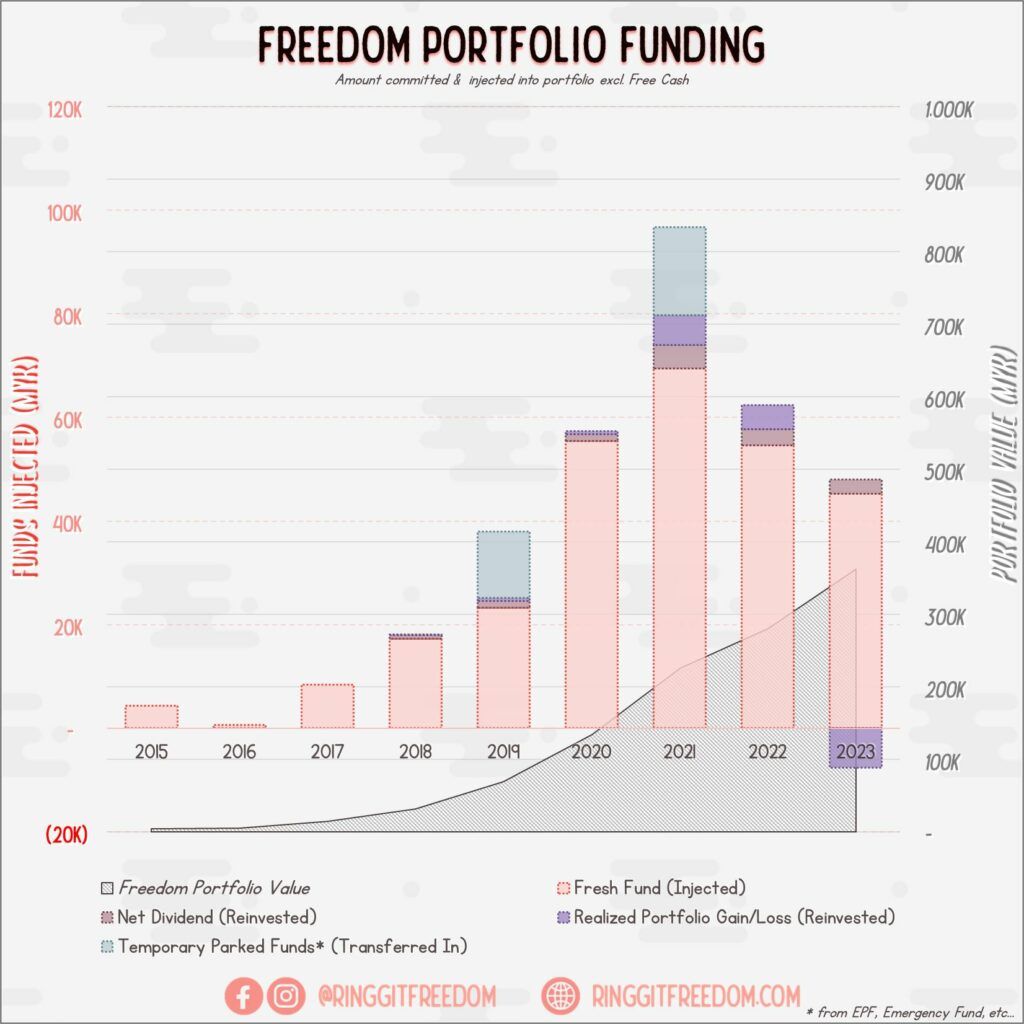

Thankfully, I broke the downward funding trend that started since 2021. Whilst still being very careful / conserved throughout 2024, I managed to invest / inject more funds than the year before and one of the main reason has got to do with the automated Recurring Investment facility offered by Interactive Broker. Note that the amount here fluctuates according to currency value hence the actual fund injected may vary.

