I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

After months and months of hesitation, I finally went ahead with my dental braces appointment and have braces fixed on my teeth. I have been comparing various options like Traditional Braces, Damon Braces and also Clear Aligners but ultimately decided to go with Damon Braces from both cost and convenience perspective. Will write more about this in a dedicated post detailing my braces journey - can't wait to get off braces! Already am missing my foods ?

Spent most of my time this month working on my blog redesign (stay tuned for the release mid-Aug) and also technical optimisation, as some of the previous page-builder plugins used were really clogging up my website (in terms of loading speed). Happy to put my basic web development skills into use again, although it have gotten very rusty. Oh well, strengths can also become the weakness after neglecting it for too long I guess...

As for the Korean Language learning that I picked up few months ago - I felt a little guilty for making no progress with my Korean learning throughout July ? as I've spent most of my time working on my website redesigns. There's also a bunch of unfinished backlog of books waiting for me...

Went for my second dose of AstraZeneca vaccination and I'm glad that the downtime (side effects) were way lesser than my initial dose. I only had mild fever on Day 1 and Day 2 but it was so mild that I could continue working on my blog redesign project over the weekends (with help of Panadol of course ?).

With the rate of vaccinations going in Malaysia, hopefully the casualty and infection rates will start going down so that life can return to normalcy sooner rather than later (though there's upsides of WFH and staying home for introverts like me, but I guess that once-in-a-while fresh air helps too).

Now, going back to our usual monthly update for my finances and portfolios.

My savings rate this month took quite some hit, as I've spent a significant portion from my Dental Sinking Fund which I've been saving for Braces. I've paid for approx. ~RM2400 as the deposits for my Damon Braces with the rest to be paid in my subsequent visits. I will continue to inject RM500/month into my braces sinking fund to cover the remaining costs (with some buffers) but I'm sure it'll worth the investment!

July 2021 was also the month where my 24-months contract for my 1GBPS TIME Broadband (~RM199 incl. tax monthly) comes to an end - and after some long hesitation I have decided to downgrade it to 100MBPS and have been using it close to 2 weeks since it took effect.

To my surprise, the speed difference isn't really that noticeable than what I initially feared. Perhaps I never really needed 1GBPS but it was just something I was tempted to try out...

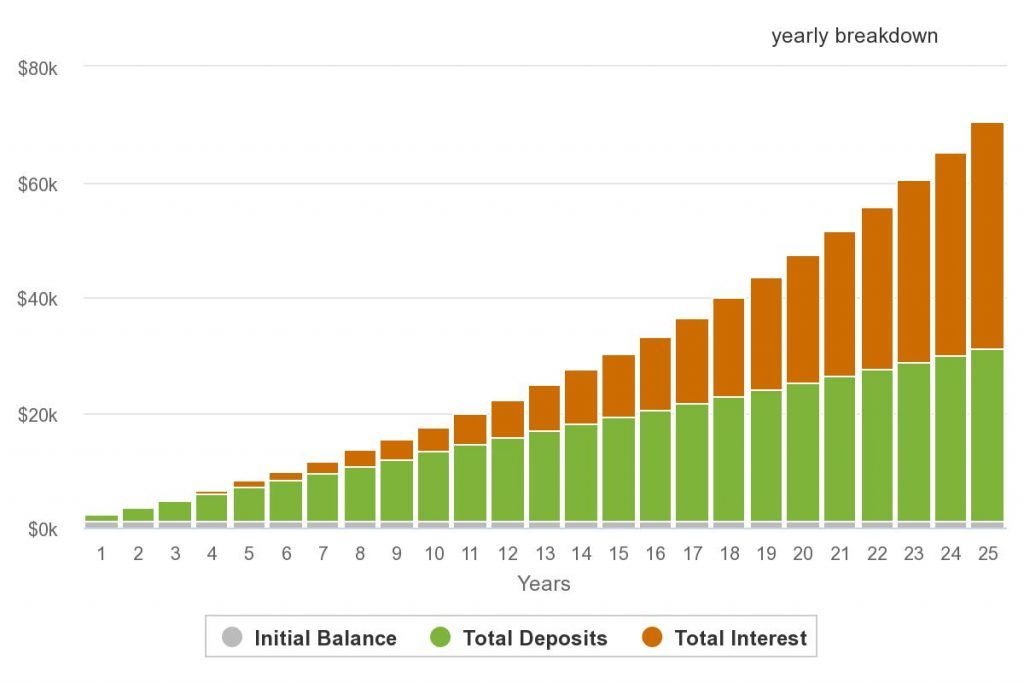

I arrived to this decision thanks to the Compound Interest Calculator. Who knew that a simple RM100/month contributions can translate into approx. RM70K in the same period of time, more than doubling the initial savings.

