If you have been thinking to invest internationally, but are worried about the upfront capital requirements and prefer an easier/automated way to invest, then StashAway Malaysia might be just for you.

For those of you who have been following my investment journey, you will definitely notice that StashAway contributes a significant portion above 25% of my entire portfolio.

There are few good reasons for this, and today we'll be breaking down on how exactly StashAway have helped me to automate my financial journey. But before we do that, as always, let's at least first understand what and who StashAway Malaysia is about!

StashAway is a Robo-advisory investment firm providing digital wealth services aiming to simplify investing, targeted at retail investors. StashAway was founded back in 2016 and headquartered in Singapore, but their initial product launch only happened almost a year later in July 2017 for Singapore and have since expanded into StashAway Malaysia since November 2018.

With the word "Robo" - most people can't help but think that there is some form of robot / artificial intelligence (AI) involved in making investment decisions to maximise profits for the client. This has to be one of the most common misconceptions people have with StashAway or any Robo-advisors for the matter.

While that may be one of the potential future direction for Robo-advisors to grow, in terms of technology in the distant future, the "Robo"-advisory in today's FinTech has not reached that stage and are mostly limiting its "Robo" use to risk assessment and consumer profiling, relying on consumer's input and a set of rather fixed algorithms.

These algorithms, on behalf of human-advisors, will then come out with some proposals on how much risk appetite the customer should be taking into account their current income, assets, liabilities, investment horizon, and goals.

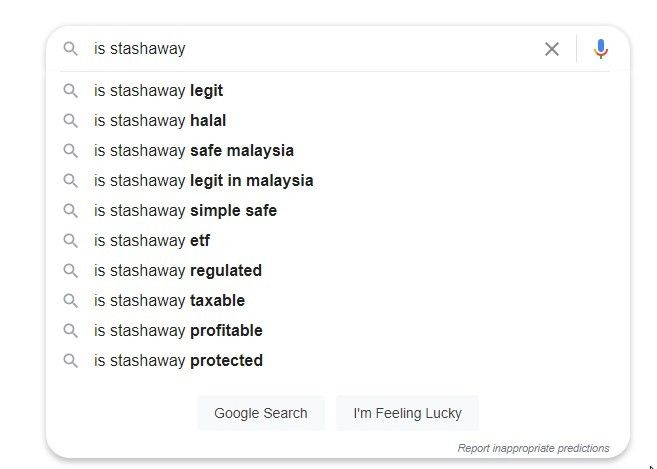

As with any other forms of investment, it will typically involve ones' hard work and savings so it's only natural to worry about the security of our funds - and whether if it is in good hands. Hence it's not surprising to see the below predictions when searching for "is StashAway ...." as the public may be concerned about how safe is their money with StashAway Malaysia.

Fret not, StashAway Malaysia is regulated by our beloved Securities Commission Malaysia, granting StashAway Malaysia with the Capital Market Services License (CMSL) to provide fund management services to us, the retail investors. Just like any other financial institutions, StashAway is subjected to the same compliance, audit or reporting requirements.

Additionally, all of the investment funds that we have deposited will be managed by Pacific Trustees Berhad, in a completely separate account from StashAway's primary account. Even if StashAway ends up winding their business due to various circumstances, our investments will still be safe in the sense that StashAway won't be able to "zhao-lou" (run away, in Cantonese) with our monies.

In layman terms, StashAway only has access to their own finances (e.g. operational profits or expenses) and all investment funds are solely held by Pacific Trustees through their Citibank's trust account or SaxoBank's brokerage account.

The only right that StashAway is to manage the investment funds on our behalf, in accordance with our agreement in the Portfolios we have created. Order execution will be done accordingly through their brokerage (Saxo Bank) - and funds will then move from Pacific Trustees' bank account into the brokerage, with Pacific Trustees named as their beneficiary.

You can read more about StashAway's commitment to security here (for Malaysia) or here (for Singapore).

Now that we know what StashAway is - let's dive into the five reasons why and how StashAway has helped me to automate my investment portfolios.

Passive Investment Strategy is one of the main reason why I like StashAway so much - as they literally simplified my investment journey.

StashAway works by buying into Exchange Traded Funds (ETF), based on their target asset class / geographical allocation in their sophisticated investment framework - the StashAway ERAA® (Economic Regime-based Asset Allocation). The framework proposes a corresponding portfolio based on individual investors' selected risk appetite or goals, focusing on reducing risk exposures whilst maximising returns.

With this, StashAway took out all the needs for me to constantly check and monitor my portfolio, finding out when to buy/sell, or the need to rebalance manually when the asset ratio goes haywire. All I needed to do was to select the corresponding risk appetite or goals that match my profile and do my monthly top-ups a.k.a Dollar Cost Averaging.

Without the need to manage and constantly think/worry about all these, I get to focus on my day-to-day and less on my investment journeys as there isn't much "thinking" that I need to do, except when reviewing my investment strategy holistically (perhaps on a quarterly/half-yearly basis).

Since StashAway invests in a basket of securities through ETFs instead of individual securities, the portfolio will be well-diversified to protect investors from overexposure to any single securities.

StashAway's investment framework (ERAA) allows them to build an all-weather portfolio taking into consideration various economic factors; aside from just doing the traditional allocation such as 60-40 stocks-bond rule. Through diversification, each of these assets will its own target allocation (in %) based on the portfolio's risk index.

If any of the assets drastically rose/dropped due to market movements and resulted in an imbalance portfolio with weights beyond the original target allocation; rebalancing will then take place automatically through their systematic algorithms.

There are two ways rebalancing can happen:-

The rebalancing would ultimately bring the portfolio back to its intended target allocation. These rebalancing activities, however, will only work if the underlying assumptions and target allocation remain unchanged. But what if the economics factor or underlying assumptions have significantly changed (e.g. after March 2020 COVID-19 Crash)?

StashAway also offers portfolio re-optimisation when such an event happens for individual investors to choose to opt-in onto the new target allocation or opt-out and remain with the old target allocation.

This has happened exactly in May 2020 when the team in StashAway decided that, based on their investment framework, to further optimise the portfolio exposures on various sectors/geographical areas.

If you are interested, you can read more on how StashAway approaches rebalancing and re-optimisation here.

For those of you whom are a salaried worker and are eligible to contribute to both EPF / Monthly Tax Deductions - do you usually give much thoughts about the auto deductions for EPF and Tax, or do you leave it as is maybe until tax filing seasons?

Chances are - most of us don't think about it as much. Because these deductions already took place before we get to see or touch the salary. This concept is very powerful and the only reason government does so is to ensure that you pay your tax dues, or forced-saving for your retirements, before spending it all. Imagine applying this to our personal finance journey.

This is where StashAway Direct Debit comes into picture - some absolutely hates it (after their last technical glitch) and some obviously loves it. I'm in the latter category. With direct debit facility offered by StashAway, it allows me to automatically deduct my bank account for fixed contributions immediately upon receiving my salary, or on dates I set it to be.

And after having auto deductions for more than 6 months (sitting at 21 months as of this article), my brain is already accustomed to not having that amount of money and eventually, it became a habit for me to "pay myself first" before spending, without even thinking about it!

The only exception here is where I need to put in some conscious efforts to make sure that I always review my "auto deductions amount" from time to time - to ensure that the deduction amount will always grow in tandem with the rate of inflation/merit increments. This way, I will be sure that I'm always taxing myself based on % of my income rather than a flat amount which may be insufficient in the long run.

For most of us when we first start our investment journey, our capital will typically be smaller - and any amount of fees (especially minimum charges) will eat up a higher % of our investments. Even though my total portfolio has already surpassed the RM100K mark, it can still be very expensive when I invest internationally if I don't pay attention to the fees.

As briefly explained in my previous post on investing internationally, cost efficiency matters especially when our capital is small. This is where StashAway truly shines as they allow us to invest any amount of capital (even if it's just RM10) with a bare minimum to near zero charges.

Just to illustrate the point, for every single "trade" (top-up) that we do, typically on a weekly or monthly basis, StashAway charges only:

Let's not forget the Fund Management Fees charged by StashAway on the total portfolio starting from 0.8% per annum, but this is true even for most if not all of the Unit Trust/Mutual Fund which typically charges at least 1.5% to 2.0% per annum, on top of other upfront load charges.

Of course, we won't be able to compare them apple-to-apple as both employs very different strategy (passively managed vs. actively managed) - but you get the point when it comes to fees, at least.

With StashAway, even if I am only investing a small sum on a monthly basis through direct debit, I do not have to worry about the fees associated, as compared to manually DIY-ing my Stock Picks / ETF purchases through my international brokerage which has a minimum amount for it to be cost efficient.

The frequency of investment/rebalancing, or the amount of diversification becomes an important factor as well - as these would rapidly ramp up the number of trades performed within a year. With StashAway, I can ensure that I can still tap into these factors without incurring additional costs - again due to the minimal fee structure.

If you are interested to further read on this topic, StashAway did a good job on the two articles below:

Last but not least, this is one of my favourites and I really like how StashAway approaches investing in a more personalized manner. Most of us today knows that we need to save for our own future (though not everyone practices it, yet); but not many do so with a clear targeted goal when it comes to savings/investing - and I am definitely guilty for this.

In StashAway, there are two types of portfolios that we can create, with the first being General Investing, followed by Goal-based Investing - as you have probably guessed!

Through Goal-based Investing in StashAway, you would be able to create a targeted savings plan based on your needs, and StashAway would then adapt the investment risk according to your investment horizons. As an example - the risk appetite for Wedding Fund which will be spent within 5 years would be completely different than the risk appetite for Retirement Fund with an investment horizon of 35 years.

Currently, I have 3 portfolios in my StashAway -

I'm thinking to add another goal-based portfolio for my future wedding fund although I'm still single right now ??. Who knows when I'll need to access the fund, better safe than sorry, right!?

While I have been enjoying my journey with StashAway Malaysia automating my investment portfolios thus far - it is not all fluffy puffy without its own flaw.

These issues obviously are not enough to pester me to pull out from StashAway completely - but improving these bits would definitely improve the "satisfaction index", for me at least. Maybe most of these are just me picking bones from the egg...

It might be ironic to see fees listed in both my likes & dislikes, but it is the truth. While it is true that StashAway's fee structure is very competitive and put many of the actively managed unit trust/mutual funds to shame - I personally still find it to be on the high side.

With the assumption that the underlying funds' expense ratio will only cost us approx. ~0.20% to ~0.40% per annum, adding the fund management fee of 0.8% per annum will easily put the total fee between ~1.0% to ~1.4%.

This is only slightly lower than most unit trust/mutual funds with fees ranging from ~1.5% to ~2.5% per annum. Since the funds are passively managed, it would have been awesome if the fund management fee starts from ~0.5% per annum, lowering as the total investment goes up.

But then again StashAway also has a business to run and they're not a charity organisation, I guess there'll always be a trade-off point when it comes to these decisions.

The only reason that holds me back from going into 100% DIY ETFs is the cost efficiency without proper economics of scale. Through DIY ETFs, it is very difficult for me to achieve the economics of scale to make the fees (e.g. FOREX Conversion Fees, FOREX Commissions, Minimum Trading Fees) worthwhile when I make my monthly investment.

Also not to forget the need to diversify into various ETF holdings as well as the rebalancing activities, which will rapidly amplify the cost of investment. At this juncture, my monthly investment amount is simply not worth it to do DIY ETFs, unless when I pump in lump-sums from time to time due to bonuses/windfalls.

One of my frustrating experience is the lead time involved when we invest through StashAway. In typical cases, the amount will only be invested approximately 2-3 days after our initial funding - from the "initial deposit" up to the point when StashAway ultimately "buys" into the underlying assets (ETFs).

While there should not be much of an effect in the long run considering that I typically do my "invest and forget" style, so technically one or two days won't really kill me. Still, it just annoys me at time when I do my monthly/bi-weekly checking to ensure my direct debits are deducted/invested correctly - and find that the amount is still "being processed".

Maybe I just got used to the same-day purchasing experience when it comes to DIY ETFs and it kinda spoilt me a bit. Thinking back, unit trust/mutual funds had the same issue as well (if not longer than 3 days).

This might sound a little hypocritical - but sometimes I do wish that StashAway allows us to play around with some custom portfolios where we can have the freedom to choose the underlying ETFs at our own risk, outside of the EERA Framework.

This way, I get to run some "experiments" with my own custom portfolios whilst having StashAway's standard portfolios as my benchmark - since their portfolio will always leverage ERAA as their guiding principles for StashAway's investment decisions.

But again this defeats the whole mantra of StashAway - to simplify & automate investing. So I don't think StashAway will venture into this area anytime soon. Maybe I just need to find workarounds to do some A/B testing outside of StashAway, perhaps through my Trading212 account ?

That's it for today! I hope that this article helps to provide you with some understanding of what StashAway is about - and also some insights into how I use StashAway as a tool to help to automate my investment journey whilst maximising my cost efficiency.

Is StashAway For You? It really depends. If you're someone like me who prefers to have a laid-back approach when it comes to investing (due to lifestyle, other time commitments, etc.), then it might be just for you as StashAway is really all about the passive-investing approach with the benefits of diversification, rebalancing, re-optimisation, and cost-efficiency already built into their offerings by default.

Having said that, even if we choose to go with StashAway, it is always important to understand how StashAway works and the underlying assets that they actually purchase. Never ever invest blindly and always strive to understand what it is (at least topline) before throwing monies in. Risk exists in all form of investments - especially those that we choose to be ignorant about.

If you would like to sign-up for StashAway, feel free to use my referral link* and get a 50% discount on the fund management fee for the first 6 months up to RM100,000 portfolio size.

As always - thanks for reading and see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie

* sign up with my referral link to get 50% off your management fee for the first 6 months up to RM100,000 portfolio managed! I will get a very small commission for every successful sign-ups - parts of it will go to charity!