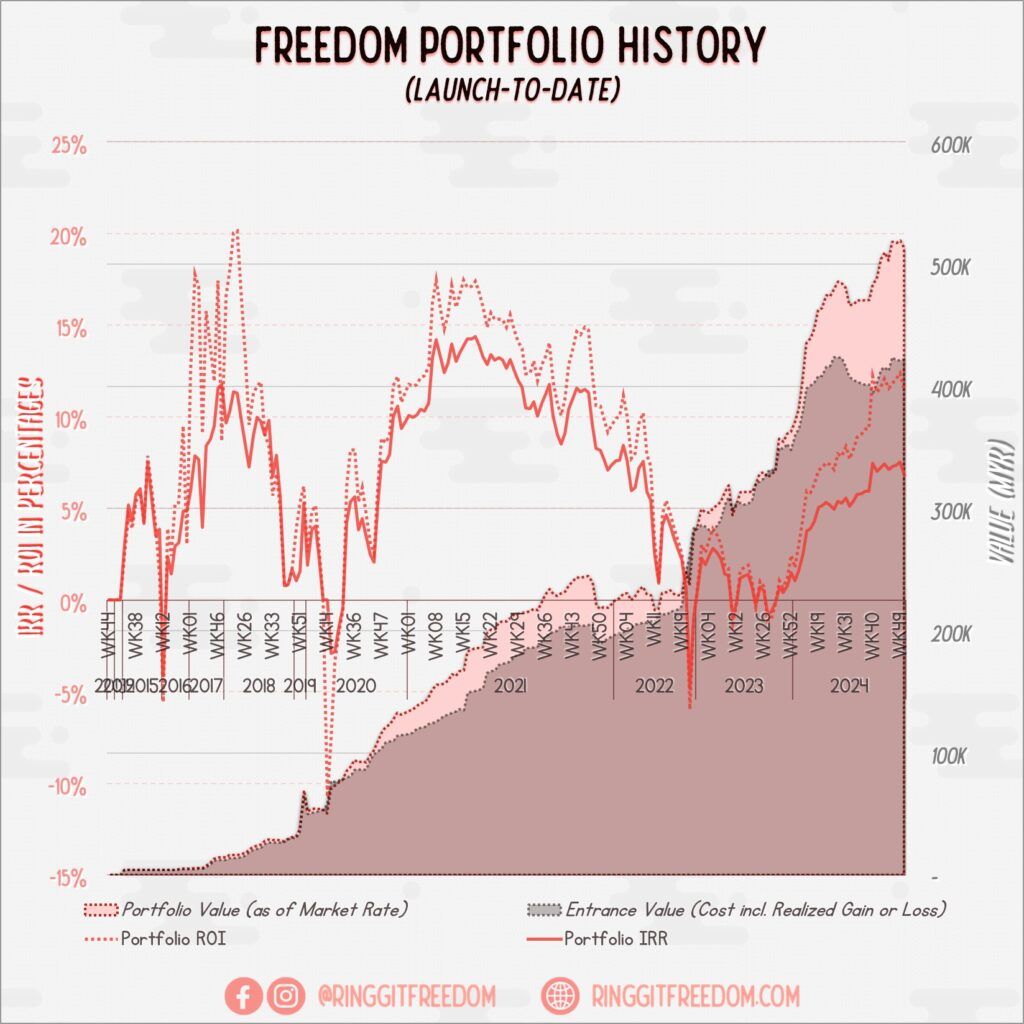

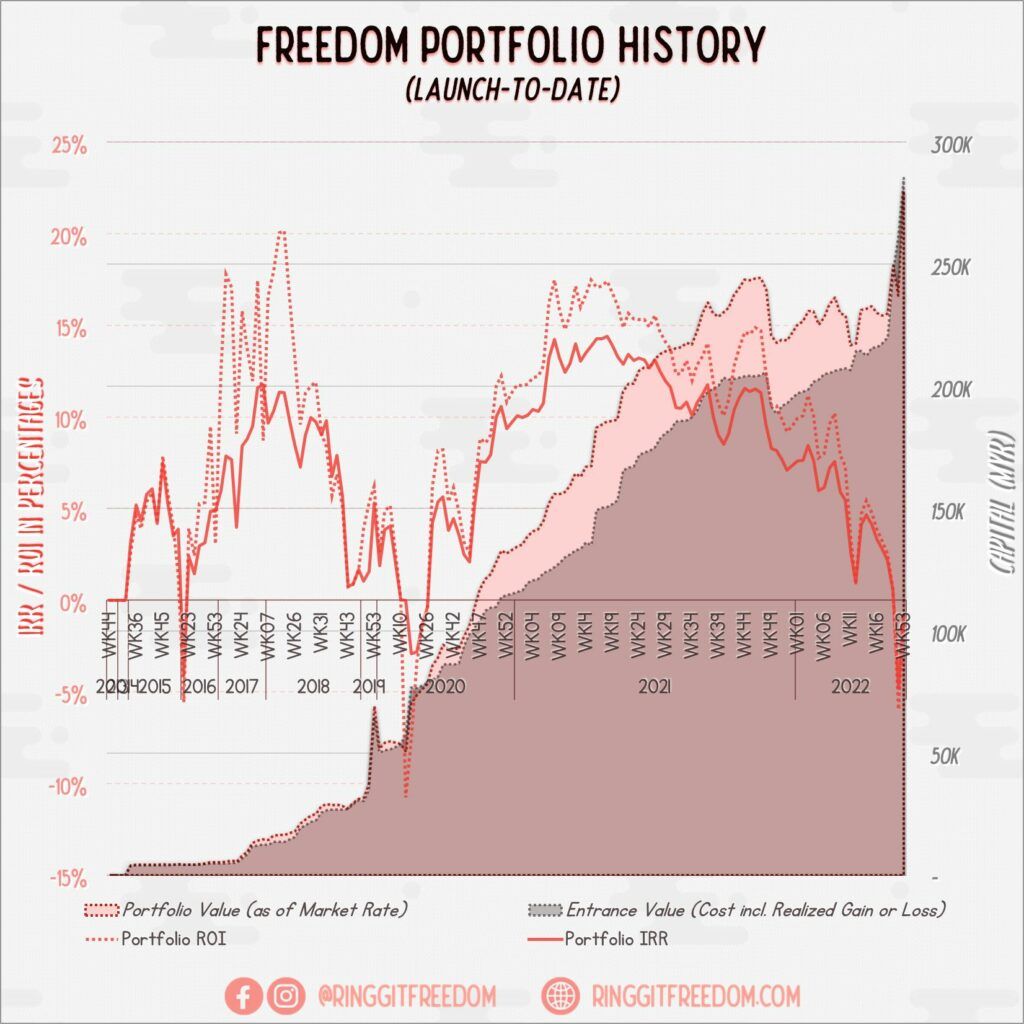

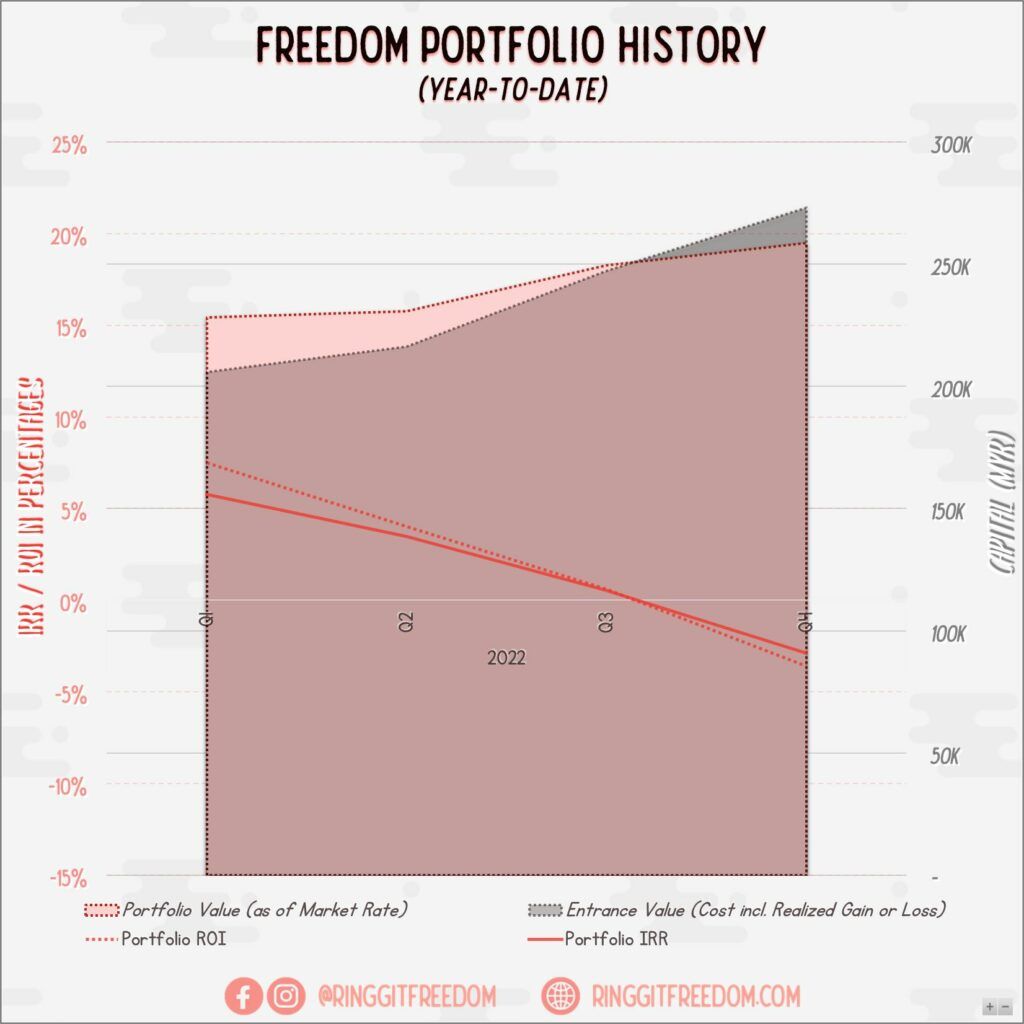

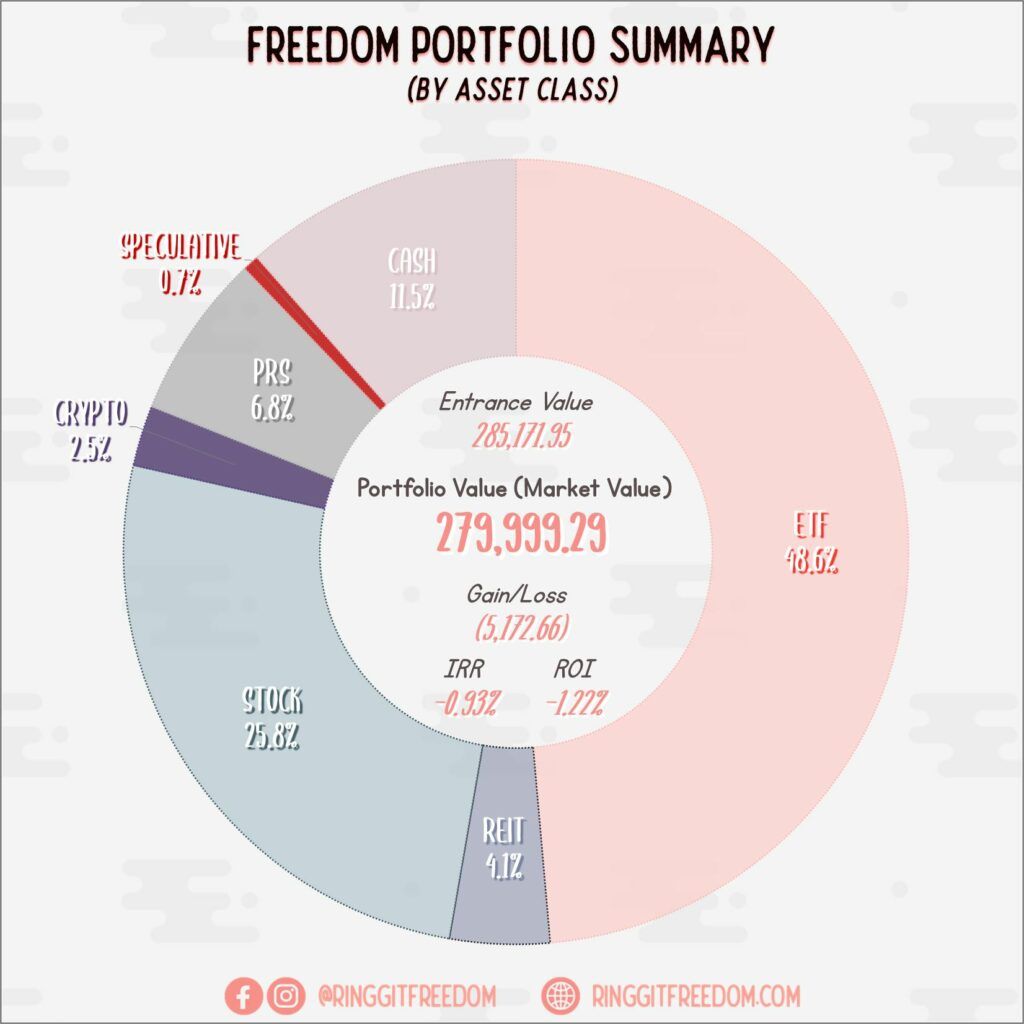

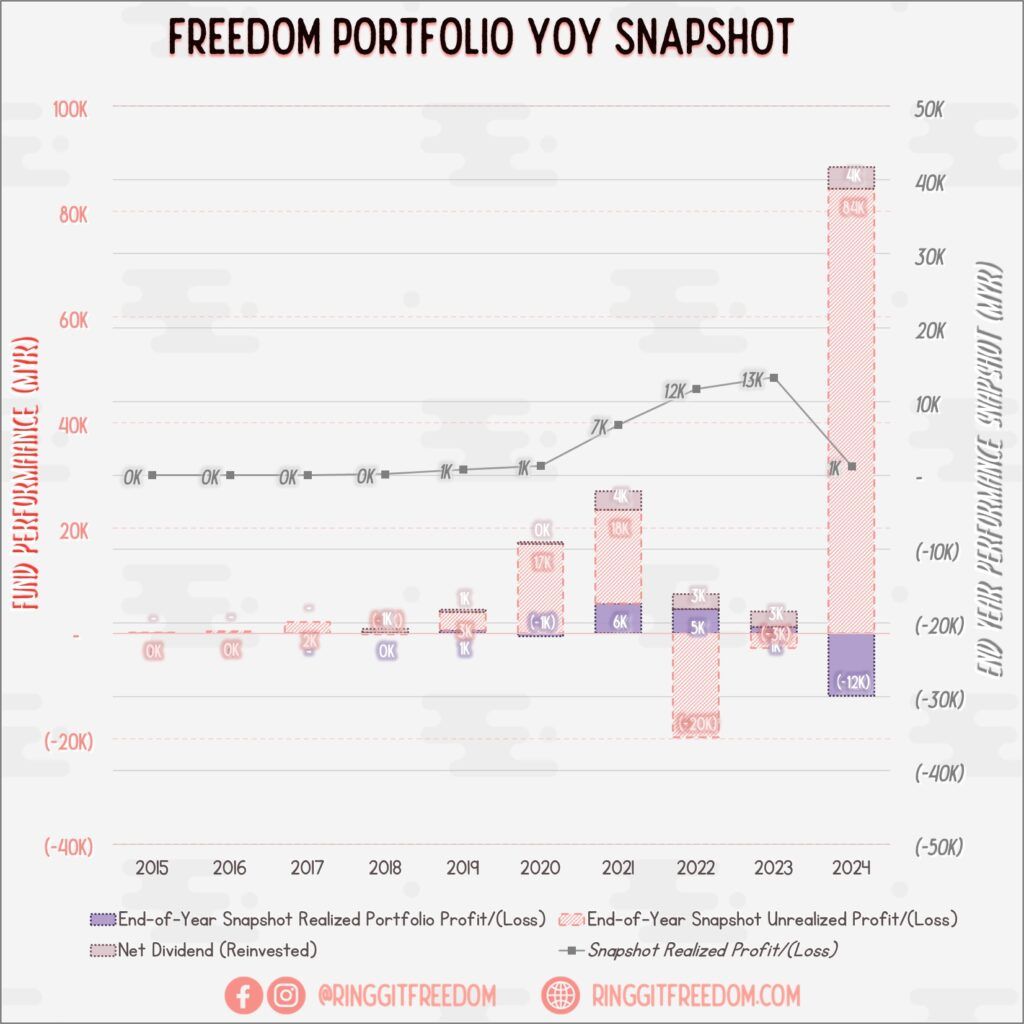

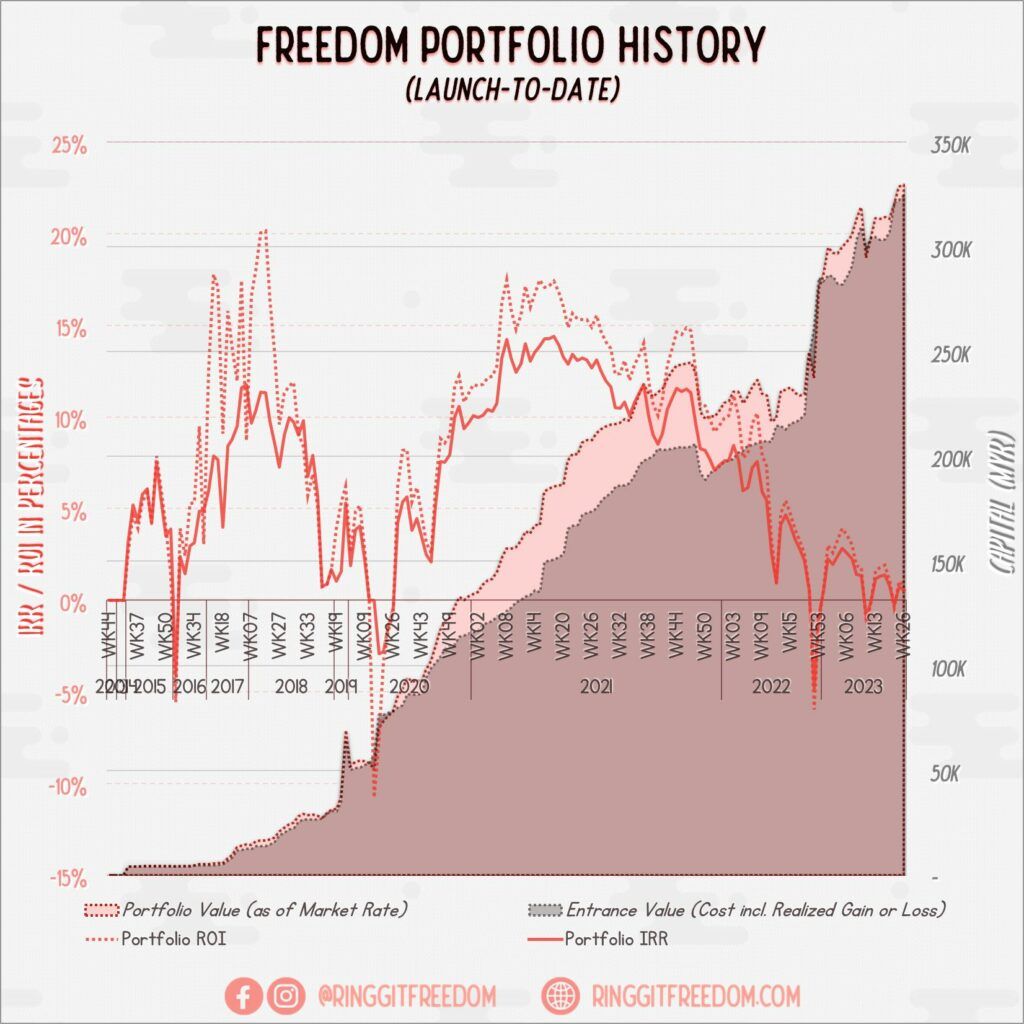

Performance

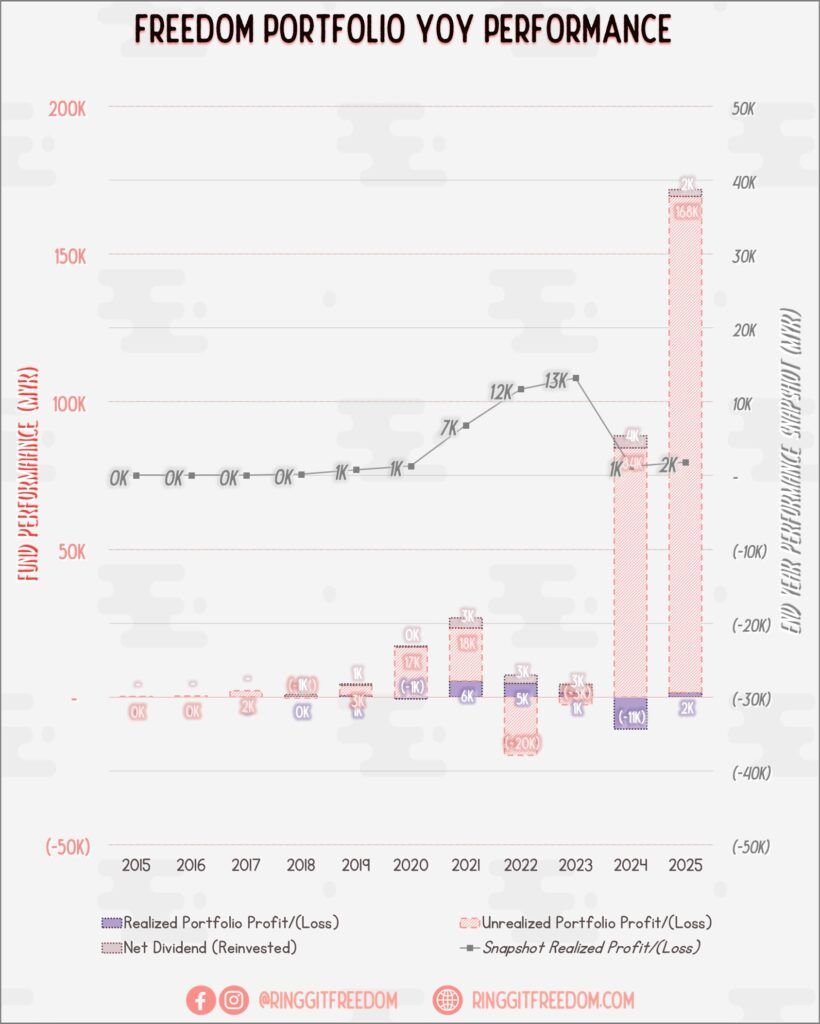

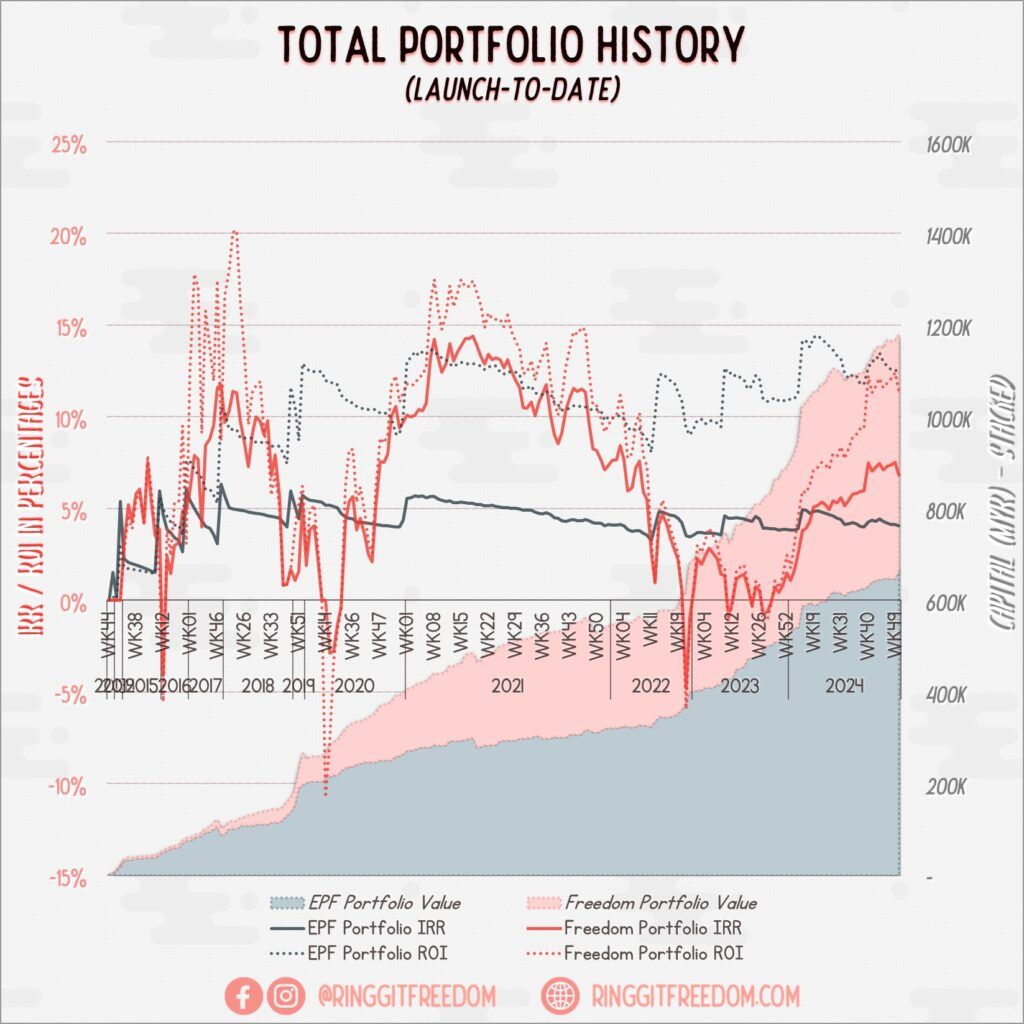

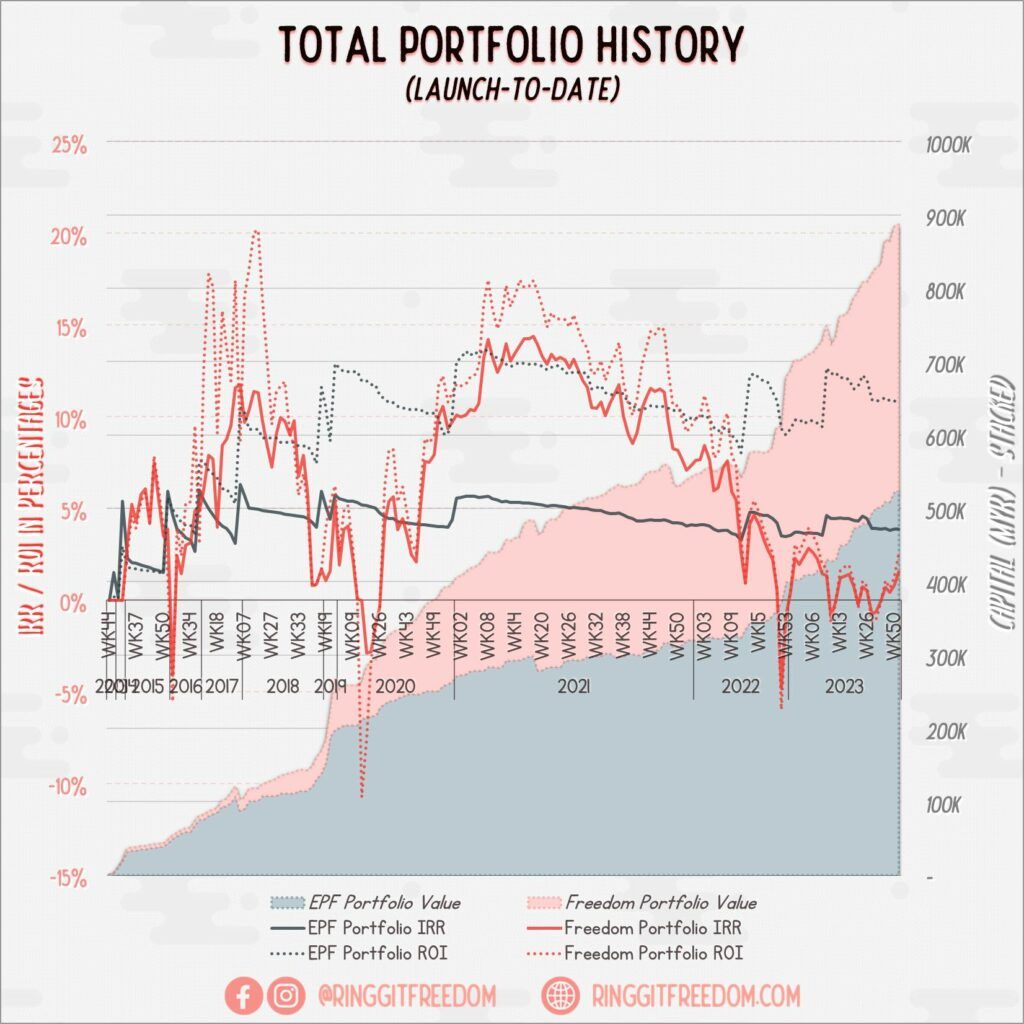

It's starting to feel dejavu by now. Not surprisingly, 2024 was a very good year, with strong performance on most of my holdings raising my unrealized IRR to above 10%. When market performs this well, it really makes me wonder... "is this really sustainable? when's the next crash?" which was also the primary factor that I refused to invest any more than my regular DCA, pumping the rest into my real estate holdings (a.k.a my home!). From numbers perspective, that may not be the best way to deploy cash considering the historical returns of S&P500 being much greater than any mortgage interest savings could potentially yield me.

A new chart added just recently! I've always wanted to track my overall year-to-year snapshot so that it helps me to assess my portfolio performance vs. market funds out there. Not gonna lie - mine looks terrible, until 2024 where suddenly there's a huge spike of unrealized gain. Just America doing it's thing I guess...

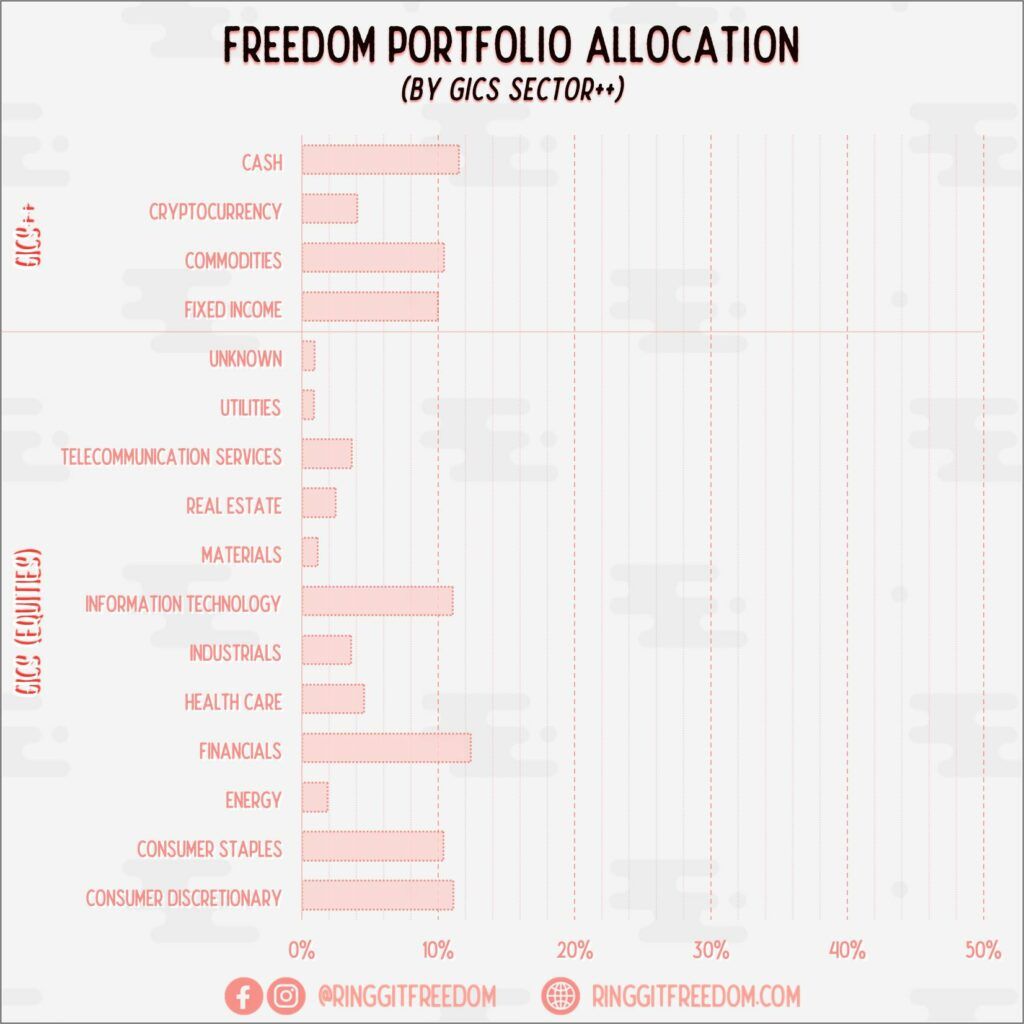

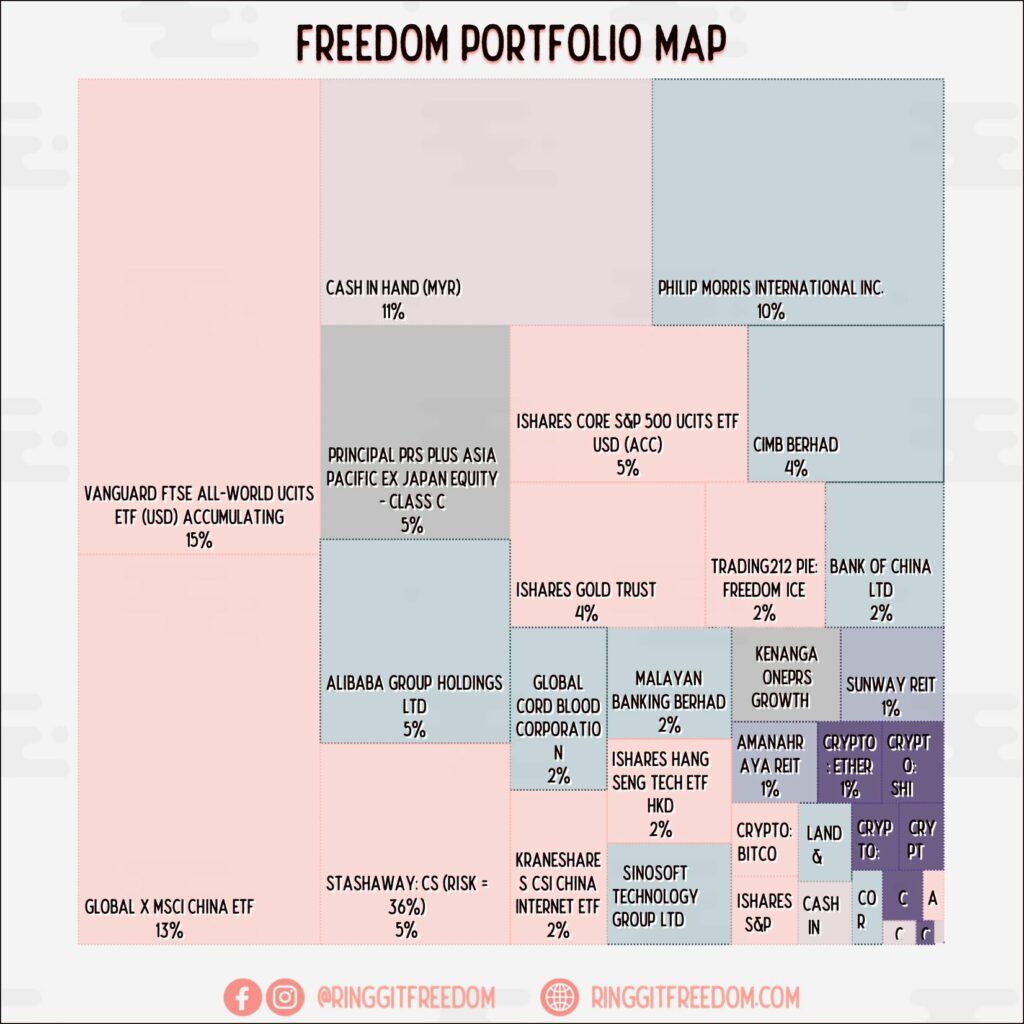

As for the realized losses, since mid-2024 I have started trimming my portfolio holdings and as a result, some of those old funds/ETFs/stocks have been "sold" at a loss but most are consolidated into equivalent siblings (e.g. BABA/9988 Stocks, 3067 China Tech ETF consolidated into 3040 China ETF).

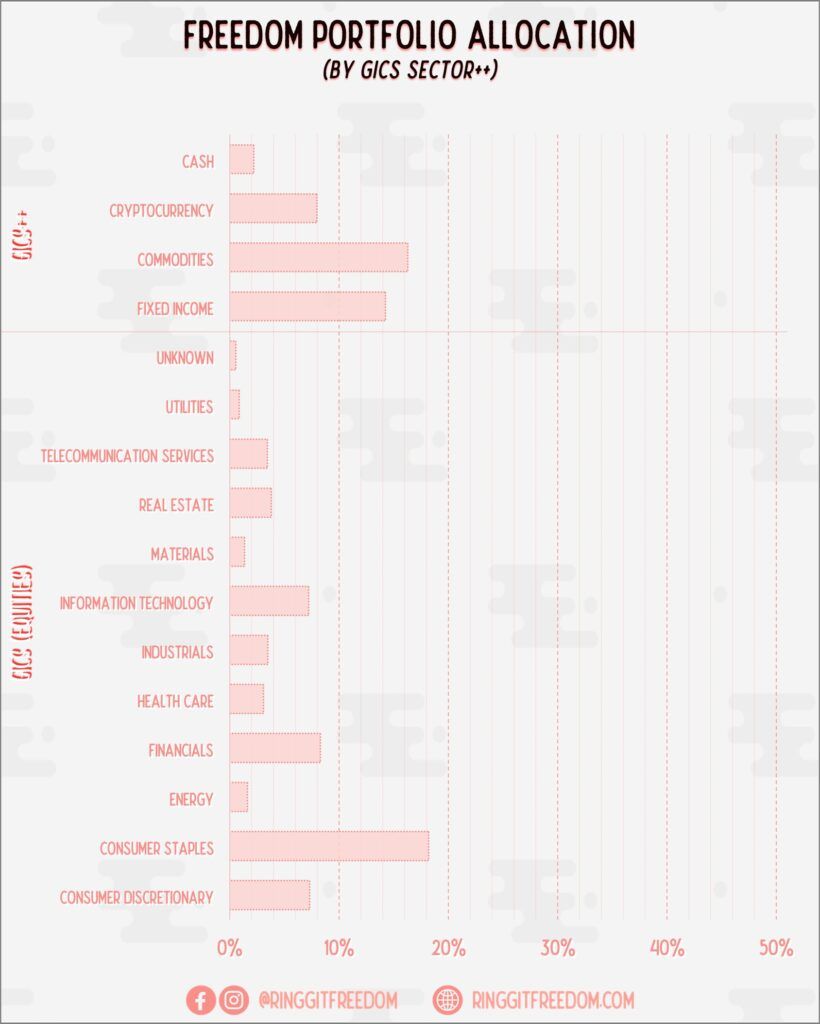

In 2024, I have closed 13 positions bringing down the active list from 30 line items to 17 line items. It's still a work-in-progress but I plan to eventually consolidate them into just a couple holdings, primarily in ETF's with a few stronghold dividend stocks. Last I counted there's still at least 3-5 funds/ETFs/stocks to be deleted or consolidated... an exercise to be continued in 2025 & 2026.