Having said that, when I saw the promotions that TIME was organising with special discounted package of RM109/month for 300MBPS, I'm tempted to sign up (I still am). Too bad the offer expired and they don't seem to provide it anymore due to the extremely limited quantity.

The Emergency Jar grew approximately 3% this month through my usual contributions using all the extra funds I have, after deducting fixed monthly budget (incl. fixed investments/pay-myself-first).

Gotta take quite some time before I hit my 12-months Emergency fund target. If you are wondering why I have decided to go to the extreme of 12-months Emergency Fund, feel free to check out my previous month's update with the detailed explanation on the why.

Aside from my typical monthly investments of Dollar-Cost Averaging (DCA) into StashAway, PRS, Luno and Trading212, there are few activities that took place this month.

Took me awhile to decide, but I have finally completed deploying my withdrawn i-Sinar funds in July with the last bits split into Global Cord Blood Corporation (NYSE:CO) and also iShares Gold Trust (NYSE:IAU). I decided to buy Gold as an additional hedging layer for my overall portfolio - as this was executed before the StashAway rebalancing.

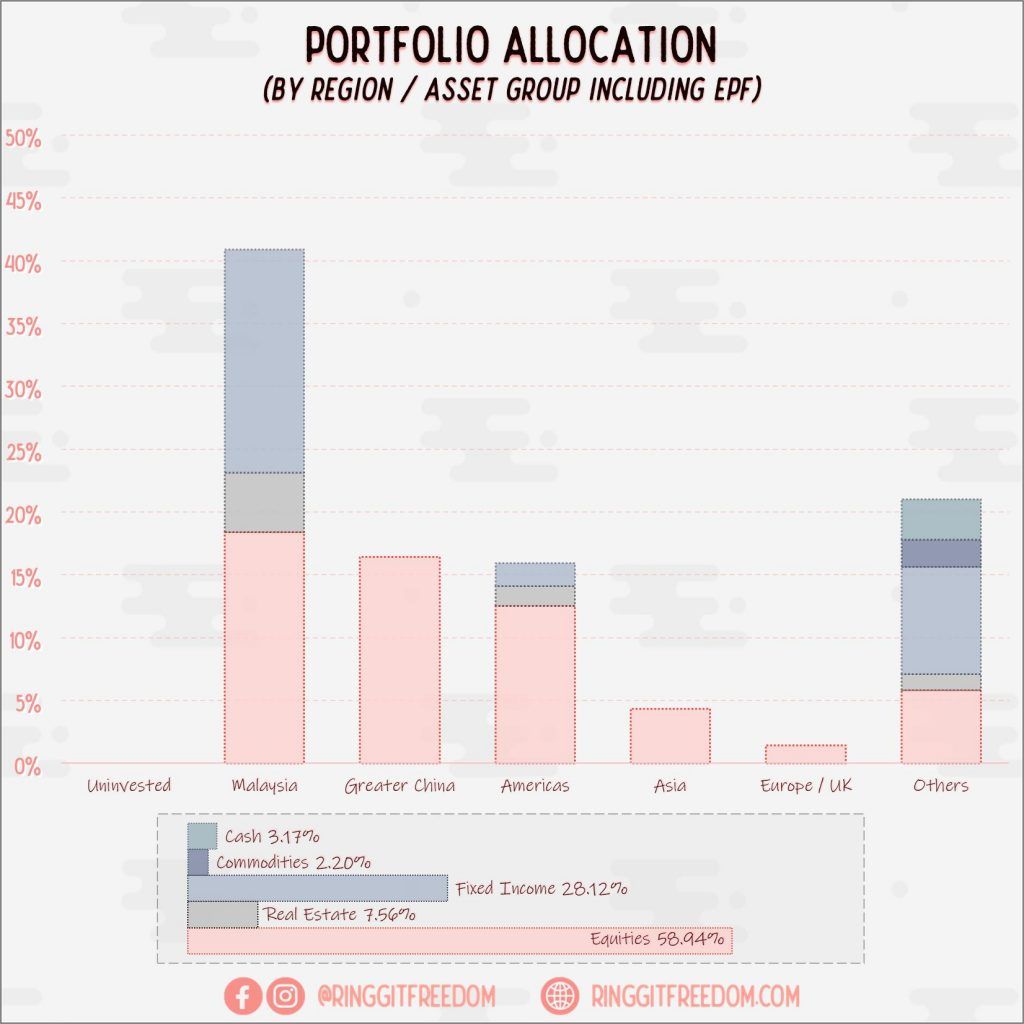

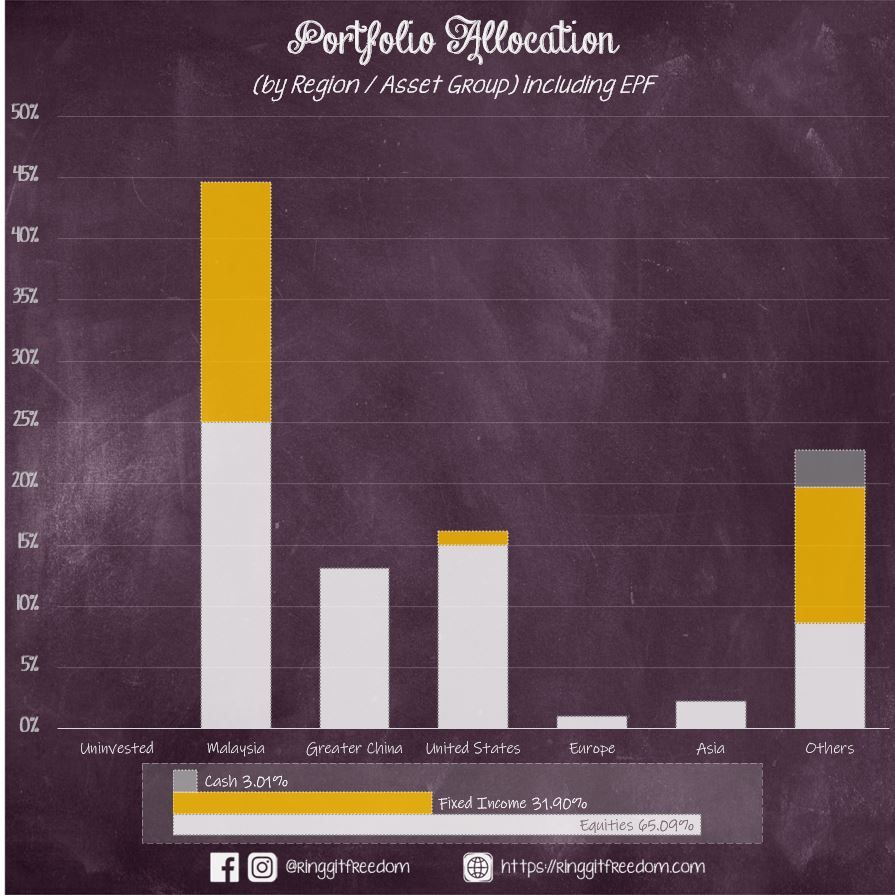

With StashAway's latest portfolio re-optimisation, my portfolio went from China-underweight to a US-underweight, though the differences contributed by StashAway is only +/- 2% here. It was just unfortunate that the China Education Sector crackdown happened immediately after the portfolio re-optimisation - and many are crying about it in forums, StashAway FB Groups, etc.

I can kind of understand where the fuss is, especially since the KWEB ETF has allocation up to 20% in some of the higher-risk StashAway profiles. The price went from $60 during optimisation to below $48 over a few days, resulting in -20% paper loss (or more, for new StashAway joiners). The crash literally wiped up the entire KWEB gains I've had the past few years - but I believe there are still merits of investing in China as they are poised to be the second largest economy in the world.

For those interested in the StashAway's rationale of running the re-optimisation, check out this detailed write up by Freddy Lim, CIO of StashAway.

Thanks to the crash, I was able to deploy the deploy the HKD dividends I have received last month, buying into the dips of Global X MSCI China ETF (HKEX:3040) again though not at the lowest point.

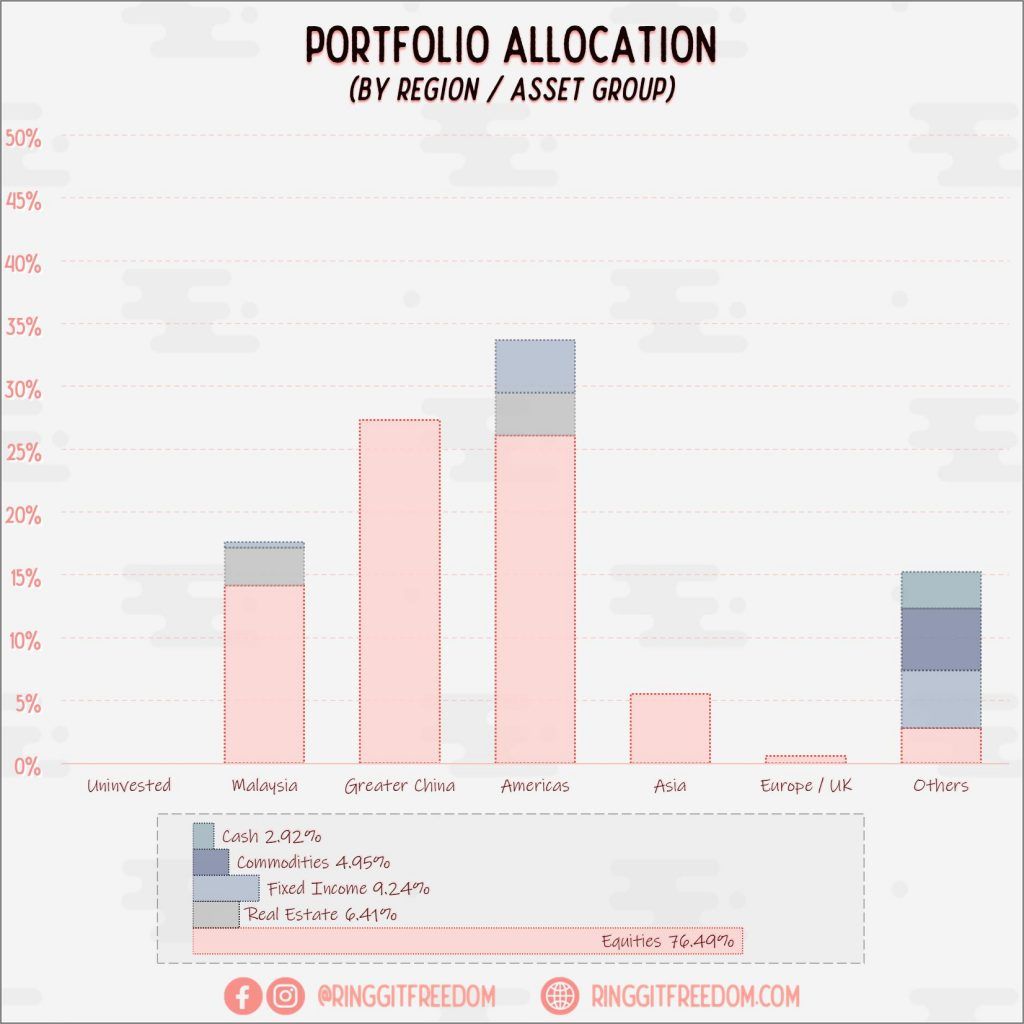

At this juncture I decided not to pump in additional funds from my personal capital, as we may not know whether if this is a falling knife or if things will get better in the short term. Long term wise, I'm definitely still holding onto China as part of my 25-25-25 strategy between Malaysia (well, thanks EPF), Greater China, and Americas.

I've made my 2nd contributions leveraging my EPF Funds through their i-Invest facility - which I will revisit every 6+/- months for an purchase opportunity. Similar to previous rounds, I kept my EPF portfolios (EPF Core Conventional, Stashaway EPF Redirection, and EPF i-Invest Facility) unpublished at this juncture as to avoid blurring my personal portfolios or jacking up my invested amount (since EPF is not something within my control) - though I still report it as part of my Net Worth.

I employ Value-Averaging strategy here where my subsequent purchase aims to re-balance the respective fund's portfolio value. Let's see how this approach go in 2-4 years time and if it is still continually beating EPF's performance (target = 6%), then the i-Invest strategy will be part of my permanent long-term investment strategy to diversify out from Malaysia.

If you are interested, check out my thoughts process before deciding on diversifying through i-Invest into Unit Trust funds. I'm definitely not a fans of Unit Trust due to their fees (up to 2% per annum) and thus whenever possible, I opt for direct ETF purchases. Unfortunately at this juncture EPF i-Invest does not support international or local ETF Funds so we're stuck with either EPF Conventional or diversify through i-Invest facility.

All in all, after all the re-balancing and top-up activities happening in July, my China and US exposures are now on par, factoring in EPF's contribution (and i-Invest diversification). Now I just need to work towards pumping into China / US bits by bits in the coming quarters to achieve my target balance.

Note: For July's chart I further broke down the Commodities and Real Estate funds, which was previously parked under Fixed Income (for Commodities) and Equities (for Real Estate) respectively.

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 4.41%

ROI: 7.70%

Profit/Loss: RM2,940.14

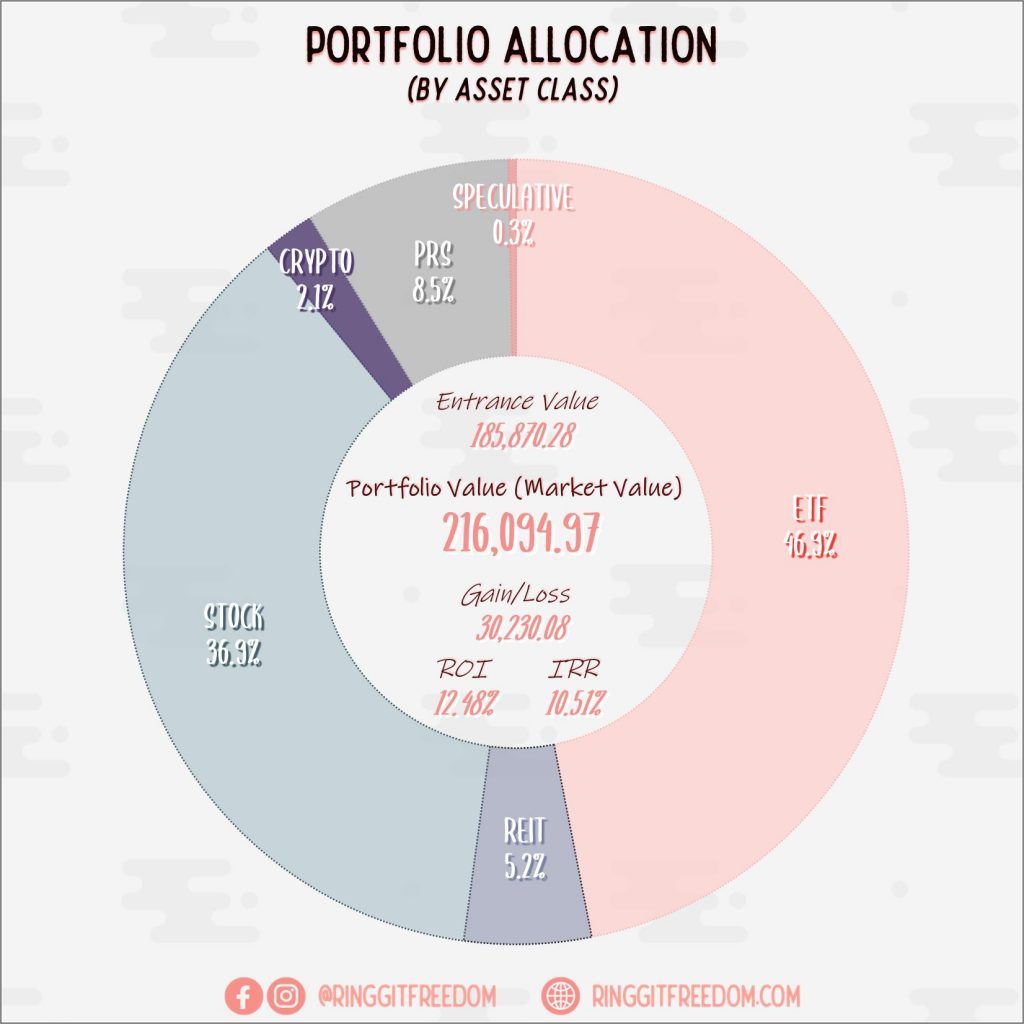

Active (Invested) Portfolio

IRR: 12.67%

ROI: 13.14%

Profit/Loss: RM26,794.34

True Cost: RM203,731.27

Total Value: RM230,711.99

Entrance Value: RM186,039.44

Portfolio Value: RM215,808.63

Nett Dividend (2021): RM3,405.86

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie