Decided to create this page out of whim and make it a little interesting way to track my journey, and also as a source of motivation for myself to achieve my next "goals", doing it the gamer-style!

Even when playing games, I loved the idea of "unlocking" or "collecting" those little achievement points. It just has the feel-good element in it.

I guess because it aligns with my motto of celebrating every small successes along the journey through conscious efforts, whilst looking forward to the next one!

There will be 3 sections in this page, where the achievements will be split into:

All kind of "unlocks" throughout my life's journey, both good or bad.

Live dangerously without a budget for more than 12 months!

Moving in to my first family home, with my own sweet-master-room!

Live dangerously without emergency funds for more than 12 months!

Getting only one Angpao throughout Lunar New Year

Saying "NO" to a properly planned monthly budgets throughout 2022 Apr - Dec without wrecking my personal finances!

I Need A Budget – for sure!

Sticking to my budget for a year straight!

Sticking to my budget for 2 years straight!

Sticking to my budget for 3 years straight! RIP 2022 Apr-Dec. My winning streak is gone.

Sticking to my budget for 4 years straight!

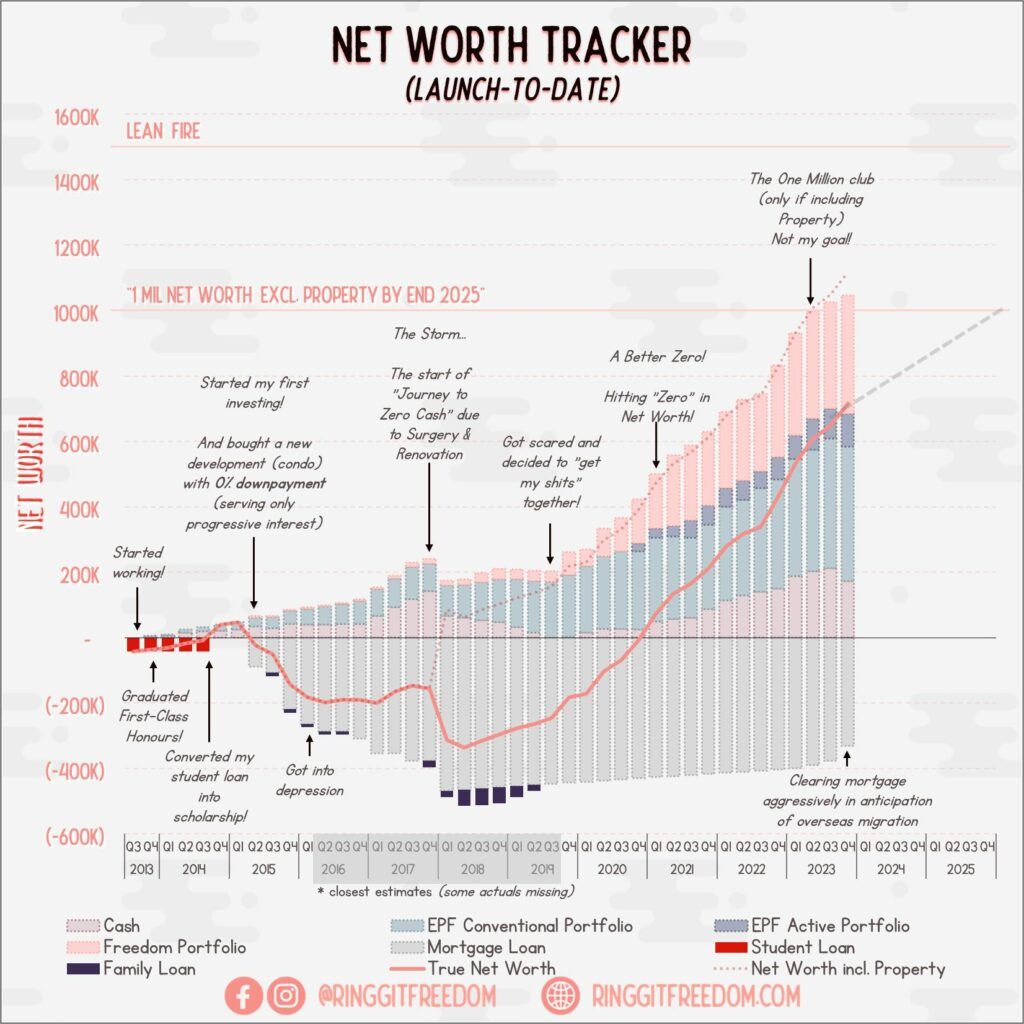

My personal net worth formula will be EXCLUDING my primary residence that I’m staying in, in the essence that it generates all the expenses/liabilities with no ability to generate income – a concept popularised from Rich Dad, Poor Dad by Robert Kiyosaki.

When it comes to tracking my investments (personal / EPF), with the market fluctuations everyday – it is almost impossible to track my net worth in an efficient manner.

Hence for my monthly monitoring, I solely rely on my YNAB budget data which captures only the invested amount AND realised gain/loss. In short, my net worth ignores market fluctuation until I actually realised the gain/loss OR during my annual review exercise (where I review my financial health in a more comprehensive manner).

I know it may not be in line with accounting standards – but I’m just more comfortable with this net worth formula as it does not feel inflated and also less work for me to “update” my budget.

-RM???: Having more debts than my worth ?

RM0: Officially “ZERO” worth… probably one of the rare ZERO’s that we actually celebrate in life.

RM250K: I need a “X4” button to click and directly skip into the millionaire’s club ?

RM1MIL: Officially “The Millionaire Next Door”. YASSSSS!!!!!!!!

RM2MIL+: Who said we was stopping at RM1mil !?!?

Tracking my portfolio investment journey since my first time exploring beyond Fixed Deposits.

My personal “Ringgit Freedom” portfolio which I fund and manages it myself (not including EPF-related investments) as I start my snowball journey.

RM1K: First step into the world of investments are scary indeed.

RM10K: Whew! My fragile heart survived the market.

RM100K: The next milestone seemed far-reached… but we shall not STOP!

RM500K: Halfway there towards the million portfolio!

RM1MIL: Who knew that we, too, can hit RM1mil !?!?

RM2MIL: Into the next million, and the next, and the next……

On areas that I have begun my exploration as a beginner! At least to “know” about the topic with enough basic understanding.

At one point I believed Fixed Deposits were the only place to ‘invest’ money

The corporate/government version of the fixed deposits!

My first baby-step into the world of bond & equities, beautifully wrapped in a basket.

That sweet, sweet tax rebates.

Hedging against risks, at a price.

Going beyond Malaysia onto the world of international investing,

At one point I was fearing it as “big risk, big rewards, kids stay out!” zone

Investing without me doing anything? Perfect for a lazy sloth like me!

We are all Ah-longs now! Legally.

My first baby-step into the world of equities, without the expensive basket.

Like the roller-coasters in theme park – getting nausea by just looking at it.

I will gradually update this page with more achievements as the idea bulb comes by! In a way - this helps me to stay focused on some of my big-picture visions whilst staying motivated to work towards the next immediate target.

Cheers,

Gracie