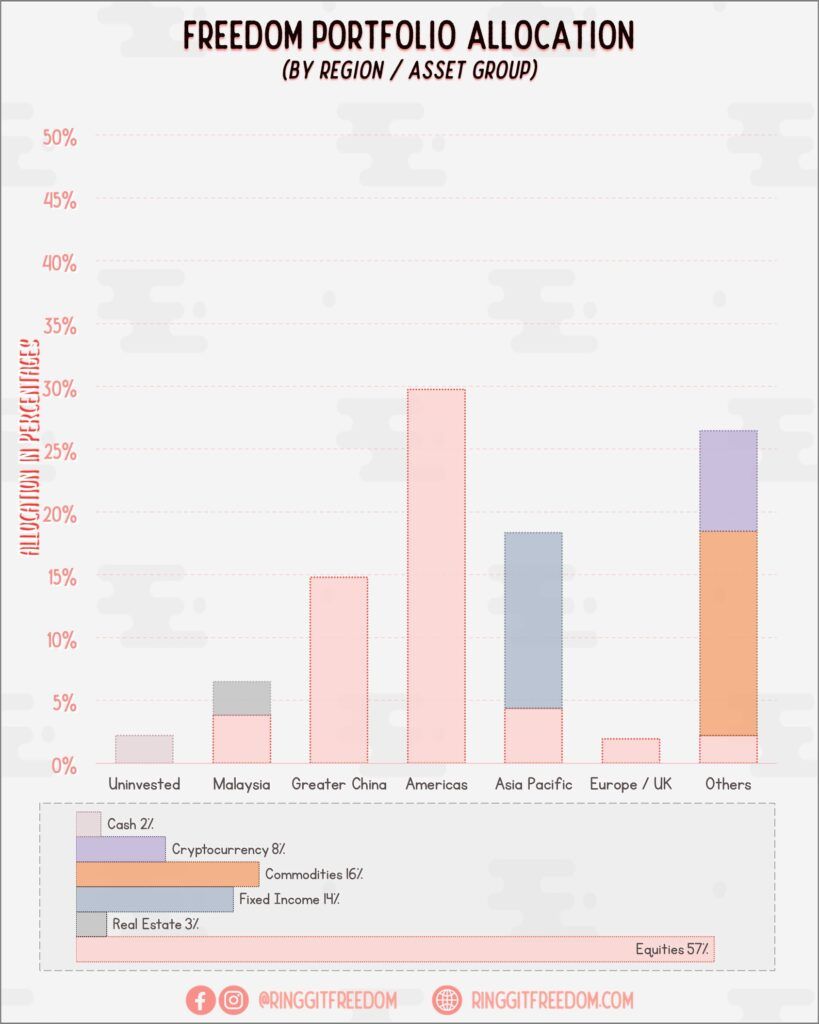

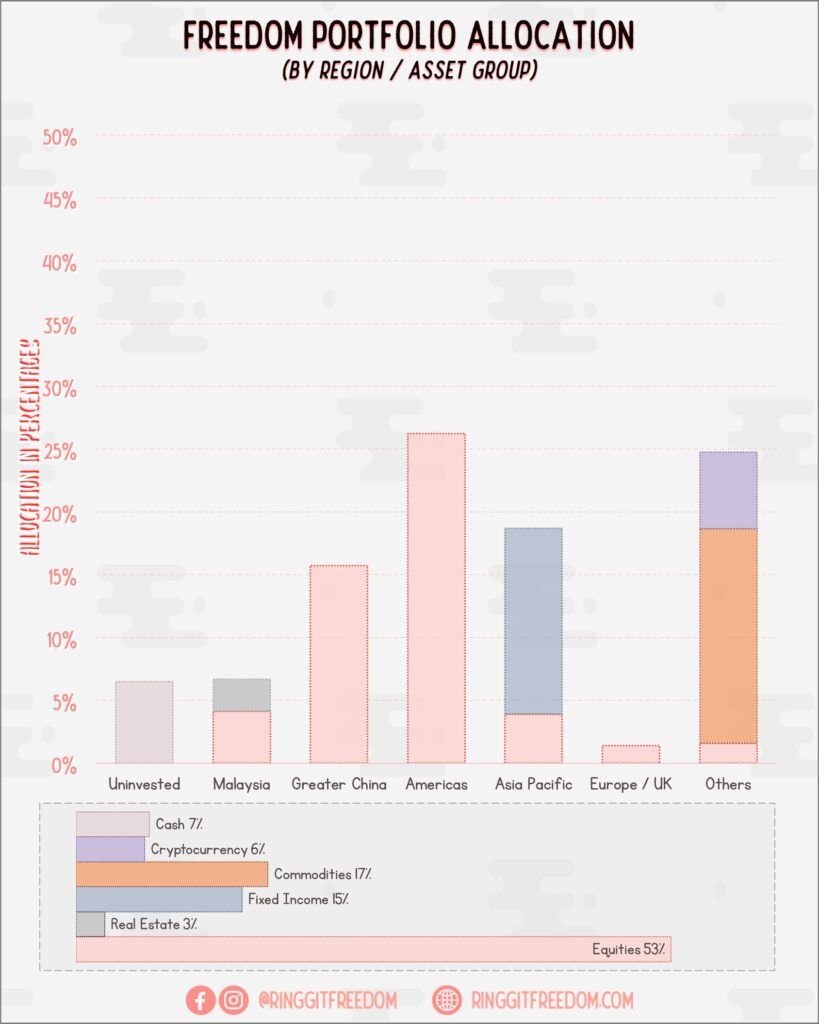

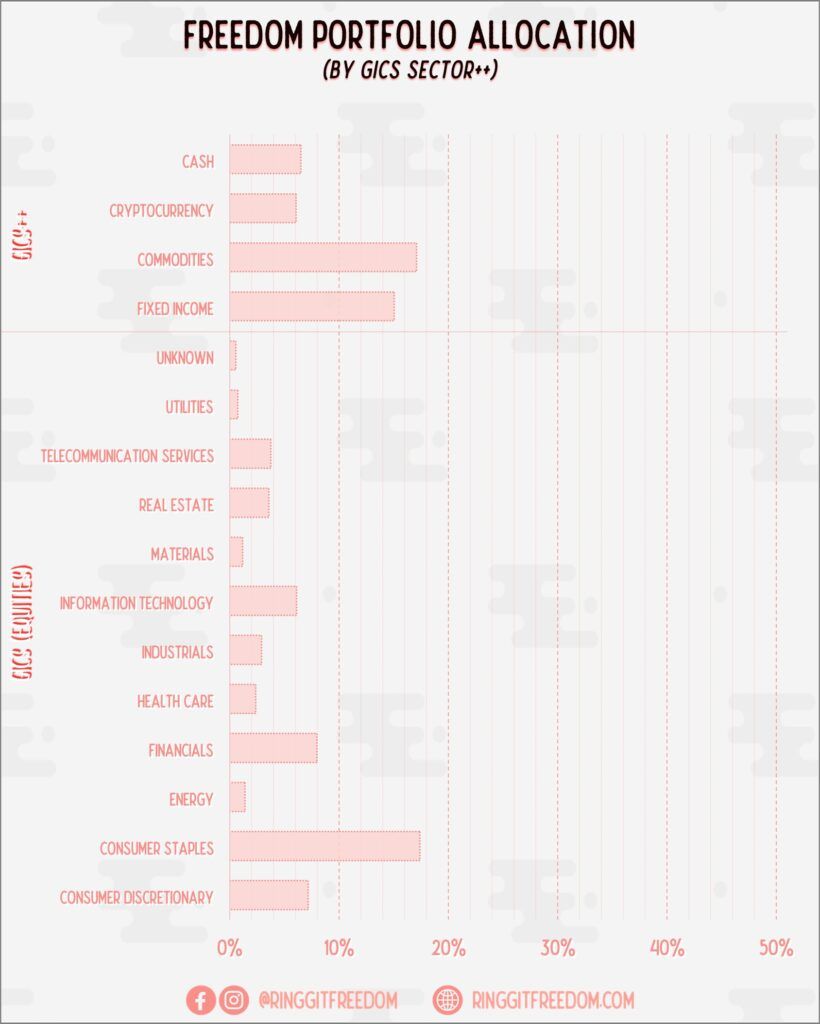

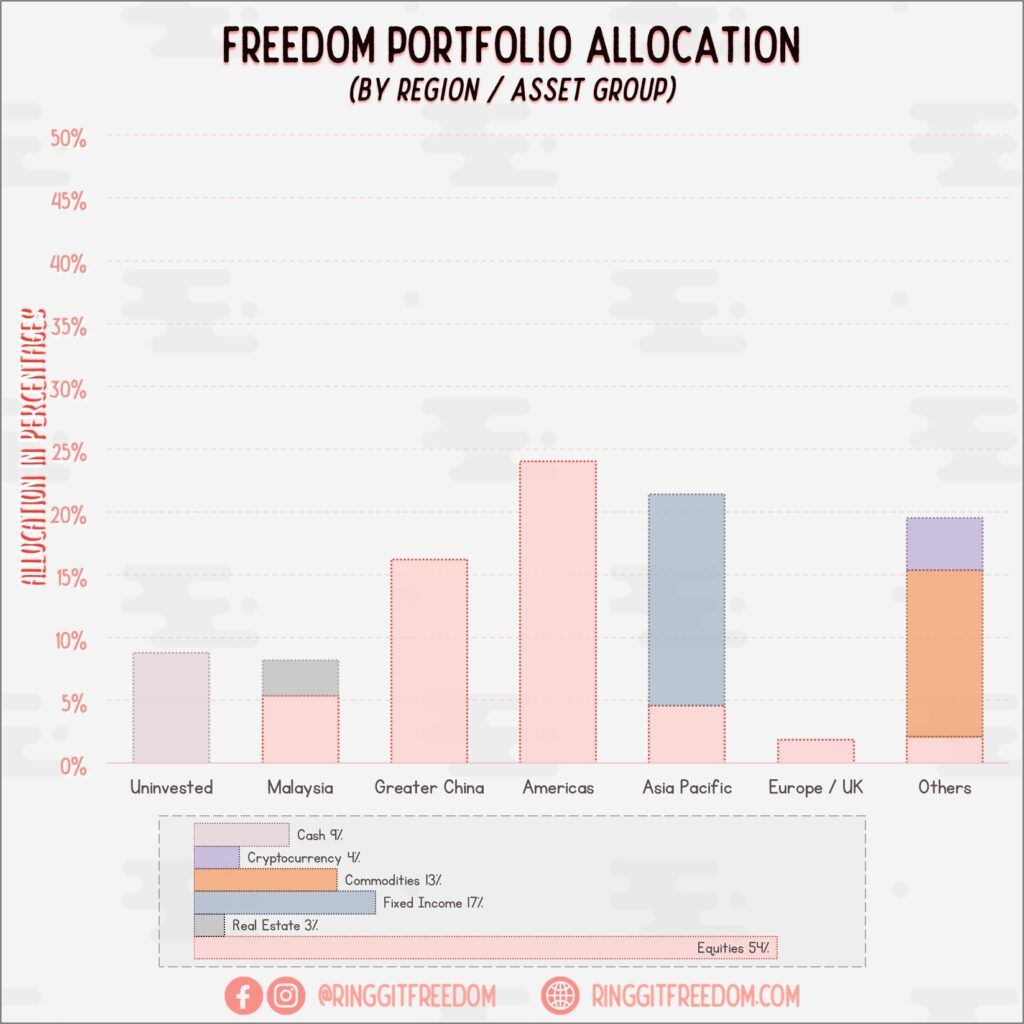

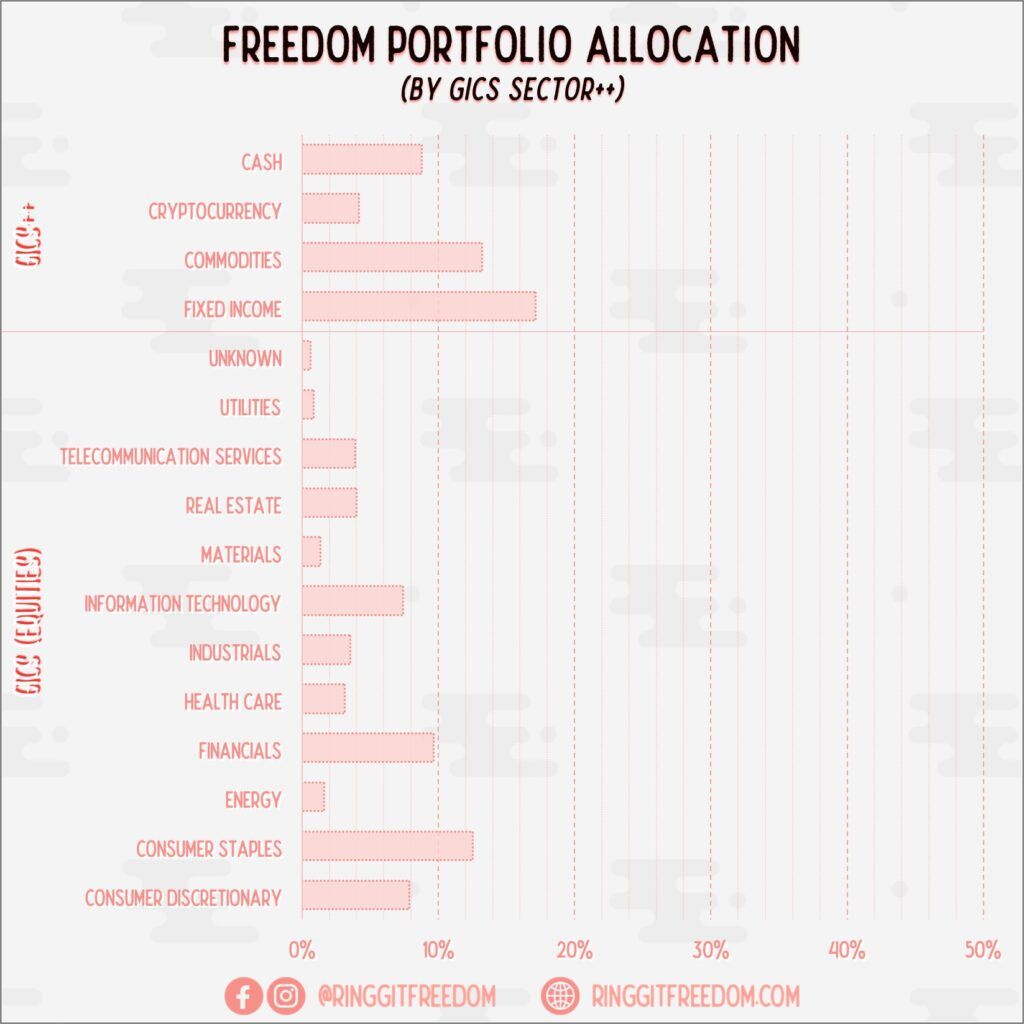

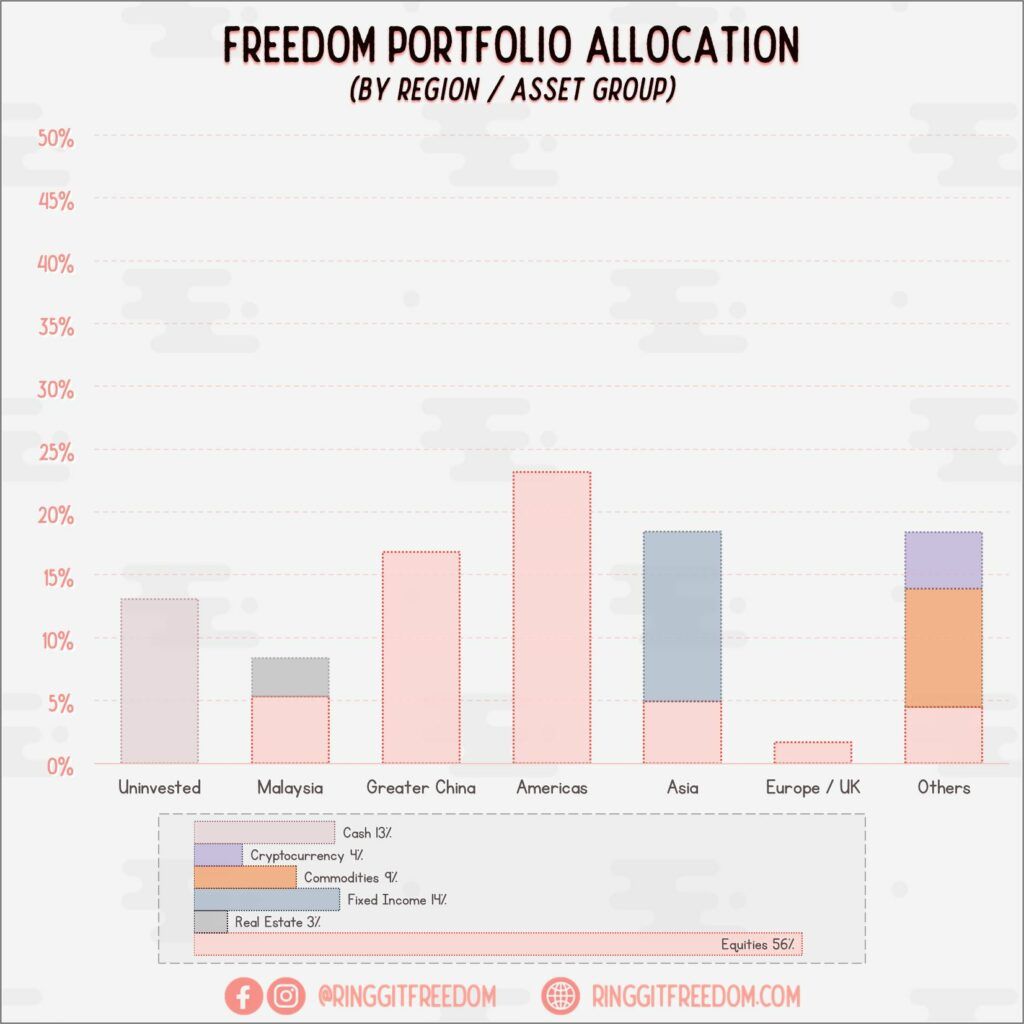

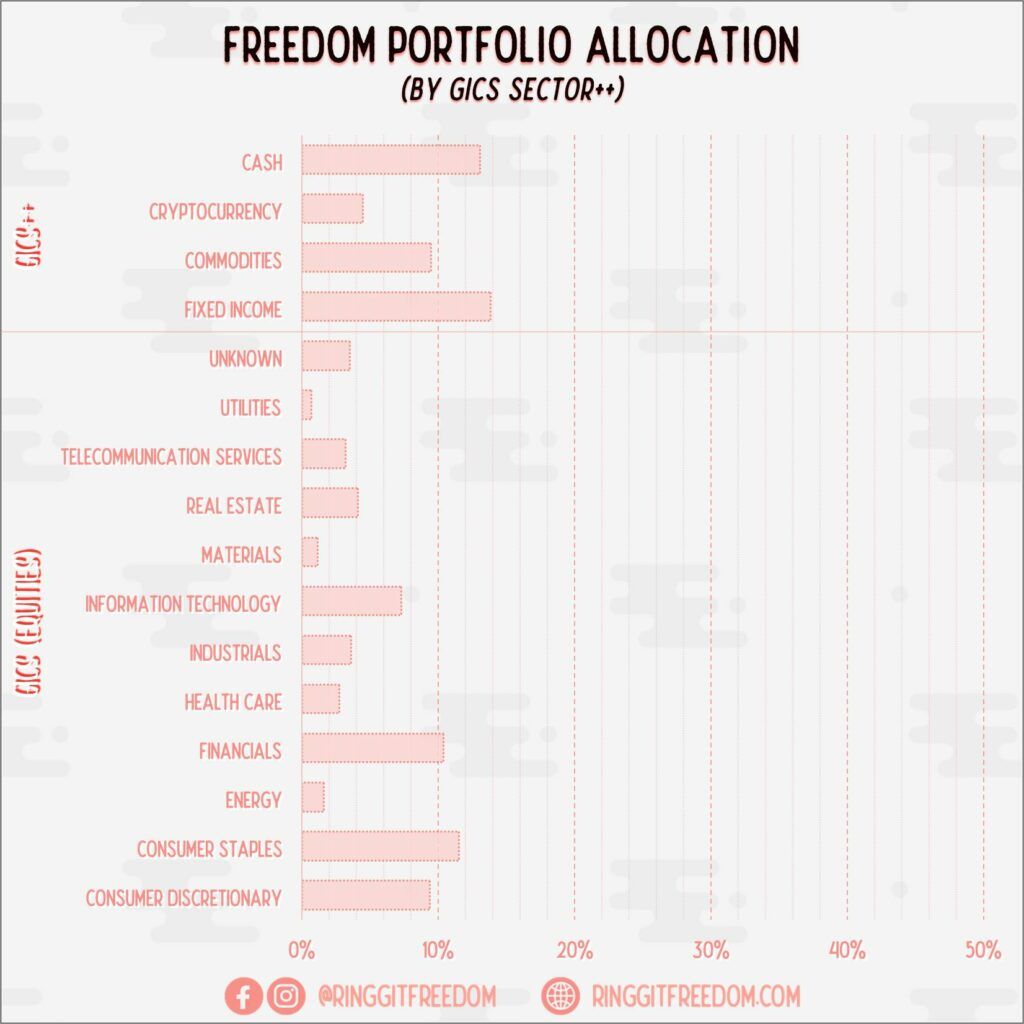

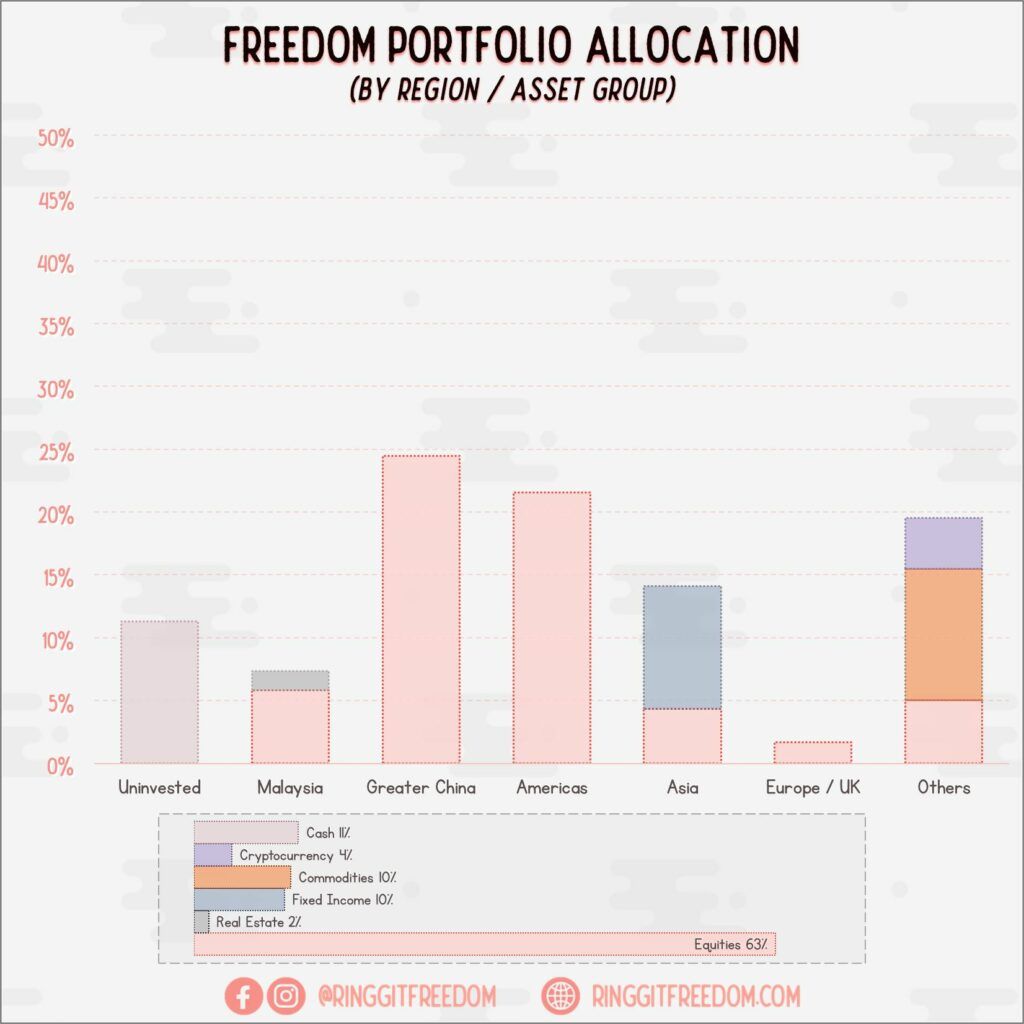

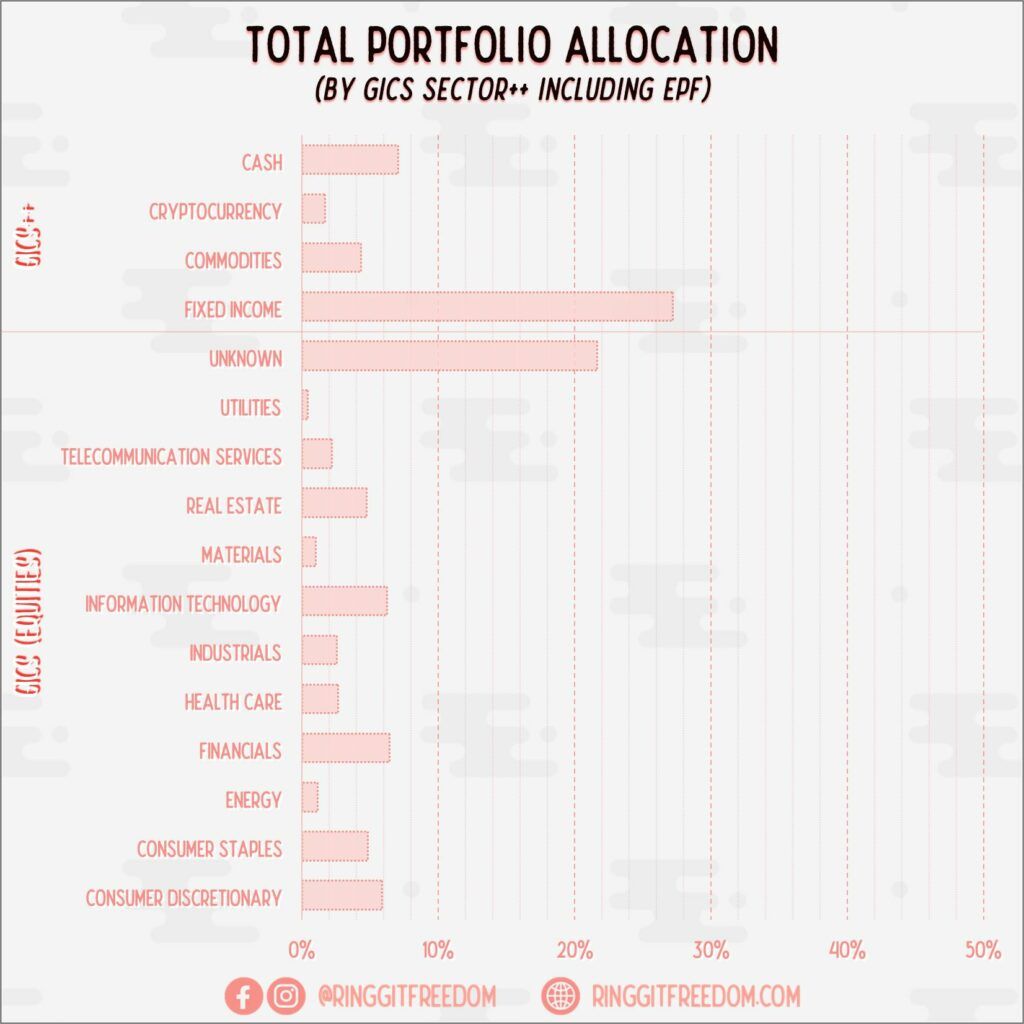

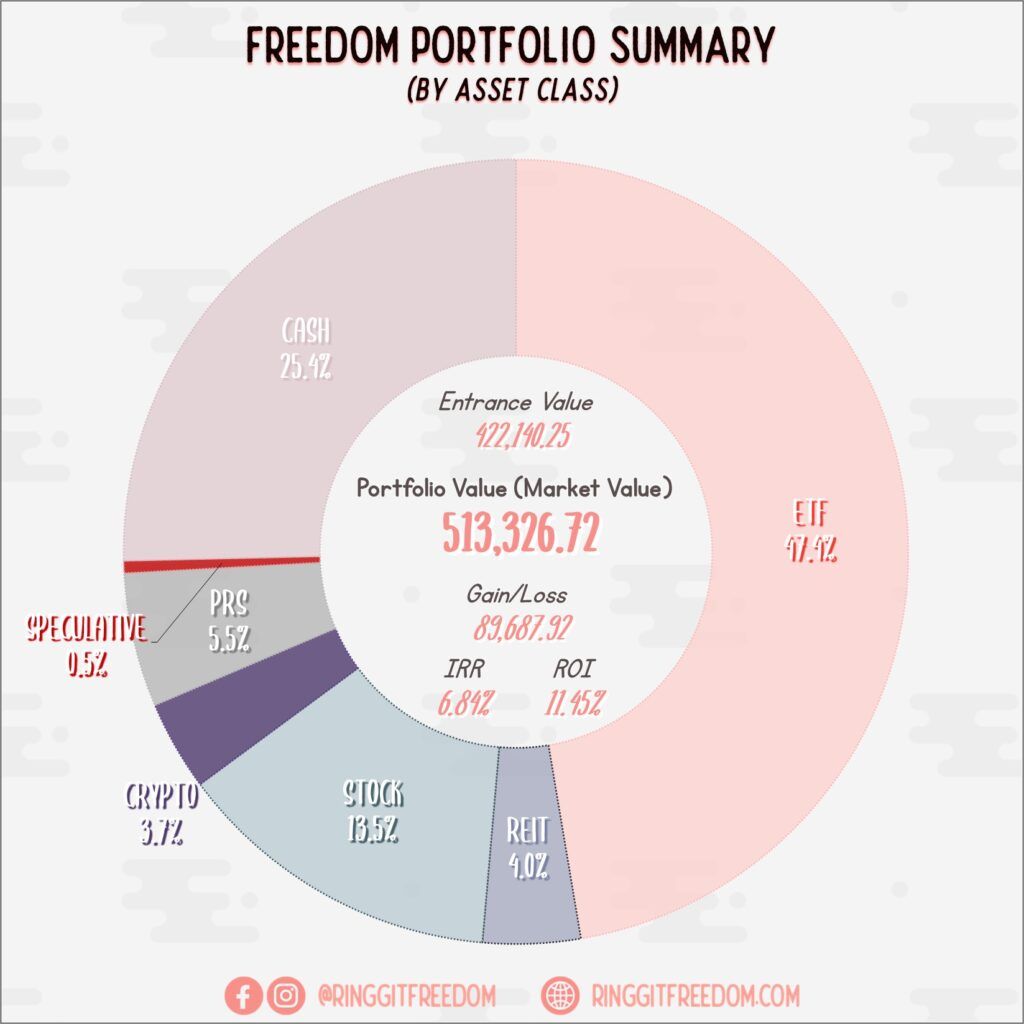

Allocation

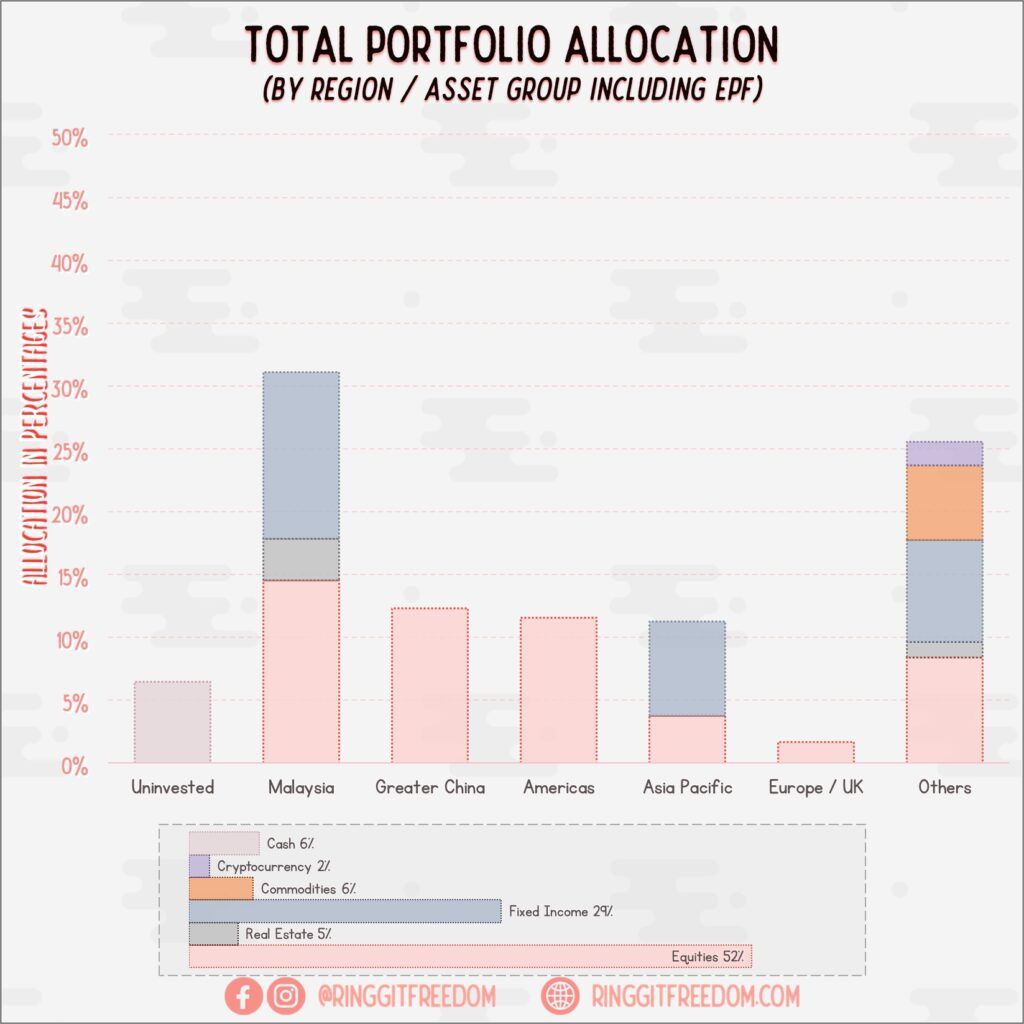

With the heated situation in the market, my cash pile continued to grow. I definitely hated holding cash (equivalents) but going all-in on anything at this juncture just simply does not make any sense. For now, these cash (equivalents) are just sitting in my fully-flexi mortgage account, reducing the amount of interest payable to bank. I think bank really hates me - last year alone, I've paid 50% less interest fees than the two years prior.

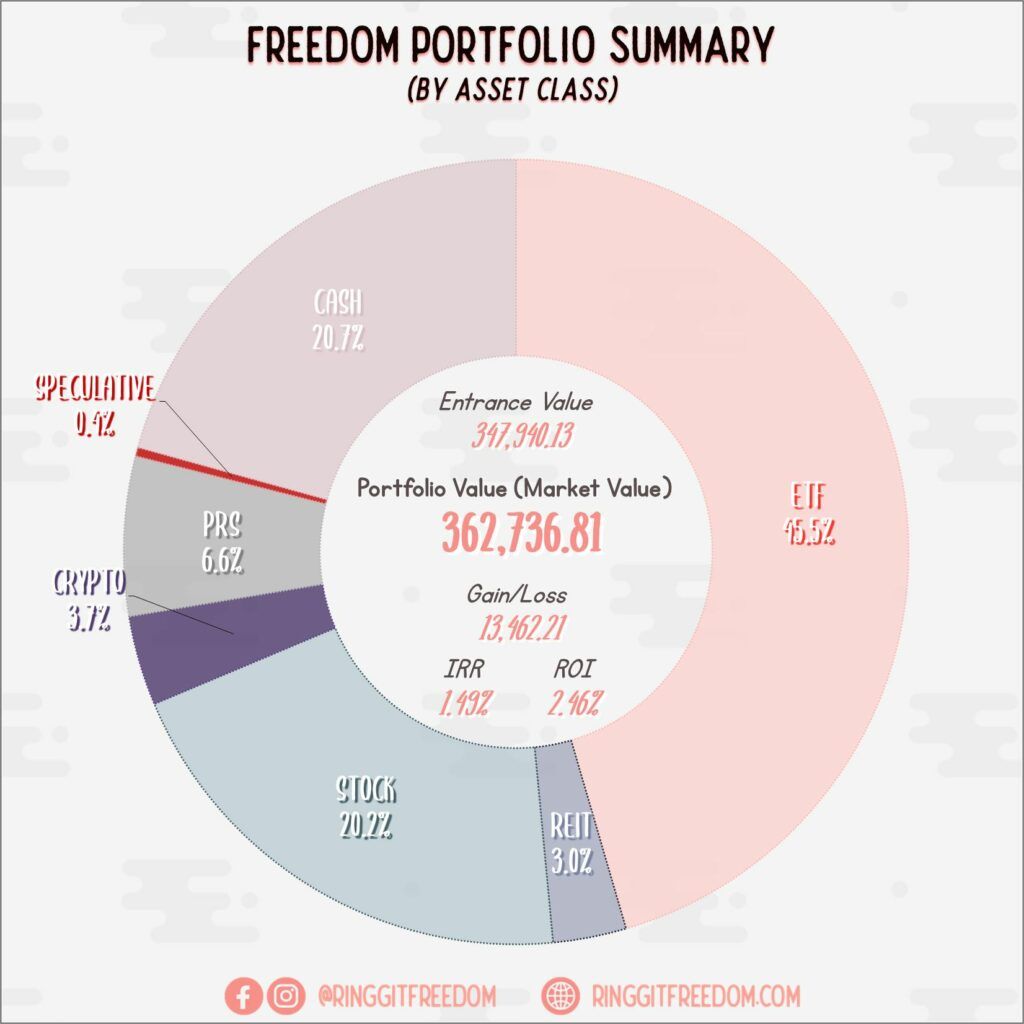

The good news though - I've finally crossed the 500K Asset Under Management mark for my very own self-managed Freedom Porfolio 🥳

There's no other better way than this to celebrate my portfolio's 10 year anniversary. Though, majority of these gain are all from 2024 itself (unrealized) due to the strong market momentum.

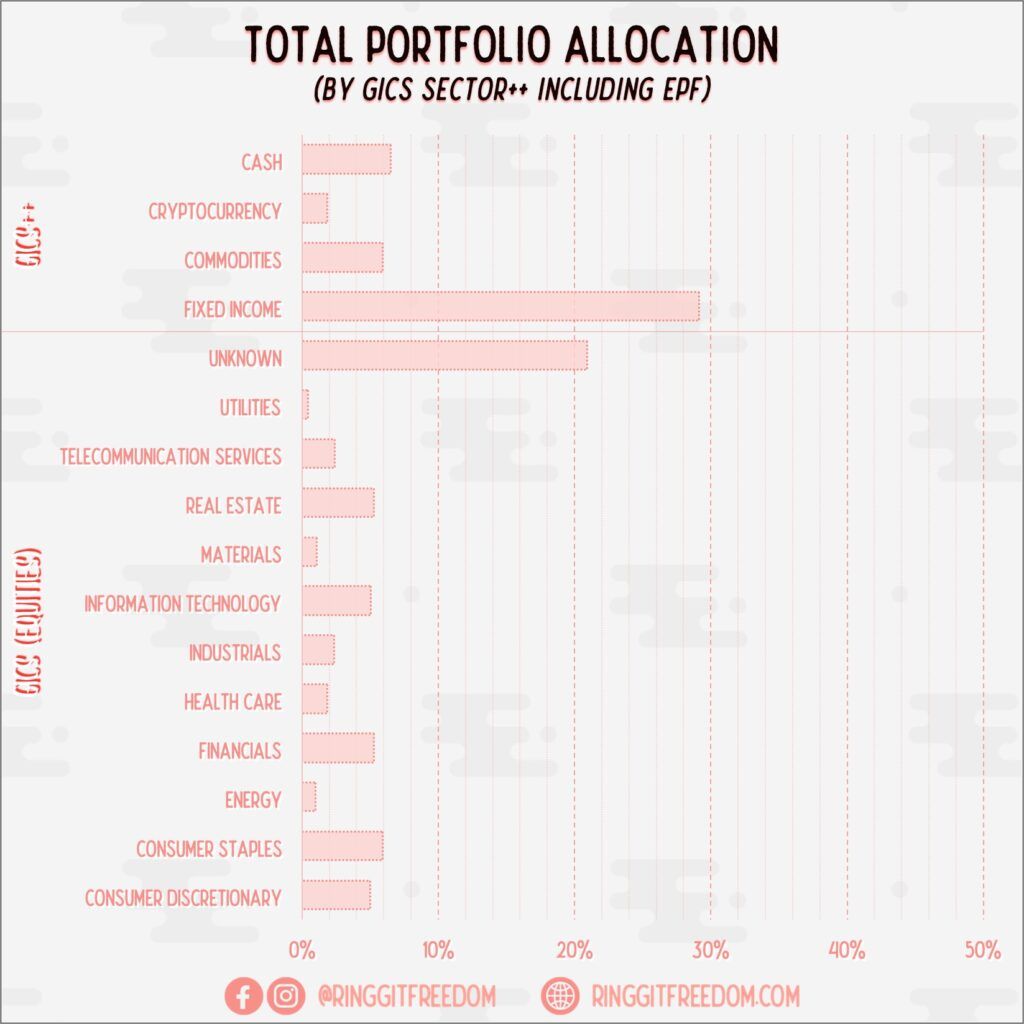

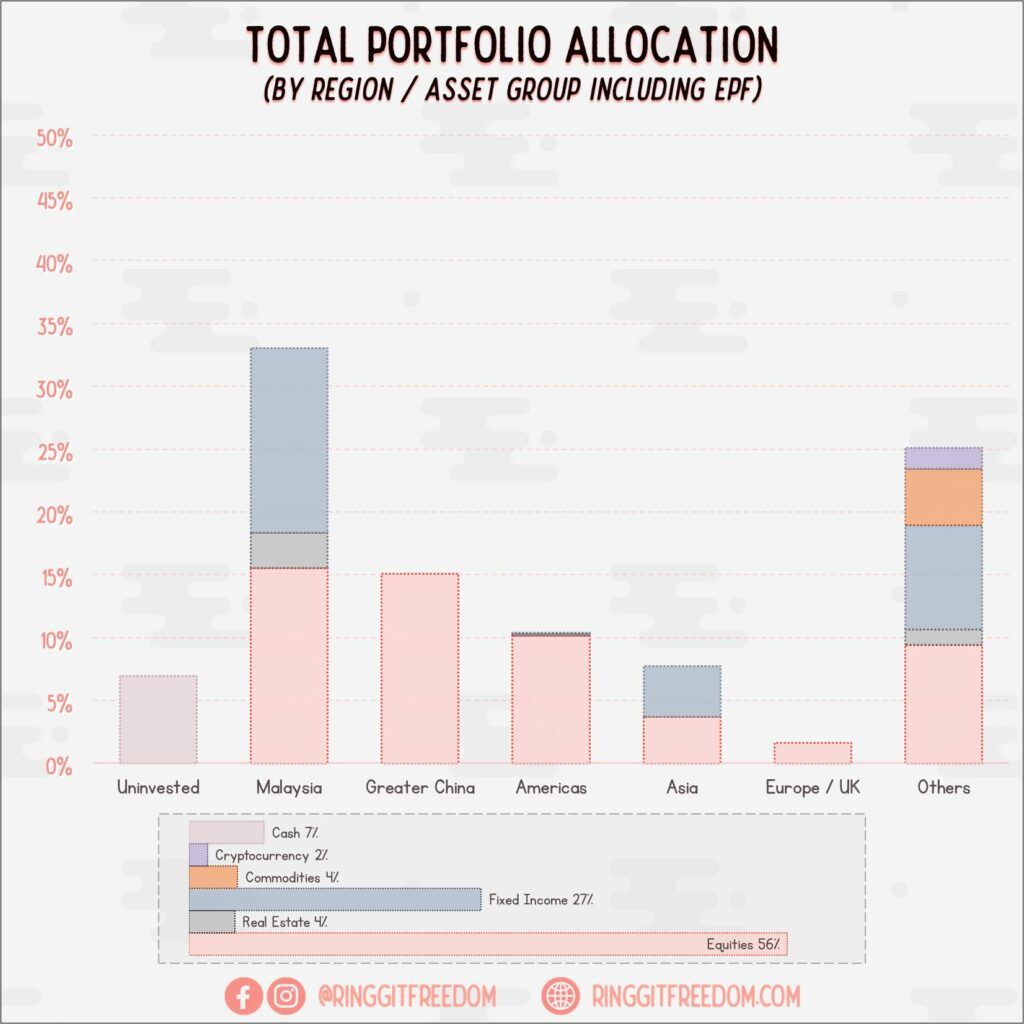

The regional allocation chart above probably speaks better in one slide than my long paragraphs can. The strong growth in US market have significantly threw my proportions out of whack, at least for my freedom portfolio 😅. Good thing is that I still have the "total" portfolio (including EPF/i-Invest) to play around with balancing.

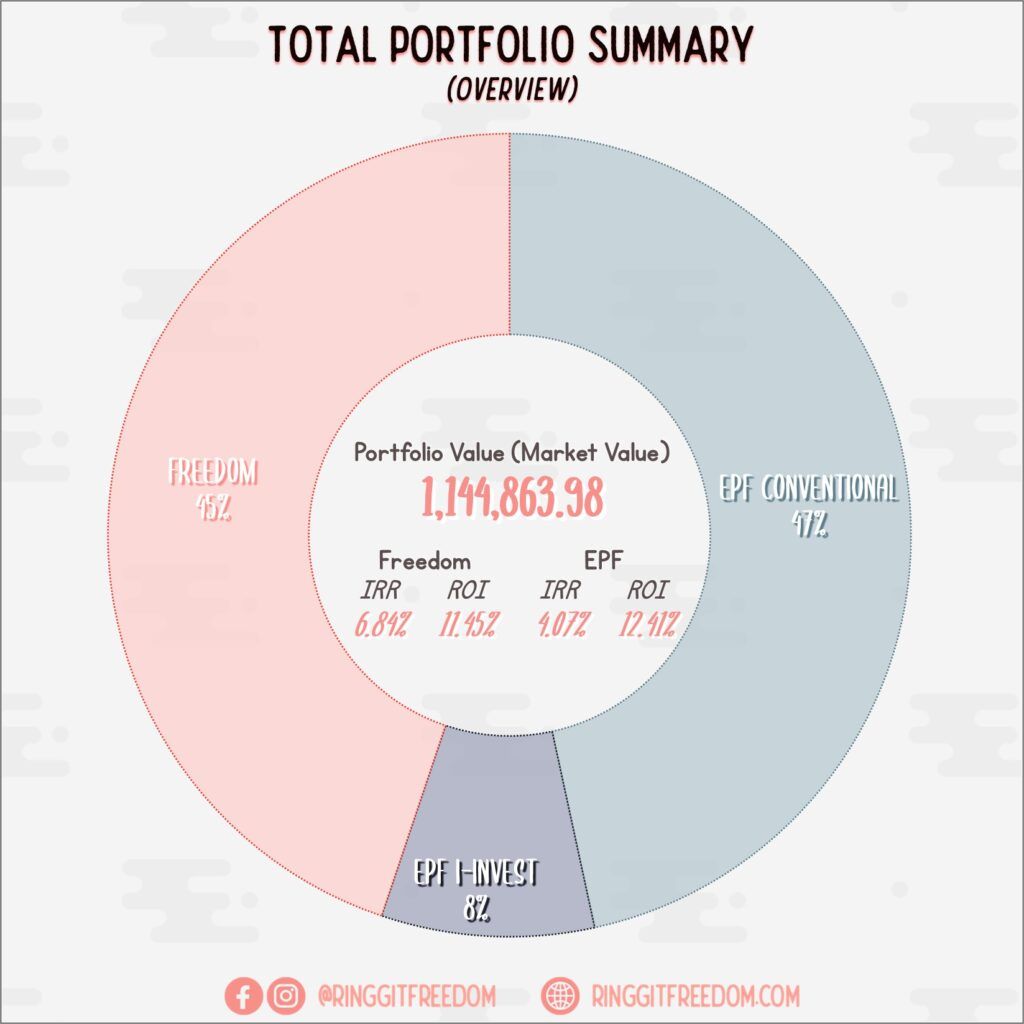

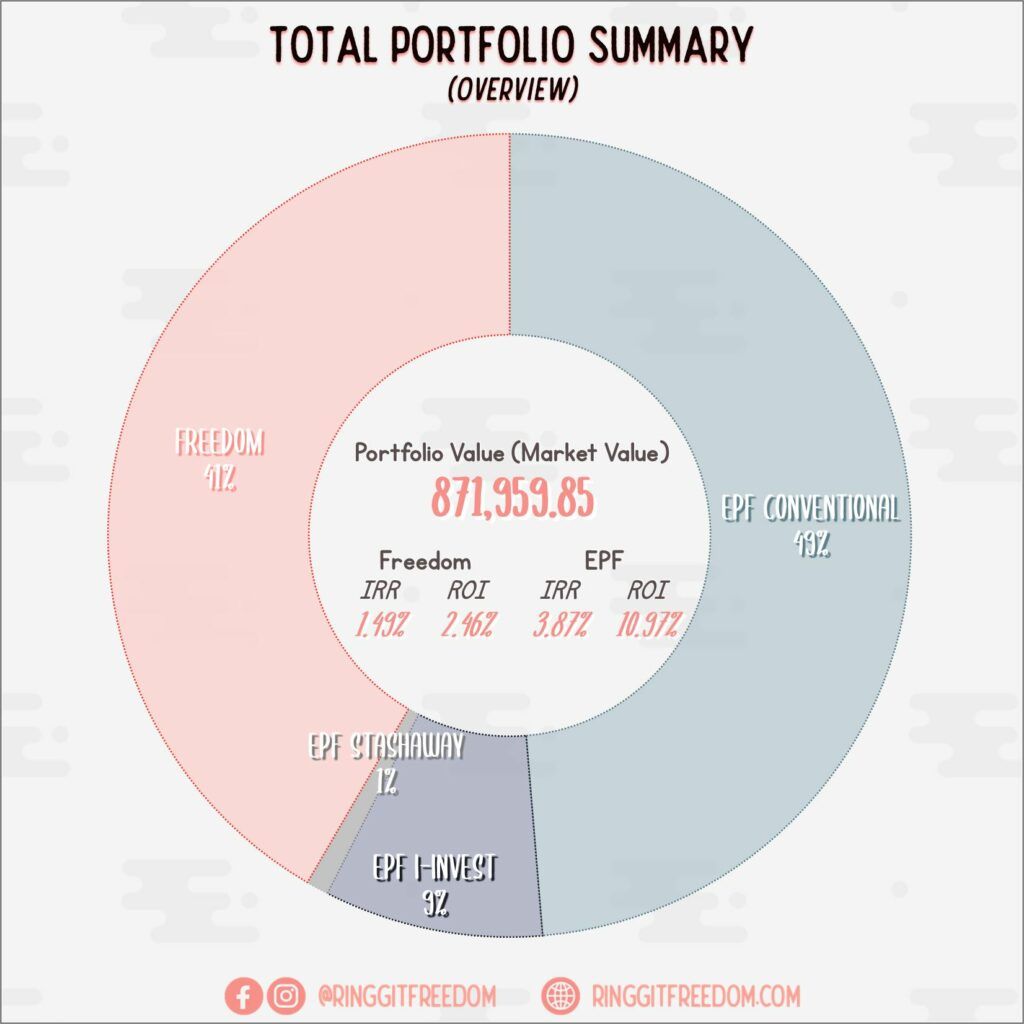

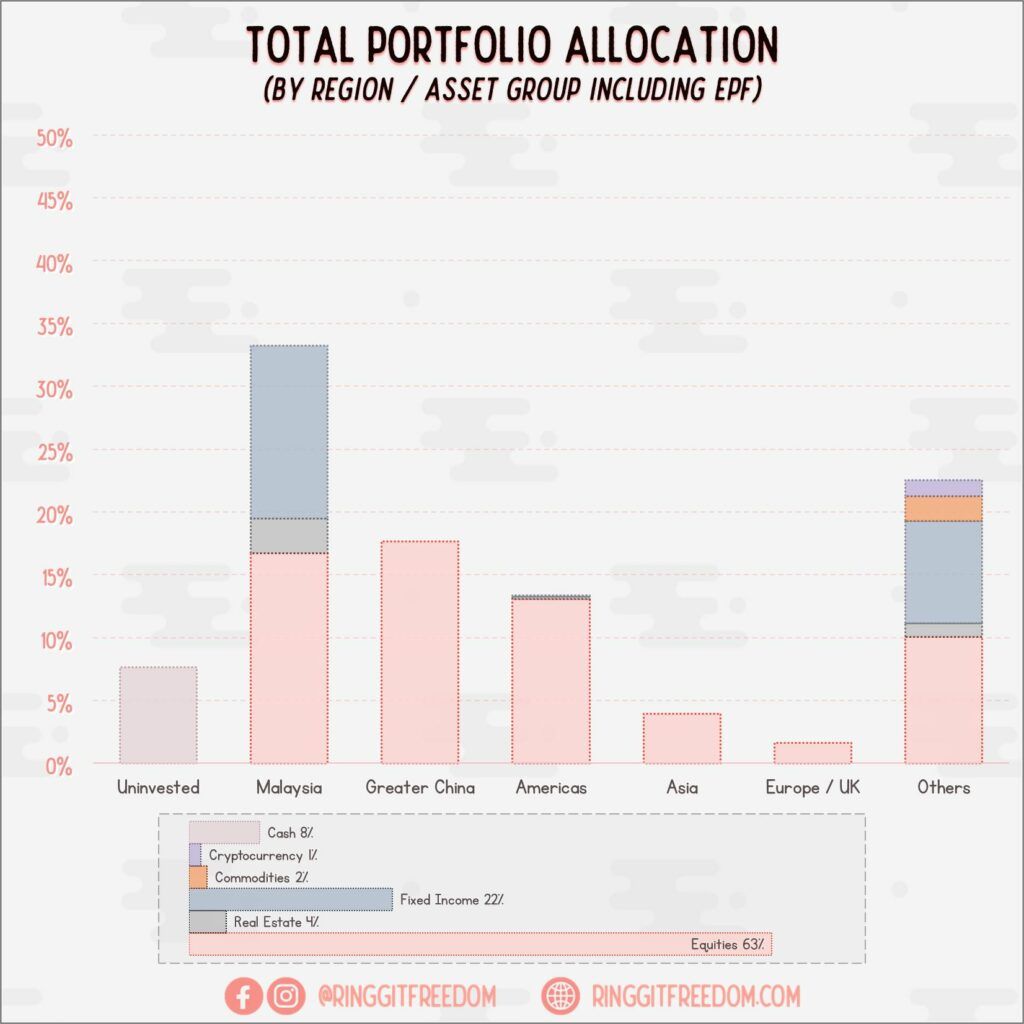

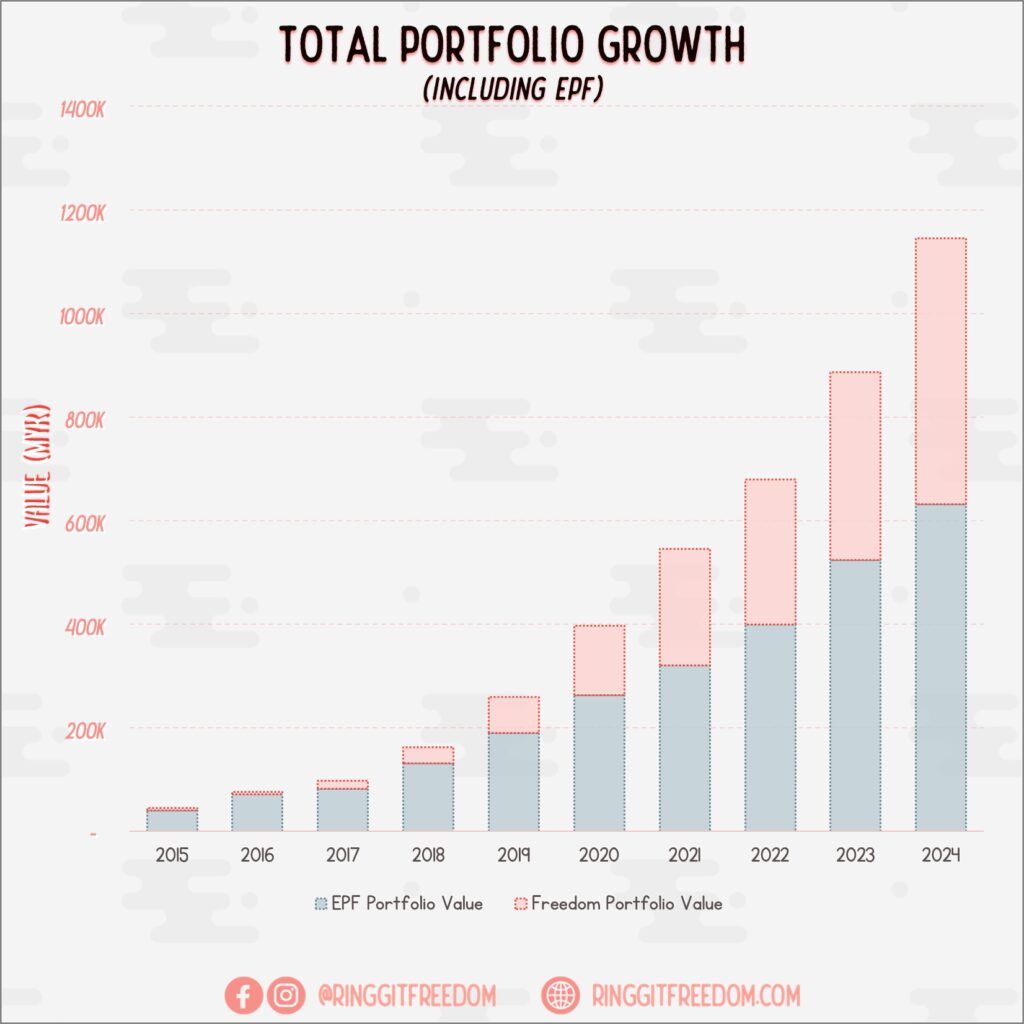

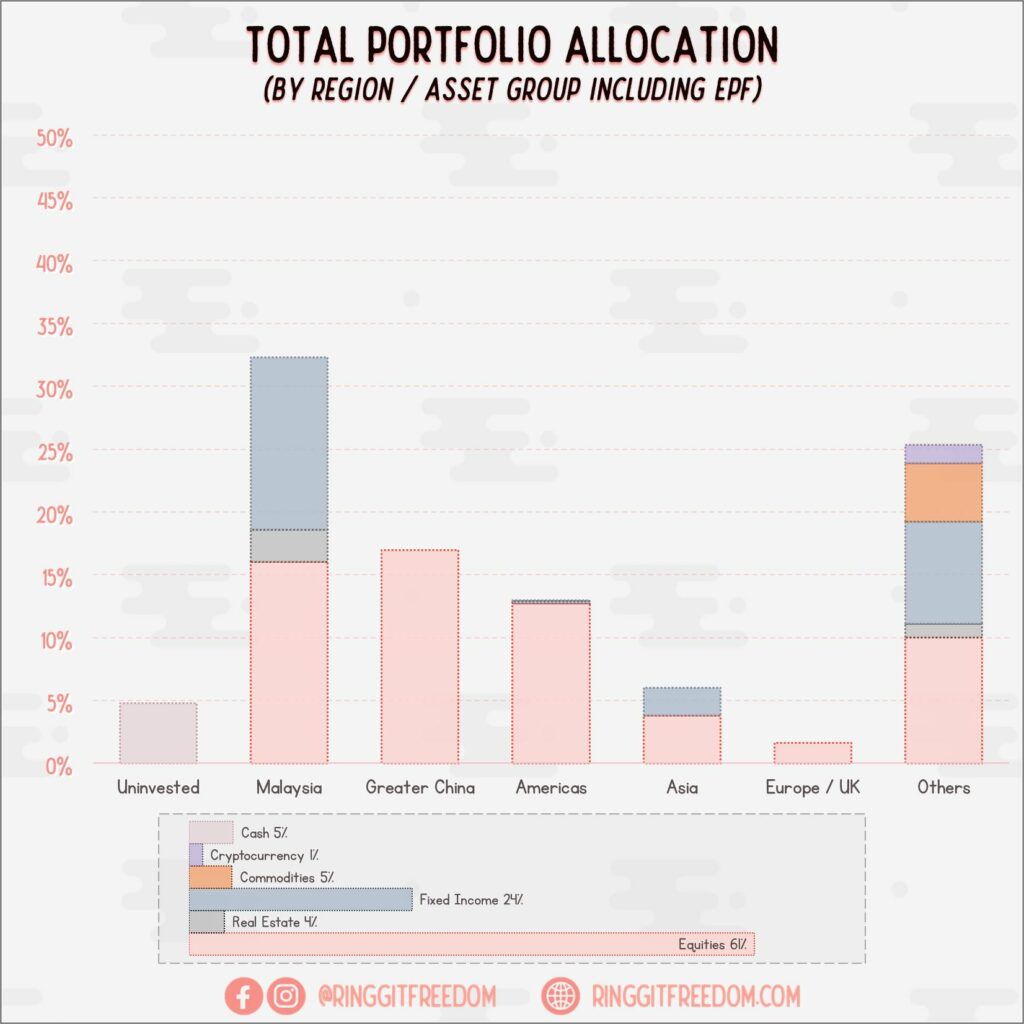

My "Total" Investments

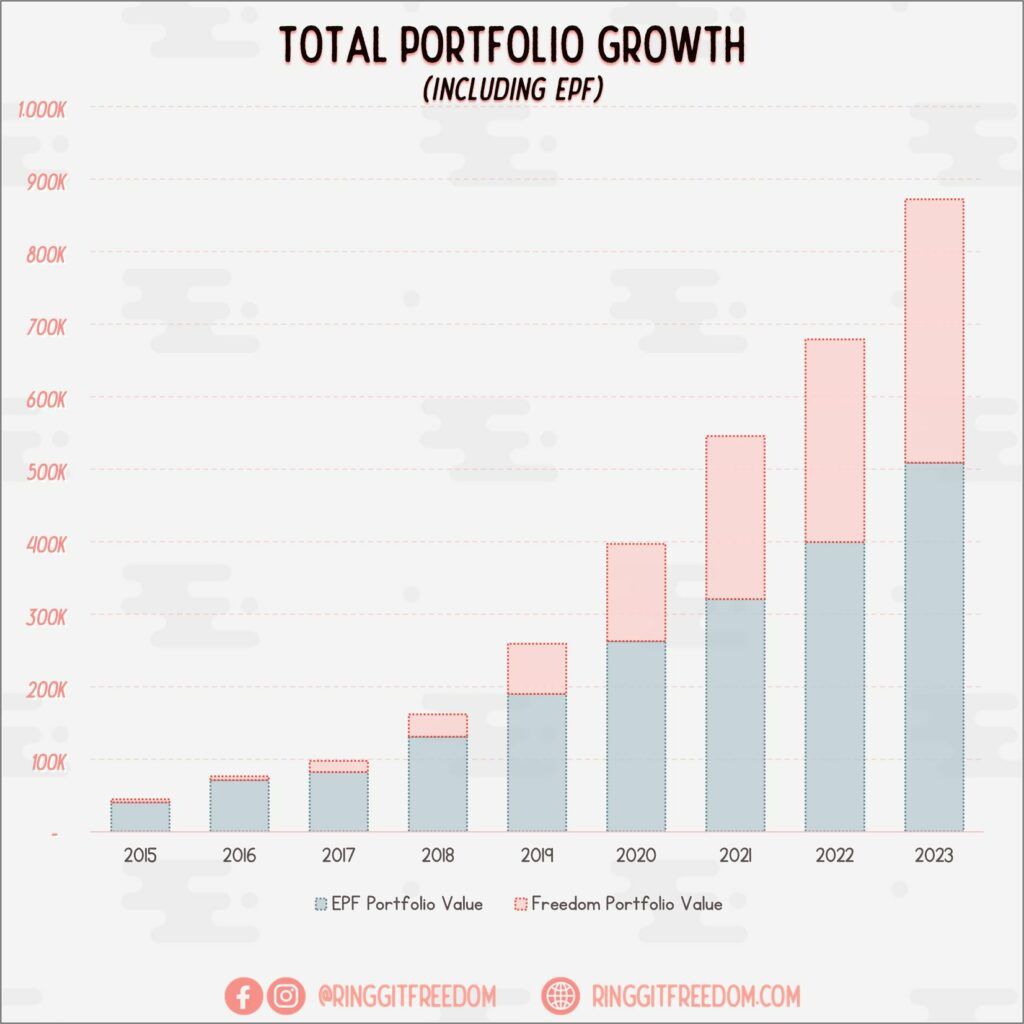

I have decided to continue my last year's trend and include EPF in my yearly review - something that I only do once a year.

Though, it won't be as granular since many of the things are happening behind the scene, directly with EPF where there's zero influence from me (except for i-Invest which I only utilize to rebalance my overall portfolio when it goes out of whack).

Funding

What I'm most happy about, looking at this chart, is the sizable growth of the pink bar. Never once I would have thought that I will be managing a sizable portion of investments, almost on par with what I have in EPF today. Maybe one day, if I don't mess up too badly, that the pink bar will outgrow the blue. Maybe, just maybe.

Performance

Another milestone worth celebrating - my total portfolio size now exceeds 1mio, with EPF still holding the "majority stake" at 55% 😛. Note that for below chart, it has not included the latest dividend which was recently announced a couple days back as the snapshot was taken during 31 December 2024 itself.

If you're curious, with the 2024 dividend factored in, it'll probably boost the value by another RM25-35K and EPF's Portfolio IRR should go from approx. 4% to 5% IRR.

Allocation

Unlike the Freedom Portfolio's Allocation that you have seen earlier, when considering EPF (and my own i-Invest) allocations, it kinda brought back the balances I've been maintaining so far between US-China-Malaysia & Others at 30:30:30:10 respectively (for equities). Though my main goal have always been keeping the balance between US and China.

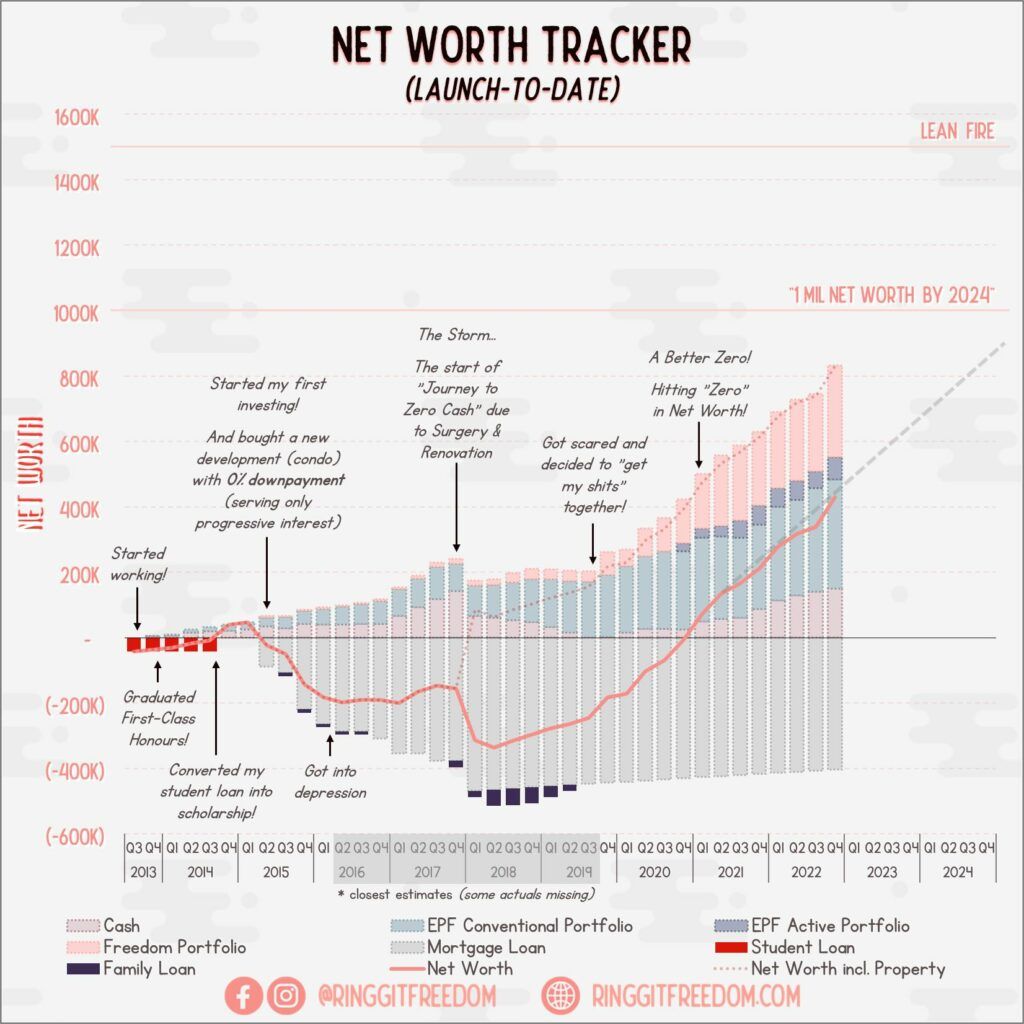

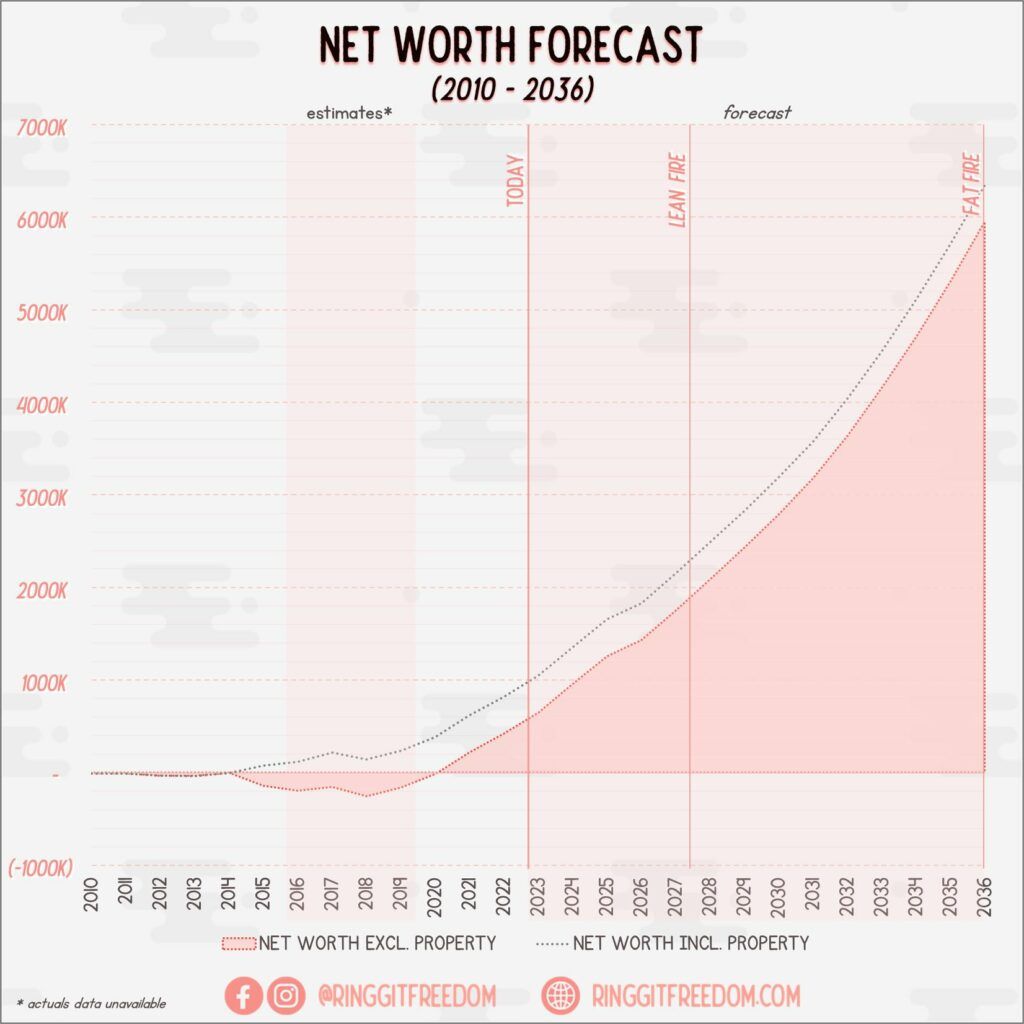

Net Worth Updates

2024 definitely is the year with significant milestones achieved. Those following my journey may recall that I've posted an update in Jun/Jul announcing that for the first time ever - I have finally achieved the "Millionaire" net worth status. In real life, it didn't change anything for me with life going on as usual - just like any other day.

Based on the extracts on last day of 2024, my net worth currently sits at ~RM1,138K (excluding the 2024 EPF dividend) which is way above my original target of achieving 1M by 2024 (before revising it to an additional year cause kiasu) .

Reflecting back, I've doubted myself when I decided to start this challenge sometime in 2019 or 2020, when I first started ringgitfreedom.com. Thinking to myself back then - 1 million in 3-4 years? Siao ah? But somehow with a bit of luck and persistence, miracle happened. For myself, it was the career growth in last 2-3 years that skyrocketed my income.

There are definitely many ways to achieve this. Some co-founded their start-up businesses into successful ventures. Some started their own content production studio. As for me, knowing myself and my level of motivation - climbing the career ladder seems to work best for me despite the stress and all kind of shit that I receive at work. I really am thankful to my company, without which I doubt I will enjoy the financial security that I have today. Though unlike the past, whilst not at the stage of throwing my performance away, I am definitely less aggressive than before in terms of the pursuit of career growth. I guess I had found the right balance that works for me.

The journey's definitely not done yet - for now, I'm not going to revise the target or set another big ambitious target numbers to chase for considering my own uncertainties in the next 1-3 years (migration). We'll cross that bridge when it comes, but for now the focus remains the same - building my equity and pay down my debts ASAP whilst I still have financial security / financial certainty in my hands to take the pressure away when I migrate overseas.

Just in case for those who are reading my year review for the first time - for my net worth calculation, I exclude the primary residence that I’m currently staying in, in the essence that it generates all the expenses/liabilities associated with home-ownership with no ability to generate income. Even if I choose to sell it, there'll be heavy costs associated with it when time is not on my side so I took an aggressive $0 value assumption for such primary residence.

This concept was popularised by Robert Kiyosaki's Rich Dad Poor Dad. However, I know that some of you, especially finance enthusiasts and/or accountants would prefer to stick with the standard accounting principles so there's also an additional dotted line for that which accounts for my home value based on past transaction values with a haircut of ~10% for miscellaneous fees associated with sales of a home.

2024 Goals Revisited

Now, with all hat said, how do I fare in terms of Goals vs. Achievements? In 2024, I've inherited two goals from 2023, and created a new Goal #3 to keep myself in check. As a quick recap:

Goal #1: Achieve at least 55% Annualised Savings Rate (Normalised)

I need to continue something been continuously doing the last couple of years - to achieve at least 55% Annualised Savings Rate (Normalised). The normalised savings rate is calculated by excluding additional principal contributed to mortgage loan and also one-off migration related fees and allows for consistency in comparison vs. past 5 years.

This allows me to ride on the savings momentum whilst not over-depriving myself to focus only on saving but forget to enjoy life.

Goal #2: Plan Another True Holiday

I'm looking forward to plan for another true holiday, perhaps bringing my mom to Hong Kong (still trying to persuade her otherwise, there really isn't much to see in Hong Kong and she's been there twice already…) or somewhere else?

Goal #3: Carefully Craft a Move-Out Plan with Backups

I need to craft a move-out (from MY to AU) plan with more granularities by further refining my current high-level timelines. I'll need to start researching on nitty gritty so that I won't have to scramble at the last minute to decide where to stay, where to work, submit resumes everywhere hoping to nail a new job in a foreign land, etc.

Read more: 2023 in Review: Slowing Down Actually Took Me Further

Now, the question is - did I achieve all 3 goals? In short, not really.

Continuing the celebration trends last couple of years, I want to celebrate what we have achieved throughout 2024 in no particular order 🥳

- Hitting a record-high 64% normalized savings rate, exceeding even my own expectations (Goal #1 Achieved)

- Successfully convinced my mom to visit Taiwan and brought our family for a 2 weeks trip (Goal #2 Achieved)

- Continued negotiation with my Employer on my intended plan to move to Australia - whilst waiting for prolonged Australian Immigration's verdict on my Visa. Let's see if I can score a WIN-WIN - migrate whilst retaining my strong career growth trajectory. (Goal #3 still W.I.P)

- Actually snagged tickets for IU's concert in Malaysia. Not one, but four tickets so my friends could go with me.

- Signing up for Korean class on a whim - 2 months before attending IU's concert. Wanted to learn Korean so I can sing-along and also understand when IU is talking on stage. Obviously it didn't work on concert day, but since then it's been almost a year of Korean classes... I'm surprised even at myself. But the amount of homeworks, ugh!!!

- Attending IU's concert in Malaysia, and seeing her live performance! It's like reactivating my decade old fans-in-me. I've stopped following her after graduating from university but I guess all it took was a single Spark to reignite my love for her XD

- During my holidays trip in Taiwan, flew back to Malaysia JUST IN TIME - exactly 12 hours before Typhoon hits (last flight out). And the best part, it was booked MONTHS in advance. I definitely don't have crystal ball but imagine the goosebumps I've got on that day...

- Survived driving in Taiwan with Right-Handed Traffic roaad systems (on a left-handed driver seat). Took me a couple of days to re-sync back to Malaysia's driving pattern upon my return...

- Taking off my Braces. LIKE FINALLY! But only to be met with Retainers... UGH!!!

- Witnessing the growth of my batchmates at (ex-)work growing - one setting up business and another migrated out of Malaysia. So proud and happy for them, and I SWEAR I'M NEXT!!!

- ringgitfreedom.com entering is coming closer to its 5 year soon (in couple of months). Though a little less active than I'd like due to hectic schedules at work 🙁

And maybe just to pen down some of my regrets - if any - to serve as my own reminder for the future me:

- Not going YOLO and just buy IU's Korea ENCORE: THE WINNING concert when I was given the opportunity to. Like GOD literally gave it to me, with ONE seat released a couple of days before the concert (after F5/refreshing the site for so many days), and I had to hesitate & pause.. WHYYYYYYYYY

- Tried to time the market with my BTC holdings trimming half of the holdings sometime last year, as well as closing my XRP position to "consolidate" / "reduce" number of holdings. I guess time and time again, time in market > timing the market. But it's really hard to go against emotions, despite the best intention/efforts that I may have.

Overall, 2024 wasn't that shabby. I achieved most goals that I've set (easy goals heh) and missed the mark on some - partially due to underestimation of the time taken for visa approvals (it's been 15 months and sill counting...).

Could I do more? Definitely. But I'm happy enough where I am at. I got to see my long-time idol for the first time, after a long hiatus from stanning after university graduation. I also somehow started my journey in learning Korean, something that I've tried multiple times in the past and failed. Third time's always the charm, huh? Fun fact, I created two websites prior to ringgitfreedom.com and both of them died within 1-3 months, just like my previous two initiatives to learn Korean.

Plans for 2025

With all those said, what is the 2025 outlook for me, and whare are my plans? Like last year, if it's ain't broken don't fix it - so I'm going to shamelessly inherit, but improvise, on my last year's goals:

Goal #1: Achieve at least 65% Annualised Savings Rate (Normalized)

Considering the continuous growth of income and somewhat successful in keeping my lifestyle inflation in check - I've decided to set a target that better aligns with what I can realistically achieve based on last year's achievement. We was merely one percent short (at 64%) during 2024, so I think setting a target of 65% is realistic enough and provides a little stretch - as long as I can contain my lifestyle inflation.

Goal #2: Pass my Korean Language TOPIK 1 Exam and earn my holiday trip to Korea

Lo and behold, after several rounds of convincing by my teacher, I've decided to just sign up for the TOPIK I exam anyway. He said it won't be too hard and I hope he's right about it. The real challenge is squeezing my motivation and a bit of time to do all these past year exam papers so I've decided to put a carrot in front of me: earning my holiday trip to Korea.

It's been at least 8 years, I think, since my last visit to Korea. Definitely wants to go back there and mainly to visit cities outside of Seoul (still thinking of Busan, Jeju, or somewhere else less "touristy").

So yeah, let's get this exam sorted first then I'll start planning the holidays!

Goal #3: Carefully Craft a Move-Out Plan with Backups

This is a direct copy-paste from last year. Basically, I sill need to craft a move-out (from MY to AU) plan with more granularities by further refining my current high-level timelines. It gets tricky with the continuous delays from Australian Immigration in terms of visa grants timeline. From 12 months to 13 to 14 to 15 and now, based on latest estimates, it'll take at least 20 months for approvals.

Regardless, it's still good if I can start researching on some of those nitty-gritty so that I won't have to scramble at the last minute to decide where to stay, where to work, submit resumes everywhere hoping to nail a new job in a foreign land, etc.

2025's Wheel of Life

So, with all that basic goals set, what does my 2025's focus look like in terms of the Circle of Life? Just two focus areas: Health and Spirituality.

And with this, introducing a new Goal #4 for myself in 2025:

Goal #4: Building a Stronger Resilient "Me"

Perhaps this should have been the #1 goal - but anyways. I have a long journey ahead of me, especially considering the tough route that I decided to pick for myself. In all truthfulness, I could have chosen to just settle down in Malaysia - perhaps by working for another 2-5 years max, I can retire super comfortably here, no longer needing to WORK FOR MONEY but do whatever I deem passionate about.

Choosing to immigrate at this age poses a challenge, as I have give up some of the head-start that I had built so hard for in the last decade - in all aspects of life, financial, social connections, etc. in a completely foreign country that may not fully recognize my talents.

To drive changes with this level of insanity - I need a STRONG ME. Both mentally and physically. I won't set big goals here like walking 10-20K steps per day because I know big numbers will just scare me away (like many times before). But I pledge to eat healthier, walk more whenever possible, and give myself some time to do soul-searching meditations rather than burying myself fully at work, lessons, homework's, gaming, and all other stuff that numbs my brain.

Final Thoughts

Remember back in those college / university years, when we have finally done with the exams and are given a long semester break whilst waiting for the next semester to start? 2024 definitely feels that way for me. It felt that I have accomplished nothing, but also accomplished plenty at the same time given how fast the time feels.

Ever since I made up my mind to pursue my Australia migration journey in 2023/24, countless number of scenarios have played in my mind - some good ones, but more often than not the bad ones are replayed countless times. Deep inside, I know that some of these are irrational fears especially at time of change (I guess my career did help me even on my personal growth after all - as all these feels so dejavu when it comes to change management of human behaviour with new things)

But still - the biggest question I still have from last year was that how will my future look like? Will everything that I've spent decade working on go down the drain (given high living cost etc.) or will my portfolio & financial numbers continue to thrive? Only time will tell.

One thing's for sure though - with the delay in visa processing by Australian Immigration Department, it also opened up potential opportunities in my negotiation with my existing employer (since they also have presence there in Australia). At this stage, I'm just keeping an open mind, whatever the outcome would be. Even in the worst case scenario, all I have to do is to stick to my original plan and start applying for jobs in Australia once I've received (fingers crossed) the visa grant - since all companies, at this stage, are screening out all applicants without valid working rights in Australia.

The Wheel of Life is also an interesting concept that I've started to like, now that I've tested it myself. 2 (or 3?) years ago when I first decided that my life pursuit should be beyond just a singular pillar (Financial), I've expanded to "Personal Growth" and "Family/Friends" but with this Wheel of Life - it also forces me to think from additional angles previously not considered for. Let's see how it goes in 2025, and if all well, it should become a baseline that I will utilize going forward in assessing priorities for my life.

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

Cheers,

Gracie

The post 2024 in Review: The Gap Year appeared first on Ringgit Freedom.

]]>The post Ringgit Freedom’s September 2024 Updates appeared first on Ringgit Freedom.

]]>My Life & Mental State

Quarter 3 in 2024 have been kind to me. I've started to create more pockets of time to spend some quality moments with my mom, amidst my chaotic working schedule.

Not just with family, I've also been spending quite some time (and money) in aspects of self-love and self-care. Went for a personal colour analysis session to better understand suitable colour (and fashion style) for myself and this gave me a good reason to start some spring cleaning exercise on my wardrobe.

Doing all these as a start so that I can learn to better appreciate both my natural beauty - and most importantly my flaws. Approaching it step by step seems like a good way to start, considering that I've never really "cared" too much about my skin or fashion. Gotta start taking care of my skin before it's too late!

And not to forget, finally, my braces are off too! Now I've gotta learn how to smile... confidently. Something that I've never done in my current lifetime.

On the not-so-bright side though - I had a chance to snatch some last minute ticket for IU HEREH ENCORE Concert @ Seoul as some people gave up / refunded their seats 72 hours before the concert. I was literally at the check-out page and was inputting my card details!

And what took it away? My own hesitation. I wasn't really sure if I could commit to such a last minute trip, and was also worried about the flight & accomodation price due to the short notice. In that span of the moment of checking flight ticket prices, the transaction got timed out and I lost my chance altogether :'). On one hand, it's a semi-good news where I avoided a financial disaster for September (you'll see why in a bit...) but on the other hand, the sad reality struck me as I instantly felt the regret of "not trying" than regret of "doing".

Guess this will be my mantra going forward - better regret for trying than to regret for giving up. Heck, I've even applied & secured K-ETA approval and was prepared to fly on a short notice... why the hesitation 🙁

Now, going back to our usual monthly update for my finances and portfolios.

My Financials

Expenses

I've decided to change the format a little. Rather than should Year-to-Date figures which is quite difficult to make comparisons to in later part of the years, I'll just do quarterly expenses review and only show the Year to Date in the final yearly review.

Just as the first two quarters of 2024, half of my expenses were actually put into my mortgage - both principal and interest included. If I can keep this up, it shouldn't take more than 5 years for me to write off my mortgage loan. May not be the best thing to do from financial numbers perspective, but I'm doing it anyway. The thoughts of being debt-free to me is priceless, no matter what the math says. Just treating it as a premium to be paid for peace of mind.

Aside from this, I've spent quite some figures (up to 20% of total expenses) on purchases for either myself or my family. For one, I've finally pressed the 'BUY' button and managed to get my mom an iPhone 15 - her first iPhone ever. This is also probably 3rd "new" phone she ever owned - with the first two "new" phone being sub-RM500 phones. Whilst she doesn't say it and kept nagging me on how I've wasted money on her, I can see her smile deep inside. That is definitely a worthwhile experience for me especially since she liked taking photos. Bought it right before iPhone 16 too - not the best, but god a pretty good deal at RM3100 for 256GB iPhone 15.

From another front - just as the last couple of years, September is usually my "spending" month where I splurge on self-care as I've mentioned in the opening of this post. Definitely should start tightening my spendings and bring it back in control - otherwise I'll be missing this year's saving rate target for sure...

Savings Rate

Yup. As explained earlier - September definitely is not looking good. As a matter of fact, the last couple of months weren't looking good as well. Quarter 4 will be the deciding moment on whether if I'll miss my savings goal target for this year

Emergency Jar

Nothing much to be said for the Emergency Jar - still there for the day that I wish will never come.

My "Freedom" Investments

Performance

Activities

Right before the end of September, China decided to do something which helped them to finally rally their stock markets, helping me to boost my portfolio value. At least my China ETFs are no longer in the red, which is a good sight after a depressing 3 years.

On the other hand, since I do have quite some subtiantial holdings denominated in foreign currencies like USD, SGD, and AUD - the recent strengthening of Ringgit (which is a good thing) definitely hit my portfolio hard. On paper, I'm losing at least 8% - 12% alone between the start of Q3 until today just from currency alone. But it's all on paper anyway so I don't really care. In any case, I am overweighted on MYR for sure, considering my EPF alone already exceeds the size of my self-managed Freedom Portfolio.

Good thing is that the US stock market index continues to rise so that kinda offset the "losses" too - but honestly not sure for how long. Everything feels overvalued nowadays.

Allocation

Snapshot as of 30 September 2024

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 0.44%

ROI: 0.67%

Profit/Loss: RM 1,971.97

Active (Invested) Portfolio

IRR: 12.49%

ROI: 20.26%

Profit/Loss: RM 82,282.73

True Cost: RM 366,513.82

Total Value: RM 487,698.67

Entrance Value: RM 386,803.42

Portfolio Value: RM 472,470.22

Nett Dividend (2024): RM 3,230.64

Oh - I've also just created this new chart and decided to add it to my blog as well - basically to show the Realized Gains/(Losses) and Dividends that I've received so far, in comparison to the paper gain/(losses) which are still unrealized to date.

Net Worth Updates

My net worth continues to climb this quarter - primarily attributed to the soaring stock market both in the US and China.

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie

The post Ringgit Freedom’s September 2024 Updates appeared first on Ringgit Freedom.

]]>The post Zero-Based Budgeting: Migrating from YNAB to Actual Budget appeared first on Ringgit Freedom.

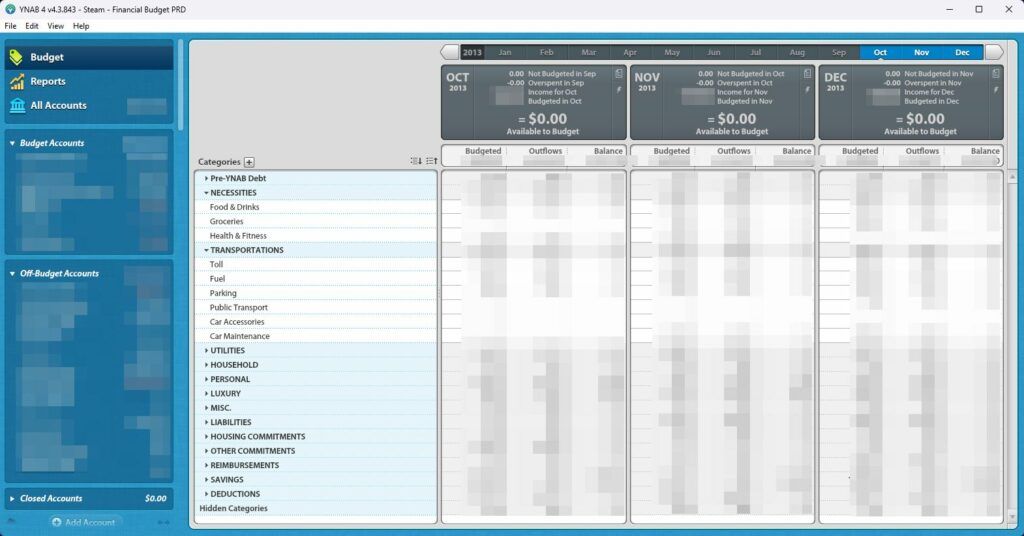

]]>Skip through the first part if you dislike rants, you have been warned! Like, really looooooong rant considering YNAB was once one of my most loved tools over the last decade.

Table of contents

YNAB, I've had enough. It's time to move on.

The sentence above summarizes how I've been feeling the last few weeks, when YNAB, again announced another shocking price increase so that "they can continue to release new features". Look, I understand, inflation sucks. The same loaf of whole wheat bread which used to cost us RM3.20 in the past now costs us RM4.50. And that's inflation and I get it.

What frustrates me is how YNAB has been handling the whole situation, which can't help but make me feel that either the founder has been so out-of-touch with the community, simply doesn't care and wants to maximize his profits/squeezes, or is just being forgetful and forgot why their story of starting up YNAB - dedicated to helping change lives. I understand that YNAB itself is a business and not a charity organisation, but their endless greed with near-zero valuable upgrades since 2015 disgusts me, to say the least.

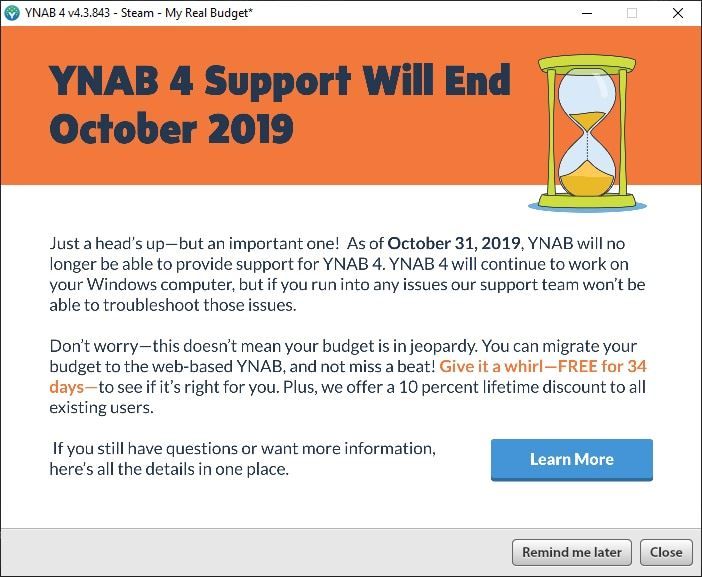

Just to share some context, YNAB was started both as a tool (excel spreadsheet) and a mindset/method (the YNAB four rules) in 2004, and gradually evolved into a beautiful desktop/mobile-based app with one-time purchase (YNAB4 @ 2011?) and later a web-based app with a subscription model (New YNAB @ 2015). I joined them and became their "cult" in 2013, when I found out how simple was it to budget using YNAB4 without feeling like I'm constraining myself - more on this part later. Probably the best $15 that I've spent during a Steam Summer Sales.

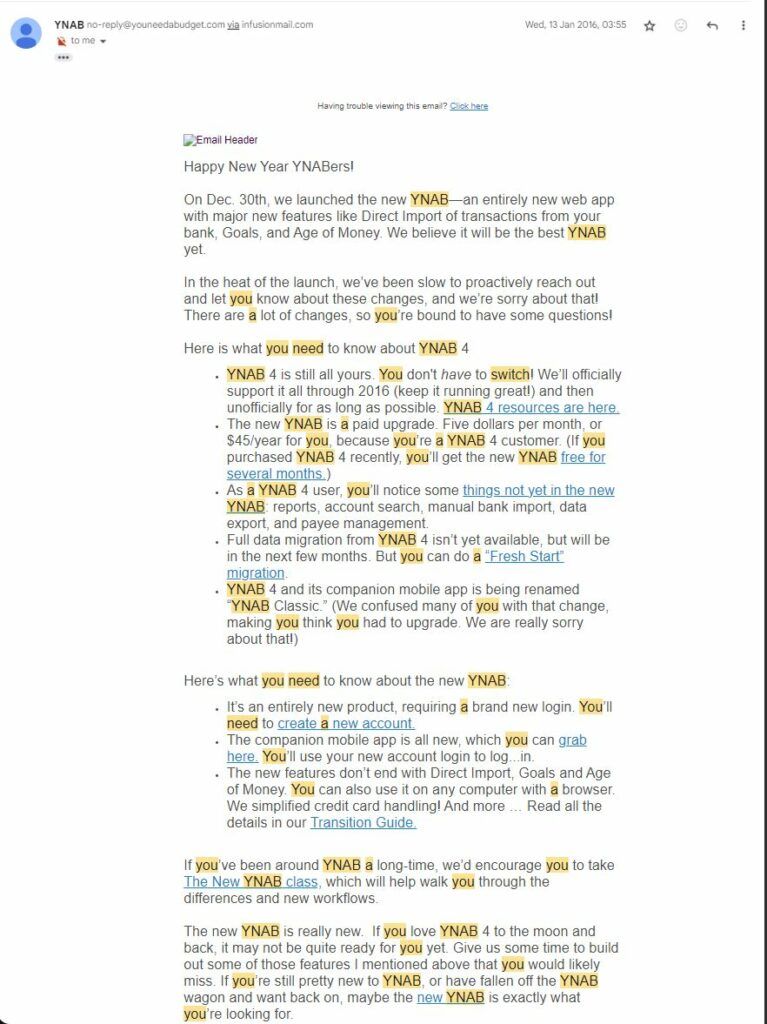

I don't have issues with app developers going for a subscription model, as it's how most software companies today sustain their business. The problem I have is how they've handled the transition, and also how they treat their cult fan base that has been following them since the early 2010s (myself included). In 2015 when they released their "New YNAB" app, gone with them were the days of one-time purchases, which was fine. I decided that I liked YNAB enough, and since they're giving their loyal fans a 10% lifetime discount, pricing the annual subscription at only $45/year, I decided to support their business, paid for it, and moved on with my life.

Aside from supporting YNAB's business, I moved along with their WebApp subscription model as I believe that is the way forward for most businesses, and had faith that they'll continue to develop the products for the better good. Scour through Reddit and you'll see countless mentions of "Reporting" feature lacking in YNAB4 (and the New YNAB) - and that was promised during the waves of migrating to new tool, as this enables them to deliver better features through a more sustainable platform vs. Adobe AIR/Flash-based YNAB4 App.

Fast forward to 2024 today, a good 9 years later, the feature is still yet to be seen or delivered - with roadmaps no longer publically published on their website recently, and most ironically: this feature was made available in 2016 through open-source collaboration - the YNAB Toolkit. It really makes you think - if random contributors can develop custom reports within 1 year after nYNAB's release, what have the YNAB team been doing with their profits over the last 9 years? Let's just recount the new major features nYNAB has released over the last 9 years: Bank/Card Direct Sync (selected banks in supported regions - not available in Asia anyway), Targets & Progress Bars, Loan Calculator, The Blurple (Coloured Theme), Buttons Changes, etc. 9 FREAKING YEARS!!!!!!

Anyway, to make matters worse, they've decided that the profits were too lucrative, and decided to continually hike the prices despite the rather disappointing developments over the last 9 years.

- In 2016, what used to be $15 one-off app purchases has become a $50/year subscription model, but thankfully legacy users get a 10% lifetime discount

- In 2017, they increased the price from $50/year to $87/year, but promised to keep the original price for YNAB4 supporters

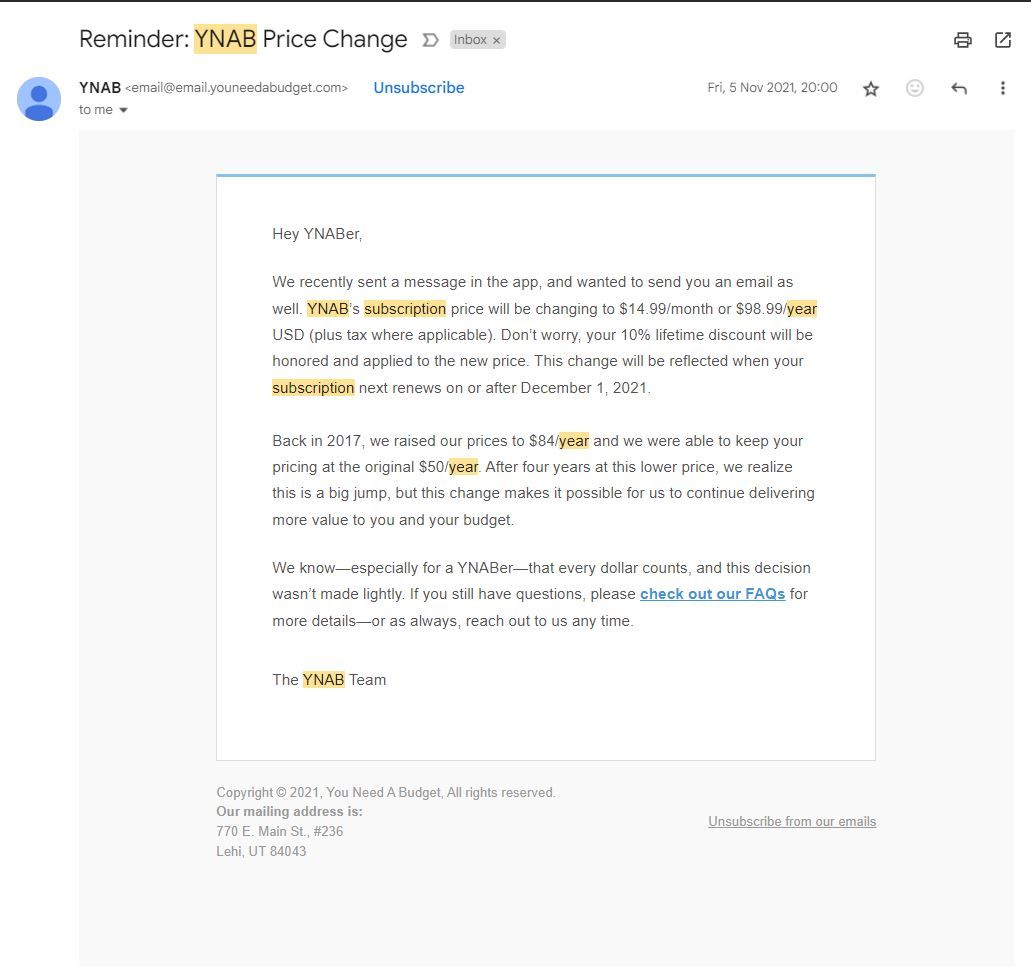

- In 2021, they decided to double their annual subscription price of legacy users from $45 to $89 after discounts

- In 2024, yet another price increase from $99 to $109 before discounts.

Since 2021 I have stopped proactively recommending YNAB to my friends, let alone readers, considering the unreasonable pricing strategy. Think about it - Microsoft Family 365 Subscription in the US costs $99.99/year - with up to 6 licenses for you and your family with total of 6TB Cloud Storage included. Put this into perspective and consider the weak MYR currency - $99 means plenty here.

I sucked it up in 2016, and again in 2021, but, not this time. YNAB, I've had enough. It's time to move on.

//END OF RANT//

What's a Zero-Based Budgeting?

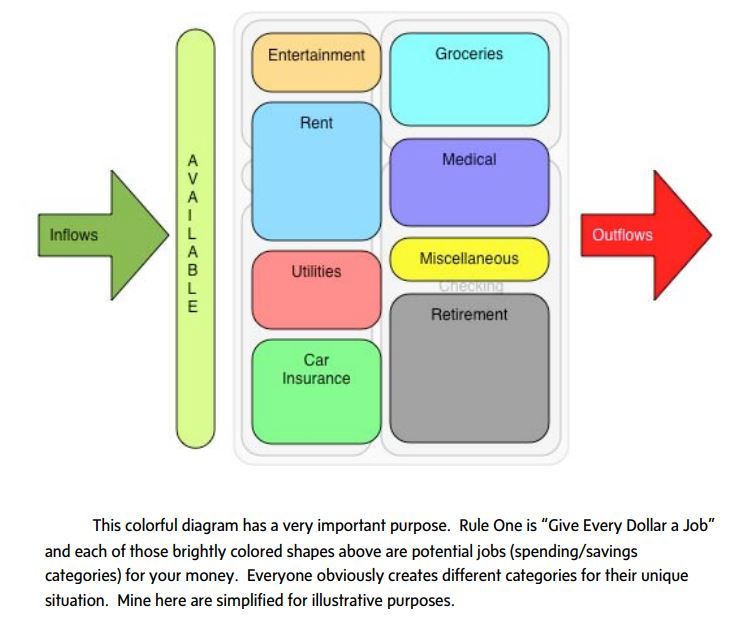

Ever found yourself scratching your head, wondering where exactly your hard-earned ringgit went by the end of the month? If you're nodding right now, it's high time we talk about Zero-Based Budgeting, a strategy that could revolutionize how you handle your finances. In layman's terms, Zero-Based Budgeting is also seen as envelope-based budgeting where you assign monies you have at hand to a purpose (category), effectively giving every ringgit a job.

1 - 1 = 0

(Income - Budgeted = 0)

Unlike the usual budgeting methods where you adjust last month’s expenses to guess this month's, Zero-Based Budgeting requires you to start from zero every single month based on the income you have received. Only actual incomes that you have at hand.

Now, you might be thinking, “Why all the fuss every month?” or perhaps "I don't have the time to track every single transaction!". But look, here's the thing: Zero-based budgeting pushes you to justify every expense. It makes you ultra-conscious of where your money is going. Think of it like giving your finances a monthly audit, except less scary!

For example, let’s say you allocate RM500 for dining out. Too much? Too little? Just right given your social plans? This method doesn't just keep your financial goals in check but adapts to your ever-changing life scenarios, making it a dynamic buddy in your quest for financial freedom.

Most importantly, personal finances are personal. You must always make it work for you and ensure that you prioritize what's important to you, as Ramit Sethi calls it: "Your Rich Life is Yours". Some people enjoy fine dining, some prefer gadgets, and some prefer experiences instead. You do you.

It takes a bit of discipline, but it'll be a total game-changer once you have mastered the art of Zero-Based Budgeting. Imagine ending up with extra cash for investments or a holiday at the year’s end just cause you budgeted smarter!

To wrap it up, Zero-Based Budgeting isn't just about tracking expenses—it's about making your money work exactly how you want it to. It's all about control, and in the financial journey we’re all on, control isn’t just nice; it’s necessary. Less stress, more fun.

What's so special about YNAB Methods?

Now, the traditional envelope-based budgeting had existed many years or decades ago, and many people (including my mom) had used it so YNAB was definitely not "special" in any way. Except, they were. They were beyond just simple software tool offerings and went into the space of philosophies and methods, or their more famously known "YNAB Four Rules" when they first started.

Rule#1: Give Every Dollar a Job

In short, the whole principle of Zero-Based budgeting is explained above.

You must only budget with the monies you received into respective categories so that you can "trust" your budget file and spend confidently the monies you have, irrespective if you're on a daily/weekly/monthly wage.

Rule#2: Save for a Rainy Day

In short, you plan for both the expenses which are either: known-knowns / known-unknowns / unknown-unknowns.

- Known Knowns: Things like insurance, road or property taxes, and utilities are some examples of known-known expenses that will happen, but infrequently.

- Known Unknowns: On the other hand, things like vehicle/property maintenance, medical bills, dentistry visits or appliances breaking down are some examples of known-unknown expenses.

- Unknown Knowns: There'll also be things that you should know, but somehow completely forgot about - at one point I forgot about the existence of Property Taxes until I found out the two years overdue!

- Unknown Unknowns: And lastly, our favourite "6 to 12 months emergency fund" topic - I see these as unknown-unknowns. Such as suddenly losing my job, COVID-19, or getting hit by a truck (literally) resulting in huge medical bills.

If you don't anticipate and plan for these expenditures to come, you'll just get stressed out and a billshock™ when it hits you, hard. Like the saying always goes - when it rains, it pours. So the whole idea of Rule#2 is to prepare yourself both financially and mentally to handle whatever life throws at you - which brings us to Rule#3.

Rule#3: Roll with the Punches

Rule 3, out of the YNAB textbook, is perhaps my favourite rule of them all. And I quite literally rolled with their price-increase punch this time around.

In simple words, we're all humans and there's no way to plan & execute perfectly. Even AI as an algorithm/computer makes mistakes. Ever prepared for budget, realizing that you went overboard and overspent on certain categories, got upset and in the end, went into the "F*CK THIS SH*T" mode and gave up budgeting altogether? It happened to me many times before I was introduced to this philosophy.

Basically - whatever life throws at you, you adapt and adjust accordingly. Overspent on gadgets because I bought an iPad last month (really) out of impulse? Fine, no luxury meals or salon the next X months, and move the monies from other categories to fund my iPad purchase so that I don't overspend the month's total budget. As long as my total budget is still within my income (after mandatory savings/investments), I am free to spend in whatever way I want. Fancy fine dining? Move some monies there from... Salon?

That's why I really like Rule 3 the most, out of all four rules.

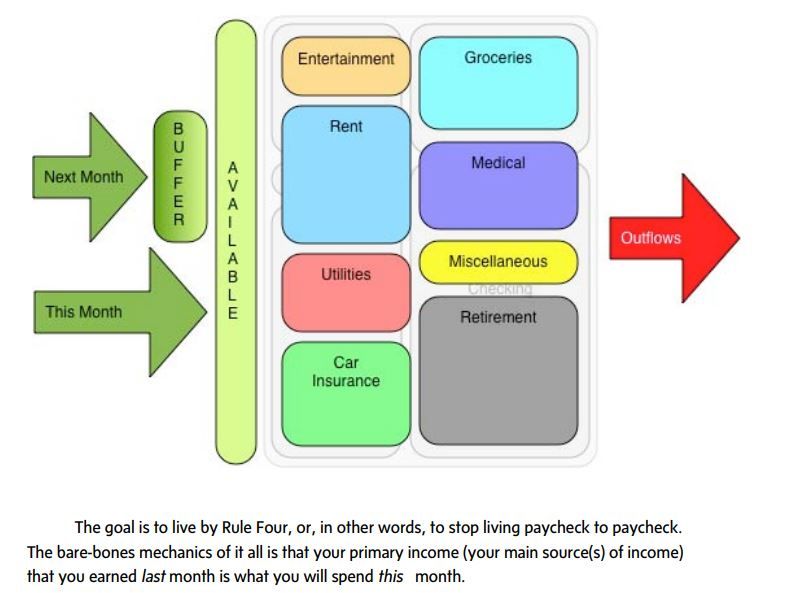

Rule#4: Stop Living Paycheck to Paycheck

I believe the graph above is pretty self-explanatory. Rule 4 is nothing but to build enough buffer that you live on last month's income. That way, when you receive your income say in May 2024, you budget all that amount to be used in June 2024 so that come June, you are technically spending May's monies. Rinse and repeat.

Once you stop living paycheck to paycheck, it's mind-boggling and you realize just how much unnecessary stress you have put yourself into.

Of course, the rules have changed over time and their latest Four Rules looked slightly different to what is written above, but the principles are mostly the same. These were the reasons that I was motivated to give Zero-Based Budgeting a try, despite the discipline required. If you're interested to take some read (mind you this was in 2014), check out their old YNAB Way book published by Jesse Mecham in 2014 - at least when his sole purpose was to drive greater awareness & help as many people as possible.

Over the years, I simplified my approach to ease my data entry so that it's easier to maintain my discipline. For example, I don't track down the exact balances across my 456534 different bank accounts/credit cards/e-wallets. Rather, I simply create one On-Budget (more on this later) account named "Monies" and all spending irrespective of the payment method will be documented here instead.

The YNAB Alternative; A Real Contender to YNAB - Actual Budget

In the past, most people (myself included) had to suck it up with YNAB despite their outrageous price increase without much developments - mainly because we just couldn't find any other product offerings in the market that does zero-based budgeting well. Quite frankly, I was very sceptical when I forced myself to scour the market again in 2024 to look for a real alternative to YNAB.

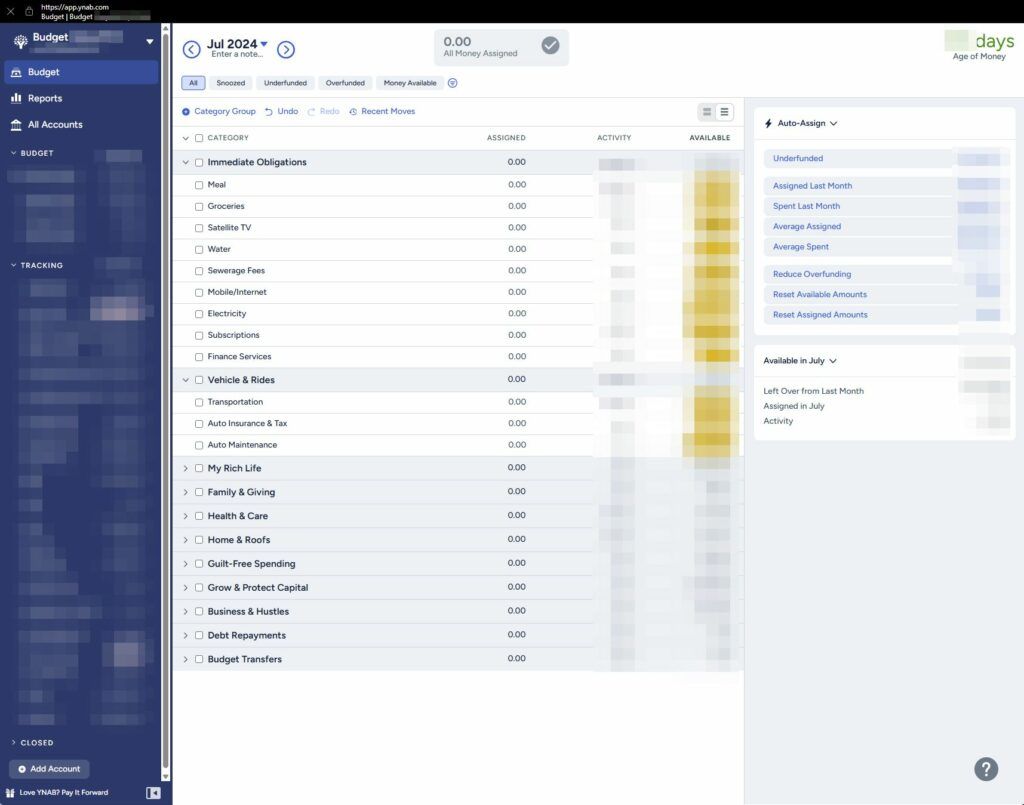

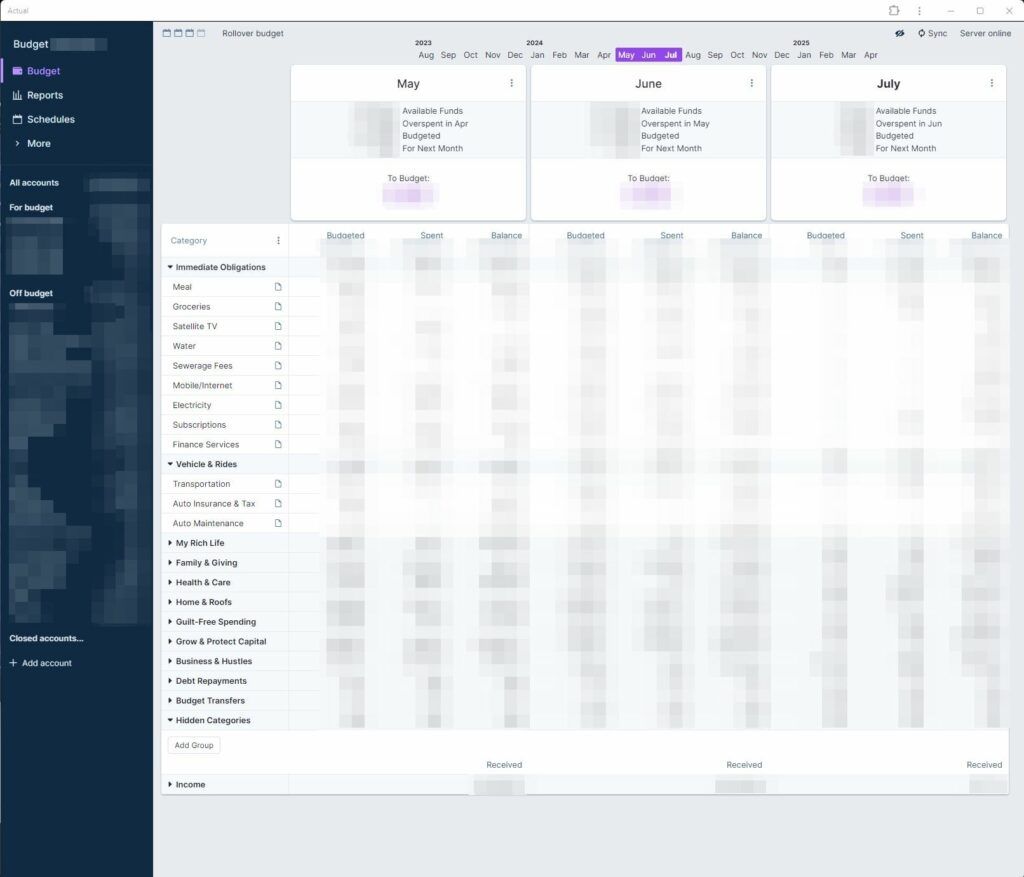

But after trying out the open-sourced variant of Actual Budget (free!), my perspectives had changed completely. I no longer view Actual Budget simply as "another YNAB Alternative" but rather, as a true contender in the zero-based budget space. I mean, just look at this side-by-side comparison below:

Yes, we can argue that YNAB is/was the market leader and started the whole cult following fan base (myself included) and made the whole envelope/zero-based budgeting more approachable to the general public, and any other apps that came later are simply "just another YNAB clone". But that's how most products/technology today grow ain't it? Due to competition. Just like how Tesla started the whole EV & self-driving bandwagon and later, all the other car manufacturers came out with their own EV cars - some with improved battery cells at cheaper prices.

Quick introduction about Actual Budget - the founder started Actual Budget as a side gig and slowly grew it into a solid product over 4 years, with aims to build it differently than most SaaS as a local-first finance app (and succeeded in building it).

However, as a business, it was difficult to sustain as a one-man team alongside his full-time job, plus at $4/month which is an acceptable price for a subscription but without volume, it simply does not generate enough revenue to warrant hiring full-time developers to support the project.

And that's when he decided to go open source with Actual Budget to leverage the power of the community. And truly, that was probably the best decision he has made for the overall finance community - as Actual Budget (Community Edition) truly shined with support from various community members.

Actual Budget Features

In this article, when referring to Actual Budget, we're talking about the Community Edition which is 100% open-source and maintained by the community. We're not talking about the now-deprecated Commercial Edition. Some additional contexts are summarized below:

Actual (Commercial Edition)

actualbudget.com which has since been deprecated since April 2022 (source: twitter) following the founder's decision to cease business operation and open source the entire project

Actual (Community Edition)

actualbudget.org, which started then is fully open source, maintained by community for community, with monthly releases.

When it comes to the features, I will probably leave you with the blog post published by the open-sourced Actual team: https://actualbudget.org/blog/2024-07-01-actual-vs-ynab

But in my view, Actual (Community edition, not to be confused with the now deprecated Commercial edition) is perhaps the second most polished zero-based/envelop-based budgeting app in the market today.

Some features are still under development and rightfully so, leaving the UI/UX experience to be less than desired but at the pace of Actual's Community development since 1.5 years ago, it'll be just a matter of time before Actual catches up (or even surpasses) YNAB.

In short, Actual has these features:

- Free and Open Source.

- Access your Budget on the Web, Mobile Progressive WebApp, or Desktop App.

- With 100% local-first data storage focused on privacy. Can optionally enable end-to-end data encryption with a 2nd layer password (just like WhatsApp). In short, no one can ever snoop over your data, and you don't have to trust any words from anyone / any corporation including your hosting provider.

- Ability to sync your data online with self-hosted options. You may need to pay some fees to host it - more on this later.

- Multi-Month Budget View and native Envelop/Zero-based budgeting support.

- Reporting w/ ability to create Custom Reports (beta).

- Scheduled Recurring Transactions.

- Advanced Payee & Rules setup to simplify/automate transaction creation.

- Bank/Card direct integration (for selected banks via SimpleFIN/GoCardless only - not applicable for Malaysia).

- etc.

If you're coming from YNAB4 or nYNAB, then Actual will feel like home to you. If you're new to Envelop/Zero-based budgeting, then there'll be some transition period where you may need further guidance but the good thing is, envelope-based budgeting is not new and this topic has been discussed everywhere irrespective of tools used (YNAB4, nYNAB, Actual, or other Envelope-based Alternatives.

Personally, I've been budgeting using zero-based since 11 years ago so there's almost zero friction when I migrated (aside from discovering the technicalities since it's a different tool/software).

How to Setup Actual Budget?

You'll have to decide whether if you're planning to migrate from YNAB4/nYNAB, or start afresh. Of course, if you're not using either one of those today, then your only option is to start fresh (which by the way, is often the most recommended approach as it helps you to have a clean-slate budgeting rather than being daunted by historical messes.)

I've personally started afresh multiple times when I screwed up my finances, but this time around since I'm still on a streak since 2019 (as you know, from my blog updates) so I had no plan to start afresh so I imported all my historical data from nYNAB. Surprisingly easy.

1. Prepare your Data in YNAB4/nYNAB (optional)

Skip this if you're not planning to import your historical data, or you simply do not use these tools today.

Depending on which version of YNAB you're currently using, your instruction differs slightly:

- If you're on legacy YNAB4, simply navigate through File Explorer to your sync folder containing YNAB files, and look for your BudgetName.ynab4 folder. Compress it into a .zip file and you're done.

- If you're on modern nYNAB, simply use the JSON Exporter for YNAB, authorize your account's API access, then download the .json file and you're done. Just make sure the file you downloaded is not 4 bytes and are of reasonable file size.

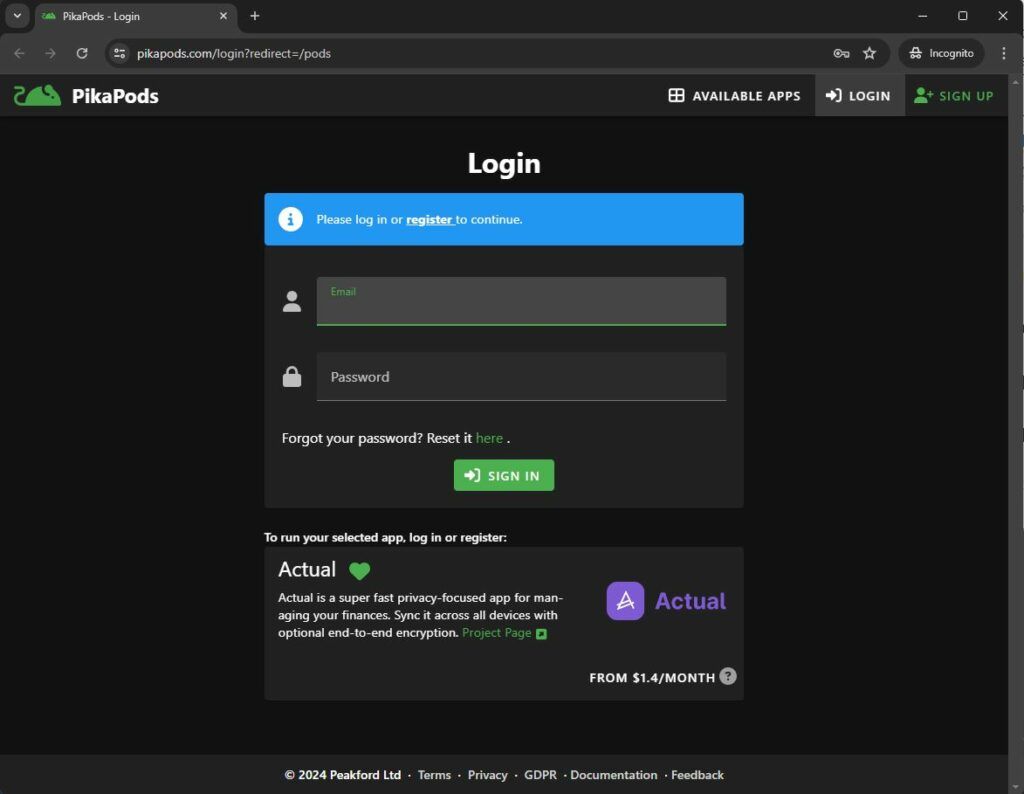

2. Setup Server to Host Actual Budget

For those of you who prefer to tinker around with self-hosting options, I'll redirect you to Actual's comprehensive documentation here: https://actualbudget.org/docs/install/

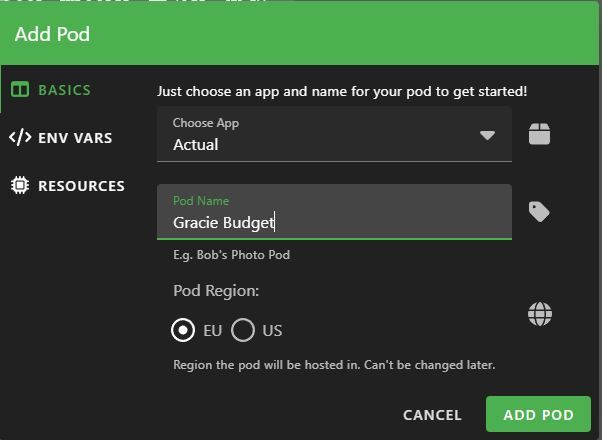

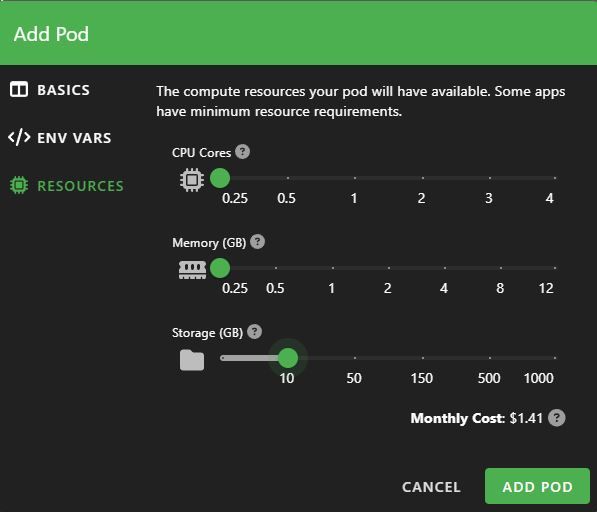

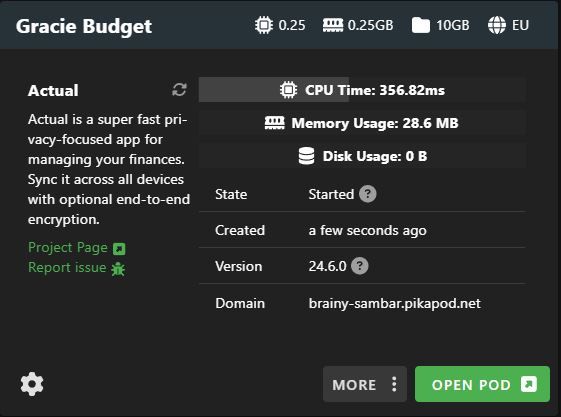

But if you're like me - either less technically inclined or simply just being lazy to tinker more stuff, just go with the simplest PikaPods-hosted option at approx. $1.4/month (or $16.8 per annum - still $92 cheaper than paying for nYNAB annually plus you get to own your data).

It's really easy. Firstly, create an account or login through PikaPods. New Users will also get a free $5 welcome credit, enough to last you for three and a half month's worth of hosting!

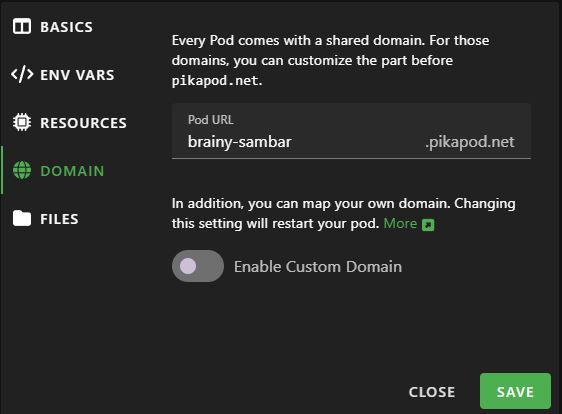

Then go through their One-Click Setup: https://www.pikapods.com/pods?run=actual.

- In 'BASICS' tab, just give the app an name, and I'd pick their EU server (since it's relatively closer to Malaysia compared to US server).

- Leave the 'ENV VARS' alone and go straight to 'RESOURCES' tab and select 10GB storage, keeping the rest at lowest setting (you don't need more, as the server is only used to sync files and not for processing).

- It may take a minute to set up and once it's done, just hit "Open Pod" or access the website directly following the auto-generated domain name.

The best part with PikaPods is also that they'll manage all the server administration works for you in terms of infrastructure maintenance as well as updating the Actual software, though they will usually wait 1-2 weeks after release to ensure that everything is stable before pushing the updates automatically to you.

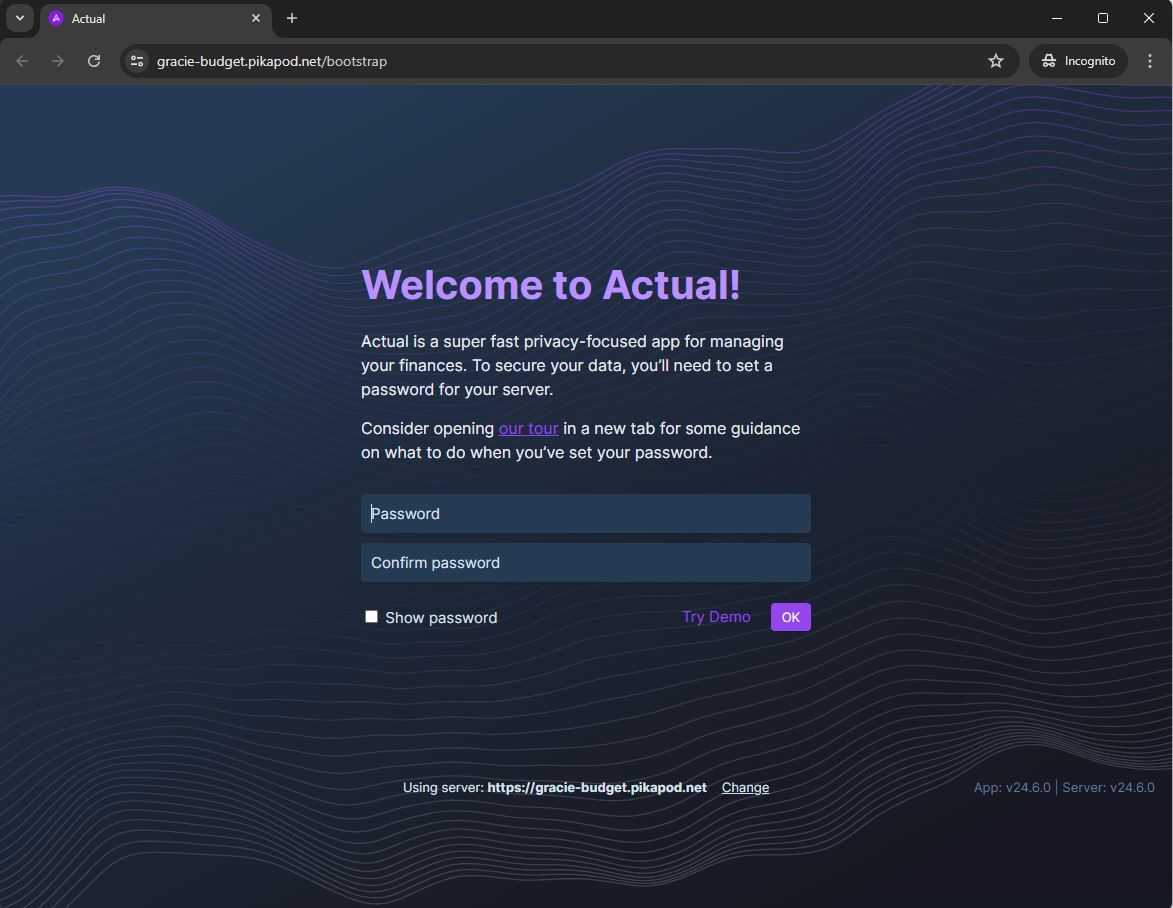

3. Launch Actual Budget

Use the Domain that was generated for you earlier to access your budget - and make sure to bookmark this in case if you forget! When you launch it for the first time - you'll be prompted to set up a password for the server.

This will be prompted for anyone trying to sync data to your server, and you should keep it to yourself unless you want anyone else to have the ability to sync (download/upload) your budget data to their local browsers on desktop/mobile.

4. Import your Data or Start Fresh

If you're coming from YNAB4/nYNAB - then simply import the budget file you've prepared earlier.

Otherwise, you can just click Start Fresh to set up your new budget file. You can also View Demo to get a gist on how the app works using dummy data.

6. Navigating Actual

Whilst I won't go through each and other details in today's post (I'll write a dedicated post separately once I've used Actual long enough to provide my long-term review/feedback) but here are some of the basic call-outs which I think will help both new Zero-Based Budgeting users or YNAB Refugees.

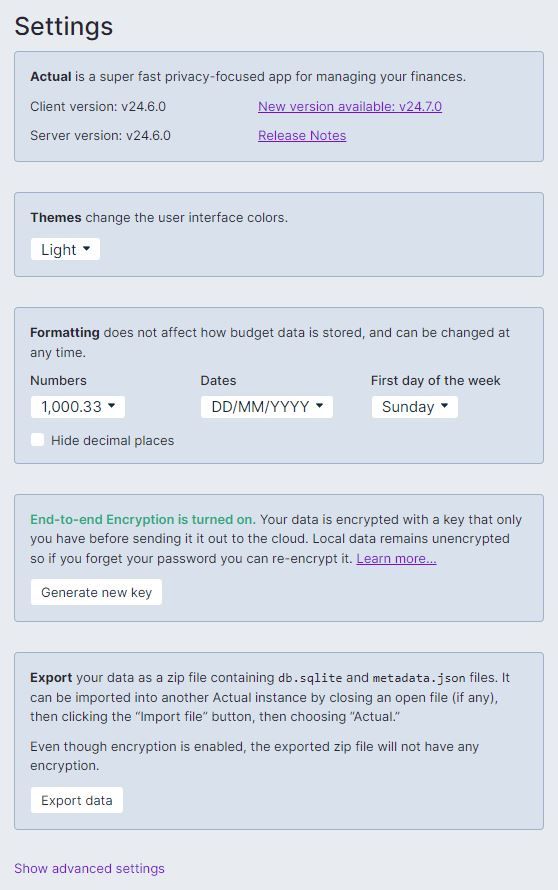

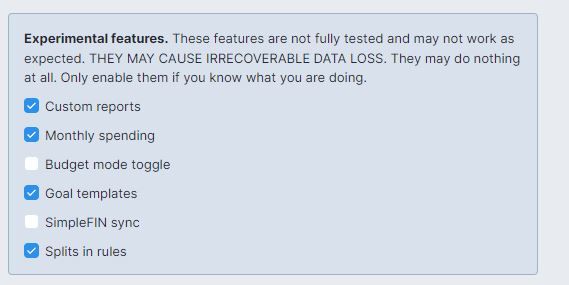

Settings & Configurations

Once you set up your budget, the first thing that you should do is configure settings to your liking under "More > Settings". Be sure to turn on End-to-End Encryption if you prefer extra privacy as it'll give you the same peace of mind like how WhatsApp does it - only you can access the data with the 2nd tier password to keep it safe. The server will see nothing except gibberish encrypted data which cannot be decrypted without your keys.

Personally, I've also turned on some of the experimental features (note: Custom Reports and Split in Rules are now officially live in the new version from v24.7.0 onwards so you won't see those toggles anymore). Eventually, these features will make it into the official release once bugs / UI / UX are optimized, so don't touch these unless you know what you are doing.

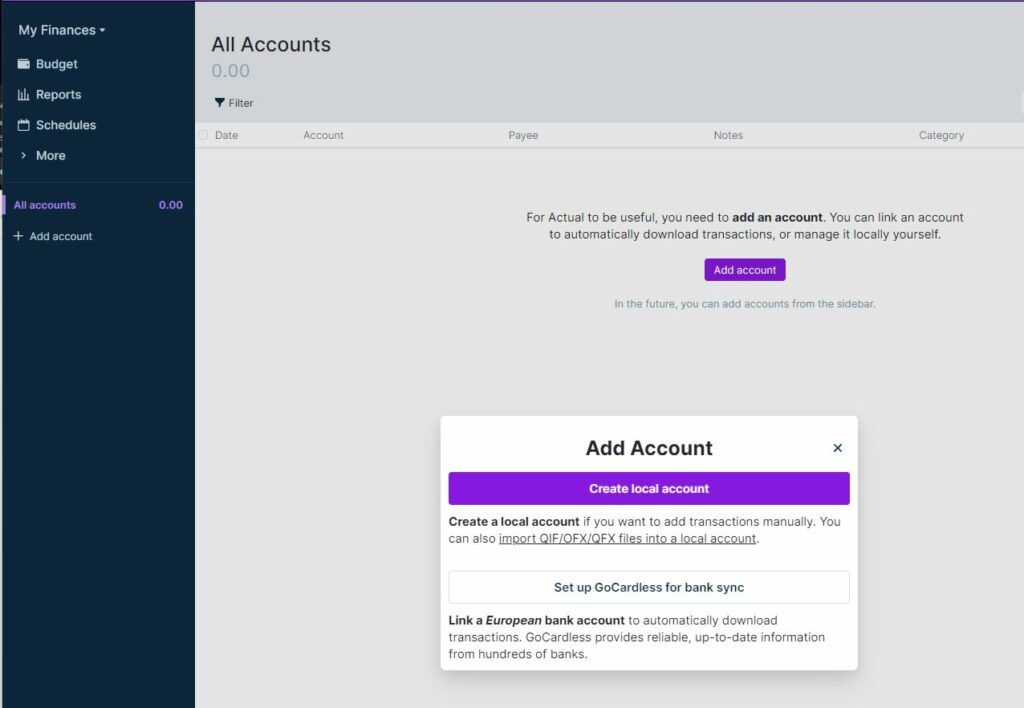

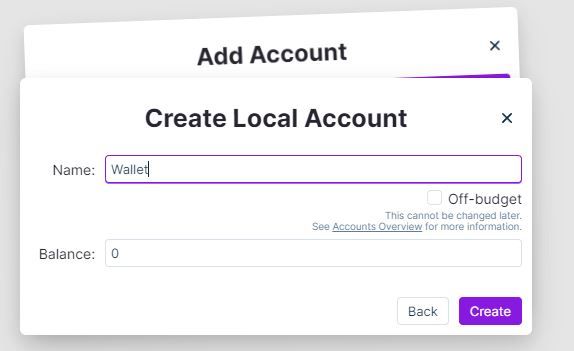

Accounts

First thing is to create an account - this is basically where you will input your transactions (spend money or receive money). There's few ways to do it - some like the extra precision and keep track of all their 10 different bank accounts/credit cards/e-wallets by creating all of them individually in Actual. Some, like me, have grown to enjoy simplicity with minor trade-offs in accuracy by creating only one single account to spend from, irrespective of payment method.

One thing to call out is the differences between "For-Budget" vs. "Off-Budget" which you need to choose when creating an account - simply put,

- "For-Budget" accounts track your spending and will affect your planned budget.

- "Off-Budget" accounts are merely used for other tracking purposes and would not impact your budget - such as tracking your investments.

There's many nice way to utilize both of these accounts (such as transferring money from On-Budget "Wallet" account into Off-Budget "StashAway" account, and spending it from your "Investment" Budget Category which I'll demonstrate later.

Budget, Groups and Categories

You have your accounts, now you manage your budget and plan your spending.

Remember, plan only with the money you have received (which is why Fresh Start is often recommended) and over time, build up enough buffers that you can Live On Last Month's Income.

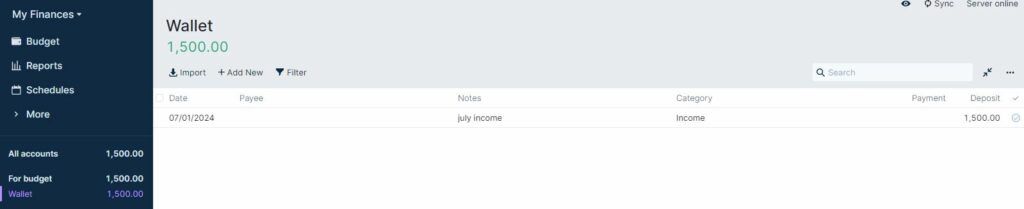

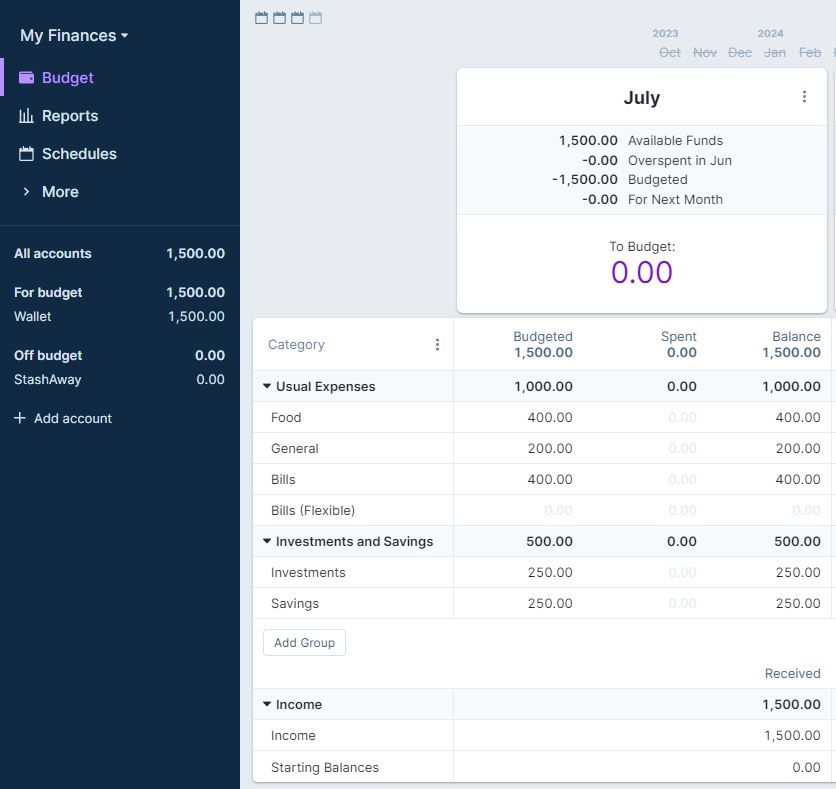

As an example, assuming I have RM1,500 as the income recorded on 1st July, my wallet now has RM1,500 for my to plan my budget for the month.

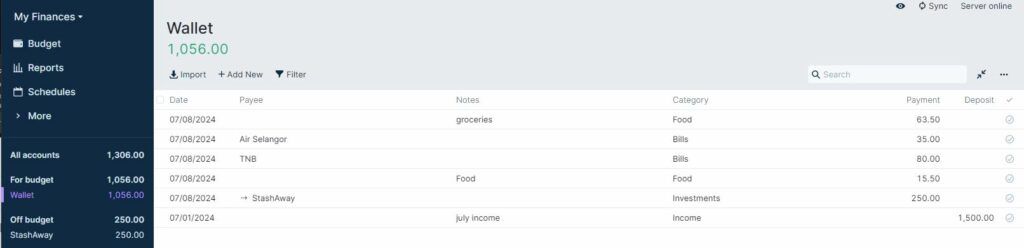

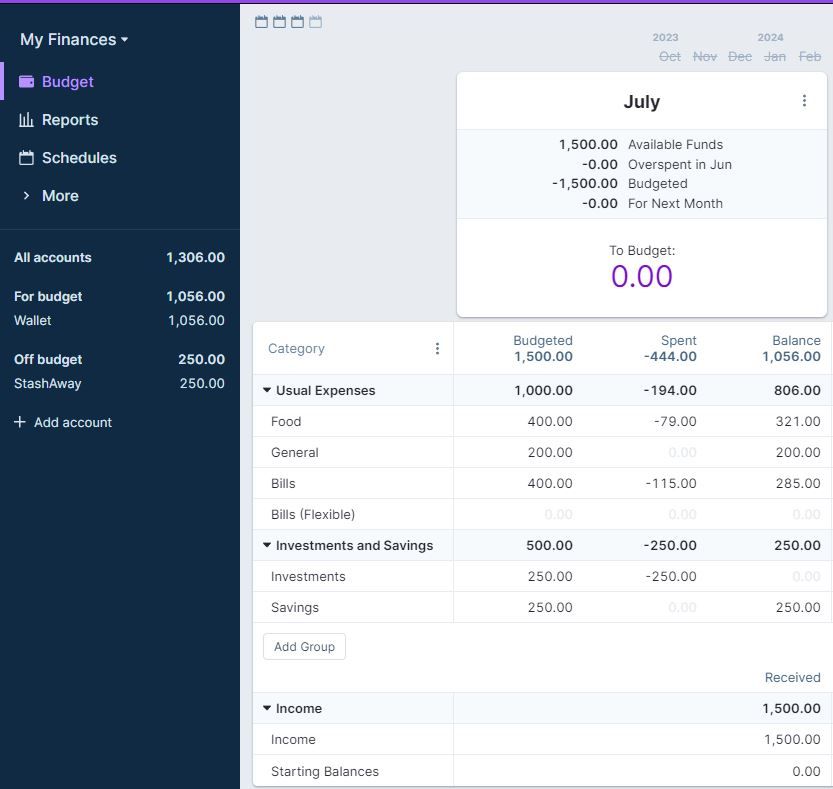

Throughout the month, there would have been multiple spendings across various categories recorded in my wallet, or even transferred to another account (example: a transaction entry of -250 categorized under 'Investment' and also transferred to Off-Budget account Stashaway. Note the small arrow -> in the Payee).

And these are basically envelope-based / zero-based budgeting in a nutshell. Even if I accidentally (or intentionally) overspend in any category, I can simply move monies around so long as I do not exceed my net earnings for the month. In another word, the next time you decide to splurge on something - check if you have category balances, and simply forget about the existence of your bank account.

Schedule & Recurring Transactions

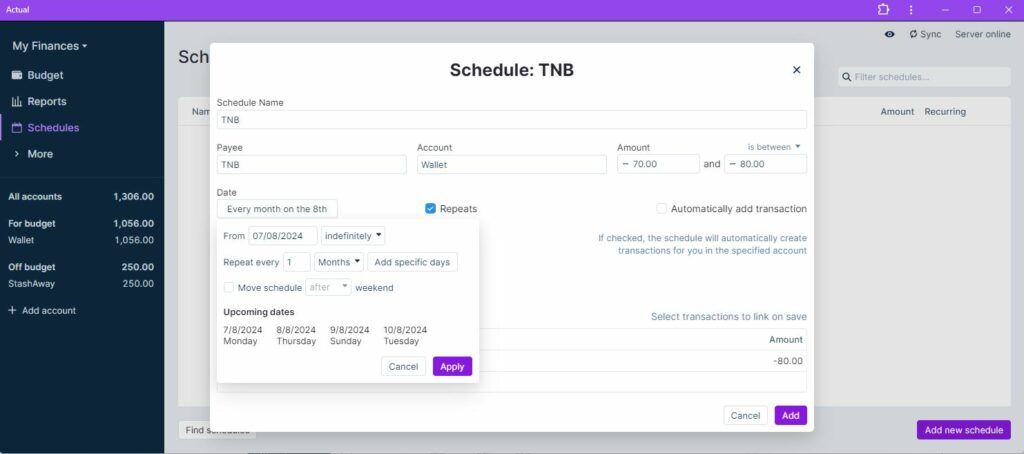

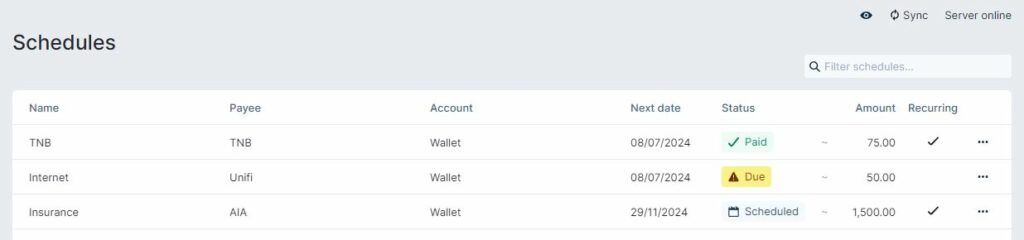

From time to time - we may have recurring bills that we'll need to enter every month, or those that happens once a year which we may accidentally forget from time to time. That's where the Schedule & Recurring Transaction comes into place. And boy, Actual took it to the next level, beyond even what YNAB4/nYNAB can offer out-of-box today.

There's so many advanced rules/capability that you can tweak with Schedule, but keeping it simple we'll use the TNB bill earlier as an example. I can simply create a schedule with an approximate / range / exact amount that happens on a certain date / certain day of the month or week and repeated on a predetermined window, and Actual will remind me from time to time to clear my bills.

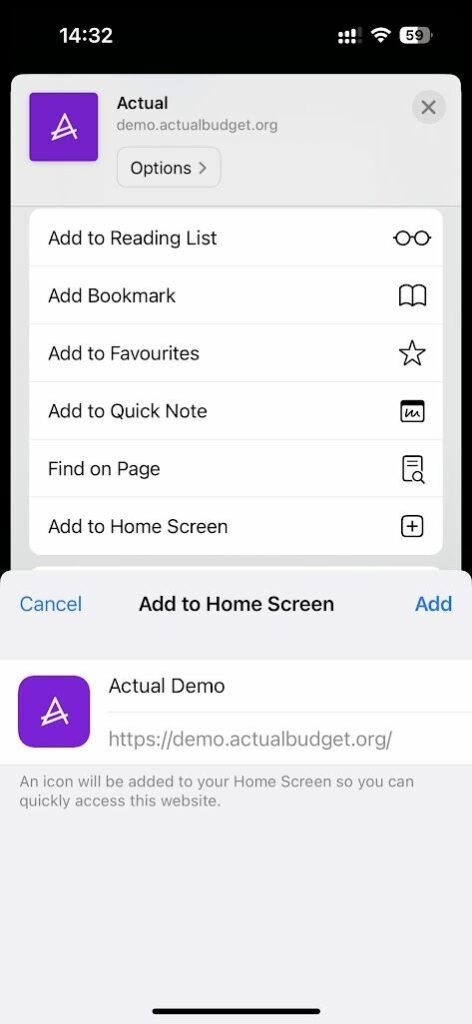

6. Setting Up Mobile WebApp

Probably one of the most important questions - does Actual support Mobile App? Yes and No!

No in the sense that you don't go to the Apple App Store / Google Play Store to "install' it as you normally would, but Yes in the sense that Actual has native Progressive Web Apps (PWAs) that can be installed on your phone and behaves exactly as any other apps natively.

The only differences are the steps to install it are... pretty unconventional. Similarly, navigate to the website that was generated for you earlier (or the custom domain that you've set) to access your budget from any browser of your choice - Safari, Chrome, etc.

Once you're in, just click share/more (depends on IOS or Android) > Add to Home Screen and give it a name, then you'll see it "installed" in your app library just like any other app. It has both auto-cloud-sync feature with end-to-end encryption enabled (should you choose to) as well as local-copy of data in case of internet inaccessibility.

7. All Other Features & Advanced Features

There are so many other features but it's simply too much to cover today - so hopefully these would be sufficient to either get you started with Actual or move you from YNAB to Actual.

In case you need further help or support, always check out their documentation which is already very comprehensive: https://actualbudget.org/docs/. If you ever run into any issues, they also have a strong active community in Discord where you can chat with other users / volunteers to seek help.

For those interested, another blogger has also written about their experiences and some tips on migrating from YNAB to Actual Budget, so do check it out if you're interested in this topic: https://samw.dev/2024/07/01/actual-for-ynab.html

Wrap Up

The post went longer than I initially planned for, especially the ranting part. But I've been wanting to write this topic for so long, and I'm glad that YNAB managed to push me to the edge - both to migrate out of it (after their ridiculous pricing strategy) and write this article.