I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

November was really a stretching month for me as I signed up for yet-another-course: The INSEAD Leadership Programme which consisted of 5-weeks virtual learning (at my own pace) plus a final assignment to be submitted by the end of the programme which would be peer-reviewed as well as by the facilitators/coaches.

This is on top of the full-time job that I have - but thankfully the course were not as crazy as the University days and I didn't have to pay for the course as it was fully sponsored by the Company as part of our development programmes. Which means that I get to further develop myself at zero expenses (yay!) except the mental burnout.

Thankfully though, the realigned focus to myself the past 2 months gave me enough room and space to breathe through my own me-time/leisure-time helped to manage the stress level faced at work / when running through the course and assignments. Bad news is that - I've gone back to the previous self where one of my coping mechanism is to spend money and this definitely is unhealthy if it goes on... more on that on the next section.

In terms of meeting people - because of the mandated return-to-office instruction from the Company, I'm slowly getting used to see people in the office though I try my best to maintain the social distancing / no touchy-touchy / sanitise until my hand dry / etc.

Quite frankly, I'm still afraid to let my guard 100% down especially since that my Mom is staying with me - plus having gone through a few rounds of COVID scare in the office (i.e. people I know getting tested positive); or the "annual dinner" organised by the Company with 200+ pax (which I opted out from participating). Especially around these times where new Omicron variant are discovered to be much more contagious than all other previous variants combined.

Now, going back to our usual monthly update for my finances and portfolios.

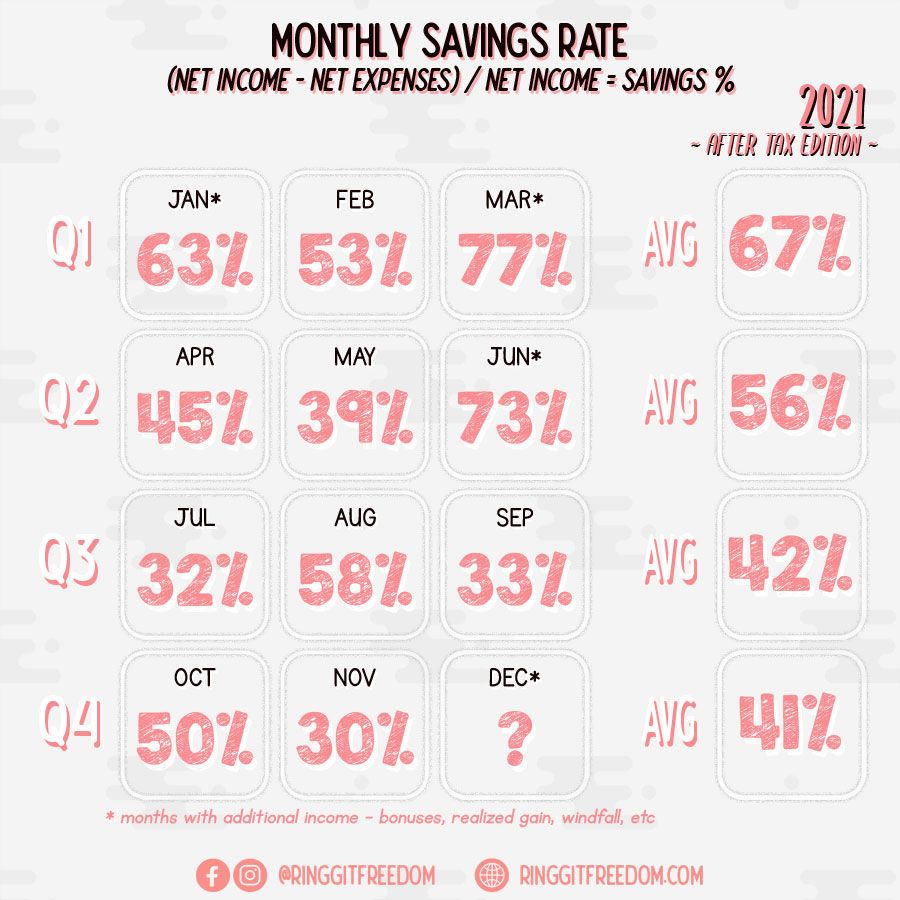

As briefly teased in the earlier introduction - you can probably already guess that the savings rate this month is definitely under-performing some of the other months - as the only savings I had this month are from those amount forcefully deducted from my accounts upon receiving the salary amounting to approx. ~30%.

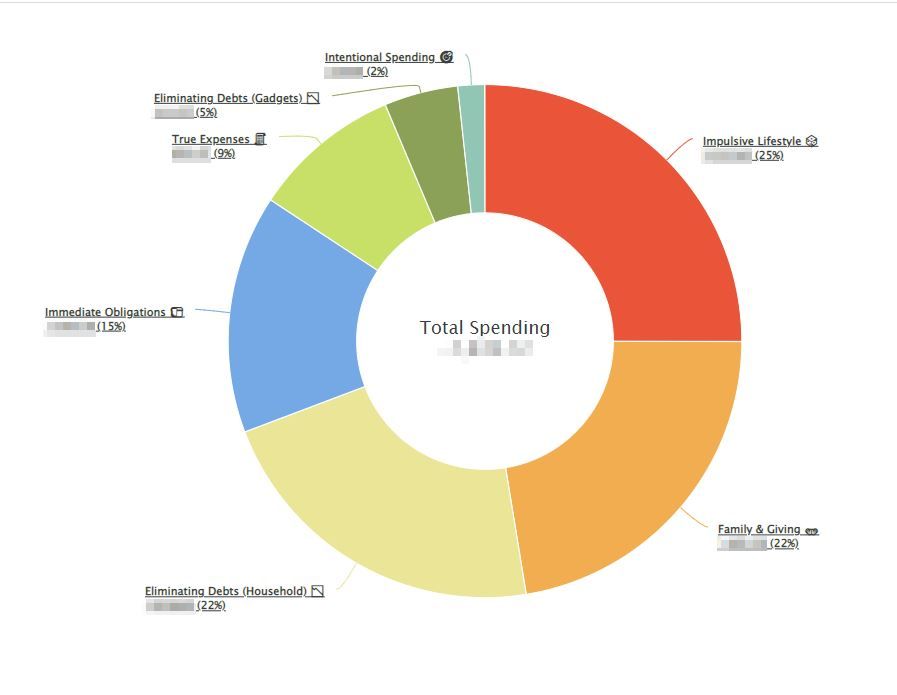

Unfortunately, what I feared back in October has happened - I've lost control again this time around and spent quite some chunks during the 11.11 sales on some of my wishlist. Deep inside my heart I know that the reason I'm spending isn't really because of the craving on the wish-lists; but really the sensation when I spend money or commonly referred as the retail therapy.

This is something that are bound to happen when I'm too stressed out and starts to lose control on all the self-imposed gates (worst time being the period in 2016-2019). I'm really not sure why this happens - perhaps it's my innate behaviour deep inside, perhaps it's to find excuses for myself to spend, or perhaps it's because I held myself too tightly for a little too long.

For now, it did not put on any significant dents on my budget thanks to the safety net I've built over time and also the mandated deduction from my salary into investments automatically every month. But how long more can this last?

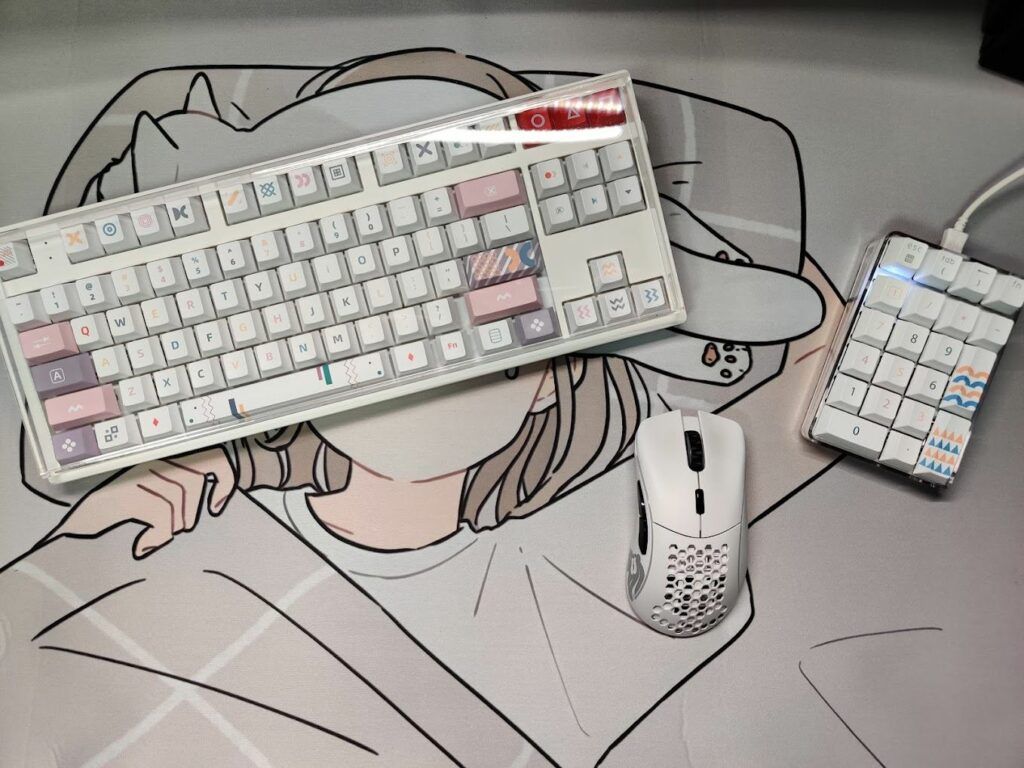

Most of the monies are actually spent on revamping my work/gaming station by upgrading/adding some of the components which I previously put on hold - things like desk organiser, monitor arm to hold my primary monitor, replacing my partially broken gaming mouse (more like upgrading to wireless :P), building my first custom mechanical keyboard kit, adding RGB soft-lighting to my desk, etc. etc. It is still an ongoing work-in-progress that I spend most of my past weekends on, bits by bits.

I told myself this will be my first and only mechanical keyboard set, but I truly doubt how long the temptation can hold up... Here's a teaser for now on my just-completed keyboard kits 🥰

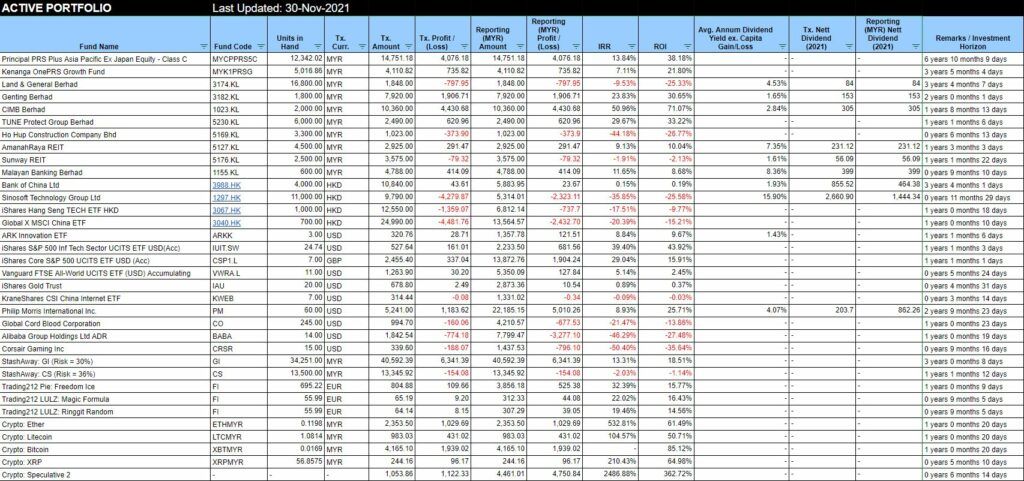

Aside from my typical monthly investments of Dollar-Cost Averaging (DCA) into StashAway, PRS, Luno and Trading212, there are few activities that took place this month.

