I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

And just like that, 2020 is no more and we're now entering into 2021. Time really flies. There'll be two updates for December - with this post focusing more on the typical month-in-review.

I'll be publishing a separate post with a more lengthy year-in-review in coming weeks.

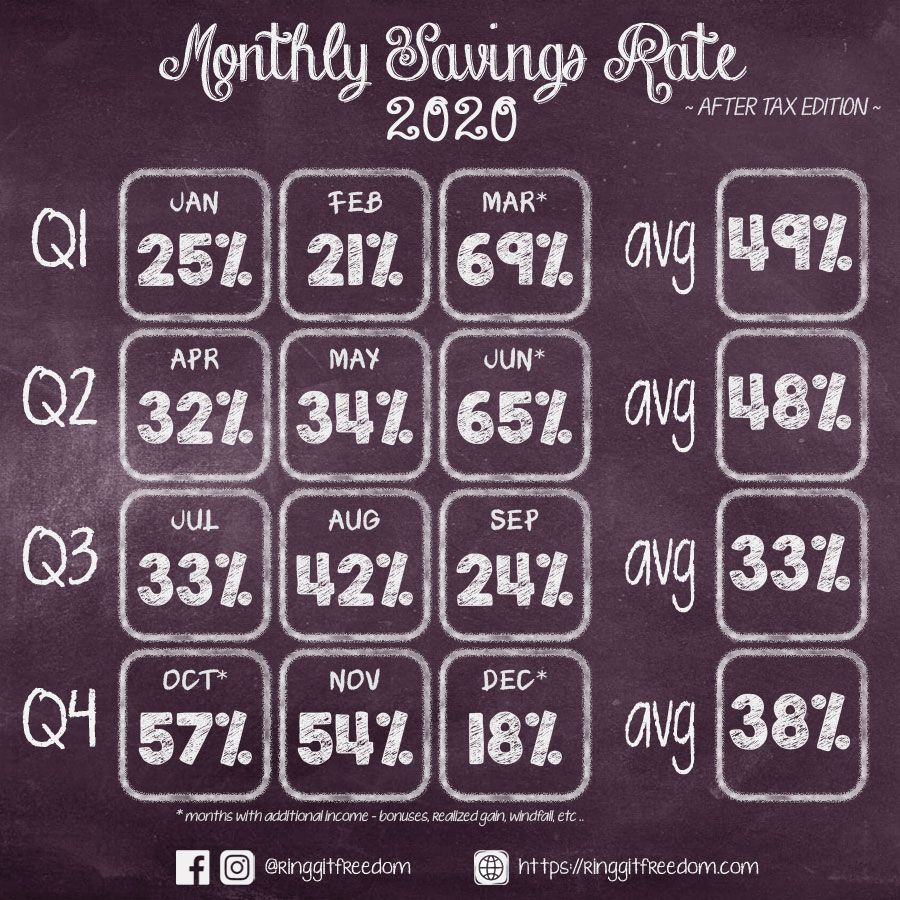

Unlike the past few months, the net savings rate took a hit as the long-awaited strata title for my condominium have finally been issued, and I had to pay more than RM13K after factoring in all the fees inclusive of stamp duties, due diligence checks, legal fees, and reimbursements related to strata title issuance (Perfection of Transfer & Perfection of Charge)

I have been preparing for this expense to come, but completely underestimated the bill - I've put aside a separate ~RM8K for this thinking it should be sufficient to cover the bill - but it was merely enough to cover stamp duty as I have also used the wrong purchase price when I initially estimated the stamp duties.

Lessons learnt - don't ever underestimate big expenses and set aside more monies for these to come. Thankfully though, it came at the exactly right timing when I receives my windfall (bonus) for December (which I'm truly grateful enough to still have it during a pandemic)

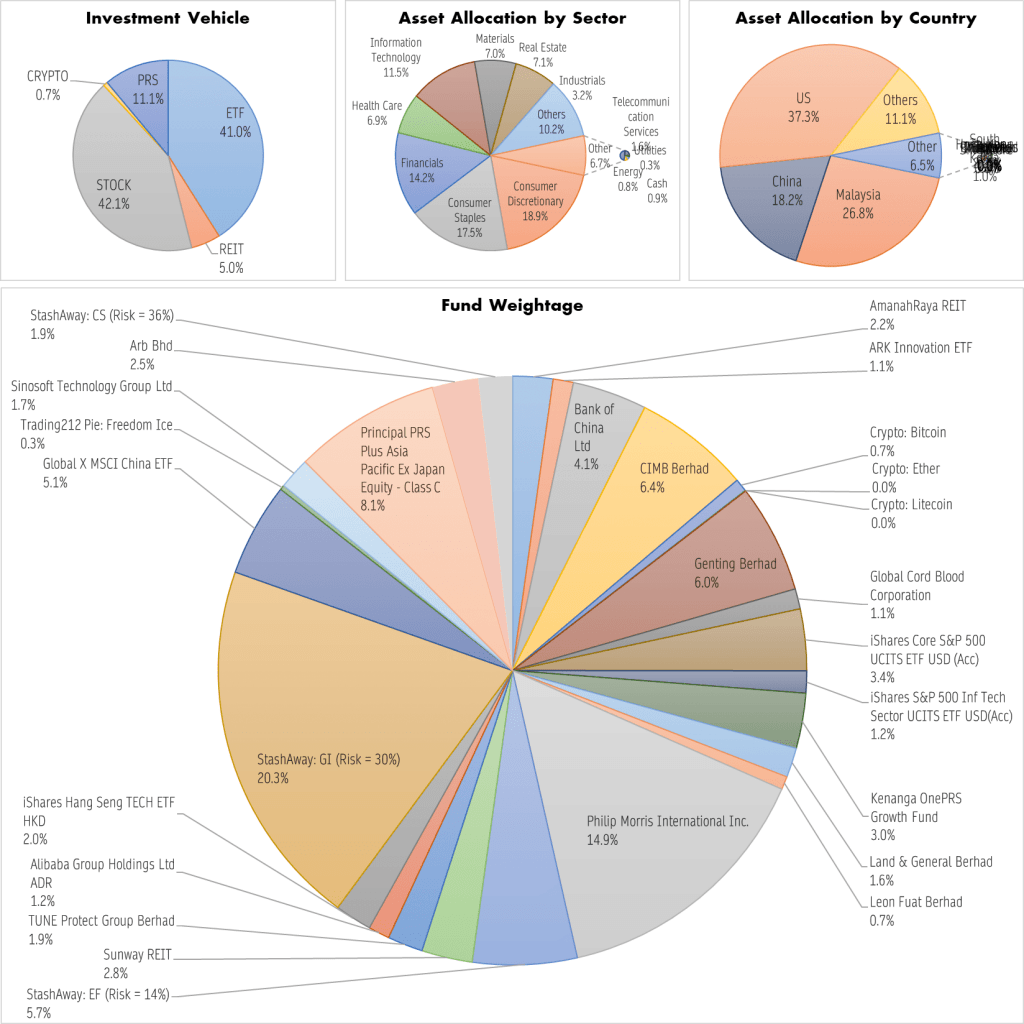

As with all previous months, I have my fixed monthly DCA into StashAway portfolio and PRS for tax relief. I have also (finally) deployed the last bit of cash sitting in HKD / MYR into some companies in KLSE and HKEX based on my fundamental analysis.Now that most adjustments are sorted out, the coming months would be rather quiet as I focuses on rebuilding my war chest / emergency fund.

Though, there's only one worthy mention - on the night before Christmas, BABA crashed more than -14% overnight after China's announcement to investigate top Internet companies for monopolistic behaviours. This wiped out the entire gains BABA had throughout 2020, which I found to unrealistic and emotionally based so I ended up buying some dips and slightly increased my BABA holdings from 0.8% to 1.2% of my entire portfolio 😛 (i.e. insignificant)

No positions were closed in December hence there were no realised gain/loss for the month.

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

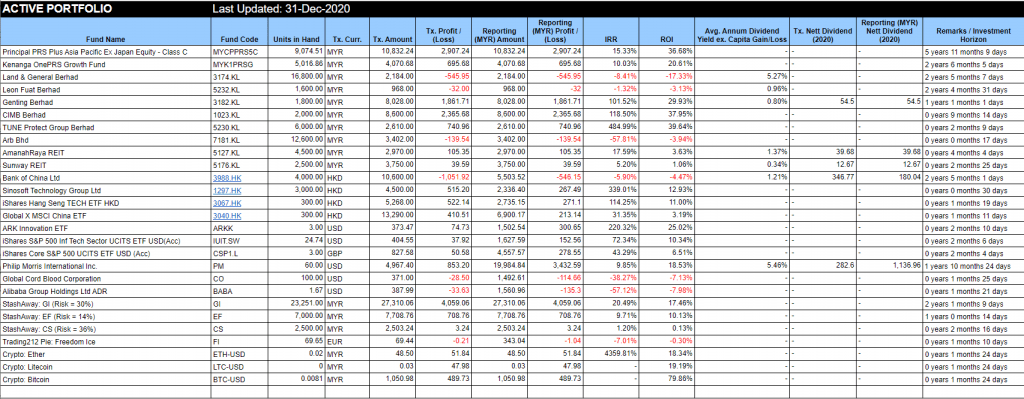

Sold (Retired) Portfolio (accumulative)

IRR: 2.15%

ROI: 4.08%

Profit/Loss: RM1,293.46

Active (Invested) Portfolio

IRR: 14.59%

ROI: 13.70%

Profit/Loss: RM17,330.39

True Cost: RM126,413.52

Total Value: RM143,790.38

Entrance Value: RM115,858.31

Portfolio Value: RM134,472.05

Nett Dividend (2020): RM1,439.01

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie