"Death and Taxes" - two of the certainties in our lifetime.

In the past, I've always prepared my tax documents manually by going straight into LHDN's website during tax seasons and scrambling to look for documents, numbers, and shreds of evidence at the last minute.

Whilst I typically give myself enough time to make sure that I don't get stressed out at the very last minute, it was still a stressful ordeal.

Later, during my short-term assignment to Hong Kong and was fortunate enough to be assigned a Certified Tax Consultant to assist me with my tax filing overseas, I learnt something very valuable: having a working sheet (excel) in preparation of tax files, with all evidences compiled into a single file (or folder, if you'd like).

Since my repatriation back home, I've copied their methods in my own tax filing exercise (and gradually) growing the complexity of my Excel spreadsheet. This spreadsheet has been going with me since 4-5 years ago from 2020 tax filing (for YE2019) until now.

And today, I'll be sharing all of these to readers whom are interested to get a little bit more organized with your tax filing.

As mentioned above, I've learnt to keep a working sheet for every tax filing year. But when exactly do I prepare it? During the tax season (i.e. March to April of every year)? At the end of the financial year (i.e. December)?

Nah, neither of those. Since I started the habit of a working sheet for my tax filing purposes, I've always made sure to create the tax folder & duplicate the working sheet every time the new year has begun.

Why do I do this? It's very simple: ever struggled trying to remember what potential items you can claim throughout the years - especially in certain categories which may be dependent on the purchases? Yeah, it's not easy especially since many other things may be going on in our life.

Even with this habit of mine, I still tend to lose some of the (smaller) purchase receipts due to the failure to file them immediately (in my folder at least) - with receipts such as Sports Equipment (running shoes, etc.) being the typical culprit.

In summary, I would be creating a Folder every Tax Year, containing the following:

Repeat every other year.

The sheet, in comparison to all of my other publications, is perhaps one of the most simple (and manual). There's not much automation except some formulas to help calculate the tax, which will also require your input on an annual basis considering the ongoing changes in tax regime every other year by LHDN.

Firstly, let's go through the basic functionalities of the sheet:

Tax - All your input & calculations go here.

Relief Table - nothing much here - basically copying the tax relief information from LHDN website to here for easy archival/references.

On the beginning of every new year, replace the information in the Relief Table with whatever latest published by LHDN here: https://www.hasil.gov.my/en/individual/individual-life-cycle/how-to-declare-income/tax-reliefs/

You can also skip this step if you prefer to just browse that information on the website. I prefer pasting them into my Excel so that I can glance through what items are relevant to me, and slowly highlight them in the Excel itself as I'll need this information to be moved back into the first "Tax" sheet.

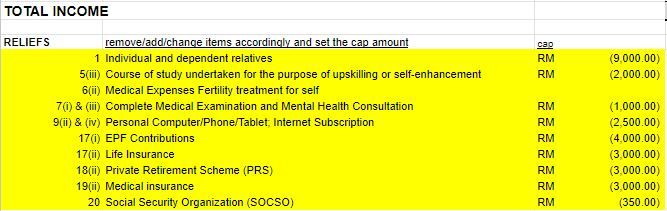

Once you have identified which items you are eligible to claim, update the "Relief" section with the relevant items that you will be claiming, together with their "MAXIMUM" limit if applicable.

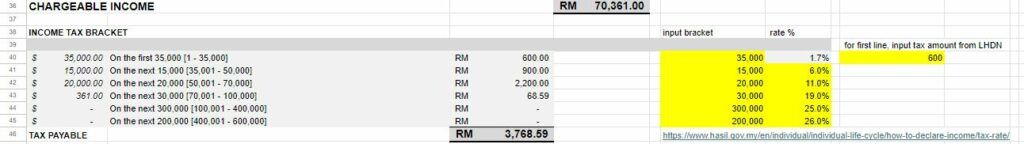

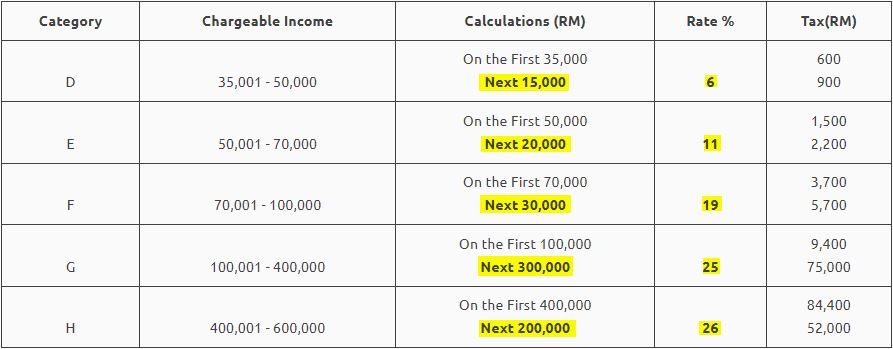

Next, we'll be updating the "Income Tax Bracket" section based on the latest tax rates as announced by LHDN here: https://www.hasil.gov.my/en/individual/individual-life-cycle/how-to-declare-income/tax-rate/

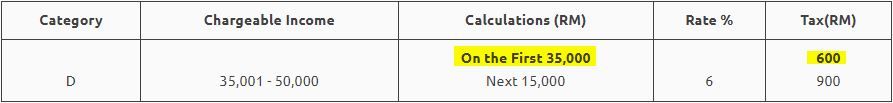

You just pick the "first tier" you'd like to start with. In my above, I picked the "first 35K" tier which according to LHDN will incur RM600 tax for this first 35K tier. Pluck the number into the first input tax bracket & tax amount in the sheet.

Once that's done, you just down down the few tiers, going as deep (and adding a new row) as you'd like. I stopped going beyond 600K as it's meaningless and not an amount that I'd be reaching in this lifetime. For all the subsequent tiers, all you need to look at is the "Next XXXXX" amount and "Rate %" and pluck them into the sheet accordingly.

Once you've done with the [SETUP] section, all you need to do is to pluck in numbers according to your income, MTD deductions, as well as items claimed under reliefs and the formula will auto-calculate the rest for you. When all your number are input correctly, it will usually match the LHDN calculations when you input into their system later.

That's the good news! I am providing this Google Sheets as part of my giving-back to the community - in another word, it's FREE!

Unfortunately, in exchange, I won't be able to provide you with 1-to-1 support/hands-on/training and I am expecting that you will have at least basic knowledge to navigate around Google Sheets. I've tried my best to keep it as simple as possible, and added some basic notes in the Sheet itself.

The Sheets are not locked/protected either - and they are entirely open source so feel free to branch out and further expand on its feature - as long as you attribute the credits back to me whenever applicable. (p/s let me know what you have added too! Maybe I could also use it :P)

If you'd like - you can also buy me a coffee / tip any amount you'd like below!

Just a few important notes before we get there:

Latest Version: https://i.ringgitfreedom.com/resources/TaxEstimator

If you have enjoyed my works and would like to support me, feel free to use any of my referral links here or buy me a coffee here!

v1 [4 Mar 2024]: Initial release

If you have been using my tools for a long time - I thank you for your support and hope that it has helped you in your journey towards financial freedom.

If you're new and are looking for some way to keep track of your multitude of portfolios - I hope these Sheets will be useful for you. Feel free to also check out my other tools here.

If not, there are plenty of other solutions out there and just don't stop finding - you will surely be able to find something that fits your needs.

Cheers,

Gracie