I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

Feels like yesterday that I just wrote my 2024 Year In Review and it's already March 😛 Quite frankly, Q1 2025 was still pretty hectic for me, at least until beginning of March, primarily due to a huge project at work which I'm overseeing.

Nevertheless, I never forgot to took some time off for myself and managed to catch the limited screening of IU Concert: The Winning during the limited screening period worldwide. In a way, it's for me to relive my regrets for not splurging last year when I given the chance to.

Other than that, it was pretty much just work, and/or festive celebrations with feasts here and there. Oh, and not to forget the constant juggle between getting some rest vs. doing Korean Class Homework/Past Year Test Papers vs. leisure gaming time for myself. Ugh, priorities!

P/S To my Muslim readers out there reading this, Selamat Hari Raya Aidilfitri, Maaf Zahir dan Batin.

Now, going back to our usual monthly update for my finances and portfolios.

One quick caveat before we start our financials update - I've decided to simplify stuff a little especially when it comes to expenses & savings rate. In the past, I've always had to run two set of numbers - one 'standard' savings rate and another 'normalised' savings rate throughout year of 2023 & 2024.

The primary reason for this was due to the additional expenditures I've incurred as one-off investment to migrate overseas (immigration related expenses) and acceleration of my mortgage paydown plan (additional principal contributed to paydown mortgage principal faster).

However, since these were ultimately investment towards myself (one way or another) I've decided to take the same blanket treatment - just like how I've always excluded investment-related spendings outside of my Expenses / Savings Rate calculation.

Going forward, just like other investments, I'll be excluding immigration related expenses and additional principal paid to my mortgage from both Expenses & Savings Rate.

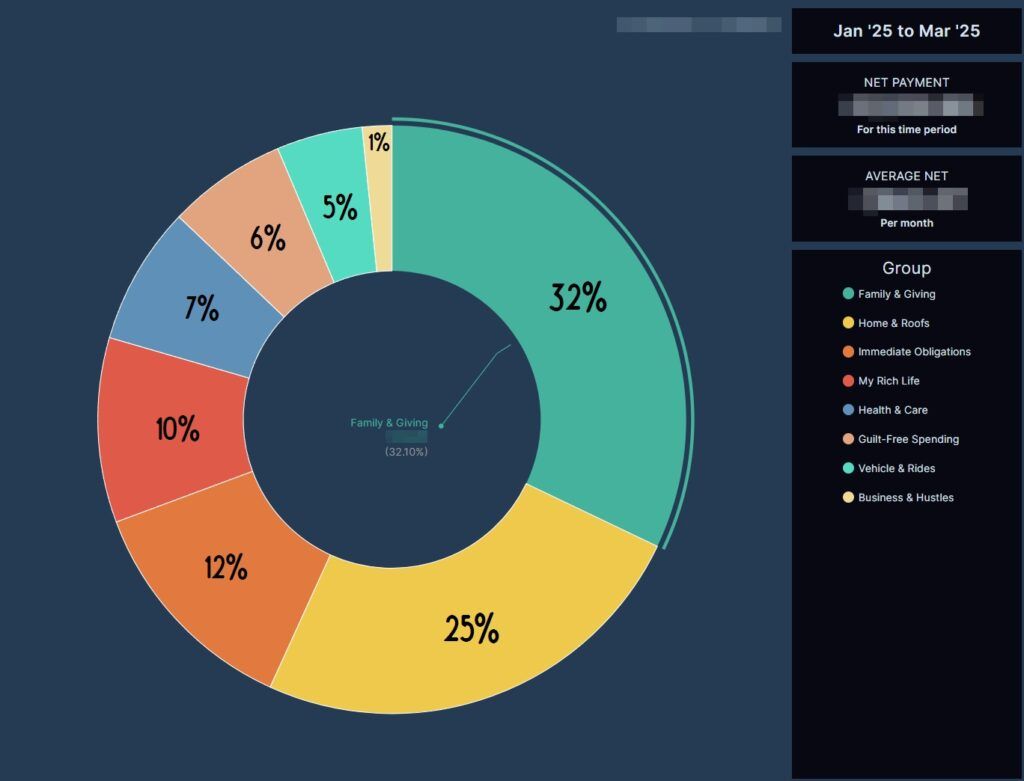

With the additional principal payments removed from the Expenses chart, it's pretty clear that a significant portion of my income goes towards my Family's spending (Allowance, Treats, Insurances, etc.) and of course not to forget the mandatory mortgage payments mandated by bank.

Aside from these two, my other expenditures remains relatively stable (and minuscule) considering my income.

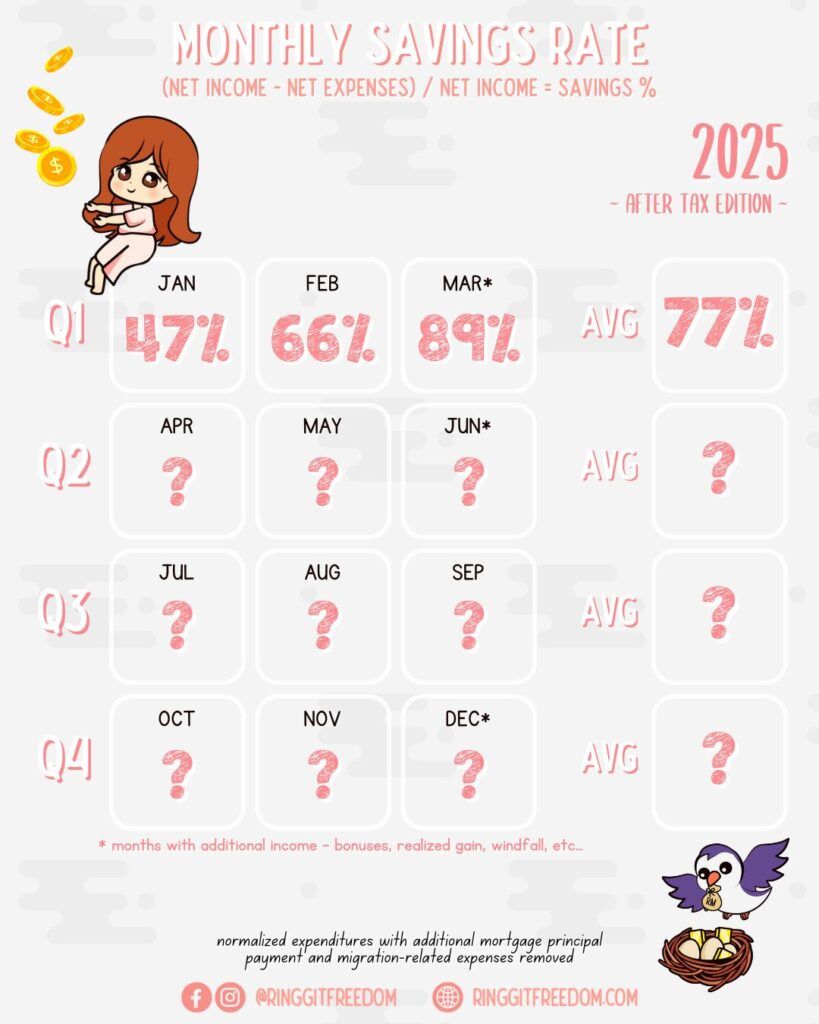

I always enjoyed Quarter 1 of the year - not just for the festive seasons, but also the extra payday from various sources - Tax Refunds, EPF Dividends, or Performance Bonuses from last year. These spikes in income have helped me in last couple of years to accelerate my goals. Of course it goes without saying that majority of these "savings" are promptly invested - whether in forms of additional principal contributions to my mortgage loan or simply funding my Freedom Portfolio.

With these bonuses, we managed to start our Quarter 1 strong with year-to-date Savings Rate of 77%. As long as I keep up my habits for the next 9 months, even if simply by mimicking my last year's savings rate trending, we should be able to hit our target just fine.

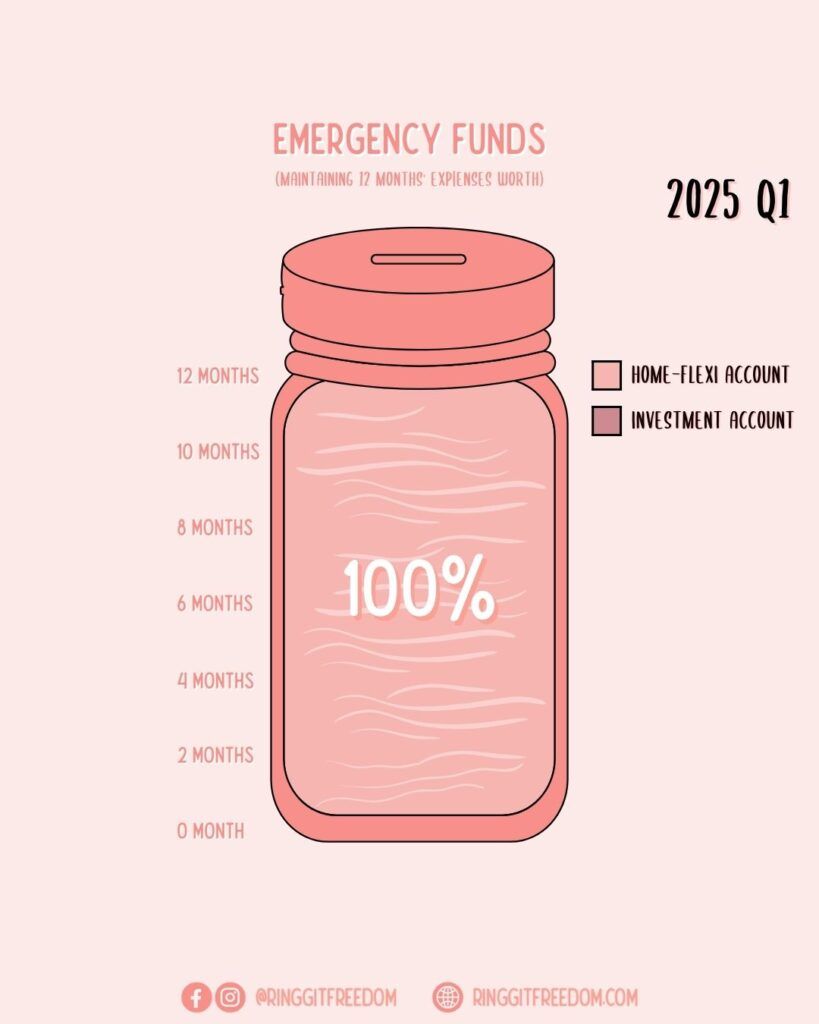

No changes to the Emergency Jar this quarter.

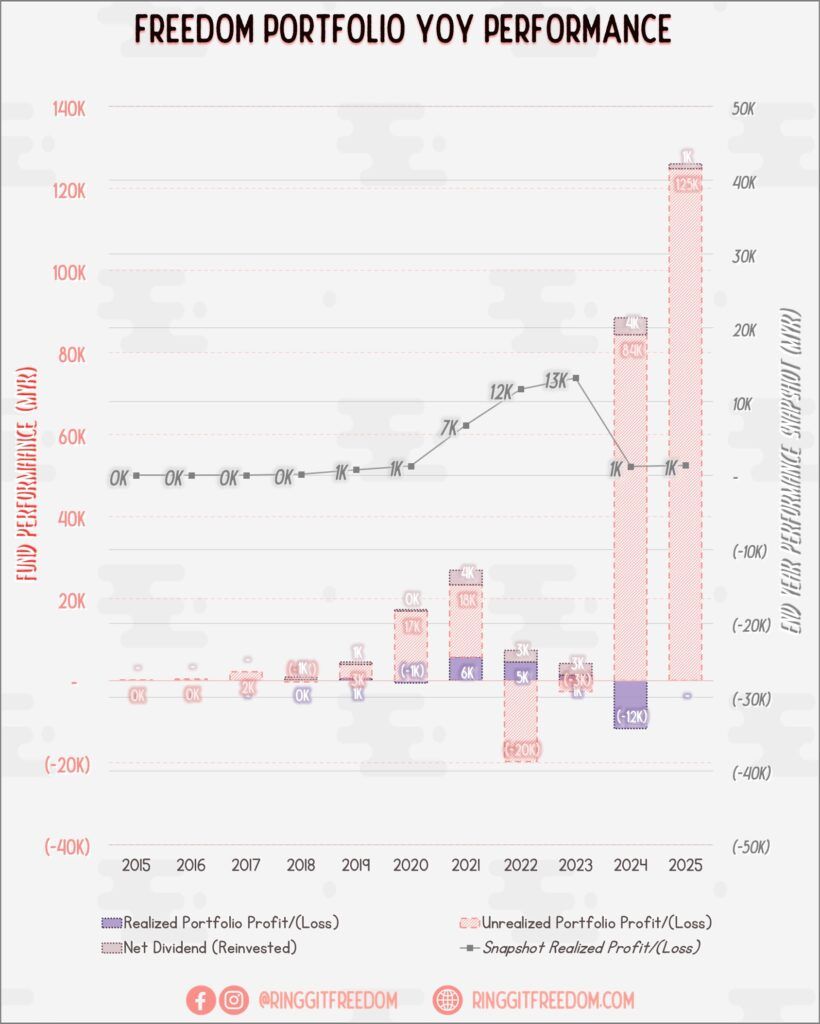

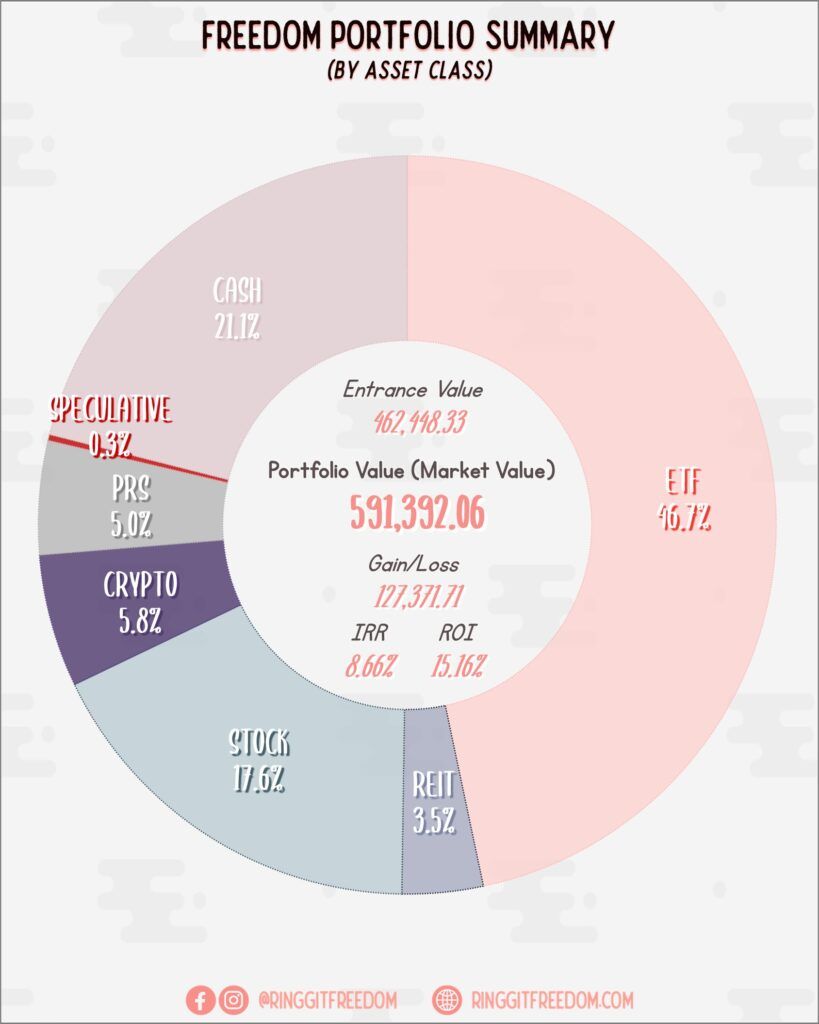

Last 3 months have been crazy ever since Trump took office - with never ending roller coasters' ride for stock market. On one hand, almost everything from SP500 to Gold to Bitcoin was creating new highs, then tumble, rise again and then tumble for a few rounds. Looking at the unrealized gain at this stage - it really really is taking a toll on me to NOT TAKE PROFIT AND CONTINUE HOLDING. Managed to buy some dips during the short Crypto Crash as well (basically undoing my "short" last year 😂)

Knowing that market cycles are cyclical and what goes up will come down (and vice versa), it's so tempting to just take some profits during the all time high so that I can scoop lows when it crashes again. But this definitely is against my investment philosophies, so am doing what I can through sheer willpower to try... not to touch my portfolio 😅😵💫

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 0.26%

ROI: 0.37%

Profit/Loss: RM 1,244.67

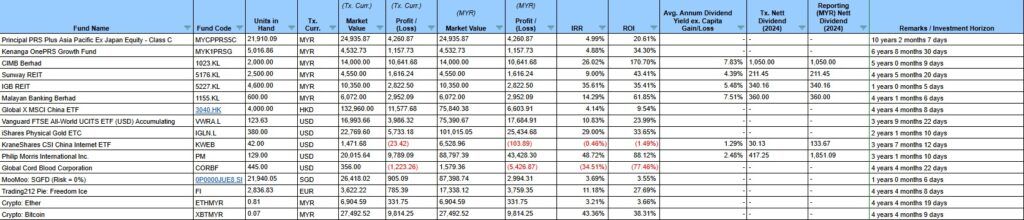

Active (Invested) Portfolio

IRR: 13.77%

ROI: 24.98%

Profit/Loss: RM 127,371.70

True Cost: RM 464,762.81

Total Value: RM 629,623.52

Entrance Value: RM 462,448.33

Portfolio Value: RM 591,392.06

Nett Dividend (2025): RM 1,209.07

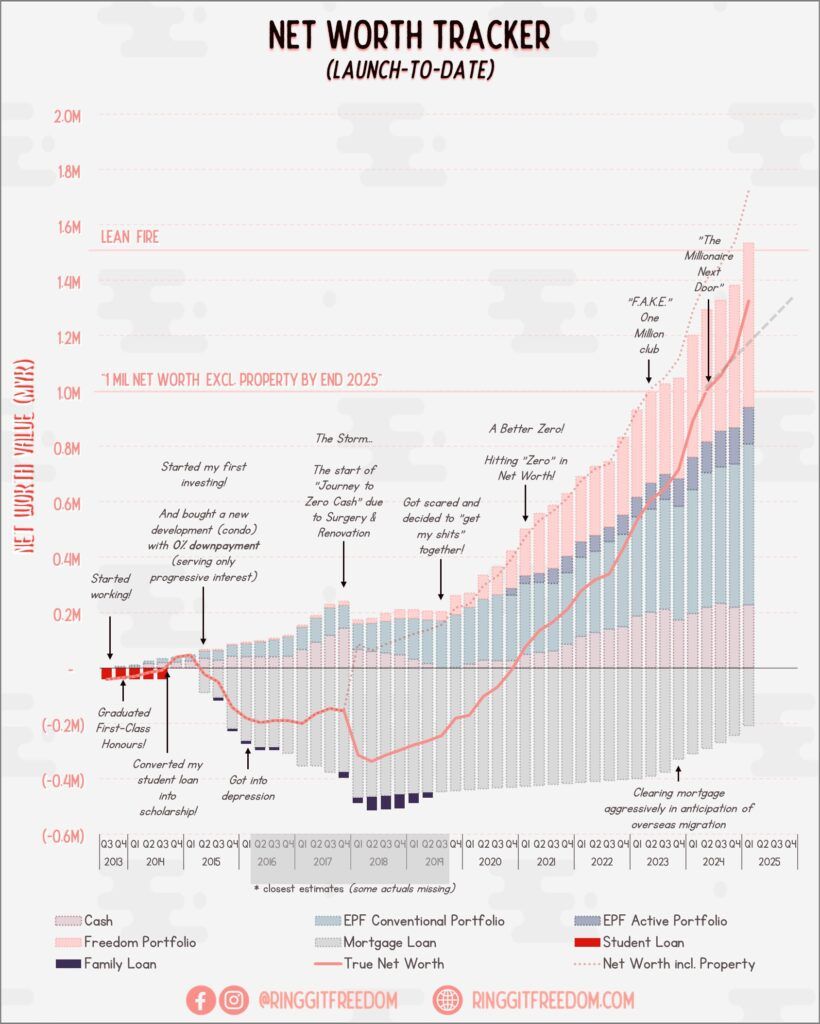

March's spike in Net Worth value always scare me - with various factors contributing to it from EPF's dividend announcement (hence recognition of values), to company's performance bonuses, and of course our not-so-beloved tax refunds. On top of it, we also have new market highs (despite the ongoing crashes) of my unrealised portfolio gains shooting up my net worth by almost 200K.

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for the latest updates!

Cheers,

Gracie