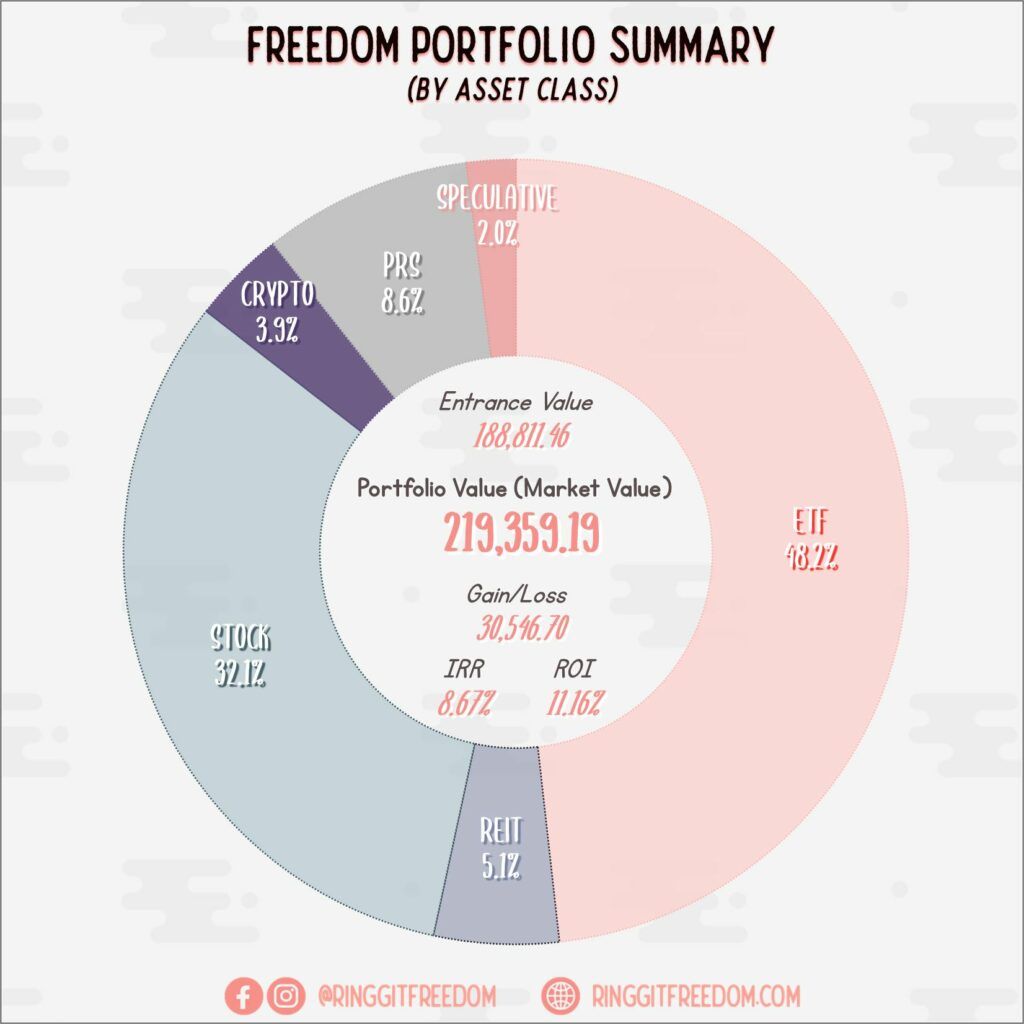

Portfolio wise - not much has happened other than selling the only 2 AAPL share I had as I start to consolidate over time some of my individual holdings / smaller ETFs into VWRA and selected ETFs, just to reduce my clutter as I start to find it hard to follow my own portfolio.

On a separate note (you may have already noticed it if you have eagle eyes) - I've withdrawn all the emergency funds sitting in my investment account just to maintain the separation between Emergency & Investment Funds. Another reason for this is partly driven by the GO+ Bonus 4% Return Rate which sets their total return rate to be around 5.45%, almost the EPF rate.

This resulted in the "significant drop" of my portfolio value from it's peak in October 2021 at ~RM243K to now at ~RM219K. To be fair, a significant chunk of the drop (~RM17K of ~RM23K) are contributed by the Emergency Fund withdrawal - with the rest being typical market movements driven by deteriorating performance of China market.

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 7.41%

ROI: 11.34%

Profit/Loss: RM6,897.81

Active (Invested) Portfolio

IRR: 9.17%

ROI: 11.10%

Profit/Loss: RM23,648.89

True Cost: RM212,772.84

Total Value: RM236,654.25

Entrance Value: RM188,811.46

Portfolio Value: RM219,359.19

Nett Dividend (2021): RM4,289.41

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie