I have decided to write down on a monthly basis all my thoughts, feelings, progressions, decisions made throughout my financial journey and anything about life really. Hopefully this will shed some insights for all readers, and even myself when I look back onto the past. If you're interested in my past month updates, take a look at Monthly Updates and I hope you enjoy reading!

After several weeks of effort in July and early August - I have finally completed my long overdue overhaul for both my blog and also my Instagram. I hope that you enjoyed the new design so far - let me know in comments! Still trying to further optimise it (both design and technical performance wise) but I'll leave it as is for now. I need a break ?

Thanks to Michelle (@her.duit), I found out about Canva Pro and gave it a try. Definitely loved its ability to create graphical stories in a quicker / easy way compared to how I created (very basic graphics) in the past using the traditional Photoshop way. Because of this, I decided to started my own 30-days challenge to post on my Instagram on a daily basis consistently.

This definitely wasn't an easy task and was actually pretty tiring to pull it off - but I'm almost there! As tiring as it was, it definitely was a fun and entertaining exercise! Absolutely loved the ability to tell story through visuals. Let's see how long more can I sustain the energy - hopefully not by getting burnt out again. If you haven't already - check out my refreshed Instagram feeds!?

Towards the end of the month, I had two of my tooth plucked out to make spaces for my braces - the pain was horrible after the anaesthesia wears off. The ability of not being able to eat, drink or chew was really killing me. The worst part was really the constant bloody taste in your mouth, and the fear of accidentally destroying the blood clots that formed around the surgical site and restarting the entire healing process from step 0 again...

Thankfully I was able to sleep through for the most part of the first 24 hours... and it's not over yet with another one in the queue to be removed in coming weeks / months ??. Oh well, braces journey month 2 (out of 30) here we go....

Now, going back to our usual monthly update for my finances and portfolios.

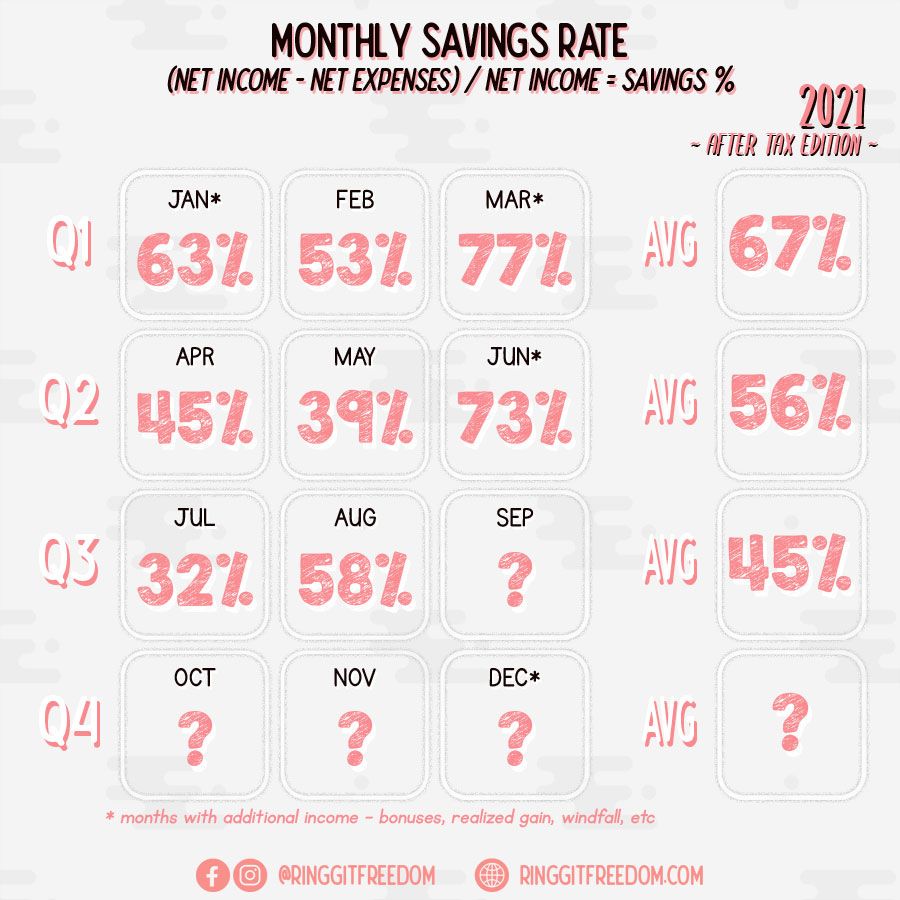

Last month's Savings Rate infographic was horrible as I struggled to find the right colour mix and I just completely ran out of ideas on how to make that version fit into the new colour scheme, whilst respecting the font designs.

Initially I planned to completely kill the legacy savings rate matrix and replace it entirely with my new month-to-month savings trend chart above - as I liked the new format more personally since I can analyse also my spending patterns depending whether if there were additional incomes for the month.

But through a quick Instagram Poll, it seems like many of you still wanted to see the legacy version - so I've decided to keep it and tried to retrofit the new colour scheme onto it! It's alive guys, ITS ALIVE!!!

This month was a good month for me - typical stay-at-home month, with no additional spending incurred means more savings for me. Still ritually building up my sinking funds for those once-a-year expenses. I realised how much my impromptu spending behaviour really (significantly) impacts my savings rate.

1% improvement is still an improvement, aye?!? Well to be fair a few of my trade orders triggered the lower-limit that I have set (more on this later) so I had to channel some of the additional savings for the month into my investments, rather than the jar. Still on track to achieve 80% of my 12-months target by end of the year, if everything goes as planned.

For those of you new here, check out my June's Update where I detailed the rationale for the 12 months emergency savings.

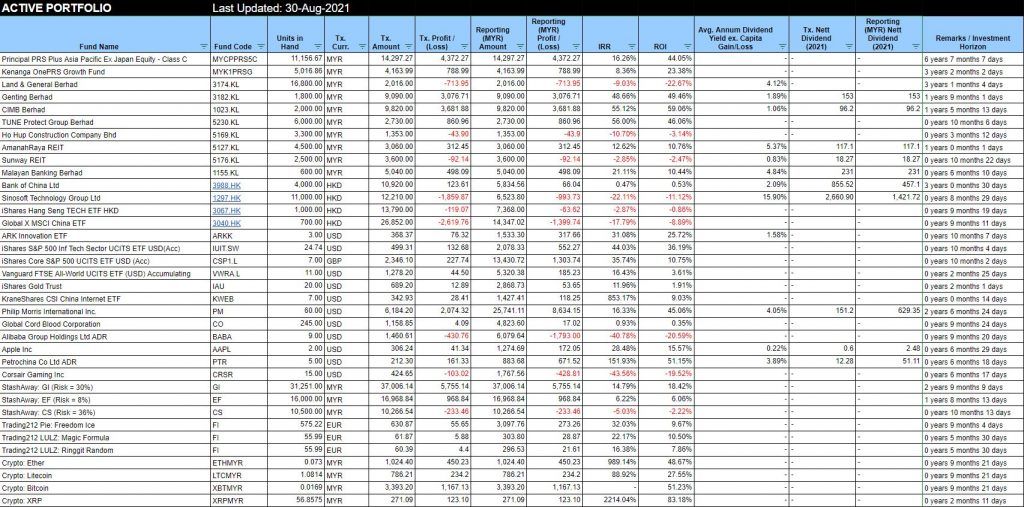

Aside from my typical monthly investments of Dollar-Cost Averaging (DCA) into StashAway, PRS, Luno and Trading212, there are few activities that took place this month.

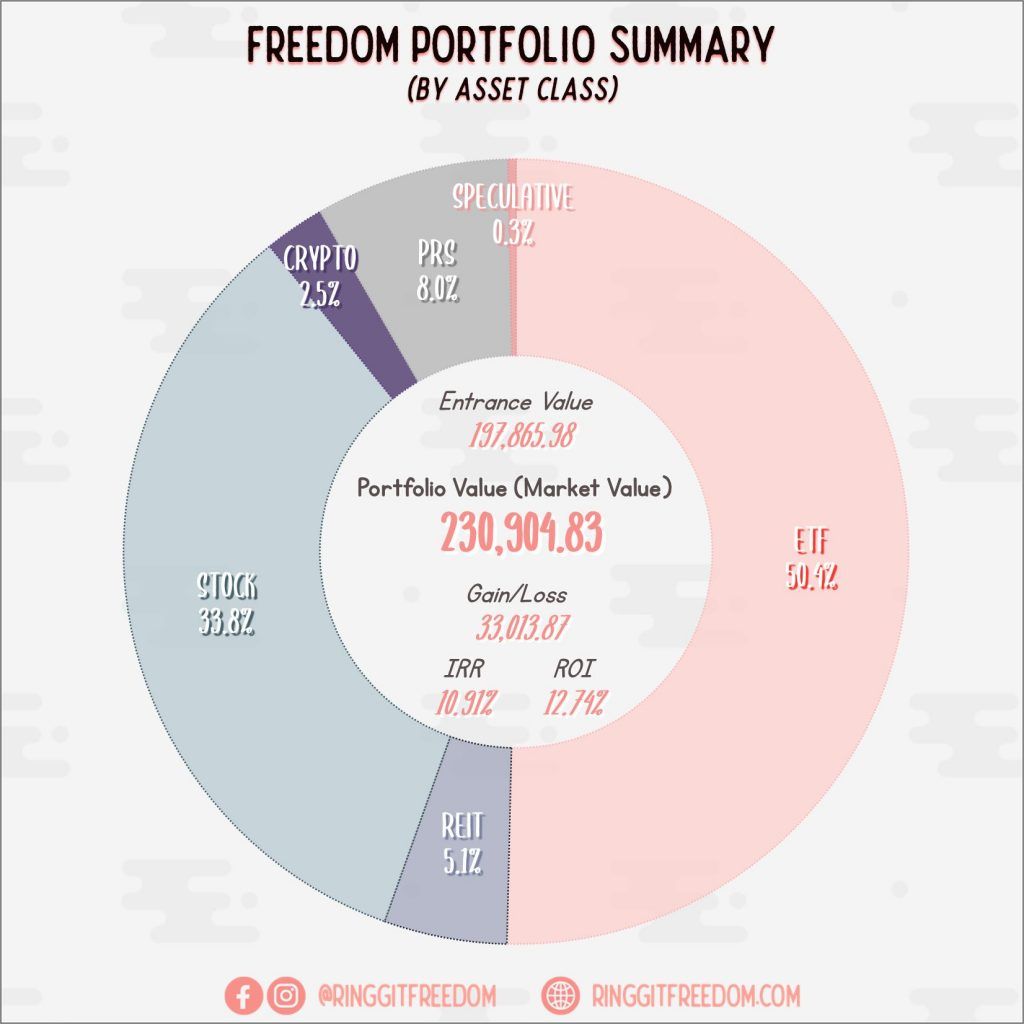

My portfolio continues to take the hit from the recent China Crash - as we can see from the peak of IRR/ROI during February 2021 followed by never-ending downwards spiral. I'm still confident with China in the long term (>10 years) though, so all these are just noises to me personally.

During the crash, I bought quite a number of entries using funds from various sources - profit taking (more on this later), my spare funds, and also my recent i-Citra withdrawal.

6885.HK (Henan Jinma Energy Co Ltd)

This was one of my small portion of individual stock picks initially meant for mid-to-long term play which I bought-in mid-May at approx. HKD 3.5/ea, right before their Dividend-ex date. Was initially planning to hold this stock for at least 1-3 years but the price hit my initial minimum target of HKD 5/ea (+42%) and with the recent China Crash (especially technology sectors), I decided to take profit of HKD 3400 (incl. Dividends) and rotate the monies elsewhere.

The taken profit went straight into 3067.HK (iShares Hang Seng TECH ETF HKD), which basically is a HKEX version of KWEB (KraneShares CSI China Internet ETF) with lower Total Expense Ratios (0.25% from 3067.HK vs. 0.73% from KWEB).

On a second thought, I should have checked KWEB's crash before the purchase as I'm pretty sure that it'd still be cheaper even if I had to pay $2 in commissions to convert my HKD's into USD, and buy KWEB instead of 3067. This time around, there's a huge premium discount of at least 20% between the two - just compare the tracking accuracy of both funds up to the point of crashing and you'll see why below...

Fortunately I realised my mistake sooner and the subsequent cash-ins went straight into KWEB at around $44.8 mark.

This was one of my unprepared orders - I wouldn't say it wasn't expected, but came sooner than I thought. I converted my IBKR account from Cash into Margin back in February 2021 as I've hated the lack of ability to place an order, until the cash is 100% cleared which may take hours or days (depending on the funding method). With that account converted, I used my "Margin Limits" to place imaginary orders at low-limit price, which would typically not trigger unless drastic crash occurred (so that I can "buy" during the crash without actually monitoring the market at all).

Well, well, well, BABA's price hit as low as $156.xx and my orders were filled - thankfully I had some spare (investment) cash lying around which could be deployed and "refill" my margin immediately. My next "low-limit" trigger is around $130 mark, let's see if it gets triggered anytime soon...

For the same reason why I withdrew i-Sinar from EPF back in May, I did the same thing again now in August. You can read more on my rationale in the previous update - but always look at your personal circumstances before making such decision. In my case, I had comfortable-enough cushion in EPF to fuel this decision (to diversify out from EPF into my Core Portfolio).

This time around, 100% of the i-Citra Withdrawal went into my S&P 500 Index Fund (CSP1.L) as a bit of counter-balance to my recent China-heavy purchases.

Well - nothing to shout about here. I received some dividends from two of my shares (PTR & AAPL) but the amount is so negligible that it's not worth mentioning at all ?

From August 2021 onward, I will be adding two additional charts above to snapshot my portfolio allocation by region, asset group, and sector on a month-to-month basis. Hope it would be interesting for y'all!

In case if you are wondering, the sectors that we see above (and also most if not all of the other fact sheets for ETFs or Unit Trusts) are basically the Global Industry Classification Standard (GICS®) developed jointly by MSCI and S&P Dow Jones Indices back in 1999.

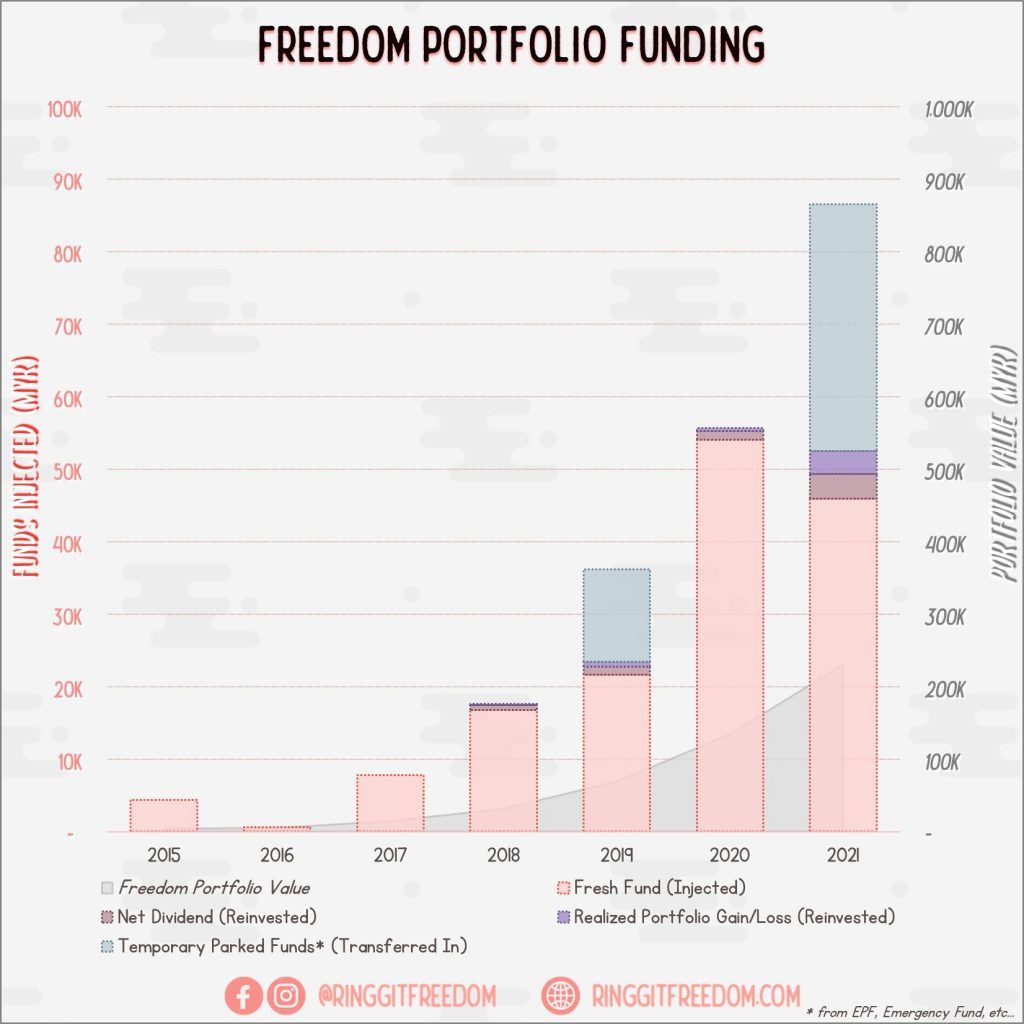

Also, a quick re-post of the launch-to-date portfolio funding chart (since we've revamped the chart designs eh? ?)

Note: For the definition of snapshots, please check My Portfolio where I elaborated it in detail.

Sold (Retired) Portfolio (accumulative)

IRR: 6.70%

ROI: 11.34%

Profit/Loss: RM4,769.87

Active (Invested) Portfolio

IRR: 12.49%

ROI: 13.01%

Profit/Loss: RM28,244.00

True Cost: RM216,926.98

Total Value: RM245,401.58

Entrance Value: RM197,865.98

Portfolio Value: RM230,904.83

Nett Dividend (2021): RM3,409.37

If you're interested in my past updates - do check out my previous Monthly Review or Year In Review!

As always, thanks for reading and I will see you again in my next post! If you haven't already, be sure to follow me on my Instagram, Facebook and YouTube for latest updates!

Cheers,

Gracie