I decided to write this post after getting inspired by one of the posts in the forum, asking about what's their "Minimum Selling Price" to breakeven from their underperforming property unit. Those of you who've lurked around the same forums I'm at would probably know which thread I'm talking about, but anyway, point aside 😛

Initially, I was just planning to write a short answer, but as old habits die hard, the answer got longer and longer, and I got nerdier as I dug deeper. In the end, I did one version for myself just to also simulate what's my "breakeven number" should I decide to sell off my property. And my jaw dropped when I saw the number.

I won't discuss further about the costs, but if you are interested do check out this post of mine which elaborates in detail on some of the other "hidden" costs for property owners, which are often neglected during our initial purchase.

This sheet is built with simplicity in mind - as all we want is just to estimate the approximate value should we decide to sell/flip our property and identify the "break-even" point, which ideally should be the bare minimum we sell our property for (provided that the market allows)

Firstly, let's go through the basic functionalities of the sheet. There are 4 key sections:

Summary - simplest section of all, as all you need to input here is the property value during the initial purchase & today's market value. Everything else will be automatically calculated based on inputs from subsequent sections.

Mortgage & Transactions - There are four sub-sections here, namely:

Just input all of them accordingly, as detailed descriptions are already provided in the Sheet itself. Amounts here will also be used to calculate opportunity cost later, should you opt to do so.

Occupational Gains (Own Stay/Rent Out/Vacant) - This section is used to estimate your net rental gained (if you rent the property out for income) or avoided (if you choose to stay in the property yourself). Amounts here will also be used to calculate opportunity cost later, should you opt to do so.

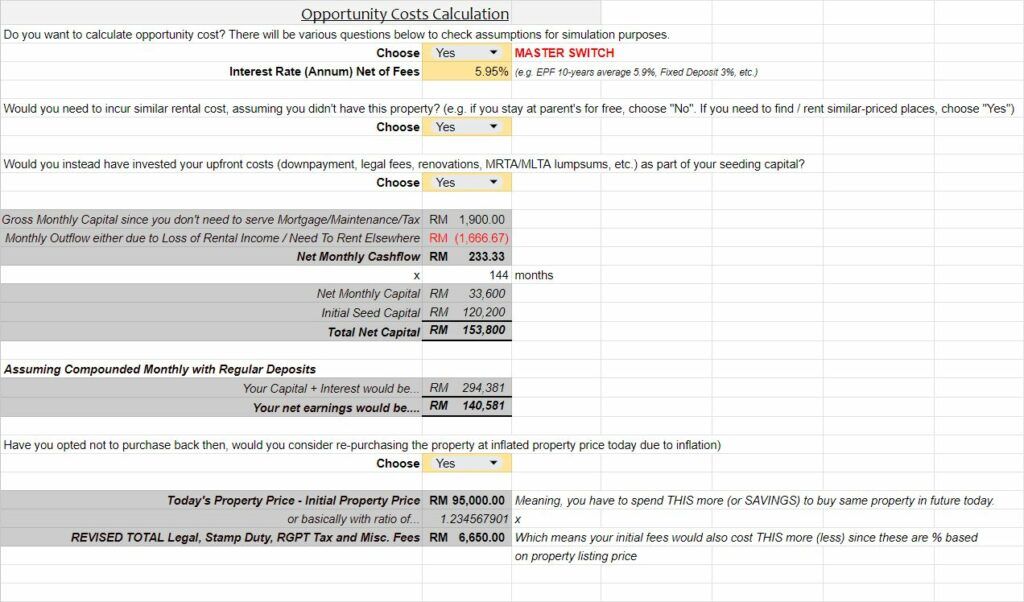

Opportunity Costs Calculation - An optional section - choose "NO" if you prefer not to include these theoretical calculations in your break-even estimates.

If you choose to include these calculations, remember that these are only theoretical exercise as reality may often involve much greater complexities in parameters which a simple Google Sheet wouldn't be able to handle.

Some key points which are considered here are:

Again, these are not exhaustive as there will be many other permutations and scenarios which will be too complicated for Google Sheets template to handle, so feel free to fork them as needed.

Get a few things ready - your property price; mortgage details; big sunk costs like renovation, furniture, appliances, etc.; recurring costs like maintenance fees, taxes, etc.; rental income (if any).

Once you have these data, just fill in the blanks and go through the questionnaire and the sheet will automatically do the rest for you.

Once you're done, just look at the "Summary" section to identify your ideal selling price, and whether if you've profited (or made losses) thus far.

That's the good news! I am providing this Google Sheets as part of my giving-back to the community - in another word, it's FREE!

Unfortunately, in exchange, I won't be able to provide you with 1-to-1 support/hands-on/training and I am expecting that you will have at least basic knowledge to navigate around Google Sheets. I've tried my best to keep it as simple as possible, and added some basic notes in the Sheet itself.

The Sheets are not locked/protected either - and they are entirely open source so feel free to branch out and further expand on its feature - as long as you attribute the credits back to me whenever applicable. (p/s let me know what you have added too! Maybe I could also use it :P)

If you'd like - you can also buy me a coffee / tip any amount you'd like below!

Just a few important notes before we get there:

Latest Version: https://i.ringgitfreedom.com/resources/PropertyBreakevenEstimator

If you have enjoyed my works and would like to support me, feel free to use any of my referral links here or buy me a coffee here!

v1 [5 May 2024]: Initial release

If you have been using my tools for a long time - I thank you for your support and hope that it has helped you in your journey towards financial freedom.

I hope these Sheets will be useful for you. Feel free to also check out my other tools here.

If not, there are plenty of other solutions out there and just don't stop finding - you will surely be able to find something that fits your needs.

Cheers,

Gracie