I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

Things at work have definitely improved compared to the last few quarters. Whilst there'll never be a single day that are completely peaceful (at least not in our company) - but at least it's not as chaotic as before, allowing us to regain some of our headspaces.

If there's a small win that I want to celebrate recently, it'll be the 1st year anniversary of my Korean Learning journey - something that started very impromptuly due to IU concerts back in 2024.

At this stage, I am only putting in the minimum required efforts to keep the learning alive (2 to 4 hours per week) - it is good enough for now since I have no intention to further my educations or move to Korea. Just wanted to have enough basics to survive when I watch Korean Dramas - or when I travel. Speaking of travel, I've finally pulled the trigger (booked everything pretty last minute, too) for a 3-weeks solo trip in Korea, something that I've been wanting to do for a few years now but put away for whatever reasons.

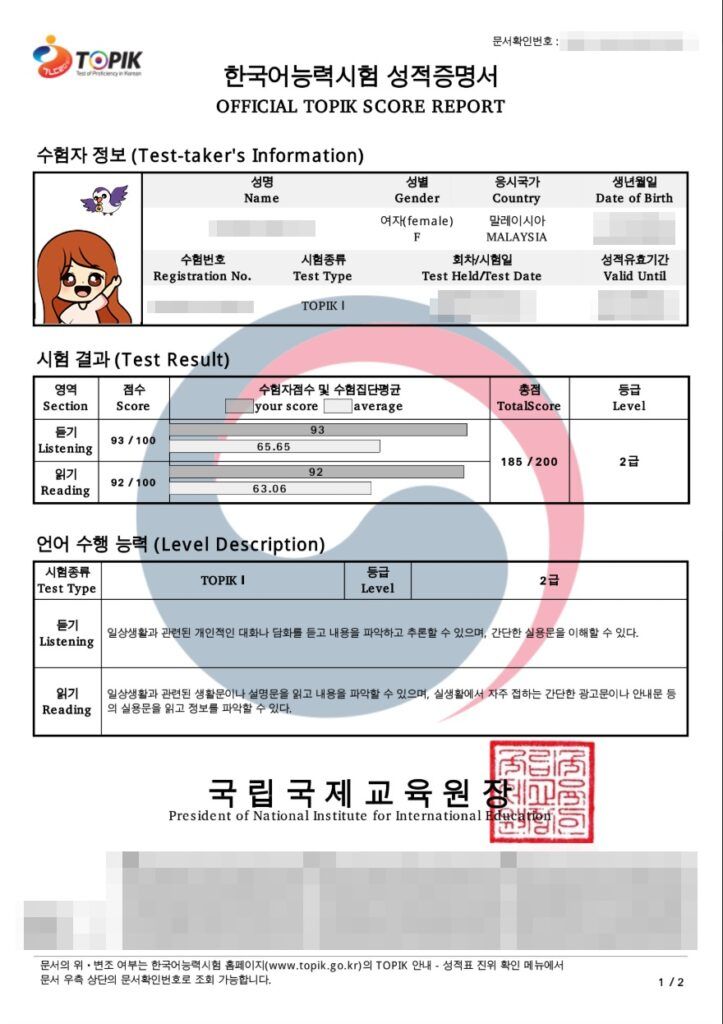

I was supposed to only go for the trip - AFTER receiving my TOPIK examination results to ensure that I've at least passed (as a reward for myself) but heck, might as well just go. Anyways, I sat for the 99th Malaysia TOPIK Exam back in April and surprisingly the exam were easier than anticipated - probably because I did quite some past year papers and also only took the TOPIK 1 examination which consists of Listening & Reading test components - without the dreaded Writing component (that I hated the most, ironically, as a blogger).

Halfway through my solo-trip holidays (not checking emails and all, obviously), my sister sent me a text to check my TOPIK results (which I couldn't without a laptop as they blocks all type of mobile/tablet devices, including "Desktop Mode" browsers 🫠). With her help, I received the good news below and continued on with my holidays 😛

Equipped with my broken Hangeul skill this time around, and also the ability to read Hangeul characters (not necessary knowing the meaning but helpful enough to take an educated guess 😂), I can definitely feel the improvements in Quality of Life for this trip as compared to all my previous Korea trips.

In the past, I had to use Papago for literally every social or non social situation but this time around, I only had to take it out very occasionally - mainly to check and make sure that I'm conveying the right message or constructing the correct sentences especially during stressful situations. But mainly it's to prepare the conversation "in my head" before it actually takes place to reduce the stress of doing live translation in my head during real conversations.

Whatever you do in Korea, forget about Google's suite as their app are pretty much lacking in South Korea. Personally I find Google Translate behaves oddly for Korean/Chinese/Japanese translations compared to Papago. Even Naver Map (or any other option like KakaoMap / T-Map really...) outperforms Google Map.

눈 깜짝할 사이에 한국어를 배운 지 일년이 됐어요!

한국어를 아직 잘 못하지만 조금 이해할 수 있어요.

한국에서 3주 여행동안 간단한 대화를 한국어로 했어요~

I still have thousands of photos unorganized and I'm also thinking if I should post them - on which Instagram account, or just leave it in my memory card/Google Photos... let's see when I have the mood to do it. Or should I just write a blogpost about the 3 weeks' trip, maybe with some financial breakdown? I don't know yet. Anyway, passing TOPIK examination wasn't the biggest win I had for Q2 of 2025. There's an even bigger win that came out of nowhere against all odds - and much earlier than anticipated too.

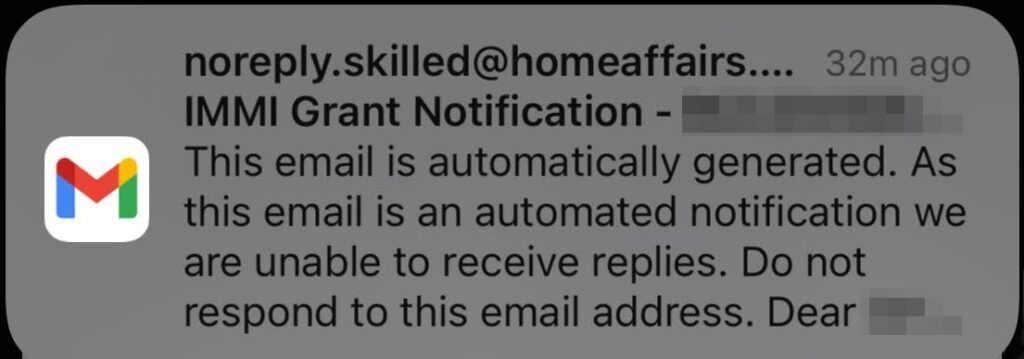

One of my biggest wins for this quarter, perhaps, is successfully securing my Permanent Residency from Australian Immigration Office since starting this journey almost two years ago in 2023. Imagine swiping down the Notification Centre and sees an email coming from [email protected] as someone whom are in midst of Visa Applications.

I went through all types of emotions in that split second - shocked, scared, denial, surprised, happy, crying, ... - you name it.

Quite frankly, I wasn't expecting the grant to happen so soon and was mentally prepared to gruellingly wait for another 12 months due to the delayed processing times. On one hand, I'm definitely grateful to finally stop living in an anxious state of waiting, but it came with some downsides too.

Whilst I've been mentally preparing myself to eventually quit my job just to physically move myself down south - facing the reality had proven to be much trickier when trying to balance it from different aspects of financial, career, and personal growth at the same time. Decisions would've been much easier if I was lacking in some (or all) of these aspects - as moving there will guarantee me a better life for sure. At my current stage in life, it'll probably be at least 2-3 steps back (or 4-7 years of setback using time as a measure) if I take that decision now.

Nevertheless - I'll eventually have to make decision one way or the another by end of the year as I'm not planning to give up my hard-earned Permanent Residency right after obtaining it. Will see what would be the best course of actions for me - not just from career/financial perspectives but more importantly my personal growth/desires. Meanwhile - I'll just continue to negotiate and find pathways whether with my current Employer or my future Employers, where ever life decides to take me to. Fingers crossed 🤞🏻.

Now, going back to our usual monthly update for my finances and portfolios.

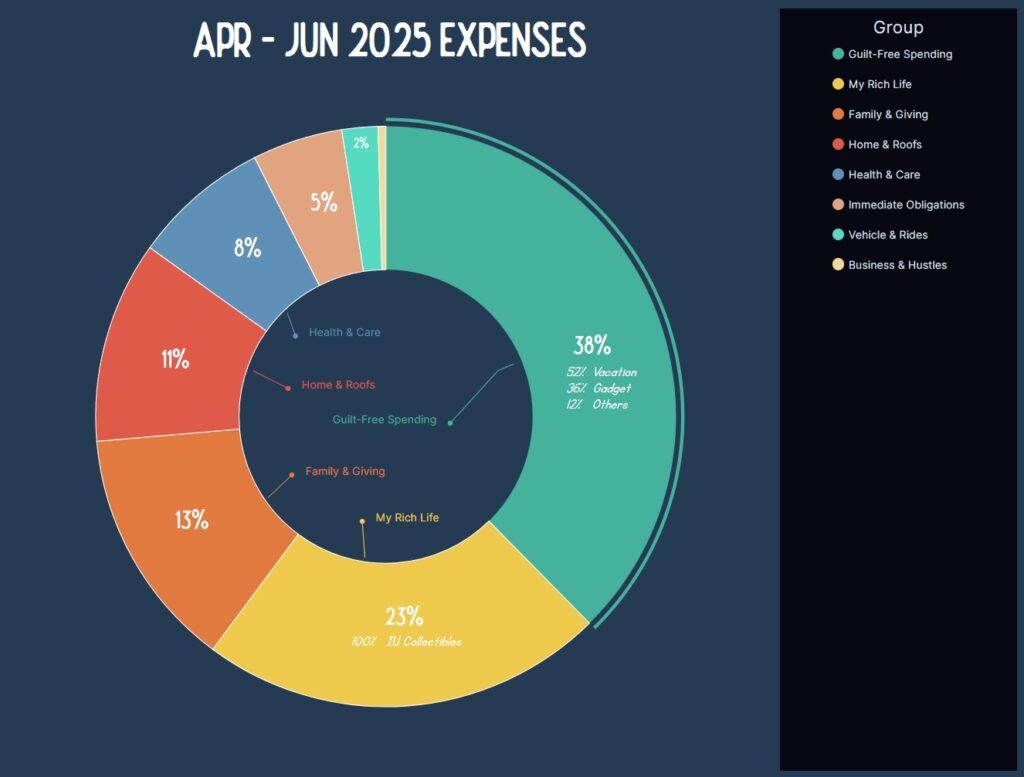

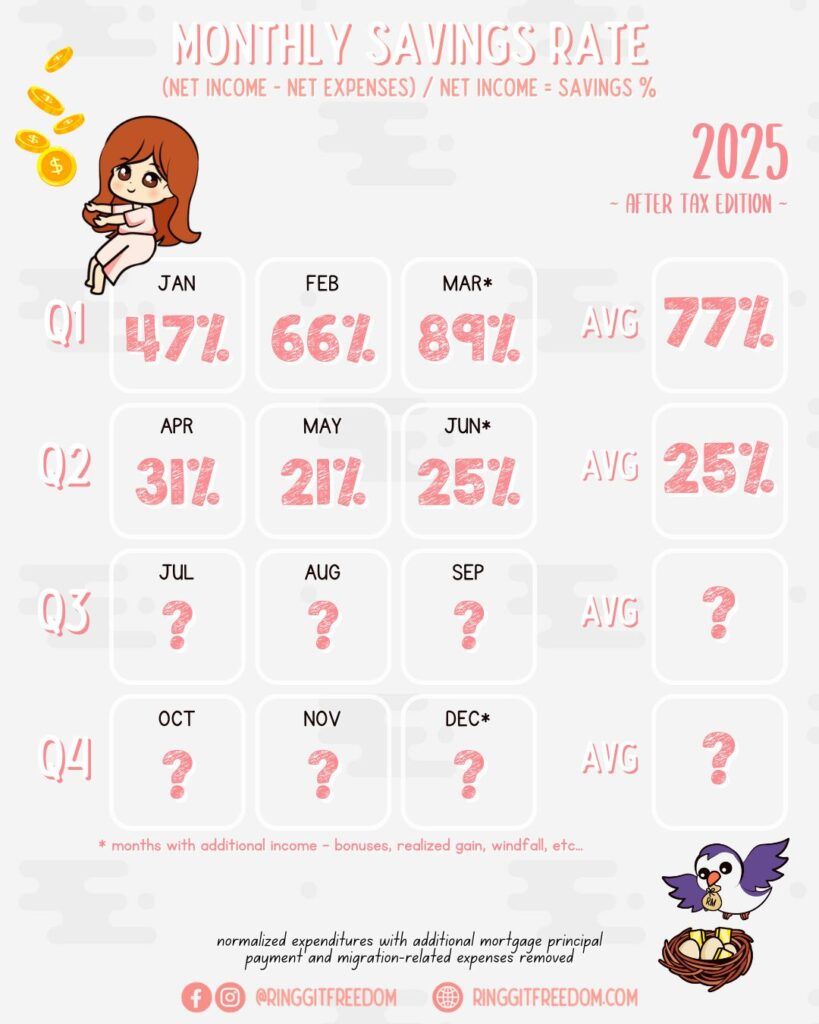

Whilst I've started my Quarter 1 strong, with solid savings rate and minimal leisure spendings, Quarter 2 is where I lost it all. I've pretty much lost my control with unbudgeted impulse purchases since before my Korea trip - with random gadget purchases to souvenir purchases during holiday and now even starting my own little (or massive?) collection of my idol's albums... guess who.

Part of me suspect that this is basically my subconscious acting up, where deep down inside I'm worried about eventually "losing" my current well-paid job should I pursue further on my migration pathways etc. - especially considering the higher tax rate and cost of living in Oz. I even checked against ChatGPT/Deepseek to explain my recent behaviours - and seems like it's a real possibility that I am lapsing exactly due to this. Not a good news for sure.

Whilst it's good that I hasn't gone into a debt yet with the recent impulsive purchase, if this goes on for just another month, I probably would start flowing into the negatives. I will have to take back control of my own finances - otherwise the efforts I put in the last 5 years would just go down into drain - just like that. Good thing is, the financial part of my had been awakened and have been calling out my impulsive behaviours whenever it happens - hopefully the situation will turnaround in my next quarter's updates.

On a completely unrelated note - here's one of my random discovery of IU's early days OST song that she sang before getting famous. Never knew how I've never stumbled into this beautiful piece throughout the last decade, no thanks to YouTube algorithm - for both hiding it from me during the entire last decade, and also randomly appearing in my feed recently.

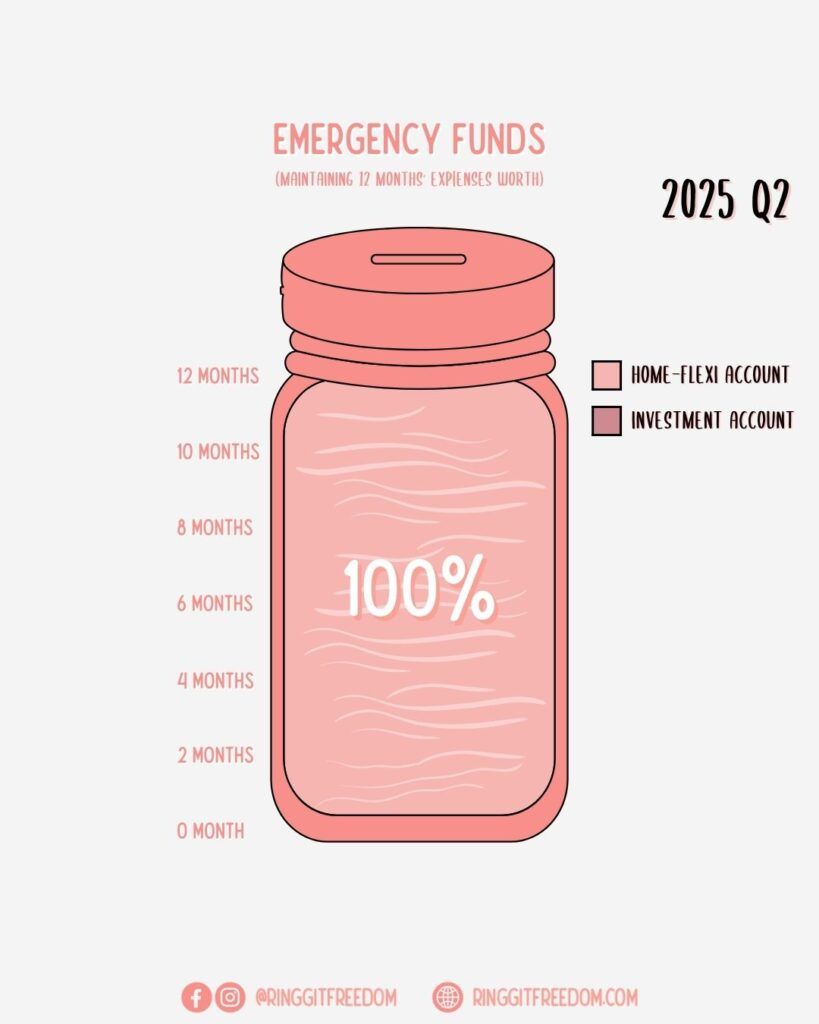

No changes to the Emergency Jar this quarter.

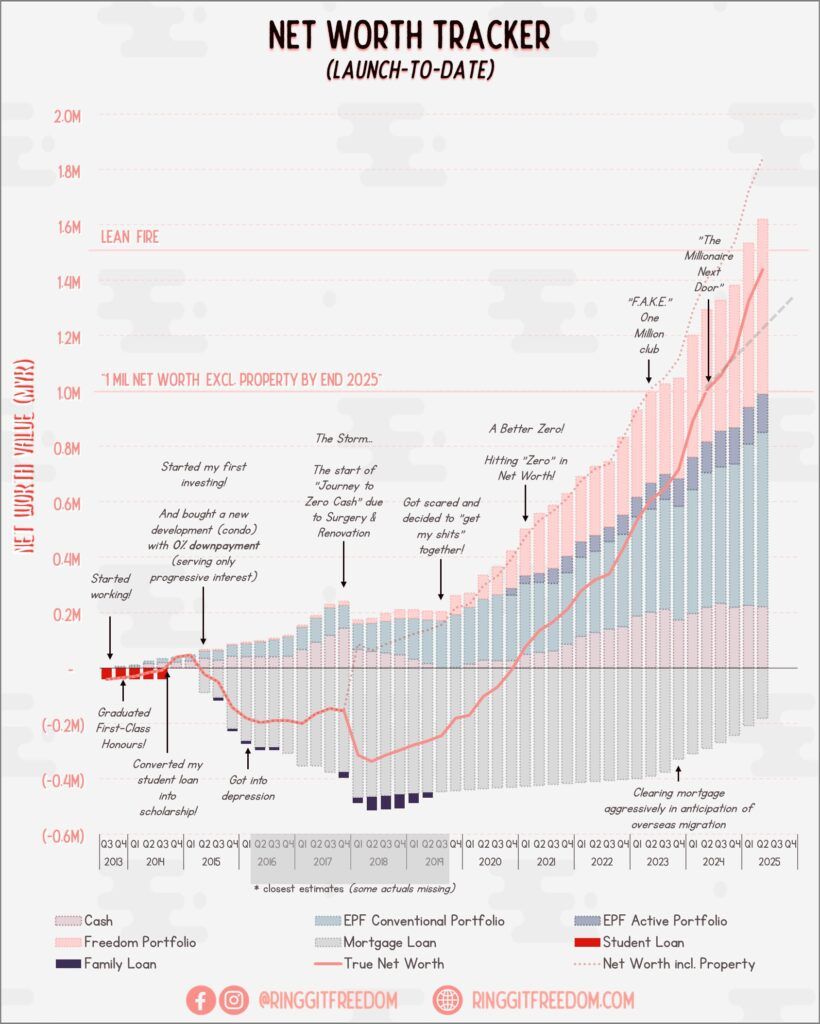

If you look at my charts above - you'll notice that I've basically turned a blind eye to whatever that's happening in the market. The last time I've updated my own excel portfolio tracker was like what, 2nd week of April? And zooooom, we're on the last week of June already.

Whether if Trump does something, or countries go into war, or random missiles exchange taking place across the globe - I basically did almost nothing to my portfolio. The quarterly (for cost transfer efficiency reasons) DCA continued to take place into my VWRA funds through my Interactive Brokers account.

Of course - market's also extremely hyped up at this moment with S&P500 again breaking its record high continuously so we're seeing a huge paper profit at the moment.

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 0.37%

ROI: 0.51%

Profit/Loss: RM 1,828.88

Active (Invested) Portfolio

IRR: 16.51%

ROI: 33.72%

Profit/Loss: RM 170,216.74

True Cost: RM 490,471.56

Total Value: RM 674,974.89

Entrance Value: RM 456,642.60

Portfolio Value: RM 630,243.84

Nett Dividend (2025): RM 2,191.06

Despite my rather poor savings rate (disappointed with myself tbh) this quarter, I'm salvaged by the surprisingly good performance in the market. If market continues to rise at this pace, I'll probably be hitting my Lean FIRE target earlier than initially anticipated. Only time will tell where our net worth will stand by end of 2025.

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie