I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

There has been quite a number of things going in October - and one of those was to finally putting off my procrastination to take my real attempt to start blogging on my personal finance journey. There's already quite a few postings on this so I won't go into the details and I'll leave the links here if you are interested (My Story, About).

I was planning to have this post ready by the time I officiate my blog but other postings took priority and I haven't really got the chance to look back to review my month. But now that things are more "settled in", let's take a look back in October 2020.

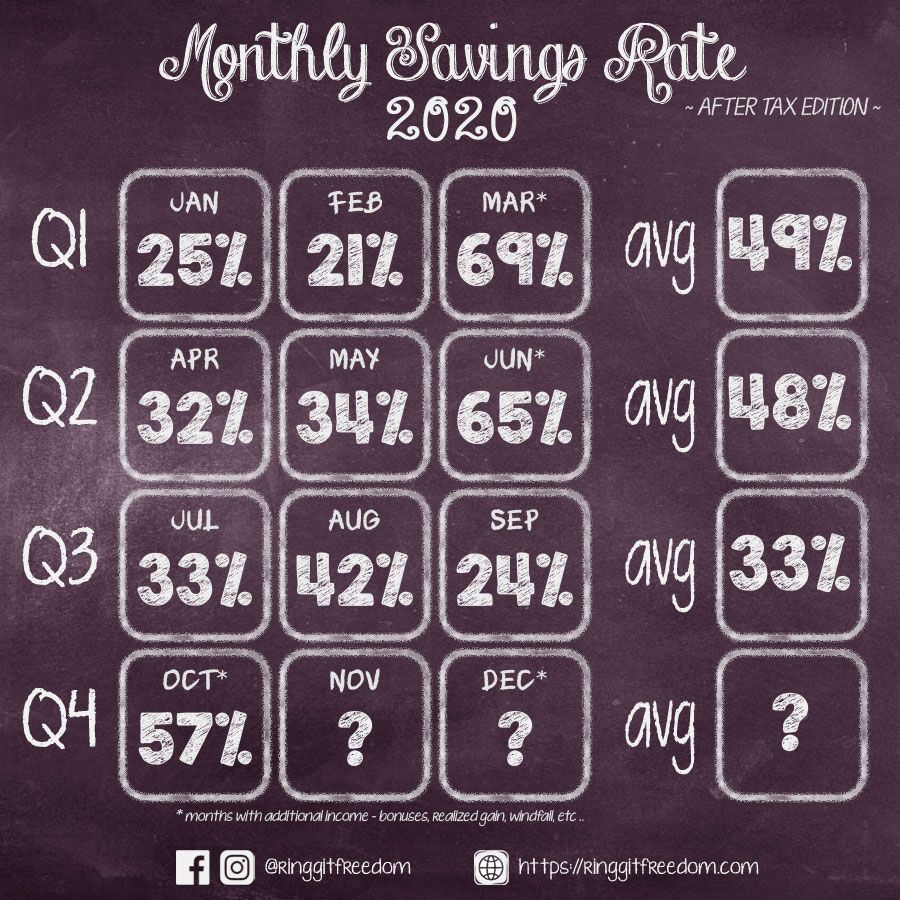

Compared to year-to-date for same period last year - it's infinitely better because I didn't track my finances last year :P. At least now I am on track to maintain my above 30% savings rate for most typical month, though October 2020 was pretty unique by itself given the realised profits from my portfolio transition.

I have enforced a hard-rule that any income beyond typical monthly salary will have to be either fully invested or kept as emergency buffers, with zero exceptions. Happy to keep that promise so far! 🙂

This month's spending been pretty quiet as well - given that we're working from home for most of the time (hence reducing expenses).

So it took me quite some time to finally be convinced (at least 2 years!), after Leigh from Dividend Magic highlighted to me again on how Fees from Unit Trust will impact my long-term returns. Well to be fair, I wasn't really "caring" about my personal finance 2 years ago so I did exactly nothing, na-da, and did not even look into how the annual fees were structured, even after hearing it from few people.

This month, I finally decided to sell of all of my unit trust portfolios with an attempt to rebuild them through various ETF funds to simulate the geographical and sectors coverage. Though it'll take some time to complete, perhaps by end of November, given the several tasks required including building the foundation blocks like Opening Singapore Bank Account or Finding My International Brokerage.

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 7.28%

ROI: 18.50%

Profit/Loss: RM4,044.25

Active (Invested) Portfolio

IRR: 0%

ROI: -0.72%

Profit/Loss: -RM751.26

True Cost: RM105,020.15

Total Value: RM104,268.89

Nett Dividend (2020): RM652.81

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie