I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

Since 2021, the recurring theme in my thoughts seems to be always about quitting my job - and the passion for work seems to be gone that I would often leave work feeling mentally exhausted. To make things worse - I broke down and cried again at work, in one of the 1-to-1 meetings with my boss (thankfully he was compassionate).

I never considered myself to have the strongest EQ - admittedly that I cry very easily when I’m upset with something or am angry during a heated argument (gosh, I still don’t understand the correlation of tears and anger). But it’s rare for me to “explode” during work hours as I usually contain it pretty well, but for some reason it’s happening so much more frequently nowadays.

The last time it happened was the same year back in April and May where I got so burnt out that I have zero energy left to do anything - be it in the space of my personal growth, blogging, or my fun hobbies (gaming). Luckily I managed to escape through temporary distractions by exploring new things (temporary because suddenly these activities are MIA again :P).

It seems ironic that my heart knows what I want to achieve but my brain is denying it in all possible ways. One thing that I can conclude for sure, at least for now - “it’s not worth it to sacrifice my mental health for work”.

On a more positive side of things, I have been sitting in several different training paid by Company (thankfully) this month for both career & personal development with many more coming in October - and all these takes up too much time away either for my work or personal time. Because of the hectic schedule all the way till end of October, rather than waiting to complete one of the certification exam within 30 days after the training (before it lapses), I decided to prepare my exam notes immediately after the training course and crammed everything within 1.5 days and took the exam. I'm surprised that I even passed ? Another certification under my belt yay! I'm now officially a Certified SAFe 5 Agilist.

There was also another interesting training for me which touched on the topic of Strength-Based Development Approach - a complete flip-side of what my entire life has been guided/built based on Weakness Fixing Development Approach.

I have (and still am) always been a strong believer that there is nothing that we cannot learn in today’s world as long as we put in enough effort. With this mindset, I always focused on identifying things that I’m weak at, to work on it and bridge the “gaps'', and ultimately turn it into my strength (or at least until it’s enough not to drag me down).

Hence this training was really a mindf*cking exercise (for lack of better word) for me, as it forced me to rethink from the opposite perspective. I also started to see the merit of Strength-Based Training, on the basis that it’ll take significantly less effort to build on top of something we’re good at, further deepening our skill sets, providing higher ROI from “time” invested since we only have 24 hours per day. Maybe like all things in life - I just need to find the right balance and identify (and APPRECIATE) my strengths, rather than constantly picking bones with myself.

The exercise starts off with the caveat that all of us have our own innate talents - whether we know it or not. To do this, they included some exercises also to help us to discover and navigate around our strengths, and also questions around whether we'd realise/agree if those are indeed our strengths through a virtual test with a series of questions that helps identify your core strength.

The virtual test is definitely not your typical Facebook Quiz type of question - it’s a rapid-fire way of 177-questions, with a timeout of 20 seconds. Ideally you should only take it under zero distractions as you’ll be relying on your gut / instinct a lot, with no time to think. For those interested to take the test, you can check out CliftonStrengths - the one I took was the Top 5 CliftonStrengths Assessment paid for by my Company.

After the test - I found out that one of my top strength (there's 4 others but I won't bore you with literature) being "Futuristic", which according to Gallup Clifton StrengthsFinder:

“Wouldn’t it be great if . . .” You are the kind of person who loves to peer over the horizon. The future fascinates you. As if it were projected on the wall, you see in detail what the future might hold, and this detailed picture keeps pulling you forwards, into tomorrow.

While the exact content of the picture will depend on your other strengths and interests—a better product, a better team, a better life or a better world—it will always be inspirational to you. You are a dreamer who sees visions of what could be and who cherishes those visions. When the present proves too frustrating and the people around you too pragmatic, you conjure up your visions of the future and they energise you. They can energise others, too.

In fact, very often people look to you to describe your visions of the future. They want a picture that can raise their sights and thereby their spirits. You can paint it for them. Practice. Choose your words carefully. Make the picture as vivid as possible. People will want to latch on to the hope you bring.

Gallup Clifton StrengthsFinder - Futuristic Trait

In fact, the above is just a generic description for the "Futuristic" trait - they actually sent me a more personalised insights on what this trait means to me and those examples are much more relatable than the above generic one - but I'll keep that for now 😛

Frankly I was surprised to even have this trait, but after digesting it for almost 1 week, the dots started connecting. Maybe that was also why I felt so distressed at work - as compared to 3 years ago where I have the absolute ability to influence many of the decisions on the then-future product launch compared to today, where we are keeping the not-so-new business running. My hands are pretty tied today at work, with "central governance" surrounding all kind of decision or discussions and politics triumph everything else.

Another interesting discovery for me was that - this was something that I've been taking for granted - I always thought that every one of us would have some sort of mental visualisation of the future - whatever it means to us. Having said that - I'm still 50/50 convince to be frank. I guess all these exercise, in the end, still boils down to us ourselves. The whole purpose after all is to trigger the introspective exercise for us to navigate ourselves.

This month's reflection is triple the size of my usual updates. Enough babbling from me (sorry!) and let's now go back to our usual monthly update for my finances and portfolios!

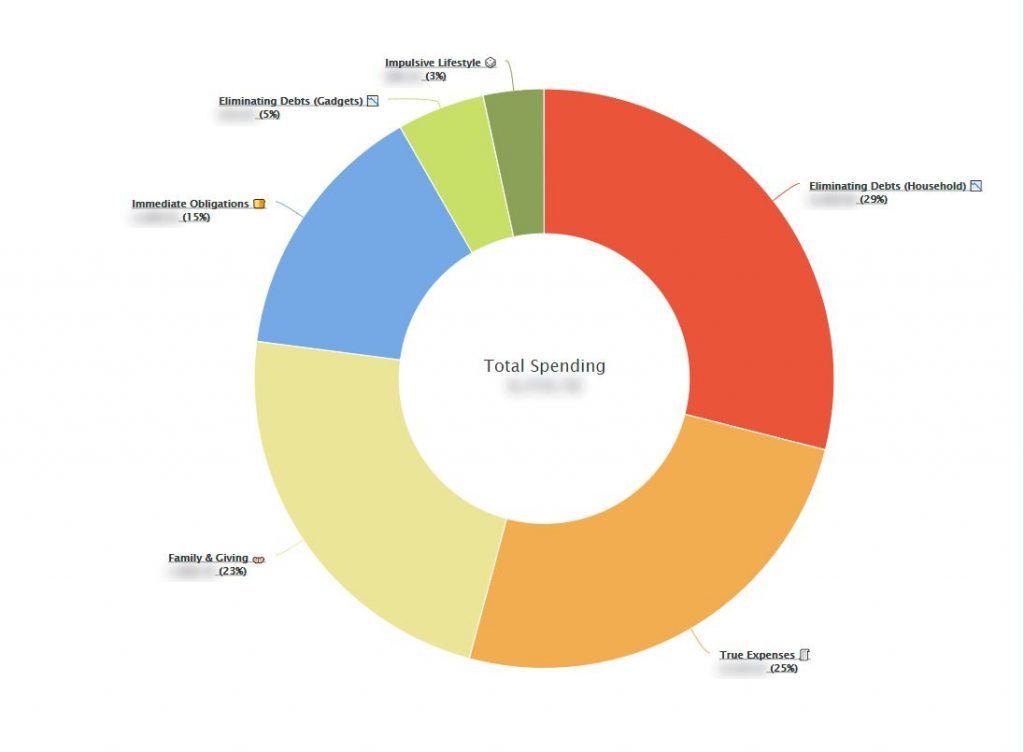

September's usually the month where I actualise a number of expenses like stocking-up my purchases for my personal care products, my long-term medicines, or visiting the salon. Well you see, September's the month I get to enjoy "Birthday Perks" - in forms of additional points, discounts, or freebies hence it's common for me to see a temporary spike in spending.

Having said that, those amount has been steadily budgeted-for since the start of the year, into my "sinking fund" until the spending actually takes place, hence there's not much impact from budget-perspective. Why do I like to stock up? Well it's mainly driven by my laziness, plus what's the harm if I get to enjoy some benefits along the way (like 9.9 discounts; or cashbacks; or points) right?

There was also some unexpected expenses on additional stamp duties to be paid to the land office for my Memorandum of Perfection / Memorandum of Charge to transfer transfer the ownership / title of my property from Developer's Name to my Name - which somehow was miscalculated during the initial payment/billing last year. Thankfully the amount was small (~RM500) and I had more than enough buffers from the monies intended to overpay my housing loan (to save interests in the long run).

In terms of impulsive spending, it's not too bad this month as I spent approx.. RM300 for 5 more books, adding to my never-ending backlogs. Well, spending impulsively knowledge is an exception right, right!? (finding excuses for myself...). Anyways these are the books I've bought, and looking forward to read them ahead of my existing backlog.

Sometimes I really wish to just take 3-4 vacation days, go somewhere remote (preferably quiet/relaxing beach-side without people), then get disconnect from the world (internet) and just binge read all of the books... Let's see when I can actually finish these (plus existing backlogs) before buying more books!

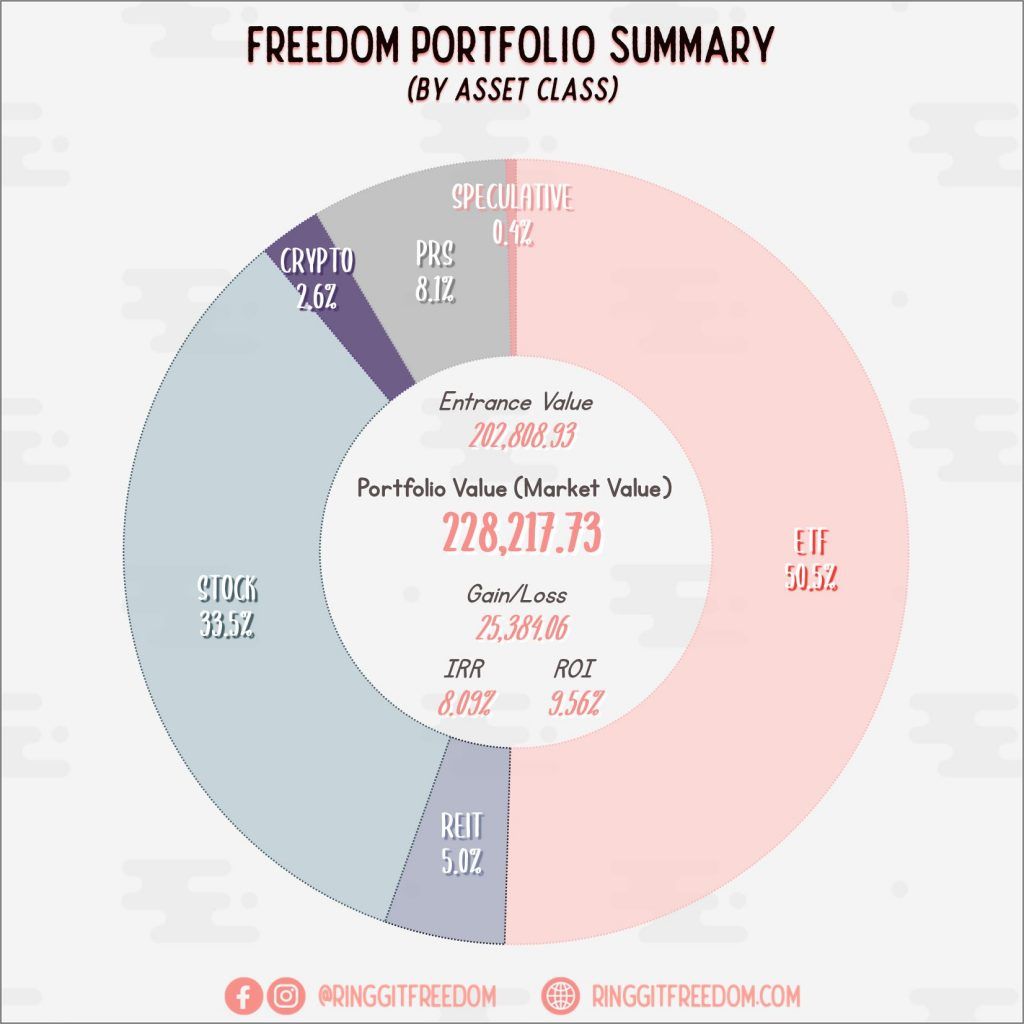

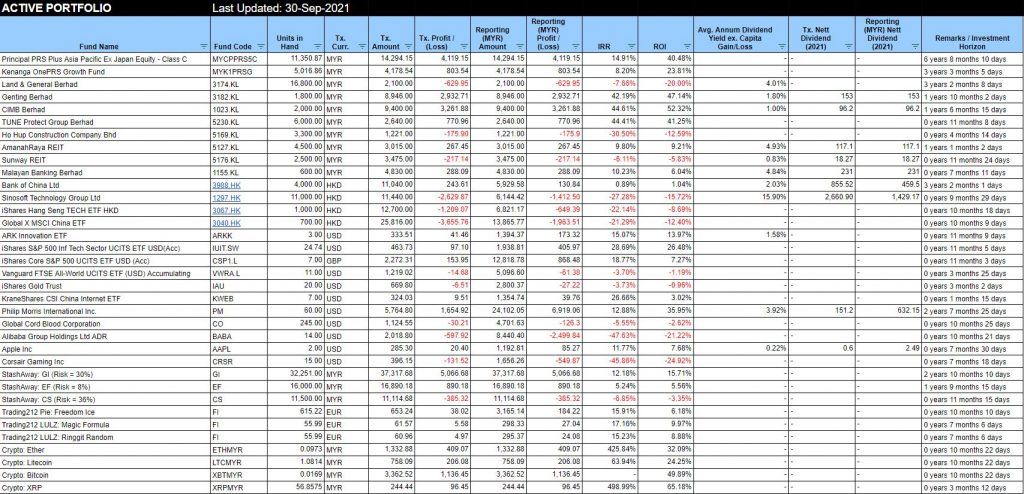

Nothing much really happened this month, except the never-ending fall of the Great China and my portfolio returns definitely are taking a hit. Aside from my typical monthly investments of Dollar-Cost Averaging (DCA) into StashAway, PRS, Luno and Trading212; the only additional purchase was few more units of BABA stock - again, similar like last month, the sudden drop triggered my future-limit order through my margin facility (thankfully only ~735 USD-ish) which I now need to "find monies" to refill the margin and avoid margin interests.

Looking at the current trend and circumstances, I'm gonna revisit all my future-limit orders and set them low enough to catch actual market crashes since I wouldn't want to disrupt my current focus (until February 2022 at least) to replenish my Emergency Jar.

Closed one of my positions with PetroChina (PTR) taking profit of approx ~USD200 just to cover part of the margin - and also received RM37.82 in dividends after tax from my SUNREIT this month.

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 7.65%

ROI: 12.91%

Profit/Loss: RM5,615.67

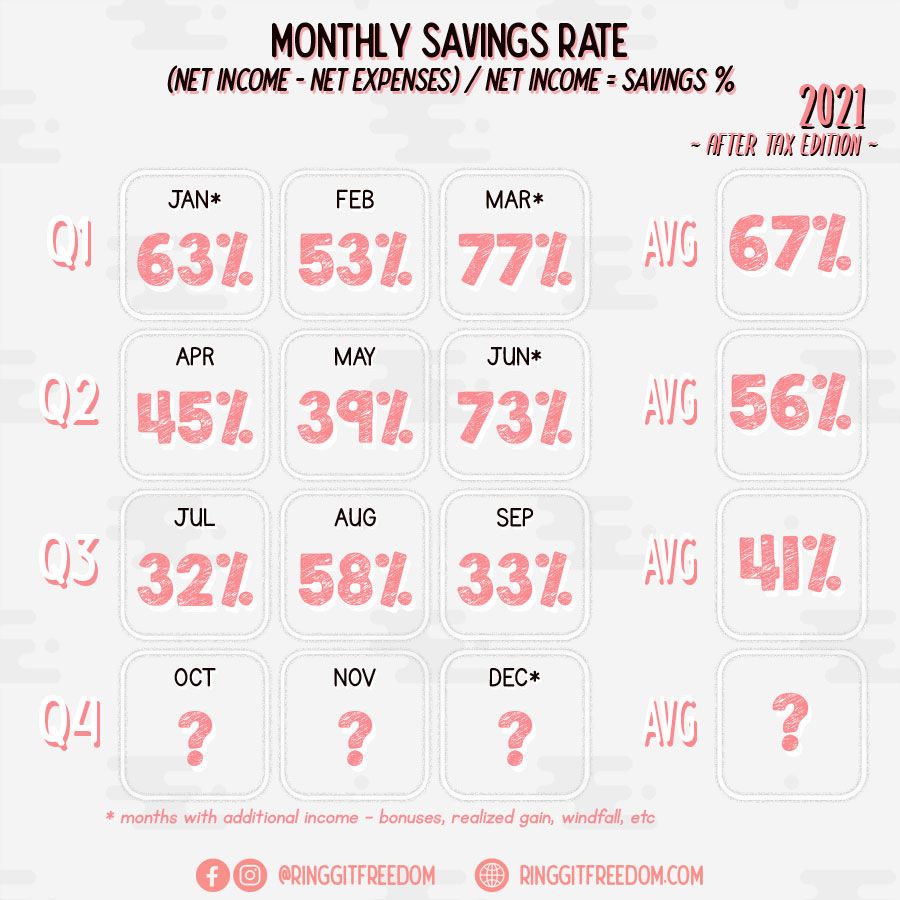

Active (Invested) Portfolio

IRR: 8.24%

ROI: 8.91%

Profit/Loss: RM19,768.39

True Cost: RM221,754.24

Total Value: RM241,753.32

Entrance Value: RM202,808.93

Portfolio Value: RM228,217.73

Nett Dividend (2021): RM3,461.29

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie