I lost my motivation, passion and energy completely sometime in April/May 2022 and became extremely depressed going into a downward spiral. With the lack of motivation and passion, I basically spent most of my time doing typical unproductive activities - things like binge-watching on Netflix, playing Games, or Sleep more than usual.

As a result, most part of this year's journey has been on autopilot mode, with near zero interventions from me unlike back in 2020/21 where I was heavily invested (time wise) in the personal finance space.

Closer to the end of the year, thanks to my Psychologist, I finally managed to partially get hold of myself by focusing only on things that I can control, one at a time. This managed to significantly lower the stress, the overwhelming feeling and also the frustration with myself / workplace that have been haunting me throughout the months.

Whilst I'm definitely not out of the woods yet, but things have became so much better and less cloudy compared to months ago - so much that I can at least have some level of energy and a clear-thinking head to write this post.

Without further ado, let's jump straight into our 2022's Year in Review!

Surprisingly, despite my mental state taking a downward spiral since May '22, my personal finances philosophy somewhat managed to hold itself out throughout the 7 months without much intervention on its own autopilot mode.

I guess the constant staying-at-home (gaming / Netflix-ing) with only occasional shopping, plus the slightly increased income vs. 2022 January baseline levels helping me to sail through without much financial damanges done.

Overall, I managed to achieve the targeted Annual Savings Rate of 60% (originally targetted for 58%) for year ending 2022, which I'm very proud of.

Maybe except the sudden splurge on gadgets & accessories in November more on that later.

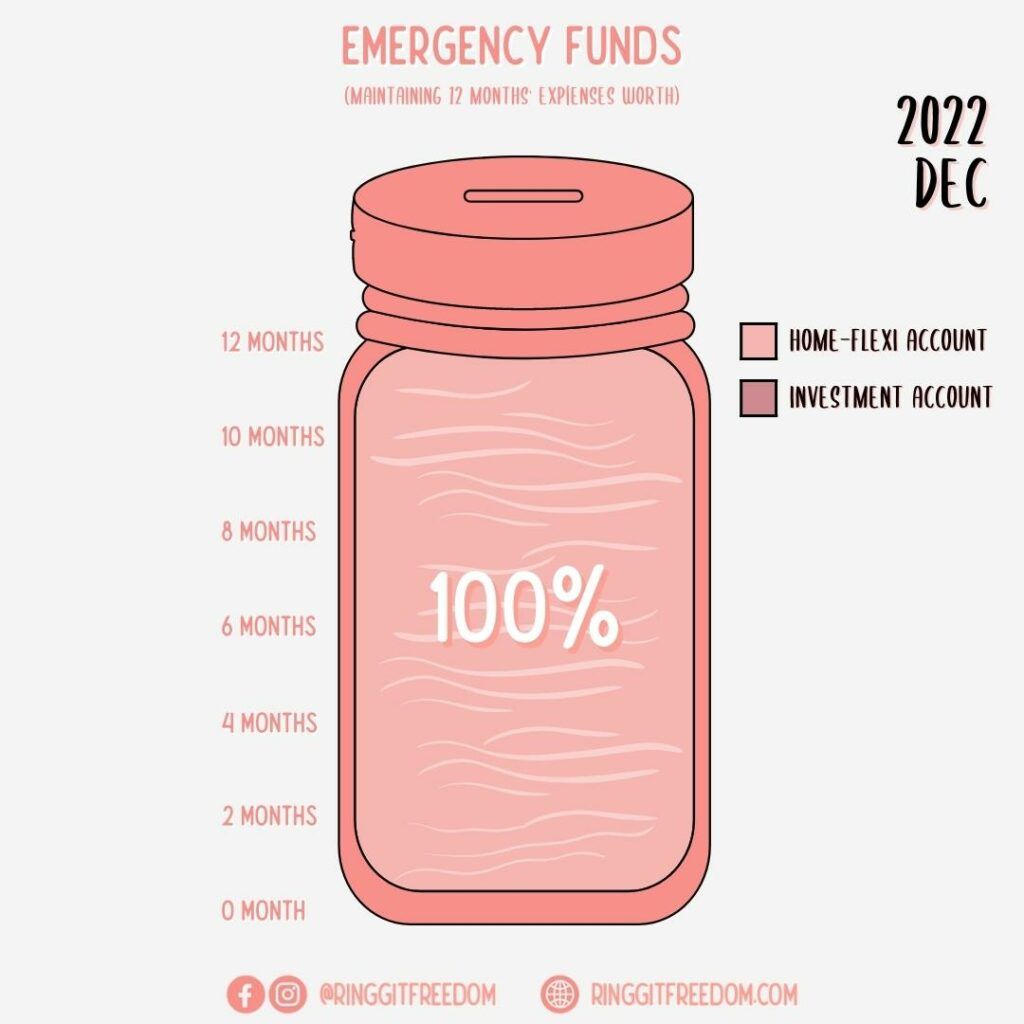

To share another bright news - a goal that I have started since mid-2021 to expand my Emergency Jar from the typical 6-months (expenses) buffer to a 12-months buffer (as explained in my June 2021's Update post) have finally been completed since middle of the 2022.

Whilst I certainly hope that I will never need to dip into the chunks of the Emergency Jar any time in the foreseeable future, it is still a great peace of mind especially knowing that recession is coming and I am ready for it.

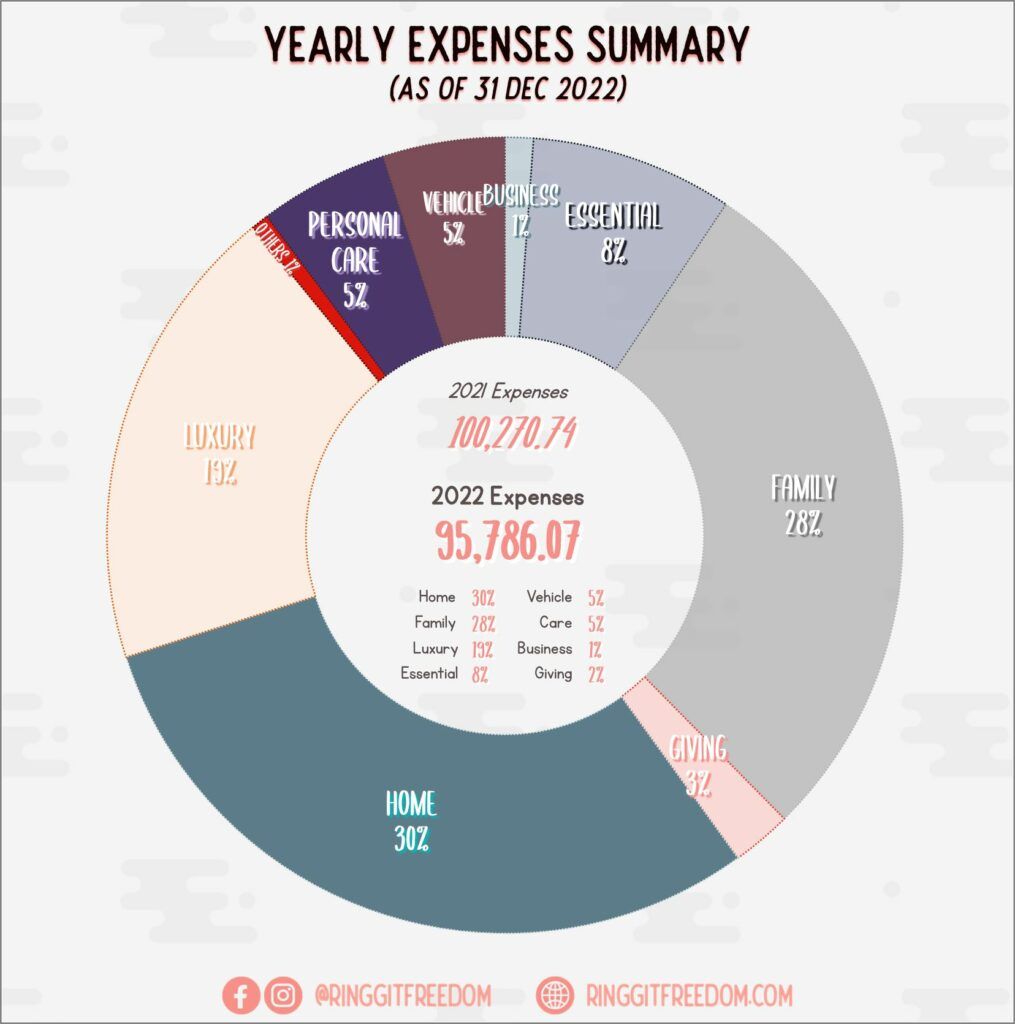

Taking an overall glance at my expenses this year, there isn't too much of a drastic change compared to last year where majority of my expenditure comes in the form of housing ownership as well as sustaining the family.

I guess it's a blessing in disguise that I'm still single and only have my mom to care of - so at the very least I'm not trapped like the sandwich generation does, for now.

Surprisingly, amongst all the mess I landed myself in - I managed to somehow spend less than last year. What sorcery is this!?!? 🤔

As for a quick comparison between 2022's spending vs. 2021's spending,

If I just double click further into the top-5 single item expenditures (excluding the mortgage, family, or giving categories) that can affect more than ~10% of my total annual expenses fully within my control, these are made up of:

Another last-minute splurge during the year end, as I was scrambling around to look for ways to maximize my company deductibles for 2022.

Considering that my previous glasses have already lasted me for close to 10 years with most of the coating already peeled off (plus it's also about time to give myself a refreshing new look), I decided to splurge a little on a pair of new glasses with all the fancy lenses coating stuff.

The total damage was more than RM2k+ but thanks to the company's deductibles, I only needed to contribute under RM1k.

Gotta take care of this new pair of glasses and hopefully it'll last me for at least another 8 years... *fingers crossed*

A triggering realization after I crossed beyond the 30's mark this year, realizing that my skins will only get older from there. That had scared me like hell and I decided to kickstart my monthly facial spa journey and started using some night care routines.

After slacking on facial care for so long - gotta make sure I properly budget this in from 2023 onwards!

Probably one of my best purchase early this year, and I have been using it at work daily for (digital) note taking purposes. It writes and feels like the typical paper notebook - except that I can wipe down on it towards the end of day with sanitizing wipes (for the peace of mind from Covid-19) without worrying that I may accidentally destroy my notebook, unlike its paper counterparts.

This was probably the real reason why I went digital, rather than all the fancy digitization bullshits XD

Even before I started my year-end review, I already knew that the amount spent on games/games credits this year will be much higher compared to any other years in the past.

Still, even with this expectations in mind, the end result still shocked me as the increase wasn't just 2x or 3x as initially anticipated, but a whooping ~5x increase vs past years where I spent RM600 in 2021 or RM700 in 2020 in the same category.

Whilst gaming has been my core "copium" mechanism having helped me to sail through the dark times, I definitely need to pay a closer attention on this category in 2023 to make sure that the problem doesn't get worse, at least; then see if there's a way to have the trend reverse itself slowly (since it's still my coping mechanism after all)

From another perspective, this cost as much as equivalent to a smoker's half-pack-a-day routine. So in a way, I guess I'm half feeling guilty but also not as guilty 😛

Well - the biggest culprit of 'em all during the November Impulsive Splurge period. I basically went hardcore and went all-in into the Apple Ecosystem, going from almost nothing (with only M1 Macbook I bought in Dec 2020) into almost-full Apple Family (iPhone 14 Pro, Apple Watch 7, Airpods Pro 2, and MagSafe/Other Accessories).

Being an Apple Hater myself, or rather, ex-Apple Hater, the transition from Android into Apple Ecosystem was surprisingly fluid. After using it for more than a month now, I kinda get why Apple users always go about with their cringy statement of "it just works" - because it really does 😅

My doubts basically took a 180° and went from "how long can I stick around with Apple devices?" into "can I really move myself out of Apple ecosystem after in my next phone replacement cycle?" 🤔

And yes, the RM4k wasn't a typo. Regretfully, iPhone's still on a 36-months 0% credit card installments so I must take care and use this phone for at least 3 years, just like my previous OnePlus (but 3x cheaper). If not for the installment, the amount will definitely be slightly more than double and hits my this year's budget, bringing my overall annual spending to be equal to last year's (the sorcery is now explained. this makes more sense!)

It's all the iPhone's fault (no Gracie it's not, it's really just you.)

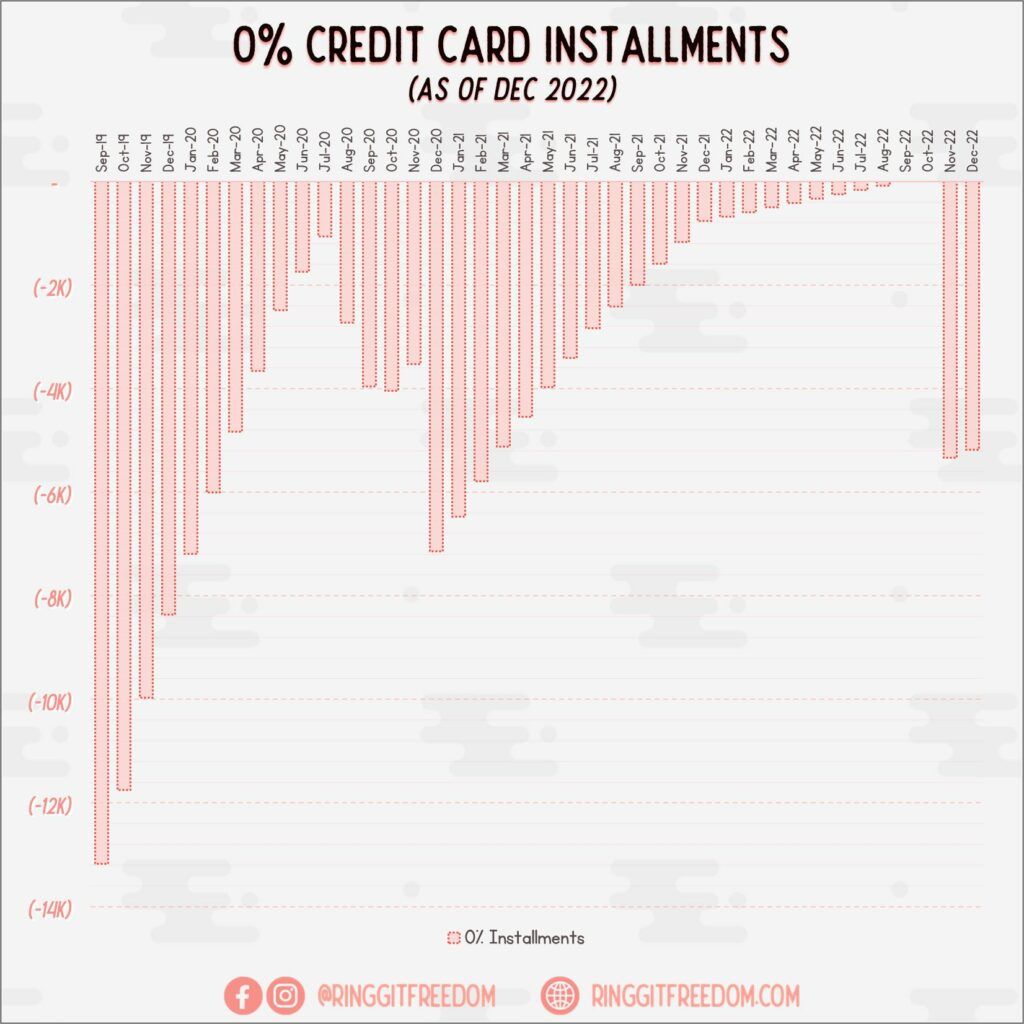

I managed to settle my 0% installments by September 2022 as initially anticipated during last year's review, but sadly, rather than funding my iPhone purchase through the Gadget Sinking Fund, I ended up going back to the 0% installment just because of how convenient & simple it is.

All the talks about resisting the urges to spend going down the drain, just like that T.T

To make it worse, I got the 36 months 0% installment rather than my usual 12 months or 24 months installment. Guess it'll be a long while again before I can fully clear my 0% debts incurred by the impulsive purchases 🙁

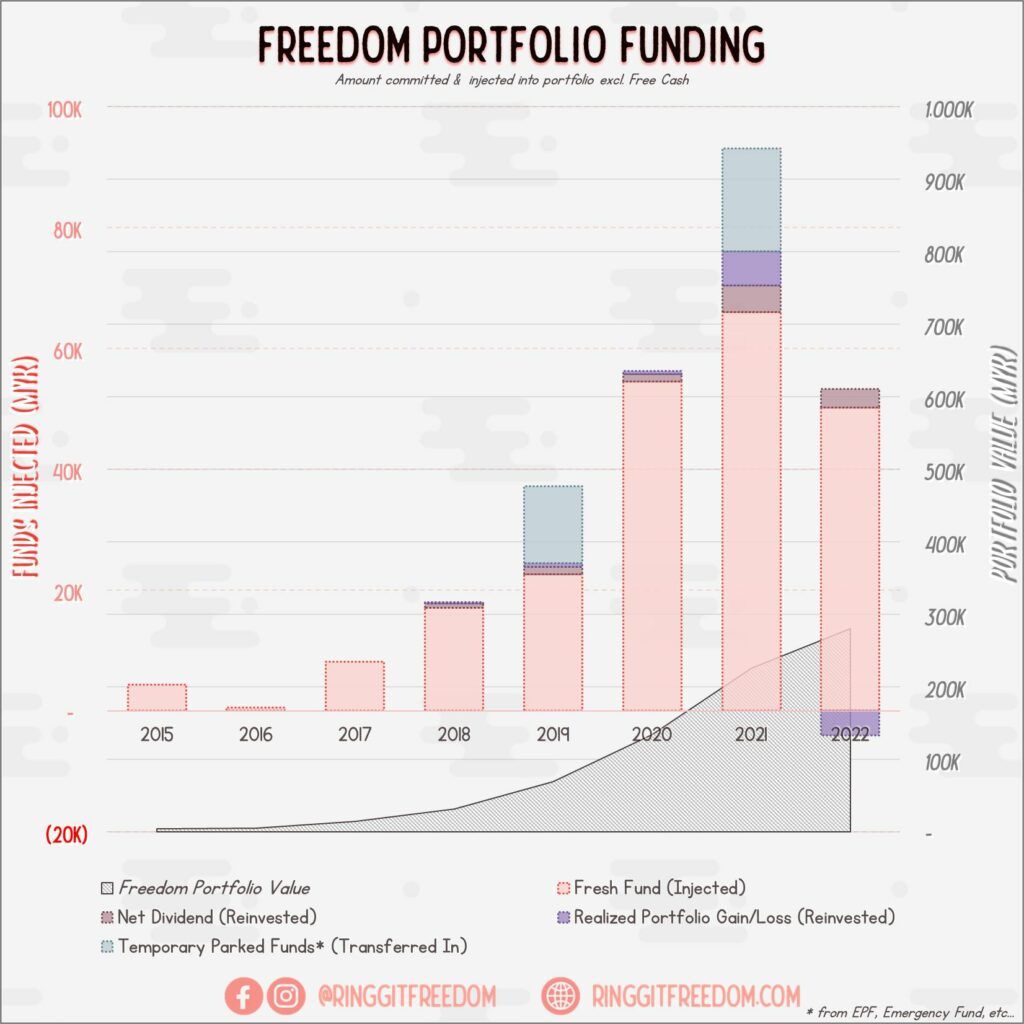

This year's funding contributed towards my personal freedom portfolio falls shy compared to the amount contributed last year by 25%, mainly due to the autopilot mode with no Auto Debit facility in place (I stopped my StashAway Monthly Auto Debit in March 2022) resulting in only manual quarterly injections this year whenever I remembers.

Another reason, is that I'm still holding a rather bear-ish view of the market and wanted to have some reserves for deployment when the time comes. Probably not a good idea trying to time the market and I might be better off in the long run to just stay in the market, but I just don't feel like going all-in yet so there's that.

I have approximately injected ~RM50k worth of fresh fund into the portfolio this year, bringing the overall value of the Freedom Portfolio to ~RM280k by the end of 2022.

Unfortunately, due to the inactivity and lack of update throughout the 2nd half of the year, I do not have much data point resulting in a rather... stagnant chart for the year of 2022.

Similar to the end of 2021, a huge majority (>80%) of my contributions this year goes straight into my ETF funds - mainly VWRA (for US + international exposures) and 3040.HK (for China exposures). All I basically do when quarter ends (and if I remember) is to convert my Ringgit into respective currencies, login into IBKR, and purchase on the spot irrespective of the trend-at-that-time.

I guess these passive-funds work best for me as they're the most boring and braindead method, fitting to my lazy investor style.

In 2021 my overall portfolio split ratio (including EPF) between Malaysia/China/US/Others was somewhere between 40-15-15-30, and there was not too big of a differences for year 2022 as well. I'm still slowly working towards reducing the Malaysia exposure (at least equity wise) but still haven't found a good way from cash-equivalents since most of them are still sitting in EPF's fixed income or my fully-flexi home loan for the interest gains/savings, bringing Malaysia's total exposure from ~40% to ~35%.

Whilst a "Venezuela" is not likely to happen in Malaysia in near-term, the deteriorating currency of Ringgit still worries me and I've been trying to find ways to hedge my cash-equivalent in other currency but are always turned off by the lack-of-interests (not even inflation-matching). Maybe I should start reading up my Singaporean's Blogger counterparts to get some insights on where to keep my cash, if I choose Singaporean Dollar as my hedging currency 😁

Whilst I am very grateful and have my career to thanks for the smooth sailing financial journey I have today, the career was also the very reason that broke me (mentally) since the last 7 months. Unlike what happened in the 2016-2019 periods though, I managed to dumb-down my financial tracking throughout the past 7 months, keeping it simple to only a basic financial tracking (a.k.a. data entry into my YNAB). Thanks to that, I managed to still track my financial health for the year and do some budgeting retrospectively. Not the best way without a proper forward-planning in place, but it got the job done for this year.

Just in case for those who are reading my year review the first time - I typically exclude my primary residence that I’m staying in for my personal net worth, in the essence that it generates all the expenses/liabilities associated with home-ownership with no ability to generate income. This concept was popularised from Rich Dad, Poor Dad by Robert Kiyosaki. However I know that some of you finance enthusiastic would prefer to stick with the standard accounting principles so there's also an additional dotted line for that.

With all that said, I am glad that the actuals for 2022 did not deviate too far from the initial estimations, putting my net worth slightly above the RM400K mark. Whilst it will still be below my "1M2024" target, at this juncture I will just maintain the current pace rather than trying further ways to accelerate it, knowing clearly the risk of crossing the burnt-out line. Let's see if the forecast for the future comes anywhere close, when we revisit this in 10 years time!

Early 2022, I have set a quite a number of stretching goals for myself, which probably contributed to my eventual burn-out on top of the career stress. As a quick recap, these were the goals set for myself early last year.

#1: I want to maintain at least 58% Average Annualised Savings Rate by end of 2022 to fuel either my Emergency Jar or Freedom Portfolio.

#2: I want to study and take up the PMP Certification Exam by end of 2022 to boost my potential career aspects (since that's mostly what I do day in day out, and are sponsored by Company anyways)

#3: Let's try this again - I want to read at least 8 non-fictional books by end of 2022 - leadership, business, finance, self-development; you name it!

#4: I want to write at least 12 additional articles in 2022 aside from my monthly / yearly updates; as a means to continue sharing my thoughts and things I've learnt throughout my financial journey, hopefully in return motivating more people to onboard the financial freedom journey.

#5: This one's a stretch goal - but I really want to pick up the Korean language by end of 2023. For 2022, let's try to learn at least 10 new vocab per week!

#6: Also a stretch goal - I want to attempt to apply for Singapore jobs - and sit in for at least 5 interviews by end 2022. Definitely not in rush to leave my job; but just wanted to tap into whatever opportunities arising and who knows what I'll land myself onto (and leave Malaysia)

Read more: 2021 in Review: A Little Too Soon?

Unlike the review done in 2021 where I gave a pass or fail rating for each of the respective goals creating a rather negative overall vibes considering that I "failed", by definition, quite a number of unachieved goals.

Let's take a different approach this year to instead celebrate what we have achieved this year, shall we? 🥳

Obviously, I only hit 1 out of 6 goals originally listed which was the target set for annual savings rate. This year, I will be trying out something new - perhaps to officially slow down my year rather than the never-ending forward chase so there will only be 3 concise goals by end of 2023.

Similar to last year - this is hopefully an easy one to achieve by riding on the savings momentum whilst not over-depriving myself to focus only on saving but forget to enjoy life.

Perhaps something that I've missed the most is to travel overseas and just go adventure around. I don't know where to go yet, perhaps Korea or Australia? The purpose is really only to divert my spending on experience rather than more and more things.

Perhaps the most important goal of them all. I've been losing my motivation and staying depressed for a little far too long, and I needed a new "goal" to look forward in life - something beyond grinding on the hamsters wheel.

For too long, I have focused on and only on tangible goals such as career progression, making and preserving monies, buying tangible stuff, progressing further in career to make more monies, etc.

In a way, I'm very grateful and proud of myself that this did not end up just like the 2016-2019 storm where I completely lost control of my personal finances, completely. I've slowed down a lot in 2022, but not without a sense of guilt which requires me to constantly remind myself that it is okay to slow down.

I'll probably still be slowing down my 2023, but this time, to try achieving it without a sense of guilt. This way, hopefully it can create the mental capacity that I needs to figure out how I'd like to navigate through the second half (or 2nd quarter?) of my lifelong journey.

There are so many questions that linger in my mind that I do not have an answer to - but one thing's for sure is that I will need to prioritise self-love and self-care which are much more important than just the financial journey alone.

Let's hope that all the clouds and storms will be gone before 2023 comes to an end!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

Cheers,

Gracie