I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

Compared to the months of April & May, I see significant improvement in terms of my well-being and mental health. Whilst work is still crazy as it always is, the hobbies and coping mechanisms from the past 2 months have managed to help me relieve the stress level (rather than holding everything back).

With lockdown, nothing much else is happening this month so I guess I'll skip it for now :/

Now, going back to our usual monthly update for my finances and portfolios.

Had some fixed bonuses/allowances paid in June and as with most other months, all the monies received as additional income/bonus go straight into either investment pool or emergency fund (the latter in this case).

In Q4 2019 till end-2020, I allowed zero exception to spend any of the bonus to refrain myself and the monies must be invested/saved and this was because of the spending habits I had in 2018-2019 (things were looking really bad back then - I was spending every cent of my bonus received).

Earlier this year (when things got better), I decided to give some leeway to myself to spend up to 10% of the net bonus received. For this month I've decided to spend it on accessories for my new gadget (which I redeemed almost for free - using almost-expired air miles collected back in those days when business trips is still a thing)

Earlier the year, I've done some exercises to consolidate my view of my finances (annual balance sheet/cash flow statement) from 2019 onwards, including forecasts beyond 2021 (up to 2050) to plan for my retirement.

However, there has always been a missing puzzle between 2010-2019, some of which I do have the historical data to compile the numbers but I was just too lazy to do it, and some which I don't have any data except for bank statements. It bothered me for a really long time and I finally couldn't take it anymore in June and decided to invest some time doing it.

All in, I think I spent close to 12-15 hours (or even longer) just to gather numbers from different apps/excels/tools for numbers I've recorded in the past, or bank statements/memory/brain cells for the lost "years" between 2016-2019.

From the exercise, I've also got to track how my behaviours have started or shifted over the years. One particularly sad finding (truth hurts, don't they!?) is to find out that I have been Under Accumulator of Wealth (UAWs) forever.

Only in 2020 which I finally jumped out of the UAWs onto the Adorable Accumulator of Wealth (AAWs) bandwagon. Nah, I'm half kidding :P. The official term is Average Accumulator of Wealth. Read The Millionaire Next Door by Thomas J. Stanley if you haven't already!!

It is definitely a lengthy exercise, but I strongly recommend everyone to do a one-off consolidation and it will then be very easy to maintain an annual cycle in the future to keep sight of your overall financial health and plans. (which by the way, I've shared the template for free here: My Networth FIRE Estimator)

In my previous month, I mentioned that I will be revising my Emergency Jar's target from a 6-months expense into a 12-months expense as part of my buffering strategy and some of you have asked me why I am holding so much cash and not deploying them. Was thinking maybe I could share my thought process during this month's update.

There are really 3 main reasons why I've decided to extend my emergency fund to at least 12 months. If I could, I'd even do 24 months if the opportunity cost isn't as expensive for every cent I do not invest... (but let's see, maybe I really will do it but definitely not in 2021)

Is 3-6 months expenses-worth of an emergency fund sufficient? While one may argue that it would be more than sufficient, plus the potential line of credit extensions to better manage cash flow *wink-wink credit card*.

It might be true for pre-pandemic days that 3-6 months is definitely sufficient but things have changed so rapidly with the COVID-19 situation. Who knows how things will turn out in the next 12-24 months? What if I lose my job? (which, thank God, have only been minimally impacted by COVID, at least in my current capacity)

I've personally seen more and more of my colleagues being let go as part of streamlining & organization restructuring - and some of them struggled to find a new job that pays equally competitively given the current markets' situation (and perhaps also learnability/skillset issue combined) - and some have been left without a job for more than 6 months.

When running through the painful exercise to repaint my entire financial picture from 2010 - 2020 mentioned earlier - I realized and learnt something very important from my mom: "The breadwinner's emergency savings is not only theirs but also for the dependant family."

Without my mom's support on my medical cost (not covered by insurance), I'd probably in deeper debt through banks with hefty interest. This means that whatever emergency fund I am saving for, has to be deployed as well in the event if my immediate family needs it.

During the March 2020 global market crash, as I've only recently "rebuilt" my finances then - I simply do not have any spare funds lying around. While I did sit tight during the crash and did not sell any of my holdings in panic; I was not able to tap into the opportunity and buy more than I wish I had.

Hence this idea came into play - to minimize the impact of "opportunity cost" for redirecting my funds into the emergency pot rather than investing it; I'll make any of my funds beyond the 6th-month pool to be a dual-role pot that can be deployed into the market should such opportunity arises.

This is a little bit of a 50/50 risk/reward play - but works for me as it helps to balance out the FOMO in me of having my monies stuck in the emergency pot.

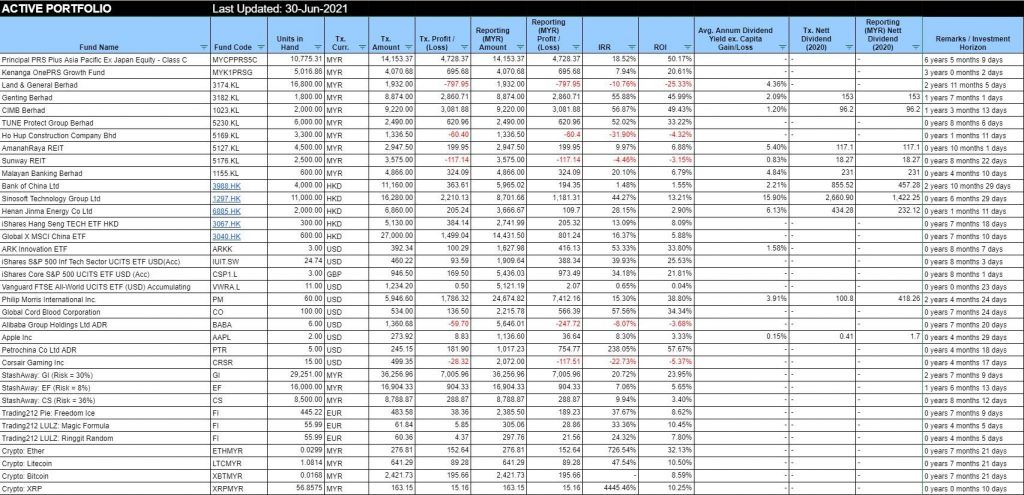

Aside from my typical monthly investments of Dollar-Cost Averaging (DCA) into StashAway, PRS, Luno and Trading212, there are few activities that took place this month.

June 2021's a happy dividend month for me, as I've received approximately ~RM2345 in dividends after withholding tax. Most of it came from my Hong Kong shares - but the biggest contributor was 1297.HK Sinosoft providing a one-off special dividend of ~RM1423 as part of their recent business restructuring selling off part of its business.

From the ~20K withdrawn from my EPF i-Sinar Programme, I've deployed another chunk of it into VWRA, which is an All-World FTSE Index Fund (Accumulating). I debated a lot between choosing VWRA or going with IWDA + EIMI combo for better flexibility in reducing US exposures / increasing emerging market exposures.

In a very short summary - I went with VRWA because I just needed a "catch-all" investment to throw money in when I have no clue what to invest. Fewer funds to maintain = fewer transactions = fewer fees paid to the brokerage. Let's not forget also the "Accumulating" feature - which means no dividend will be distributed = no transactions required to "reinvest" the dividend.

Whilst there may come a time where I want to have higher exposure in certain countries / emerging markets / specialty funds - that's where my existing choice of various ETFs come into play.

Crypto dropped quite significantly from its all-time high in April - I did make some additional purchases during the crash but the amount is still very insignificant, keeping my entire exposure onto crypto at ~2%.

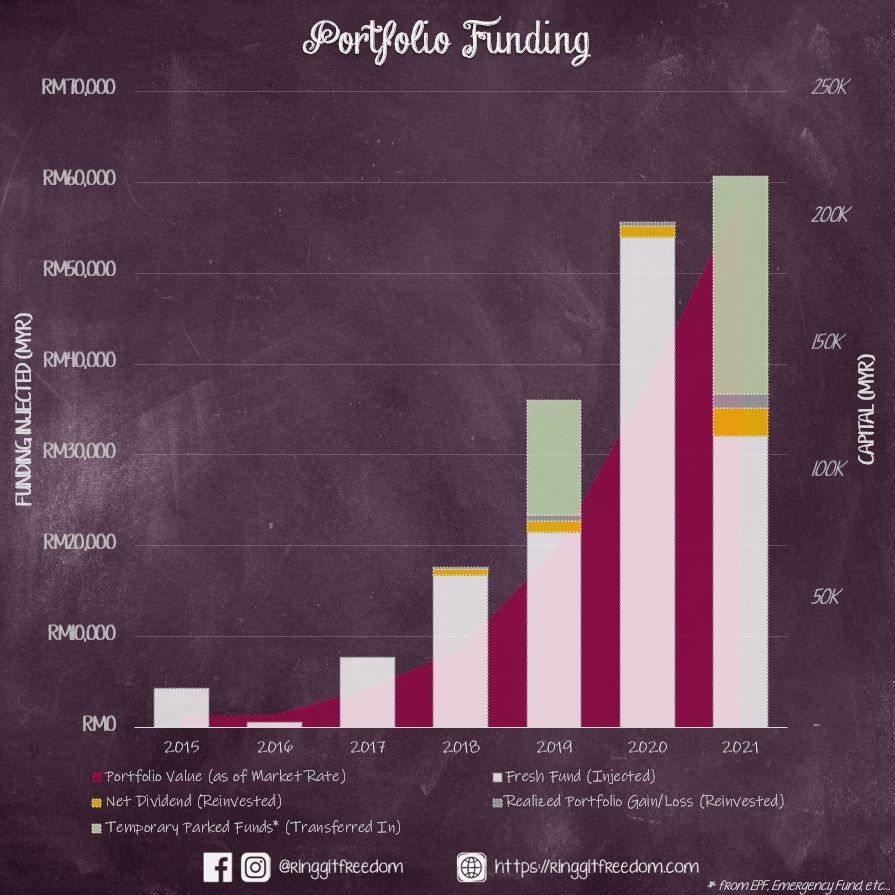

Since we've crossed the mid of the year - thought it would be good to see where we are and whether if we are on track to our targets.

Based on the current run rate, excluding the portions invested using transferred/parked funds like Emergency Fund or i-Sinar Withdrawal which tend to jack up the portfolio's worth - I'll most likely be underachieving as compared to the amounts of fresh fund injected into the portfolio last year.

The main reason is of course the current year's focus on ensuring sufficient buffering in my Emergency Jar up to 12 months expense. However, when factoring in expected Dividends or Realized Profits received this year, I might just be able to match with last year's total funding. Let's see where we will go in the next half of the year!

I rarely include EPF's in my blog update fearing confusion - but for this mid-year checkpoint, I'll just share the topline split in terms of asset allocation by region.

While my personal portfolio is extremely heavy on equities (>80%), things do not seem as crazy when looking at it holistically factoring in EPF's portfolio guided by their Strategic Asset Allocation (feel free to read my previous post on EPF here).

Compared to late last year, where I had >50% exposure within Malaysia (both Equities and FI); the situation has definitely improved tremendously. Still, Malaysia's exposure is hovering at ~45% (or ~25% if looking only at equities) and it'll be a long long long way to go before I reach my ideal allocation.

Personally, I'm looking at somewhere between 30% +/- 5% for Malaysia, United States, and Greater China respectively when it comes to equities, leaving just under 10% for other regions. As for Fixed Income - it'll be very difficult to shift it significantly, considering the extremely low interest rate in those countries so I'm fine leaving it as-is for now.

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 4.41%

ROI: 7.70%

Profit/Loss: RM2,940.14

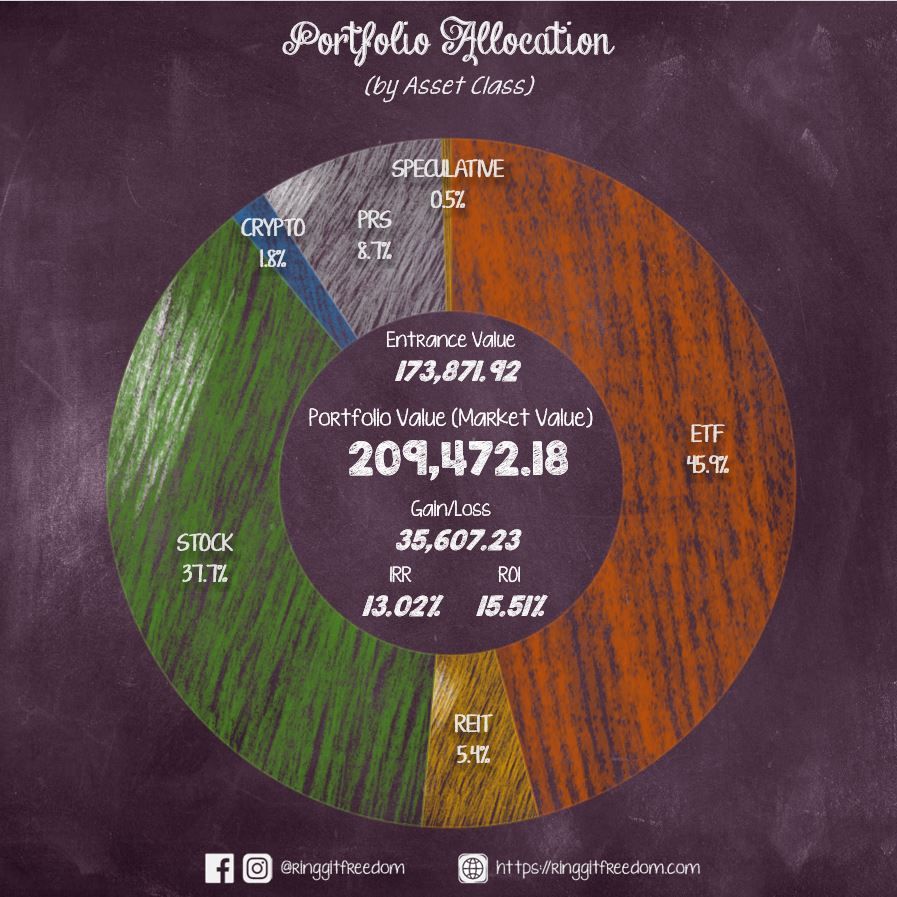

Active (Invested) Portfolio

IRR: 13.02%

ROI: 15.51%

Profit/Loss: RM32,657.69

True Cost: RM191,091.28

Total Value: RM223,932.422

Entrance Value: RM173,871.92

Portfolio Value: RM209,472.18

Nett Dividend (2021): RM3,147.18

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie