I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

A month have past since the last update posted in early October (Ringgit Freedom’s September 2021 Updates) - and life seems to be getting more hectic than ever before. Office's part-time physical reopening in October (and mandated return-to-office in November) also means a readjustment of lifestyle, again, after more than a year of battling with COVID-19.

My mental health's definitely not at its best condition, but thankfully far enough from its worst in 2016. I really want to get over with it as soon as I can, but I know from experience that these processes can't be rushed, too, as it takes time to heal. At one point - I was so distracted / lost with my inner thoughts that I can langgar tiang (translate: bumping into building's pillar) literally, when driving my car out from my car park. Thankfully only the painting of my car/wall suffered some minor scratches.

What's not helping is the never-ending pile of works that always stack up - and myself to continue losing motivation at work making it a frustrating experience. Perhaps its also due to the inner fear of returning to office and meeting people adding up to the stress level - due to the anxiety it creates around catching virus unexpectedly (even though my family's already vaccinated).

Bad news aside - one good thing that turned out from all these hoohahs is that I've really spent more time recently, with my inner self, and have more "conversations with myself". From this exercise I kinda realised that the job/work isn't the main reason for my depression relapse - but probably just one of the many triggers resulting in the explosion of my pent-up frustration with life. The frustration perhaps is also due to the helplessness that I felt, being in Malaysia, with no sense of belonging and also being accepted for who I am, being part of the minority group within a minority. Oh well, life and birth is amazing isn't it?

Through the self-conversation I also went back and forth on different ideas to further solidify / explore my plans to emigrate (and perhaps settle down via PR or even giving up my Malaysian Citizenship in exchange for Singaporean ones in the mid-to-long term). Plan's still not finalised yet but I'm definitely starting to see a clearer shape than the vague imagination I had in the past of "just getting out of Malaysia".

For now, I'm realigning my priorities in life to focus fully on myself so I won't be posting much in a while, both on my blog or my Instagram, and I sincerely apologise for this! As much as I wanted to get back to at least my weekly frequency, but I won't be rushing it for now especially in the next couple of weeks/months as I'm juggling through never-ending works, training courses, certification exams, me-time, amongst all other stuff that I am dealing with physically/mentally.

On a side note - Ringgit Freedom is now officially 1 year old! Started this blog last year without thinking much, and happy to have all of you as part of the FIRE Community to go on the journey together!

Now, going back to our usual monthly update for my finances and portfolios.

With my office mandating return-to-office effective November 2021 and my car idling at home for more than a year (except weekly/bi-weekly grocery trips), it also means that my car is long overdue for it's regular maintenance plus some of the long-term maintenance. On top of the regular engine oil change, I also did some major services like the timing belt (which haven't been replaced for almost 7-8 years as I still hasn't the mileage cap yet - just in case if the rubber gets too old). During the inspection we also found that the threads on my tyre is almost flat and for safety, I've also decided to replace the full set of tyres.

Thankfully none of these set me back in my budget as I've prepared a sinking fund of RM160+ per month for these incidental costs (and also perks of driving a cheap 2nd hand local car - saving on repair fees compared to import/luxury cars!)

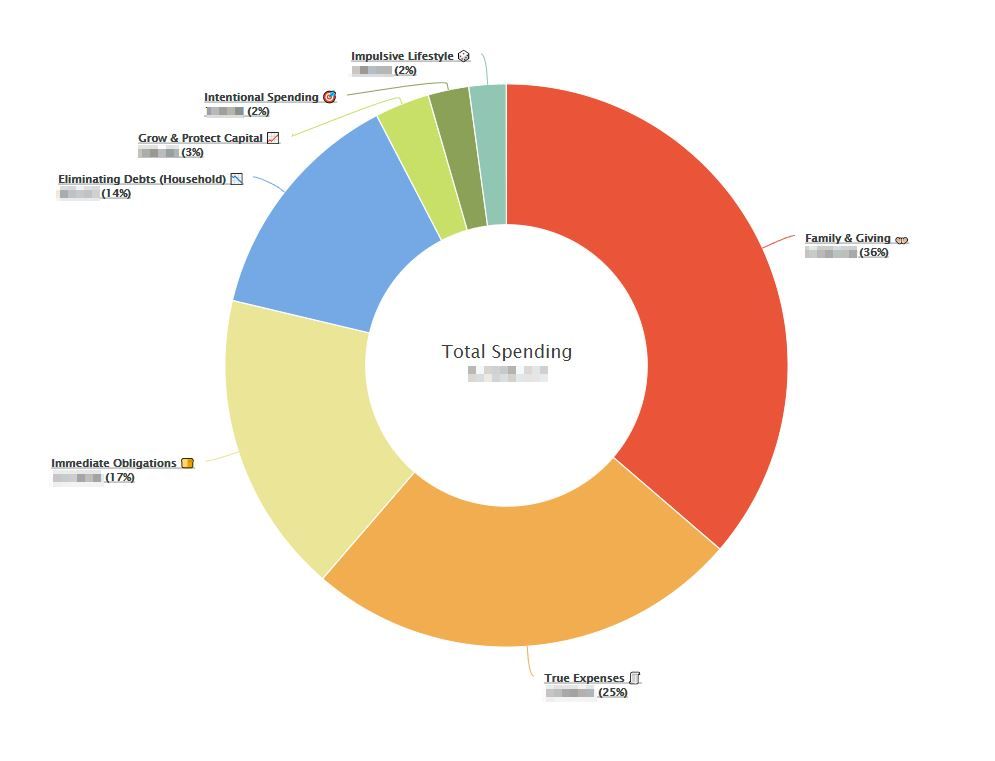

Aside from vehicle maintenance, there were also some additional leisure spending incurred for purchasing a gift for my mom, some gaming expenses for myself, and also unaccounted dental emergency for my mom (more in November later). November's spending would be more interesting, as I'm still hesitating whether to "participate" in this year's 11.11 sales to crave some of my wishlist (or not). Plus returning to office also means additional expenses in terms of fuel, toll, parking and also dining out...

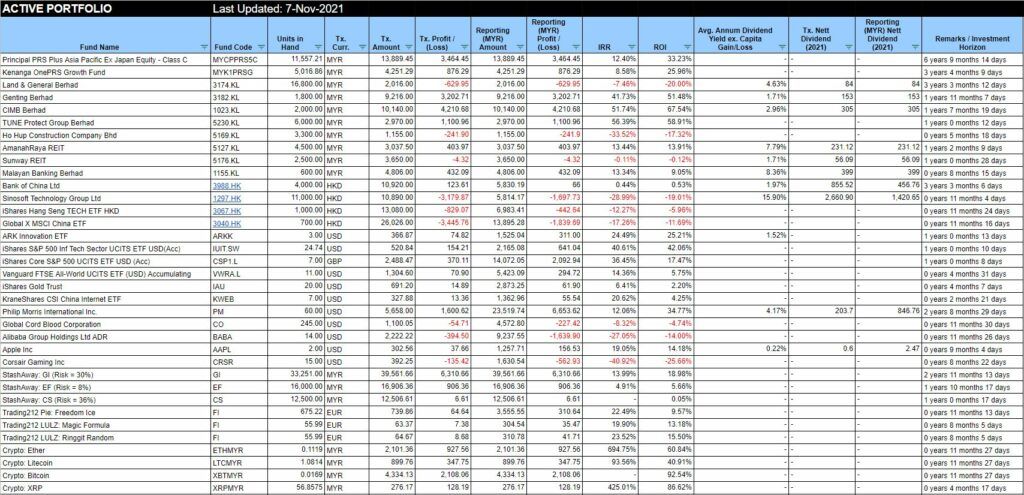

October 2021's frankly a very boring month, even for myself. I purchased nothing in this month and practically left my portfolio alone, aside from the typical monthly Dollar-Cost Averaging (DCA) into StashAway, PRS, Luno and Trading212.

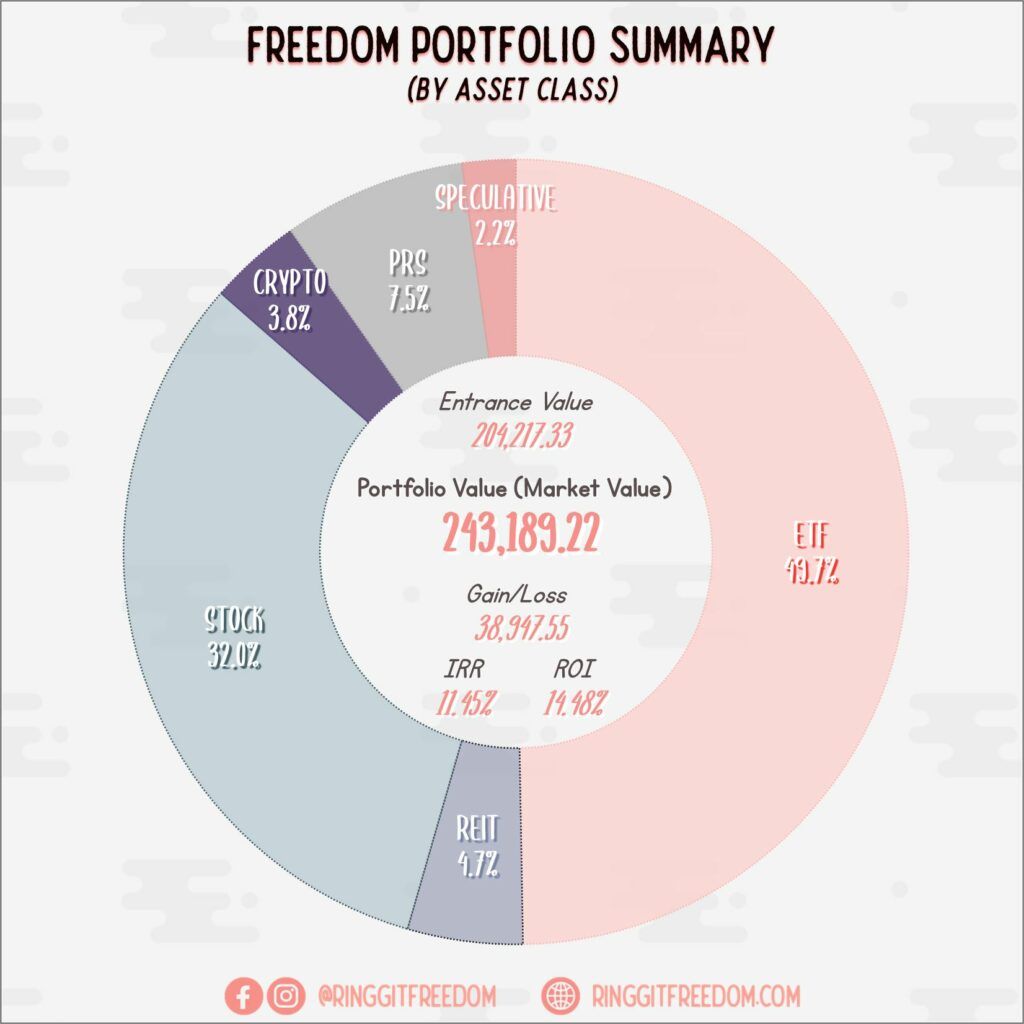

You might have noticed the surge in value (vs. September) - and this is mainly driven by the Cryptocurrency space which includes one of my speculative trade. The surge was so rapid that I took enough profits to cover my entry cost, essentially leaving the rest of "free units" there to see where the wind takes me. But we're only talking about ~1% of my entire portfolio so I definitely won't become a millionaire from that single trade, unless miracle happens of course 😀

One topic that has been bothering me though - is whether if I should start simplifying my portfolio and further consolidate/aggregate my many-ETFs into a few single-selections (e.g. VWRA, IAU, and maybe 1/2 China-ETFs), selling the rest of my portfolio (incl. Local stocks) to focusing 100% only on international passive investing (letting EPF to do the job for Malaysia Investments)

I received a total of RM793.06 worth of dividends this month from few of my holdings. Still a long way to go to make it into a sustainable monthly income to FIRE!

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 7.63%

ROI: 12.88%

Profit/Loss: RM5,580.29

Active (Invested) Portfolio

IRR: 12.74%

ROI: 14.79%

Profit/Loss: RM33,367.26

True Cost: RM225,428.14

Total Value: RM259,025.18

Entrance Value: RM204,217.33

Portfolio Value: RM243,189.22

Nett Dividend (2021): RM4,237.77

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie