I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

December have been my long-awaited month to chill & relax - as I barely took any long-leave throughout the year except the occasional half-days here and there to clear my underutilised leaves (to avoid wasting it since I can't carry forward more than 10 days).

Was initially planning to maybe go for perhaps a one-night trip somewhere remote to fully disconnect and relax myself, before the Christmas seasons start (to avoid crowds). Lo and behold, I was identified as a Close Contact after attending one of my friend's Wedding Dinner (with limited # of paxs) which I cautiously choose to attend. The unfortunate still happened and my friend was tested positive and ended up getting hospitalised due to COVID-19 (thank God, she's alright now). This really scared the heck out of me - not for my own health but the concern that I'd unknowingly bring it back home and affect my Mom.

Thankfully the 10-days quarantine period went by quickly, and PCR test result were negative for all the close contacts - can't imagine the horror otherwise. On one hand, I'm thankful for this COVID-scare as it helps to remind me that COVID is still lingering around. On the other hand, I gotta start living my life too whilst playing my part through social distancing / frequent self-testing to curb with COVID - rather than locking myself down for the full year which I believe have partially contributed to my ongoing depression.

To make the holidays even less-festive like - my hometown which I grew up from was badly affected from the recent flood that were struck on the 18th of December, 2021. It was really devastating to see photos of the familiar places getting swarmed in flood waters up to a storey high.

Not knowing what else I could do to help (other than checking in with friends whom was affected), I went to bed hoping that the flood will recede the next morning. Guess what - I woke up to a bunch of SOS Help Requests on my Facebook Feeds, from almost everyone I know. Whilst I'm grateful to not be affected directly by this disaster, mentally it was devastating enough just by witnessing it and I can't imagine what my friends and their family are actually going through with significant damages on all angles - physical, financial, home, and mentally.

These two weeks of "holidays" definitely didn't feel like one for me - but it was good enough, at least I didn't have to deal with the dramas in the workplace, allowing me to focus fully on myself and my family/friends. Still, my motivation and drive hasn't really came back and I'm still not feeling like doing anything really - not sure if I'm just bored, or I'm depressed XD.

This would be the usual monthly bite-sized version of this December updates. Stay tuned in coming weeks for the Full Year in Review for 2021!

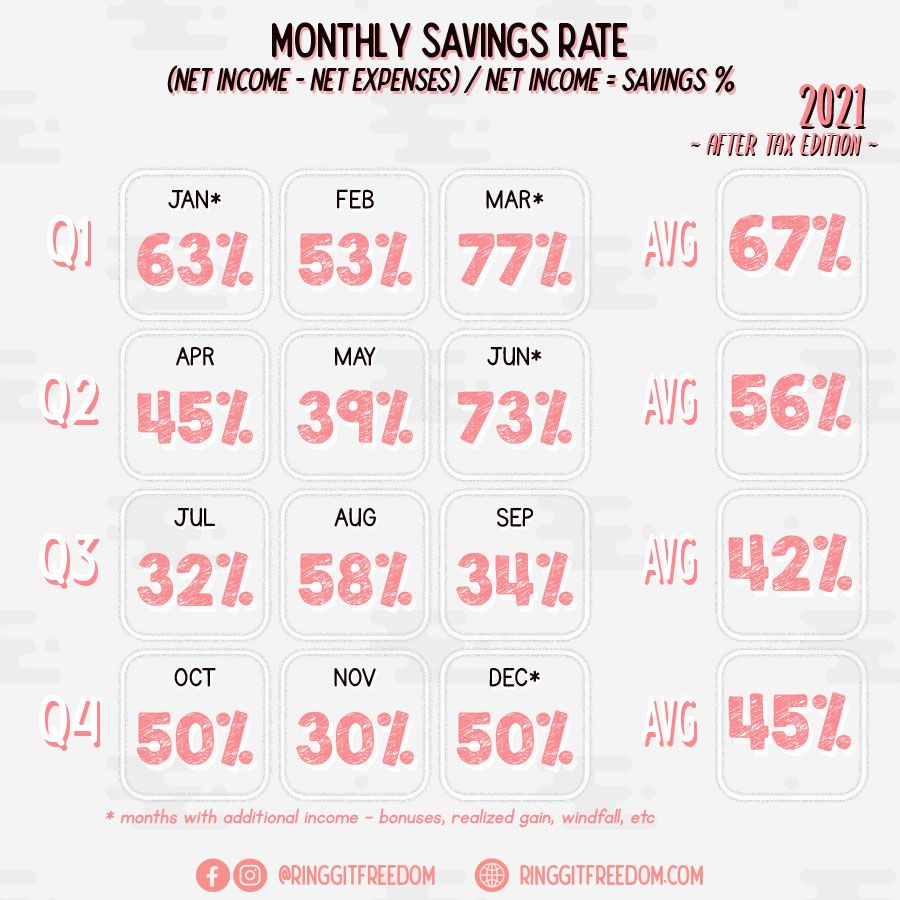

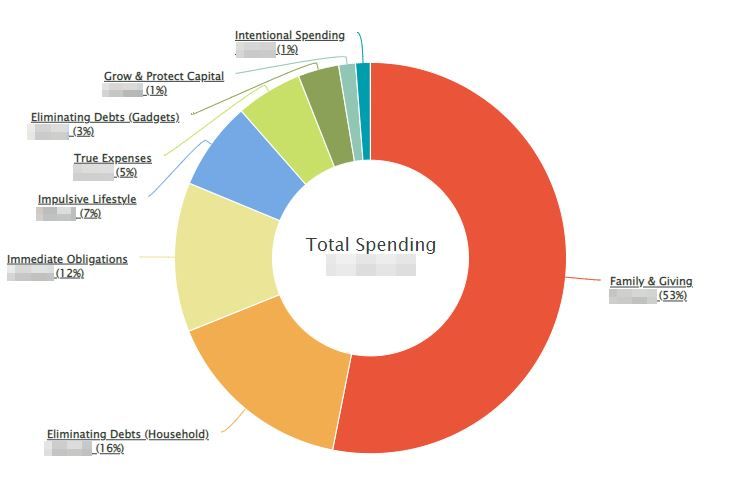

My spending spree continued from November - but the situation have improved slightly and less were spent on my impulsive purchases this month. Hopefully I can get the unplanned spending spree back under control in January next year before further damages are done.

In fact, most of the spending this month actually came in the form of Giving - be it the family allowances, wedding gifts/red packets, funeral white-packets, or flood-relief donations for charity and selected friends. Usually I only opt to do donations on a smaller sum on a monthly basis to avoid it having significant impact on my monthly budgets but decided to do an exception this month considering that I've just received my contractual year-end bonus, and are very fortunate to escape the natural disaster unscathed just because I was privileged enough to move out of my hometown 2 years ago (when I bought my current house to stay in with my Mom).

Sadly this is not the case for many of the families / friends out there, whom are rooted in the hometown *yes, the guilt trip is killing me*. Deep inside I know this is a natural disaster and there's nothing I can do about it to change the fact, other than helping out where I am capable of and are comfortable with. Hopefully the monsoon season will get over soon and the government actually do something and implement preventive measures, rather than dealing with it reactively (and slowly) after the chaos...

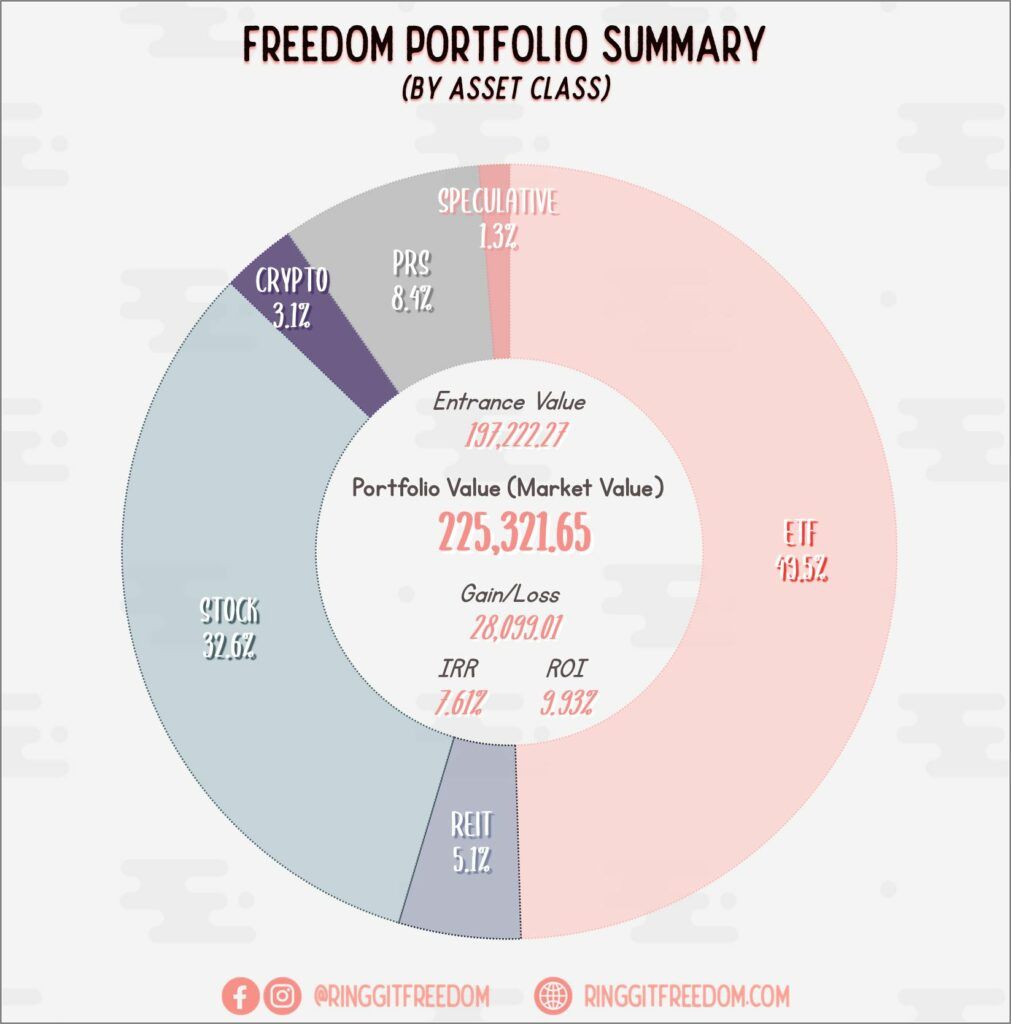

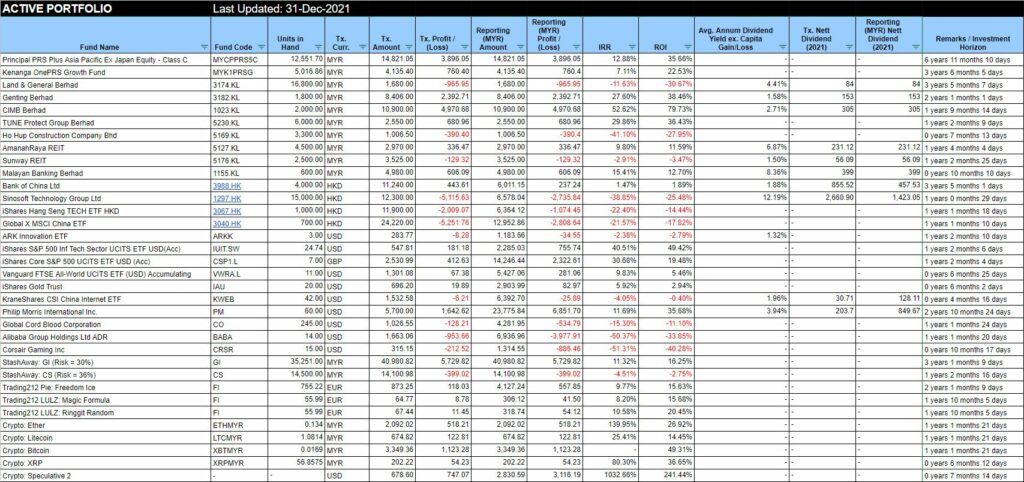

Aside from my typical monthly investments of Dollar-Cost Averaging (DCA) into StashAway, PRS, Luno and Trading212, there are few activities that took place this month.

I'm about to sound like a broken record - but nothing much has changed since the massive Emergency Fund withdrawal last month aside from the typical market movements driven by deteriorating performance of China market. As a result, it triggered two more of my KWEB buy orders bringing down my average price to ~$36 (especially the sharp drop after the special dividend ex-date).

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 7.38%

ROI: 11.29%

Profit/Loss: RM6,829.46

Active (Invested) Portfolio

IRR: 7.69%

ROI: 9.56%

Profit/Loss: RM21,269.55

True Cost: RM221,028.59

Total Value: RM242,400.60

Entrance Value: RM197,222.27

Portfolio Value: RM225,321.65

Nett Dividend (2021): RM4,372.53

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie