As a little celebration for myself after finally hitting my Zero Net Worth, I've decided to write this post more of moments for self-reflection, and also to share my top 5 money lessons for those who are working towards a similar financial freedom journey.

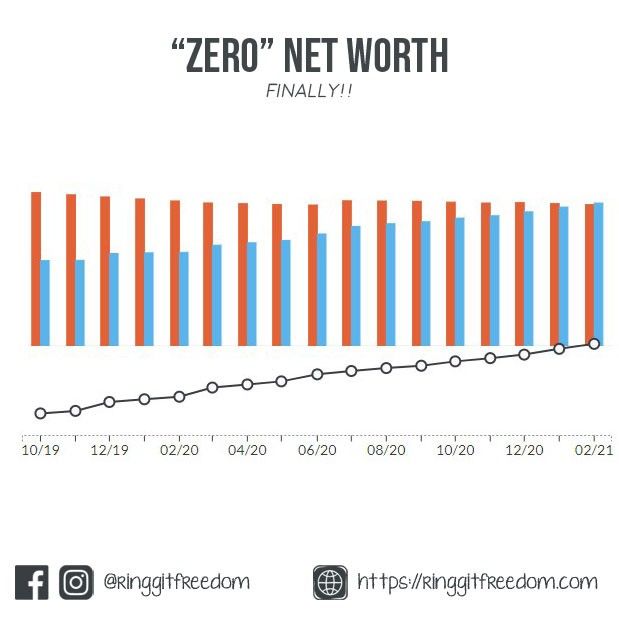

If you have not read my story yet, I basically restarted my journey towards financial freedom in late-2019, after realising that I cannot go on with my never-ending splurges.

Fast forward to March 2021, I have finally crossed the "zero" net worth marks! If you had asked me a few years ago whether if I would reach this milestone today, frankly I wouldn't be sure; or probably I might just laugh it off calling it impossible.

On a completely unrelated note, I decided to add these achievement badges to my newly compiled page My Achievements and really treat my financial freedom journey like a game ?. As I progress further in the Game of Financial Freedom, I will continue to "unlock" new achievements along the way.

Looking back, some of these easy-to-understand principles are really hard to apply at times, as we continuously try to balance priorities in our life.

By sharing my top 5 money lessons that I have learnt throughout my journey towards achieving my first milestone of Zero Net Worth, I hope that it will help or inspire you, one way or the other.

These top 5 money lessons will be sorted in the sequence from the least impactful (#5) to the most impactful (#1) towards achieving my first milestone - though everyone might have different circumstances and your sequences may differ slightly from mine, and that's okay too!

Without further ado, let's get started!

Perhaps it's the timing or just purely coincident. In less than 3 months after restarting my financial journey, COVID-19 started making its way beyond China and unemployment starts to hit record highs.

That is also when I realised that I have been living from paycheck to paycheck without any emergency funds to fall back on in case of unfortunate events. Whilst I am fortunate enough not be impacted by the pandemic; it was still a good wake-up call for me, like a slap to my face, to start rebuilding my safety nets in the event of unfortunate downfall.

The general guideline is to build at least 3 to 6 months worth of essential expenses (i.e. not including your lavish/nice-to-have lifestyles) during the unfortunate event. So far I'm halfway there, sitting at my 3-months mark and my immediate focus first half of the year will be to tap on the momentum and double it to 6-months worth.

Emergency Funds are like our safety net - you'll never know when you need it.

TAKEAWAY LESSONS #5

But when you do, it'll at least soften the impact on you.

When I was still working on my finances in the blind (i.e. without doing budgeting), from time to time I always have the impression that there's still plenty of leftover monies to be spent, so I ended up shopping for extra stuff subconsciously.

The same goes for all of my past merit increments - whenever there was a pay raise, my brain will trick me into spending more unconsciously; thinking that my purchasing power is greater now.

And just like that - bit by bits, over some time, I was sucked into the whirlpool of lifestyle inflation without even realising that I am in one. Like a hamster on a wheel, chasing for my unlimited material wants.

I realised it in early 2019 but it was hard to get out, especially after tasting the sweet things in life. To make things worse, typically the increase in my expenditure will outpace the payraise that I am getting and as a result, I ended up spending more than before and saving even lesser. Only when I forcibly taxed myself, things started to get back on the right track.

Just because I can afford more now,

TAKEAWAY LESSONS #4

doesn't necessary mean that I should spend more.

As the saying goes - two things that are certain in our lives are death and taxes. The first thing that happens to all our incomes are the taxes from the government. Regardless of its shapes or sizes in the form of personal or business income taxes, all it does is to siphon away the monies before it even reaches our eye.

But why stop at only paying the government, when we ourselves are the main character in our lifes' journey!?

When applying this concept to ourselves correctly (i.e. self taxation / paying yourself first), it can become a very powerful tool. By hiding monies from our own eyes, we will be able to trick our brains to live by with less.

This has been one of the most effective curbs against my problem of never-ending lifestyle inflation. I started my "self taxation" with a "minimum flat tax amount" which goes into emergency savings or investments, and later evolved it into flat monthly budget expenses including self taxation.

This way, even if my income grows further in the future (in line with inflation rates), I wouldn't accidentally fall into the trap of lifestyle inflation again as the total expenditure is forced to stay flat. This also means that any additional income - be it bonuses or raises, will automatically go into my emergency savings or investments, further accelerating my journey towards the goal.

Paying yourself first is one of the surefire way to hide money... from your today's self.

TAKEAWAY LESSONS #3

Your future self will thank you later.

Not having any goal in your mind is akin to driving around without knowing your destination. While it might be okay to do wander around once in a while, to gain exposure and new perspectives as well as learning new things; it will not help in the long run.

Frankly speaking, I am still struggling with this as well. I have a very vague picture of what I want to achieve in the next decade, but at the same time I'm also afraid of the unknown so I've mostly been navigating around with an eyepatch on.

Having said that, it helps to at least have that end-goal pictured in your mind, as your brain will subconsciously remind you to pursue your desires toward that direction.

I know the kind of lifestyle I want to have - not being tied to workforces, ability to game/stream as I like, managing an investment portfolio that will be self-sufficient in maintaining my lifestyle without downgrading, but potentially emigrating out from Malaysia.

With these consideration factors, although extremely vague (even for myself!), I was able to come out with a stretch goal for myself to hit $1MIL net worth by the end of 2024. It's tough and stretched, but not entirely impossible - either I expand my income sources, or extend my investment returns.

Having a goal, even a vague one, is better than having none.

TAKEAWAY LESSONS #2

They act as your compass, guiding you towards the north star.

To me, this is definitely the hardest part to continue sticking to the budget and delaying gratifications as much as possible. I have personally given up on my personal finance journey at least twice in the last 8 years and I hope that it will not happen again in the future.

This time around, I tweaked a few of the components of my personal finance journey, hoping in exchange that I'll be able to stick around forever:

All these give me the strength that I needed to keep going forward one step at a time. Not to forget also to start building in rewards mechanism as part of my budget (rather than getting the feeling of being punished) so that I still get to enjoy life as it whilst spending responsibly.

Keep going at it and don't give up.

TAKEAWAY LESSONS #1

But don't forget to love & reward yourself along the way.

While this is a relatively short reflection post than some of my other articles - I hope that you will find it useful one way or the other. Although Zero Net Worth is just a starting point - but it is one of the milestones worth celebrating in our financial journey.

As always - thanks for reading and see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie