I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

Nothing much happened this month as I've been really busy at work in March. Wrote less articles and instagram posts than I initially planned to with the constant juggle ?

Whilst the country have lifted the Movement Control Order (MCO) into Conditional MCO (CMCO), I'm grateful to still be working from home hence limiting my time outdoor to only my weekly/bi-weekly grocery trips and this remains the primary factor in accelerating my savings rate.

Managed to hit 77% savings rate this month thanks to several windfalls, including tax refund. p/s don't forget to submit your tax YA2020!

This have been the highest savings rate I've seen myself, and also the highest quarterly average at 67%, beating the previous record of 49% in 2020 Q1 ?

A significant chunk of the savings this month goes straight into the Emergency Jar towards my 6-months expense goal. Once that goal is hit, I'll probably continue to inject it into my personal portfolio (or to further extend my emergency jar from 6 to 9 months... let's see!).

Though the savings rate is high, this is also the month where I allow myself to allocate up to 10% of my windfall for my own spending rather than fully investing/emergency jar, and I decided to inject it into my dental sinking fund.

This sinking fund is for my future spendings, as one of the big item coming soon to get my dental braces and it'll definitely hit my savings rate when the cost actualises. I'm still looking for options at this stage, but I'm leaning heavily towards self-litigating Damon braces to shorten treatment time. Feel free to PM me to share your experiences! I'm really afraid of dentist for some odd reason.

No special activities this month as I did not do any trades, except for my scheduled DCA onto my StashAway, PRS, Luno and Trading212. There was a few downturns in March but I didn't really top-up as the focus was on my Emergency Jar.

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 4.13%

ROI: 7.35%

Profit/Loss: RM2,592.82

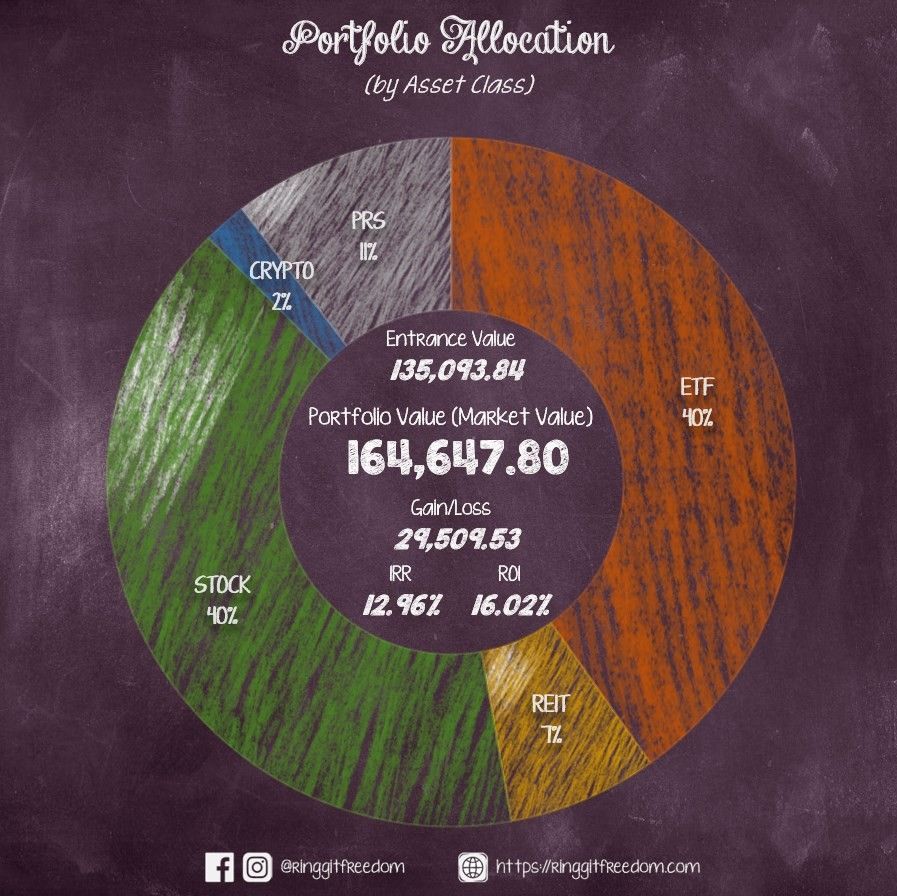

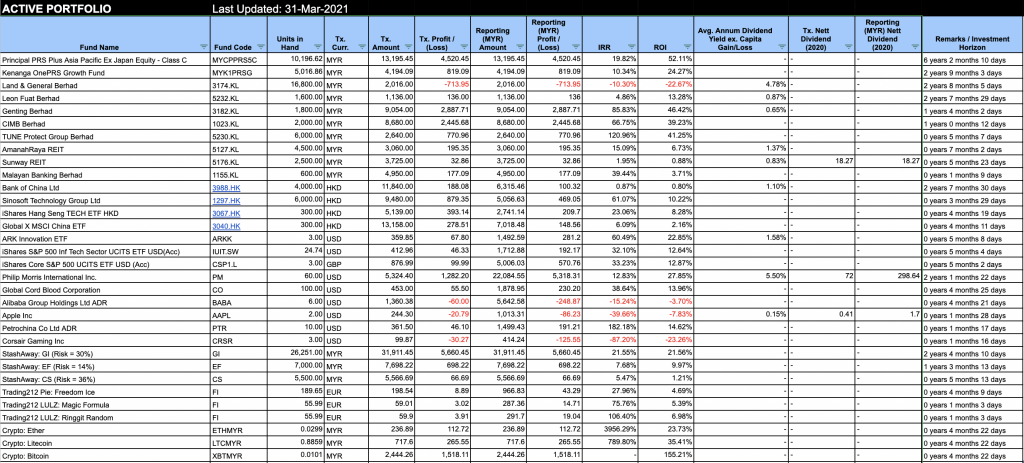

Active (Invested) Portfolio

IRR: 12.96%

ROI: 16.02%

Profit/Loss: RM29,509.53

True Cost: RM148,566.84

Total Value: RM175,490.99

Entrance Value: RM135,093.84

Portfolio Value: RM164,647.80

Nett Dividend (2021): RM316.91

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie