I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

Most of you might have noticed by now - the frequency of my blog posts are getting lesser and lesser. There are two main reasons for this - firstly because of the works I have, and with the recently increased scope of work which has been mentally draining for me, resulting in longer "recharge time" needed during off-work days.

And maybe as an (indirect) result, my mental state has deteriorated even further. Frankly, this isn't new to me as well as it has been going on since maybe the start of 2020 and I've been hanging on ever since - just living my life and surviving.

I have tried to speak with (few) people that I trust, but given my personality, it's very hard for me to open up to others. And even when I finally open up, people usually tend to jump into solutions or advice like telling me to move on/ignore/don't care/etc. when all I needed is just a pair of ears and someone who truly hear me out and acknowledge my problems, rather than giving me solutions.

Due to these various factors, I've been feeling very lifeless and have been very demotivated to get anything done other than my standard working, saving and investing. I feel like a part of me is missing and are clueless of my life goals moving forward ?

I'm sorry that I am not posting as regularly as I should - but what I'll do for sure is to keep up with these monthly updates, as this is the minimum that I could do at this juncture. Maybe a few other non-financial posts just to blog and rant my thoughts rather than suffering in silence...

Sorry for the rants and let us now get back to the main course of the updates on my finances and portfolios!

During mid-April, my company finally decided to return 25% of the workforces (once weekly) to the office which also means that I needed to restart budgeting for some of the categories which I have been neglecting - such as meals/transportation/mobile data. The impact isn't much yet in April though, since it was only half a month and maybe things will change again considering the worsening COVID-19 situation (again!) in Malaysia.

As briefly explained in my intro, I have been feeling quite stressed and part of my negative sides is coming back as a result - and this has caused me to spend impulsively just for that temporary satisfaction and I think I have spent half of my yearly clothing budget within a month ?. Thankfully this did not cause significant dents to my finances since the monies are cut and sponsored from other categories.

A significant portion of the spending this month actually went to my medical bills for my bi-annual full body checkup which I have been skipping for 1-2 years now, delayed again and again by COVID-19. I've also spent quite some amounts for my long-term medications, which again most of these budgets are coming from the medical sinking fund that I have been contributing on a monthly basis. Portions of the medical checkup are also sponsored by the Company so I was able to offset a bit there.

With all these considered, I'm thankful that I can still achieve 45% savings rate although it have dropped compared to prior months and will likely to continue if office resumption goes on. I'm still maintaining my contributions to my Emergency Jar and it should hit my 6-months milestone soon. I'll most probably be extending it to 9-months or 12-months upon completion, considering my current personal circumstances.

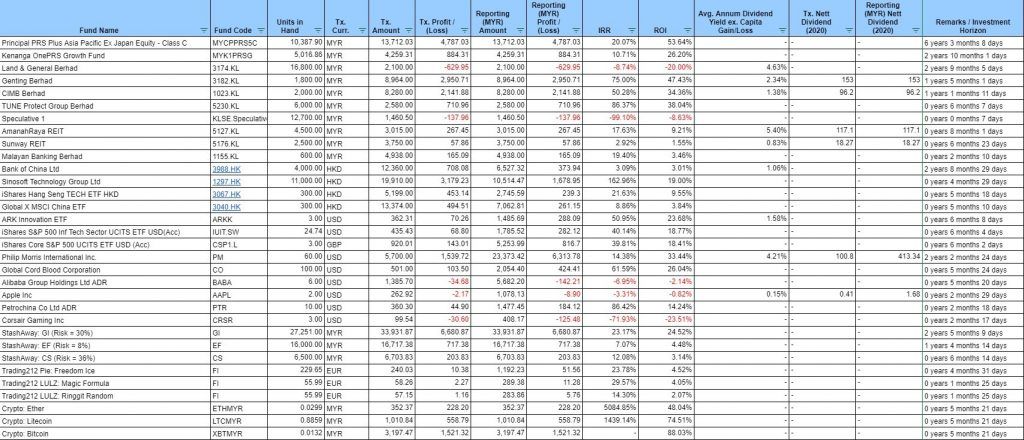

Aside from my typical monthly investments of Dollar-Cost Averaging (DCA) into StashAway, PRS, Luno and Trading212, there are few activities that took place this month.

Since I'm intending to increase the # months of emergency fund that I hold, I've decided to further allocate up to 2 months worth of emergency funds into my StashAway portfolio. But since these monies are my emergency fund which I may need to tap in the future at moments' notice, I've decided to further reduce the volatility by reducing the risk index to 8% until further notice.

I've further topped up my Hong Kong holdings on my 1297.HK SINOSOFT TECH and will be holding them for a while - and they've now become my 2nd highest weightage when it comes to individual stocks ownership.

I've also decided to take profit on one of my long-term holdings - LEONFB, which was one of my first stock pickings when I have begun adventures onto KLSE and used the profit/capitals (<1%) to try out some speculative trades - let's see how things turn out.

I have also received several dividends from Genting, ARREIT, CIMB and PMI amounting to ~RM572.97 for the month of April.

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 4.70%

ROI: 8.60%

Profit/Loss: RM3,141.04

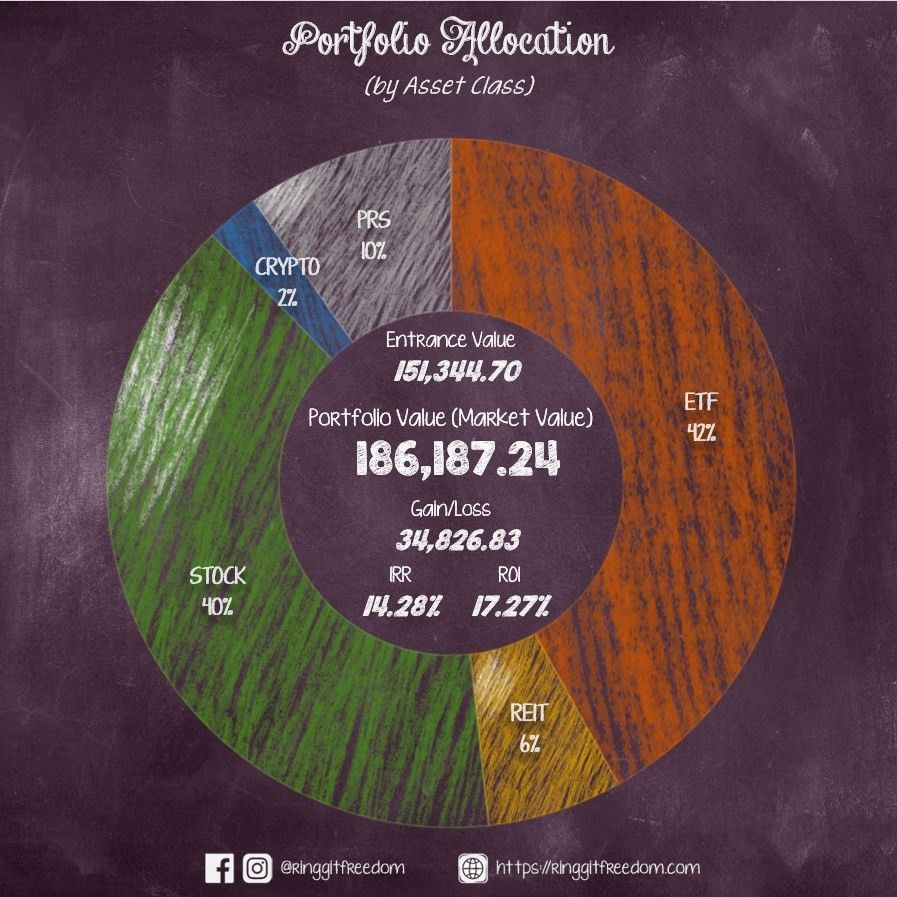

Active (Invested) Portfolio

IRR: 18.93%

ROI: 19.19%

Profit/Loss: RM31,685.79

True Cost: RM165,023.12

Total Value: RM196,788.81

Entrance Value: RM151,344.70

Portfolio Value: RM186,187.24

Nett Dividend (2021): RM799.59

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie