And just like that - a year has passed by.

I personally still feel that I haven't really achieved anything big this year, and the year's ended a little too soon. However, writing this post really helps to force me to take a more neutral stance and see things from a more holistic/optimistic perspective (I guess I have too much pessimism in me recently).

When I decided to take a step back and zoomed out a little, 2021 didn't seem to be that bad of a year for me. While I did not manage to hit all of the goals that I've set for myself, I managed to at least clear half of them.

Not too bad for a start eh?

About the same time last year, I've decided to set some of the goals for myself to achieve throughout 2021. I'm typically not the type that sets any New Year's Resolution as it's hard for me to keep up with the motivations (I'm very impromptu and acts based on my "mood-of-the-month").

Since I've set one last year despite all the odds, I figured that it'll be a good idea to at least revisit them and see if we're actually on track on meeting goals... or not.

#1 I want to be even more conscious and intentional with my spending, curbing my impulse purchase behaviour through proactive budgeting into my guilt-free jar - so that I will feel less guilty when I spend without relying on 0% instalments!

#2 Read at least 8 books in 2021. I don't think I've been consistent in this habit - always a hit-or-miss kind of thing 🙁 This is crucial for me to expand my knowledge and be more comfortable in selecting stocks. Aside from personal finance books, I'm also starting to gain interest in topics related to business / leaders so I should start diversifying my readings.

#3 Continue to maintain at least ~45% annual savings rate, and work upwards from there at least by +3% - by increasing my self-taxation rate and then figure out how to work/spend with the remaining balances 😛

#4 Continue sharing more of my thoughts and things I've learnt during my financial journey, hopefully in return motivating more people to onboard the financial freedom journey.

#5 Write faster 😛 - juggling between my full time job, my own me-time, reading or blogging; I tend to lean towards the me-time for recharge and ended up wasting my weekends.

#6 To get my dental braces that I have been putting off due to fears.. And my dental health.

2020 in Review: A Year After Restarting My Financial Journey

Now with all that said, let's first have a deeper look at how we performed in 2021, before delving into the plans moving forward for 2022!

I spent most of the 2021's working from home - with exception of the first few weeks in early Q1 and also the last quarter of the year. That definitely helped to contribute to maintaining my semi-aggressive savings rate of 54% throughout 2021.

I'm definitely happy with the annual average savings rate so far, and probably will only aim to maintain this ratio with slight increments somewhere around 55% ~ 58% in 2022 rather than trying to push myself over the top which may just be counter-intuitive.

If I exclude the months where I have more than 20% extra incomes above the baseline income of the year from the count, just to have a better sense on my savings rate during the "stable months" not affected by income fluctuations from windfall/bonuses/etc. (as I tend to be able to save more in "bonus months"); the average savings rate is approximately ~43% in 2021 which is an improvement of 7% compared to the ~36% in 2020.

In May 2021, I made the decision to continue saving more - not just into my investment portfolio but rather, further building up my Emergency Jar from the typical 6-months (expenses) buffer to a 12-months target with rationales explained in my June's Update post.

Back in early 2020 when COVID-19 started to spread globally like a wildfire, and with my Emergency Funds being close to near-zero, I was constantly worried about potential layoffs as it usually happens when most of us are not expecting it.

Having witnessed some of my ex-colleagues losing their jobs (both contracted or permanent staff) due to budget concerns and their constant struggles to seek replacement jobs with similar pay (to sustain their lifestyle) - it creeps me out every time if I just think about it.

Whilst I am still pretty far away from hitting the goal post, that decision has really helped me to be in a very comfortable position in the event of real disastrous emergencies. So far I've drawn from my Emergency Fund a few times, mostly small amounts when unexpected events took place - like my mom's dental treatment or flood relief for charity/some close friends. Without this Jar in place, I'd probably have to compensate for it elsewhere from my other budgets (or even investments).

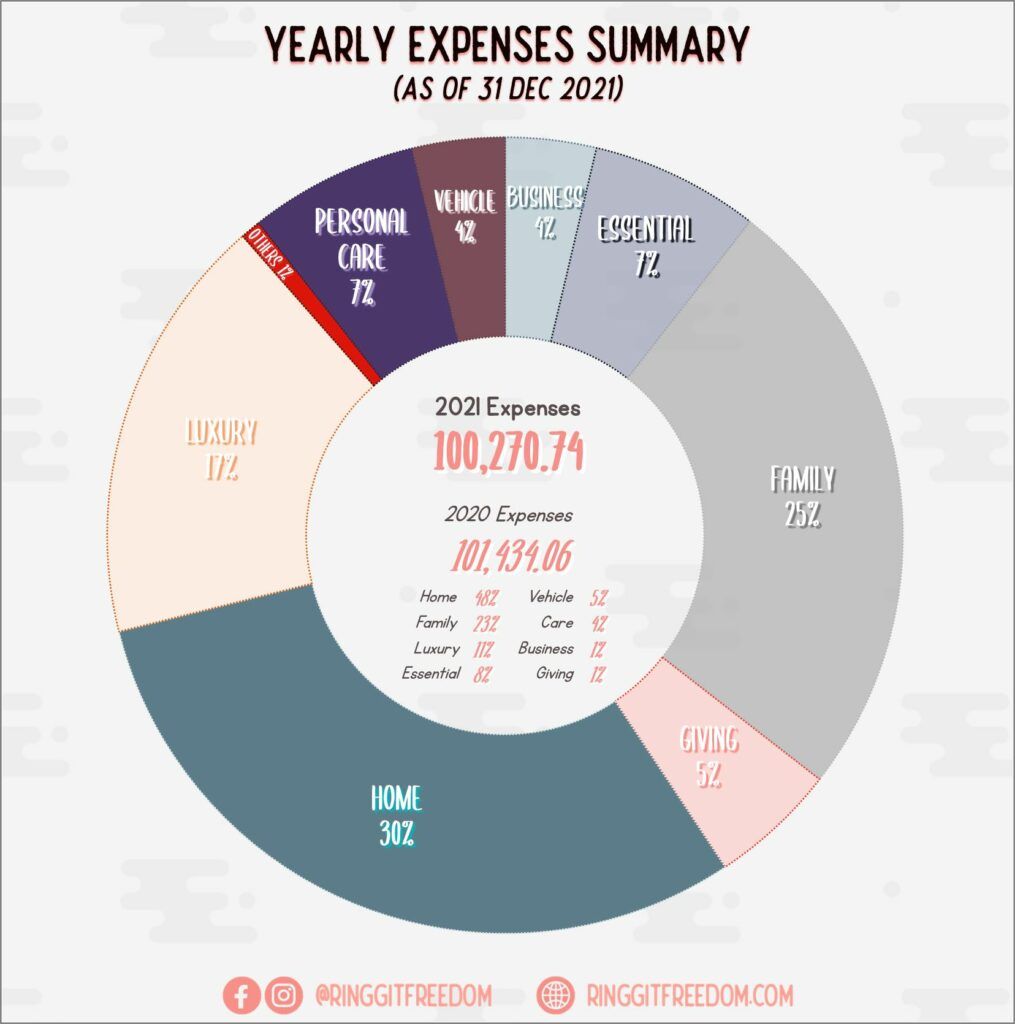

Looking at my total yearly expenses (excluding savings and investments) - it's both a good and bad thing that I managed to keep the expenses flat vs. last year. Why do I say so?

Well, at a glance, I initially thought it was at least a good thing that I did not spend more than 2020 (underspending by RM1,163.32 to be exact :P) - meaning that I did not inflate my lifestyle further. But after taking a deeper look I realised that the opposite is true.

In 2020, home-related expenditures (incl. Mortgage, Legal Fees for Title Transfer, Maintenance or Home-Servicing Fees) alone made up 48% of my total annual expenses. But in 2021, even when home-related expenditures were reduced down to 30% (since the bulk of the payment for Title Transfer were done last year), the total annual expenses stayed flat indicating that some level of lifestyle creeps did take place last year.

Thankfully though, it isn't as bad as it sounds since the huge chunks of the increase were equally distributed between the master categories of Family & Giving and Luxury. At a glance, the personal expenditure changes were attributable to:

If I just double click further into the top-5 single item expenditures (excluding the mortgage, family, or giving categories) that can affect more than ~10% of my total annual expenses fully within my control, they are made up of:

If there's one thing that I may regret, it's probably the Macbook as I severely under-utilized it (my Mac shows that I'm only on the 15th battery cycle count so far). Probably also because of the whole work-from-home and COVID-19 situation making mobility a joke... for now. The only time I use my Macbook is when I write my blogs, and are lazy to sit on my desk (I prefer to write from bed).

As for the IPL Home-Care Kit, with my Musee Platinum packages coming to an end soon and they're pretty expensive to top up - I guess I need to be less lazy about it and actually use the home-care kit rather than just leaving it lying in my wardrobe underutilized (just like the Macbook). So far I've only used it like 2 or 3 times because I was so lazy to do it myself and have always preferred to have a beautician to do it for me...

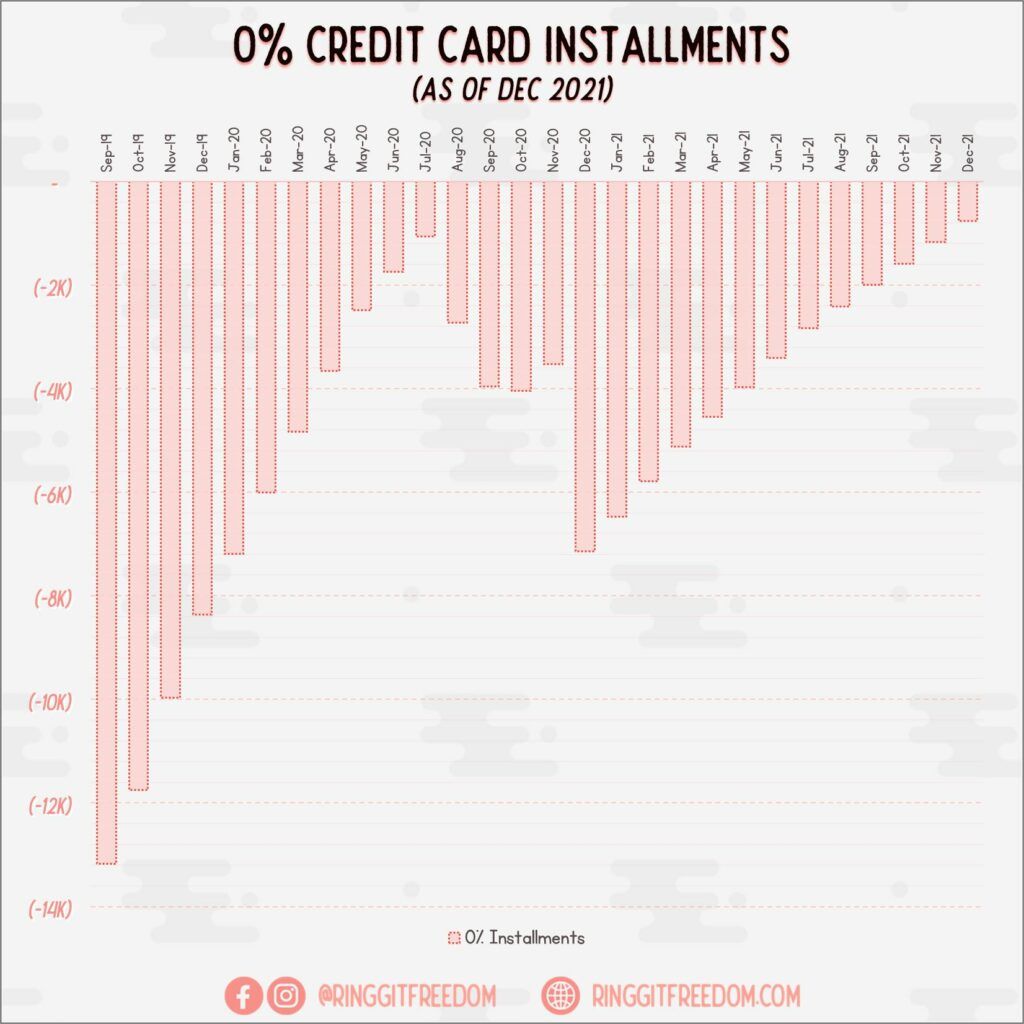

Back in 2020, I racked up further 0% debts right before the year ended (thanks Macbook!) and had to spend the entire 2021 clearing it off (plus some carried-forward 0% debts in earlier 2020 itself). Very happy to see how the charts have turned by the end of 2021!

This definitely is one of my small wins for the year - as I managed to hold my temptation (for now) on incurring further debts through 0% installment purchases. If all goes well, I should be able to fully clear it off by September 2022, allowing me to start redirecting the monies into a sinking fund for my love of gadgets rather than serving existing 0% debts.

This was something that I have been intending to start since January 2021, but it was close to impossible as I barely had any room to play around in my monthly budgets after deducting the mandatory savings or expenditures.

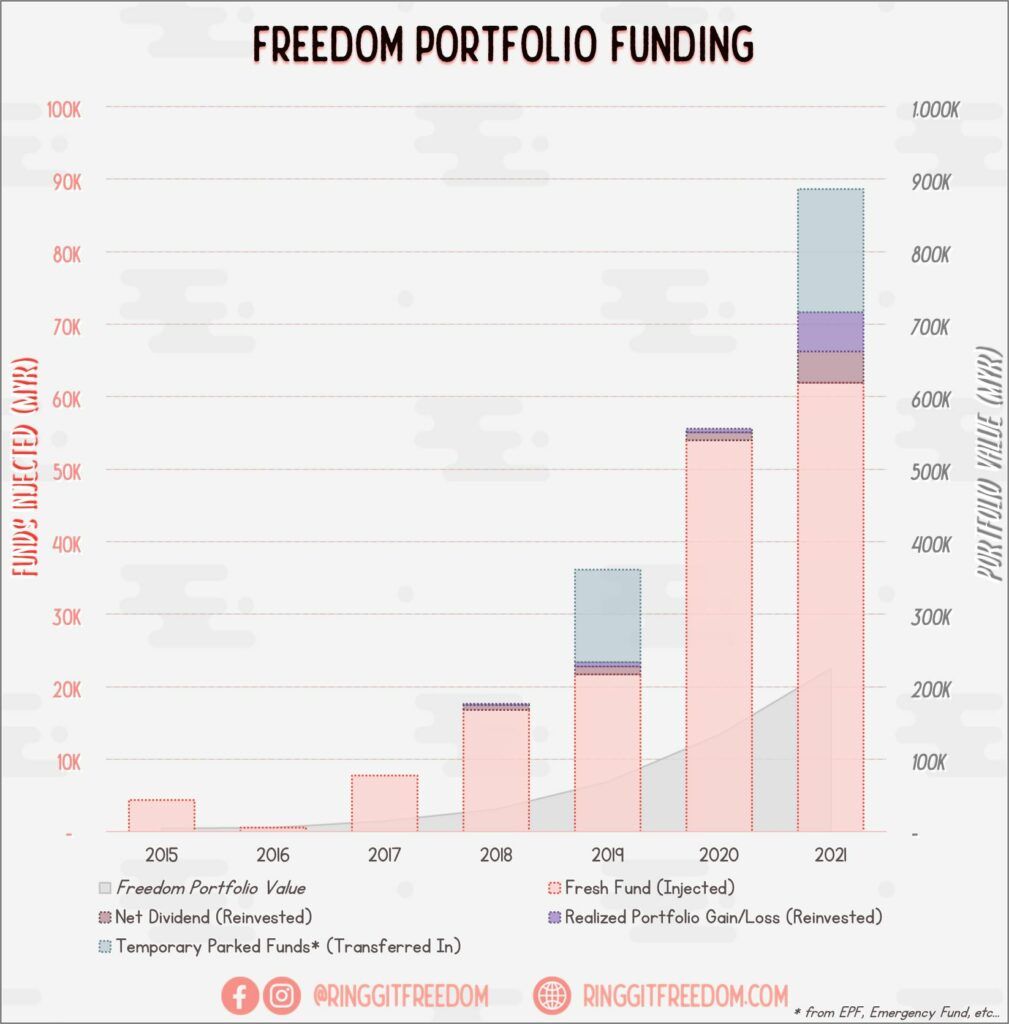

As with past years, most of the funding towards my personal freedom portfolio comes from my active income sources. There were also additional contributions of funds through the additional dividends/capital gain; or transferred in from my EPF account through the i-Citra and i-Sinar withdrawal - but these were not the main driver of funds injection.

Unlike back in 2020, I did not double my portfolio this time around.

But still, I am very happy with the outcome as I managed to grow it by at least RM90K from the original ~RM135K in 2020 and now to ~RM225K by end of 2021.

Also, not to forget that the portfolio has also been tanking a series of beating from Big Brother China in the last two quarters, and the withdrawal of ~RM16K worth of Emergency Funds from my investment portfolio to maintain the portfolio segregation.

Throughout 2021, whilst I have been trying to grow my overall freedom portfolio, I tried various different things in terms of the combination of ETF's, trying to pick individual stocks, or experimenting with some speculative plays attempting to amplify the potential returns at a manageable risk level.

In the end, I find passive-funds to be the most suitable style for me as an investor since the involvement and commitment required from my end (aside from paid-up capitals) are minimal.

From the various rebalancing and targeted focus on China / US market throughout 2021, I have finally managed to get closer to my ideal 30:30:30 ratio between Malaysia, China and US for the equities - if we look at the portfolio holistically including both my personal freedom portfolio and EPF portfolios.

Whilst the equities side of the equation is pretty balanced now, the fixed-income portion worries me, to say the least. On the personal front, I'm using my fully-flexi mortgage account to hold all my emergency funds with reasonable interest rate. On the other hand, EPF is also placing a significant amount of their funds in Fixed Income/Fixed Deposit funds from the Local Banks.

In the event of a "Venezuela" happening in Malaysia, I'm pretty much doomed given the high exposure of my cash holdings within the country (whether directly or indirectly). I haven't figured out the best way to handle or approach this yet - but definitely something that I want to look further into in 2022.

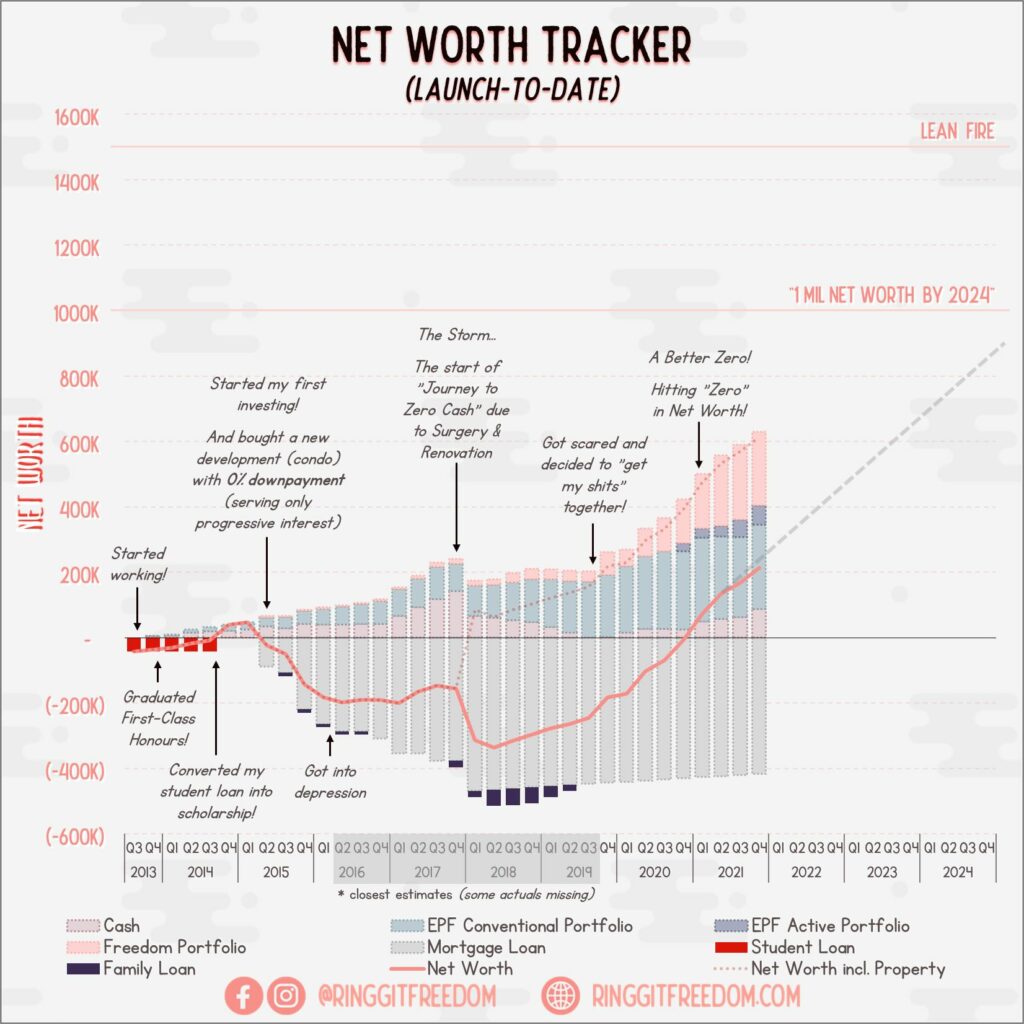

One of the biggest wins in 2021 was when I finally hit the "zero" net worth back in February 2021; after an extremely long journey of being in debt. I'm still in debt today serving my mortgage, but at least treading above the negative lines. Two years ago, I wouldn't imagine this to be something feasible or possible - and I have my career to thank for that.

As for my personal net worth, I typically exclude my primary residence that I’m staying in, in the essence that it generates all the expenses/liabilities associated with home-ownership with no ability to generate income – a concept popularised from Rich Dad, Poor Dad by Robert Kiyosaki. I've included a dotted line this time around, for those who prefer to track it using standard accounting principles.

Progress wise - I'm slightly under the original forecast for year ending 2021; and since not much have changed in terms of my overall income or expenditures, I'm definitely behind the "1M2024" vision which was a stretch goal I've set for myself to hit RM1mil in Net Worth by end of 2024.

Will have to see how it goes in the coming years and where needed, I'll be adjusting the goal to be something more realistic and attainable - whilst still retaining the objective of ramping up my early-retirement plans.

Well, it only worked for half of the goals I set last year, so no harm trying it again - achieving something planned is better than not planning to achieve anything I guess!?

#1: I want to maintain at least 58% Average Annualised Savings Rate by end of 2022 to fuel either my Emergency Jar or Freedom Portfolio.

#2: I want to study and take up the PMP Certification Exam by end of 2022 to boost my potential career aspects (since that's mostly what I do day in day out, and are sponsored by Company anyways)

#3: Let's try this again - I want to read at least 8 non-fictional books by end of 2022 - leadership, business, finance, self-development; you name it!

#4: I want to write at least 12 additional articles in 2022 aside from my monthly / yearly updates; as a means to continue sharing my thoughts and things I've learnt throughout my financial journey, hopefully in return motivating more people to onboard the financial freedom journey.

#5: This one's a stretch goal - but I really want to pick up the Korean language by end of 2023. For 2022, let's try to learn at least 10 new vocab per week!

#6: Also a stretch goal - I want to attempt to apply for Singapore jobs - and sit in for at least 5 interviews by end 2022. Definitely not in rush to leave my job; but just wanted to tap into whatever opportunities arising and who knows what I'll land myself onto (and leave Malaysia)

2021 hasn't been easy at all. Even as an extreme introvert myself, the constant lock-down and fear of catching COVID-19 virus really puts a toll on my mental health, and I'm back to the zone of "zero motivation" after leaving it back in 2016. The only differences this time around is that I'm sailing through the depression, with strong support pillars put in place - from my own financial planning, pay-myself-first strategy, my family members, friends, colleagues, and all of you beloved readers!

I'm definitely proud of myself - on where I've come so far in terms of my journey towards financial freedom. Whilst it's still a long way forward to go, it is definitely on the right track (I hope) towards my early-retirement plan and be freed from my corporate life. If you had asked me 2 or 3 years ago whether if I will achieve where I am so far, I'd probably just laugh it off and tell you "Retirement? That's like decades away. YOLO bruh!"

On the other hand, I'm extremely grateful to my Company as I've been really lucky to be able to progress my career amidst these tough times. Still, I am constantly remind myself not to be overly content with what I have so not to fall onto the trap of staying in comfort zone. After all, my goal have always been getting out of Malaysia the soonest the possible - but the planning part of it really sucks as it've been disrupted twice and the never-ending procastination from myself.

Hopefully in 2022, all that will change and I will actually take the baby steps forward, outside of my comfort zone to achieve the long dreams of mine!

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie